Key Takeaways

- DApp decentralization features eliminate single points of failure through distributed blockchain networks operating across thousands of independent validator nodes worldwide.

- Smart contracts enable autonomous execution without intermediaries, encoding business logic directly into immutable blockchain protocols that execute exactly as programmed.

- Permissionless access allows anyone globally to interact with decentralized applications without approval from gatekeepers, fundamentally democratizing digital participation.

- Cryptographic security and data immutability protect user information while creating permanent, tamper-proof records verified by distributed consensus mechanisms.

- Open-source code transparency enables community auditing and collaborative improvement, distinguishing decentralized app architecture from proprietary centralized systems.

- Token-based incentive models align participant interests through economic mechanisms that reward network contribution and enable decentralized governance structures.

- Censorship-resistant applications continue functioning even when governments or corporations attempt to restrict access, ensuring persistent availability across global markets.

- True decentralization requires distribution across infrastructure, governance, and data layers rather than simply deploying code on blockchain networks.

- Hybrid DApp models balance decentralization benefits with performance requirements, though full decentralization remains ideal for censorship resistance and user sovereignty.

- Understanding DApp decentralization features proves essential for businesses in the USA, UK, UAE, and Canada exploring blockchain-based applications.

The blockchain revolution has introduced fundamentally new application architectures that challenge traditional centralized models. As organizations across North America, Europe, and the Middle East increasingly explore blockchain solutions, understanding what truly defines decentralized applications becomes critical. While many projects claim decentralization, genuine implementation requires specific architectural features, governance mechanisms, and technical infrastructure that distribute control across networks rather than concentrating it with single entities. This comprehensive analysis examines the core DApp decentralization features that separate truly distributed systems from blockchain-flavored centralized applications.

Our agency’s eight years of experience delivering blockchain solutions across international markets reveals that misconceptions about decentralization remain widespread. Businesses often assume blockchain utilization automatically guarantees decentralization, yet architecture decisions, governance structures, and infrastructure choices determine whether applications genuinely distribute power or merely create decentralization theater. Understanding these distinctions enables organizations to make informed decisions about decentralized application features that align with specific business objectives, regulatory requirements, and user expectations in diverse markets.

The concept extends beyond merely deploying code on blockchain networks. Achieving genuine decentralization requires distributing validator nodes globally, ensuring no geographic concentration creates vulnerability. It demands open-source transparency allowing community verification of application logic and behavior. Decentralization necessitates permissionless participation where arbitrary gatekeepers cannot exclude users based on identity, location, or political considerations. These principles create fundamentally different trust models compared to traditional applications where users must trust corporate entities to maintain systems honestly, keep data secure, and preserve access rights.

Markets including the United Kingdom and United Arab Emirates increasingly recognize decentralization as regulatory consideration, particularly regarding data sovereignty and financial infrastructure. Canadian enterprises exploring blockchain solutions evaluate decentralization features through lenses of resilience, compliance, and competitive advantage. American organizations balance decentralization benefits against performance requirements and user experience expectations. Understanding what decentralization actually means in practical implementation contexts proves essential for strategic decision-making around distributed network applications.

Decentralized vs centralized apps differ fundamentally in architecture, governance, and trust requirements. Where centralized systems store data on company servers, decentralized application features include distributed storage across peer networks. Traditional apps require authentication through corporate identity systems; blockchain-based applications use cryptographic key pairs giving users sovereign control over credentials. Centralized platforms enforce rules through administrative controls; DApps encode rules in smart contracts that execute deterministically without human intervention or discretionary enforcement.

Performance characteristics differ significantly between models. Centralized applications achieve faster transaction processing and lower latency through optimized server infrastructure, but sacrifice resilience and censorship resistance. Decentralized systems prioritize immutability and availability over raw speed, accepting performance tradeoffs for enhanced security and autonomy. User experience complexity also differs, with centralized apps offering familiar authentication and interaction patterns while DApps require wallet management and transaction signing that many users find challenging initially.

| Characteristics | Centralized Apps | Decentralized Apps |

|---|---|---|

| Infrastructure Control | Single organization owns servers | Distributed across independent nodes |

| Data Storage | Centralized databases | Blockchain and distributed storage |

| Governance | Corporate decision-making | Token-based or community governance |

| Access Control | Permission-based gatekeeping | Permissionless participation |

| Transparency | Proprietary closed-source code | Open-source verifiable protocols |

| Censorship Resistance | Vulnerable to shutdowns | Resistant to single-point failures |

Permissionless blockchain applications allow anyone to participate without approval processes or identity verification beyond cryptographic authentication. No central authority can block users, reverse transactions, or modify protocol rules unilaterally. Data sovereignty places control with users through private key ownership rather than corporate custodianship. Economic incentives align participant interests through tokenization, rewarding network contribution and penalizing malicious behavior through cryptoeconomic mechanisms. Governance distribution enables stakeholders to propose and vote on protocol changes rather than accepting corporate mandates.

Censorship-resistant applications maintain availability even when powerful actors attempt interference. Network resilience ensures continued operation despite node failures or attacks. Interoperability allows integration with other protocols without requiring centralized intermediaries. These characteristics combine to create systems fundamentally different from traditional software, offering unprecedented user sovereignty at the cost of increased complexity and reduced performance compared to centralized alternatives optimized for speed rather than distribution.

Essential DApp Decentralization Features

Distributed Infrastructure

Computational processing and data storage spread across thousands of independent nodes globally, eliminating centralized server dependencies and single points of failure.

Open-Source Transparency

Publicly verifiable code allows community auditing of application logic, preventing hidden functionality and building trust through transparency rather than institutional reputation.

Permissionless Access

Anyone globally can interact with protocols without approval from gatekeepers, democratizing participation and preventing discriminatory exclusion based on identity or location.

Public blockchains like Ethereum, Solana, and Polygon serve as global computers where anyone can deploy code that executes deterministically across all nodes. Transaction finality provides certainty that confirmed operations cannot be reversed, unlike traditional payment systems allowing chargebacks. State replication ensures application data exists across thousands of machines globally rather than centralized data centers vulnerable to regional failures or government interference. Network participants validate transactions independently, preventing any single actor from manipulating outcomes.

Blockchain’s role extends beyond data storage to enabling trustless coordination among strangers. Cryptographic signatures prove transaction authenticity without requiring identity verification through centralized authorities. Token transfers occur peer-to-peer without intermediary clearinghouses. Smart contract execution happens automatically when conditions are met, removing discretionary enforcement. These capabilities create entirely new application categories impossible under centralized architectures, from decentralized finance protocols managing billions in value to autonomous organizations coordinating global contributor networks.

Real-World Example

Uniswap, the decentralized exchange protocol, demonstrates blockchain’s power in creating permissionless financial infrastructure. Anyone can trade tokens directly from their wallet without creating accounts, passing identity verification, or trusting centralized custodians. Liquidity pools operate through smart contracts that execute trades algorithmically based on mathematical formulas, with no company controlling fund flows or able to freeze user assets. The protocol has facilitated over one trillion dollars in trading volume across markets including the USA and beyond, proving blockchain can support production-scale financial applications without centralized intermediaries.

The essential role of smart contracts manifests across multiple dimensions. They automate complex multi-party interactions that would require extensive coordination and trust in traditional systems. Financial protocols use smart contracts to manage lending, trading, and derivatives without banks or brokers. Supply chain applications track asset provenance and automate payments upon delivery verification. Gaming platforms create provably fair mechanics and true digital ownership through smart contract logic. Identity systems enable self-sovereign credentials without centralized authorities.

Smart contracts provide composability, allowing applications to integrate permissionlessly with other protocols like building blocks. Developers create complex functionality by combining existing contracts rather than building from scratch. This composability drives innovation in blockchain ecosystems, particularly visible in decentralized finance where protocols layer upon each other to create sophisticated financial instruments. Immutability ensures deployed contracts behave consistently over time, though this creates upgrade challenges requiring careful architecture planning to balance permanence with adaptability needs.

Geographic distribution provides resilience against regional disruptions including natural disasters, power outages, and network partitions. A properly decentralized blockchain maintains operation even if entire countries disconnect from the internet or governments attempt to shut down local nodes. Economic distribution prevents any single entity from controlling sufficient resources to manipulate network behavior. Protocol governance distribution ensures no individual or organization can unilaterally change rules or censor transactions. These multiple layers of distribution create robust systems resistant to various failure modes.

Redundancy inherent in distributed architectures trades efficiency for resilience. Every validator maintains complete copies of blockchain state, creating massive data duplication that would seem wasteful in centralized contexts. Transaction processing requires global consensus rather than simple database writes, dramatically reducing throughput. Yet these apparent inefficiencies buy availability guarantees impossible in centralized systems. Applications remain accessible 24/7 without maintenance windows, immune to denial-of-service attacks that overwhelm single servers, and resistant to censorship attempts by governments or corporations controlling traditional infrastructure.

| Failure Type | Distributed Network Response |

|---|---|

| Node Hardware Failure | Remaining nodes continue validation; network unaffected |

| Regional Internet Outage | Global node distribution maintains consensus across regions |

| Malicious Node Attack | Consensus mechanisms reject fraudulent transactions automatically |

| Censorship Attempt | Permissionless access through uncensored nodes worldwide |

| Data Center Destruction | Complete blockchain copies exist across thousands of locations |

The collaborative benefits of open-source extend beyond transparency to driving innovation through community contribution. Developers worldwide can propose improvements, identify vulnerabilities, and build complementary tools without requiring permission from original creators. This accelerates protocol evolution and creates network effects where shared standards emerge organically. Security improves through many eyes reviewing code rather than relying on small internal teams. Bug bounties incentivize white-hat hackers to discover and report vulnerabilities before malicious actors exploit them.

Open-source licensing ensures protocols remain accessible even if founding teams abandon projects or pursue directions contrary to community interests. Forks allow communities to continue maintaining preferred versions when disagreements arise about project direction. This prevents vendor lock-in characteristic of proprietary software where users face costly switching if providers raise prices, degrade service, or terminate products. Markets in the United States, United Kingdom, and Canada particularly value this autonomy given regulatory uncertainties around blockchain technology and concerns about depending on single commercial entities for critical infrastructure.

Real-World Example

The MakerDAO protocol, which manages the DAI stablecoin, demonstrates open-source importance in high-stakes financial applications. Every line of smart contract code undergoes public auditing by security firms and community members before deployment. When vulnerabilities are discovered, the transparent codebase allows rapid verification and coordinated response. Multiple teams have built monitoring tools, user interfaces, and analytical dashboards using the open protocol, creating an ecosystem that would be impossible with proprietary systems. This openness helped MakerDAO maintain over 5 billion dollars in locked value with community confidence built on verifiable code rather than corporate promises.

Incentive alignment through tokenization addresses the cold-start problem plaguing network-effect businesses. Early adopters receive token rewards compensating for limited initial utility, creating bootstrapping mechanisms that attract participants before traditional network effects take hold. Validators earn transaction fees and block rewards for maintaining network security. Liquidity providers receive trading fees for enabling decentralized exchanges. Content creators and curators earn tokens for contributions to social platforms. These economic models distribute value to participants creating it rather than concentrating profits with platform owners.

Governance tokens enable decentralized decision-making about protocol parameters, upgrade proposals, and treasury allocations. Token holders vote on changes proportional to their stake, creating direct democracy or delegated representation models. While this introduces plutocratic risks where wealthy participants dominate decisions, it remains more distributed than traditional corporate governance concentrating control with small boards and executives. Emerging mechanisms like quadratic voting and reputation-weighted voting attempt to balance token holdings with broader community input, creating more nuanced governance approaches than simple one-token-one-vote systems.

Token Economics Framework Selection

Assess Value Distribution

Determine how protocol value should flow to different stakeholder groups including users, validators, developers, and long-term holders based on their contributions to ecosystem success.

Design Incentive Mechanisms

Create reward structures that encourage desired behaviors like network security, liquidity provision, or quality content creation while penalizing attacks or spam through economic consequences.

Balance Governance Rights

Implement voting mechanisms that distribute decision-making power appropriately across stakeholders while preventing concentration that undermines decentralization goals.

User ownership extends beyond access to encompass data sovereignty and asset control. Private keys give users exclusive authority over their accounts and assets, which protocols cannot freeze, seize, or manipulate. This contrasts sharply with centralized platforms where companies maintain ultimate control over user accounts and can terminate access arbitrarily. Digital assets like tokens, NFTs, and credentials belong to users rather than residing in corporate databases subject to company policies. Users can exit platforms freely, taking their assets and data to competing services or simply self-custodying them independent of any application.

The philosophical shift from platform-owned accounts to user-owned identities changes power dynamics fundamentally. Companies must compete for users who can switch freely rather than locking users into walled gardens through high switching costs. Censorship becomes difficult when users control their own credentials and can access protocols through multiple interfaces or directly via blockchain nodes. This sovereignty particularly resonates in markets including Canada and the United Arab Emirates where users increasingly question data practices of technology giants and seek alternatives offering greater control over digital lives.

Cryptographic security mechanisms protect blockchain applications through multiple layers. Public-key cryptography enables authentication without passwords, eliminating credential theft vulnerabilities. Digital signatures prove transaction authenticity, preventing impersonation or unauthorized actions. Hash functions create unique fingerprints for data, allowing verification without exposing sensitive information. Merkle trees enable efficient verification of large datasets. These mathematical foundations create security properties fundamentally stronger than traditional systems relying on perimeter defenses and trusted administrators.

The tradeoff between immutability and adaptability requires careful consideration. While permanent records prevent manipulation, they also prevent correcting errors or removing inappropriate content. Smart contract bugs cannot be easily fixed once deployed, necessitating upgrade mechanisms that potentially compromise immutability guarantees. Privacy concerns arise from permanent public records, driving development of privacy-preserving technologies like zero-knowledge proofs. Organizations in regulated markets must balance immutability benefits against compliance requirements for data deletion or modification, creating tension between blockchain ideals and practical governance needs.[1]

Network reliability in decentralized systems differs fundamentally from traditional service level agreements based on centralized infrastructure uptime. Rather than depending on corporate commitments to maintain servers, blockchain networks achieve reliability through economic incentives encouraging validator participation and penalizing downtime or malicious behavior. Consensus mechanisms ensure the network continues operating as long as sufficient honest validators remain active, even if substantial portions go offline. This creates resilience against various failure modes including coordinated attacks, natural disasters, or regulatory actions targeting specific geographic regions.

The social contract around censorship resistance varies across blockchain communities. Bitcoin maximalists prioritize censorship resistance above all else, accepting performance limitations to maximize decentralization and resistance to shutdown attempts. Other networks make calculated tradeoffs, accepting some centralization for improved performance while maintaining sufficient distribution to resist casual censorship. Understanding these tradeoffs helps organizations select appropriate blockchain platforms for applications where censorship resistance matters critically versus use cases where performance takes priority.

Real-World Example

During political unrest in various countries, censorship-resistant messaging applications built on blockchain have enabled communication when traditional platforms were blocked by governments. These applications route messages through decentralized networks that authorities cannot easily monitor or shut down. Users in restrictive environments access services through various interfaces and entry points that emerge organically, making comprehensive censorship impractical. This demonstrates how DApp decentralization features provide real-world value beyond theoretical benefits, offering practical solutions for populations facing digital restrictions.[2]

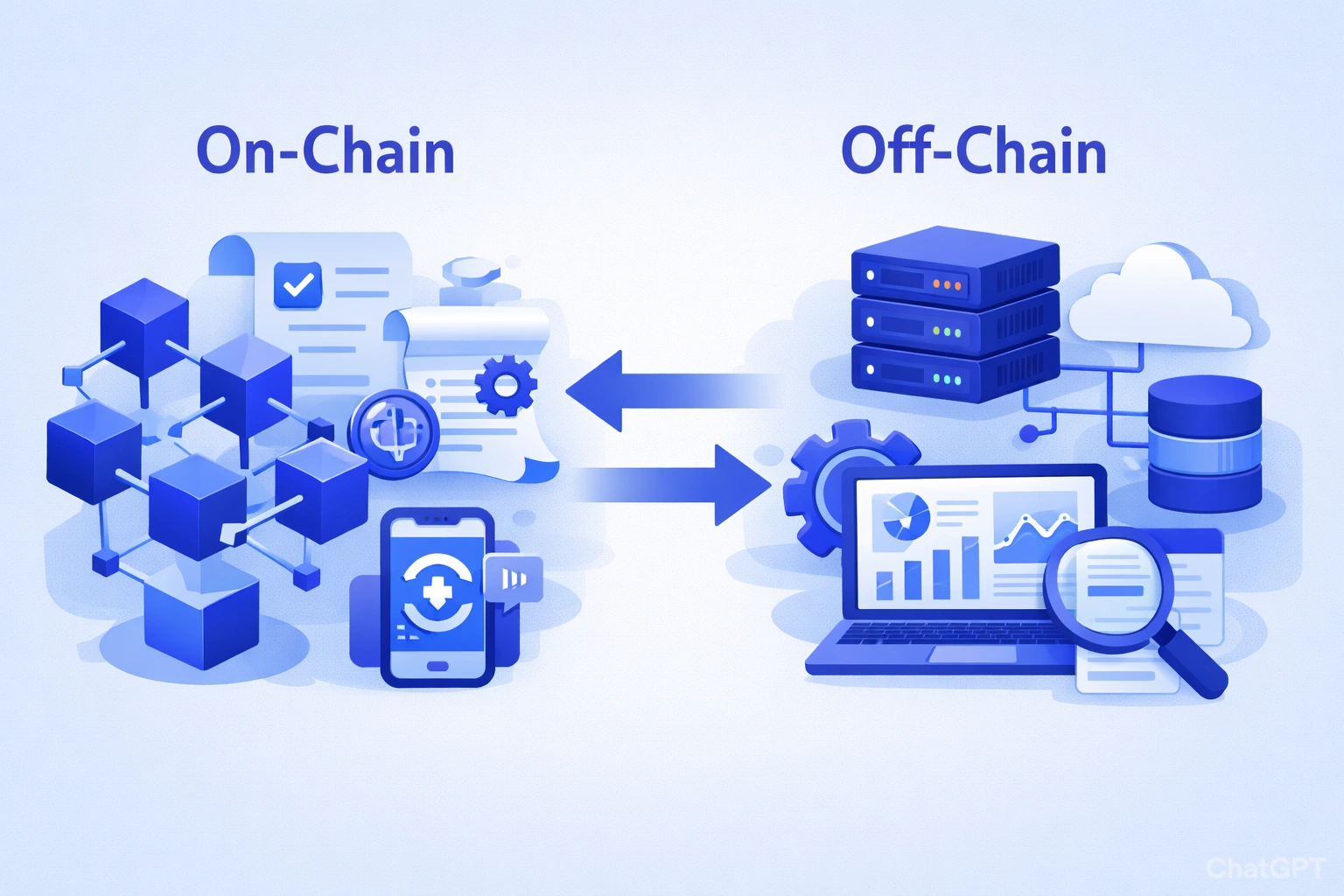

On-chain governance executes decisions automatically through smart contracts, creating binding outcomes without requiring centralized implementation. When votes reach quorum and proposals pass, protocol changes deploy automatically or treasury funds disburse according to approved allocations. This removes human discretion from execution while creating risks if governance is captured by malicious actors or proposals contain bugs. Off-chain governance involves community discussion and signaling through various channels, with core developers implementing changes based on perceived consensus rather than automated execution.

Effective governance balances multiple considerations. Plutocracy risks where wealthy token holders dominate require mitigation through quadratic voting, time-locked voting, or reputation systems. Voter apathy threatens legitimacy when participation remains low, addressed through delegation mechanisms and improved governance interfaces. Technical complexity means most token holders lack expertise to evaluate protocol changes, creating dependencies on technical experts whose opinions carry disproportionate weight. Emerging governance models experiment with multi-house systems, specialized committees, and hybrid approaches attempting to balance these competing concerns.

Governance Model Comparison

| Governance Type | Advantages | Challenges |

|---|---|---|

| Token-Weighted Voting | Simple, transparent, aligns voting power with economic stake | Plutocracy risks, whale dominance |

| Delegated Voting | Improves participation, leverages expertise | Centralization around popular delegates |

| Quadratic Voting | Reduces plutocracy, balances preferences | Sybil attack vulnerability, complexity |

| Multi-House Systems | Checks and balances, specialized input | Slower decisions, coordination overhead |

Layer 2 solutions bridge on-chain and off-chain through various mechanisms. Rollups batch multiple transactions off-chain before submitting cryptographic proofs to main chains, achieving higher throughput while maintaining security properties. State channels enable rapid interactions off-chain between parties who settle final balances on-chain. Sidechains process transactions independently while periodically checkpointing to main chains for security. These approaches attempt to capture decentralization benefits while mitigating performance limitations that make pure on-chain applications impractical for many use cases.

The division between on-chain and off-chain creates architectural decisions requiring careful analysis. Critical value transfers and state changes belong on-chain where immutability matters most. User profile data, social graphs, and content often live off-chain in decentralized storage like IPFS with content hashes stored on-chain for verification. Computational tasks unsuitable for blockchain like machine learning inference or complex simulations occur off-chain with results submitted on-chain. Finding optimal boundaries between on-chain and off-chain remains an active area of experimentation as the ecosystem matures and new solutions emerge.

Hybrid models make calculated compromises accepting some centralization for practical benefits. Common patterns include centralized user interfaces for better performance and user experience while maintaining decentralized backends. Upgradeable smart contracts allowing teams to fix bugs or add features while introducing trust assumptions around upgrade authority. Partnerships with centralized service providers for fiat on-ramps, customer support, or regulatory compliance. These tradeoffs enable broader adoption and regulatory acceptance while sacrificing pure decentralization ideals.

Evaluating whether hybrid approaches undermine fundamental value propositions requires understanding specific use cases and user priorities. Financial applications handling significant value prioritize security and censorship resistance, favoring full decentralization despite usability costs. Social platforms might accept centralized moderation to combat spam and illegal content while maintaining decentralized data ownership. Enterprise blockchain solutions often embrace permissioned networks and centralized governance for compliance and performance. Markets across the USA, UK, UAE, and Canada exhibit varying preferences based on regulatory environments and user sophistication levels.

Decentralization Assessment Criteria

| Component | Fully Decentralized | Hybrid Model |

|---|---|---|

| Node Operation | Permissionless, geographically distributed | May include centralized infrastructure |

| Smart Contract Control | Immutable or community-governed upgrades | Admin keys for updates and emergency actions |

| Governance | Token-based community decisions | Foundation or team influence on direction |

| User Interface | Decentralized hosting, multiple interfaces | Company-operated primary interface |

| Data Storage | Fully on-chain or decentralized storage | Mix of blockchain and traditional databases |

User experience complexity poses adoption barriers as decentralized applications require wallet management, private key security, transaction signing, and gas fee understanding that overwhelm mainstream users accustomed to streamlined centralized services. Recovery mechanisms for lost keys remain challenging without reintroducing centralized custodians. Transaction finality delays frustrate users expecting instant confirmation characteristic of traditional applications. These friction points create pressure toward hybrid models compromising decentralization for familiar user experiences that drive broader adoption.

Governance challenges including low voter participation, plutocratic tendencies, and coordination difficulties plague decentralized protocols. Upgrading protocols requires consensus among diverse stakeholders with conflicting incentives. Smart contract bugs cannot be easily fixed in immutable systems, requiring complex upgrade mechanisms that introduce centralization vectors. Regulatory uncertainty creates compliance challenges as jurisdictions worldwide develop varying approaches to blockchain governance, with implications for projects operating across the USA, UK, UAE, and Canada simultaneously.

Core Decentralization Principles

Distribute Infrastructure

Ensure validator nodes spread geographically across multiple jurisdictions and operators to prevent single-point failures and resist coordinated shutdown attempts.

Maintain Transparency

Publish all code open-source, enable public verification of state and transactions, and avoid hidden administrative controls that undermine stated decentralization.

Enable Permissionless Access

Remove gatekeepers requiring approval for participation, allowing anyone globally to interact with protocols using only cryptographic credentials they control.

Implement Economic Incentives

Align participant interests through token economics rewarding honest behavior and penalizing attacks, creating self-sustaining ecosystems without central coordination.

Distribute Governance

Prevent concentration of decision-making authority by implementing token-based voting and community governance mechanisms rather than corporate control structures.

Ensure Data Sovereignty

Give users exclusive control over credentials and assets through private key ownership, preventing platforms from freezing accounts or seizing funds.

Accept Tradeoffs Consciously

Recognize tensions between decentralization, performance, and user experience, making deliberate architectural choices that prioritize according to specific application requirements.

Plan for Evolution

Design upgrade mechanisms balancing protocol immutability with ability to adapt, ensuring long-term viability without sacrificing core decentralization properties.

Decentralized application features create fundamentally different trust models compared to traditional centralized systems. Rather than requiring users to trust corporate entities to maintain honest behavior and protect data, blockchain-based applications leverage mathematical proofs, economic incentives, and distributed consensus to ensure protocol integrity. This transformation enables novel use cases from censorship-resistant communications to autonomous financial protocols managing billions in value without centralized custodians. However, achieving genuine decentralization requires navigating complex tradeoffs between performance, user experience, and distribution that demand careful analysis of specific business requirements.

The spectrum between fully decentralized apps and hybrid models reflects pragmatic reality rather than ideological purity. While some applications benefit from maximizing decentralization regardless of performance costs, others appropriately compromise on certain dimensions to enable broader adoption or regulatory compliance. Success requires understanding which decentralization features matter most for specific use cases, then architecting solutions that prioritize those attributes while accepting calculated tradeoffs elsewhere. As the blockchain ecosystem matures and new solutions emerge addressing current limitations, the distinction between decentralized vs centralized apps will increasingly define digital infrastructure across industries worldwide. Organizations embracing these technologies thoughtfully position themselves advantageously in the evolving landscape of distributed applications reshaping how we interact digitally.

Elevate Your Vision with Expert DApp Solutions

Leverage our 8+ years of blockchain expertise to build truly decentralized applications that deliver censorship resistance, user sovereignty, and sustainable competitive advantages.

Frequently Asked Questions

A truly decentralized app operates without centralized control, relying on distributed networks where no single entity can manipulate data or restrict access. Core features include blockchain-based infrastructure, open-source code for transparency, and smart contracts that execute autonomously. True decentralization requires permissionless access, meaning anyone can participate without approval. Data storage happens across multiple nodes rather than central servers, ensuring immutability and censorship resistance. Additionally, governance mechanisms allow community-driven decisions rather than corporate mandates. While many DApps claim decentralization, genuine implementations distribute power across infrastructure, governance, and data layers, creating systems resilient to single points of failure and external interference.

The foundational components of a DApp include blockchain networks that serve as the backend infrastructure, smart contracts that encode business logic and automate transactions, and decentralized storage solutions like IPFS for data persistence. A user-facing frontend interface connects users to the blockchain, while cryptographic wallets enable secure authentication and asset management. Token economics provide incentive structures for network participants, and consensus mechanisms ensure agreement across distributed nodes. Oracle services bridge on-chain and off-chain data when needed. These components work together to create applications that operate transparently, resist censorship, and function without centralized intermediaries, distinguishing DApps from traditional software architectures.

DApps achieve decentralization through architectural choices that distribute control and eliminate single points of failure. They deploy smart contracts on public blockchains where execution is validated by thousands of independent nodes rather than centralized servers. Data replication across distributed networks ensures no single entity controls information storage. Open-source codebases allow community auditing and participation in application evolution. Permissionless protocols enable anyone to interact without gatekeepers. Governance tokens distribute decision-making power among stakeholders rather than concentrating it with developers. By combining blockchain immutability, cryptographic security, distributed consensus, and community governance, DApps create systems where power, data, and control exist across networks rather than within centralized organizations.

Blockchain-based apps feature immutability, meaning recorded transactions cannot be altered or deleted, creating permanent audit trails. They operate with transparency, allowing anyone to verify transactions and smart contract code on public ledgers. Trustless execution eliminates intermediaries, as protocols enforce agreements automatically through code. Cryptographic security protects data integrity and user authentication through public-key infrastructure. These applications resist censorship since no central authority can shut down distributed networks. Tokenization enables new economic models through programmable digital assets. Interoperability allows cross-chain functionality and composability with other protocols. Combined, these features create applications fundamentally different from traditional software, offering unprecedented security, transparency, and user sovereignty over digital interactions.

Centralized apps operate on servers controlled by single organizations, creating trust dependencies and vulnerability to censorship or failure. Companies control user data, modify terms unilaterally, and can restrict access arbitrarily. Decentralized apps distribute operations across blockchain networks where no single entity holds control. Users maintain data ownership through cryptographic keys, and open protocols prevent arbitrary rule changes. Centralized systems offer faster performance and easier user experiences but sacrifice user sovereignty and transparency. Decentralized alternatives prioritize censorship resistance, data immutability, and permissionless access, though often with tradeoffs in speed and complexity. The fundamental distinction lies in where power resides: concentrated with corporations versus distributed among network participants.

Not all blockchain apps achieve true decentralization despite using blockchain technology. Many projects maintain centralized control through privately-managed nodes, closed-source code, or administrative keys that override smart contracts. Some use blockchain primarily for audit trails while retaining centralized governance and infrastructure. Hybrid models combine blockchain elements with traditional servers, sacrificing full decentralization for performance benefits. Token projects often concentrate ownership among founding teams, limiting governance participation. Additionally, reliance on centralized interfaces, single oracle providers, or proprietary APIs can undermine decentralization claims. Genuine assessment requires examining infrastructure distribution, governance mechanisms, code transparency, and whether the application can function if creators disappear. Blockchain utilization doesn’t automatically guarantee decentralization.

Smart contracts enable decentralization by automating agreements through self-executing code on blockchain networks, eliminating intermediaries and central authorities. Once deployed, these programs run exactly as written without possibility of interference, downtime, or censorship. They enforce rules transparently on public blockchains where anyone can verify logic and execution. Multiple independent validators confirm each transaction, preventing single-party manipulation. Smart contracts create trustless environments where parties interact based on code rather than institutional trust. They enable complex protocols like decentralized finance, governance systems, and automated marketplaces to operate autonomously. By encoding business logic directly into immutable blockchain protocols, smart contracts transform traditional client-server architectures into distributed, permissionless systems that function without centralized control or human intervention.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.