Key Takeaways

- Market Opportunity: The global P2P lending platform market continues to expand rapidly, with online P2P lending platforms processing billions in loan originations annually across consumer, business, and real estate lending segments, creating substantial opportunities for platform operators.

- Cost Structure: The cost of P2P lending platform creation ranges from $50,000 for basic implementations to $300,000+ for enterprise solutions, with ongoing operational expenses adding 15-25% annually for hosting, maintenance, compliance, and customer support.

- Essential Features: Critical P2P lending platform features include KYC/AML verification, automated loan matching, credit scoring systems, payment processing, loan management, dual dashboards for borrowers and lenders, document management, and comprehensive reporting capabilities.

- Revenue Model: P2P lending business profitability derives from origination fees (1-5% of loan amount), annual servicing fees (0.5-1.5%), late payment charges, and premium services, with successful platforms achieving 20-40% profit margins at scale.

- Technical Architecture: P2P lending system architecture requires secure, scalable infrastructure including application servers, database management, API integrations with payment gateways and credit bureaus, automated workflow engines, and multi-layered security protocols.

- Regulatory Compliance: Operating a peer to peer lending platform requires navigating complex regulatory frameworks including lending licenses, KYC/AML compliance, consumer protection laws, data privacy regulations, and jurisdiction-specific financial reporting requirements.

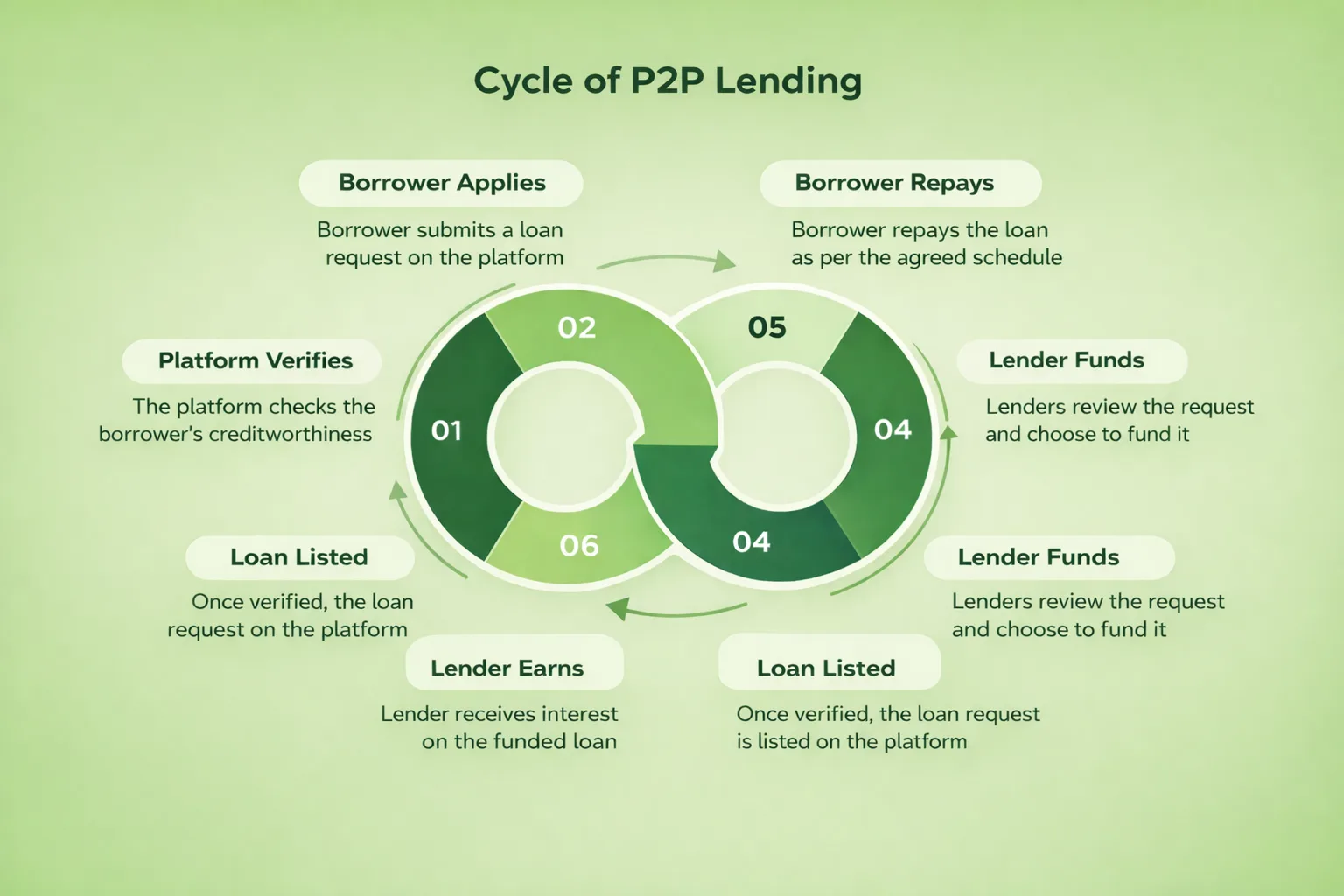

- Process Workflow: The P2P lending process encompasses borrower application and verification, credit assessment and risk grading, loan listing on the marketplace, lender selection and funding, loan disbursement, and automated repayment collection and distribution.

- Risk Management: Successful P2P lending marketplaces implement comprehensive risk mitigation including diversified loan portfolios, robust credit scoring, fraud detection systems, borrower verification, lender education, and adequate capital reserves for operational continuity.

- Competitive Advantages: Platform differentiation comes through superior user experience, innovative credit assessment using alternative data and AI, competitive fee structures, automated portfolio management, mobile accessibility, and value-added services beyond basic lending functionality.

- Growth Trajectory: Building a sustainable P2P lending business typically requires 18-36 months to achieve profitability, with success depending on loan volume growth, default rate management, regulatory navigation, technology scalability, and continuous platform optimization based on user feedback.

The financial technology landscape has undergone a dramatic transformation over the past decade, with peer to peer lending emerging as one of the most disruptive innovations challenging traditional banking models. By directly connecting individuals and businesses seeking loans with investors willing to fund them, P2P lending platforms have democratized access to capital while offering attractive returns to lenders. This revolutionary approach eliminates the inefficiencies and high costs associated with traditional financial intermediaries, creating a win-win ecosystem for all participants.

Building a successful P2P lending platform requires comprehensive understanding of market dynamics, technical requirements, regulatory compliance, and operational challenges. Whether you’re an entrepreneur identifying opportunities in underserved lending markets, an established financial institution seeking digital transformation, or a technology company expanding into fintech, this guide provides the detailed roadmap necessary for informed decision-making. We’ll explore every critical aspect from fundamental concepts and business models to technical architecture, essential features, cost structures, and growth strategies that separate successful platforms from failed attempts.

What Is a P2P Lending Platform?

A P2P lending platform represents a digital marketplace that facilitates direct lending between individuals or businesses without traditional financial institution intermediation. This innovative model leverages technology to streamline the entire lending process, from initial loan application through fund disbursement to repayment completion. By removing the middleman, these platforms create efficiencies that benefit both borrowers seeking lower interest rates and lenders pursuing higher returns than traditional savings instruments offer.

Peer to Peer Lending Platform Explained

At its core, a peer to peer lending platform functions as a sophisticated marketplace bringing together two distinct user groups with complementary financial needs. Borrowers seeking capital for various purposes including debt consolidation, business expansion, home improvements, or personal expenses submit loan applications detailing their requirements and financial profiles. Simultaneously, lenders with available capital browse these opportunities, evaluating risk-return profiles to make informed investment decisions about which loans to fund.

The platform serves as the trusted intermediary managing all transactional, operational, and compliance aspects. It verifies user identities, assesses creditworthiness, structures loan terms, facilitates fund transfers, manages repayment collections, and handles defaults when they occur. This comprehensive service model ensures borrowers receive funds efficiently while lenders enjoy passive investment management with transparent risk assessment. The sophisticated technology stack underlying modern P2P lending platforms automates most processes, enabling scalability while maintaining rigorous standards for security and compliance.

How P2P Lending Platforms Work

The P2P lending workflow begins when borrowers complete registration and submit loan applications providing personal information, financial details, and loan specifications including amount, purpose, and preferred terms. The platform’s automated systems conduct preliminary verification, run credit checks through integrated bureau APIs, and analyze submitted documentation. Based on this assessment, the system assigns a risk grade and suggests interest rates reflecting the borrower’s creditworthiness and prevailing market conditions.

Approved loan requests appear in the marketplace where registered lenders can review opportunities filtered by various criteria including loan amount, term length, purpose, borrower credit grade, and expected return. Lenders can fund entire loans or participate in portions, enabling portfolio diversification across multiple borrowers. Once a loan reaches full funding, the platform disburses funds to the borrower’s account, typically within 24-48 hours. Throughout the loan term, the platform manages monthly repayment collections from borrowers and distributes principal and interest payments to participating lenders proportionally to their funding contribution.

P2P Lending Ecosystem Overview

The P2P lending ecosystem comprises multiple stakeholders beyond borrowers and lenders, each playing crucial roles in platform operations and success. Technology providers supply the underlying infrastructure, payment processors enable secure fund transfers, credit bureaus provide creditworthiness data, collection agencies assist with delinquent accounts, and regulatory bodies establish operational frameworks ensuring consumer protection and market integrity. Additionally, marketing partners drive user acquisition, customer service teams support platform users, and legal advisors ensure ongoing compliance.

Understanding these ecosystem dynamics proves essential when building a P2P lending platform. Each relationship requires careful management through APIs, service agreements, and operational protocols. The platform must seamlessly integrate these diverse components into a cohesive user experience while maintaining security, reliability, and regulatory compliance. Successful platforms develop strong partnerships across the ecosystem, leveraging specialized expertise while focusing internal resources on core marketplace functionality and user experience optimization.

Core Principle: The most successful P2P lending platforms balance borrower accessibility with lender protection, creating sustainable marketplaces where both parties achieve their financial objectives through transparent, technology-enabled transactions.

P2P Lending Business Model Explained

The business model underlying P2P lending platforms differs fundamentally from traditional banking, creating unique value propositions and revenue streams. Rather than using their own capital to originate loans and earning interest spreads, P2P lending business operators facilitate transactions between third parties, generating income through service fees and commissions. This asset-light approach enables rapid scaling without the capital requirements that constrain traditional lenders.

P2P Lending Marketplace Structure

The P2P lending marketplace operates on a two-sided platform model requiring critical mass on both supply (lenders) and demand (borrowers) sides to function effectively. This creates a classic chicken-and-egg challenge where borrowers won’t join without available funding and lenders won’t commit capital without attractive loan opportunities. Successful platforms address this through phased launches, strategic partnerships providing initial liquidity, and carefully managed growth that maintains balance between both user segments.

The marketplace structure typically includes multiple loan categories serving different borrower needs and risk appetites. Consumer loans for personal use, business loans for working capital or expansion, real estate loans for property investment, and student loans for education financing represent common categories. Each category may feature distinct qualification criteria, interest rate ranges, term lengths, and risk characteristics. Advanced P2P lending marketplaces offer sophisticated tools enabling lenders to build diversified portfolios across categories, automatically investing in loans matching their specified criteria.

Role of Borrowers and Lenders

Borrowers bring loan demand to the platform, seeking capital more accessible or affordable than traditional banking alternatives. They complete comprehensive applications, provide supporting documentation, undergo credit assessment, and commit to repayment schedules aligned with their cash flow capabilities. Quality borrowers with strong credit profiles attract competitive rates, while those with imperfect credit may still access funding albeit at higher rates reflecting increased risk. The platform’s value proposition for borrowers centers on faster approvals, flexible terms, competitive rates, and streamlined digital processes compared to traditional lending channels.

Lenders provide the capital fueling the marketplace, seeking returns exceeding those available from traditional savings accounts, bonds, or other fixed-income investments. They evaluate loan opportunities based on risk grades, borrower profiles, loan purposes, and expected returns, making investment decisions aligned with their risk tolerance and return objectives. The platform empowers lenders with transparency, diversification tools, and detailed performance analytics unavailable in most traditional investment vehicles. Successful online P2P lending platforms cultivate both borrower and lender communities through education, support, and features that optimize outcomes for each group.

P2P Lending Revenue Model

P2P lending platforms generate revenue through multiple streams, creating diversified income sources that support sustainable operations and growth. The revenue model must balance platform profitability with competitive positioning, ensuring fees remain attractive relative to alternatives while covering operational costs and generating acceptable margins. Understanding these revenue mechanisms proves essential when evaluating the cost of P2P lending platform creation and projected return on investment.

Platform Fees and Commission

Origination fees charged to borrowers represent the primary revenue source for most P2P lending platforms. These fees typically range from 1-5% of the loan amount, deducted from disbursed funds or added to the total repayment obligation. The exact percentage varies based on loan characteristics, borrower credit grade, competitive positioning, and platform economics. Some platforms employ tiered fee structures where stronger credit profiles qualify for reduced fees, incentivizing quality applications while maintaining margins on higher-risk loans.

Servicing fees charged to lenders provide ongoing revenue throughout loan terms. These annual fees, usually 0.5-1.5% of outstanding principal, compensate the platform for payment processing, account management, reporting, and customer support. Additional revenue streams include late payment fees when borrowers miss payments, collection fees for recovery efforts on defaulted loans, premium membership subscriptions offering enhanced features or benefits, and sometimes transaction fees on secondary market trades where lenders can sell loan participations to other investors for liquidity.

Interest-Based Earnings

Some P2P lending platforms participate directly in lending economics by holding small percentages of each loan on their balance sheet or earning interest on float from funds held in platform accounts pending deployment or distribution. While this creates additional revenue, it also introduces balance sheet risk and may trigger additional regulatory requirements depending on jurisdiction. Most pure marketplace models avoid this complexity, focusing on transaction-based revenues that scale with platform volume without capital consumption or credit risk exposure.

Alternative revenue strategies include white-label partnerships where the platform technology powers lending operations for other brands, earning licensing fees or revenue shares. Data monetization through anonymized lending trends sold to financial institutions, affiliate commissions from insurance or other financial products offered to platform users, and consulting services helping other regions establish similar platforms represent emerging revenue diversification opportunities. Building advanced marketplace solutions enables these sophisticated business models.

Key P2P Lending Platform Features

The success of any P2P lending platform depends heavily on its feature set, which must address diverse needs of borrowers, lenders, and administrators while ensuring security, compliance, and operational efficiency. These features form the foundation of user experience and platform competitiveness, distinguishing market leaders from also-rans in this competitive fintech sector.

User Registration and Onboarding

User registration initiates the platform relationship, requiring seamless yet thorough processes that verify identities while minimizing friction. Modern P2P lending platform features include social login options accelerating registration, progressive profiling that collects information incrementally rather than upfront, and guided onboarding flows explaining platform mechanics and setting user expectations. The registration experience must accommodate both borrowers and lenders, with distinct pathways addressing their different information requirements and verification needs.

KYC and AML in P2P Lending

Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance represent non-negotiable requirements for legitimate P2P lending operations. The platform must collect and verify user identities through government-issued documents, validate addresses through utility bills or bank statements, screen users against sanctions lists and politically exposed persons databases, and monitor transactions for suspicious patterns indicating potential fraud or money laundering. Advanced P2P lending platform requirements include automated verification APIs that instantly validate documents and identities, reducing manual review burden while maintaining high accuracy.

Ongoing KYC procedures update user information periodically, particularly for high-value accounts or users exhibiting unusual behavior patterns. The platform must maintain comprehensive audit trails documenting verification efforts, retain records for prescribed periods meeting regulatory requirements, and implement risk-based approaches focusing enhanced due diligence on higher-risk profiles. Sophisticated platforms leverage AI and machine learning to identify potential fraud indicators, flagging accounts requiring additional scrutiny while allowing legitimate users to proceed without unnecessary delays.

Borrower and Lender Dashboard

Dual dashboard interfaces tailored to borrower and lender needs provide intuitive control centers for platform interaction. The borrower dashboard displays active loan status, repayment schedules, payment history, outstanding balances, and upcoming obligations. It enables loan applications, document uploads, communication with support, and account management functions like updating bank details or viewing statements. Visual progress indicators showing repayment completion and credit building provide positive reinforcement encouraging on-time payments.

The lender dashboard focuses on investment management, displaying portfolio composition, performance metrics, pending investments, cash available for deployment, and historical returns. Advanced features include automated investing tools that deploy capital according to predefined criteria, portfolio rebalancing recommendations, secondary market access for liquidity, and comprehensive analytics comparing performance against benchmarks. Both dashboards must function flawlessly across devices, with mobile-responsive design ensuring accessibility regardless of how users access the platform.

Automated Loan Matching

Automated loan matching algorithms represent core P2P lending platform features that efficiently pair borrower requests with lender capital based on sophisticated matching logic. The system considers multiple factors including lender investment criteria, available funding amounts, risk preferences, diversification requirements, and borrower loan characteristics. Advanced matching engines optimize for multiple objectives simultaneously, such as minimizing time to full funding, maximizing lender diversification, ensuring fair opportunity distribution, and managing platform risk concentration.

Machine learning enhances matching over time by identifying patterns in successful loans, lender preferences, and optimal portfolio compositions. The system can predict which loans will likely fund quickly, suggest adjustments to borrower terms improving funding probability, and recommend investments to lenders aligned with their historical patterns and stated preferences. Transparency in matching logic builds trust, with platforms explaining how capital allocation decisions occur and providing lenders with override capabilities to maintain control over their investment choices.

Credit Scoring in P2P Lending

Credit scoring systems assess borrower default risk, assigning grades or scores that inform interest rate pricing and investment decisions. Traditional credit bureau scores provide the foundation, supplemented by platform-specific models analyzing additional data points including income stability, debt-to-income ratios, employment history, education levels, and loan purpose. Advanced platforms incorporate alternative data such as bank transaction patterns, utility payment history, rental payments, and even social media indicators to evaluate thin-file borrowers lacking extensive traditional credit histories.

AI-based credit scoring represents the cutting edge of P2P lending innovation, using machine learning algorithms trained on historical loan performance data to identify non-obvious predictors of repayment behavior. These models continuously improve as more loans season, refining predictions and potentially identifying underserved borrower segments that traditional scoring methods overlook. The scoring system must balance accuracy with explainability, as regulatory requirements and user trust demand transparency about how decisions are made, particularly in adverse action scenarios where applications are declined.

| Feature Category | Essential Features | Advanced Features |

|---|---|---|

| User Management | Registration, KYC verification, profile management | Biometric authentication, social login, progressive profiling |

| Credit Assessment | Credit bureau integration, basic scoring | AI-based scoring, alternative data analysis, behavioral analytics |

| Loan Management | Application processing, disbursement, collection | Automated underwriting, flexible repayment, refinancing options |

| Investment Tools | Manual loan selection, portfolio view | Auto-invest, portfolio rebalancing, secondary market |

| Payment Processing | ACH transfers, payment gateway integration | Multiple payment methods, instant transfers, international payments |

| Analytics & Reporting | Basic performance reports, transaction history | Predictive analytics, custom dashboards, API for data access |

| Communication | Email notifications, support tickets | SMS alerts, in-app messaging, chatbot support |

Loan Management System

Comprehensive loan management functionality tracks each loan through its entire lifecycle from origination to final payment or default resolution. The system maintains detailed records of all transactions, generates amortization schedules, calculates interest and principal breakdowns, manages escrow accounts, processes prepayments, and handles modifications when borrowers need relief. Automated workflows trigger actions based on loan events such as sending payment reminders before due dates, initiating collection procedures for late payments, and distributing payments to multiple lenders proportionally.

The loan management system integrates with accounting software to maintain accurate financial records, generates tax documentation for lenders and borrowers, produces regulatory reports, and provides administrators with operational dashboards monitoring portfolio health. Advanced features include scenario modeling for portfolio stress testing, early warning systems identifying loans at risk of default, and automated decision engines approving standard requests while escalating exceptions for manual review. Robust loan management capabilities prove essential as platforms scale beyond manual processing capacity.

Payment Processing and Repayments

Payment processing infrastructure handles all monetary flows including borrower repayments, lender deposits and withdrawals, fee collections, and fund disbursements. Integration with multiple payment gateways provides redundancy and supports various payment methods including bank transfers, debit cards, credit cards where permitted, and emerging options like digital wallets or cryptocurrency. The system must handle scheduled recurring payments for loan repayments, one-time transactions for deposits and withdrawals, and complex split payments distributing borrower payments among multiple lenders.

Automated repayment collection attempts direct debits on scheduled dates, retrying failed transactions and notifying borrowers of payment issues. The P2P lending workflow includes grace periods, late fee assessments, and escalation to collection procedures for chronically delinquent accounts. For lenders, the system maintains cash balances, automatically reinvests funds according to preferences, and processes withdrawal requests within specified timeframes. All payment activities require comprehensive audit trails for reconciliation, dispute resolution, and regulatory compliance, with real-time synchronization between payment processors and the platform database ensuring data consistency.

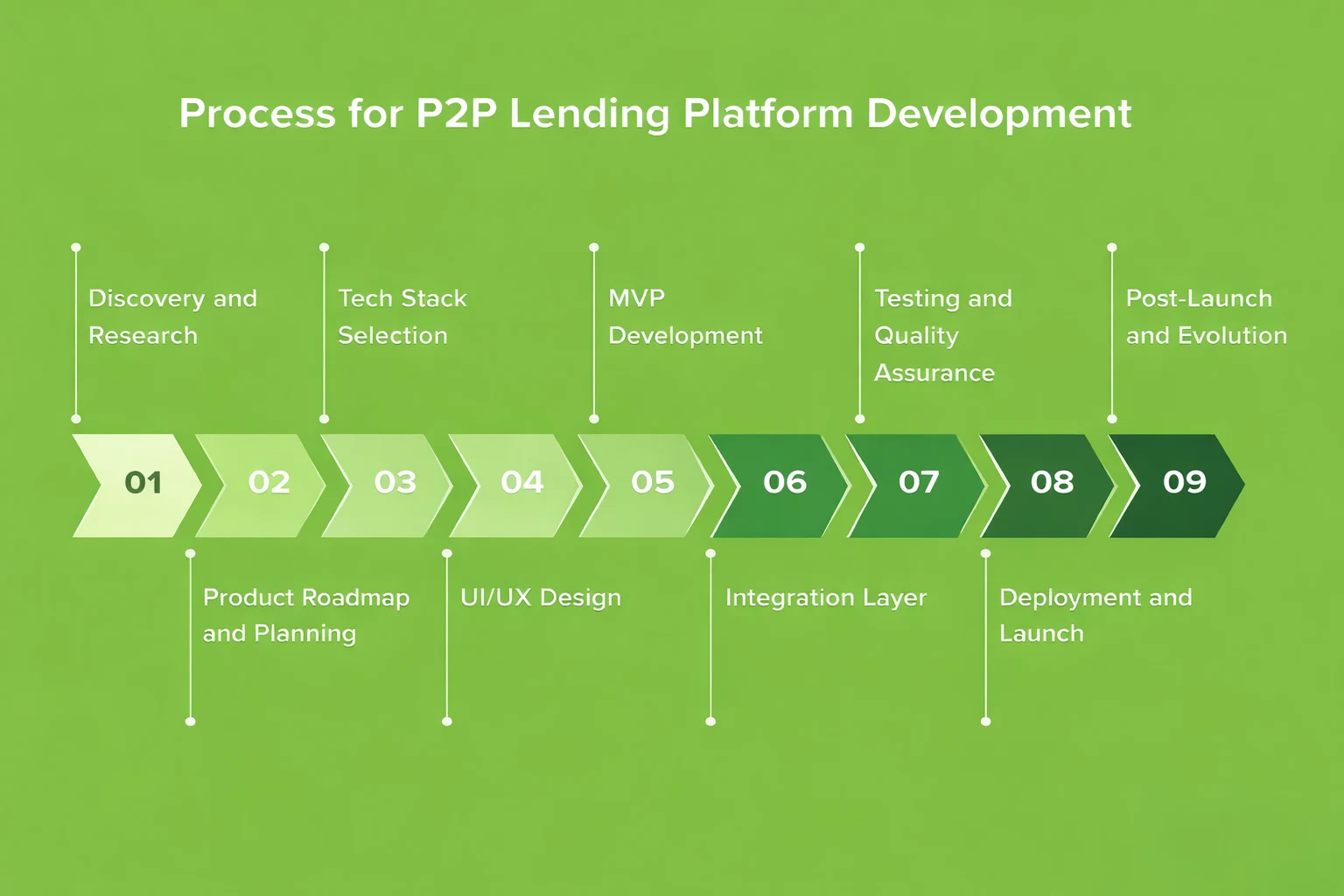

P2P Lending Process Step by Step

Understanding the complete P2P lending process from initial user contact through loan repayment completion reveals the complexity masked by streamlined user interfaces. Each step involves multiple system components, third-party integrations, and decision points requiring careful orchestration to deliver seamless experiences while maintaining security and compliance standards.

Borrower Loan Request Flow

The borrower journey begins with platform registration requiring identity verification and basic financial information. Once registered, borrowers initiate loan requests by specifying desired amounts, preferred terms, and intended use. The platform guides them through data collection including employment details, income sources, existing obligations, and supporting documentation. Progressive disclosure techniques gather information incrementally, adapting questions based on previous responses to minimize form abandonment while collecting necessary underwriting data.

Submitted applications trigger automated verification processes querying credit bureaus, validating employment through third-party services, analyzing bank statements for income confirmation, and checking provided information against fraud databases. The credit scoring algorithm processes all available data, assigning risk grades and calculating recommended interest rates. Applications meeting minimum criteria proceed to marketplace listing, while marginal cases may receive counteroffers suggesting adjusted terms like higher rates or shorter periods. Declined applications receive clear explanations enabling borrowers to understand deficiencies and potentially reapply after addressing issues.

Lender Investment Process

Lenders funding the P2P lending marketplace must first complete registration and verification before depositing capital into platform accounts. They configure investment preferences specifying acceptable risk grades, loan amounts, terms, purposes, and diversification requirements. The platform provides educational resources explaining risk-return relationships, default probabilities, and portfolio theory fundamentals, ensuring lenders make informed decisions aligned with their financial situations and objectives.

Lenders can invest through manual selection, browsing available loans and choosing specific opportunities, or automated investing where algorithms deploy capital according to predefined criteria. The auto-invest feature particularly appeals to passive investors seeking broad diversification without active management. As loans receive funding commitments, the system tracks progress toward full funding, often employing all-or-nothing models where loans must reach 100% funding within specified timeframes or applications are cancelled. Once fully funded, the platform generates loan agreements, coordinates digital signatures, and initiates disbursement procedures.

Risk Evaluation and Approval

Risk evaluation represents perhaps the most critical P2P lending process component, determining which borrowers access the marketplace and at what terms. Multi-layered assessment combines automated algorithms with human oversight for edge cases. The automated tier handles straightforward applications meeting clear qualification criteria or falling obviously outside acceptable parameters. Middle-tier applications exhibiting unusual characteristics or borderline metrics receive manual review by underwriters applying judgment to nuanced situations algorithms struggle to evaluate properly.

The approval process balances multiple considerations including default risk assessment, regulatory compliance verification, fraud prevention, platform risk concentration management, and marketplace supply-demand dynamics. During high-demand periods, approval thresholds may tighten to prevent lender capital depletion. Conversely, excess lender capital may justify accepting slightly higher-risk borrowers to maintain marketplace liquidity. This dynamic risk management optimizes platform economics while protecting all stakeholders from excessive concentration or correlation risks that could threaten platform viability during economic downturns.

Loan Disbursement and Repayment Cycle

Upon reaching full funding and completing all documentation, the platform initiates loan disbursement transferring funds from lender accounts through escrow to the borrower’s designated bank account. Most platforms process disbursements within 1-3 business days, with some offering premium services for expedited funding. The loan officially commences on the disbursement date, establishing the repayment schedule with first payments typically due 30 days later.

The repayment cycle involves monthly automated collections from borrower accounts, with the platform’s payment processor attempting direct debits on scheduled dates. Successfully collected payments are allocated between principal and interest according to amortization schedules, then distributed to participating lenders proportionally after deducting platform servicing fees. The system maintains running balances, generates payment confirmations, updates credit bureau reporting for borrowers, and provides lenders with detailed transaction histories. When loans pay off early, the platform handles final settlements including interest recalculations and principal returns. For defaults, specialized collection workflows activate, attempting recovery while keeping lenders informed of proceedings and eventual resolutions.

Risk Alert: Default rates in P2P lending typically range from 2-10% depending on borrower quality and economic conditions. Platforms must maintain adequate reserves and transparent communication about risks to sustain lender confidence during inevitable default events.

P2P Lending System Architecture

Robust technical architecture forms the backbone of successful P2P lending platform operations, supporting high transaction volumes, ensuring security, maintaining data integrity, and enabling seamless integration with numerous third-party services. The architecture must balance multiple requirements including scalability, reliability, security, performance, and cost efficiency while providing flexibility for future enhancements and market expansions.

Core Platform Components

The P2P lending system architecture comprises multiple interconnected components each serving specialized functions. The application layer includes user-facing web and mobile interfaces providing intuitive experiences for borrowers, lenders, and administrators. The business logic layer implements core platform functionality including loan matching, credit scoring, payment processing, and workflow management. The data layer consists of databases storing user information, loan records, transactions, and analytics, typically employing relational databases for structured data and NoSQL solutions for unstructured content.

Integration layers facilitate communication with external services through RESTful APIs or message queues. A robust API gateway manages authentication, rate limiting, request routing, and response aggregation across microservices architectures. Caching layers improve performance for frequently accessed data, while content delivery networks accelerate asset delivery globally. Background job processors handle asynchronous tasks like report generation, email delivery, and data synchronization. All components must operate cohesively, with monitoring systems tracking health, performance, and errors to enable rapid issue resolution before users experience disruptions.

Data Flow in P2P Lending Workflow

Understanding data flow through the P2P lending workflow reveals how information moves between components during typical operations. When borrowers submit applications, data flows from frontend forms through validation layers into the database. Simultaneously, the system triggers credit bureau queries through API integrations, awaiting responses before proceeding. The credit scoring engine retrieves historical loan performance data, applies algorithms to application data and credit report information, then returns risk grades and rate recommendations.

Approved applications flow into the marketplace database where matching algorithms access them alongside lender investment criteria and available funding. The matching engine produces investment recommendations or auto-executes investments, creating transaction records and updating account balances. Throughout the loan lifecycle, payment events trigger complex data flows collecting funds through payment gateways, allocating amounts between principal and interest, distributing to multiple lenders, updating all affected records, generating notifications, and synchronizing financial reporting systems. Comprehensive data flow mapping ensures architects understand dependencies, identify bottlenecks, and optimize for performance and reliability.

Integration with Payment Gateways

Payment gateway integration represents critical infrastructure enabling all monetary flows within the P2P lending platform. The platform typically integrates multiple gateways providing redundancy, supporting diverse payment methods, and optimizing transaction costs through intelligent routing. Integration architecture must handle synchronous payment requests for immediate confirmations, asynchronous webhook notifications for delayed events, reconciliation procedures ensuring financial accuracy, and error handling for failed transactions requiring retry or escalation.

Advanced implementations include payment orchestration layers abstracting gateway-specific details, enabling seamless failover between providers and simplifying additions of new payment methods. The integration must support complex scenarios like split payments distributing borrower repayments among multiple lenders in single transactions, escrow account management isolating customer funds from operational accounts, and compliance with payment card industry standards when processing card transactions. Security considerations demand tokenization of sensitive payment information, TLS encryption for all payment-related communications, and comprehensive audit logging of all financial events for fraud detection and regulatory reporting. Understanding security best practices proves essential for protecting financial platforms.

Security Layers and Monitoring

Multi-layered security architecture protects P2P lending platforms from diverse threats including unauthorized access, data breaches, fraud attempts, and service disruptions. The perimeter layer employs firewalls, DDoS protection, and intrusion detection systems preventing malicious traffic from reaching application servers. The application layer implements authentication and authorization controlling user access, input validation preventing injection attacks, and session management protecting against hijacking attempts.

The data layer uses encryption at rest for sensitive information, access controls limiting database exposure, and activity logging tracking all data operations. The monitoring layer continuously analyzes system behavior identifying anomalies indicating potential security incidents or performance problems. Security information and event management (SIEM) systems aggregate logs across infrastructure, applying machine learning to detect suspicious patterns warranting investigation. Regular security audits, penetration testing, and vulnerability assessments identify weaknesses before attackers exploit them, with rapid patching procedures addressing discovered issues.

Security and Compliance in P2P Lending Platforms

Operating a peer to peer lending platform demands unwavering commitment to security and regulatory compliance, as platforms handle sensitive personal information, facilitate substantial financial transactions, and operate within heavily regulated financial services sectors. Failures in either domain can result in financial losses, regulatory sanctions, reputational damage, and potentially platform closure. Successful platforms embed security and compliance into every aspect of operations rather than treating them as afterthoughts.

P2P Lending Security Features

Comprehensive security features protect users, transactions, and data from various threat vectors. Multi-factor authentication requires users to verify identity through multiple independent credentials before accessing accounts, significantly reducing unauthorized access risks. End-to-end encryption protects data transmission between users and servers, preventing interception by malicious actors. Role-based access controls ensure administrators and support staff can only access information necessary for their functions, limiting insider threat exposure.

Advanced fraud detection systems analyze user behavior, transaction patterns, and application data identifying anomalies suggesting fraudulent activity. Machine learning models trained on historical fraud patterns flag suspicious accounts for enhanced scrutiny. Document verification services using optical character recognition and liveness detection prevent identity theft through fake or stolen credentials. Regular security awareness training educates users about phishing, social engineering, and other threats, while incident response procedures enable rapid containment and recovery when security events occur.

Regulatory Compliance for P2P Lending

Regulatory frameworks governing P2P lending vary significantly across jurisdictions, requiring platforms to navigate complex compliance landscapes. Most markets require lending licenses or money transmitter registrations before operations commence. Platforms must adhere to consumer protection regulations ensuring transparent pricing, fair lending practices, and appropriate disclosures. Truth in lending laws mandate clear communication of annual percentage rates, total repayment amounts, fee structures, and terms enabling borrowers to make informed decisions.

Fair lending regulations prohibit discrimination based on protected characteristics, requiring platforms to demonstrate credit decisions rely solely on financially relevant criteria. Data protection laws like GDPR in Europe or CCPA in certain regions impose strict requirements for personal information collection, storage, usage, and disclosure. Platforms must maintain detailed privacy policies, obtain explicit user consent, enable data access and deletion requests, and report breaches within prescribed timeframes. Tax compliance involves withholding and reporting obligations, while securities regulations may apply if loan participations are classified as investment products. Ongoing regulatory monitoring ensures platforms adapt to evolving requirements maintaining compliant operations.

Data Protection and Fraud Prevention

Data protection strategies safeguard the massive volumes of sensitive information P2P lending platforms accumulate including personal identities, financial histories, bank account details, and transaction records. Encryption protects data both in transit and at rest, with strong cryptographic algorithms and proper key management preventing unauthorized access even if underlying storage is compromised. Data minimization principles limit collection to information genuinely necessary for platform operations, reducing exposure if breaches occur.

Fraud prevention requires multi-pronged approaches combining technology and human oversight. Automated systems screen applications against known fraud patterns, verify consistency across submitted information, and flag applications exhibiting red flags for manual review. Continuous monitoring detects account takeover attempts, unusual transaction patterns, or coordinated fraud rings. Platforms maintain fraud databases sharing information with industry peers through secure channels, creating network effects where individual platform learnings benefit the broader ecosystem. When fraud is detected, rapid response procedures minimize losses, notify affected parties, and cooperate with law enforcement investigations.

P2P Lending Platform Cost Breakdown

Understanding the comprehensive cost structure of creating and operating a P2P lending platform proves essential for realistic business planning and investment decisions. Costs span initial creation, ongoing operations, regulatory compliance, and continuous improvement, with substantial variation based on platform scope, feature sophistication, market positioning, and growth trajectory.

Factors Affecting P2P Lending Platform Cost

Multiple factors influence the total cost of P2P lending platform implementation. Feature complexity represents the primary driver, with basic platforms supporting essential lending workflows costing significantly less than sophisticated solutions incorporating AI-based credit scoring, automated investing, mobile applications, and secondary markets. Geographic scope affects costs through regulatory compliance requirements, payment method integrations, and localization needs. Platforms targeting single markets incur lower compliance and integration costs than multi-market operations requiring licenses and partnerships in each jurisdiction.

Technology choices impact both initial and ongoing costs. Custom-built platforms offer maximum flexibility but require substantial upfront investment and ongoing maintenance by specialized teams. White-label solutions reduce initial costs and accelerate time-to-market but may limit differentiation and create long-term licensing dependencies. Hybrid approaches combining white-label core functionality with custom enhancements balance these considerations. Team composition and location significantly affect costs, with nearshore or offshore teams typically offering lower rates than domestic resources in high-cost markets, though requiring careful management to ensure quality and communication effectiveness.

| Cost Component | Basic Platform | Advanced Platform | Enterprise Platform |

|---|---|---|---|

| Platform Core Build | $30,000 – $50,000 | $80,000 – $120,000 | $150,000 – $250,000 |

| UI/UX Design | $5,000 – $10,000 | $15,000 – $25,000 | $30,000 – $50,000 |

| Mobile Applications | Not included | $20,000 – $40,000 | $50,000 – $80,000 |

| Third-Party Integrations | $8,000 – $15,000 | $20,000 – $35,000 | $40,000 – $70,000 |

| Testing & QA | $5,000 – $8,000 | $12,000 – $20,000 | $25,000 – $40,000 |

| Legal & Compliance Setup | $10,000 – $20,000 | $25,000 – $50,000 | $60,000 – $120,000 |

| Total Initial Cost | $58,000 – $103,000 | $172,000 – $290,000 | $355,000 – $610,000 |

P2P Lending Setup Cost Explained

Initial P2P lending setup costs encompass all expenses from concept through launch including planning, design, technical creation, testing, compliance preparation, and market introduction. Planning and requirements definition typically consume 5-10% of total budgets, involving stakeholder interviews, competitive analysis, feature prioritization, and technical specification creation. Design work including user experience research, interface mockups, and brand identity creation represents 8-12% of costs for consumer-facing platforms where user experience critically impacts adoption and engagement.

The technical creation phase consuming 50-60% of budgets includes frontend interface coding, backend system engineering, database design and implementation, API integrations, and quality assurance testing. Third-party integration costs vary widely based on chosen providers and negotiated terms, with payment gateway integrations, credit bureau connections, identity verification services, and document management systems representing major line items. Legal and compliance expenses include license applications, terms of service and privacy policy drafting, regulatory consultation, and initial audit preparation, with costs varying dramatically by jurisdiction and platform complexity.

Operational and Maintenance Expenses

Ongoing operational costs typically range from 15-25% of initial creation costs annually, though scaling platforms may see percentages decline as fixed costs spread over growing transaction volumes. Infrastructure hosting represents a significant recurring expense, with cloud services offering scalable computing, storage, and networking resources. Initial platforms may operate on $500-2,000 monthly hosting budgets, while high-volume operations can require $10,000-50,000 monthly for robust infrastructure supporting millions of transactions.

Personnel costs for ongoing operations include customer support teams assisting users, technical staff maintaining systems and adding features, compliance officers ensuring regulatory adherence, and management overseeing operations. Third-party service fees accumulate for payment processing, credit bureau queries, identity verification, SMS notifications, email delivery, and security services. Marketing expenses drive user acquisition, with customer acquisition costs varying widely by channel, competition, and market maturity. Platforms must budget for continuous improvement, security updates, feature additions, and technology evolution to remain competitive and compliant in dynamic fintech markets.

P2P Lending Platform Pricing Models

For organizations seeking to build P2P lending platforms through external partners or technology providers, several pricing models exist. Fixed-price contracts specify total costs upfront based on agreed requirements, providing budget certainty but limited flexibility for scope changes. Time-and-materials arrangements charge for actual hours worked, offering flexibility for evolving requirements but less cost predictability. Value-based pricing ties costs to expected business outcomes or platform performance, aligning provider incentives with client success.

White-label licensing models charge initial setup fees plus ongoing monthly or annual licenses based on transaction volumes or user counts. Revenue-sharing arrangements where technology providers receive percentages of platform revenues eliminate upfront costs but create long-term financial commitments potentially exceeding outright purchase costs. Hybrid models combine elements like initial fixed prices for core platform creation with time-and-materials for customizations and ongoing enhancements. Selecting appropriate pricing models requires analyzing total cost of ownership over expected platform lifecycles, considering not just initial outlays but long-term operational expenses and growth implications.

Benefits of Starting a P2P Lending Business

The P2P lending business model offers compelling benefits for platform operators, borrowers, and lenders, creating value propositions that have driven rapid global adoption and substantial market growth. Understanding these benefits helps assess whether P2P lending represents an attractive opportunity aligned with your strategic objectives, capabilities, and market positioning.

Benefits for Platform Owners

Platform owners enjoy asset-light business models generating revenues without deploying significant capital for loan originations. Unlike traditional lenders requiring substantial balance sheets, P2P platforms earn fee income on transaction flows without credit risk exposure. This structure enables higher return on equity and faster scaling than capital-intensive lending models. Multiple revenue streams including origination fees, servicing fees, late charges, and premium services create diversified income reducing dependence on any single source.

Network effects provide competitive moats as platforms grow, with larger user bases attracting more participants creating self-reinforcing growth cycles. Early market entrants can establish dominant positions difficult for later competitors to challenge. Technology-driven operations offer superior unit economics compared to branch-based traditional lenders, with digital processes serving thousands of users at marginal costs approaching zero. Data accumulation creates valuable assets, with loan performance histories enabling increasingly sophisticated credit models and potential monetization opportunities through anonymized insights valuable to financial institutions and policymakers.

Benefits for Borrowers

Borrowers benefit from streamlined application processes requiring minutes rather than days or weeks for traditional loan applications. Digital-first experiences eliminate branch visits, paper documentation, and repetitive information provision. Faster approval timeframes, often within 24-48 hours, address urgent financial needs more effectively than traditional processes. Competitive rates driven by reduced overhead and direct lender connections often beat traditional bank offerings, particularly for prime and super-prime borrowers whom banks price conservatively.

Flexible qualification criteria incorporating alternative data may approve borrowers with thin credit files who struggle accessing traditional financing. Transparent pricing with clear disclosure of rates, fees, and terms enables informed decision-making. Online account management provides 24/7 access to loan status, payment history, and payoff information. Some platforms offer features like flexible repayment scheduling, hardship programs, or refinancing options providing borrowers with tools managing their obligations through changing circumstances. The competitive marketplace structure may enable borrowers to negotiate better terms as platforms compete for quality applications.

Benefits for Lenders

Lenders access investment opportunities historically reserved for institutional participants, democratizing access to lending returns. Platforms offering 5-12% annual returns significantly exceed savings account rates providing attractive risk-adjusted returns for individual investors. Diversification tools enable spreading investments across numerous loans, reducing concentration risk that would plague direct lending to individual borrowers. Transparent risk assessment with detailed borrower information, credit grades, and historical performance data facilitates informed investment decisions.

Passive income generation through automated investing requires minimal ongoing effort once investment criteria are established. Monthly interest and principal payments provide regular cash flows, while secondary market functionality on some platforms offers liquidity options for investors needing to exit positions before loan maturity. The ability to align investments with personal values by selecting specific loan purposes or borrower profiles appeals to socially conscious investors. Platforms providing comprehensive tax reporting simplify compliance obligations, while community features connecting lenders create engagement beyond pure financial returns. Successful implementations like innovative platforms demonstrate the potential of well-executed P2P models.

Challenges and Risks in P2P Lending

Despite compelling benefits, P2P lending platforms face significant challenges and risks requiring careful management and mitigation strategies. Platform operators must navigate these obstacles while maintaining user trust, regulatory compliance, and financial viability. Understanding these challenges enables realistic planning and appropriate risk management framework creation.

Credit Risk and Default Management

Credit risk represents the fundamental challenge in all lending activities, with borrower defaults directly impacting lender returns and platform reputation. Unlike traditional banks with diversified funding sources and reserve requirements, P2P platforms channel individual lender losses directly when borrowers default. Managing credit risk requires sophisticated underwriting combining traditional credit assessment with innovative data sources and predictive analytics. Platforms must balance accessibility with prudent risk management, avoiding both excessively restrictive criteria that limit growth and overly permissive standards that generate unsustainable default rates.

Default management procedures including collection efforts, workout negotiations, and potentially legal action require expertise, resources, and sensitivity to regulatory requirements governing debt collection practices. Platforms must communicate transparently with lenders about default risks, historical performance, and recovery efforts while managing expectations about loss frequency and severity. Economic downturns create correlated defaults across portfolios, testing platform resilience and potentially triggering lender panic if not managed through clear communication and demonstrated competence handling adversity.

Regulatory Challenges

Regulatory uncertainty represents perhaps the greatest operational risk for P2P lending platforms, as many jurisdictions lack clear frameworks specifically addressing this relatively new financial model. Platforms often operate in regulatory gray areas, with existing lending, securities, banking, or payment regulations potentially applicable but not designed for marketplace lending structures. Regulatory changes can fundamentally alter business models, as witnessed when some markets reclassified loan participations as securities requiring extensive compliance modifications.

Compliance costs consume significant resources, particularly for smaller platforms lacking economies of scale to spread expenses. Multi-jurisdiction operations multiply complexity as each market imposes unique requirements. Regulatory engagement including lobbying, industry association participation, and regulator education requires investment but proves essential for favorable framework creation. Platforms must maintain flexibility adapting to evolving requirements while educating regulators about the industry’s benefits and operational realities. Some platforms have failed not due to business model weaknesses but regulatory changes rendering operations impractical or unprofitable.

Trust and Liquidity Concerns

Trust represents the foundation of P2P lending marketplace success, with platforms requiring confidence from both borrowers providing sensitive financial information and lenders entrusting capital. Security breaches, fraud incidents, or operational failures can irreparably damage trust regardless of how quickly problems are resolved. Building trust requires consistent performance, transparent communication, robust security measures, and responsive customer support. Any disconnect between platform messaging and actual performance erodes trust potentially triggering user exodus.

Liquidity concerns arise when lenders cannot access their capital as expected, whether due to loan term mismatches, platform failures, or market disruptions. Unlike bank deposits with instant withdrawal capabilities and government insurance, P2P investments typically lock capital for loan terms ranging from months to years. Secondary markets addressing liquidity needs require sufficient buyer demand, which may evaporate during stress periods when lenders most need exits. Platforms must carefully communicate liquidity limitations while potentially offering mechanisms like buyback guarantees or liquidity pools, though these introduce platform balance sheet risk and regulatory considerations requiring careful structuring.

How to Choose the Right P2P Lending Platform Solution

Selecting the optimal approach for creating your P2P lending platform significantly impacts success probability, time-to-market, total cost of ownership, and long-term competitive positioning. The decision involves analyzing multiple factors including business objectives, technical capabilities, budget constraints, timeline requirements, and growth plans. No universal best choice exists, as optimal solutions depend on specific circumstances and priorities.

Scalability and Performance Factors

Scalability determines whether your platform can accommodate growth in users, loan volumes, and transaction throughput without performance degradation or architectural reinvention. Evaluate solutions based on proven scalability, examining case studies of similar platforms that achieved substantial scale. Architecture patterns like microservices, horizontal scaling capabilities, and cloud-native designs generally offer superior scalability compared to monolithic applications tied to single servers.

Performance requirements vary by user expectations and competitive positioning. Consumer-facing platforms require sub-second page loads and responsive interfaces competing with best-in-class consumer applications. Backend processing must handle peak loads during popular times, process thousands of simultaneous transactions, and execute complex matching algorithms within reasonable timeframes. Load testing, performance benchmarking, and capacity planning prove essential for ensuring solutions meet requirements. Consider not just current needs but projected requirements 2-3 years forward, as platform migrations prove expensive and disruptive.

Customization and Feature Flexibility

Customization capabilities determine how effectively you can differentiate your platform and adapt to market feedback or competitive pressures. White-label solutions offer varying customization degrees, from purely cosmetic branding to extensive feature modifications. Evaluate which aspects matter most for your differentiation strategy. If proprietary credit scoring represents your competitive advantage, ensure solutions enable custom scoring model integration. If innovative user experience drives positioning, prioritize flexible frontend customization.

Feature flexibility includes both current capabilities and roadmap alignment. Assess whether provided features match your requirements or whether significant custom work is needed. Evaluate vendor roadmaps determining if planned enhancements align with your strategic direction. Consider extensibility architecture enabling third-party integrations and custom module additions without core system modifications. Platforms built on modern, well-documented APIs offer superior extension capabilities compared to monolithic black boxes. Balance flexibility desires against complexity costs, as excessive customization can create maintenance burdens and upgrade complications.

Support, Upgrades, and Platform Growth

Ongoing support quality significantly impacts operational success, particularly during critical incidents requiring rapid resolution. Evaluate vendor support models including response times, support channels, escalation procedures, and track records handling urgent issues. Consider whether support covers all platform components or whether you’ll coordinate multiple vendors for integrated systems. Technical documentation quality affects your team’s ability to manage and modify platforms, with comprehensive API documentation, integration guides, and troubleshooting resources reducing dependence on vendor support.

Upgrade processes determine how you benefit from ongoing platform improvements and security patches. Understand whether upgrades are automatic, manual, or customizable, and how they affect any customizations you’ve implemented. Consider vendor stability and longevity, as platforms require long-term support exceeding typical software lifecycles. Assess community ecosystems around solutions, as active developer communities provide additional resources, plugins, and expertise. Finally, ensure exit strategies exist allowing platform migration if vendor relationships deteriorate or better alternatives emerge, avoiding permanent lock-in to unsuitable solutions.

Future Trends in P2P Lending Platforms

The P2P lending industry continues evolving rapidly, with technological innovations, regulatory developments, and changing market dynamics shaping future trajectories. Understanding emerging trends helps platforms position for long-term success, anticipating rather than reacting to transformative changes. Forward-thinking operators invest in capabilities supporting future opportunities while maintaining flexibility adapting to unforeseen developments.

AI-Based Credit Scoring

Artificial intelligence and machine learning are revolutionizing credit assessment, enabling analysis of vastly larger datasets with more sophisticated pattern recognition than traditional statistical models. AI algorithms process alternative data including utility payments, rental history, education credentials, employment patterns, and even behavioral signals predicting repayment likelihood. These models identify creditworthy borrowers overlooked by traditional scoring, expanding access while maintaining acceptable default rates.

Continuous learning capabilities allow AI models to improve over time as loan portfolios mature, incorporating new data sources and refining predictions based on observed outcomes. Explainable AI addresses regulatory requirements for transparent decision-making, providing human-interpretable rationales for credit decisions even when underlying models employ complex neural networks. Real-time scoring enables instant approvals for qualified borrowers, dramatically improving user experience and conversion rates. Platforms investing in AI capabilities gain competitive advantages through superior risk assessment, lower default rates, and expanded addressable markets.

Automation in P2P Lending Workflow

Workflow automation extends beyond basic process digitization to intelligent automation handling complex decisions with minimal human intervention. Robotic process automation handles repetitive tasks like document verification, data entry, and payment processing. Intelligent document processing extracts information from unstructured documents using optical character recognition and natural language processing. Chatbots and virtual assistants handle routine customer inquiries, freeing human agents for complex issues requiring judgment and empathy.

Automated underwriting makes credit decisions in seconds rather than hours or days, combining credit bureau data, alternative sources, and proprietary models. Automated investing deploys lender capital according to sophisticated algorithms optimizing risk-adjusted returns across diversified portfolios. Smart contracts on blockchain platforms could automate loan agreements, fund transfers, and repayment distributions without centralized intermediaries. While full automation remains distant due to regulatory requirements and complex edge cases, incremental automation improvements continuously reduce costs, accelerate processes, and improve user experiences.

Global Expansion of P2P Lending Marketplaces

Geographic expansion represents significant growth opportunity as online P2P lending platforms prove their models in developed markets and expand into emerging economies with large underbanked populations. Cross-border lending connecting lenders in capital-rich countries with borrowers in capital-scarce markets creates opportunities though regulatory, currency, and risk management complexities require careful navigation. Regional platforms may emerge catering to specific cultural, linguistic, or regulatory environments with localized features and partnerships.

Mobile-first platforms designed for smartphone-dominant markets enable P2P lending in regions where traditional banking infrastructure remains underdeveloped. Integration with mobile money systems, alternative identity verification using biometrics or social networks, and simplified interfaces accommodating lower digital literacy facilitate access. Regulatory arbitrage may drive platform relocations to favorable jurisdictions, while regulatory harmonization could enable pan-regional operations. The next decade likely sees consolidation as successful platforms acquire smaller competitors, expanding geographic reach and achieving economies of scale supporting innovation investments.

Strategic Insight: The most successful P2P lending platforms will combine technological innovation with deep regulatory expertise, user-centric design, and robust risk management, creating sustainable competitive advantages in increasingly crowded markets.

Final Thoughts on P2P Lending Platforms

Building a successful P2P lending platform represents a complex but potentially rewarding endeavor combining financial services expertise, technological sophistication, regulatory compliance, and user-centric design. The industry has matured significantly from its early days, with established players demonstrating sustainable business models and new entrants finding opportunities in underserved niches or emerging markets. However, success requires more than simply connecting borrowers and lenders through digital interfaces.

Launch Your Own P2P Lending Platform Today

Create a secure, feature-rich P2P platform and connect borrowers with lenders effortlessly.

Launch Your Exchange Now

Is a P2P Lending Platform the Right Business Opportunity?

Evaluating whether P2P lending aligns with your capabilities and objectives requires honest assessment of multiple factors. Do you possess or can you access the necessary expertise in financial services, technology, and regulatory compliance? Can you secure sufficient capital covering not just initial platform creation but 18-36 months of operations before profitability? Do you have strategies for acquiring both borrowers and lenders simultaneously, overcoming the marketplace chicken-and-egg challenge? Can you differentiate from established competitors through superior technology, better rates, focused market segments, or innovative features?

The P2P lending marketplace opportunity varies significantly across geographies, with mature markets offering established ecosystems but intense competition, while emerging markets provide blue ocean opportunities complicated by regulatory uncertainty and infrastructure limitations. Niche focusing on specific borrower segments, loan types, or geographic regions may offer better success prospects than attempting to compete head-to-head with well-funded incumbents across broad markets. Ultimately, P2P lending platforms succeed by solving real problems for borrowers and lenders better than alternatives, whether through superior user experience, more accurate risk assessment, faster processes, or innovative features creating genuine value rather than simply replicating existing offerings.

The path forward requires combining strategic clarity about your market positioning and value proposition, operational excellence in platform creation and management, continuous innovation maintaining competitive relevance, and unwavering commitment to regulatory compliance and user trust. Those who master these elements while adapting to evolving market conditions can build sustainable P2P lending businesses creating value for all stakeholders and contributing to the ongoing transformation of financial services through technology-enabled innovation.

Frequently Asked Questions

A P2P lending platform is an online marketplace that directly connects borrowers seeking loans with individual lenders willing to fund those loans, eliminating traditional financial intermediaries like banks. The peer to peer lending platform facilitates the entire process from loan listing, credit assessment, and fund transfer to repayment collection and distribution. Borrowers create loan requests specifying the amount and purpose, while lenders browse opportunities and choose which loans to fund based on risk profiles and potential returns, with the platform earning revenue through service fees and commissions.

The cost of P2P lending platform creation typically ranges from $50,000 to $300,000 depending on features, complexity, and customization requirements. Basic platforms with essential functionality start around $50,000-$80,000, while mid-tier solutions with advanced features like automated matching and credit scoring range from $100,000-$150,000. Enterprise-grade P2P lending platforms with comprehensive features, AI-based risk assessment, and multi-currency support can exceed $200,000-$300,000. Ongoing operational expenses including hosting, maintenance, compliance, and customer support add approximately 15-25% of initial costs annually.

Essential P2P lending platform features include user registration with KYC/AML verification, separate borrower and lender dashboards, automated loan matching algorithms, credit scoring and risk assessment tools, loan management systems tracking disbursements and repayments, integrated payment gateways supporting multiple methods, automated notification systems, document management for loan agreements, escrow account management, and comprehensive reporting and analytics. Advanced features may include mobile applications, AI-based credit evaluation, automated investment portfolios, secondary market functionality, and multi-currency support for global operations.

A P2P lending business can be highly profitable with proper execution, market positioning, and risk management. Revenue streams include origination fees from borrowers (typically 1-5% of loan amount), servicing fees from lenders (0.5-1.5% annually), late payment charges, and premium membership subscriptions. Successful P2P lending marketplaces in established markets generate millions in annual revenue with profit margins ranging from 20-40% once they achieve scale. However, profitability depends on loan volume, default rates, regulatory compliance costs, and operational efficiency, with most platforms requiring 18-36 months to reach break-even.

The primary risks include credit risk from borrower defaults potentially damaging lender confidence and platform reputation, regulatory compliance challenges as financial regulations vary by jurisdiction and frequently evolve, liquidity risk if lenders cannot withdraw funds when needed, cybersecurity threats targeting financial data and transactions, fraud from both borrowers and lenders attempting to manipulate the system, concentration risk if loan portfolio lacks diversification, and operational risks from technical failures or process breakdowns. Successful platforms mitigate these through robust credit assessment, regulatory expertise, adequate capital reserves, comprehensive security measures, and diversified loan portfolios.

P2P lending platforms assess creditworthiness through multi-layered evaluation combining traditional credit bureau data, alternative data sources, and proprietary scoring algorithms. The process analyzes credit history, income verification through bank statements and pay stubs, debt-to-income ratios, employment stability, educational background, social media presence, and transaction patterns. Advanced platforms employ AI and machine learning to identify patterns predictive of repayment behavior, assigning risk grades that help lenders make informed decisions. Some platforms also incorporate behavioral analytics, utility payment history, and peer references to create comprehensive risk profiles, especially for thin-file borrowers lacking extensive credit history.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.