Key Takeaways

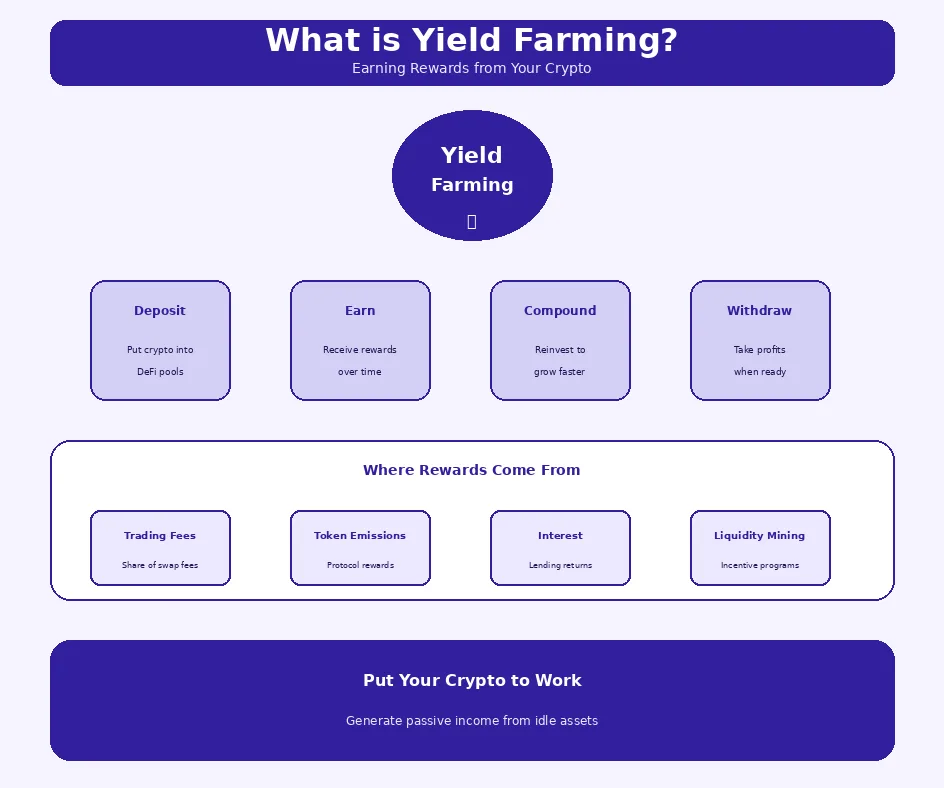

- A Yield Farming Pool is a DeFi mechanism where users deposit cryptocurrency to earn rewards from trading fees, protocol tokens, and liquidity mining incentives.

- DeFi Yield Farming works through smart contracts that automatically manage deposits, calculate rewards, and distribute earnings to liquidity providers.

- Yield farming explained simply involves providing liquidity to pools, earning DeFi rewards in return, and potentially compounding gains through strategic reinvestment.

- Liquidity mining rewards participants with protocol tokens beyond trading fees, creating additional income streams and governance participation opportunities.

- Impermanent loss represents a key risk in yield farming pools, occurring when token prices diverge from deposit ratios and potentially offsetting earned rewards.

- Staking rewards in yield farming vary dramatically based on pool selection, with APY ranging from single digits to hundreds of percent depending on risk levels.

- The yield farming mechanism relies on smart contract security, making protocol audits and track records critical factors in pool selection decisions.

- Crypto yield farming continues evolving with innovations in capital efficiency, cross-chain opportunities, and sustainable reward models replacing inflationary emissions.

The decentralized finance ecosystem has created remarkable opportunities for cryptocurrency holders to generate passive income through their digital assets. Among these opportunities, yield farming pools have emerged as one of the most popular and potentially lucrative strategies. Understanding what is yield farming and how these pools operate enables informed participation in this rapidly evolving sector of the crypto economy.

What Is a Yield Farming Pool?

A Yield Farming Pool is a smart contract-based mechanism that allows cryptocurrency holders to deposit their assets and earn rewards in return. These pools form the foundation of DeFi liquidity, enabling decentralized exchanges, lending protocols, and other financial services to function without traditional intermediaries. By contributing to these pools, users receive compensation for providing the liquidity that makes decentralized trading possible.

Understanding Yield Farming

Understanding yield farming begins with recognizing it as a strategy for putting idle cryptocurrency to work. Rather than simply holding tokens in a wallet, yield farmers deposit assets into DeFi protocols where they generate returns through various mechanisms. These returns come from trading fees, interest payments, and protocol token distributions that reward participants for their contributions.

DeFi Yield Farming has evolved significantly since its emergence in 2020. What started as simple liquidity provision has grown into a sophisticated ecosystem with multiple reward layers, complex strategies, and diverse risk profiles. Today’s yield farmers can choose from thousands of pools across dozens of protocols, each offering different return profiles and risk characteristics.

How Yield Farming Pools Work

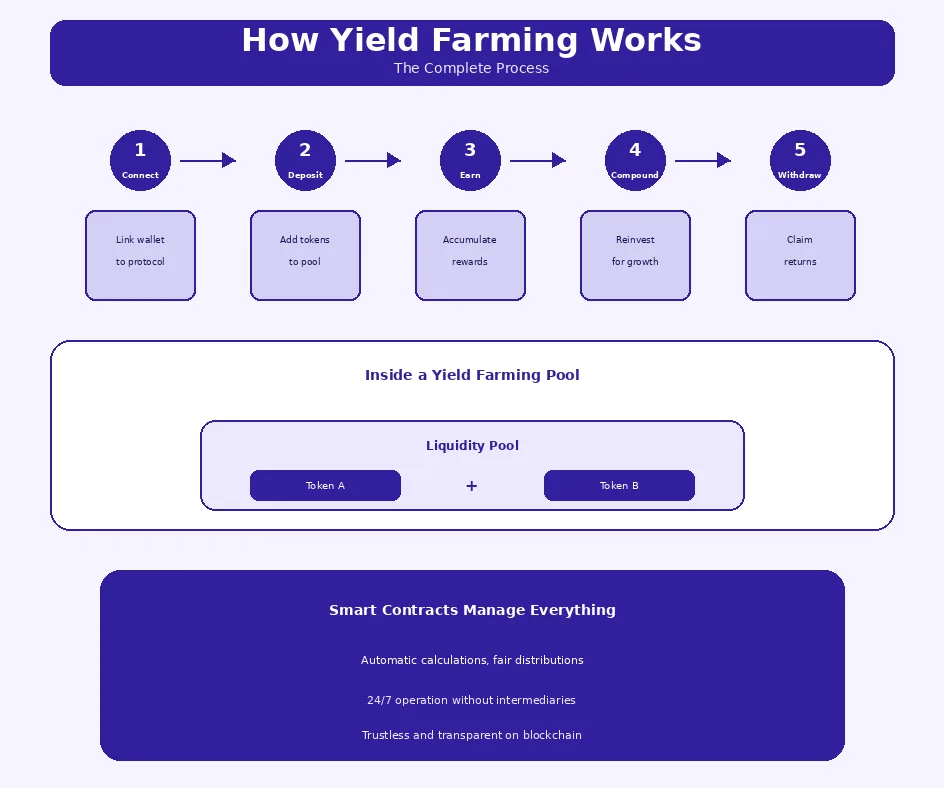

Yield farming pools work by aggregating deposits from multiple users and deploying these funds in ways that generate returns. The pool’s smart contracts handle all operations automatically, from accepting deposits to calculating and distributing rewards. This automation enables 24/7 operation without human intermediaries, reducing costs and increasing efficiency. Understanding APY calculations in decentralized exchanges helps farmers evaluate opportunities accurately.

Role of Liquidity Providers

Liquidity providers serve as the essential participants in yield farming pools. By depositing tokens, they supply the assets that trading pairs need to function. In exchange for this service, LPs receive pool tokens representing their share of the pool and entitling them to proportional rewards. The more liquidity provided, the better the trading experience for users, creating mutual benefits across the ecosystem.

Different pools require different types of contributions. Some need pairs of tokens in equal value (like ETH/USDC), while others accept single assets for lending or staking. Understanding pool requirements helps farmers select opportunities aligned with their holdings and risk preferences.

Token Staking in Pools

Token staking in pools involves locking assets for specified periods to earn staking rewards. Unlike liquidity provision for trading, staking typically supports protocol governance, security, or specific platform functions. Staking rewards often come from protocol token emissions, fee sharing, or both, providing predictable income streams with generally lower complexity than multi-asset liquidity farming.

Many yield farming strategies combine liquidity provision with staking. Farmers first provide liquidity to earn pool tokens, then stake those tokens in additional pools to earn bonus rewards. This “farming the farm” approach maximizes returns but adds complexity and risk layers.

Smart Contracts in Yield Farming

Smart contracts form the technological foundation of yield farming, executing all operations automatically based on predetermined rules. These contracts handle deposits, withdrawals, reward calculations, and distributions without human intervention. This automation enables trustless operation where participants need not trust platform operators, only the verifiable code governing pool behavior.

The yield farming mechanism depends entirely on smart contract integrity. Bugs, vulnerabilities, or malicious code can result in fund losses, making contract audits and security track records critical evaluation criteria. Understanding protocol architecture in decentralized exchanges helps farmers assess smart contract risks.

Investment Principle: Yield farming returns correlate with risk. Extremely high APY offers typically indicate higher risk through new protocols, untested contracts, or unsustainable token emissions. Conservative farmers prioritize established protocols with proven security over maximum returns.

Benefits of Yield Farming Pools

Benefits of yield farming pools extend beyond simple interest earnings to encompass diverse opportunities for cryptocurrency holders. These pools offer returns unavailable in traditional finance while providing essential services to the DeFi ecosystem. Understanding these benefits helps farmers appreciate the value proposition while recognizing associated trade-offs.

Earning DeFi Rewards

Earning DeFi rewards through yield farming creates passive income from cryptocurrency holdings. Rather than assets sitting idle, they generate returns continuously through pool participation. These rewards compound value over time, potentially growing portfolios significantly faster than simple holding strategies would achieve.

DeFi rewards come in multiple forms. Trading fees provide consistent income proportional to pool activity. Liquidity mining tokens offer additional returns and often governance rights. Some pools provide boosted rewards for longer lockup periods or larger deposits, creating opportunities for committed participants.

Maximizing APY in Yield Farming

Maximizing APY in yield farming requires strategic pool selection and active management. Farmers monitor APY changes across protocols, moving funds to capture the best opportunities while accounting for transaction costs. Automated yield optimizers like Yearn Finance simplify this process by automatically reallocating funds to highest-yielding options.

APY optimization strategies include compounding rewards frequently, stacking multiple reward streams, and leveraging governance token benefits. However, chasing maximum APY without considering risk often leads to losses. Sustainable returns typically come from balanced approaches that consider security alongside yield potential.

Advantages of Crypto Yield Farming

Advantages of crypto yield farming include accessibility, composability, and earning potential unavailable in traditional finance. Anyone with a wallet can participate without minimum investments or approval processes. DeFi’s open architecture allows strategies that combine multiple protocols, creating complex but potentially rewarding opportunities.

Building crypto exchanges requires understanding these yield mechanisms to attract liquidity. Additional advantages include 24/7 markets, transparent on-chain operations, and self-custody of assets. Farmers maintain control of their tokens while earning returns, avoiding the counterparty risks of centralized platforms.

Yield Farming Reward Types Comparison

| Reward Type | Source | Characteristics | Sustainability |

|---|---|---|---|

| Trading Fees | Swap transactions | Proportional to volume | High (real activity) |

| Liquidity Mining | Token emissions | Protocol incentives | Variable (depends on tokenomics) |

| Interest | Lending demand | Market-driven rates | High (borrower payments) |

| Staking Rewards | Protocol inflation | Fixed or variable APY | Medium (dilutes non-stakers) |

Risks and Considerations in Yield Farming

Risks and considerations in yield farming deserve careful attention before committing funds. While potential returns attract many participants, understanding and managing risks separates successful farmers from those who suffer losses. A comprehensive risk assessment informs better pool selection and position sizing decisions.

Understanding Impermanent Loss

Understanding impermanent loss is crucial for yield farming participants. This phenomenon occurs in liquidity pools when token prices change relative to each other after deposit. If one token appreciates significantly while the other stays flat, you end up with more of the cheaper token and less of the valuable one compared to simply holding both.

Impermanent loss calculations can be complex, but the concept is straightforward: greater price divergence means greater potential loss. Stablecoin pairs experience minimal impermanent loss since prices remain correlated. Volatile pairs risk significant losses that may exceed earned fees and rewards, particularly during major market movements.

Security Risks in DeFi Protocols

Security risks in DeFi protocols range from smart contract bugs to economic exploits and outright scams. Even audited protocols have suffered hacks resulting in significant user losses. The permissionless nature of DeFi means anyone can create pools, making thorough due diligence essential before depositing funds.

Rug pulls, where developers drain pool liquidity, represent another significant risk. New protocols with anonymous teams and unaudited contracts present the highest rug pull potential. Understanding token launch mechanisms helps identify legitimate projects from potential scams.

Choosing the Right Yield Farming Pool

Choosing the right yield farming pool requires balancing return potential against risk factors. Evaluation criteria include protocol track record, audit status, total value locked (TVL), team reputation, and tokenomics sustainability. Higher yields often indicate higher risks, so extreme APYs should trigger additional scrutiny rather than excitement.

Pool selection also depends on personal circumstances including risk tolerance, investment timeline, and portfolio composition. Conservative farmers may prefer established protocols with lower but sustainable yields. Risk-tolerant participants might allocate portions to newer opportunities while maintaining core positions in proven pools.

Yield Farming Pool Selection Criteria

When evaluating yield farming opportunities, consider:

- Protocol Age: Established protocols have proven security track records

- Audit Status: Multiple audits from reputable firms reduce smart contract risk

- TVL Trends: Growing or stable TVL indicates continued trust

- Tokenomics: Sustainable emission schedules support long-term yields

- Team Transparency: Known, reputable teams reduce rug pull risk

- Community Activity: Active communities often identify issues quickly

Yield Farming Participation Lifecycle

| Step | Phase | Actions | Considerations |

|---|---|---|---|

| 1 | Research | Evaluate protocols and pools | Security, yields, risks |

| 2 | Preparation | Acquire required tokens | Gas costs, token ratios |

| 3 | Deposit | Add liquidity to pool | Slippage, approval txs |

| 4 | Stake (Optional) | Stake LP tokens for bonus | Additional rewards |

| 5 | Monitor | Track rewards and risks | APY changes, IL exposure |

| 6 | Harvest/Compound | Claim or reinvest rewards | Gas efficiency timing |

| 7 | Exit | Withdraw liquidity | Timing, IL realization |

How to Participate in Yield Farming Pools

How to participate in yield farming pools involves several steps from initial research through active management. While the process has become increasingly user-friendly, understanding each step helps avoid common mistakes and optimize outcomes. Preparation and knowledge significantly improve the yield farming experience.

Steps to Stake Tokens

Steps to stake tokens begin with acquiring the assets your chosen pool requires. For liquidity pools, this typically means having equal values of both tokens in a trading pair. For single-asset staking, you need only the specific token required. Ensure your wallet has sufficient native tokens (ETH, BNB, etc.) for gas fees.

Connect your wallet to the protocol, approve token spending (a one-time transaction per token), then deposit to the pool. Many protocols require approving maximum amounts initially, though more security-conscious users approve only specific amounts per transaction. After depositing, stake any LP tokens received to maximize rewards from liquidity mining programs.

Selecting the Best DeFi Protocols

Selecting the best DeFi protocols combines research with personal risk assessment. Top-tier protocols like Aave, Uniswap, and Curve have extensive track records, multiple audits, and substantial TVL indicating community trust. These established platforms typically offer lower yields but significantly reduced risk compared to newer alternatives.

Mid-tier protocols may offer better yields with reasonable security if properly evaluated. Look for audits from reputable firms, transparent teams, and sustainable tokenomics. Understanding DEX construction principles helps evaluate protocol quality.

Strategies for Yield Farming Rewards

Strategies for yield farming rewards range from passive holding to active optimization. Simple strategies involve depositing in established pools and periodically harvesting rewards. Advanced strategies might include leveraged farming, automated compounding, and quickly rotating between highest-yield opportunities.

Most successful farmers find middle ground between passive and hyperactive approaches. They select quality pools, compound rewards at efficient intervals (weekly or monthly depending on gas costs), and reassess positions when conditions change significantly. Over-optimization often leads to gas costs exceeding additional returns.

Important Notice: Yield farming involves significant risks including smart contract exploits, impermanent loss, token price volatility, and potential total loss of deposited funds. Past returns do not guarantee future performance. Never invest more than you can afford to lose, diversify across protocols, and conduct thorough research before participating in any yield farming pool.

Future of Yield Farming in DeFi

The future of yield farming in DeFi involves continued innovation in efficiency, sustainability, and accessibility. As the ecosystem matures, yield farming mechanisms evolve beyond simple token emissions toward more sustainable models. These developments will shape how participants engage with DeFi liquidity pools going forward.

Launch Your Own Yield Farming Pool Today

Partner with us to build secure, high-performance yield farming pools. Enable staking, liquidity mining, and maximize DeFi rewards for your users.

Launch Your Exchange Now

Trends in Yield Farming Pools

Trends in yield farming pools include concentrated liquidity, real yield models, and cross-chain opportunities. Concentrated liquidity allows LPs to specify price ranges for their capital, dramatically improving capital efficiency but adding complexity. Real yield focuses on sustainable returns from actual protocol revenue rather than inflationary token emissions.

Cross-chain farming enables liquidity provision across multiple blockchains, accessing opportunities beyond Ethereum’s ecosystem. Aggregator protocols automate yield optimization across chains, simplifying participation while maximizing returns. Understanding exchange platform architecture reveals the infrastructure supporting these innovations.

Evolving Liquidity Mining Mechanisms

Evolving liquidity mining mechanisms address sustainability concerns with traditional emission models. Vote-escrowed tokens (veTokens) reward long-term commitment over short-term farming. Bonds and protocol-owned liquidity reduce dependency on mercenary capital that migrates when incentives decline. These innovations create more stable liquidity foundations for DeFi protocols.

Dynamic reward adjustments based on market conditions and pool utilization help maintain efficient capital allocation. Protocols increasingly target rewards toward liquidity that provides the most value rather than simply rewarding deposit size.

Maximizing Rewards Safely in Crypto Yield Farming

Maximizing rewards safely in crypto yield farming requires balancing opportunity with risk management. Diversification across protocols, chains, and pool types reduces exposure to any single failure. Position sizing ensures that potential losses from any pool remain acceptable within overall portfolio context.

Safe maximization also involves staying informed about protocol updates, security incidents, and market conditions. Active monitoring, even of “set and forget” positions, catches issues before they become catastrophic. Successful long-term farmers prioritize capital preservation while pursuing reasonable returns.

Frequently Asked Questions

Yield farming in crypto is a DeFi strategy where users deposit or stake cryptocurrency in liquidity pools to earn rewards. These rewards come from trading fees, protocol tokens, or interest payments generated by the pool’s activity. Participants effectively put their assets to work, generating passive income through various decentralized finance protocols.

Yield farming pools work by collecting deposits from liquidity providers and using these funds to enable trading, lending, or other DeFi activities. Smart contracts automatically manage deposits, calculate rewards, and distribute earnings to participants. The pool generates returns through trading fees, interest, or newly minted protocol tokens that are shared among contributors.

Yield farming can be profitable, but returns vary significantly based on pool selection, market conditions, and timing. High APY offers often come with higher risks including impermanent loss, smart contract vulnerabilities, and token price volatility. Successful farmers balance risk against reward, diversify across pools, and carefully evaluate protocol security before committing funds.

Yield farming typically involves providing liquidity to trading pools and earning from multiple sources including fees and tokens. Staking usually means locking tokens to support network security or governance, earning simpler, more predictable rewards. Yield farming often offers higher potential returns but carries more complexity and risks like impermanent loss that staking generally avoids.

Impermanent loss occurs when the price ratio of tokens in a liquidity pool changes compared to when you deposited them. If prices diverge significantly, you may end up with less value than simply holding the tokens. The loss is “impermanent” because it can decrease if prices return to original ratios, but it becomes permanent when you withdraw.

Liquidity mining is a form of yield farming where protocols distribute their native tokens to users who provide liquidity. Beyond earning trading fees, liquidity miners receive additional token rewards as incentives for contributing to pool depth. This mechanism helps protocols bootstrap liquidity while giving early participants ownership stakes in the platform.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.