Key Takeaways

- Peer-to-peer crypto exchange software eliminates centralized vulnerabilities by distributing transaction authority across users, significantly reducing single-point-of-failure risks that plague traditional cryptocurrency platforms.

- Escrow systems in P2P crypto exchanges provide critical transaction security by holding funds in smart contracts until both parties fulfill their obligations, protecting businesses and users from fraud and payment disputes.

- Multi-layer authentication frameworks combining two-factor authentication, biometric verification, and device-based security create robust defenses against unauthorized access and account takeover attempts in peer-to-peer crypto trading environments.

- Smart contract security in P2P crypto exchange software enables trustless transactions through automated execution and transparent code verification, reducing reliance on intermediaries while maintaining business security standards.

- Comprehensive KYC and AML compliance frameworks in P2P crypto exchange platforms balance regulatory requirements with user privacy, helping businesses prevent money laundering while maintaining competitive advantage through secure operations.

- Advanced encryption standards and decentralized data storage protect user information in P2P crypto exchanges, addressing privacy concerns while meeting business security obligations and regulatory compliance requirements.

- Automated fraud detection systems combined with dispute resolution mechanisms in peer-to-peer crypto exchange software reduce operational risks and build user trust through transparent, fair conflict resolution processes.

- The decentralized architecture of P2P crypto exchange platforms reduces infrastructure costs and liability exposure for businesses while providing enhanced security through distributed ledger technology and blockchain transparency.

In an era where digital asset security breaches cost businesses billions of dollars annually, the role of peer-to-peer crypto exchange software in business security has become increasingly critical. We have witnessed firsthand how P2P crypto exchange security frameworks transform the landscape of digital asset trading. The decentralized nature of peer-to-peer systems offers businesses a fundamentally different security paradigm compared to traditional centralized exchanges, addressing vulnerabilities that have led to some of the industry’s most devastating hacks and financial losses.

The evolution of peer-to-peer crypto trading security reflects broader shifts in how businesses approach digital asset management and customer protection. Unlike centralized platforms where a single security breach can compromise millions of user accounts and billions in assets, P2P crypto exchange platforms distribute risk across individual transactions and participants. This architectural difference creates inherent security advantages while introducing unique challenges that require sophisticated solutions. Understanding the role of P2P crypto exchange in business security is essential for any organization operating in the cryptocurrency space or considering entry into this rapidly growing market.

Understanding Peer-to-Peer Crypto Exchange Software

Before exploring the security implications, it is essential to understand what peer-to-peer crypto exchange software actually is and how it differs from traditional trading platforms. This foundational knowledge provides context for appreciating why P2P cryptocurrency exchange software security represents a paradigm shift in protecting both businesses and users in the digital asset ecosystem.

What Is Peer-to-Peer Crypto Exchange Software

Peer-to-peer crypto exchange software is a specialized platform that facilitates direct cryptocurrency transactions between individual users without requiring a centralized intermediary to custody funds or execute trades. Unlike traditional exchanges that act as custodians holding user assets in centralized wallets, P2P platforms serve as marketplaces that connect buyers and sellers while providing security infrastructure through smart contracts, escrow systems, and dispute resolution mechanisms.

The fundamental architecture of a secure P2P crypto exchange platform centers on user autonomy and decentralized trust. Users maintain control of their private keys and cryptocurrency holdings until the moment of transaction execution. The platform’s role is to provide matching services, security protocols, and conflict resolution rather than acting as a financial custodian. This distinction has profound implications for business security in P2P crypto exchange operations, as it eliminates the massive honeypot of funds that makes centralized exchanges attractive targets for sophisticated cybercriminals.

Modern P2P crypto exchange software incorporates multiple layers of functionality beyond simple trade matching. These platforms integrate reputation systems that track user trading history, escrow mechanisms that protect both parties during transactions, KYC verification systems for regulatory compliance, and sophisticated fraud detection algorithms. Together, these components create an ecosystem where peer-to-peer crypto trading security is maintained through distributed accountability rather than centralized control.

How Peer-to-Peer Crypto Exchange Software Works

Understanding the operational mechanics of P2P crypto exchange platforms illuminates why they offer distinct security advantages for businesses. The workflow differs significantly from centralized exchanges, creating a fundamentally different risk profile that sophisticated businesses can leverage to enhance their security posture while serving cryptocurrency users.

User-to-User Trading Mechanism

The user-to-user trading mechanism in P2P crypto exchanges operates through a structured process that balances flexibility with security. When a user wants to sell cryptocurrency, they create an offer specifying the amount, price, accepted payment methods, and any additional conditions. This offer is published on the platform’s marketplace where potential buyers can view it alongside the seller’s reputation score, transaction history, and verification status.

When a buyer accepts an offer, the P2P crypto transaction security protocol activates. The seller’s cryptocurrency is immediately locked in an escrow smart contract, preventing them from double-spending or withdrawing the assets. The buyer then has a specified time window to complete payment through the agreed method, which might be bank transfer, mobile payment, or other fiat channels. After sending payment, the buyer marks the transaction as paid within the platform.

The seller receives notification of payment and verifies receipt through their chosen payment channel. Once confirmed, they release the escrowed cryptocurrency, which the smart contract automatically transfers to the buyer’s wallet. This entire process occurs without the platform ever taking custody of the cryptocurrency, fundamentally altering the security dynamics compared to centralized exchanges. If disputes arise, the platform’s arbitration system intervenes to review evidence and determine the appropriate resolution, with the escrow system ensuring funds remain secure throughout the process.

Role of Blockchain in P2P Crypto Exchange Software

Blockchain technology serves as the foundational security layer for peer-to-peer crypto exchange software, providing transparency, immutability, and decentralized verification that centralized databases cannot match. Every transaction executed through a P2P platform is recorded on the blockchain, creating an permanent, auditable trail that enhances accountability and enables forensic analysis when security incidents occur.

The blockchain’s role extends beyond simple record-keeping. Smart contracts deployed on blockchain networks automate escrow functions, ensuring that predefined conditions must be met before funds are released. This automation eliminates opportunities for human error or manipulation that could compromise transaction security. The transparent nature of blockchain also enables users to independently verify that the platform operates as advertised, building trust through technical verification rather than reliance on corporate promises.

For businesses operating P2P crypto exchanges, blockchain integration provides crucial security benefits. The distributed consensus mechanism prevents unauthorized modification of transaction records, while cryptographic hashing ensures data integrity. Public blockchains offer additional security through the computational power required to attack the network, making it economically infeasible for attackers to manipulate transaction history or double-spend cryptocurrency within the P2P ecosystem.

⚠️ Core Security Principle: Blockchain immutability and transparency create a trustless environment where transaction integrity is mathematically guaranteed rather than dependent on institutional trust, fundamentally transforming business security models in cryptocurrency trading.

Difference Between Centralized Exchanges and P2P Crypto Exchange Software

The architectural and operational differences between centralized exchanges and P2P crypto exchange software create profoundly different security landscapes for businesses. Centralized exchanges operate on a custodial model where the platform holds all user funds in centralized hot and cold wallets, creating what security experts call a “single point of failure.” This concentration of assets makes centralized exchanges prime targets for sophisticated attacks, as demonstrated by numerous high-profile hacks resulting in hundreds of millions in stolen funds.

In contrast, P2P crypto exchange fraud prevention begins with the fundamental architecture that distributes assets across individual user wallets rather than centralizing them in platform-controlled addresses. This distribution means that even if an attacker compromises the platform’s infrastructure, they cannot directly access user funds since the exchange never holds custody. The security burden shifts from protecting a central vault to securing individual transactions and user accounts, creating a more resilient overall system.

Operational differences also impact security profiles significantly. Centralized exchanges must maintain extensive infrastructure for wallet management, transaction processing, and regulatory compliance, each component representing potential attack surfaces. P2P platforms leverage blockchain infrastructure for these functions, reducing the attack surface while introducing different challenges around smart contract security and user education. The trade-offs favor P2P models for businesses prioritizing distributed risk over centralized control.

| Feature | Centralized Exchange | P2P Crypto Exchange Software |

|---|---|---|

| Fund Custody | Platform holds all user assets in centralized wallets | Users maintain custody until transaction execution |

| Security Risk Profile | Single point of failure with concentrated assets | Distributed risk across individual transactions |

| Transaction Execution | Automated matching with instant settlement | User-negotiated with escrow-secured settlement |

| Privacy Level | Platform knows all transaction details | Limited platform visibility into payment methods |

| Regulatory Compliance | Heavily regulated with strict licensing requirements | Varied depending on jurisdiction and model |

| Business Liability | High liability for custodied assets and security | Reduced liability through non-custodial model |

Why Business Security Matters in P2P Crypto Exchanges

The cryptocurrency industry’s rapid growth has attracted not only legitimate businesses and users but also sophisticated criminals employing advanced techniques to exploit security vulnerabilities. For businesses operating in this space, security is not merely a technical consideration but a fundamental business imperative that affects reputation, regulatory compliance, customer trust, and long-term viability.

Growing Security Risks in Digital Asset Businesses

The digital asset industry faces an evolving threat landscape that grows more sophisticated each year. Cybercriminals have stolen billions of dollars from cryptocurrency platforms through various attack vectors including smart contract exploits, social engineering, insider threats, and infrastructure compromises. The pseudonymous nature of cryptocurrencies and the irreversibility of blockchain transactions make recovery extremely difficult once assets are stolen, amplifying the consequences of security failures.

Beyond direct theft, businesses face risks from regulatory enforcement actions, reputational damage, and legal liability. A security breach that compromises user data or enables money laundering can result in severe penalties from regulatory authorities, class action lawsuits from affected users, and permanent damage to brand reputation. In competitive markets where trust is paramount, even a single security incident can drive users to competitors and potentially end a business entirely.

The peer-to-peer crypto exchange risk management challenges are particularly complex because they involve interactions between untrusted parties using various payment methods and operating across multiple jurisdictions. Fraud schemes continue to evolve, with attackers exploiting everything from fake payment confirmations to sophisticated account takeover techniques. Businesses must maintain constant vigilance and invest continuously in security infrastructure to stay ahead of these threats.

Importance of Secure P2P Crypto Exchange Infrastructure

Secure infrastructure forms the foundation upon which all other security measures are built in P2P crypto exchange platforms. This infrastructure encompasses not only the technical components like servers, databases, and smart contracts but also the processes, policies, and personnel that maintain system integrity. Without robust infrastructure security, even the most advanced fraud detection algorithms and authentication systems cannot fully protect the platform and its users.

The importance of infrastructure security becomes evident when considering the lifecycle of a P2P transaction. Each step from user registration through KYC verification, trade matching, escrow locking, payment confirmation, and final settlement presents potential attack vectors. Comprehensive infrastructure security addresses each of these points through defense-in-depth strategies that layer multiple security controls, ensuring that failure of any single component does not compromise the entire system.

For businesses, investing in secure P2P crypto exchange platform infrastructure provides multiple returns beyond risk reduction. Strong security enables higher transaction limits and reduced friction for verified users, improving user experience and competitive positioning. It facilitates regulatory compliance by providing the audit trails and controls that authorities require. Perhaps most importantly, it builds the trust necessary for sustainable business growth in an industry where security breaches can be existential events.

Business Trust and Security in Peer-to-Peer Crypto Trading

Trust represents the most valuable and fragile asset for any P2P crypto exchange business. Unlike traditional financial institutions that benefit from government guarantees and regulatory oversight, P2P platforms must earn trust through demonstrated security competence and operational excellence. Users entrust platforms with sensitive personal information during KYC processes and rely on security systems to protect them from fraud during transactions. Any breach of this trust can have immediate and severe business consequences.

The relationship between security and trust operates cyclically in P2P exchanges. Strong security attracts users and trading volume, which generates revenue that can fund further security improvements. Conversely, security failures trigger user exodus, reducing volume and revenue, which makes it harder to maintain security standards. This dynamic creates a critical imperative for businesses to establish robust security from the outset rather than treating it as an afterthought.

Building trust through security requires transparency and communication alongside technical measures. Users need to understand what security protections exist, how their data is handled, and what recourse they have if problems occur. Businesses that openly communicate their security practices, publish audit results, and maintain responsive support systems build stronger trust relationships than those that treat security as a black box. This transparency, combined with technical excellence, creates the foundation for long-term business success in peer-to-peer crypto trading.

✓ Trust Building Principle: Security excellence combined with transparent communication creates user confidence that translates directly into business growth and competitive advantage in the P2P crypto exchange market.

Role of Peer-to-Peer Crypto Exchange Software in Business Security

The architecture and design of peer-to-peer crypto exchange software directly influence business security outcomes in ways that differ fundamentally from centralized platforms. Understanding these specific security contributions helps businesses appreciate why P2P models offer compelling advantages for organizations prioritizing security and risk management in their digital asset operations.

Eliminating Single Point of Failure in P2P Crypto Exchanges

The most significant security contribution of P2P crypto exchange software is the elimination of single points of failure that plague centralized platforms. In traditional exchanges, all user funds concentrate in the platform’s wallets, creating an enormous target for attackers. A single successful breach can compromise hundreds of millions or billions of dollars, as history has demonstrated repeatedly. This concentration represents an existential business risk that requires massive ongoing investment in security infrastructure.

P2P platforms fundamentally restructure this risk by never taking custody of user funds except during the brief escrow period of active transactions. Even if attackers compromise the platform’s servers, databases, or administrative accounts, they cannot directly access user cryptocurrency because it resides in individual wallets controlled by users’ private keys. This architectural decision transforms the security equation from defending a central honeypot to securing individual transactions and user accounts.

The business implications of this architectural difference are profound. P2P exchange operators face dramatically reduced liability exposure since they do not custody the bulk of user assets. Insurance costs decrease, regulatory capital requirements may be lower, and the platform can operate with smaller security teams focused on transaction-level protection rather than asset custody. These factors combine to create a more sustainable and scalable business model, particularly for organizations entering the competitive cryptocurrency exchange market.

Decentralized Architecture and Business Security Benefits

The decentralized architecture inherent in P2P crypto exchange software provides multiple layers of business security benefits beyond the elimination of custodial risk. By distributing functionality across blockchain networks, smart contracts, and user-controlled wallets, P2P platforms create resilient systems that continue operating even if individual components fail or come under attack. This resilience translates directly into business continuity and reduced operational risk.

Decentralization also enables geographic distribution of risk and regulatory exposure. While centralized exchanges must comply with regulations in every jurisdiction where they operate and custody funds, P2P platforms can implement more flexible compliance models. Since transactions occur directly between users, certain regulatory obligations may apply to users rather than the platform itself, depending on jurisdictional specifics. This can reduce compliance costs and legal exposure for the business while still meeting regulatory requirements.

From a technical security perspective, decentralized architectures resist many attack vectors that threaten centralized systems. Distributed denial-of-service attacks cannot easily take down blockchain-based escrow systems. Database compromises cannot expose the complete user base since information is distributed. Smart contract automation reduces opportunities for insider threats and operational errors. These technical advantages accumulate to create a security profile that aligns with business objectives around risk management and operational efficiency.

Peer-to-Peer Crypto Exchange Software for Fraud Reduction

Fraud represents a persistent challenge in cryptocurrency trading, with criminals employing increasingly sophisticated techniques to steal assets and compromise accounts. The role of peer-to-peer crypto exchange software in fraud reduction extends across multiple dimensions, from preventing unauthorized access to detecting suspicious transaction patterns and enabling effective dispute resolution when fraud attempts occur.

How P2P Crypto Exchange Prevents Unauthorized Access

Preventing unauthorized access represents the first line of defense in P2P crypto exchange fraud prevention strategies. Modern P2P platforms implement sophisticated authentication systems that verify user identity through multiple factors before allowing account access or transaction execution. These systems typically combine something the user knows (passwords), something they have (mobile devices or hardware tokens), and increasingly something they are (biometric characteristics) to create robust barriers against unauthorized access attempts.

Beyond initial authentication, P2P platforms employ continuous verification throughout user sessions. Behavioral analytics monitor patterns like typing speed, mouse movements, and navigation habits to detect account takeover attempts where credentials have been compromised but the attacker’s behavior differs from the legitimate user. Geographic anomaly detection flags login attempts from unusual locations, while device fingerprinting identifies new or suspicious devices attempting to access accounts.

The escrow system in peer-to-peer crypto exchange security adds another layer of fraud prevention by requiring explicit confirmation of transaction steps. Even if an attacker gains account access, they cannot simply withdraw funds as they might from a centralized exchange. Instead, they must complete the entire P2P transaction process including payment confirmation and escrow release, providing multiple opportunities for the legitimate user or platform security systems to detect and halt the fraudulent activity.

Risk Control Mechanisms in P2P Crypto Exchange Software

Risk control mechanisms in P2P crypto exchange software operate at multiple levels to identify and mitigate fraudulent activities before they result in losses. Transaction monitoring systems analyze patterns including trade frequency, volume, payment methods, and counterparty selection to flag suspicious behavior. Users who consistently trade with newly registered accounts, frequently cancel transactions, or exhibit other risk indicators may face additional verification requirements or trading restrictions.

Reputation systems serve as critical risk control tools in P2P environments. By tracking each user’s trading history, completion rate, dispute frequency, and feedback from counterparties, these systems enable other users to make informed decisions about trading partners. Businesses benefit from reputation systems by allowing the community to self-regulate to some extent, reducing the burden on platform administrators while maintaining security standards through distributed accountability.

Automated risk scoring algorithms evaluate each transaction based on multiple factors including user verification levels, transaction amount relative to history, payment method risk profile, and counterparty reputation. High-risk transactions may face additional scrutiny, extended escrow periods, or manual review before completion. These risk-based controls balance security needs with user experience, applying stricter measures only where warranted by actual risk indicators rather than imposing blanket restrictions on all users.

| Security Layer | Protection Mechanism | Business Benefit |

|---|---|---|

| Multi-Factor Authentication | Requires password plus 2FA code for account access | Prevents 99% of automated account takeover attempts |

| Escrow Smart Contracts | Locks funds until transaction conditions are met | Eliminates direct fund theft even if platform is compromised |

| Behavioral Analytics | Detects abnormal usage patterns indicating fraud | Identifies sophisticated attacks that bypass traditional security |

| Reputation System | Tracks user trading history and feedback scores | Enables community-based fraud prevention and risk assessment |

| Transaction Monitoring | Analyzes patterns for suspicious activity indicators | Detects fraud schemes and money laundering attempts |

| Dispute Resolution | Provides arbitration when transaction conflicts arise | Resolves fraud claims fairly while maintaining user trust |

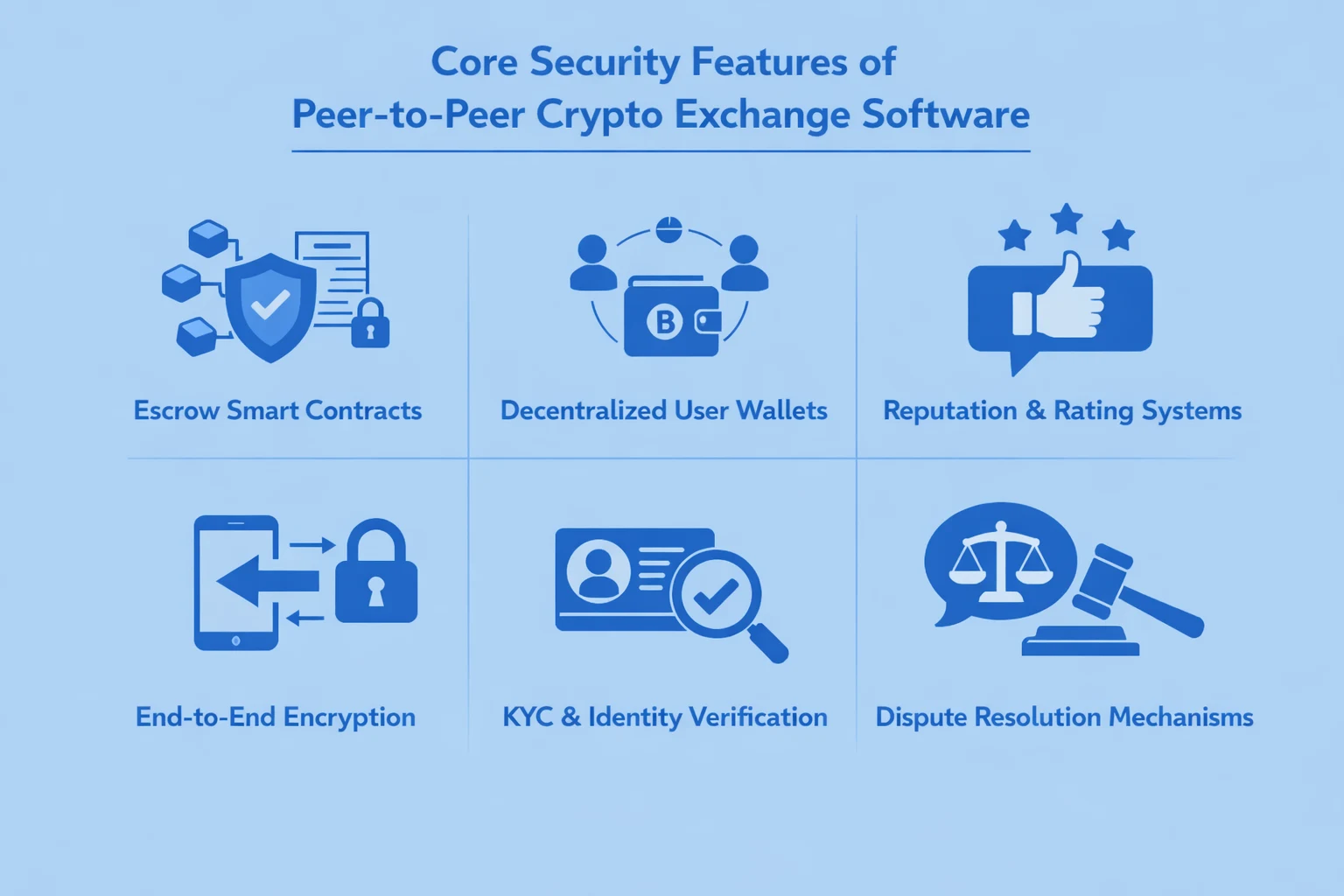

Core Security Features of Peer-to-Peer Crypto Exchange Software

The security of P2P cryptocurrency exchange software depends on multiple integrated features working in concert to protect users and businesses from various threats. Understanding these core security components helps businesses evaluate P2P platforms and implement best practices in their own operations. As experts who build crypto exchanges, we emphasize that comprehensive security requires attention to each of these elements.

Escrow System in Peer-to-Peer Crypto Exchange Security

The escrow system represents the cornerstone of P2P crypto transaction security, providing the trust mechanism that enables strangers to trade safely without requiring a centralized custodian. This system addresses the fundamental problem of peer-to-peer trading: how can a buyer and seller who do not trust each other complete a transaction where one party must act first, creating temporary vulnerability?

How Escrow Protects Buyer and Seller Funds

The escrow mechanism protects both parties by temporarily locking the seller’s cryptocurrency in a smart contract when a transaction begins. This lock prevents the seller from double-spending or withdrawing the coins while the buyer completes their fiat payment through external channels like bank transfer or mobile payment. The buyer knows the cryptocurrency is guaranteed to be available if they complete payment, while the seller knows their coins cannot be stolen during the transaction process.

For buyers, escrow provides assurance that sellers cannot accept payment and then claim they never received it or refuse to release the cryptocurrency. The smart contract holds the coins independently of either party, making it impossible for the seller to renege on the agreement once payment is verified. This protection is particularly valuable in cross-border transactions where legal recourse would be impractical or impossible.

Sellers benefit from escrow protection against chargebacks and payment fraud. Once they release the cryptocurrency from escrow after confirming payment, the transaction is final and irreversible on the blockchain. If the buyer later attempts to reverse the fiat payment through their bank or payment processor, the seller has already received and can prove delivery of the cryptocurrency through blockchain records. This protection is critical for sellers accepting payment methods that allow chargebacks.

Automated Escrow Release Mechanism

Modern P2P exchanges implement sophisticated automated escrow release mechanisms that streamline the transaction process while maintaining security. These systems use time locks, cryptographic signatures, and conditional logic to release funds when predetermined conditions are met, reducing the need for manual intervention in standard transactions while preserving the ability to handle disputes.

Time-based releases provide safety mechanisms for both parties. If a seller confirms receipt of payment, the escrow releases immediately. If the seller fails to respond within a specified timeframe after the buyer marks payment as complete, the system may automatically escalate to dispute resolution to prevent indefinite fund locking. These automated protocols ensure transactions complete efficiently while protecting against abandonment or delay tactics.

Multi-signature technology enhances escrow security by requiring multiple parties to approve fund release. A typical configuration might use two-of-three multisig where the buyer, seller, and platform each hold a key. Normal transactions complete when buyer and seller both sign the release. If disputes arise, the platform can arbitrate by providing the third signature to release funds to the appropriate party based on evidence review. This approach prevents any single party from unilaterally controlling escrowed assets.

Smart Contract Security in P2P Crypto Exchange Software

Smart contracts provide the programmable logic that powers P2P crypto exchange automation, but they also introduce unique security considerations. Unlike traditional software that can be patched after deployment, smart contracts on public blockchains are typically immutable once deployed. This permanence makes security auditing and testing before deployment absolutely critical for business security.

Trustless Transactions Using Smart Contracts

Smart contract security in P2P exchanges enables trustless transactions where neither party must rely on the other’s integrity or the platform’s honesty. The contract code executes exactly as programmed regardless of any party’s wishes, creating deterministic outcomes that can be verified in advance. Users can examine the smart contract code to understand precisely how escrow functions, fund releases occur, and disputes are handled, replacing institutional trust with mathematical certainty.

This trustless model fundamentally changes business security dynamics. Traditional escrow services require users to trust that the intermediary will act fairly and competently. Smart contracts eliminate this trust requirement by encoding the rules in transparent, auditable code that executes automatically. For businesses operating decentralized exchange platforms, this reduces liability and operational complexity while increasing user confidence.

The automation provided by smart contracts also eliminates entire categories of security risks associated with human intermediaries. Insider threats, where employees steal or manipulate funds, become impossible when smart contracts control asset custody. Operational errors from manual processing cannot occur when contracts execute according to predetermined logic. These eliminated risk factors represent significant business security improvements compared to traditional escrow models.

Smart Contract Audits and Risk Prevention

Smart contract audits represent essential risk prevention measures for P2P crypto exchange businesses. Professional audit firms employ specialized security researchers who manually review contract code line by line, searching for vulnerabilities that automated tools might miss. These audits examine not only coding errors but also logic flaws, economic attack vectors, and integration risks with external systems.

Comprehensive audit processes typically include static analysis using automated tools to detect common vulnerability patterns, manual code review by experienced security engineers, formal verification using mathematical proofs to verify correct behavior, economic modeling to assess incentive alignment and potential attack profitability, and integration testing to ensure contracts interact safely with wallets, oracles, and other components. Together, these techniques identify and remediate vulnerabilities before deployment.

Beyond initial audits, ongoing security monitoring is essential for P2P platforms. Bug bounty programs incentivize white-hat hackers to find and responsibly disclose vulnerabilities in exchange for rewards. Continuous monitoring of deployed contracts detects unusual activity that might indicate exploitation attempts. When vulnerabilities are discovered, platforms must have upgrade mechanisms in place to migrate users to patched versions while preserving their existing positions and trade history.

⚠️ Critical Security Warning: Never deploy smart contracts that control user funds without comprehensive professional audits. The immutability of blockchain makes post-deployment fixes extremely difficult, and a single vulnerability can result in complete loss of all escrowed assets.

Multi-Layer Authentication in P2P Crypto Exchange

Multi-layer authentication forms a critical defense against unauthorized access attempts in peer-to-peer crypto exchange platforms. While smart contracts protect funds during transactions, strong authentication prevents attackers from initiating fraudulent transactions in the first place. Modern P2P platforms implement sophisticated authentication frameworks that balance security with user experience.

Two-Factor Authentication for Business Security

Two-factor authentication represents the minimum acceptable security standard for P2P crypto exchanges, requiring users to provide two different types of credentials before accessing accounts or executing sensitive operations. The first factor is typically something the user knows (password), while the second is something they have (smartphone with authentication app, SMS-capable phone, or hardware security key). This combination dramatically reduces account takeover risk since attackers must compromise both factors simultaneously.

Time-based one-time passwords (TOTP) generated by applications like Google Authenticator or Authy provide strong second-factor protection that does not depend on SMS delivery, which is vulnerable to SIM-swapping attacks. Hardware security keys implementing the FIDO standard offer even stronger protection by incorporating cryptographic challenge-response protocols that resist phishing and man-in-the-middle attacks. Leading P2P platforms support multiple 2FA options, allowing users to choose based on their security needs and device capabilities.

For businesses, mandatory 2FA policies significantly reduce security incident rates and associated costs. Accounts protected by 2FA resist automated credential stuffing attacks and most phishing attempts. Customer support burden decreases as fewer users experience account compromises requiring recovery processes. Regulatory compliance improves as many jurisdictions now expect or require strong authentication for cryptocurrency platforms. These benefits justify the minor friction that 2FA introduces to user experience.

Biometric and Device-Based Authentication

Biometric authentication adds another security layer by verifying physical characteristics unique to each user. Fingerprint scanning, facial recognition, and voice authentication provide something the user is, complementing knowledge and possession factors. Modern smartphones incorporate secure biometric sensors that make this technology accessible to most users without requiring additional hardware purchases.

Device-based authentication leverages unique identifiers from users’ computers and smartphones to detect suspicious login attempts. Device fingerprinting analyzes characteristics like browser configuration, installed fonts, screen resolution, and hardware specifications to create a profile that identifies the specific device. When users log in from new devices, the platform can require additional verification steps like email confirmation or extended 2FA challenges.

Advanced P2P platforms combine biometric and device authentication with behavioral analytics that monitor how users interact with the platform. Typing patterns, mouse movements, and navigation habits create behavioral profiles that can detect account takeovers even when attackers possess valid credentials. If behavior deviates significantly from established patterns, the system can trigger additional authentication challenges or temporarily restrict high-risk actions until identity is confirmed through secondary channels.

Secure Wallet Integration in P2P Crypto Exchange Software

Secure wallet integration in P2P crypto exchange software determines how users store and access their cryptocurrency during the trading process. Unlike centralized exchanges that generate and control wallet addresses for users, P2P platforms typically support user-controlled wallets where individuals maintain their own private keys. This architecture enhances security but requires careful implementation to ensure ease of use without compromising protection.

Modern P2P platforms support multiple wallet types including browser-based Web3 wallets like MetaMask, mobile wallets like Trust Wallet or Coinbase Wallet, hardware wallets like Ledger and Trezor, and desktop wallets for users who prefer local control. This flexibility allows users to choose security levels matching their risk tolerance and technical capabilities. Hardware wallet integration provides the strongest security by keeping private keys on dedicated devices that never expose them to internet-connected computers.

The integration process must carefully handle permissions and transaction signing to prevent security vulnerabilities. Platforms should request only the minimum necessary permissions from wallets, typically just the ability to view balances and request transaction signatures. Users must explicitly approve each transaction through their wallet interface, creating a separation of concerns where the P2P platform proposes transactions but users retain final control. This architecture prevents compromised platforms from unilaterally moving user funds.

User Data Protection and Privacy in P2P Crypto Exchange Software

User data protection in P2P crypto trading extends beyond securing cryptocurrency assets to include protecting personal information, transaction history, and privacy preferences. As regulatory requirements increase and users become more privacy-conscious, businesses must implement robust data protection frameworks that meet legal obligations while preserving the privacy advantages that attract users to P2P platforms.

Encryption Standards in Peer-to-Peer Crypto Trading

Encryption forms the foundation of user data protection in P2P crypto exchange software, protecting information both in transit and at rest. Transport Layer Security (TLS) 1.3 or higher encrypts all communications between users’ devices and platform servers, preventing eavesdropping and man-in-the-middle attacks. Modern platforms enforce HTTPS connections and implement certificate pinning to resist advanced attack techniques that might compromise TLS.

Data at rest encryption protects user information stored in databases and file systems. Advanced Encryption Standard (AES) with 256-bit keys provides industry-standard protection for sensitive data including KYC documents, transaction histories, and private messages between trading counterparties. Encryption keys themselves must be carefully managed using hardware security modules or key management services that prevent unauthorized access even by platform administrators.

End-to-end encryption for user communications adds another privacy layer by ensuring that messages between buyers and sellers cannot be read by the platform itself. This approach uses public key cryptography where each user’s device encrypts messages with the recipient’s public key, and only the recipient’s private key can decrypt them. While this limits the platform’s ability to moderate communications, it provides stronger privacy guarantees that appeal to users concerned about surveillance.

User Identity Protection in P2P Crypto Exchange Software

User identity protection in P2P crypto exchange software balances regulatory KYC requirements with privacy preservation. While platforms must verify user identities to comply with anti-money laundering regulations, they should minimize exposure of this information to other users and external parties. Pseudonymous trading systems allow users to trade under usernames or randomly generated identifiers rather than real names, revealing identity only when legally required.

Selective disclosure techniques enable users to prove specific attributes without revealing complete identity information. For example, zero-knowledge proofs can demonstrate that a user is over 18 years old or resides in an approved jurisdiction without disclosing exact age or address. These privacy-enhancing technologies allow platforms to verify compliance requirements while minimizing data exposure and associated risks.

Data minimization principles dictate that platforms should collect and retain only information strictly necessary for operations and compliance. Excessive data collection increases breach exposure, storage costs, and regulatory obligations. Leading P2P platforms implement policies that automatically delete aged data no longer required for regulatory retention periods, reducing long-term privacy risks and demonstrating respect for user privacy rights.

Privacy-Focused Security Model for Crypto Businesses

Privacy-focused security models recognize that privacy and security are complementary rather than opposing objectives. By minimizing data collection, limiting access, and implementing strong encryption, businesses reduce both privacy invasion and security breach risks. This approach aligns with growing regulatory emphasis on data protection while differentiating P2P platforms from data-hungry centralized competitors.

Decentralized identity systems represent an emerging approach to privacy-focused authentication. Rather than storing KYC documents on centralized servers, these systems use blockchain-based credentials that users control. Verification occurs through cryptographic proofs that confirm the user possesses valid credentials without exposing the underlying documents to the platform. This architecture eliminates central databases of identity documents that represent attractive targets for attackers.

Privacy policies and user controls enable individuals to make informed decisions about their data. Transparent policies explain what information is collected, how it is used, who can access it, and when it will be deleted. User-facing dashboards allow individuals to review their data, download copies, request deletions where legally permissible, and adjust privacy settings. This transparency builds trust while meeting regulatory requirements like GDPR that mandate user access to their personal information.

KYC and AML Security Framework in P2P Crypto Exchange Software

KYC and AML in P2P crypto exchanges represent critical compliance and security functions that protect businesses from regulatory penalties while preventing platform misuse for money laundering and terrorist financing. Implementing effective KYC and AML frameworks requires balancing thoroughness with user experience, as overly burdensome processes drive users to unregulated competitors while inadequate controls expose businesses to legal and reputational risks.

Role of KYC in Peer-to-Peer Crypto Exchange Security

Know Your Customer procedures serve multiple security purposes in P2P crypto exchanges beyond regulatory compliance. Identity verification links real-world identities to platform accounts, creating accountability that deters fraud and enables law enforcement cooperation when criminal activity is detected. Users who know their identities are verified and traceable are less likely to attempt scams, as the risk of legal consequences increases significantly compared to fully anonymous platforms.

Tiered KYC systems allow platforms to balance security with user privacy and convenience. Basic tiers might require only email verification and phone number confirmation, enabling small-value trading with minimal friction. Intermediate tiers add government ID verification and facial recognition, unlocking higher transaction limits. Advanced tiers include proof of address, source of funds documentation, and enhanced due diligence, enabling institutional-grade trading limits and additional features.

Automated KYC verification using artificial intelligence and third-party verification services streamlines the process while maintaining security. Document authentication algorithms detect fake or altered IDs, facial recognition matches selfies to ID photos, and liveness detection prevents photo spoofing. These automated systems process verifications in minutes rather than hours or days, improving user experience while maintaining or exceeding manual review accuracy for most cases.

AML Compliance for Secure Crypto Business Operations

Anti-money laundering compliance in P2P crypto exchange platforms involves continuous monitoring and analysis of transactions to detect patterns indicative of money laundering or terrorist financing. Transaction monitoring systems track metrics including volume, frequency, counterparty relationships, and geographic patterns to identify suspicious activities that warrant further investigation or reporting to financial intelligence units.

Sanctions screening checks users and their transactions against global watchlists including OFAC, UN, and EU sanctions lists. This screening must occur during onboarding and continuously throughout the user lifecycle as sanctions lists are updated. Automated screening systems flag matches for manual review, as false positives are common with name-based matching. Businesses must balance thoroughness with operational efficiency to avoid blocking legitimate users while catching actual sanctioned parties.

Suspicious activity reporting requires platforms to file reports with financial authorities when detecting potential money laundering or other financial crimes. These reports must include detailed transaction information, customer data, and the specific suspicious indicators observed. Effective AML programs train staff to recognize red flags, establish clear escalation procedures, and maintain secure systems for preparing and filing reports while protecting the confidentiality of these sensitive compliance activities.

Balancing Privacy and Regulatory Security in P2P Exchanges

Balancing privacy with regulatory compliance represents one of the most challenging aspects of operating secure P2P crypto exchanges. Users are attracted to P2P platforms partly for privacy advantages over centralized exchanges, yet regulators increasingly require identity verification and transaction monitoring. Successfully navigating this tension requires thoughtful implementation that meets compliance obligations while preserving maximum privacy within legal constraints.

Risk-based approaches allow platforms to apply more stringent controls only where warranted by actual risk indicators. Low-risk users engaging in small, infrequent transactions might require minimal verification, while high-risk profiles involving large volumes, unusual patterns, or connections to high-risk jurisdictions trigger enhanced due diligence. This targeted approach reduces friction for the majority of users while focusing compliance resources where they provide the most value.

Transparency about compliance requirements and data usage builds user trust despite necessary privacy compromises. Clear communication about what information is collected, why it is necessary, how it is protected, and when it might be shared with authorities helps users understand that compliance serves legitimate purposes rather than unnecessary surveillance. Platforms that explain their compliance philosophy and demonstrate respect for privacy within regulatory bounds earn user loyalty even when they cannot offer complete anonymity.

| Verification Tier | Requirements | Transaction Limits | Processing Time |

|---|---|---|---|

| Basic (Tier 1) | Email and phone verification | Up to $1,000 per day | Instant |

| Intermediate (Tier 2) | Government ID and facial recognition | Up to $10,000 per day | 5-10 minutes |

| Advanced (Tier 3) | Proof of address and source of funds | Up to $50,000 per day | 1-24 hours |

| Institutional (Tier 4) | Enhanced due diligence and corporate docs | Custom limits above $50,000 | 1-3 business days |

Risk Management Strategies in Peer-to-Peer Crypto Exchange Software

Comprehensive peer-to-peer crypto exchange risk management requires systematic approaches to identifying, assessing, and mitigating threats across the entire platform ecosystem. Effective risk management protects both the business and its users while enabling sustainable growth through controlled exposure to acceptable risks and systematic elimination of unacceptable ones.

Peer-to-Peer Crypto Exchange Risk Assessment Model

Risk assessment in P2P crypto exchanges begins with systematic identification of potential threats across multiple categories including technical vulnerabilities, user fraud, regulatory changes, market conditions, and operational failures. Each identified risk must be evaluated for likelihood and potential impact, creating a risk matrix that prioritizes mitigation efforts toward the most significant threats. This structured approach ensures limited security resources focus on protecting against the most dangerous scenarios.

Quantitative risk modeling attempts to assign numerical probabilities and financial impacts to different risk scenarios. For example, analysis might show that account takeover attacks occur in 0.1% of accounts annually, with an average loss of $5,000 per incident, suggesting an annual expected loss of $5,000 per 10,000 accounts. These calculations inform decisions about security investments, as spending $30,000 on advanced authentication to reduce account takeovers by 80% would save $40,000 annually, justifying the investment.

Continuous risk reassessment adapts to changing threat landscapes and business evolution. New attack vectors emerge, regulatory requirements shift, and user behavior patterns change over time. Quarterly or semi-annual risk reviews examine whether previous assessments remain accurate and whether new risks have emerged. This ongoing process ensures risk management strategies remain relevant and effective rather than becoming outdated security theater that fails to address actual current threats.

Dispute Resolution System for Secure P2P Trading

Dispute resolution systems provide essential security functions in P2P crypto exchanges by offering fair, efficient mechanisms for resolving conflicts when transactions do not proceed smoothly. Without effective dispute resolution, users cannot trade confidently with strangers, as they have no recourse if counterparties act in bad faith. Well-designed systems balance automation with human judgment to resolve most disputes quickly while handling complex cases with appropriate care.

Automated Dispute Handling

Automated dispute handling addresses straightforward cases where evidence clearly supports one party’s position. For example, if a seller claims non-payment but the buyer provides blockchain-verified proof of a timestamped bank transfer from their verified account, the automation system can release the escrowed cryptocurrency to the buyer without requiring human review. This automation resolves simple disputes in minutes rather than hours or days, improving user experience while reducing operational costs.

Machine learning algorithms can analyze historical dispute patterns to predict outcomes and identify cases suitable for automated resolution. These systems consider factors including payment method reliability, user reputation scores, transaction history between the parties, and evidence quality to determine confidence levels. Cases with high confidence in the correct outcome proceed to automated resolution, while ambiguous situations escalate to human arbitrators.

Timeout mechanisms prevent disputes from languishing indefinitely without resolution. If neither party responds within specified timeframes, the system applies default rules based on transaction stage and evidence. These mechanisms ensure escrowed funds do not remain locked permanently, which would harm both parties and reduce platform liquidity. Clear timeout policies set user expectations and encourage prompt participation in dispute resolution processes.

Manual Arbitration and Security Controls

Manual arbitration by trained human reviewers handles complex disputes where evidence is ambiguous, claims are conflicting, or automation cannot determine the correct outcome with sufficient confidence. Arbitrators review submitted evidence including payment screenshots, blockchain records, chat logs, and account histories to make fair determinations about fund release. Their decisions should be based on documented policies that ensure consistency across similar cases.

Arbitrator selection and training critically impact dispute resolution quality and security. Arbitrators must understand P2P trading mechanics, payment system capabilities and limitations, common fraud techniques, and platform policies. Multi-arbitrator panels for high-value disputes reduce individual bias and improve decision quality. Regular calibration sessions where arbitrators review cases together ensure consistent interpretation of policies and evidence standards.

Security controls around arbitration prevent abuse by dishonest arbitrators who might collude with users to steal escrowed funds. Arbitrator actions should be logged comprehensively, with decisions subject to quality assurance review. Rotation policies prevent arbitrators from consistently handling the same users’ disputes. Segregation of duties ensures arbitrators cannot both review disputes and directly release funds, requiring a separate operations team to execute arbitrator decisions after appropriate verification.

Fraud Detection Tools in P2P Crypto Exchange Software

Fraud detection tools in P2P crypto exchange software employ multiple techniques to identify and prevent fraudulent activities before they result in user losses or platform abuse. These tools analyze user behavior, transaction patterns, device characteristics, and external data sources to build comprehensive fraud risk profiles that inform security decisions and protective actions.

Behavioral analysis examines how users interact with the platform to detect anomalies indicative of account takeovers or fraudulent intent. Sudden changes in trading patterns, login locations, device usage, or counterparty selection may signal that an account has been compromised or that a user intends to commit fraud. Machine learning models trained on historical data identify subtle patterns that human reviewers might miss, flagging suspicious accounts for additional verification or restrictions.

Network analysis identifies fraud rings where multiple accounts coordinate to exploit platform vulnerabilities or execute systematic scams. By examining relationships between accounts based on shared IP addresses, device fingerprints, payment methods, or trading counterparties, these tools reveal hidden connections that suggest organized fraud operations. Once identified, entire fraud networks can be investigated and restricted simultaneously, preventing them from simply creating new accounts to continue their activities.

Business Advantages of Secure Peer-to-Peer Crypto Exchange Software

The security features inherent in well-designed P2P crypto exchange platforms translate directly into business advantages that improve competitiveness, reduce costs, and enable sustainable growth. Understanding these advantages helps business leaders appreciate why investing in robust P2P security infrastructure delivers returns beyond mere risk reduction.

Building User Trust Through Strong P2P Security

User trust represents the most valuable intangible asset for any P2P crypto exchange business, and security excellence is the foundation upon which trust is built. Users who feel confident that their funds are protected, their data is secure, and disputes will be resolved fairly are more likely to complete trades, recommend the platform to others, and remain loyal even when competitors offer marginally better fees or features. This trust translates directly into higher lifetime customer value and lower acquisition costs.

Security certifications and audit results provide tangible evidence that reinforces user trust. Platforms that publish security audit reports, obtain compliance certifications like SOC 2 or ISO 27001, and participate in bug bounty programs demonstrate commitment to security that words alone cannot convey. These third-party validations reduce perceived risk for new users who lack technical expertise to evaluate security independently, accelerating user acquisition and reducing skepticism-driven churn.

Transparent security communication during incidents paradoxically strengthens trust when handled properly. Platforms that openly disclose security issues, explain what happened, detail remediation steps, and compensate affected users demonstrate integrity and responsibility. Users appreciate honesty and appropriate response more than they expect perfection. This transparency contrasts favorably with competitors who hide incidents, creating competitive advantage through demonstrated accountability.

Reduced Operational Risk for Crypto Businesses

The non-custodial architecture of P2P crypto exchanges fundamentally reduces operational risk compared to centralized platforms. By eliminating the need to custody user funds in hot wallets that must remain online for operational purposes, P2P platforms avoid the constant threat of exchange hacks that have plagued the industry. This risk reduction translates into lower insurance costs, reduced regulatory capital requirements in some jurisdictions, and elimination of the catastrophic liability exposure that threatens centralized exchanges.

Automated security systems reduce reliance on human processes that introduce operational risk through errors, inconsistency, or malicious action. Smart contracts execute transactions according to predetermined logic without requiring manual intervention, eliminating opportunities for operational mistakes or insider theft. Automated compliance screening, KYC verification, and fraud detection operate consistently 24/7 without fatigue or judgment lapses that affect human operators. This automation improves reliability while reducing staffing costs for security and compliance functions.

Distributed architecture provides operational resilience that centralized systems cannot match. P2P platforms leveraging blockchain infrastructure inherit the redundancy and fault tolerance of decentralized networks. If platform servers fail, smart contracts continue operating on the blockchain, ensuring user funds remain accessible and secure. This resilience reduces business continuity risks and the costs associated with maintaining redundant data centers and disaster recovery infrastructure.

Cost Efficiency and Security Combined in P2P Crypto Exchanges

P2P crypto exchange models achieve superior cost efficiency compared to centralized alternatives while maintaining or exceeding security standards. The elimination of custodial infrastructure saves substantially on secure storage facilities, insurance premiums, and the specialized security personnel required to protect centralized hot and cold wallet systems. These savings can be passed to users through lower fees, retained as profit margins, or reinvested in additional security and feature development.

Reduced compliance costs result from the distributed compliance burden in P2P models. While platforms must still implement KYC and AML controls, certain regulatory obligations may apply to users rather than the platform itself depending on jurisdiction and implementation. This can reduce licensing costs, regulatory reporting burden, and legal exposure compared to fully custodial exchanges. However, businesses must carefully analyze their specific regulatory environment as requirements vary significantly across jurisdictions.

Scalability advantages emerge from the distributed nature of P2P architecture. Rather than requiring the platform to process and settle every transaction through centralized infrastructure, blockchain networks handle settlement while the platform provides matching and security services. This division enables platforms to serve many more users without proportional infrastructure investment. The resulting economies of scale improve competitiveness and profitability as the platform grows.

💡 Business Insight: The combination of reduced custodial liability, lower infrastructure costs, and inherent scalability creates a business model where security and profitability reinforce each other rather than competing for resources.

Challenges in Peer-to-Peer Crypto Exchange Security

Despite significant advantages, P2P crypto exchange security faces unique challenges that require ongoing attention and sophisticated solutions. Understanding these challenges helps businesses develop realistic security strategies and set appropriate expectations about the continuous effort required to maintain secure P2P trading environments.

Common Security Threats in P2P Crypto Trading

Payment fraud represents one of the most persistent security threats in P2P crypto trading. Fraudsters use stolen payment credentials, fake payment confirmations, or exploit chargeback mechanisms to receive cryptocurrency without actual payment. They might send doctored screenshots showing completed transfers, use compromised bank accounts that legitimate owners later report as fraudulent, or initiate chargebacks after receiving cryptocurrency for reversible payment methods like credit cards or PayPal.

Account takeover attacks target user accounts to execute unauthorized trades or steal funds from ongoing transactions. Attackers use phishing, credential stuffing, SIM swapping, or malware to compromise accounts and bypass security controls. Once inside an account, they may initiate fraudulent purchases, manipulate ongoing transactions, or extract valuable information. Multi-factor authentication and behavioral analytics help but cannot eliminate this threat entirely, as sufficiently sophisticated attackers find ways to bypass even strong controls.

Reputation manipulation attempts to game trust systems by artificially inflating feedback scores or creating networks of fake accounts that vouch for each other. Fraudsters build apparent legitimacy through small successful trades before executing large scams. They may also use Sybil attacks where one person controls many accounts that interact to create false reputation signals. Detecting these manipulation attempts requires sophisticated network analysis and behavioral pattern recognition that goes beyond simple feedback counting.

Regulatory Challenges Impacting Business Security

Evolving regulatory frameworks create ongoing challenges for P2P crypto exchange businesses trying to maintain compliant security practices. Different jurisdictions impose varying requirements for KYC, AML, data protection, and operational security, making global operation complex and expensive. Regulatory changes can require significant platform modifications on short notice, potentially introducing security vulnerabilities if implementations are rushed to meet compliance deadlines.

Regulatory uncertainty around the classification of P2P platforms affects security requirements and business viability. Some jurisdictions may classify P2P platforms as money transmitters requiring expensive licensing, while others treat them as technology providers with lighter regulatory touch. This uncertainty makes long-term security planning difficult and may require businesses to over-invest in compliance infrastructure to hedge against potential future requirements.

Cross-border regulatory conflicts create situations where compliance with one jurisdiction’s requirements violates another’s laws. Data localization requirements may conflict with security best practices around geographic redundancy. Privacy regulations may restrict data sharing that AML rules mandate. Navigating these conflicts requires sophisticated legal analysis and potentially limiting service availability in certain jurisdictions to maintain compliant security practices elsewhere.

Managing User Behavior Risks in Peer-to-Peer Crypto Exchanges

User education challenges impact security when users fail to understand how to protect themselves in P2P trading environments. Many users do not recognize phishing attempts, share passwords across platforms, ignore two-factor authentication recommendations, or fall for social engineering attacks. No amount of platform security can fully compensate for users who voluntarily compromise their own accounts through unsafe practices.

Transaction dispute complexity arises from the peer-to-peer nature of trading where parties use external payment systems the platform cannot directly verify. When buyers and sellers present conflicting evidence about whether payment occurred, arbitrators must make difficult judgments based on imperfect information. False payment confirmations, photoshopped screenshots, and timing discrepancies create ambiguity that sophisticated fraudsters exploit while honest users sometimes struggle to provide clear proof of legitimate actions.

Chargeback risks with reversible payment methods create fundamental security challenges in P2P crypto trading. Sellers who accept credit cards, PayPal, or other reversible methods face the possibility that buyers will receive cryptocurrency and then dispute the original payment, forcing reversal. The irreversible nature of blockchain transactions means sellers cannot recover the cryptocurrency once sent. This asymmetric risk makes certain payment methods practically unusable for sellers unless platforms implement extremely strict controls or prohibit them entirely.

Future of Peer-to-Peer Crypto Exchange Software in Business Security

The future of P2P crypto exchange security will be shaped by emerging technologies, evolving threats, and changing regulatory landscapes. Businesses that anticipate these trends and invest appropriately will gain competitive advantages while those that fail to adapt may find their security postures increasingly inadequate for the sophisticated threats ahead.

Blockchain Innovations Enhancing P2P Crypto Security

Layer-2 scaling solutions promise to enhance P2P crypto security by enabling faster, cheaper transactions with improved privacy features. Lightning Network for Bitcoin and similar solutions for other blockchains reduce on-chain transaction costs and settlement times, making smaller P2P trades economically viable while maintaining security through cryptographic channels. These technologies also offer better privacy than base-layer transactions, appealing to users who value confidentiality without sacrificing security.

Cross-chain interoperability protocols will enable secure P2P trading across different blockchain networks without trusted intermediaries. Atomic swap technology allows users to exchange Bitcoin for Ethereum or other cryptocurrencies directly through cryptographic protocols that ensure either both sides of the trade complete or neither does. This eliminates counterparty risk in cross-chain trades and expands P2P market liquidity without requiring centralized bridges that introduce security vulnerabilities.

Zero-knowledge proof integration offers revolutionary privacy enhancements while maintaining regulatory compliance. These cryptographic techniques allow users to prove they meet requirements like minimum age, approved jurisdiction, or clean sanctions screening without revealing underlying personal information. For P2P exchanges, this enables privacy-preserving KYC where users prove compliance without exposing identity details to the platform, other users, or potential attackers who might breach platform databases.

AI-Based Fraud Detection in P2P Crypto Exchange Software

Artificial intelligence and machine learning will become increasingly sophisticated at detecting fraud patterns in P2P crypto exchanges. Advanced neural networks can analyze millions of data points across user behavior, transaction characteristics, device information, and network relationships to identify fraud with accuracy that surpasses rule-based systems. These AI systems continuously learn from new fraud attempts, adapting detection algorithms faster than criminals can develop new attack techniques.

Natural language processing applied to user communications will help identify scam attempts and fraudulent representations. By analyzing chat messages between buyers and sellers, AI can detect language patterns associated with social engineering, fake payment confirmations, or other fraud techniques. This analysis occurs in real-time, potentially warning users about suspicious counterparty behavior before they complete transactions, preventing fraud rather than merely detecting it afterward.

Predictive analytics using AI will enable proactive security measures that prevent attacks before they occur. By identifying accounts and behavioral patterns that correlate with future fraud attempts, platforms can implement preventive restrictions or enhanced verification for high-risk users. This shifts security from reactive incident response toward predictive prevention, reducing fraud losses while minimizing friction for the majority of legitimate users who do not exhibit risk indicators.

Evolving Compliance Standards for Secure Crypto Businesses

Global regulatory harmonization efforts will gradually create more consistent compliance standards for P2P crypto exchanges, reducing the complexity of multi-jurisdictional operations. Organizations like the Financial Action Task Force continue developing international standards that member countries implement through national legislation. While complete harmonization remains unlikely, convergence on core principles around KYC, AML, and consumer protection will simplify compliance while maintaining security standards.

Industry self-regulation initiatives may develop standards that exceed regulatory minimums, creating competitive advantages for participating platforms. Industry associations could establish certification programs that audit members’ security practices, dispute resolution procedures, and user protection measures. These certifications would help users identify trustworthy platforms while demonstrating to regulators that the industry takes self-governance seriously, potentially influencing future regulation toward principles-based approaches rather than prescriptive rules.

Automated compliance technology will reduce the burden of meeting complex regulatory requirements while improving accuracy and consistency. RegTech solutions using AI and blockchain will automate transaction monitoring, sanctions screening, suspicious activity reporting, and regulatory data submission. This automation allows smaller P2P platforms to achieve compliance standards previously accessible only to large exchanges with dedicated compliance teams, democratizing participation in regulated markets while maintaining high security standards.

Best Practices for Businesses Using Peer-to-Peer Crypto Exchange Software

Implementing P2P crypto exchange compliance security requires businesses to follow established best practices while adapting to their specific context, user base, and risk tolerance. These recommendations draw from eight years of experience building and securing cryptocurrency platforms across various jurisdictions and market conditions.

Implementing Strong Security Policies

Comprehensive security policies establish the foundation for all security activities in P2P crypto exchange operations. These policies should address authentication requirements, access control, data protection, incident response, business continuity, and acceptable use. Policies must be documented clearly, communicated to all stakeholders, and enforced consistently through technical controls and operational procedures. Regular policy reviews ensure they remain relevant as threats evolve and business operations change.

Access control policies implement least privilege principles where users and administrators receive only the minimum permissions necessary for their legitimate functions. Multi-person approval requirements for sensitive operations like smart contract deployments, configuration changes, or large fund movements prevent single individuals from compromising security unilaterally. Segregation of duties ensures that no single role combines authorization, execution, and verification functions, reducing insider threat risks.

Incident response planning prepares organizations to handle security breaches effectively when they occur. Detailed playbooks outline steps for detecting, containing, investigating, and recovering from various incident types. Regular tabletop exercises test these plans and train response teams before real incidents occur. Post-incident reviews identify lessons learned and drive continuous improvement in security practices. Organizations with prepared incident response capabilities minimize damage and recovery time compared to those that improvise responses during crises.

Regular Security Audits for P2P Crypto Exchange Software

Annual security audits by independent third parties provide objective assessment of security posture and identify vulnerabilities that internal teams might miss. Comprehensive audits examine smart contracts, platform infrastructure, application security, operational procedures, and compliance controls. Audit findings drive prioritized remediation roadmaps that address the most critical vulnerabilities first. Publishing audit results demonstrates security commitment to users and regulators while building trust through transparency.

Penetration testing simulates real-world attacks to evaluate how security controls perform against determined adversaries. Ethical hackers attempt to compromise the platform using techniques that actual attackers might employ, revealing weaknesses in defenses before criminals exploit them. Regular penetration tests, especially after significant platform updates, ensure new features do not introduce security regressions. Bug bounty programs complement scheduled testing by incentivizing continuous security research by the global security community.

Continuous monitoring and logging provide visibility into platform operations that enables rapid threat detection and forensic investigation. Security information and event management (SIEM) systems aggregate logs from all platform components, apply correlation rules to identify suspicious patterns, and alert security teams to potential incidents. Comprehensive logging also satisfies regulatory requirements for audit trails and enables detailed investigation when security incidents or disputes occur.

Educating Users for Safer Peer-to-Peer Crypto Trading

User education programs reduce security risks by helping users understand threats and protective measures. Educational content should cover topics including password security, phishing recognition, two-factor authentication usage, safe trading practices, and red flags indicating potential scams. Multi-format delivery through videos, articles, interactive tutorials, and email campaigns ensures broad reach across user segments with different learning preferences.

Just-in-time education delivers security guidance at moments when users most need it. When users attempt risky actions like disabling 2FA or trading with counterparties who have poor reputation scores, contextual warnings explain the risks and recommended alternatives. This targeted approach proves more effective than generic security advice that users ignore because it lacks immediate relevance to their current activities.

Community-driven security awareness leverages experienced users to educate newcomers through forums, social media, and peer mentoring. Platforms can recognize and reward community members who help others avoid scams, creating positive incentives for peer education. User-generated content about security experiences and lessons learned often resonates more effectively than official communications, as users trust advice from peers who have faced similar challenges.

Build a Secure Peer-to-Peer Crypto Exchange with Experts

Work with a leading crypto exchange development company to build a secure, scalable peer-to-peer crypto exchange for your business.

Conclusion

The role of peer-to-peer crypto exchange software in business security extends far beyond simple technological features to encompass fundamental architectural advantages that reshape risk management in digital asset trading. Through our eight years of experience building cryptocurrency platforms, we have observed how P2P models eliminate single points of failure, distribute risk across individual transactions, and create incentive structures that align security with business success rather than treating them as competing priorities.

The security advantages of P2P crypto exchange platforms stem from deliberate architectural choices including non-custodial fund management, smart contract automation, multi-layer authentication, and comprehensive KYC/AML frameworks. These components work synergistically to create environments where users can trade confidently with strangers while businesses reduce liability exposure, operational costs, and regulatory burdens. The escrow systems, reputation mechanisms, and dispute resolution procedures provide practical solutions to the trust problems inherent in peer-to-peer transactions.