Key Market Insights

- The ICO service market has evolved from the highly speculative boom of 2017 into a more structured, compliance-driven, and utility-focused fundraising ecosystem by 2025.

- Market projections indicate steady expansion, with the ICO service market expected to reach USD 25–26 billion by 2033–2035, supported by CAGR estimates ranging from ~7.8% to 12.5%.

- Clearer regulatory frameworks, KYC/AML compliance, and the rise of STOs and IEOs are increasing investor confidence, institutional participation, and secondary-market liquidity.

- Advancements in blockchain scalability, digital contracts, AI, RegTech, and security protocols are reducing fraud risks, improving operational efficiency, and professionalizing ICO services.

- Modern ICOs emphasize real use cases, strong tokenomics, MVPs, and long-term value creation rather than short-term price speculation.

- Ethereum remains the dominant platform for ICO launches, while alternative blockchains such as BSC, Solana, and Polkadot are gaining traction due to lower costs and faster transactions.

- ICOs continue to provide startups with global access to capital, supported by improved cross-border regulatory coordination and streamlined registration systems.

- A growing share of institutional capital is flowing into fully compliant token offerings, indicating that ICOs are becoming an integral part of the broader digital investment landscape.

- While regulatory compliance increases upfront costs and timelines, it delivers advantages such as higher liquidity, stronger investor trust, and broader market access.

- Data from 2025 confirms that ICO growth is driven by real fundraising activity, technological integration, and regulatory alignment—making the market’s expansion evidence-based rather than speculative.

The ICO service market represents a dynamic convergence of blockchain innovation, digital finance, and modern fundraising models. Cryptocurrency and blockchain technology have transformed the way startups and businesses raise capital, with the Initial Coin Offering (ICO) emerging as one of the most prominent approaches. ICOs enable companies to raise funds by issuing digital tokens, offering an alternative to traditional financing methods such as bank loans or venture capital. Through ICOs, startups can reach global investor communities, while the issued tokens may provide utility, governance rights, or future access to a platform. Similar to Initial Public Offerings (IPOs) in the stock market, ICOs facilitate capital raising, but they do not grant ownership in the issuing company.

The ICO market saw massive growth in 2017, with millions of dollars raised in short periods. However, weak regulation, frequent scams, and the volatility of cryptocurrency markets led to investor losses and declining trust. Despite these setbacks, the ICO service market is showing signs of recovery, supported by technological improvements, clearer regulations, and growing investor confidence.

This guide provides an in-depth overview of the ICO service market, including its size, expected growth, key trends, technological developments, regulatory factors, and the reasons its growth is increasingly tied to real-world adoption rather than speculation.

What is an ICO Service?

An Initial Coin Offering (ICO) is a fundraising mechanism used by blockchain-based startups and companies to raise capital by issuing digital tokens. These tokens serve as a type of investment, similar to purchasing shares in a traditional Initial Public Offering (IPO), but they often provide access to platform features, governance rights, or tradable digital assets rather than ownership in the company. ICOs have become a popular way for innovative blockchain projects to gain early-stage funding while bypassing traditional venture capital or banking systems.

Introduction to the ICO Service Market

The (Initial Coin Offering) ICO service market is a growing segment of the global blockchain and cryptocurrency ecosystem that supports companies in raising funds through digital token sales. ICOs allow startups and established organizations to issue their own cryptocurrency tokens to investors in exchange for funding in the form of major cryptocurrencies (like Bitcoin or Ethereum) or fiat money. Unlike traditional fundraising channels such as bank loans or venture capital financing, ICOs provide a decentralized and direct way to secure capital for blockchain-based projects without giving up equity ownership.

In essence, ICOs act as a crypto-version of Initial Public Offerings (IPOs), but instead of selling shares of a company, they sell tokens that may offer future platform utility, access rights, or other functional features within a project’s ecosystem. Because of this utility-based structure, ICOs have become a popular tool for funding blockchain innovations in finance, technology, healthcare, gaming, supply chain, energy, and other industries around the world.[1]

ICO Service Market Size and Future Growth (2025–2035)

The ICO service market is showing a clear trajectory of growth, evolving from a largely speculative phase in 2017 to a more mature and regulated ecosystem by 2025. Market projections indicate that both ICO-specific services and the broader ICO service market are set to expand significantly over the next decade.

1. 2024–2025 Market Overview

- According to WiseGuy Reports, the ICO service market was valued at approximately $10.92 billion in 2024,[2] whereas Verified Market Reports estimated a lower value of around $5.3 billion,[3] reflecting differences in methodology and coverage of token-related services.

- By 2025, the ICO service market segment is projected to reach $11.77 billion,[4] and the total market activity—which includes fundraising through token sales, platform solutions, marketing, and advisory services is expected to grow further as the global ICO service market expands toward an estimated $25 billion by 2035, reflecting sustained growth driven by broader adoption of blockchain-based fundraising and related services.

| Year | Market Size / Forecast | Key Observations |

|---|---|---|

| 2024 | USD 10.92 Billion | The report adopts a broader market definition, incorporating ICO-related fundraising activity, platform solutions, marketing, and advisory services, resulting in a significantly higher valuation. |

| 2024 | USD 5.3 Billion | The Market Reports applies a narrower scope focused primarily on core ICO service offerings, excluding some adjacent token-related activities, leading to a lower market estimate. |

| 2025 | USD 11.77 Billion | Continued growth reflects expanding enterprise adoption of tokenization, increased regulatory clarity, and rising demand for end-to-end ICO service solutions. |

| 2025 | Approaching USD 12 Billion + (Total Market Activity) | When including token sales, marketing, advisory, and infrastructure services, overall ICO-related market activity is projected to reach a higher aggregate value than the core service segment alone. |

2. Platform Adoption & Blockchain Trends

- Ethereum Dominance: Ethereum remains preferred blockchain for ICO due to its robust digital contract capabilities, security, and widespread expert support. In 2025, around 43%[5] of all ICOs were launched on Ethereum, indicating its continued relevance in token creation and sales.

- Emerging Platforms: Other blockchains like Binance Smart Chain (BSC), Solana, and Polkadot are gaining traction due to lower transaction costs and faster confirmation times, capturing a growing share of ICO launches.

3. Average Fundraising per ICO

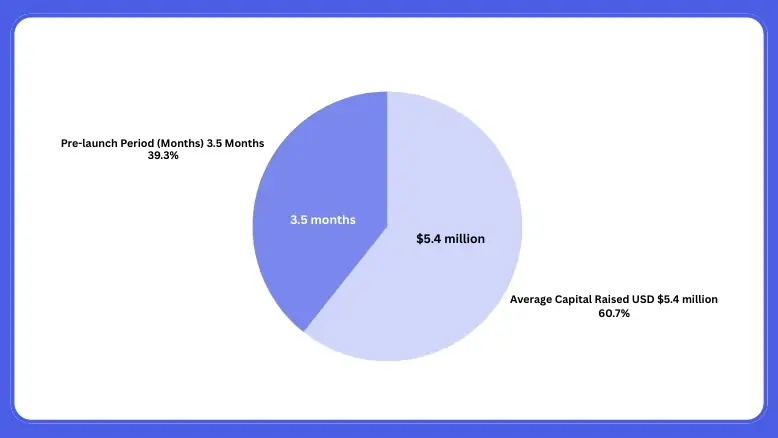

- In 2025, the average capital raised per ICO was approximately $5.4 million,[6] signaling increased investor confidence in well-structured, compliant projects.

- The pre-launch period averaged 3.5 months,[7] allowing startups time to finalize whitepapers, digital contracts, and marketing campaigns, while providing investors sufficient information for informed decision-making.

- Higher average fundraising amounts reflect maturing investor behavior, as participants are focusing on projects with real utility, technical feasibility, and transparent roadmaps.

4. Forecast for 2030–2035

- Analysts project that the ICO service market could grow to $25-26 billion by 2035,[8] depending on adoption rates, regulatory evolution, and technological innovation.

- Some reports suggest an ICO service market size of $25.7 billion by 2033 with a CAGR of 10.5%,[9] highlighting steady long-term growth.

- The growth trajectory reflects the transition from speculative token sales to structured fundraising, including regulated Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs).

| Year / Period | Market Size – Forecast (by source) | Key Observations |

|---|---|---|

| 2030 (est.) | USD ~20–22 Billion | Growth reflects the accelerating adoption of regulated token fundraising models, with ICO services increasingly overlapping with STO and IEO infrastructure. |

| 2033 | USD 25.7 Billion | The forecast is based on a 10.5% CAGR (2026–2033), indicating steady long-term expansion driven by institutional participation and regulatory alignment. |

| 2033–2035 | USD 25–26 Billion | Projection range depends on regulatory evolution, technological innovation, and the pace of global blockchain adoption. |

| 2035 (upper bound) | USD ~26 Billion | Represents a mature market stage where ICO services function as structured, compliance-oriented digital fundraising solutions rather than speculative instruments. |

5. CAGR Variations and ICO Service Market Drivers

CAGR Projections: Growth rates for the 2025–2035 period range from ~7.8%,[10]to over 12.5%,[11] depending on the source and methodology. Variations are influenced by:

-

- The level of regulatory adoption in key markets (US, EU, Singapore, Japan).

- Institutional participation tends to favor more regulated offerings.

Technological innovations, such as AI integration, Layer-2 scalability solutions, and blockchain interoperability.

-

Key Growth Drivers:

- Blockchain Adoption: Broader use of blockchain in DeFi, supply chain, gaming, and enterprise solutions drives demand for ICO-funded projects.

- Regulatory Clarity: Compliance with KYC/AML laws and securities regulations reduces risk, attracting both retail and institutional investors.

- Investor Maturity: Modern investors focus on verified projects with Minimum Viable Products (MVPs), strong tokenomics, and transparent governance.

- Technological Integration: digital contracts, AI analytics, and advanced security protocols improve efficiency and trust.

Global Reach: ICOs allow startups to access international investor pools, increasing fundraising potential beyond local markets.

6. Historical Growth Context

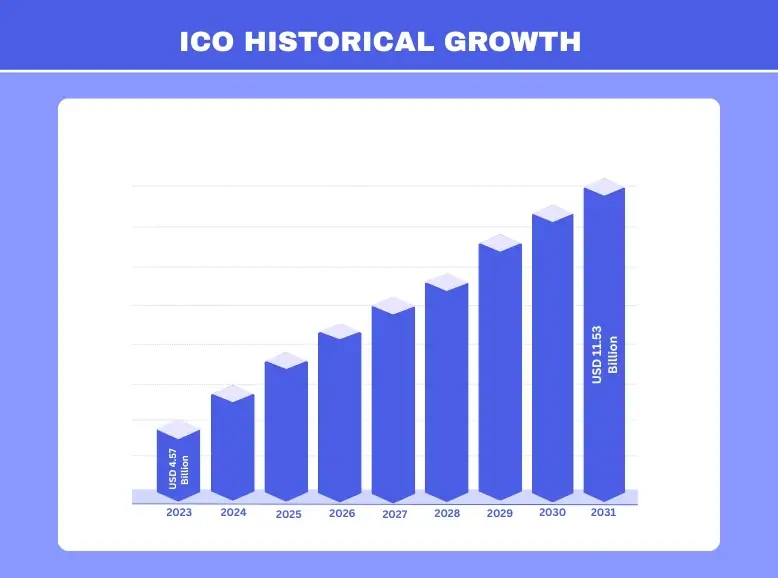

- In 2023, the ICO service market was valued at $4.57 billion,[12] reflecting the post-2017 consolidation phase where many projects failed or shifted to other fundraising models.

Forecasts indicate the ICO service market will reach $11.53 billion by 2031,[13] growing at a CAGR of 12.5% from 2024 to 2031, driven by renewed investor confidence and the rise of regulation-compliant projects.

7. Regional Insights

- North America: Leads ICO adoption due to technological infrastructure, active investor communities, and relatively favorable regulations.

- Asia-Pacific: Countries like Singapore, Japan, and South Korea are facilitating blockchain innovation through sandbox programs and supportive ICO regulations.

- Europe: GDPR compliance and regulatory sandboxes are enabling secure, transparent ICO launches.

The ICO service market is maturing from a speculative trend to a structured, regulated, and technologically advanced ecosystem. Investors are increasingly focusing on projects with real utility, transparent governance, and robust technical frameworks, while startups benefit from a growing network of solution, marketing, and compliance services.

With projections pointing to $25–26 billion by 2035 [14] and steady annual growth, the ICO service market represents a viable and sustainable avenue for blockchain funding, combining technological innovation with increasing investor confidence.

Key ICO service Market Trends

- Regulatory Evolution: The ICO service market is increasingly prioritizing compliance, with Security Token Offerings (STOs) gaining momentum as a regulated alternative to traditional ICOs. STOs provide legal clarity and are often backed by real-world assets, improving investor protection and trust.

- DeFi and DAO Integration: ICOs are increasingly used to fund projects within Decentralized Finance (DeFi) ecosystems and Decentralized Autonomous Organizations (DAOs). This convergence is expanding access to global capital pools and redefining traditional fundraising structures.

- Real-World Asset (RWA) Tokenization: The tokenization of tangible assets such as real estate, commodities, and financial instruments is adding stability and legitimacy to token offerings, appealing to investors seeking asset-backed value.

- AI and Automation: Artificial intelligence is being applied to market forecasting, fraud detection, and automated community engagement, while digital contracts continue to enhance transparency, efficiency, and operational automation across ICO platforms.

- Emphasis on Utility and Tokenomics: Projects are increasingly required to demonstrate clear use cases, well-defined token economics, and realistic roadmaps to attract more sophisticated and risk-aware investors.

- Improved Transparency and Due Diligence: Higher expectations around digital security audits, disclosure standards, and governance frameworks are helping reduce fraud risks and improve overall ICO service market credibility.

- Community-Driven Approaches: Strong online communities play a critical role in building awareness, trust, and long-term engagement, making community management a central component of ICO strategies.

- Blockchain Scalability Advancements: Solutions such as Layer 2 solutions and sharding technologies are enabling higher transaction throughput and lower fees, making ICO platforms more efficient and attractive.

Sustainable and Green ICOs: There is a growing industry focus on environmentally responsible blockchain solutions, including energy-efficient consensus mechanisms and sustainable token models.

Technological Innovations Impacting ICO Services

Technological innovation is playing a crucial role in reshaping Initial Coin Offering (ICO) services by improving security, operational efficiency, regulatory compliance, and overall functionality. As the ICO service market matures, the integration of advanced technologies has helped address many of the challenges faced during earlier fundraising cycles, particularly those related to fraud, scalability, and investor protection. These innovations have transformed ICOs into more structured and reliable fundraising mechanisms within the broader blockchain ecosystem.

Key Technological Innovations and Their Impact on ICO Services:

Blockchain Technology:

Blockchain technology serves as the foundation of ICO services by providing a decentralized and transparent ledger for recording transactions and token ownership. This transparency allows investors to independently verify token issuance and fund flows, reducing the risk of manipulation and fraud. The immutability of blockchain records further enhances trust by ensuring that transaction data cannot be altered after execution.

Digital Contracts:

Digital contracts are self-executing programs that automate the token sale process, including fund collection, token distribution, and vesting schedules. By removing the need for intermediaries, digital contracts reduce operational costs and minimize human error. When subjected to rigorous digital security audits, these contracts significantly lower the risk of vulnerabilities and ensure a secure and reliable fundraising environment.

Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML technologies are increasingly integrated into ICO services to improve compliance, security, and user engagement. AI-driven systems automate Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, enhance fraud detection through behavioral analysis, and provide predictive analytics that help optimize investment strategies. Additionally, AI enables personalized user experiences, improving investor engagement and platform usability.

Regulatory Technology (RegTech):

RegTech solutions leverage automation and data analytics to help ICO platforms navigate complex and evolving regulatory environments. These tools assist in monitoring compliance requirements across jurisdictions, managing documentation, and ensuring adherence to AML and KYC regulations. The adoption of RegTech enhances legitimacy while reducing legal and operational risks for ICO projects.

Advanced Security Protocols:

To protect investor assets and maintain platform integrity, ICO services implement robust security measures such as multi-factor authentication, data encryption, distributed denial-of-service (DDoS) protection, and regular digital security audits. These protocols are essential for preventing unauthorized access, safeguarding sensitive information, and sustaining investor confidence in digital fundraising platforms.

Decentralized Finance (DeFi) Integration:

ICOs are increasingly integrating with DeFi protocols to expand token utility beyond fundraising. Through DeFi integration, tokens can be used for lending, borrowing, liquidity provision, and governance participation. This added functionality enhances the value proposition of tokens and attracts a broader range of investors seeking both utility and financial incentives.

Cloud Computing Infrastructure:

Cloud computing provides the scalability, flexibility, and security required for ICO platforms to handle large transaction volumes and growing user bases. By leveraging cloud infrastructure, ICO service providers can deploy platforms efficiently without significant upfront investment in physical infrastructure, enabling rapid scaling and cost optimization.

Advanced Data Analytics:

Data analytics tools enable ICO projects to collect and analyze large volumes of ICO service market and investor data. These insights support data-driven decision-making in areas such as token design, marketing strategy, and community engagement. By understanding investor behavior and market trends, projects can improve campaign effectiveness and long-term sustainability.

Regulatory Challenges and Opportunities for ICO

The regulatory environment for Initial Coin Offerings (ICOs) is evolving rapidly. While compliance provides legitimacy and investor protection, it also introduces challenges that can affect project timelines, costs, and operational strategies.

Approval Process and Delays

The average regulatory approval process currently takes 3.5 months, causing delays for nearly 46% of new ICO startups. These procedural timelines highlight the importance of early planning for issuers seeking to launch their token sales efficiently.

Compliance Costs

Meeting global regulatory standards involves significant financial investment. Compliance costs for ICO issuers typically range from $150,000 to $500,000, creating hurdles for 38% of smaller projects that may lack sufficient capital. These costs cover legal advisory, auditing, reporting, and licensing requirements.

Additional Licensing Requirements

Hybrid token projects, which combine utility and security features, face additional regulatory scrutiny. In 2025, 22% of hybrid token projects required extra licenses to resolve regulatory ambiguities, reflecting ongoing challenges in aligning novel token structures with existing frameworks.

Cross-Border Compliance

ICOs targeting investors in multiple regions encounter extra regulatory layers. About 41% of such ICOs must comply with U.S., Asian, or other jurisdictional rules, increasing operational complexity and the need for multi-jurisdictional legal guidance.

Stablecoin Regulations

Stablecoin-backed ICOs face stricter requirements, including 100% reserve obligations, which have impacted launch rates for 29% of smaller issuers. While these rules enhance investor confidence, they also pose capital-intensive constraints for new entrants.

Institutional Participation

Regulatory-compliant projects are attracting more institutional investment. In 2025, 45% of institutional capital targeted fully compliant ICOs, up from 21% in 2023, signaling growing confidence in regulated offerings.

Global Regulatory Trends

Regulatory harmonization is spreading worldwide. Approximately 64% of Asian and U.S. regulators are evaluating or implementing frameworks to oversee cross-border ICO offerings, highlighting the global influence of regulatory standards.

Secondary Market Liquidity

Compliance positively affects the ICO service market dynamics. In 2025, 67% of regulated ICO tokens experienced increased secondary-market liquidity on exchanges, reflecting investor trust and enhanced tradability.

Streamlined Registration

New cross-border registration systems now cover multiple regions, significantly improving efficiency by streamlining ICO registration by 92%. This allows compliant projects to access multiple markets through a single approval process.

In this information, while global regulatory frameworks[15] introduce costs and procedural requirements, they also provide clear advantages: improved investor confidence, greater institutional participation, enhanced liquidity, and streamlined cross-border operations. ICO issuers that proactively integrate regulatory compliance into their planning are better positioned to navigate challenges and capitalize on these opportunities.

Why Is ICO Service Market Growth Not Just a Prediction?

The growth of the ICO service market isn’t simply a guess, it is grounded in real data and measurable trends that show clear momentum in 2025. After the early excitement around ICOs in 2017 faded, the market stabilized and began to grow again as technology, regulation, and investor interest improved. Today, ICOs are no longer just speculative projects; they are becoming structured, compliant, and strategically valuable ways for blockchain projects to raise capital.

Real‑World ICO Service Market Growth

In 2025, the overall ICO service market saw a significant rebound, with total funding and activity increasing across regions such as North America, Asia‑Pacific, and Europe. A global fundraising total of $38.1 billion in 2025 reflects strong investor participation and renewed confidence in blockchain funding channels not just short‑lived speculation.

Smarter Fundraising Models

Today’s ICOs are much more sophisticated than the early versions. Instead of purely speculative tokens, many projects now use smarter structures like:

- Security Token Offerings (STOs) that give clearer legal backing

- IEOs (Initial Exchange Offerings), where established exchanges help manage compliance and investor access

These regulated or hybrid models make fundraising safer and more reliable, helping attract serious investors rather than speculative traders.

Institutional and Retail Investor Interest

Investor confidence is growing. While detailed institutional data on ICOs specifically varies by region, broader reports show increasing institutional participation in digital assets[16] overall in 2025, with many institutions allocating more to crypto strategies that include tokenized offerings.

This shift means ICOs are not just hobby projects — they are part of an expanding digital investment landscape.

AI and Technology Integration

Another real driver of growth is modern technology. Projects in 2025 are increasingly integrating AI, machine learning, and advanced blockchain features,[17] such as AI‑enhanced fundraising analytics and cross‑chain token sales. These technologies improve market analysis, digital contract security, and investor engagement, which helps make ICOs more efficient and credible.

Evolving Compliance and Regulation

Improved regulatory clarity in many markets — such as clearer rules for token classification and fundraising compliance — has also helped legitimize ICOs. Regulations no longer simply restrict ICOs; they guide them toward transparent, legal structures that give investors more protection and confidence.

A Focus on Utility and Long‑Term Value

Modern ICO projects are increasingly focused on real utility rather than short‑term price speculation. Tokens now often offer meaningful functions within ecosystems — such as governance voting, access to services, or revenue‑sharing rights — making them more attractive to both retail and professional investors.

The growth of the ICO service market is supported by concrete 2025 facts, including major funding totals, new compliance frameworks, evolving technology, and rising participation from both retail and institutional investors. These trends show that ICOs are moving beyond hype — becoming a stable, adaptive, and strategic funding mechanism in the blockchain economy.

Frequently Asked Questions

An ICO, or Initial Coin Offering, is a blockchain-based fundraising method in which a project issues its own cryptocurrency tokens to investors, typically in exchange for established cryptocurrencies such as Bitcoin or Ethereum.

During an ICO, a project publishes a whitepaper detailing its objectives and tokenomics, then launches a token sale. Investors contribute cryptocurrency to the project’s wallet and, in return, receive new tokens that can often be traded on exchanges afterward.

The ICO service market was valued at several billion USD in 2024, and it is projected to grow to over $11–12 billion by 2025, with further expansion expected to surpass $25 billion by the early 2030s.

The legality of ICOs differs across countries. While some jurisdictions are establishing clear frameworks to safeguard investors and enable compliant token sales, others remain cautious. Emerging regulations, such as Europe’s MiCA, are creating more defined pathways for compliance.

ICO activity is most prominent in DeFi and finance-focused projects, with significant participation also in payments, infrastructure, and blockchain services, fueled by investor demand and practical use cases.

The market’s growth is driven by regulatory developments that increase legitimacy, technological innovations such as smart contracts and DeFi integration, and rising investor participation enabled by greater information access and widespread blockchain adoption.

Investors need to be aware of regulatory uncertainties, potential fraud or scams, vulnerabilities in smart contracts, and price volatility, all of which have historically affected market confidence.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.