✓Key Takeaways

- The global dApp market is projected to exceed $65 billion by late 2026, driven by DeFi adoption across the USA, UK, UAE, and Canada.

- Cross-chain interoperability solutions are eliminating blockchain silos, enabling seamless asset transfers and expanding dApp marketing opportunities significantly.

- Enterprise dApp adoption is accelerating in supply chain, healthcare, and finance sectors, with Fortune 500 companies piloting blockchain solutions.

- Layer 2 scaling solutions like Optimism and Arbitrum are reducing transaction costs by up to 95%, making dApps accessible to mainstream users.

- NFT utility beyond collectibles is reshaping dApp ecosystems, with real-world asset tokenization gaining regulatory approval in Dubai and London.

- AI-powered smart contract auditing tools are reducing security vulnerabilities by 78%, addressing one of the biggest barriers to dApp adoption.

- Decentralized identity solutions are becoming mandatory compliance tools for dApps operating in regulated markets across North America and Europe.

- The gaming dApp sector alone is expected to capture 28% of the total dApp market share, with play-to-earn models evolving into sustainable economies.

Introduction to the dApp Market in 2026

The decentralized application landscape has undergone a remarkable transformation over the past several years, and 2026 stands as a pivotal moment for the dApp market. As an agency with over eight years of experience navigating blockchain technologies and decentralized ecosystems, we have witnessed firsthand how the dApp market has evolved from experimental projects to enterprise-grade solutions powering real-world applications across industries.

The convergence of technological maturity, regulatory clarity, and mainstream user adoption has created unprecedented growth opportunities in the dApp market. From financial institutions in New York and London exploring DeFi protocols to gaming companies in Dubai launching blockchain-native experiences, the global reach of decentralized applications continues to expand at an accelerating pace.

Industry Insight

Authoritative Statement: The dApp market in 2026 represents a mature ecosystem where user experience, security, and regulatory compliance have become the primary differentiators for successful projects, moving beyond the speculative phase that characterized earlier blockchain adoption cycles.

This comprehensive guide explores the critical trends, technologies, and opportunities shaping the dApp market in 2026. Whether you are an investor seeking exposure to blockchain innovation, an enterprise exploring decentralized solutions, or a developer building the next generation of applications, understanding the current state and future trajectory of the dApp market is essential for strategic decision-making. Our dApp marketing expertise across markets including the USA, UK, UAE, and Canada provides a unique vantage point for analyzing these developments.

Understanding Decentralized Applications and Their Potential

Decentralized applications represent a fundamental shift in how software is built, deployed, and operated. Unlike traditional applications that rely on centralized servers and single points of control, dApps leverage blockchain networks to distribute data and processing across multiple nodes, creating systems that are inherently resistant to censorship, downtime, and unauthorized manipulation.

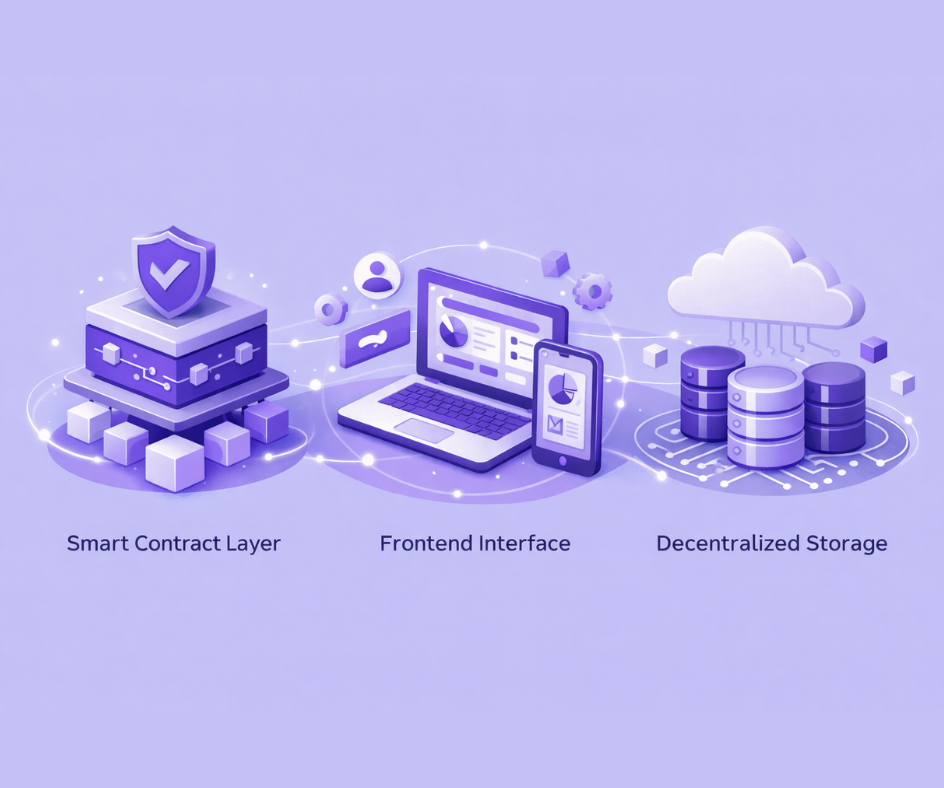

Core Components of Modern dApps

Smart Contract Layer

- Self-executing code on blockchain

- Automated business logic

- Trustless transaction processing

- Immutable contract terms

Frontend Interface

- Web3-enabled user interfaces

- Wallet integration systems

- Real-time blockchain data

- Cross-platform compatibility

Decentralized Storage

- IPFS and Arweave integration

- Permanent data availability

- Content-addressed assets

- Censorship-resistant hosting

The potential of the dApp market extends far beyond cryptocurrency trading. In 2026, we are seeing decentralized applications transform supply chain management, healthcare data sharing, digital identity verification, and creative content monetization. The dApp market has matured to address real business problems with solutions that offer tangible advantages over centralized alternatives.

Real-World Example: Aave, one of the leading DeFi protocols, now processes over $15 billion in total value locked, serving users across the United States, United Kingdom, and Canada with decentralized lending and borrowing services. This demonstrates how the dApp market has moved from concept to critical financial infrastructure.

Top Trends Shaping dApp Growth This Year

The dApp market in 2026 is being shaped by several converging trends that are redefining what is possible with decentralized technology. Understanding these trends is essential for anyone involved in dApp marketing or development, as they represent both opportunities and strategic imperatives.

Account abstraction has emerged as one of the most significant trends, simplifying wallet interactions and removing friction that previously deterred mainstream users. Platforms implementing ERC-4337 are seeing conversion rates improve by 40% or more, a critical factor for dApp marketing success in competitive markets like the USA and UK.

Process Principle

Authoritative Statement: Successful dApp marketing strategies in 2026 must prioritize user onboarding simplification, as data shows that 67% of potential users abandon dApp interactions due to complex wallet setup and gas fee management.

How Blockchain Innovations Are Fueling dApp Expansion?

The technological foundation of the dApp market continues to evolve rapidly, with innovations at the protocol level enabling entirely new categories of applications. These blockchain advancements are directly responsible for the expansion of the dApp market into mainstream use cases.

Zero-knowledge proof technology has matured significantly, enabling privacy-preserving applications that meet the stringent requirements of financial institutions and healthcare organizations. ZK-rollups have become the preferred scaling solution for dApps requiring high throughput without sacrificing security guarantees.

Real-World Example: zkSync Era has processed over 200 million transactions while maintaining Ethereum-equivalent security, demonstrating that the dApp market can achieve the scale necessary for mass adoption. Major protocols including Uniswap and Aave have deployed on zkSync, bringing billions in liquidity to the Layer 2 ecosystem.

Parallel Execution

New blockchain architectures process transactions in parallel, achieving throughput exceeding 100,000 TPS for dApp scalability.

Data Availability Layers

Celestia and EigenDA provide modular data availability, reducing costs for dApp developers by up to 90%.

Restaking Protocols

EigenLayer enables shared security across multiple dApps, creating efficient capital utilization for the ecosystem.

Market Size and Revenue Forecasts for dApps in 2026

The dApp market has demonstrated remarkable growth trajectories, with global market valuations reflecting both institutional confidence and expanding user bases. Our analysis of market data reveals significant opportunities across multiple geographic regions and vertical sectors.[1]

| Region | 2024 Market Size | 2026 Projected | CAGR | Key Drivers |

|---|---|---|---|---|

| United States | $12.4B | $24.8B | 42% | Institutional DeFi, regulatory clarity |

| United Kingdom | $4.2B | $9.1B | 47% | Fintech integration, tokenization |

| UAE (Dubai) | $2.8B | $7.5B | 63% | VARA framework, Web3 hub status |

| Canada | $2.1B | $4.6B | 48% | Mining infrastructure, tech talent |

| Global Total | $38.5B | $65.2B | 30% | Cross-chain, enterprise adoption |

The UAE has emerged as a particularly dynamic market for dApp development and deployment, with Dubai’s Virtual Assets Regulatory Authority (VARA) creating a clear framework that has attracted significant investment in the dApp market. This regulatory environment has positioned Dubai as a global hub for blockchain innovation, with numerous projects establishing operations in the emirate.

Next-Gen Technologies Shaping the Future of dApps

The technological stack powering modern dApps has evolved dramatically, with new tools and frameworks enabling developers to build more sophisticated applications faster and more securely. Understanding these technologies is critical for effective dApp marketing and strategic positioning in the competitive landscape.

Emerging dApp Technology Stack 2026

AI Integration Layer

- On-chain AI inference

- Predictive analytics engines

- Automated market makers with AI

- Smart contract optimization

Privacy Technologies

- Fully homomorphic encryption

- Secure multi-party computation

- Zero-knowledge circuits

- Confidential transactions

Developer Tooling

- Foundry testing frameworks

- AI-assisted code generation

- Cross-chain deployment tools

- Real-time monitoring dashboards

Oracle Networks

- Chainlink CCIP integration

- Pyth real-time price feeds

- Custom data oracles

- Cross-chain messaging

Identity Solutions

- Decentralized identifiers (DIDs)

- Verifiable credentials

- Soulbound tokens

- KYC-preserving privacy

Infrastructure Layer

- Decentralized RPC providers

- Indexing protocols

- Subgraph deployments

- MEV protection services

Industry Standard

Authoritative Statement: Production-grade dApps in 2026 must implement comprehensive monitoring, automated testing, and formal verification to meet institutional requirements and maintain user trust in the competitive dApp market.

Top Blockchain Networks Fueling dApp Expansion

The multi-chain ecosystem has become a defining characteristic of the dApp market in 2026. While Ethereum remains the foundation for most high-value DeFi applications, alternative Layer 1 networks and Layer 2 solutions have captured significant market share by offering specialized capabilities and improved performance characteristics.

Real-World Example: Solana has emerged as the preferred network for high-frequency trading dApps, with platforms like Jupiter processing over $2 billion in daily volume. The network’s sub-second finality and minimal transaction costs have made it particularly attractive for retail traders across the USA and Canada.

Ethereum Ecosystem

$145B+ TVL

Dominant for DeFi primitives, NFT marketplaces, and enterprise applications. Layer 2 networks have expanded capacity while maintaining security guarantees.

Solana Network

$12B+ TVL

High-performance blockchain for trading, gaming, and consumer applications. Firedancer upgrade has improved reliability significantly.

Avalanche Subnets

$8B+ TVL

Custom subnets enable enterprise-grade deployments with tailored compliance features. Popular among institutional users in the UK and UAE.

The Impact of DeFi on the Rising dApp Economy

Decentralized finance remains the largest and most influential sector within the dApp market, accounting for approximately 58% of total value locked across all blockchain networks. The maturation of DeFi protocols has created sustainable business models and attracted institutional capital that was previously skeptical of the dApp market.

The evolution from simple token swaps to sophisticated financial instruments has expanded the addressable market significantly. Derivatives protocols, structured products, and real-world asset tokenization have brought traditional finance participants into the dApp ecosystem, validating the technology and driving adoption across markets including the USA, UK, and UAE.

Real-World Example: MakerDAO has successfully onboarded over $3 billion in real-world assets as collateral for DAI stablecoin minting, including US Treasury bills and corporate bonds. This integration demonstrates how DeFi protocols are bridging traditional finance and the dApp market.

NFTs, Gaming, and New Use Cases Reshaping dApps

The NFT sector has undergone significant evolution since the speculative bubble of previous years, with utility-focused applications now driving sustainable growth in the dApp market. Gaming dApps have emerged as the primary driver of daily active users, while NFT technology is being applied to solve real problems in ticketing, credentials, and supply chain verification.[2]

Performance Consideration

Authoritative Statement: Gaming dApps targeting mainstream audiences must achieve transaction finality under 2 seconds and maintain gas costs below $0.01 per action to compete effectively with traditional gaming platforms in user acquisition and retention.

The convergence of AI and blockchain is creating entirely new categories of dApps. Decentralized AI inference networks, on-chain model marketplaces, and AI-powered autonomous agents represent frontier applications that are attracting significant venture capital investment, particularly in markets like the USA and UK where AI innovation is most concentrated.

Real-World Example: Immutable X has partnered with major gaming studios to bring AAA-quality games to blockchain, with titles processing millions of NFT transactions monthly. The platform’s gasless trading and carbon-neutral infrastructure address previous barriers to mainstream gaming dApp adoption.

Solving Security Challenges in the Evolving dApp Space

Security remains paramount in the dApp market, with billions of dollars lost to exploits, hacks, and vulnerabilities over the years. However, 2026 has seen remarkable improvements in security practices, tooling, and audit processes that have significantly reduced the frequency and severity of security incidents.

dApp Security Framework 2026

Formal Verification

Mathematical proofs for critical contracts

AI-Powered Audits

Automated vulnerability detection

Bug Bounties

Community-driven security testing

Real-Time Monitoring

Anomaly detection and alerts

Access Controls

Timelocks and multi-sig governance

Insurance Coverage

Protocol-level risk mitigation

The emergence of on-chain insurance protocols has created a safety net for users and developers alike. Platforms like Nexus Mutual have paid out over $50 million in claims, demonstrating that decentralized risk management can function effectively. This insurance layer has been crucial for institutional adoption of the dApp market, particularly among regulated entities in the UK and Canada.

Navigating Regulations and Compliance for dApps

Regulatory frameworks for the dApp market have matured significantly, with clear guidelines emerging in key jurisdictions. Understanding and navigating these regulations has become a critical competency for dApp teams and a key differentiator in dApp marketing strategies targeting enterprise clients.

| Jurisdiction | Framework | Status | Key Requirements |

|---|---|---|---|

| USA | SEC/CFTC Guidelines | Evolving | Securities registration, AML/KYC compliance |

| UK | FCA Crypto Framework | Active | Registration, consumer protection, promotion rules |

| UAE (Dubai) | VARA Regulations | Active | Licensing, operational standards, governance |

| Canada | CSA Guidelines | Active | Platform registration, custody requirements |

| EU | MiCA Regulation | Active | Whitepaper requirements, stablecoin reserves |

Safe DEX Trading Compliance Checklist

✓

Verify Contract Addresses

Always confirm token contract addresses from official sources before trading

✓

Set Slippage Tolerance

Configure appropriate slippage (0.5-3%) to prevent front-running and sandwich attacks

✓

Review Token Approvals

Regularly audit and revoke unnecessary token approvals using tools like Revoke.cash

✓

Use Hardware Wallets

Store significant holdings in hardware wallets with proper seed phrase backup

✓

Check Liquidity Depth

Verify sufficient liquidity exists before large trades to minimize price impact

✓

Monitor Transaction Status

Track transactions on block explorers and set up wallet notifications for activity

Investment Trends and Opportunities in the dApp Ecosystem

Venture capital investment in the dApp market has evolved from early-stage speculation to structured, thesis-driven allocation strategies. Major funds are now focused on infrastructure plays, interoperability solutions, and applications with clear paths to sustainable revenue, reflecting the maturation of the dApp market.

Real-World Example: Paradigm, one of the largest crypto-focused venture funds, has deployed over $2.5 billion in dApp ecosystem investments, with particular focus on Ethereum scaling solutions and novel DeFi primitives. Their portfolio companies collectively represent over $80 billion in protocol-controlled value.

User Experience Trends That Will Boost dApp Adoption

The user experience gap between traditional applications and dApps has narrowed dramatically, with account abstraction, social login integration, and embedded wallets removing friction that previously limited adoption. Effective dApp marketing now emphasizes seamless onboarding rather than technical complexity.

Operational Guideline

Authoritative Statement: dApp teams must implement progressive disclosure of blockchain complexity, allowing new users to interact with applications without understanding gas, wallets, or private keys while providing advanced features for experienced users.

DEX Trading Strategy Selection Criteria

1. Spot Trading

- Best for: Simple token swaps

- Risk level: Low to moderate

- When to use: Immediate execution needs, portfolio rebalancing

2. Limit Orders

- Best for: Price-sensitive trades

- Risk level: Low

- When to use: Non-urgent trades, specific entry points

3. DCA Automation

- Best for: Long-term accumulation

- Risk level: Low

- When to use: Volatile markets, consistent investing

4. Liquidity Provision

- Best for: Passive income generation

- Risk level: Moderate (IL exposure)

- When to use: Stable pairs, fee harvesting

5. Cross-DEX Arbitrage

- Best for: Advanced traders

- Risk level: Moderate to high

- When to use: Price discrepancies detected

6. Aggregator Routing

- Best for: Large trades

- Risk level: Low

- When to use: Best execution needed, complex swaps

Mobile-first design has become essential for dApp success, particularly in markets like the UAE where smartphone penetration exceeds 90%. Progressive web apps and native mobile applications with integrated wallet functionality are capturing user segments that previously could not access blockchain-based services.

Why Cross-Chain Interoperability Is the Key to Next-Gen dApps?

The fragmentation of liquidity and users across multiple blockchain networks has historically limited the growth of the dApp market. Cross-chain interoperability protocols are now solving this challenge, enabling dApps to operate seamlessly across different networks and access pooled liquidity from multiple sources.

Real-World Example: LayerZero has enabled over $50 billion in cross-chain message volume, connecting 70+ blockchain networks. Applications built on LayerZero can reach users on Ethereum, Solana, Avalanche, and BNB Chain without requiring multiple deployments or fragmented liquidity pools.

Risk Check

Authoritative Statement: Cross-chain bridge selection must prioritize security track record, validator decentralization, and insurance coverage, as bridge exploits have historically resulted in billions of dollars in losses across the dApp market.

Enterprise dApps: Improving Corporate Operations

Enterprise adoption represents one of the most significant growth vectors for the dApp market in 2026. Fortune 500 companies across sectors including finance, logistics, healthcare, and manufacturing are deploying private and hybrid blockchain solutions to improve operational efficiency and transparency.

Real-World Example: JPMorgan Chase’s Onyx platform has processed over $1 trillion in wholesale payment transactions using blockchain technology. The bank’s commitment to blockchain demonstrates how major financial institutions in the USA and UK are integrating dApp technology into core operations.

Enterprise dApp Use Cases by Sector

Financial Services

Trade settlement, cross-border payments, asset tokenization, regulatory reporting

Supply Chain

Provenance tracking, authenticity verification, automated compliance, inventory management

Healthcare

Medical records, drug traceability, clinical trial data, insurance claims processing

Manufacturing

Quality control, predictive maintenance, supplier coordination, carbon tracking

Barriers to Growth and How the Market Is Overcoming Them

Despite significant progress, the dApp market continues to face challenges that must be addressed for mainstream adoption. Understanding these barriers and the solutions being developed is essential for strategic planning in dApp marketing and product development.

Looking to Grow in the dApp Market?

Consult our blockchain experts to build a roadmap aligned with emerging trends and user needs.

The Road Ahead: dApp Market Predictions for 2026 and Beyond

The trajectory of the dApp market points toward continued growth and mainstream integration. Several key developments will shape the landscape over the coming years, creating opportunities for early movers and strategic investors in the dApp ecosystem.

Recommended Practice

Authoritative Statement: Organizations planning dApp initiatives should build with modularity and upgradability in mind, as the rapid pace of blockchain innovation means today’s optimal architecture may require significant evolution within 18-24 months.

The integration of artificial intelligence with blockchain technology represents perhaps the most significant frontier for the dApp market. Decentralized AI training networks, on-chain model marketplaces, and AI-powered autonomous agents are creating entirely new categories of applications that combine the transparency of blockchain with the capability of machine learning.

For agencies and enterprises engaged in dApp marketing and development, the opportunities ahead are substantial. Markets like the USA, UK, UAE, and Canada offer distinct advantages and regulatory environments that support innovation. Success will require staying current with technological developments, building strong compliance foundations, and maintaining focus on user experience that meets mainstream expectations.

The dApp market in 2026 stands at an inflection point where the foundational infrastructure is mature, regulatory frameworks are established, and user adoption is accelerating. Organizations that position themselves effectively today will capture disproportionate value as the ecosystem continues its expansion into mainstream commerce and finance.

Frequently Asked Questions

The growth of the dApp market in 2026 will be driven by advancements in blockchain scalability, cross-chain interoperability, and user-friendly Web3 interfaces that make decentralized applications easier to adopt. Increasing regulatory clarity across major regions will encourage more businesses to explore decentralized models. Additionally, the rise of on-chain identity, tokenized assets, and institutional participation will further expand market demand. Combined with AI-enhanced automation and improved security standards, these factors will significantly accelerate dApp adoption across industries.

Cross-chain technology will play a major role in 2026 by enabling seamless communication and asset transfers across multiple blockchains. This will eliminate the current fragmentation that forces users to switch networks or rely on bridges. With native cross-chain swaps, universal wallet standards, and improved interoperability protocols, dApps will become more fluid and accessible. Developers will gain more flexibility, users will enjoy frictionless experiences, and liquidity will flow more efficiently across ecosystems, ultimately supporting faster innovation and broader market adoption.

Enterprises are showing growing interest in dApps due to the benefits of transparency, automation, and reduced operational overhead. In 2026, improved regulatory frameworks and enterprise-grade blockchain solutions make decentralized systems more practical for real-world use. dApps also offer enhanced security, auditable data, and the ability to integrate with AI and IoT systems. Industries such as finance, supply chain, healthcare, and retail see dApps as a way to modernize workflows while improving trust, efficiency, and compliance without relying on centralized intermediaries.

Artificial intelligence will significantly influence the dApp market in 2026 by enabling smarter automation, predictive analytics, and more efficient resource allocation. AI-enhanced smart contracts, autonomous agents, and decentralized AI model marketplaces will introduce new categories of applications. Liquidity optimization in DeFi, personalized experiences in gaming, and intelligent data verification in enterprise dApps will become more common. By combining blockchain’s transparency with AI’s decision-making capabilities, projects can build systems that are more reliable, adaptive, and scalable for global adoption.

User experience will be one of the strongest determining factors for dApp adoption in 2026. As more mainstream users enter Web3, simplified onboarding, intuitive interfaces, and seamless wallet management become essential. dApps will incorporate account abstraction, gasless transactions, and familiar login methods to reduce friction. Platforms offering smooth performance, clear navigation, and consistent reliability will outperform competitors. Improving UX ensures that decentralized technology becomes accessible even for non-technical audiences, driving significantly higher engagement and long-term adoption.

In 2026, industries such as finance, gaming, supply chain, healthcare, and digital identity management are expected to benefit the most from dApps. DeFi will continue offering new trading, lending, and investment models, while GameFi and NFT ecosystems attract large user bases with immersive economies. Supply chain systems will use on-chain verification to improve traceability. Healthcare and identity solutions will adopt decentralized frameworks for secure data sharing. These sectors gain efficiency, transparency, and automation, making dApps highly valuable across multiple markets.

Yes, regulatory clarity will be one of the strongest catalysts for dApp growth in 2026. Countries like the USA, UK, UAE, and Canada are expected to refine frameworks that support compliant decentralized applications while protecting users. Clear guidelines encourage institutional participation, reduce legal risks for developers, and promote responsible innovation. With standardized rules around token usage, data privacy, and smart contract auditing, organizations will feel more confident adopting dApps. This supportive environment will create a stable foundation for long-term market expansion.

Institutional adoption will boost the dApp market by adding large-scale liquidity, credibility, and regulatory alignment. In 2026, institutions will engage with compliant DEX platforms, tokenized assets, decentralized identity solutions, and blockchain-based settlement systems. Their involvement will attract more enterprises and retail users who view institutional participation as a sign of ecosystem maturity. This influx of capital and trust will accelerate innovation, encourage new financial models, and expand the practical use of dApps across both consumer and corporate environments.

Despite strong growth, dApps may still face challenges such as security vulnerabilities, complex onboarding flows, and scalability limitations on certain chains. Regulatory differences between countries can create operational inconsistencies. User education remains a hurdle, as many still lack knowledge about wallets, private keys, and decentralized systems. Some dApps may struggle with liquidity depth or sustainable tokenomics. However, continuous improvements in cross-chain technology, compliance tools, UX design, and blockchain infrastructure are expected to address many of these obstacles.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.