Key Takeaways

- Cryptocurrency exchanges have evolved from niche trading platforms into sophisticated digital trading ecosystems that serve millions of users globally, offering 24/7 access to markets and unprecedented trading opportunities across thousands of digital assets.

- The distinction between centralized crypto exchange platforms and decentralized exchange (DEX) models represents different approaches to security, control, and user experience, with each offering unique advantages for specific trading needs and risk profiles.

- Blockchain trading technology provides transparency, immutability, and security features that traditional financial systems cannot match, fundamentally transforming how digital assets trading occurs and creating new paradigms for financial transactions.

- Current crypto market trends indicate growing institutional adoption, regulatory clarity, and technological innovation that will drive the future of crypto trading toward mainstream acceptance and integration with traditional finance.

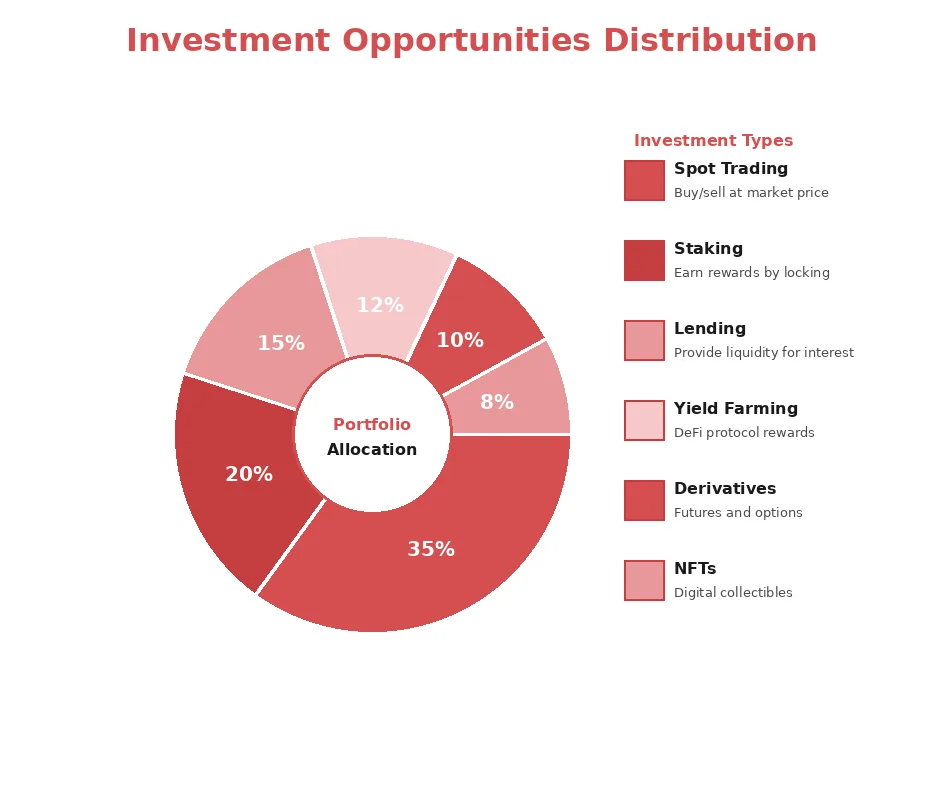

- Modern crypto investment platforms offer diverse opportunities beyond simple trading, including staking, yield farming, lending protocols, and token trading platform features that enable comprehensive portfolio management strategies.

- Enhanced security measures, regulatory compliance frameworks, and technological advancements in cryptocurrency exchange platforms are addressing historical concerns and building trust among both retail and institutional investors.

- The integration of artificial intelligence, machine learning, and advanced analytics into online crypto exchange systems is revolutionizing trading strategies, risk management, and market prediction capabilities.

- Digital trading platforms are expanding beyond cryptocurrency to encompass tokenized real-world assets, creating bridges between traditional finance and blockchain-based systems that will define the future financial landscape.

- The evolution of cryptocurrency trading infrastructure, from improved scalability solutions to cross-chain interoperability, is eliminating technical barriers and enabling seamless global participation in digital asset markets.

- As regulatory frameworks mature and institutional infrastructure develops, cryptocurrency exchange platforms are positioned to become the primary venues for all forms of digital value exchange, fundamentally reshaping global financial markets.

The financial landscape is undergoing a profound transformation as cryptocurrency exchanges emerge as the cornerstone of modern digital trading. With over eight years of experience developing and deploying cryptocurrency exchange platforms, we have witnessed firsthand the remarkable evolution from experimental trading venues to sophisticated financial infrastructure serving millions of users worldwide. The convergence of blockchain technology, growing institutional adoption, and changing regulatory attitudes has created an environment where cryptocurrency trading is no longer a fringe activity but a legitimate component of diversified investment strategies. This comprehensive analysis explores why crypto exchanges represent the future of digital trading and how they are fundamentally reshaping the global financial ecosystem.

Understanding Cryptocurrency Trading

What is Cryptocurrency Trading?

Cryptocurrency trading represents the act of speculating on price movements of digital currencies through buying and selling activities on specialized platforms. Unlike traditional stock markets that operate during fixed hours, cryptocurrency trading occurs continuously across global markets, enabling participants to respond immediately to market developments regardless of their geographic location or time zone. The fundamental mechanism involves exchanging one cryptocurrency for another or converting digital assets into fiat currencies through online crypto exchange platforms that facilitate these transactions.

The trading process encompasses various strategies ranging from day trading and swing trading to long-term holding strategies known as “HODLing” in cryptocurrency communities. Traders utilize technical analysis, fundamental research, and market sentiment indicators to make informed decisions about entry and exit points. Modern cryptocurrency exchange platforms provide sophisticated tools including real-time charting, order book depth analysis, trading volume indicators, and automated trading capabilities that empower both novice and experienced traders to execute their strategies effectively.

The democratization of financial markets through cryptocurrency trading has eliminated many traditional barriers to entry. Anyone with internet access can participate in global markets, accessing the same opportunities previously reserved for institutional investors or wealthy individuals. This accessibility, combined with the potential for significant returns and the innovative nature of blockchain technology, has attracted millions of new participants to digital trading platforms, fundamentally changing how people interact with financial markets.

Role of Digital Assets Trading

Digital assets trading extends beyond simple cryptocurrency transactions to encompass a broad ecosystem of tokenized assets, non-fungible tokens (NFTs), stablecoins, and utility tokens that represent various forms of value and ownership. These digital assets leverage blockchain technology to create verifiable scarcity, transparent ownership records, and programmable functionality that traditional assets cannot provide. The role of digital assets trading in modern finance involves creating new markets, enabling fractional ownership of previously illiquid assets, and facilitating instant global transfers of value without intermediaries.

The significance of digital assets trading manifests in its capacity to tokenize real-world assets such as real estate, artwork, commodities, and even intellectual property rights. This tokenization process converts physical or intangible assets into digital representations that can be traded on blockchain-based platforms, dramatically increasing liquidity and accessibility. Investors can now own fractions of expensive assets, diversify portfolios across previously inaccessible markets, and trade these holdings with unprecedented efficiency. The ability to build crypto exchange platforms that support diverse digital assets has become crucial for businesses seeking to participate in this evolving ecosystem.

Furthermore, digital assets trading introduces programmable money through smart contracts that can automatically execute complex financial operations. This capability enables innovative financial products such as decentralized lending, automated market making, yield optimization strategies, and synthetic assets that mirror traditional financial instruments. The fusion of blockchain technology with financial innovation creates opportunities for building entirely new economic models that operate more efficiently than legacy systems while providing greater transparency and user control.

Importance of Crypto Investment Platforms

Crypto investment platforms serve as critical infrastructure connecting traditional finance with the emerging digital economy. These platforms provide the essential services, security measures, and user interfaces necessary for mainstream adoption of cryptocurrency trading. Their importance extends beyond mere transaction facilitation to encompass custody solutions, regulatory compliance, educational resources, and portfolio management tools that address the unique challenges of digital asset investing. Without robust crypto investment platforms, the broader cryptocurrency ecosystem would remain fragmented and inaccessible to most potential participants.

The value proposition of established crypto investment platforms includes professional-grade security protecting billions of dollars in user assets, insurance coverage for certain types of losses, regulatory compliance ensuring legal operation across multiple jurisdictions, and liquidity provision enabling efficient price discovery and trade execution. These platforms invest heavily in user experience design, recognizing that intuitive interfaces and educational content are essential for converting curious individuals into active traders. Many platforms now offer comprehensive suites of services including spot trading, derivatives markets, staking opportunities, lending facilities, and even credit cards integrated with cryptocurrency balances.

Looking forward, crypto investment platforms are evolving into comprehensive financial service providers that bridge the gap between traditional banking and blockchain-based systems. This evolution includes offering fiat on-ramps and off-ramps, tax reporting assistance, institutional custody solutions, and integration with existing financial infrastructure. The platforms that successfully navigate regulatory requirements while maintaining the innovative spirit of cryptocurrency will become the primary gateways through which mainstream users access digital financial services, fundamentally reshaping how individuals and institutions manage wealth in the digital age.

Types of Crypto Exchanges

Centralized Crypto Exchange

Centralized crypto exchange platforms operate under a traditional business model where a single entity manages the platform, maintains custody of user funds, and facilitates all trading activities through a centralized order book system. These exchanges function similarly to conventional stock exchanges, matching buyers with sellers and executing trades on behalf of users. The centralized architecture enables high-performance trading engines capable of processing thousands of transactions per second, providing the liquidity and speed necessary for active trading strategies. Major centralized exchanges have become household names, serving tens of millions of users and processing billions of dollars in daily trading volume.

The operational model of a centralized crypto exchange involves users depositing funds into exchange-controlled wallets, where the platform assumes responsibility for securing these assets. This custodial arrangement allows for faster trade execution since transactions occur within the exchange’s internal ledger rather than requiring blockchain confirmations for each trade. Centralized platforms typically offer advanced trading features including margin trading, futures contracts, options, lending services, and staking programs that cater to sophisticated traders seeking to maximize returns or hedge positions. The user experience generally prioritizes simplicity and speed, making these platforms particularly attractive to newcomers and active traders alike.

However, the centralized model introduces specific risks including the potential for exchange hacks, regulatory interventions, operational failures, and the fundamental requirement to trust the exchange operator. Historical incidents have demonstrated these vulnerabilities, leading to billions of dollars in losses over the cryptocurrency industry’s history. Despite these risks, centralized exchanges continue to dominate trading volume due to their superior liquidity, user-friendly interfaces, comprehensive customer support, and the convenience of having multiple services available through a single platform. The ongoing challenge for centralized operators involves balancing accessibility and performance with robust security measures and regulatory compliance.

Decentralized Exchange (DEX)

Decentralized exchange platforms represent a fundamentally different approach to cryptocurrency trading, eliminating central intermediaries through blockchain-based smart contracts that facilitate peer-to-peer transactions directly between users’ wallets. Unlike centralized platforms, DEX systems never take custody of user funds, instead enabling traders to maintain complete control over their private keys and assets throughout the entire trading process. This non-custodial model addresses many security concerns associated with centralized exchanges while embodying the core cryptocurrency principle of eliminating trusted third parties from financial transactions.

The technical implementation of decentralized exchange systems typically employs automated market makers (AMMs) rather than traditional order books. AMM protocols use liquidity pools where users deposit paired assets, and algorithms automatically determine exchange rates based on the ratio of assets in these pools. This innovation enables continuous liquidity provision without requiring centralized order matching, though it introduces new challenges such as impermanent loss for liquidity providers and potential price slippage for large trades. Alternative DEX designs include order book-based systems running on high-performance blockchains and hybrid models combining elements of both centralized and decentralized architectures.

Despite their advantages in security and user control, decentralized exchanges face limitations including lower liquidity compared to major centralized platforms, more complex user interfaces requiring blockchain knowledge, higher transaction costs during periods of network congestion, and limited trading features beyond basic swaps. The regulatory status of DEX platforms remains uncertain in many jurisdictions, creating potential compliance challenges. Nevertheless, the DEX ecosystem continues evolving rapidly, with innovations in cross-chain trading, layer-two scaling solutions, and improved user experiences gradually addressing these limitations and expanding the appeal of decentralized trading to broader audiences.

Online Crypto Exchange Options

The landscape of online crypto exchange options has diversified significantly to accommodate different user preferences, regulatory requirements, and trading objectives. Beyond the primary distinction between centralized and decentralized platforms, exchanges vary by specialization, geographic focus, supported assets, and target user segments. Some platforms focus exclusively on spot trading of major cryptocurrencies, while others offer comprehensive ecosystems including derivatives, lending, staking, and even NFT marketplaces. Regional exchanges cater to specific countries or regulatory jurisdictions, optimizing their services for local payment methods, languages, and compliance requirements.

Peer-to-peer (P2P) cryptocurrency platforms represent another category of online crypto exchange options, connecting individual buyers and sellers directly while providing escrow services and dispute resolution mechanisms. These platforms excel in markets with limited banking infrastructure or strict capital controls, enabling users to trade cryptocurrencies using local payment methods and currencies that major exchanges may not support. P2P platforms typically feature reputation systems where traders build trust scores based on successful transaction histories, creating a decentralized form of social proof that helps participants identify reliable trading partners.

Hybrid exchanges are emerging as a new category attempting to combine the benefits of both centralized and decentralized models. These platforms might offer centralized trading engines for performance while maintaining non-custodial wallet integration, or provide DEX-like security features alongside centralized customer support and user interfaces. Additionally, specialized platforms focusing on specific asset classes such as security tokens, derivatives, or institutional-grade trading have emerged to serve particular market segments. The diversity of online crypto exchange options ensures that users can find platforms aligned with their specific needs, risk tolerance, and regulatory comfort levels, contributing to the overall maturation of the cryptocurrency trading ecosystem.

Features of Digital Trading Platforms

Modern digital trading platforms incorporate a comprehensive suite of features designed to meet the diverse needs of cryptocurrency traders ranging from beginners to institutional participants. Core functionality includes real-time order books displaying current buy and sell orders at various price levels, advanced charting tools with dozens of technical indicators, multiple order types such as market, limit, stop-loss, and trailing stop orders, and portfolio tracking systems that calculate holdings, performance metrics, and profit/loss statements. These foundational features enable traders to execute strategies effectively while maintaining awareness of market conditions and position performance.

Security features constitute critical components of digital trading platform architecture. Industry-standard protections include two-factor authentication (2FA) using apps or hardware tokens, withdrawal whitelist functions restricting fund transfers to pre-approved addresses, cold storage systems keeping the majority of assets offline in secure facilities, regular security audits by independent third parties, and insurance coverage protecting against certain types of losses. Advanced platforms implement additional measures such as biometric authentication, anti-phishing codes, device management systems, and real-time monitoring for suspicious activities. These layered security approaches protect user assets while maintaining the accessibility necessary for convenient trading.

Beyond basic trading and security, leading platforms differentiate themselves through value-added services and innovative features. These include educational resources such as trading academies, market analysis reports, and video tutorials; social trading features allowing users to follow and copy successful traders; API access enabling algorithmic trading and integration with external tools; mobile applications providing full platform functionality on smartphones; staking and earning programs generating passive income from held assets; margin and leverage trading for experienced users; and comprehensive customer support through multiple channels. The continuous evolution of digital trading platform features reflects intense competition within the industry and drives ongoing improvement in user experience, security standards, and trading capabilities.

Emerging Crypto Market Trends

Current Trends in Cryptocurrency Trading

The cryptocurrency trading landscape is experiencing several transformative trends that are reshaping market dynamics and participant behavior. Institutional adoption has accelerated dramatically, with major financial institutions, corporations, and investment funds allocating significant capital to digital assets. This institutional participation brings increased liquidity, price stability, and legitimacy to cryptocurrency markets while demanding more sophisticated trading infrastructure, compliance frameworks, and custody solutions. The entry of traditional finance players has also driven development of regulated products such as cryptocurrency futures, options, and exchange-traded products that make digital asset exposure accessible through conventional investment accounts.

Another prominent trend involves the integration of decentralized finance (DeFi) protocols with cryptocurrency trading platforms. Users increasingly expect access to yield-generating opportunities, liquidity mining programs, and complex financial instruments previously available only through separate DeFi platforms. This convergence creates more comprehensive financial ecosystems where users can trade, lend, borrow, and earn returns on their assets through unified interfaces. Additionally, the rise of layer-two scaling solutions and alternative blockchain networks has addressed many performance limitations of earlier cryptocurrency systems, enabling higher transaction throughput, lower fees, and improved user experiences that rival centralized systems.

The growing focus on regulatory compliance represents a critical trend shaping the cryptocurrency trading industry’s evolution. Exchanges worldwide are implementing robust know-your-customer (KYC) and anti-money laundering (AML) procedures, geographic restrictions based on regulatory requirements, tax reporting features, and transparent operational practices. While some cryptocurrency purists view these developments as compromising the industry’s original ideals, increased regulatory clarity actually facilitates mainstream adoption by providing legal certainty and consumer protections that traditional investors require. The successful navigation of regulatory requirements while maintaining innovation will determine which platforms dominate the next phase of cryptocurrency market development.

Future of Crypto Trading

The future of crypto trading will be characterized by unprecedented integration with traditional financial systems, creating seamless bridges between legacy banking infrastructure and blockchain-based digital assets. This integration will manifest through central bank digital currencies (CBDCs) interfacing with cryptocurrency markets, tokenized versions of traditional securities trading alongside native digital assets, and financial institutions offering cryptocurrency services directly to retail and institutional clients. The distinction between “cryptocurrency exchanges” and “financial exchanges” will blur as digital assets become standard components of diversified portfolios and trading platforms evolve into comprehensive financial service providers serving all asset classes.

Technological advancement will drive significant improvements in trading capabilities and user experiences. Artificial intelligence and machine learning algorithms will power sophisticated trading bots, predictive analytics, risk management systems, and personalized recommendations that help users navigate increasingly complex markets. Cross-chain interoperability solutions will enable seamless trading across different blockchain networks without requiring multiple platform accounts or complicated bridging processes. Enhanced privacy technologies will allow users to maintain transaction confidentiality while still satisfying regulatory requirements, addressing concerns about financial surveillance in fully transparent blockchain systems.

The democratization of financial markets will accelerate as cryptocurrency trading platforms expand access to previously exclusive investment opportunities. Tokenization of real-world assets will enable fractional ownership of real estate, fine art, private equity, and other traditionally illiquid investments. Micro-investing capabilities will allow participation with minimal capital requirements, while social features and community-driven governance will empower users to influence platform development and market creation. The combination of technological innovation, regulatory maturation, and expanding use cases positions cryptocurrency trading platforms as the foundation for a more inclusive, efficient, and globally accessible financial system that transcends the limitations of legacy infrastructure.

Token Trading Platform Evolution

Token trading platform evolution reflects the cryptocurrency industry’s maturation from simple coin exchanges to sophisticated multi-asset marketplaces supporting diverse token economies. Early platforms focused exclusively on major cryptocurrencies like Bitcoin and Ethereum, but modern token trading platforms support thousands of assets including utility tokens, governance tokens, security tokens, stablecoins, wrapped assets, and synthetic instruments. This expansion enables traders to access emerging projects, participate in token sales, engage with decentralized autonomous organizations (DAOs), and diversify across various blockchain ecosystems. The proliferation of tokens has created specialized platforms focusing on specific categories such as gaming tokens, DeFi governance tokens, or real-world asset tokens.

The technical infrastructure supporting token trading platforms has evolved significantly to handle increased complexity and scale. Advanced platforms now feature multi-chain support enabling trading across Ethereum, Binance Smart Chain, Solana, Polygon, and numerous other networks from unified interfaces. Automated market maker integrations provide instant liquidity for long-tail tokens that might have insufficient depth on traditional order books. Cross-chain bridges facilitate movement of assets between different blockchain ecosystems, while aggregators scan multiple DEX platforms and liquidity sources to find optimal pricing for trades. These technological improvements reduce friction and enhance efficiency in token trading platform operations.

Looking forward, token trading platforms will likely incorporate more sophisticated features addressing current limitations and expanding use cases. Improved discovery mechanisms will help users identify promising projects among thousands of available tokens through data-driven analytics, community signals, and fundamental analysis tools. Enhanced due diligence and security screening will protect users from scams and low-quality projects while maintaining open access principles. Integration with social platforms, gaming ecosystems, and metaverse applications will create direct trading channels within these environments. The evolution of token trading platforms toward becoming comprehensive digital asset marketplaces supporting any form of tokenized value represents a fundamental shift in how assets are created, distributed, and exchanged in the digital economy.

Advantages of Digital Trading Platforms

Enhanced Trading Efficiency

Digital trading platforms deliver unprecedented efficiency advantages compared to traditional financial markets through their 24/7 operational model, instant settlement capabilities, and automated execution systems. Unlike stock markets that close evenings and weekends, cryptocurrency markets operate continuously, enabling traders to respond immediately to news events, market movements, or personal circumstances regardless of time or location. This constant availability eliminates the frustration of waiting for markets to open and removes opportunities for gap risk where prices move significantly during closed periods. The global nature of cryptocurrency trading means that liquidity exists around the clock as participants from different time zones engage with markets.

Transaction settlement on blockchain-based digital trading platforms occurs dramatically faster than traditional securities transactions. While conventional stock trades may require two to three business days to settle, cryptocurrency trades can finalize in seconds to minutes depending on the blockchain network and confirmation requirements. This rapid settlement reduces counterparty risk, enables faster capital redeployment, and improves overall market efficiency. Advanced platforms further enhance speed through internal ledger systems that allow instant trades between users without requiring blockchain confirmations for every transaction. The combination of continuous operation and rapid settlement creates trading efficiency that legacy financial systems cannot match.

Automation capabilities inherent in digital trading platforms provide additional efficiency gains through programmable trading strategies, algorithmic execution, and smart contract-based operations. Traders can implement sophisticated strategies using APIs and trading bots that monitor markets continuously, execute trades based on technical indicators, and manage positions automatically according to predefined rules. Stop-loss orders, take-profit targets, and rebalancing strategies can execute without manual intervention, protecting against adverse movements and capitalizing on opportunities even when traders are not actively monitoring markets. This automation reduces the time commitment required for active trading while improving execution quality and emotional discipline in trading decisions.

Access to Global Markets

Cryptocurrency exchange platforms democratize access to global financial markets in ways previously impossible for average individuals. Traditional international investing often requires specialized brokerage accounts, faces currency conversion complexities, involves high minimum investments, and restricts access based on geography or accreditation status. In contrast, anyone with an internet connection can access cryptocurrency markets regardless of their location, wealth, or institutional affiliations. This universal accessibility breaks down barriers that have historically concentrated financial opportunities among wealthy individuals and institutions in developed countries, creating more equitable participation in global markets.

The borderless nature of cryptocurrency trading enables seamless capital flows across international boundaries without the friction, costs, and delays associated with traditional cross-border transactions. Users can trade assets originated in any country, access projects from emerging markets, and diversify portfolios across global opportunities through unified platforms. This global market access extends beyond major cryptocurrencies to include tokens representing projects, companies, and assets from every corner of the world. The elimination of geographic restrictions creates more efficient capital allocation as investment flows to the most promising opportunities regardless of physical location, while providing projects worldwide with access to global capital pools.

Furthermore, cryptocurrency exchange platforms provide exposure to entirely new asset classes and investment strategies unavailable through traditional channels. Users can participate in decentralized finance protocols generating yields impossible in conventional banking, invest in tokenized real-world assets typically restricted to institutional investors, support innovative blockchain projects through token purchases, and access derivatives markets with leverage and hedging capabilities. This expanded opportunity set allows for portfolio construction strategies and diversification approaches that transcend traditional asset class limitations. The combination of universal accessibility and diverse opportunities positions digital trading platforms as the gateway to a truly global and inclusive financial ecosystem.

Security and Transparency through Blockchain Trading

Blockchain trading technology provides fundamental security and transparency advantages that address many vulnerabilities of traditional financial systems. Every transaction recorded on a blockchain creates an immutable, permanent record that cannot be altered or deleted retroactively. This tamper-proof audit trail enables verification of all historical transactions, making fraud detection easier and creating accountability for all participants. The distributed nature of blockchain networks eliminates single points of failure that plague centralized systems, as the ledger exists across thousands of nodes worldwide. Even if individual nodes fail or face attacks, the network continues operating and maintaining transaction history integrity.

The transparency of public blockchains allows anyone to verify transactions, track asset movements, and audit platform operations in real-time without requiring permission or special access. This radical transparency contrasts sharply with opaque traditional financial systems where transaction details remain hidden within institutional databases. Users can independently verify that cryptocurrency exchange platforms maintain adequate reserves, that transactions execute as claimed, and that platform operators handle funds appropriately. While this transparency raises some privacy concerns that newer technologies are addressing, it fundamentally shifts power dynamics by enabling users to trust mathematical and cryptographic verification rather than institutional reputations.

Advanced security features enabled by blockchain technology include multi-signature wallets requiring multiple parties to approve transactions, time-locked contracts that prevent premature fund access, programmable permissions defining exactly what actions different parties can take, and cryptographic proof systems validating operations without revealing sensitive details. Smart contracts can enforce trading rules, custody arrangements, and financial agreements automatically without requiring trust in human intermediaries. While cryptocurrency platforms still face security challenges, particularly around private key management and user education, the underlying blockchain technology provides a more secure foundation than legacy systems built on centuries-old banking infrastructure never designed for the digital age.

Comparing Centralized and Decentralized Exchanges

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Custody | Platform controls user funds | Users maintain full control of assets |

| Liquidity | High liquidity and tight spreads | Variable liquidity, potential slippage |

| Speed | Instant internal transactions | Depends on blockchain confirmation time |

| Privacy | Requires KYC verification | Pseudonymous, minimal personal data |

| User Experience | Intuitive interfaces, customer support | Complex, requires blockchain knowledge |

| Security Risk | Platform hacks, regulatory seizure | Smart contract vulnerabilities, user error |

| Trading Features | Advanced tools, margin, derivatives | Basic swaps, limited advanced features |

| Regulation | Subject to regulatory oversight | Uncertain regulatory status |

Pros and Cons of Centralized Crypto Exchange

Centralized crypto exchange platforms offer compelling advantages that explain their continued dominance in trading volume and user adoption. The superior liquidity available on major centralized exchanges enables efficient price discovery and minimal slippage even for large trades, making them ideal for active traders and institutional participants. The intuitive user interfaces, comprehensive customer support, and familiar account structures lower barriers to entry for cryptocurrency newcomers accustomed to traditional financial services. Advanced trading features including margin trading, futures contracts, options, and lending services provide sophisticated tools that professional traders require. Additionally, centralized platforms typically offer better fiat currency integration, making deposits and withdrawals more convenient for users without existing cryptocurrency holdings.

However, centralized exchanges present significant disadvantages that users must carefully consider. The custodial model requires trusting the exchange operator with your funds, creating vulnerability to hacks, mismanagement, or fraud as historical incidents have demonstrated. Regulatory risks include potential account freezes, geographic restrictions, or platform shutdowns based on government actions. Privacy concerns arise from extensive KYC requirements that collect detailed personal information and transaction data. Centralized exchanges can experience downtime during high-volatility periods when trading activity overwhelms system capacity. The concentration of assets on centralized platforms creates attractive targets for cybercriminals and introduces systemic risks to the broader cryptocurrency ecosystem.

The decision to use centralized crypto exchange platforms involves weighing convenience and features against control and security concerns. For users prioritizing ease of use, liquidity, and advanced trading capabilities, centralized exchanges remain the practical choice despite their drawbacks. However, security-conscious users should implement protective measures including minimizing exchange balances, enabling all available security features, using hardware wallets for long-term storage, and diversifying across multiple platforms. Understanding both the advantages and limitations of centralized exchanges enables users to make informed decisions aligned with their risk tolerance and trading requirements.

Pros and Cons of Decentralized Exchange

Decentralized exchange platforms provide unique advantages centered on user control, privacy, and alignment with cryptocurrency’s original vision. The non-custodial architecture means users maintain complete control over their private keys and assets throughout the trading process, eliminating the risk of exchange hacks stealing user funds. Enhanced privacy through pseudonymous transactions allows users to trade without revealing personal information or submitting to KYC procedures. The censorship-resistant nature of DEX platforms means no central authority can freeze accounts, restrict access, or prevent transactions. Open-source smart contracts enable community verification of platform operations and create transparency impossible with proprietary centralized systems. For users valuing sovereignty and privacy, these attributes make decentralized exchanges appealing despite their limitations.

The disadvantages of decentralized exchange platforms primarily relate to usability, performance, and feature limitations. Lower liquidity compared to centralized platforms results in wider bid-ask spreads and potential slippage, particularly for less popular trading pairs or larger orders. More complex user interfaces require understanding wallet management, gas fees, transaction confirmations, and blockchain operations that intimidate newcomers. Transaction costs can become prohibitively expensive during network congestion periods, especially on Ethereum where gas fees have historically spiked dramatically. Limited trading features restrict advanced strategies available on centralized platforms. Smart contract risks include potential vulnerabilities or bugs that could lead to loss of funds, while impermanent loss affects liquidity providers in AMM-based systems.

The future development of decentralized exchange technology aims to address current limitations while preserving core advantages. Layer-two scaling solutions and alternative blockchain networks are dramatically reducing transaction costs and improving speed. User experience improvements make DEX platforms more accessible to non-technical users through better interfaces and wallet integrations. Cross-chain protocols enable trading across multiple blockchain networks from unified platforms. Despite ongoing challenges, the DEX ecosystem continues growing as users increasingly value the security, privacy, and control benefits that decentralized architectures provide. The ideal choice between centralized and decentralized exchanges depends on individual priorities regarding convenience versus control, with many users ultimately utilizing both types of platforms for different purposes.

Choosing the Right Platform for Your Needs

Selecting the appropriate cryptocurrency exchange requires careful evaluation of multiple factors aligned with your specific trading objectives, risk tolerance, and experience level. Begin by identifying your primary use case: are you a long-term investor making occasional purchases, an active day trader requiring advanced tools and high liquidity, a privacy-focused user prioritizing anonymity, or an institutional participant needing regulatory compliance and custody solutions? Your trading frequency, typical transaction sizes, preferred cryptocurrencies, and geographic location all influence which platforms best serve your needs. Understanding your priorities enables more effective evaluation of the trade-offs inherent in different platform types.

Key evaluation criteria should include security track record and measures, regulatory compliance and licensing, available trading pairs and supported assets, fee structure including trading, deposit, and withdrawal costs, liquidity depth for your preferred markets, user interface quality and ease of use, customer support responsiveness and channels, payment method options, mobile app functionality, and additional features like staking, lending, or educational resources. Research platform histories for security incidents, read user reviews focusing on customer service experiences, and test platforms with small amounts before committing significant capital. Consider using multiple platforms to access the best features from different providers while avoiding overconcentration of assets on any single exchange.

Risk management principles should guide platform selection decisions. Never maintain more funds on any exchange than necessary for active trading, regularly withdraw excess holdings to personal wallets you control, enable all available security features including two-factor authentication and withdrawal whitelists, use unique strong passwords for each platform, and verify website URLs before entering credentials to avoid phishing attacks. Stay informed about regulatory developments affecting exchanges in your jurisdiction and be prepared to adapt if platforms face legal challenges or operational changes. The quality of crypto exchange developers and the platform’s technical infrastructure should factor into your decision, as these elements determine reliability, security, and future innovation capabilities. A thoughtful, cautious approach to platform selection protects your assets while enabling effective participation in cryptocurrency markets.

Investment Opportunities on Crypto Exchanges

Crypto Investment Platforms and Their Offerings

Modern crypto investment platforms have evolved far beyond simple buy-and-sell functionality to become comprehensive financial ecosystems offering diverse investment opportunities. Spot trading remains the foundation, allowing direct purchase and sale of cryptocurrencies at current market prices, but platforms now provide numerous additional revenue-generating options. Staking programs enable users to earn passive income by locking tokens to support blockchain network operations, with annual percentage yields varying from low single digits to double-digit returns depending on the asset and lock-up terms. Lending services allow users to supply cryptocurrencies to borrowers in exchange for interest payments, creating income streams from otherwise idle holdings.

Yield farming and liquidity provision opportunities on integrated DeFi protocols enable users to earn trading fees and token rewards by contributing assets to liquidity pools. Launchpad services provide early access to new token offerings, potentially allowing investors to purchase promising projects before they trade publicly, though these opportunities carry significant risk alongside their potential rewards. Savings accounts offering guaranteed interest rates on stable cryptocurrency deposits provide low-risk options for conservative investors. Derivatives markets including futures, options, and perpetual swaps enable sophisticated trading strategies such as hedging, speculation on price movements without owning underlying assets, and leveraged positions amplifying both gains and losses.

The expanding service offerings reflect crypto investment platforms positioning themselves as all-in-one financial service providers rather than single-purpose trading venues. Some platforms now offer crypto-backed loans allowing users to borrow against their holdings without selling, crypto debit cards enabling spending directly from cryptocurrency balances, recurring purchase plans for dollar-cost averaging strategies, portfolio rebalancing tools, tax reporting assistance, and educational programs helping users understand increasingly complex financial products. This comprehensive approach attracts users seeking to consolidate their cryptocurrency activities on unified platforms while generating multiple income streams from their digital asset portfolios.

Diversification through Digital Assets Trading

Digital assets trading enables portfolio diversification strategies that transcend traditional asset class limitations. Cryptocurrencies themselves represent a new asset class with return profiles and risk characteristics largely uncorrelated with traditional stocks, bonds, and commodities. Within the cryptocurrency universe, thousands of distinct tokens offer exposure to different sectors including decentralized finance, non-fungible token ecosystems, gaming platforms, enterprise blockchain solutions, payment networks, and emerging Web3 applications. This diversity allows investors to construct portfolios reflecting specific theses about which blockchain sectors will succeed while spreading risk across multiple projects and technologies.

The tokenization of real-world assets through blockchain technology creates additional diversification opportunities by enabling fractional ownership of previously inaccessible investments. Real estate tokens allow small investors to own portions of properties and receive proportional rental income without the capital requirements and management responsibilities of direct ownership. Tokenized commodities provide exposure to gold, silver, oil, and other physical goods without storage concerns. Security tokens representing equity or debt in private companies democratize access to private market investments traditionally reserved for accredited investors and institutions. This expansion of investable assets through tokenization dramatically increases portfolio construction possibilities.

Effective diversification through digital assets trading requires understanding correlation patterns, risk factors, and market dynamics specific to cryptocurrency markets. While cryptocurrencies often move together during major market trends, individual projects can experience dramatically different outcomes based on technological development, adoption metrics, competitive positioning, and regulatory treatment. Geographic diversification across projects originated in different jurisdictions provides some protection against country-specific regulatory actions. Temporal diversification through dollar-cost averaging reduces timing risk in volatile markets. Combining different investment strategies such as long-term holding, active trading, yield generation, and speculative positions creates more robust portfolios capable of performing across various market conditions.

Market Timing and Trend Analysis

Market timing and trend analysis in cryptocurrency trading utilize both technical and fundamental methodologies to identify optimal entry and exit points. Technical analysis examines price charts, trading volumes, and mathematical indicators to identify patterns suggesting future price movements. Common tools include moving averages indicating trend direction, relative strength index (RSI) measuring overbought or oversold conditions, MACD (Moving Average Convergence Divergence) signaling momentum changes, Fibonacci retracements identifying potential support and resistance levels, and chart patterns like head-and-shoulders formations or triangle consolidations. While technical analysis cannot predict prices with certainty, it provides frameworks for making probabilistic assessments about likely market movements.

Fundamental analysis evaluates the intrinsic value of cryptocurrencies based on underlying factors such as network activity metrics, developer activity, adoption rates, competitive positioning, technological capabilities, tokenomics including supply schedules and token utility, partnership announcements, regulatory developments, and macroeconomic conditions. On-chain analysis examines blockchain data directly, tracking metrics like transaction volumes, active addresses, exchange inflows and outflows, holder distributions, and smart contract activity to gauge network health and investor behavior. Combining technical and fundamental approaches provides more comprehensive market understanding than relying on either methodology alone.

Effective market timing requires discipline, patience, and realistic expectations about prediction accuracy. No strategy wins consistently, and even sophisticated approaches produce losing trades regularly. Successful traders employ risk management principles including position sizing limiting any single trade to a small percentage of total capital, stop-loss orders automatically closing positions at predetermined loss levels, take-profit targets securing gains before reversals, and portfolio rebalancing maintaining desired risk exposures. Understanding that market timing is inherently challenging and that long-term holding often outperforms active trading for most participants tempers expectations and prevents overtrading. Continuous learning, adaptation to changing market conditions, and emotional discipline separate successful traders from those who struggle in volatile cryptocurrency markets.

Regulatory and Security Considerations

Compliance in Cryptocurrency Exchange Platforms

Regulatory compliance has become a central concern for cryptocurrency exchange platforms as governments worldwide develop frameworks to govern digital asset activities. Exchanges must navigate complex, often conflicting requirements across multiple jurisdictions where they operate or serve users. Core compliance obligations typically include anti-money laundering (AML) programs monitoring transactions for suspicious activities, know-your-customer (KYC) procedures verifying user identities, financial licensing obtaining permits to operate as money transmitters or securities platforms, reporting requirements providing transaction data to tax authorities and regulators, and operational standards ensuring adequate reserves, internal controls, and business continuity planning. Meeting these obligations requires substantial investments in compliance personnel, technological systems, and legal expertise.

The regulatory landscape varies dramatically across jurisdictions, creating challenges for global platforms and users. Some countries like El Salvador and Switzerland have embraced cryptocurrencies with clear, supportive regulations encouraging innovation while protecting consumers. Others including China and Algeria have imposed outright bans on cryptocurrency trading. Most nations fall somewhere between these extremes, with evolving regulatory approaches reflecting ongoing debates about how to balance innovation encouragement with consumer protection, financial stability, and law enforcement concerns. The United States presents particular complexity with overlapping federal and state regulations, multiple agencies claiming jurisdiction, and ongoing uncertainty about which cryptocurrencies qualify as securities versus commodities.

Forward-thinking cryptocurrency exchange platforms view regulatory compliance not as a burden but as a competitive advantage and necessary step toward mainstream adoption. Platforms with robust compliance programs can partner with traditional financial institutions, attract institutional investors requiring regulatory certainty, and access banking services that non-compliant competitors cannot obtain. Proactive engagement with regulators helps shape policy development, while transparent operations build trust with users and authorities. As the industry matures, regulatory compliance will increasingly separate legitimate, sustainable platforms from those operating in legal gray areas. Exchanges investing in compliance infrastructure position themselves for long-term success in an environment where regulatory expectations will only intensify.

Security Features of Digital Trading Platforms

Security architecture forms the foundation of trustworthy digital trading platforms, with multiple defensive layers protecting user assets against diverse threats. Cold storage systems maintain the majority of exchange assets offline in hardware security modules or paper wallets physically isolated from internet connections, dramatically reducing exposure to remote hacking attempts. Hot wallets maintaining sufficient liquidity for immediate withdrawals employ advanced security measures including multi-signature requirements where multiple parties must approve transactions, hardware security modules (HSMs) providing tamper-resistant key storage, and sophisticated monitoring systems detecting anomalous activities. Leading platforms maintain insurance coverage protecting users against losses from security breaches, providing additional peace of mind.

User-facing security features empower individuals to protect their accounts through two-factor authentication (2FA) requiring verification codes from mobile apps or hardware tokens, withdrawal address whitelisting restricting fund transfers to pre-approved destinations, anti-phishing codes appearing in official platform emails to verify authenticity, device management systems alerting users to logins from unrecognized devices or locations, and session management allowing users to terminate active sessions remotely. Advanced platforms implement additional protections such as behavioral analysis detecting unusual account activity patterns, mandatory security checkups requiring users to update passwords periodically, and educational prompts teaching security best practices throughout the user interface.

Beyond technical measures, organizational security practices including regular third-party security audits, penetration testing simulating attack scenarios, bug bounty programs incentivizing security researchers to report vulnerabilities, employee security training, and incident response planning establish comprehensive security cultures. Transparency about security measures and historical incidents builds user trust more effectively than claiming perfect security, as informed users understand that all systems face risks and can make better decisions about appropriate precautions. The ongoing arms race between platform security teams and sophisticated attackers requires continuous investment in emerging technologies, threat intelligence, and security personnel to stay ahead of evolving threats targeting increasingly valuable digital assets.

Future Regulations and Impact on Trading

The future regulatory environment for cryptocurrency trading will likely feature increased clarity, standardization, and coordination across jurisdictions as governments gain confidence in their understanding of digital assets and appropriate oversight frameworks. We anticipate comprehensive regulatory regimes emerging that classify different token types with corresponding requirements, establish clear licensing frameworks for exchanges and service providers, mandate consumer protection standards including insurance requirements and capital reserves, implement robust AML/KYC standards while respecting legitimate privacy interests, and create international cooperation mechanisms addressing the borderless nature of cryptocurrency networks. These developments will provide legal certainty that currently inhibits many traditional institutions from fully embracing digital assets.

Regulatory evolution will impact cryptocurrency trading in complex ways with both constraining and enabling effects. Increased compliance requirements will raise operational costs, potentially forcing smaller exchanges to exit markets or consolidate with larger competitors. Geographic restrictions may fragment global liquidity pools as platforms limit services based on user locations. Enhanced KYC requirements will reduce pseudonymity that some users value. However, regulatory clarity will also catalyze mainstream adoption by providing legal certainty for institutional investors, enabling traditional financial institutions to offer cryptocurrency services, facilitating integration with existing financial infrastructure, and protecting consumers from fraud and market manipulation that currently plague less-regulated platforms.

The cryptocurrency industry must actively participate in regulatory development to ensure frameworks balance legitimate oversight concerns with innovation preservation. Industry associations, individual platforms, and technology developers should engage constructively with policymakers, provide technical education, propose workable compliance approaches, and demonstrate commitment to consumer protection and market integrity. The alternative of hostile, poorly-informed regulations imposed without industry input could stifle innovation and push activities to underground markets where oversight is impossible. Successfully navigating the regulatory transition will require sophisticated compliance capabilities, proactive engagement with authorities, and commitment to operating transparently within established legal frameworks while advocating for sensible rules that recognize cryptocurrency’s unique characteristics.

The Future Landscape of Digital Trading

Integration of AI and Advanced Analytics in Crypto Exchanges

Artificial intelligence and machine learning technologies are transforming cryptocurrency exchange capabilities through applications spanning market prediction, risk management, user experience personalization, and operational optimization. Predictive analytics systems analyze vast datasets including price histories, trading volumes, social media sentiment, news events, and on-chain metrics to identify patterns correlating with future price movements. While perfect prediction remains impossible in chaotic markets, AI models provide probabilistic assessments helping traders make more informed decisions. Algorithmic trading systems powered by machine learning can execute complex strategies automatically, responding to market conditions faster than human traders while removing emotional biases from trading decisions.

AI-driven personalization engines create customized user experiences based on individual trading patterns, experience levels, and stated preferences. Recommendation systems suggest relevant trading pairs, identify potentially interesting investment opportunities, and provide educational content matched to user knowledge levels. Natural language processing enables conversational interfaces where users can execute trades, query account information, and receive market analysis through chatbot interactions. Anomaly detection algorithms monitor user accounts and platform activities for suspicious patterns indicating potential fraud, account compromise, or market manipulation, enhancing security while reducing false positive alerts that frustrate legitimate users.

The future integration of AI into cryptocurrency exchanges will become increasingly sophisticated as models improve and training data accumulates. Advanced systems will provide comprehensive risk assessment quantifying potential downside across portfolio holdings, automated rebalancing maintaining desired asset allocations, tax optimization suggesting trades that minimize tax liability, and simulated trading environments where users test strategies against historical data before risking capital. However, users must understand that AI systems are tools amplifying human judgment rather than infallible oracles, and that market unpredictability ensures even sophisticated models will experience incorrect predictions. The most effective approach combines AI capabilities with human oversight, domain expertise, and critical thinking about model limitations.

Expansion of Blockchain Trading Ecosystem

The blockchain trading ecosystem is expanding rapidly beyond pure cryptocurrency exchanges to encompass diverse platforms, protocols, and services creating a comprehensive financial infrastructure. Cross-chain bridges enable asset transfers between different blockchain networks, allowing users to access opportunities across multiple ecosystems without maintaining separate holdings on each chain. Layer-two scaling solutions built atop primary blockchains dramatically increase transaction throughput and reduce costs while inheriting security properties of underlying networks. Decentralized finance protocols offer sophisticated financial services including lending, borrowing, derivatives, insurance, and structured products entirely through smart contracts without traditional intermediaries.

Interoperability solutions are emerging to address blockchain fragmentation, with protocols enabling seamless communication and value transfer across previously isolated networks. Universal wallets provide unified interfaces for managing assets across multiple blockchains, while aggregator platforms scan diverse DEX and liquidity sources to find optimal pricing for trades. Oracle networks supply external data to smart contracts, enabling blockchain applications to interact with real-world information and events. Identity solutions based on self-sovereign identity principles allow users to maintain portable, verifiable credentials usable across multiple platforms while controlling personal data disclosure. These infrastructure developments create a more cohesive ecosystem where different components interoperate smoothly.

Looking forward, the blockchain trading ecosystem will increasingly integrate with traditional financial infrastructure through central bank digital currencies, tokenized securities, and hybrid systems combining blockchain efficiency with regulatory compliance. Real-world asset tokenization will accelerate as legal frameworks clarify ownership rights and transfer mechanisms for digital representations of physical assets. The distinction between “cryptocurrency” and “traditional finance” will blur as blockchain technology becomes the underlying infrastructure for all value transfer, while user interfaces abstract away technical complexity. This evolution positions blockchain trading systems as the foundation for a more efficient, transparent, and accessible global financial system transcending limitations of legacy infrastructure developed before digital technology.

Why Crypto Exchanges are the Future of Digital Trading

Cryptocurrency exchanges represent the future of digital trading because they fundamentally address limitations inherent in legacy financial infrastructure while enabling entirely new economic possibilities. The 24/7 operation eliminates arbitrary market closures, the global accessibility democratizes financial participation, the programmability through smart contracts automates complex operations, the transparency of blockchain systems enables verifiable trust, and the digital nature allows for fractional ownership and instant settlement impossible with physical assets. These advantages are not incremental improvements but paradigm shifts in how financial markets can function, creating capabilities that legacy systems cannot match regardless of how much they modernize.

The convergence of multiple technological and social trends positions cryptocurrency exchanges at the intersection of several major transformations. Growing digital native populations comfortable with purely digital assets and online interactions find cryptocurrency trading natural extensions of their existing digital lives. Increasing distrust of traditional institutions after financial crises, monetary inflation, and surveillance concerns drives interest in decentralized alternatives offering user control. Technological maturation of blockchain systems addresses early scalability and usability problems that limited adoption. Regulatory evolution provides legal clarity encouraging institutional participation. These converging factors create a perfect storm of conditions favoring cryptocurrency exchange ascendance.

Perhaps most importantly, cryptocurrency exchanges serve as gateways to entirely new economic paradigms including decentralized autonomous organizations, tokenized ownership of real-world assets, programmable money with embedded logic, borderless value transfer without intermediaries, and composable financial services where different protocols interoperate seamlessly. These innovations transcend simple trading to reimagine fundamental aspects of economic organization. As these new models demonstrate superiority over legacy approaches in specific use cases, adoption will accelerate and expand into more areas of economic activity. Cryptocurrency exchanges, as the primary access points for this emerging digital economy, will naturally become central infrastructure for a financial system that will look dramatically different from today’s centralized, analog-legacy systems.

Build Your Exchange | Expert crypto platform development

Launch Your Digital Trading Platform, Transform your vision into reality with our proven crypto exchange development solutions.

Conclusion

The transformation of financial markets through cryptocurrency exchanges represents one of the most significant developments in modern economic history. Over our eight years of experience in the cryptocurrency exchange development industry, we have observed the evolution from experimental platforms serving enthusiasts to sophisticated financial infrastructure handling trillions of dollars in annual trading volume. The advantages of cryptocurrency trading including continuous operation, global accessibility, rapid settlement, transparent blockchain technology, and innovative financial products position digital trading platforms as superior alternatives to legacy systems for many use cases. While challenges remain around security, regulation, and user education, the trajectory clearly points toward increasing adoption and integration with mainstream finance.

The distinction between centralized and decentralized exchanges reflects different philosophical approaches and technical trade-offs, with both models serving valuable roles in the broader ecosystem. Centralized platforms provide the liquidity, features, and user experience necessary for mainstream adoption, while decentralized alternatives offer control, privacy, and censorship resistance valued by users prioritizing sovereignty over convenience. The future likely involves hybrid models combining advantages from both approaches, alongside continued innovation in user experience, security, and functionality. Investors and traders should understand the characteristics of different platform types to select options aligned with their specific needs, risk tolerance, and values.

The emerging trends in cryptocurrency trading including institutional adoption, artificial intelligence integration, regulatory maturation, blockchain interoperability, and real-world asset tokenization suggest that digital trading platforms will expand far beyond their current scope. What began as platforms for trading experimental digital currencies is evolving into comprehensive financial ecosystems supporting diverse investment strategies, passive income generation, and access to previously exclusive opportunities. The democratization of finance through accessible, transparent, and efficient digital trading platforms has the potential to create a more equitable global financial system where participation is not limited by geography, wealth, or institutional connections.

Looking toward the future, cryptocurrency exchanges will likely become indistinguishable from “financial exchanges” broadly as digital assets become standard portfolio components and blockchain technology becomes the underlying infrastructure for all value transfer. The innovations pioneered by cryptocurrency trading platforms including programmable transactions, decentralized operation, transparent ledgers, and global accessibility will influence how all financial markets function. Traditional financial institutions are already adopting these technologies, recognizing that resistance to change threatens their relevance in an increasingly digital world. The next decade will determine whether incumbent institutions successfully adapt or whether new blockchain-native platforms fully displace legacy systems.

For individuals and institutions considering participation in cryptocurrency markets, the present moment offers compelling opportunities alongside genuine risks requiring careful consideration. The importance of thorough research, appropriate risk management, diversification, security consciousness, and regulatory awareness cannot be overstated. Those who approach cryptocurrency trading with realistic expectations, continuous learning mindsets, and disciplined strategies position themselves to benefit from the ongoing transformation of global financial markets. Conversely, those who ignore due diligence, chase unsustainable returns, or fail to implement basic security precautions expose themselves to significant losses in volatile, rapidly-evolving markets.

The vision of cryptocurrency exchanges as the future of digital trading is not merely speculative but grounded in observable trends, technological capabilities, and demonstrated user preferences. The billions of users worldwide who have embraced cryptocurrency trading represent a permanent shift in how people interact with financial markets rather than a temporary fad. As blockchain technology matures, regulatory frameworks clarify, institutional infrastructure develops, and user experiences improve, the transition toward digital trading platforms will accelerate. Those who understand and prepare for this transition position themselves advantageously in the emerging financial landscape, while those who dismiss or ignore these developments risk obsolescence in a world where digital assets and blockchain-based systems become standard rather than exceptional.

In conclusion, cryptocurrency exchanges embody the future of digital trading through their superior technological capabilities, alignment with digital-native user preferences, enablement of innovative financial products, and potential to create more accessible and efficient financial markets. The transformation is already underway, with momentum building across technological development, regulatory evolution, institutional adoption, and user growth. While uncertainties remain about specific outcomes, the direction of travel is clear. Understanding why crypto exchanges represent the future of digital trading and positioning oneself appropriately within this evolving ecosystem will prove essential for participants ranging from individual investors to major financial institutions. The financial revolution enabled by cryptocurrency exchanges is not coming; it is here, and its influence will only expand in the years ahead.

Frequently Asked Questions

A cryptocurrency exchange is a digital platform that facilitates the buying, selling, and trading of cryptocurrencies and other digital assets. These platforms act as intermediaries between buyers and sellers, matching orders and executing trades in real-time. Cryptocurrency exchanges work by maintaining order books that list all buy and sell orders, using sophisticated matching engines to pair compatible trades based on price and volume, while charging transaction fees for their services.

Centralized exchanges (CEX) are operated by companies that act as custodians of user funds and facilitate trades through a traditional order book system, offering high liquidity and user-friendly interfaces. Decentralized exchanges (DEX) operate on blockchain technology without a central authority, allowing users to maintain control of their private keys and trade directly from their wallets through smart contracts. The primary difference lies in custody, control, and the underlying technology, with centralized platforms offering convenience and speed while decentralized options provide greater privacy and security.

The safety of cryptocurrency exchanges varies significantly based on the platform’s security measures, regulatory compliance, and operational practices. Reputable exchanges implement multiple security layers including two-factor authentication, cold storage for the majority of funds, encryption protocols, and regular security audits. However, users should understand that cryptocurrency trading carries inherent risks including market volatility, potential platform vulnerabilities, and regulatory uncertainties. Choosing established, regulated exchanges with proven security track records and enabling all available security features significantly reduces but does not eliminate these risks.

Cryptocurrency trading fees typically include several components that vary by platform and transaction type. Trading fees, usually calculated as a percentage of the transaction value, range from 0.1% to 1% per trade on most platforms, with many offering reduced rates for high-volume traders. Additional costs include deposit and withdrawal fees for moving funds to and from the exchange, network fees paid to blockchain validators for processing transactions, and spread costs representing the difference between buy and sell prices. Some platforms also charge monthly subscription fees for advanced features or premium services.

Selecting the right cryptocurrency exchange requires evaluating multiple factors based on your specific trading needs and priorities. Key considerations include the platform’s security features and regulatory compliance, available cryptocurrency pairs and trading volume, fee structure and competitive pricing, user interface and ease of use, customer support quality, and payment method options. Additionally, assess the exchange’s reputation through user reviews, verify its licensing and jurisdiction, examine liquidity levels for your preferred trading pairs, and ensure it offers appropriate tools for your trading strategy whether you’re a beginner or advanced trader.

The future of cryptocurrency exchanges points toward increased integration of artificial intelligence for predictive analytics and automated trading, enhanced regulatory compliance frameworks providing greater legitimacy and user protection, and hybrid models combining the benefits of centralized and decentralized systems. Emerging trends include cross-chain trading capabilities enabling seamless transactions across different blockchain networks, improved user experiences through intuitive interfaces and educational resources, and institutional-grade infrastructure attracting traditional financial institutions. The evolution will likely feature greater interoperability, advanced security measures, and expanded services beyond simple trading to include staking, lending, and decentralized finance integration.

Beginners can successfully start trading on cryptocurrency exchanges by choosing platforms specifically designed for new users with intuitive interfaces, educational resources, and simplified trading options. Most major exchanges offer beginner-friendly features including guided onboarding processes, demo accounts for practice trading, educational materials explaining market concepts, and simple buy/sell interfaces that don’t require understanding complex order types. However, beginners should start with small investments they can afford to lose, thoroughly research before trading, understand the volatility of cryptocurrency markets, enable all security features, and gradually expand their knowledge through the platform’s educational resources and market analysis tools.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.