A next-gen AI-powered crypto exchange development company building high-performance, low-latency trading platforms for secure, scalable, and high-volume crypto trading.

From centralized and decentralized to AI-driven and NFT exchanges, we develop custom crypto trading platforms designed for speed, security, and a seamless user experience. Our crypto exchange development services provide everything you need to succeed in the crypto market.

We build high-performance centralized crypto exchange platforms designed for speed, security, and scalability. Our exchanges include an ultra-fast matching engine capable of handling high-volume trades with minimal latency. We integrate multi-fiat on-ramp and off-ramp systems, bank-grade security, liquidity management, and deep wallet infrastructure. Full KYC/AML compliance, advanced risk control, and regulatory-ready features ensure safe and legally compliant operations. With a clean UI, powerful admin panel, and enterprise-grade APIs, we deliver exchanges ready for global deployment.

As a leading crypto exchange development company, we provide cryptocurrency exchange solutions with advanced features for both users and admins. From trading tools and staking to liquidity and compliance management, our platform ensures a secure, scalable, and efficient trading experience.

Certified Crypto Specialists

Platforms Launched Globally

Years of Experiance

Global Clients

To succeed, your platform must handle high traffic and adapt to future regulations. As a leading cryptocurrency exchange development company, we build these exact solutions. Our platforms, whether centralized or hybrid, are architected for peak performance, global compliance, and long-term scalawbility.

Secure hot and cold wallets ensuring fast withdrawals, offline asset storage, multi-currency support, and enterprise-grade protection for user funds.

Advanced multi-sig and MPC security architecture safeguarding assets through distributed key management and eliminating single points of failure.

Automated KYC and KYB system enabling fast identity verification, business validation, secure onboarding, and regulatory compliance across jurisdictions.

AI-powered AML and fraud detection with real-time monitoring, transaction screening, risk scoring, and proactive compliance enforcement.

Robust API trading support enabling algorithmic strategies, high-frequency execution, secure endpoints, real-time data access, and integrations.

Professional advanced charting tools with real-time price data, technical indicators, drawing tools, and multi-timeframe analysis for informed trading decisions.

High-performance order matching engine built for enterprise crypto exchange development, delivering microsecond latency, high throughput, and fair execution across markets.

Built-in referral system with commission tracking, reward automation, affiliate dashboards, and viral tools for organic user acquisition.

Cross-platform mobile app support for iOS and Android delivering secure trading, wallet access, biometric security, and push notifications.

We are more than just a crypto exchange development company; we are your strategic technology partner. We architect Smart and Secure trading platforms designed not just for transactions, but for long-term growth and market leadership. Let us build the foundation for your success in the digital asset economy.

We don’t just develop, we accelerate. Our agile crypto exchange development services help you launch faster without compromising performance or security. We ensure your platform enters the market early and scales seamlessly.

Every business is unique, and so should be your exchange. Our crypto exchange platform development experts create customized trading engines, APIs, and liquidity modules tailored to your goals, ensuring a seamless and engaging trading experience for your users.

Security lies at the core of every cryptocurrency exchange development project we deliver. We integrate cold wallet storage, DDoS protection, encryption layers, and compliance checks, ensuring your users and digital assets remain safe from every potential threat.

From strategy to post-launch support, Nadcab Labs stands as a trusted crypto exchange development company offering end-to-end solutions. Our dedicated experts build exchanges that are fast, compliant, and future-ready for global cryptocurrency markets.

AML & Fraud Detection

Two-Factor Authentication (2FA)

HTTPS / SSL Encryption

Jail Login / Account Lockout

End-to-End Data Encryption

SSRF & CSRF Prevention

SQL Injection

Hot & Cold Wallet Integration

KYC / KYB Compliance

Anti-DDoS / Anti-Denial-of-Service

Biometric Authentication

Real-Time Monitoring & Alerts

Escrow System

Hardware Security Module (HSM) Integration

Multi-Signature / MPC Security

Smart Contract Audit & Verification

Experience how an exchange built for everyday traders performs in live markets. You get faster trades, stronger security, and a smooth interface that supports consistent growth. Each real-world example shows how these exchanges help users trade with confidence and reliability.

Explore how Rubic developed a multi-chain crypto exchange, enabling secure, fast, and interoperable trading across multiple blockchain networks.

ViewOur trusted client ratings show how strongly businesses believe in our cryptocurrency exchange development services. Companies rely on us to build secure, fast, and scalable exchange platforms that meet global compliance standards. These verified reviews highlight our consistency, reliability, and the long-term value we deliver as a dependable technology partner.

We offers crypto exchange development solutions for spot, margin, and derivatives trading. Our secure, scalable platforms feature P2P trading, fiat ramps, and advanced tools, ensuring seamless global trading experiences.

Real-time spot trading with instant buy sell execution, deep liquidity, competitive fees, and secure infrastructure for global digital asset markets worldwide.

Advanced futures trading supporting perpetual contracts, leverage options, real-time risk controls, and ultra-low latency execution for professional traders worldwide.

Powerful margin trading with flexible leverage, collateral management, automated liquidation, and live monitoring to increase overall platform trading volume securely.

Institutional-grade OTC desk enabling high-volume trades, minimal slippage, and negotiated pricing delivered by an expert crypto exchange development company.

Integrated fiat on off-ramp, enabling fast deposits and withdrawals through banks and cards, ensuring frictionless onboarding and global accessibility compliance.

Global liquidity aggregation connecting exchanges and market makers to provide deep order books, tighter spreads, reduced slippage, and execution efficiency worldwide.

Automated market maker bot enhancing liquidity, stabilizing prices, tightening spreads, reducing volatility, and improving overall exchange trading efficiency.

Integrated staking and earn features enabling passive income, flexible lockups, validator support, and higher user engagement across DeFi ecosystems.

Real-time spot trading with instant buy sell execution, deep liquidity, competitive fees, and secure infrastructure for global digital asset markets worldwide.

Advanced futures trading supporting perpetual contracts, leverage options, real-time risk controls, and ultra-low latency execution for professional traders worldwide.

Nadcab Labs follows strict AML and KYC procedures, including PEP screening, Enhanced Due Diligence (EDD), and real-time transaction monitoring, to prevent money laundering, verify user identities, and maintain transparent and secure transactions across every crypto exchange platform.

Our crypto exchange solutions comply with GDPR, MiCA (EU), and PCI-DSS standards, along with Travel Rule compliance, ensuring encrypted payment processing, secure cross-exchange data sharing, strong data protection, and complete transparency for global crypto users.

We build cryptocurrency exchanges aligned with FCA (UK), MAS (Singapore), FATF, FINRA, and SEC (USA) guidelines, implementing advanced monitoring frameworks, regulatory reporting, and compliance controls that ensure legal integrity, operational resilience, and long-term trust among international investors.

We power next-generation crypto exchange development with advanced blockchain networks. At Nadcab Labs, we deliver secure and feature-rich trading platforms supporting everything from spot trading to margin trading, helping your business stay ahead in the fast-evolving digital trading era.

We integrate next-generation blockchain frameworks, automated smart contract systems, and secure backend modules to build high-performance crypto exchange platforms. Our crypto exchange development services are designed to deliver unmatched performance, reliability, and market-ready scalability

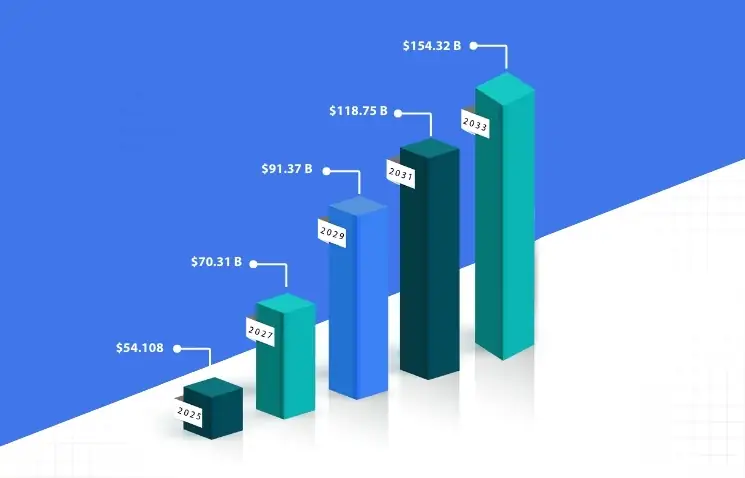

Building your own crypto exchange platform is more than a tech trend; it’s a profitable step toward long-term business growth. As global demand rises, choosing a professional cryptocurrency exchange development company like Nadcab Labs ensures you enter the market with a powerful, compliant, and scalable system.

The global crypto market is surging, projected to reach $80.9 billion by 2028 with an 14% CAGR. Launching your own exchange platform helps you capitalize on this massive growth curve.

In 2025, the average revenue per crypto user is expected to hit $54.7 billion, making crypto exchange development one of the most lucrative business models in fintech today.

Partnering with an Industry-leading cryptocurrency exchange software development company enables you to operate globally, manage high-volume transactions, and ensure smooth scalability with full regulatory readiness.

The success of a crypto exchange largely depends on factors such as government regulations, licensing requirements, taxation policies, and user adoption rates. Countries with high crypto usage and supportive regulatory frameworks offer a strong foundation for exchange growth, better liquidity, and long-term sustainability.

Top Countries with the Most Crypto Users

We develop an intelligent, AI-powered crypto trading platform that empowers Web3 startups and enterprises to automate operations, enhance security, and make smarter market decisions. With fast performance, real-time insights, and seamless automation, our software helps your business stay competitive and future-ready in today’s fast-moving crypto economy.

We begin with strategic planning to define your exchange vision, core features, user flows, and business goals. This ensures the crypto exchange development process aligns with real requirements and long-term scalability.

Create a secure, customizable Crypto Exchange platform built around your goals.

Starts From

Ready To Market Exchange

Starts Above

Advance Exchange

The cost of developing a crypto exchange is not fixed; it varies based on multiple factors. These include the type of crypto exchange, features, customizations, wallet integration, payment gateways, trading widgets, plugins, and the technology stack used. The complexity of the trading functionalities and the need for a seamless, bug-free platform also play a major role in determining the cost.

Location can influence pricing as well, as regulatory requirements and local development resources differ. We deliver high-quality, fully customized crypto exchange development services that cater to your unique business goals, ensuring performance, security, and scalability without compromise.

Nadcab Labs’ excellence in building secure, high-performance cryptocurrency exchanges has earned multiple global recognitions and industry awards a true reflection of our commitment to innovation and trust.

AI-powered crypto exchange platforms are redefining how users trade and secure digital assets. With features like automated trading bots, advanced security protocols, and real-time data analytics, these platforms create smarter, faster, and safer trading environments for users worldwide.

AI boosts accuracy with smart trade

Automation cuts errors and saves time

Real-time analytics power better trading

Predictive tools boost decisions

Smart bots ensure faster trade execution

Data-driven AI improves user experience

The development timeline typically ranges from 3 to 9 months depending on features, modules, and integrations. As a trusted cryptocurrency exchange software development company, we deliver an MVP in 12–16 weeks, while full-featured platforms take additional time for design, testing, and deployment.

Our Cryptocurrency exchange development services cost varies from $25,000 to $500,000, depending on the exchange type, trading engine complexity, security integrations, liquidity modules, and global compliance requirements.

Key security layers include cold storage, 2FA, anti-DDoS protection, encryption, KYC/AML modules, smart contract audits, and continuous transaction monitoring to safeguard user funds and maintain regulatory compliance.

A reliable exchange uses tech stack like React or Angular for the frontend, Node.js or Python for backend services, and PostgreSQL or MongoDB for databases. We integrate Web3.js, blockchain APIs, and high-speed trading engines to deliver fast and scalable platforms.

Depending on the region, you may need MSB (USA), FCA registration (UK), VASP (EU/MiCA), or local digital asset licenses. We guide you through the entire regulatory process to ensure a compliant launch.

We use modular architecture, optimized trading engines, microservices, and distributed systems to ensure your exchange can handle increasing users, large trading volumes, and peak traffic.

Yes, we offer customizable white-label crypto exchange solutions for businesses wanting a faster, cost-effective launch with essential trading and security features.

Yes. Our Cryptocurrency exchange platforms follow AML/KYC, GDPR, MiCA, FCA (UK), SEC/FINRA (USA), FATF, and MAS guidelines, ensuring global legal compliance.

The crypto market is evolving faster than ever, and Nadcab Labs provides top-level crypto exchange development services to help you stay ahead. Our team builds advanced cryptocurrency exchange platforms designed for high performance, global reach, and long-term success in a $108 trillion trading landscape.

Get a Free Consultation