Key Takeaways

- A white label cryptocurrency exchange provides a pre-built, turnkey solution that reduces time-to-market from 12-18 months to just 2-6 months while cutting development costs by 60-80% compared to custom builds.

- White label crypto trading platforms must integrate multiple liquidity sources to ensure competitive spreads and deep order books, typically connecting to 3-5 tier-1 exchanges or dedicated market makers.

- Comprehensive white label crypto security features including cold wallet storage (95%+ of funds), multi-signature authentication, DDoS protection, and regular third-party audits are non-negotiable for protecting user assets and maintaining platform credibility.

- The white label crypto licensing guide varies dramatically by jurisdiction, with costs ranging from $10,000 to $50,000 and timelines spanning 2-6 months depending on regulatory complexity in your target markets.

- White label crypto customization extends beyond basic branding to include trading features, user workflows, payment integrations, and API functionality, allowing businesses to differentiate while leveraging proven infrastructure.

- White label crypto scalability must be architected from inception to handle user growth from hundreds to millions and support expanding cryptocurrency portfolios without performance degradation.

- White label crypto multi-currency support requires robust wallet infrastructure, real-time price feeds, and automated conversion mechanisms across 50-200+ cryptocurrencies and multiple fiat currencies.

- Ongoing white label crypto maintenance consuming 10-15% of initial investment annually covers security updates, performance optimization, regulatory compliance, and new feature integration essential for competitive positioning.

The cryptocurrency exchange market continues its explosive growth, with global trading volumes exceeding $60 trillion annually and millions of new users entering digital asset markets monthly. For entrepreneurs and businesses seeking to capitalize on this opportunity, launching a cryptocurrency exchange presents significant potential but also substantial challenges. As an agency with over 8 years of experience developing blockchain infrastructure and exchange platforms, we have guided hundreds of clients through the complexities of exchange deployment, and white label solutions have emerged as the optimal path for most businesses entering this space.

A white label cryptocurrency exchange offers a turnkey solution that dramatically reduces the time, cost, and technical expertise required to launch a competitive trading platform. Rather than spending 12-18 months and millions of dollars building exchange infrastructure from scratch, white label solutions enable businesses to deploy fully functional platforms in 2-6 months at a fraction of the cost. This comprehensive guide explores every aspect of starting a white label crypto exchange, from initial planning through ongoing operations, providing the practical insights needed to make informed decisions and avoid costly mistakes.

White Label Cryptocurrency Exchange Overview

What is a White Label Cryptocurrency Exchange?

A white label cryptocurrency exchange is a pre-developed, fully functional trading platform that businesses can rebrand, customize, and deploy under their own identity. The term “white label” originates from manufacturing, where products are produced by one company but sold under another brand’s name. In the cryptocurrency context, specialized technology providers develop sophisticated exchange platforms with all core functionality, then license these platforms to businesses that want to operate exchanges without building the underlying technology.

The white label model contrasts sharply with custom development, where businesses hire development teams to build exchanges from scratch according to unique specifications. While custom development offers complete control and unlimited customization potential, it requires substantial resources, technical expertise, and time. White label solutions sacrifice some flexibility in exchange for proven, tested infrastructure that can be deployed rapidly at significantly lower cost. For businesses exploring various approaches, understanding comprehensive cryptocurrency exchange strategies provides valuable context for making informed platform decisions.

White label providers handle the complex technical challenges of exchange development including order matching engines capable of processing thousands of transactions per second, wallet infrastructure securing hundreds of millions in digital assets, real-time price feed integrations, compliance tools for KYC and AML requirements, and administrative dashboards managing all platform operations. Buyers receive access to this sophisticated infrastructure along with ongoing technical support, regular updates, and often, assistance with regulatory compliance and liquidity integration.

Importance of a White Label Cryptocurrency Exchange

The importance of white label solutions in cryptocurrency exchange cannot be overstated, particularly for businesses without deep technical expertise or unlimited budgets. The cryptocurrency industry moves at exceptional speed, with new competitors launching constantly and user expectations continuously rising. Businesses that spend 18 months building custom exchanges risk entering markets with outdated features or missing critical opportunities during bull market cycles when user acquisition costs are lowest and trading volumes peak.

White label crypto startup acceleration represents perhaps the most significant advantage. Traditional exchange development follows a lengthy process: requirement gathering (2-3 months), architecture design (1-2 months), core development (6-9 months), security auditing (2-3 months), and testing (1-2 months). White label solutions compress this timeline to platform selection (2-4 weeks), customization (4-8 weeks), compliance setup (4-8 weeks), and testing (2-4 weeks). This acceleration allows businesses to capture market opportunities while they exist rather than arriving after competitors have established dominant positions.

Cost efficiency drives many businesses toward white label solutions. Custom exchange development costs typically range from $1 million to $5 million depending on feature complexity, team location, and timeline pressures. White label solutions cost $50,000 to $500,000 for comparable functionality, representing 70-90% cost savings. These savings allow businesses to allocate more resources to marketing, liquidity provision, and customer acquisition rather than sinking capital into technical development with uncertain outcomes.

Key Features of a White Label Cryptocurrency Exchange

Comprehensive white label cryptocurrency exchanges must include numerous features across trading, security, compliance, and administrative functions. Understanding these features helps businesses evaluate different providers and ensure selected platforms meet operational requirements.

White Label Crypto Trading

The trading engine forms the heart of any exchange, determining platform performance, user experience, and competitive positioning. White label crypto trading functionality includes multiple order types (market, limit, stop-loss, stop-limit), advanced order matching algorithms ensuring fair price execution, real-time order book visualization, trading history and portfolio tracking, margin trading capabilities for leveraged positions, and API access for algorithmic traders and institutional clients.

Performance specifications matter tremendously for white label crypto trading engines. The platform should handle at least 100,000 transactions per second to support growth without performance degradation. Order matching latency under 10 milliseconds ensures competitive execution speeds. The system must maintain 99.9% uptime through redundant infrastructure and automatic failover mechanisms. These performance characteristics directly impact user satisfaction and platform reputation, as traders quickly abandon exchanges with slow execution or frequent downtime.

White Label Crypto Liquidity Integration

Liquidity represents the single most critical factor determining exchange success or failure. Even the most beautiful, feature-rich platform fails without sufficient liquidity to execute trades at competitive prices with minimal slippage. White label crypto liquidity integration connects your platform to external liquidity sources ensuring deep order books and tight spreads that attract and retain traders.

Integration approaches vary in complexity and cost. Basic API connections to major exchanges like Binance, Huobi, or Kraken aggregate their liquidity into your platform’s order books. More sophisticated integrations involve partnerships with dedicated market makers who provide two-sided quotes across multiple trading pairs. Hybrid models combine exchange APIs, market maker relationships, and internal liquidity from your user base. The optimal approach depends on your target markets, expected trading volumes, and available capital for liquidity provision.

White Label Crypto Security Features

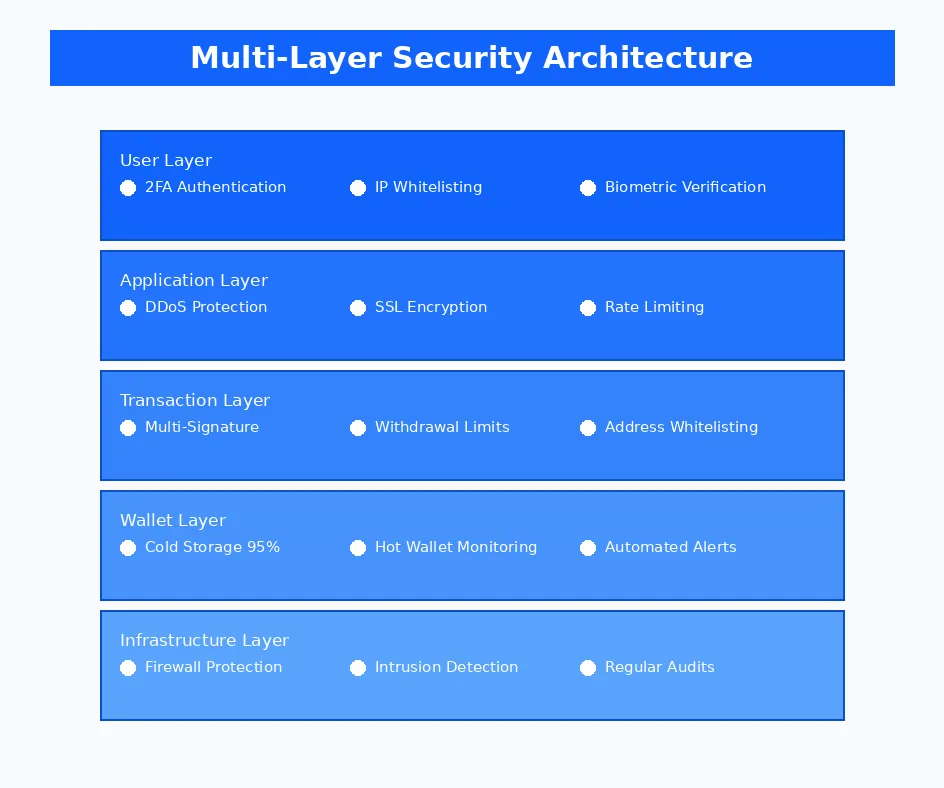

Security infrastructure protects billions in user assets and maintains platform credibility in an industry plagued by high-profile hacks and fraud. White label crypto security features must include cold wallet storage maintaining 95% or more of user funds offline in hardware wallets requiring physical access for transactions. Hot wallets, while necessary for operational liquidity, should hold minimal balances with strict withdrawal limits and approval processes.

Multi-signature wallet architecture requires multiple private keys to authorize transactions, preventing single points of failure. Two-factor authentication (2FA) protects user accounts from unauthorized access. IP whitelisting restricts administrative access to approved addresses. DDoS protection prevents service disruptions from distributed attacks. SSL encryption secures all data transmission between users and servers. Regular security audits by reputable third-party firms identify vulnerabilities before attackers exploit them. These layered security measures create defense-in-depth protecting against various attack vectors.

How to Launch a White Label Crypto Exchange

Steps to Launch a White Label Crypto Exchange

Launching a successful white label crypto exchange requires systematic planning and execution across multiple dimensions. While the technical infrastructure comes pre-built, businesses must still navigate regulatory requirements, establish operational processes, and develop go-to-market strategies.

White Label Crypto Startup Preparation

Preparation begins with market research identifying target customer segments, competitive positioning, and unique value propositions. Analyze existing exchanges in your target markets, identifying gaps in service quality, supported currencies, user experience, or regulatory compliance that your platform can address. Define your ideal customer profile considering factors like trading experience level, preferred cryptocurrencies, geographic location, and typical transaction sizes.

Financial planning requires realistic budgeting across multiple categories: initial platform purchase ($50,000-$500,000), licensing and legal compliance ($10,000-$50,000), initial liquidity provision ($100,000-$1,000,000), marketing and user acquisition ($50,000-$200,000 for first year), and operational expenses including staff, infrastructure, and customer support ($20,000-$50,000 monthly). Many startups underestimate ongoing costs, particularly liquidity requirements and marketing expenses necessary to attract users in competitive markets.

Team assembly determines operational success. Essential roles include compliance officer managing regulatory requirements, customer support staff handling user inquiries and issues, marketing manager driving user acquisition, operations manager overseeing daily platform functions, and technical liaison coordinating with white label provider. While white label solutions reduce technical staffing needs compared to custom development, some technical capability remains essential for troubleshooting and provider communication.

White Label Crypto Licensing Guide

Regulatory compliance represents one of the most complex and jurisdiction-dependent aspects of launching a crypto exchange. The white label crypto licensing guide varies dramatically based on your operating locations and target markets. Some jurisdictions like Malta, Estonia, and Singapore have established clear licensing frameworks specifically for cryptocurrency exchanges, while others apply existing financial services regulations with varying degrees of clarity.

United States operations typically require money transmitter licenses in each state where you operate, coordinated through FinCEN registration at the federal level. Costs range from $5,000 to $15,000 per state with ongoing compliance expenses. European Union operations may benefit from MiCA regulations establishing harmonized standards, though national licenses remain necessary during transition periods. Asian jurisdictions vary widely, from crypto-friendly Singapore requiring straightforward licensing to restrictive environments like China prohibiting cryptocurrency exchange operations entirely.

The licensing process typically spans 2-6 months depending on jurisdiction complexity and application completeness. Required documentation includes business plans, financial projections, ownership structure, AML/KYC policies, cybersecurity measures, and often, proof of minimum capital requirements ranging from $50,000 to $500,000. Engaging legal counsel specializing in cryptocurrency regulations in your target jurisdictions is essential, as licensing mistakes can result in fines, operational restrictions, or complete prohibition from operating.

White Label Crypto Setup

Technical setup involves configuring your white label platform for your specific business requirements. This includes branding customization with your logo, color scheme, and domain name, selecting which cryptocurrencies and fiat currencies to support initially, configuring trading pairs and their associated fees, setting up payment processor integrations for fiat deposits and withdrawals, implementing KYC verification workflows, and connecting liquidity sources.

Infrastructure decisions impact performance and costs. Cloud hosting through AWS, Google Cloud, or Azure provides scalability and reliability but requires ongoing management. Dedicated servers offer more control but need technical expertise for maintenance. Most white label providers offer hosting as part of their package, simplifying infrastructure management. Geographic server distribution reduces latency for users in different regions, improving trading experience and competitive positioning.

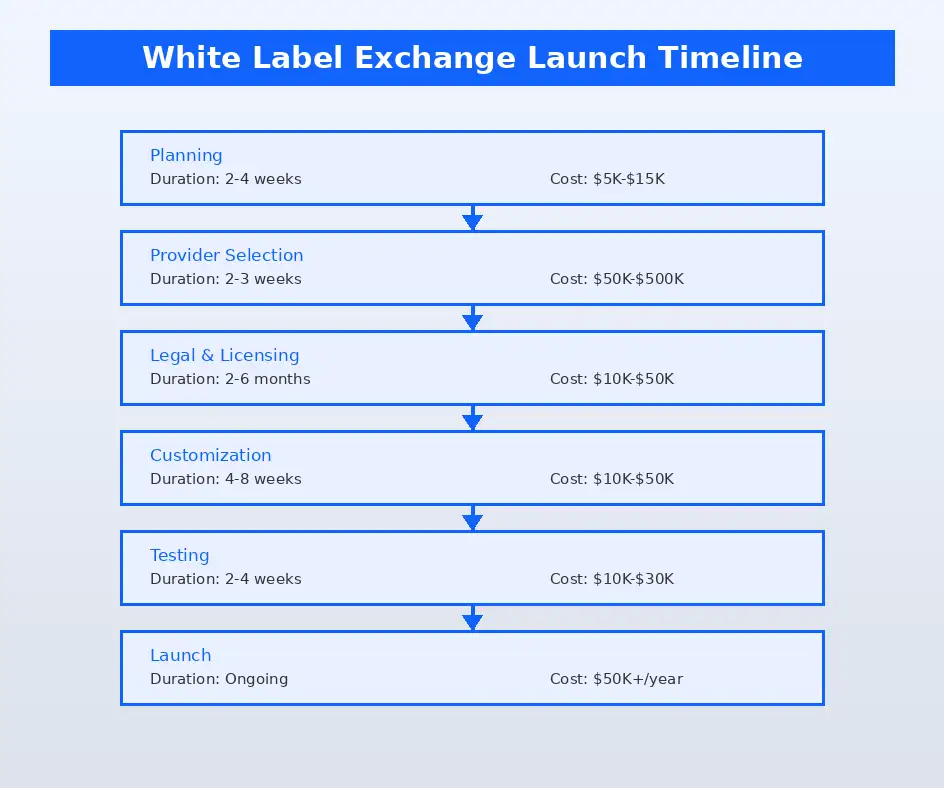

| Phase | Duration | Key Activities | Estimated Cost |

|---|---|---|---|

| Planning & Research | 2-4 weeks | Market analysis, competitor research, business plan development | $5,000-$15,000 |

| Provider Selection | 2-3 weeks | Evaluate providers, review features, negotiate contracts | $50,000-$500,000 |

| Legal & Licensing | 2-6 months | License applications, legal entity formation, compliance setup | $10,000-$50,000 |

| Customization | 4-8 weeks | Branding, feature configuration, trading pairs setup | $10,000-$50,000 |

| Liquidity Integration | 1-2 weeks | Connect liquidity providers, test order routing | $100,000-$1,000,000 |

| Testing & Audit | 2-4 weeks | Security audit, penetration testing, user acceptance testing | $10,000-$30,000 |

| Launch & Marketing | Ongoing | Platform launch, user acquisition, community building | $50,000-$200,000/year |

Choosing the Right White Label Crypto Turnkey

Selecting the optimal white label crypto turnkey provider requires evaluating multiple factors beyond initial price. The provider becomes your long-term technology partner, so their capabilities, support quality, and industry reputation significantly impact your success.

Technical capabilities assessment should examine the order matching engine’s performance specifications, supported trading types and features, wallet infrastructure security measures, API functionality and documentation, mobile app quality for iOS and Android, and scalability to handle growing user bases. Request demonstrations of the platform under load, review client testimonials, and if possible, speak directly with existing customers about their experiences.

Support and maintenance terms vary significantly across providers. Some offer comprehensive packages including 24/7 technical support, regular security updates, new feature additions, and infrastructure monitoring. Others provide minimal support after initial deployment, leaving you responsible for troubleshooting and updates. Understand what is included in base pricing versus additional charges, typical response times for support requests, and the provider’s track record for platform uptime and issue resolution.

Compliance assistance becomes increasingly valuable as regulations evolve. Providers familiar with regulatory requirements in your target jurisdictions can guide you through licensing processes, implement necessary KYC/AML tools, and update the platform as regulations change. This expertise can save substantial time and prevent costly compliance mistakes that could jeopardize your operations.

Customization in a White Label Crypto Exchange

While white label solutions are pre-built, extensive customization remains possible and often necessary for competitive differentiation. Understanding customization options helps you evaluate providers and plan your platform’s unique features.

White Label Crypto Customization Options

Basic customization includes branding elements like logos, color schemes, typography, and domain names that establish your visual identity. User interface customization involves modifying layouts, navigation structures, and information architecture to optimize for your target users. More advanced customization includes developing custom trading features, implementing unique order types, creating proprietary indicators or analysis tools, and integrating specialized payment methods specific to your markets.

Backend customization enables integration with existing business systems, implementation of custom reporting and analytics, development of specialized admin tools, and creation of unique user workflows. API customization allows you to build custom integrations, develop white-label solutions for your own clients, or create specialized trading bots and algorithmic trading infrastructure. The extent of possible customization depends on the provider’s flexibility and your technical resources for implementation and ongoing maintenance.

White Label Crypto Multi-Currency Support

Multi-currency support is essential for attracting diverse user bases and maximizing trading opportunities. Comprehensive white label crypto multi-currency support includes 50-200+ cryptocurrencies spanning major assets like Bitcoin, Ethereum, and stablecoins, promising altcoins with strong communities, and niche tokens serving specific use cases. Fiat currency support typically includes USD, EUR, GBP, and regional currencies relevant to your target markets.

Technical infrastructure for multi-currency support requires separate wallet systems for each blockchain, real-time price feeds from multiple data sources for accuracy and redundancy, automated conversion mechanisms enabling seamless currency swaps, and comprehensive transaction monitoring across all supported assets. The platform must handle varying block times, confirmation requirements, and transaction fees across different blockchains while maintaining consistent user experiences.

Technical Structure of a White Label Cryptocurrency Exchange

White Label Crypto Architecture Explained

Understanding white label crypto architecture helps you evaluate different solutions and make informed decisions about platform capabilities and limitations. Modern exchange architecture follows microservices patterns with specialized components handling specific functions.

The frontend layer includes web interfaces built with React, Angular, or Vue frameworks providing responsive designs across devices, mobile applications for iOS and Android offering native experiences, and API endpoints enabling programmatic access for algorithmic traders. The application layer contains the order matching engine processing trades, user authentication and authorization systems, trading logic implementing various order types, and business rules enforcing platform policies.

The integration layer connects to external services including liquidity providers for order routing, payment processors for fiat transactions, KYC verification services for compliance, blockchain nodes for cryptocurrency transactions, and data feeds for real-time pricing. The data layer includes relational databases storing user accounts and transaction history, caching layers for performance optimization, and blockchain integration for wallet management. Each component should be independently scalable to handle varying loads across different platform functions.

Scalability in a White Label Crypto Exchange

White label crypto scalability determines whether your platform can grow from serving hundreds of users to millions without performance degradation or complete rebuilds. Scalability considerations must address both user growth and cryptocurrency portfolio expansion.

White Label Crypto Scalability for Growing Users

User scalability requires horizontal scaling capabilities where additional servers can be added to distribute load across multiple machines rather than vertical scaling that maxes out individual server capacity. The order matching engine must maintain sub-second latency even with millions of concurrent users and thousands of orders per second. Database sharding distributes user data across multiple database instances preventing single database bottlenecks.

Caching strategies reduce database loads by storing frequently accessed data in memory. Content delivery networks (CDNs) distribute static assets geographically, reducing page load times globally. Load balancers distribute incoming traffic across multiple application servers ensuring no single server becomes overwhelmed. These architectural patterns enable smooth scaling as your user base grows from thousands to millions.

White Label Crypto Scalability for Multiple Currencies

Currency scalability involves the platform’s ability to add new cryptocurrencies without major architectural changes. Well-designed systems use abstraction layers that separate blockchain-specific logic from core platform functionality. Adding a new cryptocurrency should require minimal code changes, primarily configuring new wallet connections and price feeds rather than modifying core trading logic.

Each cryptocurrency requires dedicated infrastructure including blockchain nodes or third-party API connections, separate hot and cold wallets with appropriate security measures, price feed integrations for accurate market data, and transaction monitoring for deposits and withdrawals. The platform must handle varying confirmation requirements, fee structures, and technical peculiarities across different blockchains. Modular architecture enables adding new currencies quickly to capitalize on trending tokens or respond to user demands.

Maintenance of a White Label Crypto Exchange

Ongoing white label crypto maintenance ensures platform security, performance, and competitiveness. While white label providers handle much technical maintenance, platform operators retain significant operational responsibilities.

White Label Crypto Maintenance Tasks

Regular maintenance tasks include monitoring platform performance and user activity, managing liquidity provider relationships and order routing, updating cryptocurrency integrations as blockchains evolve, processing user support requests and account issues, conducting regular security reviews and penetration tests, backing up databases and disaster recovery testing, optimizing trading engine performance, and updating compliance procedures as regulations change.

Content updates keep your platform competitive including adding new trading pairs based on market demand, implementing new features requested by users, updating educational content and trading guides, refreshing marketing materials and promotional campaigns, and announcing platform improvements and partnerships. Regular communication with users through blog posts, social media, and email newsletters maintains engagement and builds community around your platform.

White Label Crypto Security Maintenance

Security maintenance receives highest priority given the value at risk and frequency of attacks on cryptocurrency platforms. Monthly security tasks include reviewing access logs for unauthorized attempts, updating firewall rules and IP whitelists, testing DDoS protection capabilities, auditing wallet security and key management, reviewing user account activity for suspicious patterns, and ensuring all software dependencies are patched against known vulnerabilities.

Quarterly security activities involve conducting comprehensive penetration tests by external security firms, reviewing and updating incident response procedures, testing backup restoration processes, auditing cold wallet security and access procedures, and training staff on security best practices and social engineering prevention. Annual security audits by reputable firms provide independent verification of your security posture and identify potential vulnerabilities before attackers exploit them.

Security and Compliance in White Label Crypto Exchanges

White Label Crypto Security Features

Comprehensive security infrastructure protects user assets, maintains platform availability, and builds the trust essential for attracting users in a market scarred by high-profile hacks and frauds.

Liquidity Protection in White Label Crypto Trading

Liquidity protection prevents manipulation and ensures fair trading for all users. Anti-manipulation measures include monitoring for wash trading where users trade with themselves to create artificial volume, detecting spoofing where large orders are placed then cancelled to manipulate prices, identifying pump-and-dump schemes through unusual trading patterns, and restricting insider trading on new listing information.

Circuit breakers pause trading during extreme volatility preventing flash crashes, maximum order size limits prevent market manipulation from whale traders, rate limiting prevents rapid-fire order placement and cancellation, and surveillance systems flag suspicious trading patterns for manual review. These protections maintain market integrity and protect less sophisticated traders from manipulation by bad actors.

Multi-Currency Security in White Label Crypto Exchange

Each supported cryptocurrency requires tailored security measures accounting for blockchain-specific vulnerabilities and attack vectors. Bitcoin’s UTXO model requires different wallet management than Ethereum’s account-based system. Smart contract tokens introduce additional risks around contract vulnerabilities and token standard implementations. Privacy coins like Monero necessitate enhanced monitoring for regulatory compliance.

Wallet security varies by currency type with appropriate cold storage ratios, multi-signature configurations, and withdrawal approval processes. Transaction monitoring systems must understand each blockchain’s specific characteristics including confirmation requirements, fee markets, and potential reorganization risks. Keeping pace with blockchain protocol updates and hard forks requires ongoing technical attention preventing loss of funds or service disruptions.

White Label Crypto Licensing Guide

Regulatory compliance provides legal authorization to operate while protecting your business from enforcement actions, fines, or shutdowns. The licensing landscape varies dramatically across jurisdictions requiring careful navigation.

Legal Compliance for White Label Crypto Startup

Comprehensive legal compliance extends beyond initial licensing to ongoing obligations including regular reporting to regulatory authorities, maintaining minimum capital requirements, submitting to periodic audits, updating policies as regulations evolve, and responding to regulatory inquiries. Failure to maintain compliance can result in license revocation, operational restrictions, or significant financial penalties.

Legal structure selection impacts regulatory requirements and tax obligations. Options include incorporating in crypto-friendly jurisdictions like Malta or Estonia while serving global markets, establishing entities in each operating jurisdiction, or licensing existing entities to operate in new markets. Each approach involves tradeoffs between regulatory complexity, tax efficiency, and operational flexibility. Consulting with legal and tax professionals specializing in cryptocurrency businesses is essential for optimizing your structure.

KYC/AML Considerations for White Label Crypto Exchange

Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements form the foundation of exchange compliance globally. KYC procedures verify user identities through government-issued identification, proof of address, and increasingly, biometric verification. AML monitoring tracks transaction patterns identifying suspicious activity including structuring transactions to avoid reporting thresholds, unusual transfer patterns suggesting money laundering, connections to known criminal entities or sanctioned individuals, and high-risk jurisdictions flagged by international bodies.

Implementation requires integrating third-party KYC verification services, developing internal compliance teams for transaction monitoring, filing suspicious activity reports with relevant authorities, maintaining detailed records for regulatory inspection, and continuously updating screening lists against sanctions databases. The cost and complexity of compliance operations represent significant ongoing expenses that must be factored into business planning. Collaborating with expert blockchain development specialists ensures compliance mechanisms are properly integrated from the platform’s inception.

| Aspect | White Label Solution | Custom Development |

|---|---|---|

| Time to Market | 2-6 months | 12-18 months |

| Initial Cost | $50,000-$500,000 | $1,000,000-$5,000,000 |

| Technical Expertise Required | Minimal | Extensive |

| Customization Flexibility | Moderate to High | Unlimited |

| Ongoing Maintenance | Provider-handled | Self-managed |

| Security Testing | Pre-tested, proven | Requires extensive auditing |

| Best For | Fast market entry, limited budget | Unique requirements, large budget |

Advantages of a White Label Crypto Exchange

Benefits of White Label Crypto Trading

White label crypto trading platforms provide immediate access to sophisticated trading features that would take months or years to develop independently. Users benefit from proven order matching engines, advanced order types, charting tools, and market analysis features comparable to major exchanges. The platform’s track record with other deployments provides confidence in reliability and performance under various market conditions.

Benefits of White Label Crypto Turnkey

Turnkey solutions eliminate the technical complexity of exchange development, allowing you to focus on business operations, marketing, and customer acquisition. Provider support handles infrastructure management, security updates, and technical troubleshooting, reducing your required technical staff. The proven architecture and existing integrations accelerate go-to-market and reduce the risk of technical failures that plague custom developments.

Advantages of White Label Crypto Multi-Currency Support

Comprehensive multi-currency support attracts diverse user bases interested in different cryptocurrencies and enables multiple trading pairs increasing platform activity. Users can diversify portfolios within your platform rather than maintaining accounts on multiple exchanges. Supporting trending cryptocurrencies quickly allows you to capitalize on market interest and attract users seeking specific tokens.

Advantages of White Label Crypto Customization

Customization capabilities enable brand differentiation and unique feature offerings while maintaining the reliability of proven infrastructure. You can implement features specifically addressing your target market’s needs without building entire platforms from scratch. The balance between standardization and customization optimizes development efficiency while enabling competitive positioning.

Challenges in White Label Crypto Exchange

Security Challenges in White Label Crypto Exchange

While white label providers implement strong security measures, ultimate responsibility for user asset protection rests with exchange operators. Security challenges include maintaining vigilance against evolving attack vectors, ensuring staff follow security protocols, managing third-party integration security, and responding quickly to security incidents. Even with robust infrastructure, human error or process failures can compromise security.

Liquidity Challenges in White Label Crypto Trading

Attracting sufficient liquidity to provide competitive trading experiences represents perhaps the greatest operational challenge for new exchanges. Users gravitate toward platforms with deep order books and tight spreads, creating chicken-and-egg problems where low liquidity deters users, reducing liquidity further. Overcoming this requires significant capital for market making, partnerships with established liquidity providers, or innovative incentive programs attracting organic liquidity from users.

Licensing and Regulatory Challenges in White Label Crypto Startup

Navigating complex, evolving regulatory landscapes across multiple jurisdictions creates ongoing challenges. Licensing requirements change frequently, compliance costs increase as regulations tighten, and international operations multiply regulatory complexity. Maintaining compliance requires dedicated resources, specialized expertise, and continuous monitoring of regulatory developments across all operating jurisdictions.

Future of White Label Cryptocurrency Exchange

White Label Crypto Scalability and Growth

The future will see white label solutions with even greater scalability handling millions of concurrent users and supporting hundreds of cryptocurrencies without performance degradation. Cloud-native architectures, microservices designs, and advanced caching strategies will enable seamless scaling. This improved scalability will lower barriers for new entrants while enabling existing platforms to grow without technical constraints.

White Label Crypto Security Advancements

Emerging security technologies including hardware security modules, multi-party computation for distributed key management, and AI-powered fraud detection will become standard in white label solutions. Biometric authentication, behavioral analytics, and zero-knowledge proof systems will enhance security while improving user experiences. These advancements will reduce breach risks and increase user confidence in platform security.

White Label Crypto Trading Trends

Future white label platforms will integrate DeFi capabilities including yield farming, liquidity mining, and decentralized trading alongside traditional exchange functions. NFT marketplaces, social trading features, and gamification elements will attract broader user bases. Cross-chain interoperability will enable seamless trading across different blockchain networks, expanding available assets and liquidity sources.

Build a Fully Customized White Label Crypto Exchange

Choose your branding, trading pairs, liquidity sources, security controls, and compliance settings to launch a crypto exchange that fits your business goals.

Conclusion

Starting a white label cryptocurrency exchange offers entrepreneurs and businesses a proven path to entering the lucrative cryptocurrency trading market without the extreme costs, technical complexities, and time requirements of custom development. With over 8 years of experience guiding clients through exchange deployments, we have seen white label solutions evolve from basic platforms into sophisticated, feature-rich systems rivaling the capabilities of custom-built exchanges.

The key to success with white label crypto startups lies in careful provider selection, thorough planning across technical, legal, and operational dimensions, and unwavering commitment to security and compliance. While white label solutions dramatically reduce barriers to entry, operating a successful exchange still requires significant capital, ongoing operational excellence, and strategic focus on liquidity provision and user acquisition.

As the cryptocurrency market continues its explosive growth trajectory, white label solutions will play an increasingly important role in democratizing access to exchange operations. By following the comprehensive guidelines outlined in this guide, understanding the full scope of requirements and challenges, and maintaining focus on delivering exceptional user experiences, businesses can leverage white label platforms to capture their share of this dynamic, high-growth market.

Frequently Asked Questions

A white label cryptocurrency exchange is a pre-built, ready-to-deploy trading platform that businesses can rebrand and customize under their own identity. Instead of developing an exchange from scratch, which can take 12-18 months and cost millions, companies purchase a turnkey solution that includes core trading functionality, security features, and technical infrastructure. The white label provider handles the complex backend development while the buyer focuses on branding, customization, and business operations.

The cost to launch a white label crypto exchange typically ranges from $50,000 to $500,000 depending on features, customization level, and ongoing support requirements. Basic packages with standard features start around $50,000-$100,000, while advanced solutions with custom integrations, extensive security features, and dedicated support can exceed $300,000. Additional costs include licensing fees ($10,000-$50,000), ongoing maintenance (10-15% annually), liquidity provision, marketing, and regulatory compliance expenses.

Launching a white label crypto exchange typically takes 2-6 months from initial purchase to full deployment, compared to 12-18 months for custom development. The timeline includes platform customization (2-4 weeks), security audits and testing (2-3 weeks), regulatory compliance setup (4-8 weeks), liquidity integration (1-2 weeks), and marketing preparation (2-4 weeks). Faster launches of 6-8 weeks are possible with minimal customization and pre-established licensing, while more complex deployments requiring extensive customization may extend to 6 months.

Essential features include multi-currency support for major cryptocurrencies and fiat currencies, robust order matching engine handling high transaction volumes, integrated KYC/AML compliance tools, cold and hot wallet infrastructure, liquidity aggregation from multiple providers, advanced trading features like spot and margin trading, comprehensive admin dashboard, mobile responsive design, multi-language support, and two-factor authentication. Additional valuable features include staking, lending, DeFi integration, and automated market making capabilities.

Yes, most jurisdictions require cryptocurrency exchange operators to obtain specific licenses or register with financial regulators. Requirements vary significantly by country, ranging from money transmitter licenses in the United States to specialized crypto exchange licenses in jurisdictions like Malta, Estonia, or Singapore. Even with a white label solution, you remain responsible for regulatory compliance in your operating jurisdictions. Consulting with legal experts specializing in cryptocurrency regulations is essential before launching operations.

White label exchanges typically integrate with external liquidity providers through APIs that connect to major exchanges and market makers. This aggregated liquidity ensures sufficient order book depth for smooth trading experiences. Solutions include connecting to liquidity pools from tier-1 exchanges, partnering with dedicated crypto market makers, implementing hybrid models combining internal and external liquidity, or using automated market maker (AMM) protocols. Most white label providers offer built-in liquidity integration as part of their platform, though businesses must establish relationships with liquidity providers independently.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.