Key Takeaways

- ICOs modernize asset fundraising by enabling startups and enterprises to raise capital through blockchain-based digital tokens without relying on banks, VCs, or IPOs.

- Tokenization bridges real-world assets and digital finance, allowing assets like real estate, art, and commodities to be fractionally owned, globally accessible, and more liquid.

- Blockchain ensures transparency and efficiency through immutable ledgers and smart contracts that automate asset fundraising, distribution, and compliance processes.

- ICOs democratize investment access, opening participation to global retail investors rather than limiting opportunities to institutions or accredited investors.

- Compared to traditional asset fundraising, ICOs are faster and more cost-effective, often raising capital in days instead of months with reduced legal and intermediary costs.

- Regulation is evolving, shifting ICOs from a high-risk, unregulated space toward compliant models like STOs and IDOs that attract institutional trust.

- Real-world asset fundraising benefits most, gaining liquidity, transparency, global reach, and operational efficiency through blockchain tokenization.

- Risks remain significant, including regulatory uncertainty, market volatility, fraud, and project failure—making due diligence essential for investors.

- Modern ICO models emphasize compliance and fundamentals, focusing on audited smart contracts, KYC/AML, strong teams, and real product utility.

- The future of capital markets is increasingly digital, with ICO solutions playing a key role in reshaping how innovation, assets, and global investment are funded.

Understanding Initial Coin Offerings

How ICOs Differ from Traditional Capital Raising?

Key Differences :

| Aspect | Traditional (VC/IPOs) | ICO Solution |

|---|---|---|

| What Investors Get | Equity (ownership, voting rights, profit share) in an IPO or stake in a VC deal | Digital tokens granting access to a service, platform, or future product, not company ownership |

| Regulation | Heavily regulated (e.g., SEC for IPOs), requiring extensive documentation and investor protection | Often minimally regulated, allowing faster asset fundraising but higher risk of fraud or project failure |

| Investor Base | Often limited to accredited investors or institutions | Open to anyone globally, democratizing investment |

| Speed & Process | Slow, months-long processes involving due diligence and legal frameworks | Can raise millions in days or hours through automated blockchain processes |

| Liquidity | Shares can be liquid (IPOs) or locked in (VCs) | Tokens can often be traded quickly on exchanges, offering high liquidity |

| Control | Investors gain board seats and decision-making power | Investors typically have no voting power or control over the company |

Traditional Methods Compared

- Venture Capital (VC): Private, relationship-driven, for equity, slower, targeted high returns.

- Initial Public Offering (IPO): Public, highly regulated, equity-based, slower, high compliance costs.

Why ICO solutions are Different

The Role of Blockchain in ICO Based Capital Raising

Key Roles of Blockchain in ICOs

- Decentralized and Trustless Infrastructure: An immutable, shared ledger removes reliance on centralized authorities, increasing trust through transparent protocol rules.

- Token Creation and Ownership Tracking: Blockchain enables secure issuance and management of tokens (e.g., ERC-20), with verifiable ownership and transaction history.

- Smart Contract Automation: Smart contracts automate asset fundraising, token distribution, and compliance, reducing costs, errors, and manual intervention.

- Transparency and Investor Confidence: Public transaction records allow real-time verification of fund flows and token supply, improving accountability and credibility.

- Global Participation and Liquidity: ICO allow borderless participation and faster access to secondary markets, offering early liquidity compared to traditional asset fundraising.

- Lower Capital-Raising Barriers: Startups can raise funds more quickly and cost-effectively than through IPOs or venture capital.

- Regulatory Alignment and Market Growth: According to SQ Magazine, regulatory clarity under frameworks such as the EU’s MiCA has improved investor protection, increased institutional participation, and supported renewed growth in ICO asset fundraising.

ICOs in the Modern Regulatory Landscape

Key Regulatory Principles

- Token Classification: Regulators focus on a token’s rights and function, not its label.

- Security Tokens: Function like traditional securities (ownership, dividends, profit-sharing) and must comply with securities laws.

- Utility Tokens: Provide access to a blockchain product/service and may avoid strict securities rules if not primarily purchased for profit.

- Payment Tokens: Serve as a medium of exchange (e.g., Bitcoin) and are often regulated under payment services or commodities laws.

- Investor Protection & Disclosure: Regulations aim to prevent fraud and misleading claims, requiring detailed disclosures (whitepapers), though less standardized than IPO prospectuses.

- AML & KYC: Issuers and exchanges must verify investor identities and monitor transactions to prevent illicit activity.

- Regulatory Scrutiny & Enforcement: Authorities like the SEC actively penalize non-compliant projects with fines and market restrictions.

Enterprise and Startup Use Cases

Common Use Cases for Startups

- Product Development: AI-powered market analysis and predictive modeling for ideation, testing, and success prediction.

- Marketing & Sales: Automated content creation, targeted campaigns, lead scoring, and personalized customer journeys.

- Customer Service: 24/7 support via AI chatbots, FAQ handling, and self-service improvements.

- Operations: Automating data tasks, boosting productivity, and streamlining early-stage processes.

- Recruitment: Resume screening, candidate shortlisting, and interview scheduling.

Common Use Cases for Enterprises (Scale & Optimization)

- Customer Experience: Deep personalization (e.g., Amazon), dynamic pricing (e.g., Uber), and conversational AI.

- Operations & IT: Predictive maintenance, AIOps for autonomous IT, cloud cost optimization, and process automation.

- Finance & Accounting: Automated reporting, risk management, and fraud detection.

- Workforce Management: Optimized staffing, improved onboarding, and enhanced security (user authentication).

Major Ways ICOs Impact Real‑World Asset Fundraising

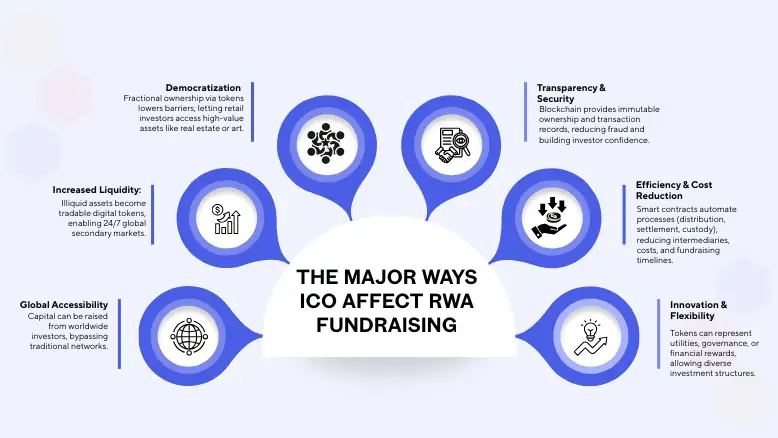

The major ways ICOs affect Real-World Asset fundraising are:

- Democratization: Fractional ownership via tokens lowers barriers, letting retail investors access high-value assets like real estate or art.

- Increased Liquidity: Illiquid assets become tradable digital tokens, enabling 24/7 global secondary markets.

- Transparency & Security: Blockchain provides immutable ownership and transaction records, reducing fraud and building investor confidence.

- Efficiency & Cost Reduction: Smart contracts automate processes (distribution, settlement, custody), reducing intermediaries, costs, and asset fundraising timelines.

- Global Accessibility: Capital can be raised from worldwide investors, bypassing traditional networks.

- Innovation & Flexibility: Tokens can represent utilities, governance, or financial rewards, allowing diverse investment structures.

Risks and Challenges in ICO-Based Asset Fundraising

Regulatory and Legal Challenges

- Legal Uncertainty: Token classification varies by jurisdiction, creating legal risks; ICOs may be legal in some countries but banned in others (e.g., China, South Korea).

- Lack of Investor Protection: Many ICOs operate without the disclosures or safeguards of traditional IPOs, leaving investors with limited legal recourse.

- Information Asymmetry: Whitepapers are often unaudited and may omit key details, making due diligence difficult.

Fraud and Security Risks

- Scams and Fraud: Early ICO solutions faced exit scams and Ponzi schemes; scam rates once reached ~80%.

- Market Manipulation: Unregulated markets allow practices like pump-and-dump schemes.

- Hacking & Technical Vulnerabilities: Smart contracts, exchanges, and wallets can be exploited, risking fund loss.

Financial and Project-Specific Risks

- Extreme Volatility: Token prices fluctuate drastically; ~90% fell below the ICO price within six months during peak markets.

- Project Failure: Many ICOs lack a working product or experienced team; <10% survive long-term.

- Liquidity & Valuation Challenges: Tokens may be illiquid, and traditional valuation methods are often unavailable.

Why ICO Continue to Transform Capital Raising?

Key Transformations & Advantages of ICOs

- Global, Inclusive Access: ICO solutions connect startups with a worldwide investor base, removing the geographical barriers of traditional finance.

- Decentralization & Intermediary-Free Funding: By bypassing banks and venture capitalists, ICO solutions create direct funding channels, reducing costs and time.

- Speed & Efficiency: Fundraising can be completed in weeks, much faster than traditional VC rounds, with minimal overhead.

- Transparency & Automation: Smart contracts govern funds and rules, ensuring automated, secure, and fully transparent processes.

- Community & Ecosystem Engagement: Tokens offer utility, governance, or rewards, fostering active investor communities and aligning incentives.

- Liquidity & Early Participation: Tokens can be traded on crypto exchanges, providing early investors with liquidity while delivering immediate capital to startups.

- Driving Web3 & DeFi Innovation: ICO solutions are key to funding decentralized finance and metaverse projects, fueling growth in new digital economies.

Evolution & Modern Relevance

- Regulatory Adaptation: Modern ICO solutions models such as IDOs and STOs incorporate compliance measures, build trust, and attract institutional participation, unlike early, unregulated ICOs.

- Hybrid Fundraising Models: Hybrid ICO–IDO approaches launch tokens via decentralized exchanges with pre-allocated liquidity, combining ICO advantages with instant public trading.

- Tokenization of Real-World Assets (RWAs): ICO solutions are increasingly used to tokenize tangible assets, unlocking new investment opportunities and emerging market potential.

The Future of ICOs in Capital Markets

Key Trends Shaping the Future of ICOs

- Regulatory Maturation: Frameworks like the EU’s MiCA and evolving U.S. rules provide legal clarity, boosting investor confidence and attracting institutional capital.

- Rise of Security Tokens (STOs): STOs offer compliant, regulated alternatives to utility tokens, representing real-world assets and appealing to traditional investors.

- Emphasis on Fundamentals & Due Diligence: Investors now prioritize strong roadmaps, working prototypes, transparent teams, audits, and KYC to reduce fraud risks.

- DeFi Integration: ICO tokens often power lending, staking, and governance in decentralized platforms, fostering vibrant, community-driven ecosystems.

- Launchpads & Vetting: Platforms like Coinbase vet projects, improve token distribution, and align incentives with long-term success rather than speculation.

Impact on Capital Markets

- Democratized Capital: ICOs lower barriers for entrepreneurs and retail investors, enabling early-stage participation beyond traditional finance.

- Disrupting Traditional Finance: They challenge slow, costly, and centralized capital-raising models.

- Market Growth & Hubs: The global ICO market hit $38.1B[2] in 2025, with crypto-friendly regions like Singapore, Switzerland, and the EU leading activity.

Ready to Explore How Your Startup Can Raise Capital via ICOs

Frequently Asked Questions

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.