Key Takeaways

- A comprehensive crypto exchange creation roadmap requires 4-12 months and involves strategic planning, technical architecture, regulatory compliance, security implementation, and market positioning across multiple phases.

- The crypto exchange creation process begins with defining clear business objectives, selecting between centralized, decentralized, or hybrid models, and establishing technical infrastructure that supports scalability and security from inception.

- Core technical components in the crypto exchange setup guide include matching engines capable of processing thousands of transactions per second, multi-currency wallet systems, KYC/AML verification modules, and admin dashboards for operational management.

- Security architecture represents the foundation of any crypto exchange step by step execution, requiring implementation of cold storage for 90-95% of funds, multi-signature wallets, SSL encryption, DDoS protection, and regular third-party security audits.

- Regulatory compliance varies significantly across jurisdictions, with licensing requirements, operational standards, and reporting obligations that must be addressed during the crypto exchange platform roadmap before launch to ensure legal operation.

- Liquidity provision through market makers, API connections to established exchanges, and strategic partnerships determines trading experience quality and directly impacts user acquisition and retention rates.

- The testing phase encompasses functional testing of all features, performance testing under high-load scenarios, security penetration testing, and user acceptance testing to identify and resolve issues before public launch.

- Post-launch support including 24/7 monitoring, rapid incident response, continuous feature updates, community management, and marketing initiatives ensures sustained growth and competitive positioning in the dynamic cryptocurrency market.

The cryptocurrency trading landscape has evolved dramatically, with digital asset exchanges becoming critical infrastructure connecting millions of users to global markets operating 24/7 across every timezone. Creating a successful crypto exchange requires navigating complex technical challenges, regulatory requirements, security considerations, and competitive market dynamics. Whether you envision building a platform serving retail traders, institutional investors, or specialized niches like derivatives or NFT trading, understanding the complete crypto exchange creation roadmap transforms this ambitious goal into achievable milestones. This comprehensive guide draws from extensive industry experience to provide actionable insights covering every phase from initial concept through post-launch operations. The journey demands careful planning, strategic decision-making, and meticulous execution across technical, legal, and business domains. Organizations and entrepreneurs entering this space must balance innovation with security, user experience with regulatory compliance, and rapid deployment with long-term scalability. The specialized expertise required spans blockchain technology, financial systems, cybersecurity, and regulatory frameworks, making the crypto exchange creation process a multidisciplinary endeavor requiring coordinated effort across diverse skill sets.

Crypto Exchange Creation Roadmap Overview

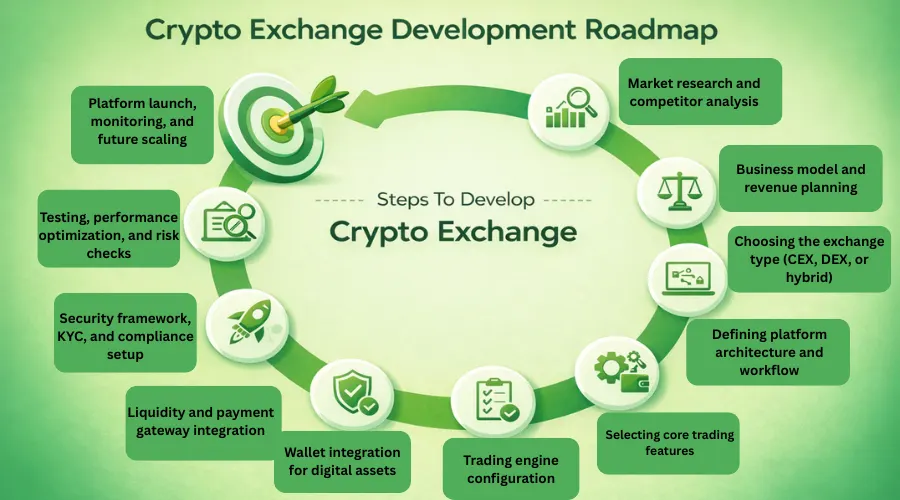

The crypto exchange creation roadmap provides a structured framework guiding the transformation from conceptual vision to operational trading platform. This roadmap encompasses distinct phases including strategic planning, technical architecture design, platform construction, security implementation, regulatory compliance, testing procedures, and launch preparation. Each phase builds upon previous accomplishments while setting foundations for subsequent stages. The roadmap serves as both a project management tool and a strategic guide, helping teams allocate resources effectively, anticipate challenges, manage dependencies, and maintain progress toward clearly defined objectives.

Understanding that exchange creation represents a significant investment of time, capital, and expertise, the roadmap approach enables realistic timeline estimation, budget planning, and risk management. Successful crypto exchange creation roadmap implementation requires acknowledging that this journey involves iterative refinement rather than linear progression. Market conditions, regulatory developments, technological advances, and competitive dynamics may necessitate adjustments to initial plans. The roadmap provides structure while maintaining flexibility to adapt to evolving circumstances. Organizations following a well-defined roadmap reduce the likelihood of costly mistakes, regulatory violations, security vulnerabilities, and market misjudgments that have derailed numerous exchange projects throughout the industry’s history.

What Is Crypto Exchange

A crypto exchange functions as a digital marketplace facilitating the buying, selling, and trading of cryptocurrencies and digital assets. These platforms serve as intermediaries connecting buyers and sellers, providing the infrastructure, liquidity, and trust mechanisms necessary for efficient price discovery and transaction execution. Crypto exchanges operate continuously, enabling global participants to trade assets regardless of geographic location or time zone. Unlike traditional stock exchanges with defined trading hours, cryptocurrency markets never close, creating unique operational and technical requirements for exchange platforms.

Modern crypto exchanges extend far beyond simple buy-sell functionality, offering sophisticated trading instruments including spot markets, futures contracts, perpetual swaps, options, margin trading, and staking services. These platforms integrate complex systems including matching engines processing thousands of orders per second, wallet infrastructure securing billions in digital assets, KYC/AML systems verifying user identities, risk management tools monitoring market conditions, and analytics dashboards providing real-time insights. The exchange ecosystem encompasses web platforms, mobile applications, API interfaces for algorithmic trading, and administrative systems for operational management. Understanding what a crypto exchange truly represents helps establish appropriate scope, resources, and expectations for the creation process.

Crypto Exchange Creation Process Explained

The crypto exchange creation process encompasses the complete sequence of activities transforming an exchange concept into a functioning, compliant, and competitive platform. This process extends beyond mere technical construction to include market research, business planning, regulatory strategy, team assembly, technology selection, security architecture, user experience design, liquidity arrangement, marketing preparation, and operational infrastructure establishment. Each element contributes to the exchange’s potential for success in an increasingly competitive and sophisticated market.

How to create a crypto exchange effectively requires understanding that this process involves parallel workstreams rather than strictly sequential steps. While certain activities naturally precede others, numerous tasks can proceed simultaneously with proper coordination. For example, regulatory consultation can occur while technical architecture is being designed, and liquidity partnerships can be established while the platform is under construction. The creation process typically spans 6-12 months for comprehensive exchanges, though timelines vary based on complexity, resource availability, regulatory requirements, and whether organizations utilize white-label solutions versus custom builds. Success depends on maintaining clear communication across teams, adhering to quality standards, managing scope carefully, and remaining responsive to emerging challenges throughout the journey.

Planning the Crypto Exchange Creation Process

Comprehensive planning establishes the foundation for successful crypto exchange creation, determining strategic direction, resource allocation, and operational approach. The planning phase involves market analysis identifying target users, competitive positioning, and unique value propositions that differentiate your exchange. This analysis examines existing platforms, identifies underserved market segments, evaluates geographic opportunities, and assesses potential competitive advantages. Planning also addresses fundamental business model questions including revenue streams, fee structures, supported assets, and geographic focus.

Technical planning decisions made during this phase have lasting implications for platform capabilities, scalability, and operational costs. Teams must determine technology stacks, infrastructure requirements, third-party service integrations, and architectural patterns balancing performance, security, and maintainability. Financial planning establishes budgets covering initial creation costs and ongoing operational expenses including infrastructure, personnel, compliance, marketing, and liquidity provision. Risk planning identifies potential challenges across technical, regulatory, market, and operational dimensions, developing mitigation strategies and contingency plans. Comprehensive planning documentation serves as a reference point throughout the creation process, helping teams maintain focus on core objectives while managing the inevitable complexity of exchange construction.

Defining Goals for Crypto Exchange Creation

Clear goal definition provides direction and measurable success criteria for the crypto exchange creation process. Goals should address multiple dimensions including user acquisition targets, trading volume objectives, revenue projections, geographic expansion plans, and feature roadmaps. Specific goals might include achieving 10,000 active users within six months, processing $100 million in monthly trading volume within the first year, or securing regulatory approval in three target jurisdictions. These concrete targets enable progress tracking and inform resource allocation decisions.

Beyond quantitative metrics, qualitative goals shape the exchange’s character and competitive positioning. These might include establishing reputation for superior security, providing the most user-friendly interface in your market segment, offering the lowest fees for specific trading pairs, or becoming the preferred platform for institutional traders. Goals should be ambitious yet achievable, specific rather than vague, measurable to enable tracking, and time-bound to create urgency. Well-defined goals align teams around shared objectives, facilitate decision-making when trade-offs arise, and provide motivation throughout the challenging creation process. Regularly reviewing and adjusting goals based on market feedback and changing conditions ensures the exchange remains responsive to reality while maintaining strategic focus.

Choosing the Right Model for Crypto Exchange Creation

Selecting the appropriate exchange model represents one of the most consequential decisions in the crypto exchange setup guide, fundamentally shaping platform architecture, user experience, regulatory requirements, and competitive positioning. The primary models include centralized exchanges (CEX) where the platform controls user funds and facilitates trades through an order book, decentralized exchanges (DEX) enabling peer-to-peer trading through smart contracts without custodial control, and hybrid models combining elements of both approaches. Each model presents distinct advantages, challenges, and suitability for different market segments and business objectives.

Selection Principle: The exchange model decision should align with your target market’s preferences, technical capabilities, regulatory environment, and long-term vision. Centralized models suit mainstream users prioritizing convenience and liquidity, decentralized models appeal to privacy-conscious users valuing self-custody, while hybrid models attempt to balance benefits of both approaches.

Centralized exchanges dominate trading volume and user numbers due to superior liquidity, faster transaction speeds, user-friendly interfaces, and ability to offer advanced features like margin trading and fiat on-ramps. However, they face greater regulatory scrutiny, require robust security infrastructure to protect custodied funds, and must build user trust regarding fund safety. Decentralized exchanges provide enhanced security through non-custodial architecture, greater privacy, and censorship resistance, but typically suffer from lower liquidity, more complex user experiences, and limited feature sets. Hybrid models seek to combine centralized efficiency with decentralized security but introduce technical complexity. Your choice should reflect realistic assessment of your team’s capabilities, target market preferences, competitive landscape, and available resources for ongoing operations.

Technical Structure in Crypto Exchange Creation Process

The technical structure forms the backbone enabling all exchange functionality, user interactions, and operational processes. This architecture must balance multiple competing demands including performance under high load, security against sophisticated threats, scalability to accommodate growth, reliability ensuring continuous operation, and maintainability allowing ongoing improvements. The technical structure typically follows a modular architecture separating concerns across distinct components that communicate through well-defined interfaces, enabling independent scaling and updates while maintaining system integrity.

Modern crypto exchange architecture commonly employs microservices patterns where discrete services handle specific functions like user authentication, order matching, wallet operations, KYC verification, and reporting. This approach enables horizontal scaling of individual components based on demand, facilitates technology diversity allowing optimal tools for specific tasks, and improves fault isolation preventing failures from cascading across the entire system. The technical structure encompasses frontend applications providing user interfaces across web and mobile platforms, backend services implementing business logic and data management, databases storing user information and transaction records, caching layers improving performance, message queues managing asynchronous operations, and external integrations connecting to blockchain networks, payment processors, and third-party services. Careful architectural planning during the creation process prevents costly refactoring later when changing fundamental structures becomes exponentially more difficult.

Core Components in Crypto Exchange Creation

Core components represent the essential building blocks that must exist for the exchange to function. The matching engine stands as arguably the most critical component, responsible for pairing buy and sell orders efficiently, calculating trade prices, and executing transactions at high speed. Advanced matching engines process thousands of orders per second while maintaining fairness through time-priority or pro-rata algorithms. The wallet system manages user deposits, withdrawals, and balances across multiple cryptocurrencies, implementing hot wallets for operational liquidity and cold storage for the majority of funds to minimize security exposure.

The user management system handles registration, authentication, authorization, and profile management, implementing robust security measures including two-factor authentication and session management. The KYC/AML module verifies user identities through document verification, facial recognition, and ongoing monitoring to comply with regulatory requirements. The order management system tracks all orders throughout their lifecycle from placement through execution or cancellation, maintaining detailed audit trails. The liquidity management system monitors available liquidity across trading pairs, interfaces with market makers, and may connect to external liquidity sources. The admin dashboard provides operational staff with tools for user support, fraud detection, system monitoring, and business intelligence. Each component must be built to enterprise standards for reliability, security, and performance while integrating seamlessly with other system elements.

Platform Flow in Crypto Exchange Creation

Understanding platform flow illuminates how different components interact to deliver complete user experiences from registration through trading and withdrawal. The typical flow begins with user registration where prospective traders create accounts providing email, password, and basic information. The system sends verification emails, creates user records, and initializes security settings. Upon successful registration, users proceed to KYC verification submitting identity documents that undergo automated and manual review. Once verified, users gain full platform access and can deposit funds.

The deposit flow involves users generating deposit addresses for specific cryptocurrencies through the wallet system, sending funds from external wallets, and the platform monitoring blockchain networks for incoming transactions. Upon confirmation, the system credits user balances and sends notifications. Trading flows begin with users viewing market data, placing orders through the interface, which the system validates and forwards to the matching engine. When matches occur, the engine executes trades, updates balances, records transactions, and notifies participants. Withdrawal flows reverse the deposit process, with users submitting withdrawal requests that undergo security checks, receive administrative approval if required, and execute through the wallet system sending funds to user-specified addresses. Each flow must be optimized for speed, reliability, and security while providing clear feedback to users at every stage.

Crypto Exchange Setup Guide – Step by Step

The crypto exchange setup guide provides detailed instructions for configuring and preparing your platform for operation. This phase translates architectural plans into concrete infrastructure, configures services, implements security measures, and establishes operational procedures. The setup process requires methodical attention to detail as each configuration decision impacts security, performance, and user experience. Proper setup establishes the foundation for reliable operations, efficient scaling, and ongoing maintenance throughout the exchange’s lifecycle.

Setup activities span infrastructure provisioning, service configuration, security hardening, integration testing, and operational preparation. Teams must establish server environments, configure databases, deploy application code, set up monitoring systems, implement backup procedures, configure API integrations with blockchain networks and external services, and establish administrative access controls. The setup phase also involves creating operational documentation, training support staff, establishing incident response procedures, and preparing customer communication channels. Thorough setup prevents operational issues, security vulnerabilities, and performance problems that could damage reputation and user trust from launch. Following a comprehensive platform construction methodology ensures consistent quality and reduces risk of oversight.

Initial Setup in Crypto Exchange Setup Guide

Initial setup focuses on establishing the technical infrastructure and environments supporting the exchange platform. This begins with selecting and provisioning hosting infrastructure, whether cloud-based services from providers like AWS, Google Cloud, or Azure, or dedicated server infrastructure for organizations prioritizing maximum control. Cloud infrastructure offers flexibility, rapid scaling, and geographic distribution but requires careful cost management and security configuration. The setup process involves creating multiple environments including production for live operations, staging for pre-production testing, and production for active construction and testing.

Database setup represents a critical initial task, requiring selection of appropriate database technologies for different needs. Relational databases like PostgreSQL handle structured data including user accounts, orders, and transactions. NoSQL databases like MongoDB manage flexible schemas for market data and logs. In-memory databases like Redis provide high-speed caching and session management. Database configuration must address replication for redundancy, backups for disaster recovery, and access controls for security. Network setup establishes VPCs, subnets, firewalls, and load balancers creating secure, performant traffic management. SSL certificates must be obtained and configured for all public-facing services. DNS configuration routes traffic appropriately. Monitoring systems including log aggregation, metrics collection, and alerting establish visibility into system health from the outset.

Infrastructure Planning in Crypto Exchange Setup Guide

Infrastructure planning determines the technical foundation supporting all exchange operations, requiring careful consideration of current needs and future growth. The planning process assesses computational requirements based on expected user volumes, trading frequency, and concurrent connections. Exchanges serving retail traders might plan for thousands of concurrent users and hundreds of trades per second, while institutional-focused platforms require capacity for lower user counts but higher individual transaction values and more complex order types. Infrastructure must accommodate peak loads that can exceed average usage by 10x during volatile market periods.

Geographic distribution decisions impact latency, redundancy, and regulatory compliance. Multi-region deployments reduce latency for global users, provide failover capabilities if one region experiences outages, and may satisfy data residency requirements in certain jurisdictions. However, distributed infrastructure increases complexity and cost. Infrastructure planning addresses security requirements including DDoS protection services, Web Application Firewalls (WAF), intrusion detection systems, and network segmentation isolating sensitive components. Backup and disaster recovery planning establishes procedures for data protection, including regular automated backups, backup verification testing, and documented recovery procedures. The infrastructure plan should accommodate anticipated growth for 12-24 months while allowing for rapid scaling if growth exceeds projections, balancing prudent resource utilization with the ability to respond to success.

Feature Selection in Crypto Exchange Setup Guide

Feature selection determines the capabilities your exchange offers, directly influencing user appeal, competitive positioning, and technical complexity. The selection process balances user demand, competitive differentiation, technical feasibility, regulatory implications, and resource constraints. Core features essential for any exchange include user registration and authentication, basic buy/sell orders, wallet deposit and withdrawal, transaction history, and basic security measures. Beyond these fundamentals, feature decisions shape your exchange’s market position and user experience.

Advanced trading features might include limit orders, stop-loss orders, market orders, trailing stops, and algorithmic order types appealing to sophisticated traders. Portfolio management features help users track holdings, analyze performance, and generate tax reports. Social features including copy trading, trading competitions, and community forums build engagement. Staking services, lending programs, and yield farming opportunities diversify revenue streams while providing value to users. Each additional feature increases creation complexity, extends timelines, and creates ongoing maintenance obligations. Successful feature selection focuses on delivering a coherent set of capabilities aligned with your target market rather than attempting to match feature-for-feature with established competitors. Starting with a focused feature set enables faster launch, simpler operations, and the ability to refine based on actual user feedback rather than assumptions.

Trading Features in Crypto Exchange Setup Guide

Trading features define how users interact with markets and execute transactions, fundamentally shaping the platform’s utility and appeal. The most basic trading interface supports simple market orders executing immediately at current prices, suitable for casual traders prioritizing convenience over price optimization. Limit orders allow users to specify exact prices they’re willing to pay or accept, providing price control while requiring patience for execution. Stop-loss orders automatically trigger sales when prices fall below specified thresholds, helping traders manage risk and limit losses during adverse market movements.

Advanced trading features cater to sophisticated users demanding greater control and automation. Trailing stop orders dynamically adjust stop prices as markets move favorably, protecting profits while allowing continued participation in trends. Conditional orders execute based on specified market conditions or technical indicators. Margin trading enables leveraged positions amplifying both potential gains and losses, requiring robust risk management systems to prevent excessive losses. Futures and derivatives trading demand complex systems for contract management, margin calculation, and settlement. Trading bots and API access allow algorithmic traders to implement automated strategies. Charts and technical analysis tools provide the data visualization traders need for informed decision-making. Feature implementation must consider not just technical construction but user experience design, ensuring even complex capabilities remain accessible to appropriate user segments.

Security Features in Crypto Exchange Setup Guide

Security features protect user funds, personal data, and platform integrity against an evolving landscape of threats including hacking attempts, phishing attacks, DDoS assaults, and insider risks. Multi-factor authentication (MFA) represents the most fundamental security feature, requiring users to provide multiple forms of verification beyond passwords. Options include SMS codes, authenticator app tokens, hardware security keys, and biometric verification. Withdrawal protection features like address whitelisting, withdrawal confirmations via email or SMS, and time-delayed withdrawals for large amounts provide additional barriers against unauthorized access.

Security Warning: Security cannot be an afterthought in exchange creation. Implementing comprehensive security measures from the beginning proves far more effective and cost-efficient than attempting to retrofit security after launch. Historical exchange hacks have resulted in billions in losses and irreparable reputation damage, making security the highest priority throughout the creation process.

Advanced security features include IP whitelisting restricting account access to approved addresses, device fingerprinting identifying unusual access patterns, anti-phishing codes allowing users to verify legitimate platform communications, session management limiting active sessions and implementing automatic timeouts, and comprehensive audit logging recording all account activities for forensic analysis. Cold wallet storage maintaining 90-95% of funds offline in air-gapped systems dramatically reduces exposure to online attacks. Regular security audits by independent firms identify vulnerabilities before malicious actors can exploit them. Bug bounty programs incentivize security researchers to responsibly disclose vulnerabilities. Insurance policies covering potential losses from successful attacks provide additional user protection. The security architecture must balance protection with usability, implementing strong safeguards without creating friction that drives users to less secure competitors.

Crypto Exchange Step by Step Execution

Crypto exchange step by step execution transforms plans and preparations into functioning platform components through systematic construction, integration, and refinement. This phase involves actual coding, configuration, and assembly of all system elements into a cohesive platform. The execution process requires disciplined project management, quality assurance practices, and continuous integration of emerging components. Teams must maintain momentum while ensuring quality standards, managing dependencies, and adapting to discoveries made during construction that necessitate plan adjustments.

| Execution Phase | Key Activities | Duration | Critical Success Factors |

|---|---|---|---|

| Foundation Building | Core infrastructure, database setup, basic authentication, wallet integration | 4-6 weeks | Solid architecture, security-first approach, scalable design |

| Feature Construction | Trading engine, order management, KYC system, UI creation | 8-12 weeks | Component integration, performance optimization, user experience focus |

| Integration Phase | Payment gateways, blockchain nodes, third-party APIs, liquidity sources | 3-4 weeks | Robust error handling, monitoring implementation, fallback systems |

| Testing & Refinement | Functional testing, security audits, performance optimization, bug fixing | 4-8 weeks | Comprehensive test coverage, realistic load testing, security validation |

Building the Platform Crypto Exchange Step by Step

Platform construction follows a methodical progression from foundational elements through increasingly sophisticated features. The process typically begins with backend services establishing core functionality including user authentication, database operations, and API endpoints. Parallel frontend creation produces user interfaces for web and mobile platforms, implementing designs validated through user research and competitor analysis. The matching engine receives particular attention given its critical role in exchange functionality, requiring specialized expertise in high-performance computing and financial systems.

Wallet system construction integrates with blockchain networks, implementing deposit address generation, transaction monitoring, and withdrawal processing across supported cryptocurrencies. Each integration requires understanding specific blockchain characteristics, implementing appropriate security measures, and handling edge cases like chain reorganizations and network congestion. The KYC system integrates identity verification services, implements document storage, and creates workflows for review and approval. Administrative tools provide operational staff with capabilities for user support, system monitoring, and business analytics. Throughout construction, teams maintain code quality through reviews, automated testing, and continuous integration practices ensuring new additions don’t break existing functionality. Understanding typical project timelines helps set realistic expectations and milestones.

Frontend and Backend Flow in Crypto Exchange Step by Step

Frontend and backend architecture must work seamlessly together, creating responsive user experiences while maintaining security and data integrity. The frontend encompasses all user-facing interfaces including web applications built with modern frameworks like React or Vue.js, mobile applications for iOS and Android platforms, and potentially desktop applications for professional traders. Frontend code handles user input validation, API communication, state management, and responsive design ensuring proper display across device sizes. Advanced frontends implement real-time data updates through WebSocket connections, displaying live price feeds, order book changes, and trade executions without page refreshes.

The backend implements business logic, data persistence, external integrations, and security controls. RESTful APIs provide structured endpoints for frontend applications to request data and submit operations. WebSocket servers push real-time updates to connected clients. Background workers process asynchronous tasks like blockchain monitoring, notification sending, and report generation. The backend enforces security policies including authentication verification, authorization checks, rate limiting, and input sanitization preventing injection attacks. Database interactions use parameterized queries preventing SQL injection while implementing connection pooling for performance. Caching strategies reduce database load and improve response times for frequently accessed data. The backend architecture must support horizontal scaling, allowing additional server instances to handle increased load without code changes. Clean separation between frontend and backend enables independent evolution, platform diversity, and potential future offerings like white-label solutions.

Testing Phase in Crypto Exchange Step by Step

The testing phase validates that all platform components function correctly individually and collectively, identifying defects before they impact real users. Comprehensive testing encompasses multiple dimensions including functional correctness, performance under load, security against attacks, usability for target audiences, and compatibility across browsers and devices. Testing should begin early in construction rather than as a distinct phase after completion, with developers writing unit tests for individual components, integration tests validating component interactions, and end-to-end tests simulating complete user workflows.

Different testing types address distinct quality dimensions. Functional testing verifies that features work as specified, including happy paths and error conditions. Regression testing ensures that new changes don’t break existing functionality. User acceptance testing involves real users evaluating the platform against their needs and expectations. Exploratory testing relies on experienced testers to identify issues that scripted tests might miss. The testing phase should include diverse scenarios covering edge cases, error conditions, and unusual usage patterns. Test environments should mirror production configurations as closely as possible while using test data that doesn’t risk real user funds. Thorough testing prevents costly post-launch issues, builds confidence in platform reliability, and protects reputation by ensuring quality before public exposure.

Performance Testing in Crypto Exchange Step by Step

Performance testing evaluates how the platform behaves under various load conditions, identifying bottlenecks, capacity limits, and optimization opportunities. Load testing simulates expected user volumes and transaction rates, measuring response times, throughput, and resource utilization under typical conditions. Stress testing pushes the system beyond normal operating parameters to identify breaking points and understand failure modes. Spike testing examines response to sudden traffic increases mimicking situations like major news events or token listings that drive user surges. Endurance testing runs sustained loads over extended periods detecting issues like memory leaks or resource exhaustion that only manifest over time.

Performance testing must address the unique characteristics of cryptocurrency trading including 24/7 operation, global user distribution, and extreme volatility periods. The matching engine receives particular scrutiny, with tests validating it can process target throughput while maintaining order priority fairness and sub-millisecond latencies. Database performance testing ensures queries scale appropriately, indexes are optimized, and connection pooling works effectively. API endpoint testing verifies rate limiting functions correctly, responses meet latency targets, and caching delivers expected benefits. WebSocket performance testing validates the system can maintain thousands of concurrent connections while delivering real-time updates promptly. Testing should identify the maximum capacity for critical metrics like concurrent users, orders per second, and trades per second, ensuring production capacity provides comfortable headroom above expected loads.

Security Testing in Crypto Exchange Step by Step

Security testing proactively identifies vulnerabilities before malicious actors can exploit them, protecting user funds, personal data, and platform integrity. Vulnerability scanning using automated tools identifies common weaknesses like outdated software versions, misconfigured services, and known vulnerabilities. Penetration testing engages ethical hackers to attempt real-world attacks against the platform, identifying security gaps that automated tools might miss. Code review examines source code for security anti-patterns including injection vulnerabilities, authentication bypasses, insecure cryptographic implementations, and privilege escalation risks.

Security testing should address all attack vectors including application-layer attacks exploiting code vulnerabilities, infrastructure attacks targeting servers and networks, social engineering attempts manipulating users or staff, and insider threats from privileged users. Testing validates authentication mechanisms properly verify identities, authorization controls restrict access appropriately, session management prevents hijacking, encryption protects sensitive data in transit and at rest, and logging captures security-relevant events for monitoring and forensics. Smart contract audits examine any blockchain-based components for reentrancy attacks, integer overflows, and logic errors. The security testing process should be iterative, with findings addressed and retested, and should involve independent third-party security firms providing objective assessments. Given the high-value targets crypto exchanges represent, security testing represents an essential investment rather than an optional expense.

Crypto Exchange Platform Roadmap to Launch

The crypto exchange platform roadmap guides the final preparations transforming a tested platform into a market-ready business. This phase encompasses regulatory finalization, liquidity arrangement, marketing preparation, operational readiness, and launch orchestration. While the platform may be technically complete, numerous business activities must align for successful market entry. The launch roadmap coordinates these parallel workstreams, ensuring all prerequisites are satisfied before opening to public trading.

Launch preparation involves finalizing regulatory approvals, establishing banking relationships, securing insurance coverage, completing legal documentation, and implementing compliance monitoring systems. Marketing activities build anticipation through pre-launch campaigns, content creation, social media engagement, partnership announcements, and influencer relationships. Operational preparation includes staff training, support system setup, community management tools, monitoring dashboards, and incident response procedures. Liquidity arrangements with market makers ensure sufficient depth for quality trading experiences from day one. The launch roadmap establishes clear go/no-go criteria based on regulatory status, security audit completion, liquidity availability, and operational readiness, ensuring launch only proceeds when truly prepared rather than succumbing to arbitrary timeline pressure.

Final Review in Crypto Exchange Platform Roadmap

Final review provides a systematic evaluation ensuring all platform elements meet quality standards, regulatory requirements, and business objectives before launch. This comprehensive assessment examines technical functionality, security posture, regulatory compliance, operational readiness, and market positioning. Technical review validates that all features work correctly, performance meets targets, security controls are properly implemented, monitoring systems provide adequate visibility, and documentation is complete. User acceptance testing with a small group of beta users provides real-world validation and identifies usability issues that internal testing missed.

Legal and compliance review verifies all regulatory requirements are satisfied, terms of service properly protect the business, privacy policies comply with data protection regulations, and anti-money laundering procedures are operational. Business readiness review confirms that marketing materials are prepared, support staff are trained, banking relationships are established, and financial systems can handle operations. The final review should involve all stakeholders including technical teams, legal counsel, compliance officers, business leaders, and potentially external advisors providing objective perspectives. Any critical issues identified must be resolved before proceeding to launch, while minor issues can be addressed post-launch through rapid updates. The review process culminates in a formal launch decision based on objective criteria rather than subjective enthusiasm.

Compliance Checks in Crypto Exchange Platform Roadmap

Compliance checks validate that the platform satisfies all legal and regulatory requirements in target operating jurisdictions. This process begins with understanding applicable regulations which vary significantly across jurisdictions. Many markets require specific licenses for operating cryptocurrency exchanges, including money transmitter licenses, virtual asset service provider registrations, or securities dealer licenses depending on assets offered. The compliance process involves engaging legal counsel familiar with crypto regulations, completing license applications including extensive documentation about business structure, principals, financials, and compliance programs.

KYC/AML compliance represents a universal requirement across regulated markets. Compliance checks verify that identity verification procedures meet regulatory standards, transaction monitoring systems can detect suspicious activities, reporting mechanisms enable timely filing of required reports, and record-keeping systems maintain audit trails for specified periods. Additional compliance areas include data privacy regulations like GDPR, tax reporting requirements, consumer protection standards, and advertising restrictions. Some jurisdictions impose specific requirements around fund custody, reserve management, or disclosures. Compliance is not one-time but ongoing, requiring continuous monitoring of regulatory changes, periodic assessments, and program updates. Working with experienced compliance consultants and legal advisors helps navigate this complex landscape, though even with expert help, obtaining licenses can take 6-18 months in many jurisdictions. Exploring various foundational approaches helps understand compliance in context.

Go-Live Strategy in Crypto Exchange Platform Roadmap

The go-live strategy orchestrates the actual launch process, transitioning from pre-launch preparation to active operations serving real users trading real assets. Launch approaches range from “soft launches” opening to limited users for final validation under real conditions, to “hard launches” immediately accepting all users. Soft launches enable gradual scaling, allowing teams to identify and address issues with limited user impact before full public opening. This approach works well for new organizations building reputation and operational experience. Hard launches generate maximum publicity and user acquisition but carry higher risk if issues emerge under full load.

The launch sequence typically begins with infrastructure validation ensuring all systems are operational, security controls are active, monitoring is functioning, and backups are running. User onboarding systems go live, allowing registration and KYC submission. Initial users might include beta testers, partners, or early supporters who can provide feedback and generate initial activity. Trading features activate in stages, perhaps starting with basic spot trading before enabling advanced features. Marketing campaigns time announcements to maximize impact while avoiding overwhelming support resources. The first 24-72 hours require intense monitoring with technical teams on standby to address any issues rapidly. Communication channels keep users informed about system status, known issues, and resolution progress. Success metrics track user registrations, KYC completions, deposits, active traders, and trading volumes, validating that the platform achieves desired market traction.

Build Your Crypto Exchange with Industry Experts

Launch a secure, scalable crypto exchange with expert support, advanced features, and end-to-end guidance tailored to your business goals.

Launch Your Exchange Now

Post-Launch Support in Crypto Exchange Platform Roadmap

Post-launch support represents the beginning of ongoing operations rather than the end of the creation journey. The initial weeks and months after launch prove critical for establishing reputation, building user trust, and demonstrating platform reliability. Support operations must handle user inquiries efficiently, resolve technical issues quickly, and maintain platform security vigilantly. Customer support systems process questions about registration, KYC, deposits, withdrawals, trading, and fees through multiple channels including email, live chat, and social media. Comprehensive FAQ documentation and video tutorials reduce support burden by enabling self-service.

Technical operations maintain 24/7 monitoring of system health, performance metrics, security indicators, and blockchain network status. Alert systems notify teams immediately when issues arise, enabling rapid response before users experience significant impact. Regular maintenance windows implement updates, security patches, and performance optimizations. Incident response procedures guide teams through detecting, diagnosing, resolving, and communicating about technical issues. Community management builds engagement through social media, forums, newsletters, and events. Marketing efforts continue driving user acquisition, promoting new features, and building brand awareness. Product teams gather user feedback, analyze usage patterns, and plan feature enhancements. Successful post-launch operations balance stability with continuous improvement, maintaining reliable service while evolving the platform to meet changing market demands and user expectations. Learning from successful industry implementations provides valuable insights for optimization.

Frequently Asked Questions

Creating a crypto exchange typically costs between $50,000 to $500,000 depending on the complexity and features required. A basic platform with essential trading functionalities might start at the lower end, while a comprehensive exchange with advanced features, custom architecture, and robust security measures can reach the higher range. Additional ongoing costs include server maintenance, compliance management, liquidity provision, customer support infrastructure, and continuous security updates that can add $10,000 to $50,000 monthly to operational expenses.

Crypto exchange licensing requirements vary by jurisdiction but commonly include money transmitter licenses, virtual asset service provider registrations, and securities dealer licenses depending on the assets traded. Major markets require compliance with anti-money laundering regulations, know-your-customer procedures, and financial reporting standards. Some jurisdictions like Malta, Estonia, and Singapore offer clearer regulatory frameworks specifically for crypto businesses. Obtaining proper licenses can take 6-18 months and cost $100,000 to $500,000 in legal and application fees.

Building a crypto exchange generally takes 4 to 12 months from initial planning to launch. A minimum viable product with basic features can be ready in 3-4 months, while a fully-featured exchange with custom components, advanced trading tools, and comprehensive security measures typically requires 8-12 months. The timeline depends on factors including technical complexity, regulatory requirements, feature scope, team size, and whether you use white-label solutions versus building from scratch. Testing and compliance verification phases often extend timelines significantly.

Centralized exchanges (CEX) operate through a central authority that holds user funds and facilitates trades through order matching engines, offering high liquidity and user-friendly interfaces but requiring users to trust the platform with their assets. Decentralized exchanges (DEX) enable peer-to-peer trading directly from users’ wallets through smart contracts, providing greater security and privacy without custodial risks but typically with lower liquidity and more complex user experiences. CEX platforms dominate trading volume while DEX platforms appeal to users prioritizing self-custody and censorship resistance.

Crypto exchanges generate revenue primarily through trading fees charged on each transaction, typically ranging from 0.1% to 0.5% per trade. Additional revenue streams include listing fees for new cryptocurrencies ($50,000 to $1 million per token), withdrawal fees for moving funds off the platform, margin trading interest for leveraged positions, premium subscription tiers offering reduced fees and advanced features, and staking services where the exchange earns a portion of staking rewards. High-volume exchanges can generate millions in daily revenue through these combined channels.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.