Key Takeaways

- Crypto exchanges provide the essential infrastructure for listing, trading, and managing tokenized real estate assets, transforming illiquid property investments into tradable digital securities accessible to global investors.

- Blockchain technology enables transparency, immutability, and security in real estate transactions, eliminating traditional intermediaries while creating tamper-proof ownership records that cannot be fraudulently altered.

- Fractional ownership through tokenization reduces investment barriers from hundreds of thousands to as little as hundreds of dollars, democratizing access to premium real estate markets globally and enabling portfolio diversification.

- Secondary markets on crypto exchanges solve real estate’s historic liquidity problem, allowing investors to exit positions in hours instead of months or years through continuous token trading.

- Smart contracts automate rental income distribution, ownership transfers, and compliance enforcement, reducing administrative costs while increasing transaction efficiency, accuracy, and transparency for all participants.

- Regulatory compliance frameworks including KYC and AML protocols on crypto exchanges ensure legal trading while maintaining the borderless accessibility that blockchain technology enables across multiple jurisdictions.

- Institutional investor participation through specialized crypto exchange platforms brings market maturity, enhanced liquidity, credibility, and professional standards to the tokenized real estate ecosystem.

- The integration of property tokenization platforms with crypto exchanges creates an end-to-end lifecycle from asset origination through secondary market trading, ongoing management, and eventual exit or redemption.

What is Real Estate Tokenization

Real estate tokenization represents a fundamental transformation in how property ownership is structured, traded, and accessed. At its core, tokenization converts the ownership rights of physical real estate assets into digital tokens that exist on a blockchain network. Each token represents a specific fraction of ownership in the underlying property, whether residential, commercial, or mixed-use real estate. This innovative approach combines the tangible value of physical property with the digital flexibility and transparency of blockchain technology.

The process begins when property owners or developers decide to tokenize their assets, working with specialized platforms to create digital representations of ownership stakes. These digital tokens embody the same legal rights as traditional property ownership, including claims to rental income, appreciation, and voting rights on major property decisions. Unlike traditional real estate investment trusts or partnerships, tokenized assets provide direct ownership representation that can be verified, transferred, and traded on blockchain networks with unprecedented efficiency and transparency.

Through our eight years of experience implementing tokenization solutions across diverse markets, we have observed that successful real estate tokenization requires careful legal structuring to ensure tokens truly represent enforceable ownership rights. The underlying property is typically held in a special purpose vehicle that issues tokens corresponding to equity stakes, with smart contracts encoding the rules governing token holder rights and obligations. This structure provides both the legal certainty investors require and the technical functionality that makes blockchain-based ownership practical.

Evolution of Real Estate Investment

Real estate investment has evolved dramatically from direct property ownership requiring substantial capital and local market knowledge to increasingly accessible investment vehicles that serve broader investor populations. Traditional methods limited participation to wealthy individuals and institutional investors who could afford entire properties or significant partnership stakes. The introduction of Real Estate Investment Trusts in the 1960s provided some liquidity and accessibility, but still maintained relatively high minimum investments and limited trading flexibility compared to other financial instruments.

The digital age brought online crowdfunding platforms that reduced minimum investments to tens of thousands of dollars, yet these platforms still suffered from illiquidity, long holding periods, and geographic restrictions. Real estate tokenization represents the next evolutionary step, combining the accessibility of crowdfunding with the liquidity of public markets and the transparency of blockchain technology. This evolution democratizes real estate investment while maintaining the asset class’s fundamental characteristics and risk-return profiles.

Role of Digital Tokens in Modern Ownership

Digital tokens serve as programmable certificates of ownership that exist on blockchain networks, providing features impossible with traditional paper deeds or electronic records. These tokens carry embedded metadata about ownership percentages, property details, income distribution schedules, and transfer restrictions. Token holders can prove ownership instantly through blockchain verification without requiring title companies or registries, dramatically reducing the time and cost associated with ownership validation.

The programmable nature of digital tokens enables automation of previously manual processes that traditionally required significant administrative overhead. When rental income is received, smart contracts can automatically calculate each token holder’s proportional share and distribute payments without property managers or accounting intermediaries. Similarly, when tokens change hands through trading on crypto exchanges, ownership records update instantaneously with complete transparency visible to all network participants. This automation reduces costs, eliminates errors, and accelerates processes throughout the real estate investment lifecycle.

Why Crypto Exchanges Matter in This Ecosystem

Crypto exchanges provide the critical missing link between property tokenization and widespread investor adoption. While tokenization platforms can create digital ownership certificates, these tokens have limited value without liquid markets where they can be traded efficiently. Crypto exchanges build the marketplace infrastructure, matching buyers and sellers, facilitating price discovery, and providing the custody and security mechanisms essential for investor confidence in digital asset ownership. Build crypto exchanges with robust infrastructure to support tokenized assets trading.

Without crypto exchanges, tokenized real estate would remain as illiquid as traditional property ownership, undermining one of tokenization’s primary value propositions. Exchanges transform static digital assets into dynamic tradable securities, enabling investors to enter and exit positions based on market conditions rather than being locked into multi-year holding periods. This liquidity premium attracts more capital to tokenized real estate, creating a virtuous cycle of increased participation, better price discovery, and enhanced market efficiency that benefits all ecosystem participants.

Understanding Blockchain Technology in Real Estate

What is Blockchain Technology

Blockchain technology is a distributed ledger system that records transactions across multiple computers in a way that prevents retroactive alteration. Each block in the chain contains a set of transactions, a timestamp, and a cryptographic link to the previous block, creating an immutable record of all activity. This decentralized architecture eliminates single points of failure and removes the need for trusted intermediaries to validate transactions.

In the context of real estate, blockchain serves as a transparent, permanent record-keeping system for property ownership and transaction history. Every token transfer, income distribution, and ownership change is recorded on the blockchain, creating an auditable trail that any participant can verify. The technology’s consensus mechanisms ensure that all network participants agree on the current state of ownership without requiring a central authority.

Blockchain vs Traditional Real Estate Systems

Traditional real estate systems rely on centralized databases maintained by government registries, title companies, and financial institutions. These systems suffer from fragmentation, with different parties maintaining separate records that must be reconciled during transactions. Paper-based processes create opportunities for fraud, errors, and disputes while adding significant time and cost to property transfers.

| Aspect | Traditional System | Blockchain System |

|---|---|---|

| Record Keeping | Centralized databases, paper records | Distributed ledger, digital tokens |

| Transaction Time | Weeks to months | Minutes to hours |

| Intermediaries | Title companies, escrow, lawyers, brokers | Smart contracts, minimal intermediaries |

| Transaction Costs | 5-10% of property value | 0.5-2% of transaction value |

| Transparency | Limited, opaque records | Complete, public transaction history |

| Accessibility | High capital requirements | Fractional ownership available |

| Liquidity | Highly illiquid | Enhanced through secondary markets |

Blockchain based systems enable simultaneous access to a single source of truth that updates in real-time as transactions occur. All parties can verify ownership status, transaction history, and encumbrances without requesting documents from multiple sources. This reduces friction, accelerates closing times, and minimizes the risk of conflicting records or fraudulent claims.

Transparency and Immutability in Property Records

Transparency in blockchain systems means that all participants can view the complete transaction history of any tokenized asset. This visibility extends to ownership changes, income distributions, property valuations, and any other recorded events. Investors can conduct due diligence by examining the blockchain directly rather than relying on third-party reports that may be incomplete or outdated.

Immutability ensures that once transactions are recorded on the blockchain, they cannot be altered or deleted. This permanent record-keeping creates accountability and prevents the backdating of ownership claims or manipulation of transaction history. In our experience working with blockchain implementations, immutability provides the foundation for trust in digital ownership systems, as participants know that records reflect genuine historical activity.

The combination of transparency and immutability addresses many pain points in traditional real estate. Title fraud becomes nearly impossible when ownership records exist on an immutable ledger. Disputed ownership claims can be resolved by examining the transparent transaction history. Income distribution disputes are eliminated when blockchain records show exactly what payments were made to which token holders.

Blockchain Based Assets in Real Estate

Blockchain based assets in real estate extend beyond simple ownership tokens to include various financial instruments and property-related securities. These assets leverage blockchain’s programmability to create sophisticated investment products that were impractical in traditional systems. Examples include income-producing tokens that automatically distribute rental payments, development tokens that represent stakes in construction projects, and derivative tokens that track property market indices.

The key advantage of blockchain based assets is their composability, meaning they can be combined, split, or integrated with other blockchain protocols. A real estate investment token might be used as collateral for a blockchain-based loan, traded on multiple crypto exchanges simultaneously, or bundled with tokens from other properties to create diversified investment products. This flexibility creates new possibilities for real estate finance that traditional systems cannot replicate.

What Are Crypto Exchanges?

Definition of Crypto Exchanges

Crypto exchanges are digital marketplaces that facilitate the buying, selling, and trading of cryptocurrencies and tokenized assets. These platforms match buyers and sellers, maintain order books, execute trades, and provide custody services for digital assets. In the context of real estate tokenization, crypto exchanges serve as the primary venues where tokenized real estate assets are listed, priced, and traded among investors.

Modern crypto exchanges have evolved into sophisticated financial platforms offering spot trading, derivatives, staking services, and institutional-grade custody solutions. Leading exchanges process billions of dollars in daily trading volume while implementing robust security measures, regulatory compliance protocols, and user protection mechanisms.

How Crypto Exchanges Work

Crypto exchanges operate operate through order matching systems that connect buyers willing to purchase tokens at specific prices with sellers willing to sell at those prices. Users deposit funds or tokens into exchange-controlled wallets, place buy or sell orders specifying quantity and price, and the exchange’s matching engine pairs compatible orders to execute trades. Once matched, the exchange updates both parties’ account balances to reflect the completed transaction.

Behind the scenes, exchanges maintain hot wallets for active trading and cold storage for the majority of user funds to balance accessibility with security. They implement maker-taker fee structures to incentivize liquidity provision, with makers who place limit orders receiving fee discounts while takers who execute against existing orders pay slightly higher fees. Advanced exchanges offer features like margin trading, stop-loss orders, and API access for algorithmic trading strategies.

Difference Between Centralized and Decentralized Exchanges

Centralized exchanges operate as traditional companies that maintain custody of user funds, run order matching systems on private servers, and require users to create accounts with identity verification. These platforms offer high trading volumes, advanced features, fiat currency on-ramps, and customer support, but require users to trust the exchange with asset custody. Examples include major platforms like Coinbase, Binance, and Kraken that serve millions of users globally.

Decentralized exchanges use smart contracts on blockchain networks to facilitate peer-to-peer trading without centralized custody. Users maintain control of their private keys and assets throughout the trading process, connecting wallets directly to exchange protocols. While decentralized exchanges eliminate counterparty risk and censorship concerns, they typically offer lower liquidity, limited fiat integration, and less intuitive user experiences compared to centralized alternatives.

For real estate tokenization, centralized exchanges currently provide the most practical infrastructure due to their regulatory compliance capabilities, higher liquidity, and ability to serve institutional investors. However, hybrid models combining centralized liquidity provision with decentralized settlement are emerging as potential solutions that balance regulatory requirements with blockchain’s self-custody principles.

Why Crypto Exchanges Are Critical for Tokenized Assets

Tokenized assets derive much of their value from liquidity, and crypto exchanges provide the marketplace infrastructure essential for creating that liquidity. Without exchanges, token holders would need to find counterparties manually through over-the-counter transactions, limiting trading activity and price discovery. Exchanges aggregate supply and demand, creating visible order books that establish market prices and enable instant execution of trades.

Beyond basic trading functionality, crypto exchanges provide essential services that legitimize tokenized assets as investment vehicles. They conduct due diligence on listed assets, implement compliance controls to prevent illicit activity, offer custody solutions that institutional investors require, and create trading interfaces accessible to both retail and professional participants. This infrastructure transforms novel blockchain tokens into credible investment products that can compete for capital against traditional financial assets.

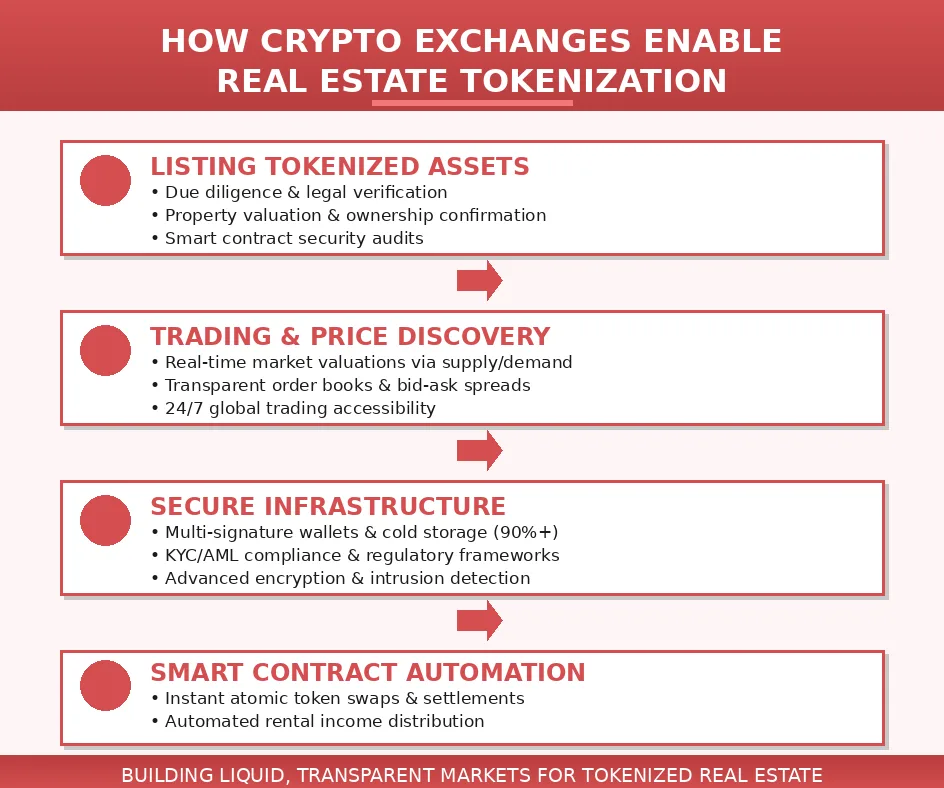

How Crypto Exchanges Enable Real Estate Tokenization

Listing Tokenized Real Estate Assets on Exchanges

The listing process begins when property tokenization platforms complete the legal structuring, token creation, and initial distribution of real estate tokens. These platforms then approach crypto exchanges to list their tokens for secondary market trading. Exchanges conduct extensive due diligence, reviewing legal opinions confirming token holder rights, verifying property ownership and valuation, assessing smart contract security, and ensuring regulatory compliance in relevant jurisdictions.

During our years of facilitating exchange listings, we have learned that successful applications require comprehensive documentation including legal structure diagrams, property appraisals, token economic models, and regulatory compliance attestations. Exchanges evaluate whether the tokenized asset meets their listing standards for legitimacy, investor protection, and market viability. Once approved, tokens receive trading pairs against major cryptocurrencies or stablecoins, enabling investors to acquire real estate exposure through the exchange platform.

Token Trading and Price Discovery

Token trading on crypto exchanges enables continuous price discovery through the interaction of supply and demand. Unlike traditional real estate where prices are established through infrequent transactions and appraisal estimates, tokenized properties have real-time market valuations reflecting current investor sentiment. Buyers place bids indicating their willingness to purchase tokens at specific prices, while sellers post asks representing their minimum acceptable sale prices. When bids and asks overlap, trades execute at the agreed price.

This market-based pricing provides several advantages over traditional valuation methods. Investors can observe bid-ask spreads to gauge market liquidity and pricing confidence. Large price movements or trading volume spikes may indicate changing perceptions about property value, local market conditions, or broader real estate trends. The availability of historical price charts allows technical analysis and helps investors make informed decisions about entry and exit timing.

Secure Infrastructure and Security Mechanisms

Crypto exchanges implement multi-layered security architectures to protect user funds and prevent unauthorized access. These systems include cold storage solutions that keep the majority of assets offline in hardware wallets or air-gapped systems, hot wallets with minimal balances for facilitating active withdrawals, multi-signature authentication requiring multiple keys to authorize transactions, and advanced encryption protecting sensitive user data and private keys.

Operational security extends to trading system integrity through measures like distributed denial-of-service protection, intrusion detection systems, regular security audits by third-party firms, and bug bounty programs incentivizing white-hat hackers to identify vulnerabilities. Employee access controls limit internal threats, while insurance coverage provides additional protection against losses from security breaches or operational failures.

Automated Transactions Through Smart Contracts

Smart contracts enable automated execution of real estate transactions without manual intervention or intermediary coordination. When investors trade tokenized real estate on crypto exchanges, smart contracts automatically transfer tokens from seller to buyer while simultaneously transferring payment in the opposite direction. This atomic swap ensures that both parties receive their expected assets or the entire transaction is reversed, eliminating counterparty risk inherent in traditional settlement processes.

Beyond simple ownership transfers, smart contracts automate ongoing property management functions. When rental income is deposited into the property’s blockchain address, smart contracts calculate each token holder’s proportional share based on their ownership percentage and distribute payments automatically. Similarly, when property expenses are due, smart contracts can execute payments from collected reserves according to pre-programmed schedules and authorization rules.

Tokenized Real Estate Assets Explained

What Are Tokenized Real Estate Assets

Tokenized real estate assets are digital securities representing ownership stakes in physical properties, created and managed on blockchain networks. Each token corresponds to a specific fraction of the underlying real estate, whether a single building, a portfolio of properties, or shares in a real estate development project. These digital representations carry the same economic rights as traditional ownership, including claims to rental income, property appreciation, and decision-making authority over asset management.

Real Estate Investment Tokens Structure

Real estate investment tokens can be structured as equity tokens representing ownership shares, debt tokens representing loan positions secured by property, or hybrid instruments combining features of both. Equity tokens provide holders with proportional ownership rights, entitling them to their share of rental income after expenses, appreciation when properties are sold, and voting rights on major decisions. These tokens function similarly to shares in real estate investment trusts but with enhanced liquidity and transparency through blockchain.

| Token Type | Rights Granted | Income Source | Risk Level |

|---|---|---|---|

| Equity Token | Ownership shares, voting rights | Rental income, appreciation | Higher |

| Debt Token | Fixed interest claims | Interest payments | Lower |

| Hybrid Token | Combined equity and debt features | Base interest plus profit participation | Moderate |

| Income Token | Revenue share only | Rental distributions | Moderate |

Digital Ownership and Ownership Rights

Digital ownership through tokenization provides legally enforceable rights that are encoded in smart contracts and backed by traditional legal agreements. Token holders possess provable ownership that can be verified on the blockchain without requiring permission from central authorities. This ownership includes economic rights to property income and appreciation, governance rights to vote on major decisions, and transfer rights to sell or gift tokens to other parties subject to any regulatory restrictions.

How Asset Value is Reflected in Tokens

Tokens reflect underlying asset value through their proportional representation of property equity. If a property is valued at ten million dollars and one million tokens are issued, each token theoretically represents ten dollars of property value. However, actual token prices on crypto exchanges may trade at premiums or discounts to this calculated value based on market dynamics, liquidity conditions, and investor sentiment.

Fractional Ownership: Lowering Entry Barriers

Meaning of Fractional Ownership

Fractional ownership allows multiple investors to own portions of a single asset that would be prohibitively expensive for individuals to acquire entirely. In real estate, this concept enables investors to purchase specific percentages of properties rather than needing capital for complete acquisitions. A luxury apartment building worth fifty million dollars can be divided into tokens representing tiny fractions of ownership, making premium real estate accessible to investors with modest capital.

How Crypto Exchanges Support Fractional Ownership

Crypto exchanges make fractional ownership practical by providing liquid markets where small token quantities can be traded efficiently. Traditional fractional ownership schemes often require minimum investments of tens of thousands of dollars and restrict transfers to approved buyers. Exchanges eliminate these barriers by allowing investors to purchase single tokens worth hundreds or even tens of dollars, creating true micro-ownership opportunities.

Benefits for Retail and Institutional Investors

Retail investors gain unprecedented access to institutional-quality real estate through fractional tokenization. Properties that previously required accredited investor status or million-dollar minimum investments become available to anyone with a few hundred dollars and an exchange account. This democratization allows ordinary investors to build diversified real estate portfolios, generate passive income from rental distributions, and potentially benefit from property appreciation across global markets.

Institutional investors benefit from fractional ownership through improved capital deployment flexibility. Rather than committing hundreds of millions to single large properties, institutions can allocate capital across dozens of tokenized assets, fine-tuning portfolio composition at granular levels. Fractional positions allow institutions to access markets or property types where suitable large-scale opportunities are scarce.

Comparison with Traditional Real Estate Investment

Traditional real estate investment requires substantial capital, local market expertise, and tolerance for illiquidity and concentration risk. Investors must typically commit hundreds of thousands of dollars to single properties, accept holding periods measured in years, and manage the complexities of property ownership including maintenance, tenant relationships, and regulatory compliance. Exit options are limited to finding buyers willing to purchase entire properties, a process that can take months or fail entirely in difficult market conditions.

Fractional ownership through tokenization transforms these dynamics. Entry barriers drop from six or seven figures to potentially hundreds of dollars. Geographic limitations disappear as investors access global real estate markets through exchange platforms. Management responsibilities are handled by professional property managers while token holders receive income distributions automatically. Liquidity improves dramatically with secondary markets enabling exits within hours rather than months. Portfolio diversification becomes achievable across multiple properties, markets, and investment strategies.

Liquidity Creation Through Secondary Markets

Liquidity Challenges in Traditional Real Estate

Real estate is historically one of the least liquid asset classes, with transactions requiring extensive time, high costs, and uncertain outcomes. Property sales involve months of marketing, negotiations, due diligence, financing arrangements, and legal processes before closing. During this extended timeline, market conditions may change, buyers may withdraw, or financing may fall through, creating significant execution risk and preventing investors from quickly adjusting portfolio allocations or accessing capital.

Role of Secondary Markets in Tokenized Real Estate

Secondary markets on crypto exchanges fundamentally solve real estate’s liquidity problem by creating continuous trading venues where token holders can exit positions without requiring property sales. After initial token distribution, these tokens trade freely among investors on exchange platforms, with prices determined by supply and demand rather than property transaction timelines. An investor holding tokens can list them for sale and potentially find buyers within hours, transforming an illiquid asset into a relatively liquid investment.

Secondary Market for Real Estate Tokens

The secondary market for real estate tokens operates similarly to equity markets, with continuous price quotes, limit and market orders, and visible order books showing supply and demand at various price levels. Market makers may provide liquidity by maintaining buy and sell quotes, narrowing spreads and ensuring tokens can be traded even during periods of lower activity. Trading activity generates valuable market data including price trends, volume patterns, and volatility metrics that help investors make informed decisions.

Faster Exit Options for Investors

Token holders can exit positions through simple exchange sales that execute within minutes once buyers are matched. This speed contrasts dramatically with traditional real estate exits requiring marketing properties, negotiating terms, conducting inspections, arranging financing, and navigating closing processes. Even in situations where token liquidity is limited, investors can typically find buyers within days or weeks rather than the months required for property sales.

Smart Contracts Powering Real Estate Transactions

What Are Smart Contracts

Smart contracts are self-executing programs stored on blockchain networks that automatically enforce agreement terms when predefined conditions are met. Unlike traditional contracts requiring lawyers, courts, or intermediaries to interpret and enforce provisions, smart contracts execute deterministically based on code logic and blockchain state. When triggering conditions occur, such as payment receipt or date passage, smart contracts automatically perform specified actions without requiring human intervention or discretionary judgment.

Smart Contracts in Real Estate Transactions

Real estate transactions via smart contracts occur through atomic exchanges where token transfers and payments happen simultaneously in single blockchain transactions. When a buyer purchases tokens on an exchange, the smart contract verifies the buyer has sufficient funds, confirms the seller owns the tokens being sold, and executes the exchange only if both conditions are satisfied. This eliminates settlement risk where one party might fail to deliver after receiving consideration from the counterparty.

| Transaction Phase | Traditional Process | Smart Contract Process | Time Saved |

|---|---|---|---|

| Agreement | Negotiate terms, draft contracts, legal review | Review token terms, submit order | Days to weeks |

| Due Diligence | Inspections, title search, appraisal | Review blockchain records, property docs | Weeks |

| Financing | Loan application, underwriting, approval | Fund exchange account | Weeks to months |

| Closing | Title transfer, escrow, recording | Automatic token transfer | Days to weeks |

| Settlement | Payment processing, fee distribution | Atomic payment and token swap | Instant |

Rental Income Distribution via Smart Contracts

Smart contracts revolutionize rental income distribution by automating calculations and payments that traditionally require property managers, accountants, and payment processing systems. When rental payments are received at the property’s blockchain address, smart contracts immediately calculate each token holder’s proportional share based on their ownership percentage. The contracts then execute distribution transactions sending appropriate amounts to each holder’s wallet without manual intervention or processing delays.

Reducing Fraud and Intermediaries

Smart contracts reduce fraud by eliminating opportunities for manipulation that exist when humans control transaction execution. Traditional real estate transactions involve trusting title companies, escrow agents, and attorneys to handle funds and documents appropriately. Smart contracts execute automatically based on blockchain state, removing discretionary control that bad actors could exploit. The transparency of smart contract code and execution allows participants to verify proper operation without trusting intermediaries.

Security, Transparency, and Immutability

Security Mechanisms in Crypto Exchanges

Crypto exchanges implement comprehensive security frameworks protecting user funds, personal information, and trading systems from various threat vectors. Multi-signature wallet technology requires multiple authorized parties to approve withdrawals, preventing single points of failure or insider theft. Hardware security modules store private keys in tamper-resistant devices that physically protect cryptographic material. Regular penetration testing by security firms identifies vulnerabilities before attackers can exploit them.

Transparency in Transaction Records

Blockchain’s transparent transaction records provide unprecedented visibility into real estate ownership and financial flows. Every token transfer, income distribution, and governance vote is permanently recorded on public ledgers that anyone can audit. Investors can trace complete ownership histories, verify that income distributions match property financials, and monitor trading activity to detect manipulation or insider trading patterns.

Immutability and Tamper-Proof Ownership Data

Immutability means that once transactions are recorded on the blockchain, they cannot be altered or deleted, creating permanent ownership records resistant to fraud and manipulation. Traditional property records can be forged, lost, or destroyed, creating disputes about rightful ownership. Blockchain’s cryptographic linking of blocks makes retroactive changes computationally infeasible, providing certainty that ownership records accurately reflect historical transactions.

Investor Trust in Blockchain Systems

Investor trust in blockchain systems builds from the technology’s mathematical foundations rather than reliance on institutions or individuals. Cryptographic proofs replace trust in intermediaries, consensus mechanisms ensure agreement on transaction validity, and open-source code allows independent verification of system operation. These technical features create trustless systems where participants can transact confidently without knowing or trusting counterparties.

Regulatory Compliance and Legal Frameworks

Why Regulatory Compliance Matters

Regulatory compliance ensures tokenized real estate operates within legal boundaries, protecting both investors and ecosystem participants from enforcement actions, fraud, and market manipulation. Securities regulations in most jurisdictions classify real estate tokens as securities requiring registration or exemption qualifications, issuer disclosure obligations, and investor protection measures. Failing to comply with these requirements can result in severe penalties including fines, trading suspensions, and criminal charges against project operators.

Legal Frameworks for Tokenized Assets

Legal frameworks for tokenized assets vary significantly across jurisdictions, creating complex compliance challenges for global platforms. In the United States, the Securities and Exchange Commission applies existing securities laws to token offerings, requiring registration or exemptions like Regulation D for accredited investors or Regulation A for broader public offerings with lower dollar limits. European Union member states implement Markets in Crypto-Assets regulations providing comprehensive frameworks specifically designed for digital assets.

KYC and AML on Crypto Exchanges

Know Your Customer and Anti-Money Laundering protocols are fundamental compliance requirements for crypto exchanges facilitating tokenized real estate trading. KYC processes verify user identities through government-issued identification, address confirmation, and biometric validation, ensuring exchanges know who is trading on their platforms. This information allows exchanges to screen users against sanctions lists, prevent account creation by prohibited individuals, and provide records to authorities investigating financial crimes.

Cross-Border Compliance Challenges

Cross-border compliance presents significant challenges because tokenized real estate platforms often serve global investor bases while legal requirements vary by jurisdiction. A platform listing tokens representing properties in one country must comply with securities laws where properties are located, where tokens are offered, where the platform operates, and where investors reside. This multiplicity creates complex compliance matrixes requiring legal expertise across numerous jurisdictions.

Global Access to Real Estate Investment

Breaking Geographical Barriers

Traditional real estate investment is inherently local, requiring physical presence, local market knowledge, and relationships with regional service providers. International real estate investment faces additional barriers including currency exchange risks, unfamiliar legal systems, foreign ownership restrictions, and difficulties managing properties across borders. These challenges have historically limited most investors to properties in their immediate geographic areas, preventing diversification across global markets.

Tokenization eliminates geographical barriers by enabling digital ownership that transcends physical location. An investor in Asia can own fractions of commercial properties in Europe, residential buildings in South America, and industrial facilities in North America through simple token purchases on crypto exchanges. Property management remains local with professional operators handling day-to-day responsibilities, while token holders receive their proportional returns regardless of where they reside.

Global Access Through Digital Ownership

Digital ownership enables global access by converting property rights into tradable tokens accessible through internet-connected devices from anywhere in the world. Investors no longer need to travel to property locations, establish local banking relationships, or navigate foreign legal systems to acquire real estate exposure. Instead, they can research properties through online platforms, purchase tokens through crypto exchanges, and manage their holdings through digital wallets and portfolio tracking tools.

Crypto Exchanges Enabling International Participation

Crypto exchanges serve as global marketplaces connecting investors worldwide with tokenized real estate opportunities. These platforms aggregate supply from multiple properties and geographies while matching it with demand from diverse international investor bases. Exchange infrastructure handles currency conversions, regulatory compliance across jurisdictions, and technical integration with various blockchain networks, making international participation seamless for users.

Democratization of Real Estate Investment

Democratization means making real estate investment accessible to ordinary people rather than reserving it for wealthy individuals and institutions. Tokenization combined with crypto exchange infrastructure achieves this democratization through multiple mechanisms including fractional ownership reducing minimum investments, digital access eliminating geographic barriers, automated processes lowering transaction costs, and transparent markets providing equal information access to all participants.

Role of Institutional Investors

Why Institutional Investors Are Entering Tokenized Real Estate

Institutional investors including pension funds, endowments, insurance companies, and asset managers are increasingly exploring tokenized real estate for several strategic reasons. Enhanced liquidity through secondary markets allows institutions to adjust portfolio allocations more dynamically than traditional real estate permits. Fractional ownership enables precise position sizing and exposure management impossible with whole property acquisitions. Blockchain transparency provides superior due diligence and ongoing monitoring capabilities compared to traditional real estate structures.

Crypto Exchanges as Trusted Platforms

Institutional investors require exchange platforms meeting stringent standards for security, regulatory compliance, operational reliability, and financial controls. Leading crypto exchanges have invested heavily in institutional-grade infrastructure including segregated custody solutions, enhanced security protocols exceeding retail requirements, dedicated account management teams, and integration capabilities with existing portfolio management and accounting systems used by institutions.

Market Maturity and Credibility

Institutional participation brings market maturity by introducing professional investment processes, sophisticated risk management, and long-term capital commitments. Institutions conduct rigorous due diligence on tokenized assets, demanding high-quality property management, credible valuations, and strong legal structures. This scrutiny raises standards across the ecosystem, benefiting all participants through improved quality and reduced fraud risk.

Impact on Liquidity and Valuation

Institutional investor participation significantly enhances market liquidity by providing large pools of capital available for token purchases and deep pockets willing to take the opposite side of retail trades. Institutions often serve as market stabilizers, purchasing tokens during panic selling and providing liquidity when retail investors want to exit. This stabilization reduces volatility and creates more orderly markets where prices reflect fundamental values rather than temporary supply-demand imbalances.

Property Tokenization Platforms and Exchanges

Difference Between Tokenization Platforms and Exchanges

Property tokenization platforms and crypto exchanges serve distinct but complementary functions in the tokenized real estate ecosystem. Tokenization platforms specialize in converting physical real estate into digital tokens, handling legal structuring, asset valuation, regulatory compliance for token issuance, and initial token distribution. These platforms work with property owners, legal advisors, and technical teams to create token offerings that accurately represent ownership rights and comply with securities regulations.

Crypto exchanges provide marketplace infrastructure where previously created tokens trade among investors. Exchanges do not typically create tokens themselves but instead list tokens created by tokenization platforms, operate trading systems matching buyers and sellers, provide custody services for token storage, and implement compliance controls for secondary market trading. The distinction parallels traditional finance where investment banks underwrite securities while stock exchanges provide trading venues.

Property Tokenization Platforms Overview

Property tokenization platforms offer end-to-end services transforming traditional real estate into blockchain-based investment products. These platforms begin by working with property owners to establish legal structures, typically special purpose vehicles holding properties and issuing tokens representing equity or debt positions. They coordinate property appraisals establishing fair market values, conduct legal reviews ensuring token structures comply with securities regulations, and develop offering documents disclosing material information to prospective investors.

Integration with Crypto Exchanges

Successful integration between tokenization platforms and crypto exchanges requires technical, legal, and operational coordination. Technically, tokens must be created on blockchain networks supported by target exchanges using compatible token standards enabling seamless trading. Legal integration involves ensuring token structures meet exchange listing requirements, regulatory compliance in relevant jurisdictions, and disclosure standards protecting investors.

End-to-End Token Lifecycle

The complete token lifecycle spans from property acquisition through tokenization, initial distribution, secondary market trading, ongoing operations, and eventual exit or redemption. Understanding this lifecycle helps investors and operators manage expectations and plan for various phases.

| Lifecycle Stage | Key Activities | Primary Participants | Timeline |

|---|---|---|---|

| Property Acquisition | Purchase property, establish legal structure | Property owner, tokenization platform | 1 to 3 months |

| Tokenization | Create tokens, develop smart contracts, regulatory compliance | Tokenization platform, legal advisors, developers | 2 to 4 months |

| Initial Distribution | Market offering, sell tokens to investors | Tokenization platform, initial investors | 1 to 6 months |

| Exchange Listing | Due diligence, approve listing, begin trading | Crypto exchange, tokenization platform | 1 to 3 months |

| Secondary Trading | Token trading, price discovery, liquidity provision | Token holders, crypto exchange, market makers | Ongoing |

| Operations | Property management, income distribution, reporting | Property managers, tokenization platform | Ongoing |

| Exit or Redemption | Property sale, distribute proceeds, token retirement | Token holders, property owner, tokenization platform | 1 to 6 months |

Challenges in Real Estate Tokenization

Regulatory Uncertainty

Regulatory uncertainty remains one of the most significant obstacles to widespread real estate tokenization adoption. Legal frameworks are still evolving, with many jurisdictions lacking clear guidance on how existing securities laws apply to tokenized assets. Regulatory agencies may change positions, issue new interpretations, or implement additional requirements that could impact existing token offerings and trading platforms. This uncertainty creates compliance risks and makes long-term planning difficult for ecosystem participants.

Market Adoption Issues

Market adoption faces barriers from unfamiliarity with blockchain technology, concerns about security and fraud, and preference for traditional investment methods. Many potential investors lack understanding of how tokens represent ownership, how to use crypto wallets and exchanges, or how to evaluate tokenized real estate opportunities. This knowledge gap limits participation to early adopters and technology enthusiasts, preventing mainstream adoption.

Liquidity Limitations in Early Stages

Despite tokenization’s promise of enhanced liquidity, early-stage markets often suffer from low trading volumes and wide bid-ask spreads that limit practical liquidity. Without sufficient participants, token holders may struggle to find buyers at acceptable prices or to execute large trades without significant market impact. This liquidity constraint undermines one of tokenization’s primary value propositions and may discourage participation.

Technical and Security Risks

Technical risks include smart contract vulnerabilities that could be exploited to steal funds or manipulate ownership records, blockchain network failures or congestion preventing transactions, wallet security issues compromising private keys, and integration problems between different system components. These risks are inherent to any blockchain-based system and require careful management through security audits, redundant systems, and conservative technical design.

Explore Tokenized Real Estate Trading on Crypto Exchanges

Learn how crypto exchanges enable real estate token trading

Future of Real Estate Tokenization via Crypto Exchanges

Growth of Tokenized Assets Market

The tokenized assets market is projected to experience substantial growth over the coming decade as technology matures, regulations clarify, and adoption increases. Industry analysts forecast tokenized real estate could reach trillions of dollars in value as more properties are converted to blockchain-based ownership structures. This growth will be driven by demonstrated benefits including enhanced liquidity, reduced transaction costs, improved transparency, and expanded investor access that address real pain points in traditional real estate markets.

Evolution of Crypto Exchanges

Crypto exchanges will continue evolving to better serve tokenized real estate markets through specialized features and infrastructure improvements. Future exchanges may offer real estate-specific trading interfaces displaying property details, location maps, financial metrics, and comparable market data alongside standard trading information. They might integrate property management tools allowing token holders to monitor operations, vote on decisions, and communicate with managers directly through exchange platforms.

Institutional Adoption Trends

Institutional adoption is expected to accelerate as regulatory clarity improves, market infrastructure matures, and successful case studies demonstrate viability. Major asset managers are already piloting tokenized real estate programs, testing technology and processes with small allocations before potentially scaling to larger commitments. Pension funds and endowments are conducting research and due diligence, preparing for potential allocations pending regulatory approval and board acceptance.

Long-Term Impact on Real Estate Transactions

Real estate transactions could be fundamentally transformed over the long term as tokenization becomes mainstream rather than niche. Property sales might routinely involve token transfers settled in minutes rather than lengthy closing processes. Ownership could be continuously divisible and tradable, with properties having constant real-time valuations based on market prices rather than periodic appraisals. Income distribution might occur automatically and instantaneously rather than through quarterly or annual processes.

Why Crypto Exchanges Are the Backbone of Tokenized Real Estate

Summary of Benefits

Crypto exchanges provide indispensable infrastructure making real estate tokenization practical and valuable for investors and property owners. They create liquid secondary markets transforming illiquid property interests into tradable digital securities. They implement security mechanisms protecting user funds and preventing fraud. They facilitate global access connecting investors worldwide with tokenized real estate opportunities. They enable price discovery through continuous trading that establishes fair market values. They automate processes through smart contract integration reducing costs and improving efficiency.

Crypto Exchanges as Liquidity Engines

The liquidity that crypto exchanges provide represents perhaps their most valuable contribution to tokenized real estate. By aggregating supply and demand from global participant bases, exchanges create markets where tokens can be bought and sold continuously at transparent prices. This liquidity addresses real estate’s historic weakness as an asset class, enabling investors to adjust positions based on changing circumstances rather than being locked into multi-year holding periods.

Secure and Scalable Infrastructure

Crypto exchanges provide battle-tested infrastructure capable of handling billions in daily transaction volumes while maintaining high security standards. Their technology stacks combine hot and cold wallet systems, multi-signature authentication, advanced encryption, intrusion detection, and distributed denial-of-service protection creating multi-layered security architectures. These systems protect user funds against various attack vectors while enabling the high-performance trading required for liquid markets.

Future Outlook

The future of crypto exchanges in real estate tokenization appears promising as multiple positive trends converge. Regulatory frameworks are gradually clarifying, reducing uncertainty that has limited participation. Technology continues improving with more capable blockchain networks, more sophisticated smart contracts, and better user interfaces. Market acceptance grows as successful projects demonstrate benefits and build track records of delivering returns to investors.

Based on our eight years working in this ecosystem, we believe crypto exchanges will remain central to real estate tokenization’s success. Their infrastructure, liquidity provision, regulatory compliance, and market-building functions address fundamental challenges that have limited real estate investment accessibility. As these platforms continue evolving and improving, they will enable the vision of liquid, transparent, globally accessible real estate markets serving investors and property owners more effectively than traditional systems.

Frequently Asked Questions

Real estate tokenization is the process of converting ownership rights in physical property into digital tokens on a blockchain. These tokens represent fractional ownership shares that can be bought, sold, and traded on crypto exchanges. The process involves creating smart contracts that encode property rights, issuing tokens that represent specific ownership percentages, and enabling investors to purchase these tokens through secure blockchain platforms.

Crypto exchanges provide the critical infrastructure for listing, trading, and managing tokenized real estate assets. They enable price discovery through market mechanisms, offer secure custody solutions for digital ownership certificates, and create secondary markets where investors can exit positions without traditional real estate sale timelines. Exchanges also implement regulatory compliance features like KYC and AML protocols to ensure legal trading of property tokens.

Fractional ownership through tokenization dramatically lowers entry barriers, allowing investors to participate in high-value real estate markets with minimal capital. Instead of requiring hundreds of thousands of dollars for a single property, investors can purchase tokens representing small percentages of ownership. This democratizes access to premium real estate, enables portfolio diversification across multiple properties, and provides liquidity options through secondary market trading that traditional real estate ownership cannot offer.

Tokenized real estate investments leverage blockchain technology’s inherent security features including immutability, transparency, and cryptographic protection. Ownership records cannot be altered retroactively, all transactions are permanently recorded on distributed ledgers, and smart contracts execute automatically without human intervention risks. However, investors should evaluate the security practices of specific crypto exchanges, verify regulatory compliance, and understand that technology risks, market volatility, and regulatory uncertainty still exist in this emerging sector.

Blockchain technology eliminates intermediaries, reduces transaction costs, and accelerates settlement times in real estate deals. Traditional property transactions require title companies, escrow services, and extensive paperwork that can take weeks or months to complete. Blockchain based assets enable instant verification of ownership, automated execution of contract terms through smart contracts, and transparent record-keeping that all parties can access. This streamlines processes, minimizes fraud risks, and creates efficiency gains throughout the transaction lifecycle.

Smart contracts are self-executing programs that automatically enforce the terms of real estate agreements without requiring intermediaries. They manage token issuance, distribute rental income to token holders proportionally, handle ownership transfers when tokens are traded, and ensure compliance with predefined rules. Smart contracts reduce administrative overhead, eliminate human error, and provide transparent execution of property-related obligations that all stakeholders can verify on the blockchain.

Tokenized real estate significantly expands global access to property investment, but regulatory compliance requirements vary by jurisdiction. While blockchain technology enables borderless transactions, investors must still meet specific legal requirements including identity verification, accreditation standards in some markets, and adherence to local securities regulations. Crypto exchanges implement geographic restrictions based on regulatory frameworks, meaning global access depends on both the platform’s licensing and the investor’s location and qualification status.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.