Key Takeaways

- ✓

Deflationary cryptocurrencies have a fixed or decreasing token supply, which creates scarcity and drives potential value appreciation over time. - ✓

Token burning is the most common mechanism used to reduce supply in deflationary crypto models, sending tokens permanently to inaccessible wallet addresses. - ✓

Inflationary tokens increase their supply over time through minting, while deflationary tokens decrease their supply through burning or capped issuance. - ✓

Bitcoin’s 21 million supply cap is the most well known example of a fixed supply deflationary model, while BNB uses periodic token burns. - ✓

DAOs in DeFi Space increasingly adopt deflationary tokenomics to align community governance incentives with long term token value preservation. - ✓

Transaction fee burns, as seen in Ethereum’s EIP 1559, automatically reduce supply with every on chain transaction, creating organic deflation. - ✓

Scarcity is a key economic principle that supports deflationary crypto models, mirroring the supply and demand dynamics of precious metals like gold. - ✓

Risks of deflationary tokens include potential liquidity challenges, hoarding behavior among holders, and slower network adoption if token spending is discouraged. - ✓

Evaluating deflationary crypto projects requires analysis of burn rate, total supply cap, team transparency, smart contract audits, and community governance. - ✓

Future trends point toward hybrid models that combine elements of both inflationary and deflationary mechanics for balanced ecosystem growth.

Introduction to Deflationary Cryptocurrencies

In the world of digital finance, the concept of deflation takes on a whole new meaning. Unlike traditional currencies that central banks can print in unlimited quantities, deflationary cryptocurrencies are designed with mechanisms that reduce their total supply over time. This approach creates an environment where each remaining token becomes increasingly rare, potentially boosting its value as demand grows or stays constant. The philosophy behind deflationary tokens mirrors the logic of precious commodities: when supply is limited, perceived and market value tends to rise.

As DAOs in DeFi Space continue to reshape how communities govern financial protocols, many of these organizations are choosing deflationary token models to ensure their governance tokens hold real economic weight. The integration of deflation into tokenomics is not just a gimmick; it is a carefully designed economic strategy that affects everything from investor behavior to network adoption and long term sustainability. With the crypto market maturing rapidly, understanding how deflationary mechanics work is no longer optional for serious participants.

What Are Deflationary Cryptocurrencies?

A deflationary cryptocurrency is a digital asset whose total supply decreases over time. This reduction can happen through several mechanisms, including token burning, halving events, or capped token issuance. The core idea is that as the available supply shrinks, each individual token becomes more scarce and, theoretically, more valuable. This contrasts sharply with inflationary currencies (both fiat and crypto), where the money supply continuously expands.

For example, Bitcoin has a hard cap of 21 million coins. No more will ever be created. As mining rewards are halved approximately every four years, the rate at which new Bitcoin enters circulation slows dramatically. This predictable reduction in new supply is a form of disinflation that eventually leads to a fully deflationary state once all coins are mined. Similarly, tokens like BNB conduct quarterly burns, actively removing tokens from the total supply based on trading volumes and platform revenue.

For businesses and startups looking to launch their own deflationary assets, working with experienced professionals is crucial to ensure secure tokenomics, smart contract accuracy, and compliance. Choosing from the best crypto token developers can help you design and implement reliable deflationary mechanisms tailored to your project’s long-term goals.

How Deflationary Cryptocurrencies Work

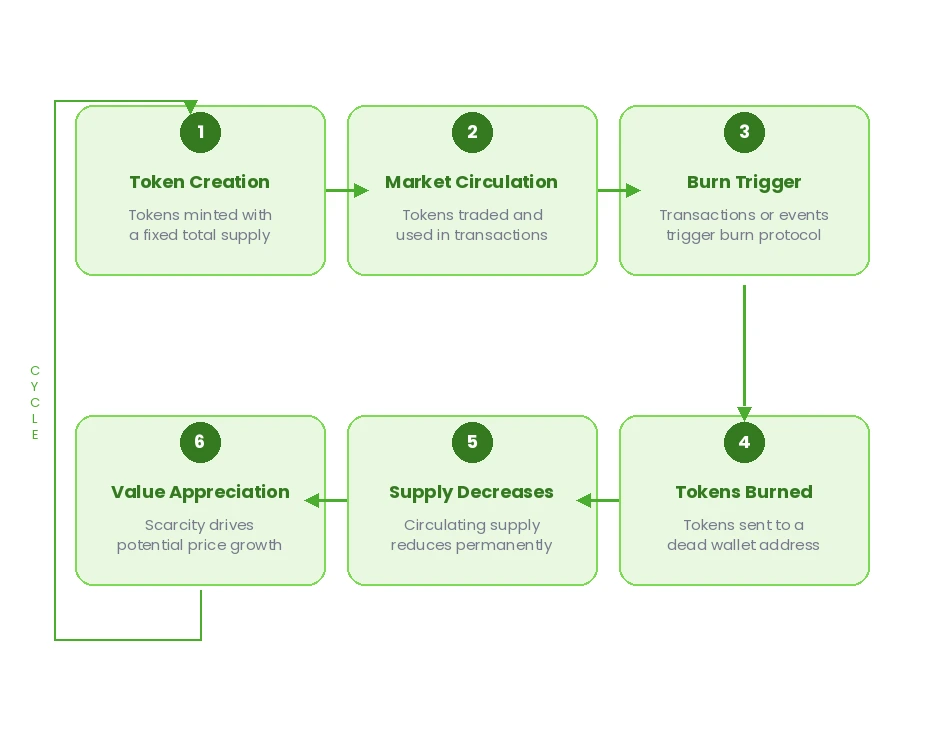

The operational mechanics of deflationary tokens revolve around systematic supply reduction. Here is a breakdown of how these tokens typically function within blockchain ecosystems:

Token creation begins when a project launches its native token with a defined maximum supply. This maximum can be fixed permanently (like Bitcoin’s 21 million) or it can be programmed to decrease over time through smart contracts. Once tokens enter circulation through mining, staking, or initial distribution, the deflationary mechanism kicks in.

Supply reduction occurs through various channels. The most common method is token burning, where a portion of tokens is sent to a “dead” wallet address from which they can never be retrieved. Other methods include automatic transaction fee burns, scheduled halving events that reduce block rewards, and buyback and burn programs funded by project revenues.

Value dynamics then come into play. As the circulating supply decreases and demand remains stable or grows, the price per token may increase. This economic pressure is what attracts long term holders and investors who view deflationary tokens as appreciating assets rather than spending currencies.

It is worth noting that deflationary mechanisms do not operate in isolation. They interact with other factors such as market sentiment, macroeconomic conditions, regulatory news, technological upgrades, and community engagement. A well designed deflationary token takes all of these variables into account, creating a tokenomics model that is resilient under different market conditions. The most sophisticated projects use a combination of scheduled burns, automatic transaction burns, and buyback programs to create multiple layers of deflationary pressure that reinforce each other.

Statement: A robust deflationary mechanism is not just about reducing supply; it is about creating a self reinforcing economic system where token scarcity, network utility, and community incentives work together to generate sustainable long term value.

Inflationary vs Deflationary Cryptocurrencies

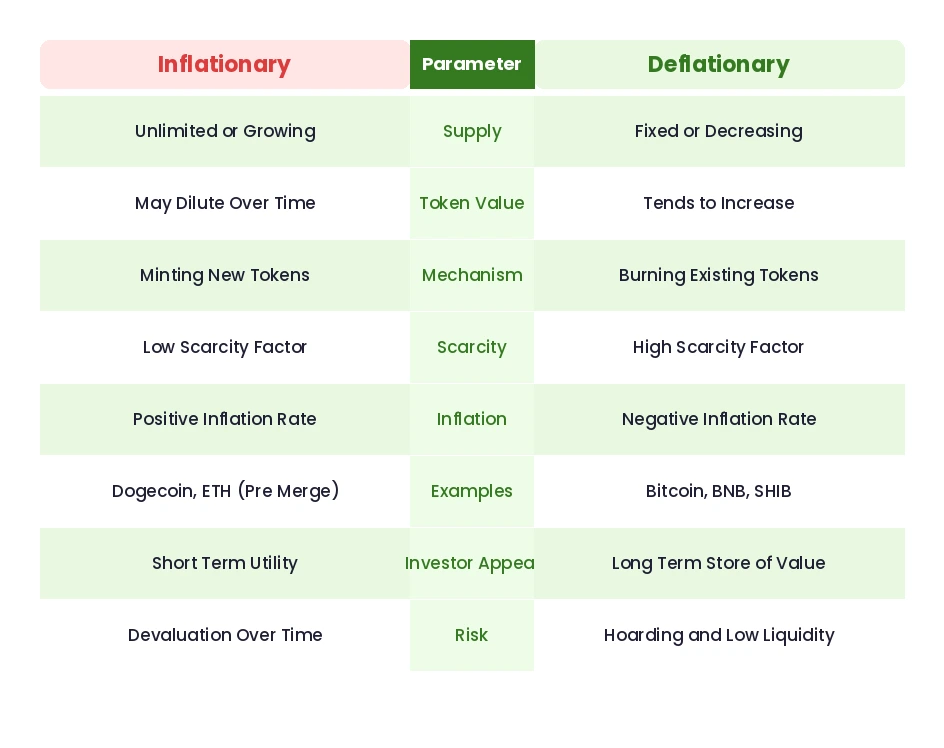

Understanding the distinction between inflationary and deflationary cryptocurrencies is essential for any crypto investor or blockchain project creator. Both models serve different purposes and carry distinct risk profiles. Inflationary tokens are designed to encourage spending and network participation, while deflationary tokens are built to encourage holding and long term value appreciation.

| Parameter | Inflationary Crypto | Deflationary Crypto |

|---|---|---|

| Supply Direction | Increases over time | Decreases or stays fixed |

| Mechanism | Minting new tokens | Burning or halving tokens |

| Scarcity Level | Low; supply grows | High; supply shrinks |

| Price Pressure | Downward over time | Upward over time |

| Investor Incentive | Spend and use quickly | Hold for appreciation |

| Use Case | Payments, rewards, staking | Store of value, governance |

| Examples | Dogecoin, Polkadot | Bitcoin, BNB, SHIB |

| Risk Profile | Value dilution | Liquidity shortage |

Both models have their place in the broader crypto ecosystem. Inflationary tokens work well for networks that need continuous incentives for validators and participants, while deflationary tokens are better suited for projects that want to position their token as a long term investment. Many DAOs in DeFi Space are now experimenting with hybrid models that incorporate elements of both approaches to balance growth incentives with value preservation.

Key Economic Principles Behind Deflationary Tokens

Deflationary cryptocurrency models are rooted in well established economic principles that have governed traditional markets for centuries. The most fundamental of these is the law of supply and demand. When the supply of any asset decreases while demand remains constant or increases, the price of that asset rises. Deflationary tokens are engineered to exploit this exact principle.

Another key concept is monetary velocity. In inflationary economies, people are incentivized to spend quickly because holding money means losing value over time. In deflationary models, the opposite is true: people tend to hold their tokens because their purchasing power is expected to increase. This dynamic is sometimes called the “deflationary spiral” in traditional economics, but in the crypto world it is viewed more positively as a mechanism that rewards early and loyal holders.

The stock to flow model, which has been famously applied to Bitcoin, is also central to understanding deflationary token value. This model measures the relationship between existing supply (stock) and the rate of new production (flow). A high stock to flow ratio indicates scarcity, and assets with high scarcity (like gold) tend to command higher market valuations. Deflationary tokens are specifically designed to increase their stock to flow ratio over time.

Token Burning Mechanisms Explained

Token burning is the most widely used technique for creating deflation in cryptocurrency ecosystems. At its core, burning involves sending tokens to a wallet address that has no private key, making those tokens permanently inaccessible. This effectively removes them from the circulating supply forever. Think of it as the digital equivalent of physically destroying paper currency.

There are several types of burn mechanisms used across different blockchain projects:

Manual Burns: The project team periodically decides to burn a specific quantity of tokens. Binance, for example, conducts quarterly BNB burns based on platform trading volumes. These scheduled events are announced in advance and verified on the blockchain.

Automatic Burns: Smart contracts are programmed to burn a percentage of every transaction. Tokens like SafeMoon popularized this model, where a portion of each trade is automatically sent to the burn address. This creates continuous and decentralized deflation without relying on a central team.

Event Based Burns: Some projects tie burns to specific milestones or events. For instance, a project may burn tokens when it reaches a certain number of users, completes a partnership, or generates a certain level of revenue. This approach ties token scarcity directly to project success.

Buyback and Burn: In this model, the project uses revenue to purchase tokens from the open market and then burns them. This method not only reduces supply but also creates buying pressure, which can support the token price in the short term.

Fixed Supply vs Decreasing Supply Models

Not all deflationary cryptocurrencies work the same way. Two primary models exist within the deflationary category: fixed supply and decreasing supply. Understanding the difference between them is important for evaluating any crypto asset.

Fixed supply models establish a hard cap on the total number of tokens that can ever exist. Bitcoin is the quintessential example, with its 21 million coin limit. In this model, no new tokens are created beyond the cap, and the supply can only decrease if tokens are lost (sent to wrong addresses, lost private keys, etc.). The deflationary pressure here comes from the finite nature of the supply itself rather than active burning.

Decreasing supply models go a step further. These tokens start with a defined initial supply and actively reduce it over time through burning mechanisms. BNB and SHIB are notable examples. BNB started with 200 million tokens and has a target of reducing total supply to 100 million through periodic burns. SHIB has community driven burn initiatives that have already removed trillions of tokens from circulation.

Fixed Supply vs Decreasing Supply: Quick Comparison

| Feature | Fixed Supply | Decreasing Supply |

|---|---|---|

| Cap | Hard maximum set at launch | Initial supply reduced via burns |

| Mechanism | No new issuance beyond cap | Active token burns over time |

| Deflation Speed | Gradual, tied to lost coins | Faster, driven by burn events |

| Examples | Bitcoin, Litecoin | BNB, SHIB, LUNA Classic |

Transaction Fee Burns and Their Impact

One of the most elegant forms of deflationary mechanics is the transaction fee burn. Rather than relying on periodic manual burns by a project team, transaction fee burns happen automatically every time someone uses the network. Ethereum’s EIP 1559 upgrade is the most prominent example of this approach.

Before EIP 1559, all transaction fees (gas fees) on Ethereum went to miners. After the upgrade, a portion of every transaction fee, called the “base fee,” is burned. This means that every time someone sends ETH, executes a smart contract, trades on a decentralized exchange, or mints an NFT, a small amount of ETH is permanently destroyed. During periods of high network activity, Ethereum can actually become net deflationary, meaning more ETH is burned than is created through block rewards.

The impact of transaction fee burns is significant. They create a direct link between network usage and token scarcity. The more popular and useful a network becomes, the more tokens are burned, and the scarcer the remaining supply becomes. This alignment between utility and value is one of the strongest arguments in favor of fee burn models.

For blockchain projects and eco friendly NFT platforms that operate within DeFi ecosystems, transaction fee burns provide a self sustaining deflationary pressure that does not depend on any centralized decision making.

Role of Scarcity in Deflationary Crypto Value

Scarcity has always been a fundamental driver of value in human economics. Gold is valuable partly because it is rare and difficult to extract. Diamonds command premium prices because their supply is perceived as limited. Deflationary cryptocurrencies apply this same principle to the digital world, but with one crucial advantage: the scarcity is mathematically guaranteed and publicly verifiable on the blockchain.

In the context of deflationary tokens, scarcity operates on two levels. First, there is absolute scarcity, which refers to the total supply cap. A token with a hard cap of 10 million units is inherently scarcer than one with a cap of 10 billion. Second, there is relative scarcity, which changes over time as tokens are burned and the circulating supply decreases. Even a token with a large initial supply can become increasingly scarce if its burn rate is high enough.

The psychological impact of scarcity should not be underestimated. When investors know that the supply of a token is decreasing, they are more inclined to hold rather than sell. This creates a positive feedback loop where reduced selling pressure further supports price stability and growth. Many successful DAOs in DeFi Space leverage this psychology by making their governance tokens deflationary, ensuring that community members have a financial incentive to participate and hold.

Popular Deflationary Cryptocurrencies in the Market

The crypto market features several well known deflationary tokens, each with its own unique approach to supply reduction. Here are some of the most notable examples:

| Token | Deflationary Mechanism | Max Supply | Notable Feature |

|---|---|---|---|

| Bitcoin (BTC) | Halving events every ~4 years | 21 million | Pioneer of fixed supply model |

| BNB | Quarterly auto burn | Target: 100M | Burns tied to platform usage |

| Ethereum (ETH) | EIP 1559 base fee burn | No hard cap (net deflationary) | Burns tied to network activity |

| SHIB | Community and portal burns | Trillions (reducing) | Community driven deflation |

| PancakeSwap (CAKE) | Regular token burns | Reducing supply | DeFi native deflationary token |

Each of these projects demonstrates a different philosophy toward deflation. Bitcoin relies on predetermined scarcity, Ethereum uses usage based burns, BNB ties burns to corporate revenue, and SHIB empowers its community to drive supply reduction. This diversity shows that there is no single “right” approach to deflationary tokenomics.

Use Cases of Deflationary Cryptocurrencies

Deflationary tokens serve a variety of purposes beyond simple speculation. Their unique economic properties make them well suited for several practical applications in the blockchain ecosystem.

Store of Value: The most straightforward use case for deflationary tokens is as a digital store of value. Just as people buy gold to preserve wealth, investors purchase deflationary tokens with the expectation that their value will hold or increase over time. Bitcoin is often referred to as “digital gold” precisely because of this characteristic.

Governance Tokens: In decentralized autonomous organizations, deflationary governance tokens give holders both voting power and economic incentive. Because the tokens become scarcer over time, governance participants are rewarded for their commitment. DAOs in DeFi Space frequently use deflationary mechanics to align community interests with protocol health.

Collateral in DeFi: Deflationary tokens can serve as collateral in lending and borrowing protocols. Because their value is expected to hold or appreciate, they are often preferred as collateral over inflationary tokens that might lose value. This makes them particularly useful in DeFi lending markets.

NFT Ecosystems: Some NFT platforms and NFT marketplace smart contract implementations use deflationary tokens for minting and trading NFTs. As the token supply decreases, the cost of minting may increase, which can add a layer of exclusivity and value to the NFTs created on that platform.

Loyalty and Rewards: Businesses building on blockchain can use deflationary tokens for loyalty programs. As users earn and hold tokens, the decreasing supply means their rewards become more valuable over time, creating stronger customer retention.

Advantages of Deflationary Crypto Models

Deflationary cryptocurrencies offer several compelling advantages that make them attractive to both individual investors and institutional participants.

The most obvious advantage is potential value appreciation. By reducing supply over time, deflationary tokens create upward price pressure when demand remains constant or grows. This built in economic incentive makes them appealing for long term investment strategies.

Transparency and predictability are also major benefits. Unlike central bank monetary policies that can change without warning, deflationary crypto mechanisms are encoded in smart contracts. Anyone can verify the burn rate, total supply, and scheduled events on the blockchain. This level of transparency builds trust among investors.

Inflation protection is another significant advantage. In a global economy where fiat currencies are constantly losing purchasing power, deflationary tokens offer an alternative that moves in the opposite direction. This makes them particularly attractive in regions with high currency inflation.

Community alignment is strengthened through deflationary models. When every token holder benefits from supply reduction, the entire community has a shared incentive to promote the project, participate in governance, and support the ecosystem. This alignment is especially powerful in DAO structures.

Finally, deflationary tokens tend to attract serious long term investors rather than short term speculators. The incentive to hold rather than flip creates a more stable investor base, which can lead to less volatile price action and more sustainable growth over time.

Risks and Limitations of Deflationary Tokens

While deflationary tokens have many advantages, they are not without risks and limitations. A responsible investor or project creator should carefully consider these challenges before committing.

Liquidity concerns are perhaps the most significant risk. When token holders are incentivized to hold rather than sell, the number of tokens available for trading on exchanges may decrease. Low liquidity can lead to wide bid ask spreads, high slippage, and difficulty entering or exiting positions at desired prices.

Hoarding behavior can stifle network activity. If everyone holds their tokens and nobody spends them, the network’s actual utility decreases. A cryptocurrency that nobody uses for transactions or interactions becomes little more than a speculative asset, which undermines the original purpose of blockchain technology.

Deflationary spirals in extreme cases can be harmful. If users expect prices to continuously rise, they may delay spending indefinitely. This can slow economic activity within the token’s ecosystem and reduce the attractiveness of the network for new users and businesses.

Smart contract risks exist for any token that relies on automated burn mechanisms. If the burn logic has a bug or vulnerability, it could result in excessive burns, insufficient burns, or even exploitation by malicious actors. Thorough auditing of smart contracts is essential.

Regulatory uncertainty is another factor. As governments around the world develop crypto regulations, deflationary tokens may face scrutiny, especially if they are classified as securities due to the expectation of profit from holding them.

Impact of Deflation on Investor Behavior

The deflationary nature of a cryptocurrency significantly influences how investors interact with it. Understanding these behavioral patterns is crucial for anyone participating in the crypto market or designing tokenomics for a new project.

The hold mentality is the most prominent behavioral shift. When investors know that the supply of a token is shrinking, they are more likely to buy and hold rather than trade actively. This “hodl” culture, which originated in the Bitcoin community, is directly tied to deflationary expectations. Investors view their tokens as appreciating assets and are reluctant to sell.

Fear of missing out (FOMO) is amplified by deflationary mechanics. As tokens are burned and become scarcer, potential buyers feel urgency to acquire them before prices rise further. This can lead to accelerated buying during burn events or supply milestones.

Deflationary tokens also attract a different investor demographic. Long term value investors who are accustomed to traditional assets like gold or real estate find deflationary crypto models familiar and appealing. This can broaden the investor base beyond typical crypto enthusiasts to include more conservative and institutional investors.

However, deflationary dynamics can also lead to irrational exuberance. During bull markets, the combination of rising prices and decreasing supply can create speculative bubbles. Investors may overestimate the price appreciation potential and invest more than they can afford to lose, leading to painful corrections when market sentiment shifts.

Deflationary Cryptocurrencies and Long Term Value

The long term value proposition of deflationary cryptocurrencies rests on a simple thesis: assets that become scarcer over time tend to appreciate in value, provided that demand remains stable or grows. This thesis has been validated by Bitcoin’s price trajectory over the past decade, where each halving event has been followed by significant price appreciation.

However, long term value is not guaranteed solely by deflation. The underlying utility of the token must also grow. A deflationary token with no real use case will eventually lose value regardless of how many tokens are burned. The most successful deflationary projects combine supply reduction with genuine utility, strong community engagement, active development, and integration with the broader DeFi and Web3 ecosystem.

For institutional investors, deflationary tokens offer a unique portfolio diversification opportunity. Because their value dynamics differ fundamentally from traditional equities and bonds, they can serve as an uncorrelated asset class that provides upside potential during inflationary macroeconomic environments.

Thesis: Deflationary tokens that combine engineered scarcity with genuine ecosystem utility will outperform those that rely solely on supply reduction mechanics over multi year holding periods.

How to Evaluate a Deflationary Crypto Project

With hundreds of deflationary tokens in the market, knowing how to evaluate them is critical. Not all deflationary projects are created equal, and several key parameters can help distinguish high quality projects from those that are unlikely to deliver long term value.

| Evaluation Parameter | What to Look For | Red Flag |

|---|---|---|

| Burn Mechanism | Transparent, automated, audited | Manual burns with no schedule |

| Total Supply Cap | Clearly defined and immutable | Team can modify supply cap |

| Team Transparency | Known team, public profiles | Anonymous with no track record |

| Smart Contract Audit | Audited by reputable firms | No audit or unknown auditor |

| Utility | Real use case beyond speculation | Token exists only for trading |

| Community Governance | Active DAO and voting system | Centralized control over burns |

Beyond these parameters, look at the project’s roadmap and execution history. A deflationary token backed by a team that consistently delivers on its promises is far more likely to succeed than one with ambitious plans but no track record. Also consider the liquidity profile: adequate trading volume on reputable exchanges is essential for any investment you might want to exit in the future.

Tokenomics Design for Deflationary Models

Designing effective tokenomics for a deflationary model requires balancing multiple factors to create a sustainable ecosystem. The goal is to make the token valuable enough to hold while maintaining sufficient liquidity and network activity.

Initial supply distribution is the foundation. A well designed deflationary token should allocate its initial supply across development, community rewards, team vesting, liquidity pools, and burn reserves. Heavy concentration in team wallets is a red flag, as it gives insiders disproportionate control over the token’s economic dynamics.

Burn rate calibration is crucial. Burning too many tokens too quickly can starve the ecosystem of liquidity. Burning too few or too slowly may not create enough deflationary pressure to attract investors. The ideal burn rate depends on factors like total supply, expected transaction volume, and the token’s primary use case.

Incentive alignment ensures that all participants benefit from the deflationary mechanics. Token holders should see value appreciation, users should receive utility from using the token, and the project team should have long term incentives aligned with the community. Vesting schedules, lock up periods, and DAO governance mechanisms all play a role in achieving this alignment.

Example: Consider a hypothetical DeFi lending protocol that issues 100 million governance tokens. It might allocate 40% to community rewards (vested over 4 years), 20% to the development team (with a 2 year cliff), 20% to liquidity provision, 10% to a burn reserve, and 10% to strategic partnerships. A 2% transaction burn rate would gradually reduce supply while maintaining healthy trading activity.

Vesting and lock up structures are equally important in deflationary tokenomics design. When team tokens are locked for extended periods, it signals long term commitment and prevents early dumping that could erode community trust. Many successful deflationary projects implement cliff vesting, where team tokens remain fully locked for an initial period before gradually unlocking. Combined with ongoing token burns, this creates a dual mechanism of supply reduction and controlled distribution that supports price stability.

Dynamic burn rate adjustment is an advanced tokenomics strategy where the burn percentage changes based on predefined conditions. For example, a project might increase the burn rate when trading volume exceeds a certain threshold and reduce it during periods of low activity. This responsive approach prevents excessive deflation during quiet markets while maximizing supply reduction during peak demand. Several DAOs in DeFi Space are now incorporating governance votes to adjust burn rates, giving the community direct control over the token’s deflationary trajectory.

Token utility diversification is another pillar of sound deflationary design. A token that serves multiple purposes within its ecosystem, such as governance voting, fee payments, staking rewards, and access to premium features, generates more organic transaction volume. Higher transaction volume, combined with per transaction burns, creates stronger and more sustainable deflationary pressure. Projects that rely on a single use case for their token often struggle to maintain sufficient burn activity to deliver meaningful deflation.

Regulatory Considerations for Deflationary Cryptos

As the cryptocurrency industry matures, regulatory scrutiny is increasing worldwide. Deflationary tokens face unique regulatory challenges that project creators and investors should understand.

In many jurisdictions, the Howey Test (or its equivalent) is used to determine whether a token qualifies as a security. Deflationary tokens that are marketed primarily as investments with an expectation of profit from the efforts of others may be classified as securities. This classification would subject them to registration requirements, disclosure obligations, and trading restrictions.

Tax implications also differ for deflationary tokens. In some countries, token burns may trigger taxable events if they affect the token’s fair market value. Investors need to understand the tax treatment of deflationary tokens in their specific jurisdiction and maintain accurate records of all transactions and burn events.

Anti manipulation regulations are another area of concern. Some regulators may view coordinated burn events or buyback and burn programs as forms of market manipulation if they are designed primarily to inflate the token’s price. Projects should ensure that their burn mechanisms serve legitimate economic purposes beyond price support.

Engaging with legal counsel experienced in blockchain and crypto regulation is essential for any project implementing deflationary tokenomics. Smart and sustainable blockchain approaches that proactively address regulatory concerns are more likely to achieve long term success and institutional adoption.

Deflationary Cryptocurrencies in DeFi Ecosystems

Decentralized Finance has become one of the most dynamic sectors in the blockchain industry, and deflationary tokens play an increasingly important role within it. The intersection of deflation and DeFi creates unique opportunities and challenges that are shaping the future of decentralized economics.

In decentralized exchanges (DEXs), deflationary tokens are popular trading pairs because their scarcity dynamics attract both traders and liquidity providers. Platforms like PancakeSwap burn CAKE tokens regularly, making the platform’s native token increasingly scarce while rewarding users who provide liquidity.

Lending and borrowing protocols benefit from deflationary tokens as collateral. Because deflationary tokens are expected to maintain or increase their value, they offer lenders better collateral security compared to inflationary tokens that might lose value. This makes deflationary tokens preferred collateral in protocols like Aave, Compound, and their successors.

Yield farming with deflationary tokens presents an interesting dynamic. Users who stake deflationary tokens in yield farming pools benefit from both the farming rewards and the potential price appreciation driven by token burns. This dual incentive structure can make deflationary token farms particularly attractive.

DAOs in DeFi Space are perhaps the most natural home for deflationary tokens. When a DAO’s governance token is deflationary, every member’s voting power and economic stake becomes proportionally more valuable over time. This creates a powerful alignment between governance participation and financial reward, encouraging active and thoughtful community engagement.

Future Trends in Deflationary Cryptocurrency Development

The future of deflationary cryptocurrencies is being shaped by technological innovation, evolving market demands, and regulatory developments. Several emerging trends are worth watching closely.

Hybrid tokenomics models are gaining traction. Rather than being purely inflationary or deflationary, new projects are designing tokens that switch between modes based on network conditions. For example, a token might be inflationary during its growth phase to incentivize adoption and then transition to a deflationary model once the network reaches maturity. This adaptive approach allows projects to enjoy the benefits of both models at the right times.

AI driven burn optimization is an emerging area. Some projects are exploring the use of artificial intelligence to dynamically adjust burn rates based on real time market conditions, network usage patterns, and economic indicators. This could create more efficient deflationary mechanisms that respond intelligently to changing circumstances.

Cross chain deflationary protocols are becoming more common as the multi chain ecosystem grows. Tokens that operate across multiple blockchains need coordinated burn mechanisms that work consistently regardless of which chain the tokens are on. This presents both technical challenges and opportunities for innovation.

Layer 2 integration will play a significant role in the future of deflationary tokens. As more transactions move to Layer 2 scaling solutions, the fee burn mechanisms that operate on Layer 1 may need to be adapted. Projects that successfully implement deflationary mechanics on Layer 2 networks will have a significant competitive advantage.

Institutional adoption of deflationary crypto assets is expected to accelerate. As traditional finance continues to embrace digital assets, the predictable and transparent nature of deflationary tokenomics makes these tokens particularly attractive to institutional investors who value mathematical certainty over discretionary monetary policy.

The evolution of DAOs in DeFi Space will also drive innovation in deflationary design. As DAOs become more sophisticated, their governance frameworks will increasingly incorporate dynamic deflationary mechanisms that adjust based on community votes, protocol revenues, and ecosystem growth metrics.

Real world asset tokenization is another frontier where deflationary tokens are expected to make an impact. As physical assets like real estate, commodities, and art are tokenized on the blockchain, deflationary supply models can be applied to these digital representations. This creates a fascinating intersection between traditional asset scarcity and programmable digital deflation.

Privacy focused deflationary tokens represent yet another emerging trend. Projects are exploring how to combine privacy preserving technologies with transparent deflationary mechanisms, allowing users to transact privately while still benefiting from provably decreasing token supplies. This balance between privacy and transparency is a technically challenging but commercially valuable frontier.

Statement: The next generation of deflationary tokens will not just reduce supply; they will dynamically optimize their economic models using artificial intelligence, cross chain coordination, and community governance to create unprecedented value for holders and participants alike.

Ready to Build Your Deflationary Token or Blockchain Project?

Consult with blockchain experts who understand tokenomics, smart contract design, and DeFi ecosystems inside and out.

Why Nadcab Labs is Your Trusted Partner for Deflationary Token Projects

When it comes to designing, building, and deploying deflationary cryptocurrency projects, Nadcab Labs stands out as an industry leader with over 8+ years of hands on experience in blockchain technology, smart contract engineering, and decentralized ecosystem architecture. Our team has worked with startups, enterprises, and DAOs across the globe to create robust tokenomics models that balance scarcity, utility, and community growth. From architecting DAOs in DeFi Space to implementing sophisticated burn mechanisms and multi chain token frameworks, Nadcab Labs brings deep technical authority and a proven track record of delivering production grade blockchain solutions. We understand the nuances of deflationary design, including regulatory compliance, smart contract auditing, liquidity management, and governance integration. Whether you are launching a new deflationary token, upgrading your existing tokenomics, or building a full scale DeFi protocol, Nadcab Labs provides end to end support grounded in real world expertise and a commitment to innovation. Our authoritative approach to blockchain consulting ensures that your project is built on a solid foundation that can withstand market volatility and evolve with the rapidly changing crypto landscape. Partner with Nadcab Labs and turn your deflationary crypto vision into a market ready reality.

Frequently Asked Questions

Yes, some tokens are designed with adaptive tokenomics. Ethereum, for example, was inflationary before EIP 1559 and The Merge but now experiences periods of net deflation when network activity is high enough for base fee burns to exceed new issuance.

In practice, all tokens can never be fully burned. Most burn mechanisms are percentage based, meaning each burn removes a fraction of the remaining supply. This creates an asymptotic curve where supply approaches zero but never actually reaches it.

Not necessarily. While deflationary tokens benefit from supply reduction, their long term success depends on actual utility, community adoption, team execution, and market conditions. A strong inflationary token with massive utility can outperform a deflationary token with no real use case.

You can verify burns by checking the designated burn wallet address on blockchain explorers like Etherscan or BscScan. Legitimate projects publish their burn address publicly, and every burn transaction is permanently recorded on chain for anyone to audit.

Tokens with on chain burn mechanisms may have slightly higher gas costs because the burn function adds extra computation to each transaction. However, the difference is usually minimal and is considered a worthwhile tradeoff for the deflationary benefits.

Yes, many deflationary tokens offer staking options. When you stake a deflationary token, you earn staking rewards while simultaneously benefiting from the supply reduction. This creates a compounding effect where your holdings grow in quantity and potentially in value.

Yes, deflationary token logic can be implemented on most smart contract capable blockchains including Ethereum, BNB Smart Chain, Solana, Polygon, and Avalanche. The specific implementation varies by chain, but the core concept of automated burning works across all of them.

Market capitalization is calculated by multiplying the circulating supply by the current token price. When tokens are burned, the circulating supply decreases. If the price stays the same, market cap drops. But often, the reduced supply pushes prices up, which can maintain or increase the overall market cap.

Community members are often the driving force behind deflationary ecosystems. In many projects, community members can vote on burn proposals through DAO governance, participate in voluntary burn events, and promote adoption that increases transaction volume and triggers more automatic burns.

Token burning itself does not consume significant energy beyond the standard transaction cost. Unlike proof of work mining, which is energy intensive, sending tokens to a burn address is a simple blockchain transaction. Projects on proof of stake chains have an even smaller environmental footprint.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.