Key Takeaways

- On-chain trading executes and records all transactions directly on a blockchain network, providing complete transparency and immutability that traditional trading systems cannot match.

- Smart contracts automate trade execution, removing the need for intermediaries and significantly reducing counterparty risk in every transaction.

- While on-chain trading offers superior security and auditability, it faces challenges like higher gas fees and slower transaction speeds compared to off-chain alternatives.

- Liquidity aggregation through DEX aggregators helps traders find optimal rates across multiple decentralized exchanges, minimizing slippage on large orders.

- The integration of on-chain trading with broader DeFi applications creates new opportunities for yield farming, staking, and cross-chain operations.

The way people trade digital assets has changed dramatically over the past decade. With blockchain technology maturing and decentralized finance gaining mainstream attention, on-chain trading has become a topic that every serious investor and developer needs to understand. But what exactly does on-chain trading mean, and why does it matter for the future of finance?

This guide breaks down everything you need to know about on-chain trading. We will cover how it works, how it compares to traditional off-chain methods, the technology that powers it, and where the industry is headed. Whether you are a trader looking to understand your options or a developer building the next generation of financial tools, this article will give you the foundation you need.

Understanding On-Chain Trading: The Basic Concept

On-chain trading refers to the process of executing and settling trades directly on a blockchain network. Every buy order, sell order, and resulting transaction gets recorded permanently on the distributed ledger. This stands in contrast to traditional trading platforms where transactions happen on private servers and only final settlements might touch a blockchain.

Think of it this way: when you trade on a centralized exchange, you are essentially trusting that exchange to keep accurate records of your trades. The exchange acts as an intermediary, matching buyers with sellers and maintaining its own database of who owns what. With on-chain trading, the blockchain itself serves as the ultimate record keeper. According to Wikipedia’s blockchain overview, this distributed ledger technology enables secure, transparent record-keeping without requiring trust in any single entity.

The practical implications of this difference are significant. On-chain trades cannot be altered, deleted, or disputed after execution. Anyone can verify that a trade occurred by checking the public blockchain. This transparency creates accountability that simply does not exist in traditional financial systems.

The Role of Smart Contracts in On-Chain Trading

Smart contracts form the backbone of on-chain trading systems. These self-executing programs live on the blockchain and automatically enforce the rules of each trade. When certain conditions are met, the smart contract executes the agreed-upon actions without human intervention.

For example, consider a simple token swap. The smart contract holds both assets in escrow, verifies that both parties have deposited the correct amounts, and then simultaneously transfers ownership. If either party fails to meet their obligations, the contract automatically reverses the transaction. This automation eliminates the need for trusted intermediaries and removes many opportunities for fraud or error.

The reliability of smart contracts depends heavily on proper development and auditing. A bug in the code could potentially lock funds or enable exploits. This is why working with experienced blockchain development companies matters when building or deploying on-chain trading solutions. Proper testing, security audits, and ongoing monitoring are essential.

On-Chain Trading vs Off-Chain Trading: Key Differences

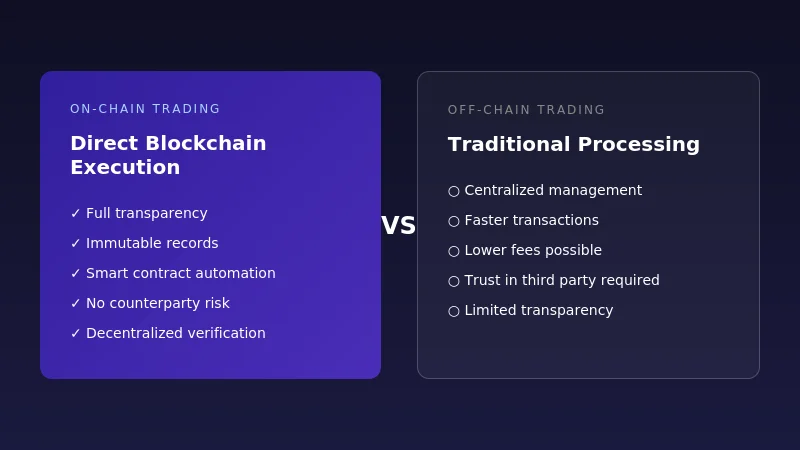

Understanding the distinction between on-chain and off-chain trading helps clarify when each approach makes sense. Both methods have their place in the broader ecosystem.

| Feature | On-Chain Trading | Off-Chain Trading |

|---|---|---|

| Transaction Recording | All trades recorded on public blockchain | Trades recorded on private servers |

| Speed | Limited by block confirmation times | Near-instant execution possible |

| Transaction Costs | Gas fees required for each trade | Lower or no network fees |

| Transparency | Complete and verifiable by anyone | Limited to what the platform shows |

| Counterparty Risk | Eliminated through smart contracts | Depends on platform trustworthiness |

| Asset Custody | User maintains control of assets | Platform holds assets during trading |

| Regulatory Clarity | Evolving regulatory framework | More established regulatory oversight |

The choice between on-chain and off-chain trading often comes down to priorities. Traders who value transparency, security, and maintaining control of their assets tend to prefer on-chain solutions. Those who prioritize speed and lower transaction costs might lean toward off-chain options, accepting the tradeoffs involved.

How On-Chain Trading Actually Works: Step by Step

Understanding the mechanics of on-chain trading helps demystify the process. While the underlying technology is complex, the user experience can be straightforward once you understand the flow.

Step 1: Order Placement

The process begins when a trader submits an order through a decentralized application. This could be a swap on a decentralized exchange, a limit order on an order book protocol, or any other type of trade supported by the platform. The trader signs the transaction with their private key, authorizing the smart contract to execute the trade on their behalf.

Step 2: Smart Contract Validation

The smart contract receives the order and validates it against its programmed rules. It checks whether the trader has sufficient funds, whether the trade parameters fall within acceptable ranges, and whether all conditions for execution are met. This validation happens automatically and consistently every time.

Step 3: Trade Execution

Once validated, the smart contract executes the trade. For automated market makers, this means calculating the exchange rate based on the liquidity pool ratios and performing the swap. For order book systems, it means matching the order against existing orders at compatible prices. The execution follows the exact logic coded into the smart contract.

Step 4: Settlement and Recording

After execution, the transaction gets broadcast to the network and included in a block. Miners or validators confirm the transaction, and it becomes a permanent part of the blockchain record. The trader’s wallet balances update to reflect the completed trade, and anyone can verify the transaction details on a block explorer.

The process of node synchronization in blockchain ensures that all participants in the network have the same view of completed transactions. This consensus mechanism prevents double-spending and maintains the integrity of the trading record.

Decentralized Exchanges: The Primary Venue for On-Chain Trading

Decentralized exchanges, commonly called DEXs, serve as the main platforms where on-chain trading happens. Unlike centralized exchanges that maintain their own order books and custody user funds, DEXs operate entirely through smart contracts.

Two main models dominate the DEX landscape. Automated market makers, pioneered by platforms like Uniswap, use liquidity pools instead of order books. Traders swap against these pools, with prices determined algorithmically based on supply and demand. This model enables trading without requiring a counterparty willing to take the other side of each trade.

Order book DEXs, on the other hand, more closely resemble traditional exchanges. They maintain on-chain or hybrid order books where traders can place limit orders at specific prices. These orders remain active until filled or canceled, providing more control over execution prices but potentially slower fills.

The growth of DEXs demonstrates real demand for on-chain trading. According to industry data, DEX trading volumes have grown substantially over the past few years, with billions of dollars in daily volume during peak periods. This growth reflects increasing comfort with decentralized systems and recognition of their benefits.

Liquidity Aggregation: Getting Better Prices On-Chain

One challenge with on-chain trading is that liquidity gets fragmented across many different platforms. A token might trade on Uniswap, SushiSwap, Curve, and dozens of other venues, each with different prices and available liquidity. Finding the best rate manually would be time-consuming and often impractical.

Liquidity aggregators solve this problem by scanning multiple DEXs simultaneously and routing trades through the optimal path. When you trade through an aggregator, it might split your order across several venues or route it through intermediate tokens to get you the best possible rate.

The mechanics involve sophisticated algorithms that consider not just current prices but also the impact your trade will have on those prices. A large order on a single DEX might move the price significantly against you, a phenomenon called slippage. By splitting the order across multiple pools, aggregators minimize this impact and improve your overall execution.

This technology represents a significant advancement in on-chain trading efficiency. Users benefit from better prices without needing to manually compare rates across platforms. The aggregator’s smart contracts handle the complexity, executing multi-step trades in single transactions.

Build Your On-Chain Trading Solution

Ready to leverage blockchain for transparent, secure trading? Our team brings 8+ years of experience in building decentralized exchange solutions, liquidity protocols, and DeFi applications.

Security Considerations in On-Chain Trading

Security in on-chain trading operates differently than in traditional finance. The blockchain provides certain guarantees while introducing its own set of risks that traders need to understand.

Cryptographic Security

Every on-chain transaction requires cryptographic signatures that prove ownership and authorize actions. Without your private key, no one can move your assets or execute trades on your behalf. This creates strong protection against unauthorized access, assuming you properly secure your keys.

The cryptographic foundations of blockchain technology have been tested extensively over the years. The core algorithms used by major networks have proven resistant to attacks, providing a solid base for building trading applications.

Smart Contract Risks

While blockchain technology itself is secure, the smart contracts built on top of it can contain vulnerabilities. Bugs in contract code have led to significant losses in the past. This risk makes thorough auditing essential before deploying or interacting with any trading protocol.

The concept of quorum in blockchain governance adds another layer of security for protocol changes. Many decentralized protocols require agreement from multiple parties before making changes to smart contracts, reducing the risk of malicious modifications.

Network-Level Protections

Decentralized networks distribute verification across many independent nodes. This architecture prevents any single entity from manipulating transaction records. To alter the blockchain, an attacker would need to control a majority of the network’s computing power or stake, which becomes increasingly impractical as networks grow.

Challenges Facing On-Chain Trading Platforms

Despite its advantages, on-chain trading faces real challenges that the industry continues to address. Understanding these limitations helps set appropriate expectations.

| Challenge | Impact | Current Solutions |

|---|---|---|

| Scalability Limits | Network congestion during high demand | Layer 2 solutions, alternative chains |

| High Gas Fees | Makes small trades uneconomical | Rollups, efficient contract design |

| Transaction Finality | Wait times for confirmation | Faster consensus mechanisms |

| User Experience | Complexity deters mainstream adoption | Better interfaces, account abstraction |

| Front-Running | MEV extraction affects trade prices | Private transaction pools, fair ordering |

Scalability remains perhaps the most significant hurdle. Popular networks like Ethereum can only process a limited number of transactions per second. During busy periods, this creates competition for block space that drives up transaction costs.

Several approaches aim to address scalability. Layer 2 solutions like rollups process transactions off the main chain while inheriting its security. Alternative blockchains offer higher throughput, though often with different tradeoff profiles. The technology of Plasma in blockchain represents one such scaling approach that processes transactions in child chains.

Integration with the Broader DeFi Ecosystem

On-chain trading does not exist in isolation. It connects with a broader ecosystem of decentralized finance applications, creating opportunities for sophisticated financial strategies.

Lending protocols allow traders to borrow assets, enabling leveraged positions and short selling on-chain. Yield farming combines trading with liquidity provision, earning fees from other traders while also receiving protocol incentives. Staking mechanisms let token holders earn rewards while participating in network security.

Cross-chain bridges expand the possibilities further, allowing assets to move between different blockchain networks. This interoperability means traders can access opportunities across multiple ecosystems from a single position. The development of sidechain peg mechanisms has been crucial for enabling these cross-chain capabilities.

The composability of DeFi applications creates what developers often call “money legos.” Different protocols can be combined in novel ways, building complex financial products from simpler components. This innovation happens permissionlessly, with anyone able to develop new combinations.

Consensus Mechanisms and Their Impact on Trading

The consensus mechanism a blockchain uses affects how on-chain trading performs on that network. Different approaches offer different tradeoffs between speed, cost, and decentralization.

Proof of Work networks like Bitcoin prioritize security and decentralization but process transactions relatively slowly. Proof of Stake networks can achieve higher throughput and lower costs, though they introduce different security assumptions. The DPoS (Delegated Proof of Stake) mechanism used by some networks offers even faster finality by concentrating validation among elected delegates.

Understanding these tradeoffs helps traders choose appropriate networks for their needs. A high-frequency trading strategy might require a faster chain, while long-term positions might prioritize the security of more established networks.

Real-World Applications: On-Chain Trading in Practice

On-chain trading has moved beyond experimental technology into real-world applications serving significant user bases.

Token launches commonly use decentralized exchanges, providing fair access to new assets without gatekeepers. Community governance tokens trade on-chain, enabling participation in protocol decisions. Stablecoins facilitate value transfer and serve as trading pairs across thousands of markets.

Professional traders and institutions have begun incorporating on-chain trading into their strategies. The transparency of on-chain data enables sophisticated analysis that would be impossible with traditional markets. Anyone can see trading volumes, liquidity depths, and historical patterns without relying on proprietary data feeds.

Education represents another growing application. The Open Campus blockchain education case study demonstrates how blockchain technology supports learning platforms, and similar principles apply to understanding trading systems through direct observation of on-chain activity.

The Future Direction of On-Chain Trading

Several trends point to the continued evolution of on-chain trading technology and adoption.

Layer 2 scaling solutions are maturing rapidly, promising to address the cost and speed limitations that currently constrain on-chain trading. As these technologies improve, the practical advantages of off-chain trading will diminish while the transparency benefits of on-chain trading remain.

Regulatory frameworks are developing around the world, providing clearer rules for decentralized trading. While uncertainty remains, the direction suggests eventual mainstream acceptance of on-chain trading as a legitimate financial activity.

User experience improvements continue to lower barriers to entry. Wallet technology has become more intuitive, transaction costs more predictable, and interfaces more polished. These improvements make on-chain trading accessible to users who would have found earlier iterations too complex.

The concept of orphan blocks in blockchain becomes less relevant as consensus mechanisms improve, leading to more reliable transaction finality and better trading experiences.

Why Experience Matters in Blockchain Development

Building on-chain trading systems requires deep expertise across multiple technical domains. Smart contract security, blockchain architecture, liquidity mathematics, and user interface design all play critical roles in successful implementations.

Nadcab Labs has accumulated over 8 years of hands-on experience developing blockchain solutions, including decentralized exchange protocols, liquidity aggregation systems, and DeFi applications. This experience translates into practical knowledge about what works in production environments and what pitfalls to avoid.

The team’s work spans the full stack of blockchain development, from low-level smart contract optimization to user-facing application design. This comprehensive approach ensures that technical excellence at the protocol level translates into practical utility for end users.

Understanding both the possibilities and limitations of current technology allows for realistic project planning and execution. Not every idea translates well to on-chain implementation, and experienced developers can help identify the right approach for each use case.

Conclusion: Making Sense of On-Chain Trading

On-chain trading represents a fundamental shift in how financial transactions can work. By recording trades directly on public blockchains, it creates transparency and accountability that traditional systems struggle to match. Smart contracts automate execution, reducing reliance on intermediaries and their associated risks.

The technology continues to mature. Current limitations around speed and cost are being addressed through scaling solutions and more efficient blockchain designs. User experience improvements make these systems accessible to a broader audience with each passing year.

For traders, on-chain options offer unique advantages worth understanding, even if they do not replace traditional trading entirely. For developers and businesses, the opportunity to build new financial infrastructure remains substantial.

The shift toward on-chain trading appears structural rather than temporary. As the underlying technology improves and familiarity grows, expect to see increasing adoption across a wider range of use cases and user types. Understanding these systems now positions you to take advantage of opportunities as they emerge.

Frequently Asked Questions

On-chain trading executes and records every transaction directly on the blockchain network, making each trade permanently visible and verifiable by anyone. Regular cryptocurrency trading on centralized exchanges happens on private servers, with the exchange maintaining its own records. The key distinction is custody and transparency. With on-chain trading, you maintain control of your assets until the moment of exchange, and the smart contract handles the swap automatically without any intermediary holding your funds.

On-chain trading typically involves gas fees that can vary significantly based on network congestion. During busy periods on Ethereum, a simple swap might cost $10 to $50 or more in gas. However, many Layer 2 solutions and alternative blockchains offer much lower fees, sometimes just a few cents per transaction. Centralized exchanges usually charge percentage-based trading fees around 0.1% to 0.5% but do not require gas payments. The best choice depends on trade size and timing.

DEX aggregators scan multiple decentralized exchanges simultaneously to find the best available price for any given trade. Instead of checking each platform manually, the aggregator’s algorithm identifies the optimal route, which might involve splitting orders across several liquidity pools or using intermediate tokens. This approach typically results in better execution prices and reduced slippage, especially for larger trades that would significantly impact a single liquidity pool.

The main risks include smart contract vulnerabilities, which could allow exploits if code contains bugs. Always use well-audited protocols with strong track records. Private key management is critical since losing your keys means losing access to funds permanently. Phishing attacks targeting wallet approvals represent another threat. Front-running and sandwich attacks can affect trade execution prices. Using reputable platforms, limiting token approvals, and understanding transaction details before signing helps mitigate these risks.

On-chain trading is available on most smart contract platforms, including Ethereum, BNB Chain, Polygon, Arbitrum, Solana, Avalanche, and many others. Each network has its own ecosystem of decentralized exchanges and trading protocols. The choice of network affects transaction costs, speed, available trading pairs, and liquidity depth. Many traders operate across multiple chains to access different opportunities, using cross-chain bridges to move assets between networks as needed.

Completion time depends heavily on the blockchain network used. On Ethereum mainnet, a trade typically confirms within 12 to 60 seconds, though network congestion can extend this. Layer 2 solutions like Arbitrum or Optimism often confirm within seconds. Faster chains like Solana process transactions in under a second. However, for complete finality where the transaction cannot be reversed, you might wait for multiple block confirmations, which can take several minutes on proof-of-work chains.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.