The global financial system is undergoing one of its biggest transitions in modern history, and cryptocurrency exchanges are at the center of this transformation. What began as simple platforms to buy and sell Bitcoin has now evolved into a multi-trillion-dollar digital finance ecosystem. As blockchain technology matures and digital assets gain mainstream acceptance, crypto exchanges are no longer optional infrastructure; they are becoming foundational pillars of the global digital economy. Crypto exchange market size and long-term valuation are no longer speculative debates. Instead, they are grounded in real adoption numbers, institutional participation, regulatory developments, and technological maturity.

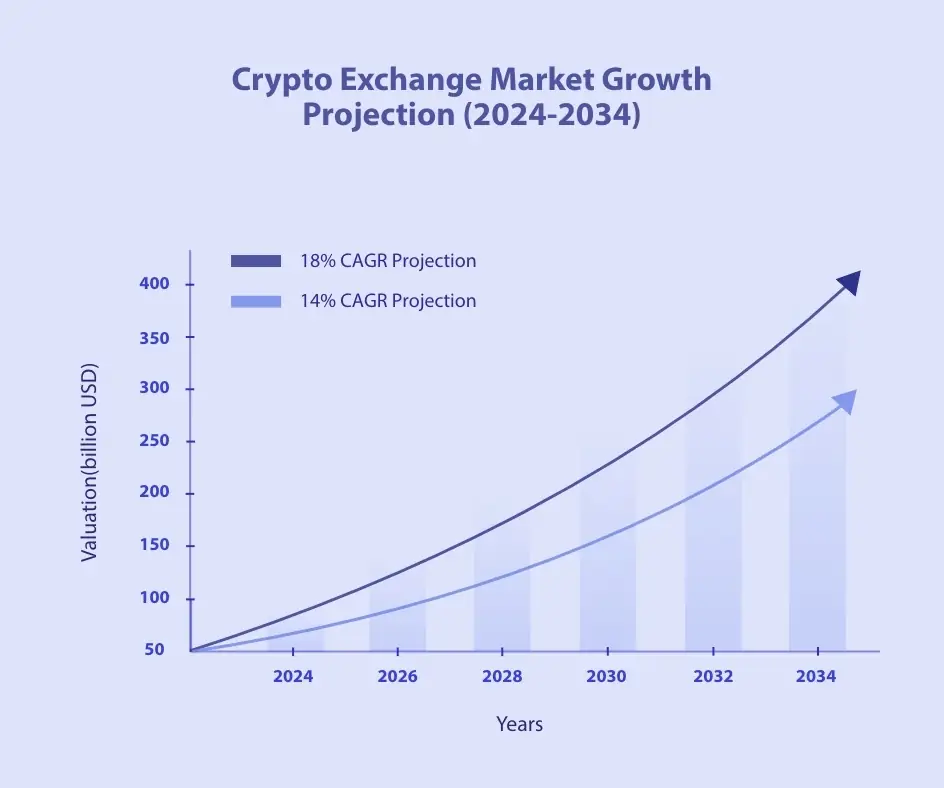

In 2025, the global cryptocurrency exchange market was estimated to have reached a valuation of approximately $70.5 billion by 15.3% CAGR. Over the coming decade, this market is expected to expand at a strong double-digit growth rate, potentially crossing $300 billion by 2035. This crypto exchange market forecast is driven not only by short-term speculation but also by structural shifts in finance, technology, and global economic behavior. [1]

From institutional adoption and regulatory clarity to emerging market demand and blockchain innovation, crypto exchanges are transitioning from trading tools into full-scale digital asset platforms. By 2035, these platforms may function much like global digital banks, enabling trading, custody, payments, lending, tokenization, and cross-border financial access for billions of users worldwide.

This in-depth analysis explores crypto exchange market size projections, adoption patterns, growth drivers, technology trends, ecosystem expansion, challenges, and strategic opportunities that will shape the cryptocurrency exchange industry between 2025 and 2035.

Cryptocurrency Exchange Market Size & Growth Outlook (2025–2035)

Market Valuation Overview

The cryptocurrency exchange market has experienced rapid acceleration over the last five years due to increasing trading volumes, rising user participation, and wider real-world use cases for digital assets.

- 2025 Market Size- $54.5 billion [2]

- Projected Market Size (2035)- $200–300+ billion

- Expected CAGR (2025–2035)- 14%

This forward-looking crypto exchange market forecast underscores sustained long-term crypto exchange growth for both centralized crypto exchanges (CEXs) and decentralized trading platforms (DEXs). As digital assets integrate deeper into traditional finance, the role of crypto exchanges expands far beyond basic spot trading.

Why the Crypto Trading Platform Market Is Expanding So Fast

Several structural forces are driving growth across the crypto trading platform market-

- Increasing global crypto ownership

- Expansion of derivatives and advanced trading products

- Institutional participation with large capital inflows

- Integration of blockchain with real-world assets

- Demand for secure, regulated, and scalable trading infrastructure

- Rapid growth of digital economies in emerging regions

Modern exchanges now process millions of transactions per second, manage massive liquidity pools, and serve both retail and institutional participants globally, strengthening the overall cryptocurrency exchange industry.

Global Crypto Exchange Adoption & User Growth Trends

Rising Number of Crypto Users

Global crypto exchange adoption has transitioned from early adopters to mainstream participation. By the end of 2024, over 560 million users will have interacted with crypto platforms worldwide.

Forecasts suggest-

- 2025- 860-900+ million users [3]

- 2030- 1.4-1.6 billion users

- 2035- Over 2 billion users

As internet penetration and digital awareness expand, exchanges remain the primary gateway driving crypto exchange adoption, reinforcing sustained demand across the cryptocurrency exchange market.

Exchanges as the First Gateway to Crypto

For most users, a centralized crypto exchange or decentralized platform represents their first interaction with blockchain technology. Whether buying Bitcoin, trading altcoins, staking assets, or accessing tokenized products, exchanges provide a secure onboarding experience.

Key onboarding drivers include-

- Mobile-friendly interfaces

- Local fiat currency support

- Simplified KYC and compliance processes

- Educational tools and trading assistance

- Low entry barriers

This accessibility directly fuels crypto exchange growth across both retail and institutional segments.

Build Your Crypto Exchange Today

Launch a Secure, Scalable, and Profitable Crypto Exchange with Expert Guidance

Shifting the Market Structure

From Retail-Driven to Institution-Led Growth

The cryptocurrency exchange industry has undergone a significant shift. Retail traders largely drove earlier growth cycles. Today, institutional participation is a dominant force.

Hedge funds, asset managers, fintech firms, and payment providers are entering the market through regulated platforms, driving demand for

- Deep liquidity

- Institutional custody

- Risk management tools

- Derivatives and structured products

- Compliance-ready trading environments

This shift significantly impacts the crypto trading platform market and reinforces the role of regulated platforms.

Impact on Crypto Exchange Development

As institutions enter the market, crypto exchange platforms must meet enterprise-level standards. This is reshaping crypto exchange development in areas such as:

- High-performance matching engines

- Advanced order types

- API-based trading access

- Secure asset custody solutions

- Governance and reporting systems

These changes are redefining the future of crypto exchanges toward greater scalability and trust.

Decentralized vs Centralized Exchanges- Market Evolution

The crypto market is evolving as DEX vs CEX models grow in parallel, DEXs gaining traction through self-custody, on-chain transparency, and DeFi adoption, while CEXs continue leading the cryptocurrency exchange market with higher liquidity, regulated services, and advanced trading features. This shift is shaping the future of crypto exchanges and long-term crypto exchange market growth.

Growth of Decentralized Crypto Exchanges (DEXs)

The decentralized exchange market has moved from niche to mainstream, supported by growing on‑chain activity, rising user adoption, and increased market share. In Q2 2025 alone, DEX spot trading surged to approximately US$876.3 billion [4], marking a significant quarterly jump and reflecting renewed investor interest in non‑custodial trading.

On a broader scale, by mid‑2025, the weekly spot trading volume on DEXs averaged around US$18.6 billion, and the number of unique wallets interacting with DEXs rose to 9.7 million, up from 6.8 million [5], indicating strong crypto exchange adoption in non-custodial systems.

These numbers underscore the growing preference for self‑custody, decentralized trading, and DeFi‑enabled features among crypto users. DEXs are increasingly favored for their transparent on‑chain execution, decentralized liquidity, and freedom from centralized gatekeepers, making them a credible alternative to traditional centralized exchanges.

Key Drivers Fueling DEX Adoption-

- Self‑custody and full control over assets

- On‑chain settlement and transparent execution

- Permissionless access without KYC friction (on many DEXs)

- Growing DeFi integrations, lending, staking, yield, token swaps, and multi‑chain liquidity

- Growing institutional participation in the decentralized exchange market

Growth of Centralized Crypto Exchanges (CEXs)

Centralized crypto exchanges (CEXs) continue to be the backbone of the cryptocurrency trading ecosystem, dominating global trading volumes due to their liquidity, speed, advanced trading tools, and institutional-grade security. In 2024, the top 15 centralized cryptocurrency exchanges collectively processed approximately US$18.83 trillion [6] in spot trading volume, reinforcing their importance within the cryptocurrency exchange market.

Despite the rise of decentralized exchanges (DEXs) capturing around 7–8% of global crypto trading volume by 2025, centralized crypto exchanges are projected to grow at a compound annual growth rate (CAGR) of ~12–15% between 2025 and 2030. This growth is driven by-

- Institutional adoption of crypto, including banks, hedge funds, and large-scale investment firms entering the market for regulated trading and custody solutions

- Regulatory clarity across major jurisdictions such as the US, EU, and Asia is increasing trust in centralized crypto exchanges

- Expansion of fiat on-ramp crypto exchange services, enabling smooth onboarding for retail and professional traders

- Integration of advanced crypto exchange features like staking, lending, derivatives trading, and tokenized asset markets

CEXs remain the primary gateway for the majority of crypto investors and traders, especially for high-volume trading and institutional participation. Their ability to provide custodial security, robust infrastructure, and comprehensive crypto exchange services ensures continued dominance, even as the decentralized exchange market grows.

Key Drivers Fueling CEX Growth in 2025 and Beyond-

- Deep liquidity and high-speed execution for traders and investors.

- Institutional crypto trading adoption is driving high-value transactions.

- Secure custodial solutions protecting user assets from hacks.

- Integration with advanced financial products such as staking, lending, tokenized real-world assets, and derivatives.

- User-friendly platforms and fiat gateways are enhancing global crypto adoption.

Emergence of Hybrid Exchange Models

To address limitations on both sides, hybrid exchanges are gaining popularity. These platforms combine:

- Speed and liquidity of centralized exchanges

- Transparency and control of decentralized protocols

- On-chain settlement with off-chain performance

By 2030, hybrid cryptocurrency exchanges are expected to play a major role in serving institutional and advanced retail users.

Emerging Markets- The Engine of Crypto Exchange Expansion

Emerging economies continue to drive global crypto exchange market size expansion due to inflation, weak banking systems, and cross-border payment needs.

Why Emerging Economies Are Driving Adoption

Crypto adoption is accelerating fastest in regions where traditional banking systems remain inefficient or inaccessible. Economic instability, inflation, capital controls, and remittance dependency have made digital assets attractive alternatives.

High-growth regions include

- Asia-Pacific

- Latin America

- Africa

- Middle East

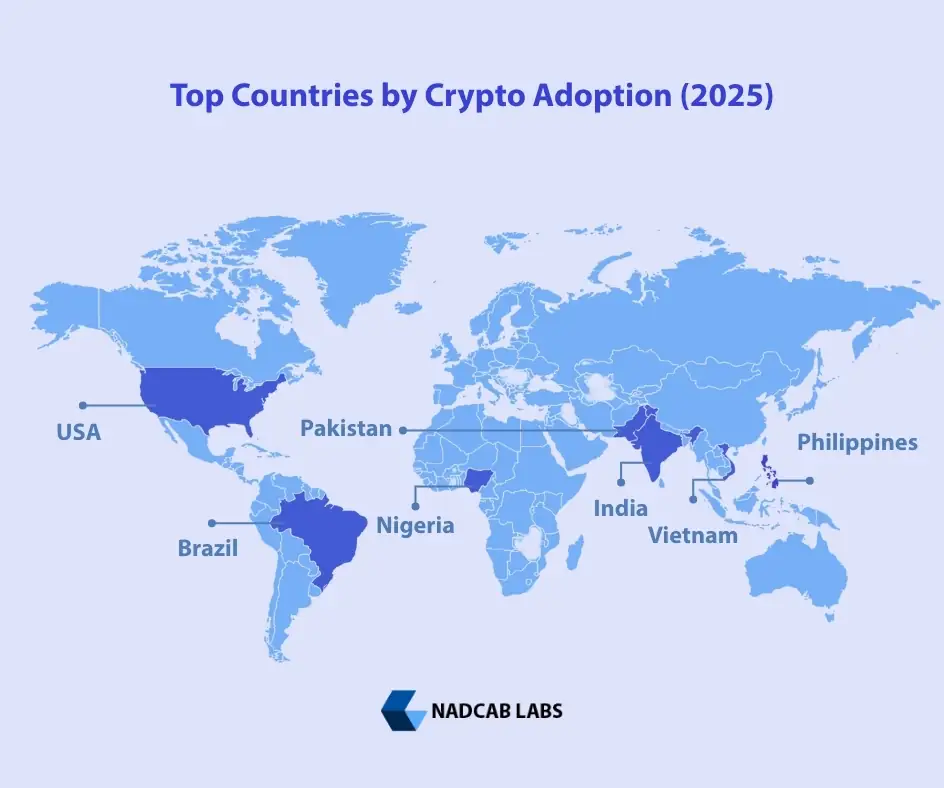

Top Countries by Crypto Adoption

- India (Rank #1, 2025)

- USA (Rank #2)

- Pakistan

- Philippines

- Vietnam

- Brazil

- Nigeria

Localized platforms strengthen crypto exchange adoption by offering regional payments, languages, and compliance alignment.

Users in these regions rely on crypto exchanges for

- Value preservation

- Cross-border payments

- Low-cost remittances

- Access to global financial markets

Localization as a Growth Strategy

Exchanges that tailor their platforms to local markets gain rapid adoption. Key localization strategies include-

- Regional fiat payment gateways

- Local languages and UX customization

- Country-specific compliance frameworks

- Mobile-first design

These strategies help exchanges scale user bases quickly while maintaining regulatory alignment.

Technology Trends Transforming Crypto Exchanges

Artificial Intelligence & Automation

AI is playing a critical role in the next generation of crypto exchange platforms. From fraud detection to customer support, AI enhances operational efficiency and security.

Use cases include:

- Automated risk analysis

- Behavioral fraud monitoring

- Predictive trading analytics

- Smart order routing

- AI-powered chat support

AI integration enables exchanges to deliver personalized trading experiences at scale.

Cross-Chain Interoperability

With hundreds of blockchains in existence, liquidity fragmentation poses a challenge. Interoperability solutions allow crypto exchanges to operate across multiple networks seamlessly.

Benefits include:

- Unified liquidity access

- Multi-chain trading support

- Faster asset transfers

- Improved capital efficiency

This trend is crucial for supporting a multi-chain crypto economy.

Layer-2 Scaling & Performance Optimization

High transaction fees and network congestion have led exchanges to integrate Layer-2 solutions. These allow-

- Faster trade settlement

- Lower gas costs

- Greater throughput

- Enhanced scalability

Layer-2 adoption will be essential as user volumes reach billions.

Expansion of Crypto Exchange Ecosystems

From Trading Platforms to Financial Super Apps

Modern crypto exchanges now offer a wide range of integrated services beyond trading:

- Staking and passive income tools

- Lending and borrowing products

- Yield generation programs

- Derivatives trading

- NFT marketplaces

- Token launch platforms

This ecosystem approach increases user retention and lifetime value.

Tokenized Real-World Assets (RWA)

One of the most significant trends is the tokenization of real-world assets. Exchanges that support tokenized stocks, commodities, bonds, and real estate will unlock new liquidity pools.

By 2030, tokenized assets are expected to reach multi-trillion-dollar valuations, transforming how value is exchanged globally.

What’s Fueling the Surge in Crypto Exchange Growth

1. Rising Trading Volumes

Spot trading volumes surpassed $1.5–$2 trillion per month across leading exchanges in 2024–2025, while derivatives markets exceeded $4 trillion monthly.

Higher volume = higher revenue + stronger markets.

2. Growing Global User Base

Crypto users reached 562 million in 2024 and are projected to hit 950 million+ by 2025, fueling demand for new and scalable exchanges.

3. Institutional Money Inflows

Institutions require-

- liquidity

- regulated platforms

- secure custodial solutions

This is driving exchanges toward becoming enterprise-grade digital asset banks.

4. Rise of Tokenization

Everything from stocks to commodities is moving on-chain, expanding the market and liquidity for crypto platforms.

Challenges That Could Limit the Cryptocurrency Exchange Industry

Regulatory Complexity

Operating across jurisdictions requires dynamic compliance strategies. Exchanges must adapt to changing regulations while maintaining global operations.

Future exchanges will adopt-

- automated compliance engines

- AI-based transaction screening

- country-specific KYC modules

Security & Cyber Threats

As exchanges grow, security threats increase. Robust infrastructure, including cold storage, risk monitoring, and insurance mechanisms, is essential.

Over $1.7B lost [7] to crypto hacks in 2023

Exchanges will invest in-

- MPC wallets

- Hardware security modules

- On-chain monitoring

- Insurance funds

- Zero-trust architecture

Liquidity Fragmentation

Fragmented liquidity across chains can reduce efficiency. Advanced aggregation and routing solutions help solve this problem.

Why 2025–2035 Will Be the Golden Future of Crypto Exchanges

This decade represents a convergence point where modern crypto exchange platforms serve as the foundation for scalable, intelligent, and globally connected financial ecosystems.

- Technology is ready

- Adoption is accelerating

- Institutions are on board

- Regulation is evolving

- Global demand is rising

These forces define long-term crypto exchange growth and solidify exchanges as financial access points for billions worldwide.

Frequently Asked Questions

Compliance ensures regulatory approval, reduces fraud, prevents AML violations, and protects user funds. Exchanges that follow strong KYC/KYB standards gain more trust and scale faster in global markets.

The crypto exchange market is growing steadily each year due to institutional participation, rising retail trading, and the integration of advanced features like derivatives, AI-driven trading tools, and high-frequency execution systems.

The crypto exchange market size is mainly determined by global trading volume, liquidity depth, user adoption, security standards, and regulatory frameworks. Platforms with strong compliance and high-performance matching engines contribute the most to overall market expansion.

The future of crypto exchanges will be shaped by institutional DeFi integration, tokenized real-world assets, cross-chain liquidity, advanced compliance automation, and hybrid CEX-DEX models that offer both security and high throughput.

Centralized exchanges run on proprietary servers, offer higher speed, and manage user custody, while decentralized exchanges execute trades via smart contracts, AMMs, and non-custodial wallets.

Modern exchanges rely on blockchain nodes, matching engines, FIX & WebSocket APIs, high-availability servers, MPC/Multisig wallets, and AI-backed risk monitoring systems to deliver secure and ultra-fast trading experiences.

Liquidity depth combined with a high-speed order-matching engine reduces slippage, improves execution speed, and attracts high-frequency traders directly influencing an exchange’s growth and competitiveness.

The cryptocurrency exchange market is a digital ecosystem where users trade crypto assets using order books, automated market makers, liquidity pools, and custodial or non-custodial wallet systems. It functions through smart contracts and secure transaction validation mechanisms.

Scaling solutions like microservice architecture, horizontal scaling, load balancing, improved TPS matching engines, and distributed nodes help exchanges manage high traffic and large order flows efficiently.

Key security layers include MPC wallets, cold storage, DDoS protection, anti-phishing tools, real-time anomaly detection, and smart-contract audits. These safeguard user assets and ensure uninterrupted trading.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.