The Real Estate Tokenization sector is currently undergoing a structural transformation, evolving from early pilots to a core pillar of global finance. This analysis focuses solely on the observable data, market growth, and expert forecasts for the pivotal period of 2025–2030, detailing the massive increase in value and the required shift in Real Estate Tokenization Development Solutions.

- Current Market Status and Structural Anchors (2025 Data)

The foundation of the tokenized real estate boom in 2025 is anchored by the explosion of the broader Real-World Asset (RWA) tokenization segment, driven by a convergence of institutional necessity and technological maturity.

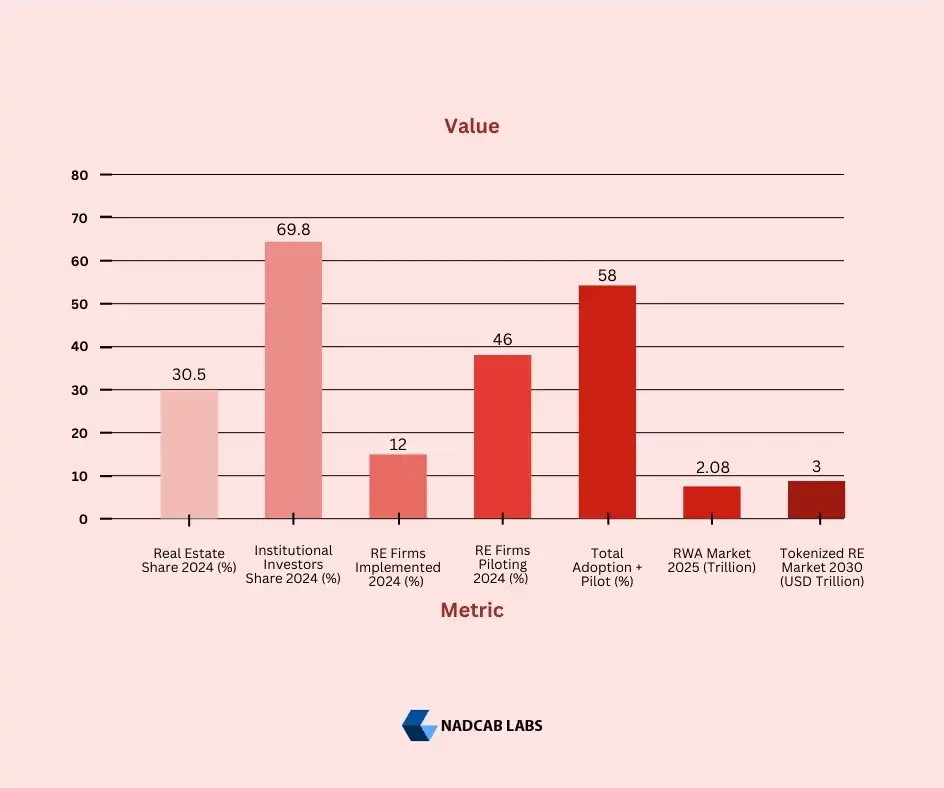

- Mordor Intelligence also reports that in 2024, the real estate asset-class accounted for 30.50 % of the overall asset-tokenization market. [1]

- For 2024, institutional investors reportedly held 69.80 % of the tokenization market.

- According to ScienceSoft (a software & consulting firm), as of June 2024, about 12 % of global real-estate firms had implemented tokenization and another 46 % were piloting it — i.e. ~58 % adoption or pilot among firms.

- According to Mordor Intelligence, the total asset-tokenization (RWA) market is forecast at USD 2.08 trillion in 2025.

ScienceSoft also projects long-term growth: in its 2025 report, it forecasts that by 2030 the global market for tokenized real estate could reach up to USD 3 trillion. [2]

- Real Estate Tokenization Navigating Regulations and Solutions

The primary factor that restrained market size pre-2025 was the lack of clear, uniform regulatory frameworks, creating an environment of legal uncertainty.

2.1. Initial Downfall Regulatory Uncertainty

Analysts at KPMG and EY stressed that the opaque US legal framework was a huge setback for market growth, with real estate tokens often being treated as traditional, heavily restricted securities [3] .

2.2. The Regulatory Catalyst (2025 Onward)

The shift in the 2025 landscape provided a catalyst for growth, driven by two key global regions:

- European Union (EU) – MiCA Implementation: The Markets in Crypto-Assets Regulation (MiCA), which entered into force in June 2023, began its final implementation phase toward full application in the 2025–2026 period. This framework institutes the world’s most comprehensive rules for crypto-assets not covered by existing financial legislation, providing a clear path for compliant real estate tokenization and resolving much of the jurisdictional friction previously seen across EU member states.[4]

- United States (US) – Clarity and Innovation: Following the period of ‘regulation by enforcement’, 2025 saw a concerted effort toward regulatory clarity. Submissions to the U.S. Securities and Exchange Commission (SEC) have emphasized models like IoT-Enabled Tokenization, grounding physical assets in verifiable data to advance market integrity and investor protection. [5] This focus ensures that new tokenization platforms are built with robust, technology-driven compliance frameworks.

2.3. The Preference for Permissioned Systems

Due to this initial legal friction, Permissioned Blockchains held 51.20% of the market share in 2024, favored by institutions for greater control, compliance, and governance necessary to navigate disparate global regulations. [6]

However, as regulatory clarity emerges, platform development is shifting towards hybrid models that seek to blend institutional compliance with the liquidity of public, permissionless chains.

- Year-by-Year Growth and Trillion-Dollar Prediction (2025-2030)

The market is projected to grow dramatically, mirroring the accelerated 45.46% CAGR of the overall RWA market (Mordor Intelligence). While forecasts for the total RWA market diverge—with BCG/ADDX estimating a conservative $16.1 Trillion by 2030 [7] and McKinsey projecting roughly $2 Trillion [8] the growth trajectory for tokenized real estate specifically remains consistently robust due to its intrinsic value proposition (liquidity).

Create My Real Estate Tokens Now!

Access expert analysis on the booming real estate tokenization market and its growth outlook!

Book Expert Support

| Year | Estimated Tokenized Real Estate Market Value | Futuristic Prediction & Key Updates | Required Services & Platform Development |

|---|---|---|---|

| 2025 | $0.25 T – $0.35 T | Institutional Launch: JPMorgan & Goldman Sachs tokenization platforms start. [9] | Tokenization Platforms/Middleware (59.60% revenue). High demand for Tokenization Consulting. [14] |

| 2026 | $0.4 T – $0.7 T | Portfolio Shift: HNWIs (8.6%) & institutions (5.6%) allocation to tokenized assets. Tokenized funds surge. [10] | Compliance & Legal-Tech fastest growth (49.40% CAGR). AI-driven RegTech standard. [15] |

| 2027 | $0.8 T – $1.2 T | Asia-Pacific fastest growth (55.40% CAGR). Assets used as DeFi collateral. [11] | Focus on cross-chain interoperability + global compliance. [16] |

| 2028 | $1.3 T – $1.9 T | Retail expansion (52.00% CAGR). Entry as low as $50 for tokenized property fractions. [12] | Enterprise-grade platforms: AI valuation + secure oracles. |

| 2029 | $2.0 T – $2.6 T | Debt tokenization dominates; secondary markets stabilize. | Advanced tokenomics, debt structuring, automated taxation. |

| 2030 | $2.5 T – $3.0 T | Market hits $3T & ~15% of global real estate AUM. [13] | Hybrid blockchain, AI risk analytics & global regulatory maintenance. |

Analysis of Platform and Service Evolution

The projected exponential growth is intrinsically linked to the maturity and innovation of Real Estate Tokenization Development Solutions. The new wave of platforms is solving the fundamental problems of liquidity and operational inefficiency.

4.1. The Liquidity Solution: Fractionalization and Secondary Trading

Tokenization directly addresses the high capital intensity and inherent illiquidity of traditional real estate. [17]

- Democratization of Access: Fractional ownership is the cornerstone of this liquidity push, allowing properties to be split into manageable digital tokens. This has drastically lowered the entry barrier, with platforms like RealT and Lofty offering investment minimums as low as $50 for U.S. rental properties [18] . This democratization expands the potential investor base globally, increasing overall market depth and volume [19] .

- Secondary Market Integration: Platforms like tZERO and Securitize are focusing on regulated Secondary Trading venues to provide the necessary liquidity rails. Securitize, for instance, has demonstrated convergence with traditional finance by crossing $1 billion in issued tokens and administering $38 billion across 715 funds after acquiring MG Stover. [20]

4.2. Next-Generation Real Estate Platforms AI, RegTech & Hybrid Blockchain Post-2028

The future of Real Estate Tokenization Platform Development (post-2028) is moving beyond simple asset issuance to focus on intelligent automation and global compliance.

- Hyper-Automation via Smart Contracts: Platforms are leveraging sophisticated smart contracts to automate operational tasks, including dividend distribution, governance voting, tax reporting, and compliance checks. This automation is expected to dramatically reduce reliance on intermediaries and corresponding costs. [21]

- AI-Powered Compliance (RegTech): By 2026, Artificial Intelligence (AI) has become integral to compliance. AI-driven RegTech systems underpin real-time compliance monitoring, automated Know-Your-Customer/Know-Your-Business (KYC/KYB) checks, and cross-border transaction intelligence, addressing the fragmentation of global regulation. [27] Leading platforms like Zoniqx emphasize this focus on AI-driven compliance for seamless digitization. [22]

- The Hybrid Chain Model: While Permissioned Chains currently dominate for security, Permissionless Networks are forecast to grow faster (53.20% CAGR) to 2030. [23] This suggests that platform architects are increasingly finding ways to combine the deep, global liquidity of public chains (e.g., Ethereum/Polygon) with the security and compliance features of private networks, moving toward a hybrid model that maximizes both institutional control and public market access.

The rapid rise in demand for Real Estate Tokenization Consulting and platform services is the structural reflection of the real estate industry transforming itself to compete on liquidity, speed, and investor experience.

Frequently Asked Questions

Real estate tokenization is the process of converting ownership of physical properties into blockchain-based digital tokens, allowing fractional ownership, global trading, and enhanced liquidity.

The market is expected to grow fast and could reach $3–$5 trillion by 2030, thanks to more businesses joining, clearer rules, and new technology.

The main trends include owning part of a property (fractional ownership), using AI to manage properties, easy rule-following tools (RegTech), connecting with DeFi, and investing in properties across countries.

North America leads due to its mature financial infrastructure, while Asia-Pacific is the fastest-growing region, driven by urbanization and increasing retail investor participation.

Platforms create digital tokens representing property shares. Investors can buy, sell, or trade these tokens on blockchain based secondary markets with automated compliance and settlement through smart contracts.

Big institutions bring in large amounts of money, create their own token platforms, and help trust the market, making it easier for people to use and trade tokenized real estate.

Smart contracts, AI-powered property management, hybrid blockchain networks, interoperability protocols, and DeFi integration are driving efficiency, security, and scalability.

The main parts of the market include homes, office and shop buildings, tokenized REITs, shared rental properties, and real estate loans turned into tokens.

Investors can buy tokenized real estate on special platforms, own small parts of properties with less money, and spread their investments across different properties and countries.

Reviewed By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.