Key Takeaways

- ICOs remain relevant in 2026, but they are no longer speculative free-for-alls. Modern ICOs emphasize regulatory compliance, real utility, strong tokenomics, and audited technology.

- Token classification is critical. Whether a token is a utility token or a security token determines legal obligations, investor rights, and jurisdictional compliance requirements.

- Strong tokenomics drive long-term success. Fair token distribution, vesting schedules, clear utility, and supply controls are essential to prevent dumping and align incentives.

- Regulatory compliance is no longer optional. KYC/AML, jurisdictional analysis, SEC considerations, and EU MiCA compliance are now standard expectations.

- Security failures are often internal, not just external hacks. Weak governance, poor access controls, and a lack of incident response planning cause most breaches.

- Hybrid on-chain and off-chain architectures are now the norm, balancing transparency with scalability, performance, and data privacy.

- Audits and testing are essential, not optional. Professional smart contract audits and testnet deployments reduce irreversible failures.

- Marketing and community matter as much as technology. Trust is built through transparency, communication, and engagement—not hype.

- ICO costs vary widely, typically ranging from $40,000 to $200,000+, depending on compliance, development, and marketing scope.

- ICOs enable global fundraising and community ownership but carry higher execution, regulatory, and reputational risks.

- Choosing the right vendors and partners is strategic. Security expertise, regulatory awareness, and post-launch support matter more than low pricing.

- Due diligence protects everyone. Investors must research thoroughly, and founders must ensure accuracy, transparency, and compliance.

Initial Coin Offerings (ICO) have been one of the most important fundraising methods in blockchain history. They became extremely popular during the 2017–2018 crypto boom, and they continue to evolve and stay relevant in 2026, now in more regulated, advanced, and security-focused forms. This guide offers a clear, practical, and reliable resource for founders, developers, investors, and blockchain professionals by covering modern ICO launch solutions, best practices, and execution strategies.

The Basics of Initial Coin Offerings

An Initial Coin Offering (ICO) is a way for new blockchain startups to raise money by selling digital tokens in exchange for established cryptocurrencies, like Bitcoin or Ethereum, or traditional money. It serves as an alternative to funding from venture capital or going public through an IPO.

Overview of ICO:

- Mechanism: In an Initial Coin Offering (ICO), a project creates and sells a new cryptocurrency token to early investors. These tokens usually give users access to the project’s future services or features, and in some cases, they act like shares in the company, similar to securities.

- Key Document: The project team releases a “whitepaper,” similar to a business plan. It explains the project’s technology, objectives, how much money is needed, how the money will be spent, and details about the token.

- Process:-

- Preparation: The team defines the project idea, writes a whitepaper, and creates the token, often using the Ethereum ERC-20 standard.

- Marketing: The project is promoted online through social media, forums, and a dedicated website to reach a global audience.

- Token Sale: During the ICO period, investors send funds to a specific crypto wallet and receive the corresponding number of tokens.

- Listing: If the ICO is successful, the tokens are added to cryptocurrency exchanges, giving investors an opportunity to sell their tokens and access liquidity.

History and Evolution

The concept of Initial Coin Offering (ICO) traces back to the early days of cryptocurrency:

- 2013: The first ICO was conducted by the Mastercoin (now Omni Layer) project, which raised over 5,000 Bitcoin.

- 2014: The Ethereum Initial Coin Offering (ICO) further popularized the model, leveraging digital contracts to facilitate token creation and distribution, raising over $18 million and demonstrating the potential of the fundraising mechanism.

- 2017-2018 Boom: This period saw an explosion in Initial Coin Offering (ICO) activity, with projects raising billions of dollars. This era was characterized by high potential returns, but also by a lack of regulation and a high incidence of scams and project failures.

- Post-2018: The market experienced a downturn due to increased regulatory scrutiny (e.g., in China and South Korea) and investor losses from fraudulent projects. This led to the emergence of alternative, more compliant models like Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs), which offer more investor protection and regulatory adherence.

| Year | Initial Coin Offering (ICO) Project | Amount Raised | Notes |

|---|---|---|---|

| 2013 | Mastercoin | ~$5M | First significant ICO concept.[1] |

| 2014 | Ethereum | ~$18M | Widely recognized early ICO. |

| 2017 | Filecoin | ~$257M | Led one of the largest ICOs recorded. |

| 2017 | Binance Coin | ~$15M | Became major exchange token. |

| 2017 | Tezos | ~$232M | Faced governance hurdles. |

| 2017 | Polkadot | ~$144M | Elevated multi‑chain ecosystem.[2] |

Relevance in Modern Fundraising

Initial Coin Offering (ICO) remains relevant in modern fundraising, primarily for its ability to offer:

- Global Accessibility: ICOs let anyone with internet access invest, opening early-stage project funding to a wider audience beyond traditional accredited investors.

- Speed and Efficiency: Startups can raise money quickly without the long, complex procedures, paperwork, and intermediaries—like investment banks—required for IPOs or traditional venture capital.

- Community Building: Early token buyers often become a project’s first users and supporters, helping grow the community and encourage adoption of the platform.

- Liquidity Potential: Unlike traditional private investments, ICO tokens can often be traded on exchanges soon after the sale, giving investors early access to liquidity.

However, because many countries do not have standardized regulations for Initial Coin Offering (ICO), they carry significant risks, including high price volatility and potential fraud. This makes careful research and due diligence essential for investors.

The ICO Fundamentals and Terminology

For founders launching a blockchain project, understanding key Initial Coin Offering (ICO) concepts and terminology is crucial for a compliant and successful fundraising. The primary concepts include differentiating token types, setting fundraising goals, and choosing the appropriate offering model.

Key Concepts

- Utility vs. Security Tokens: The classification of a token dictates its regulatory requirements and purpose.

- Utility Tokens: These tokens give holders access to a specific product, service, or feature within a project’s ecosystem, such as using DApps, voting in governance, or paying network fees. They are usually not considered investments and face fewer securities regulations if structured correctly. Their value depends on how much people use and need the platform’s services.

- Security Tokens: These tokens represent ownership in a real-world asset or company, similar to stocks or bonds. They can give holders rights like dividends, profit-sharing, or voting on company decisions. Security tokens are strictly regulated by financial authorities, such as the SEC in the U.S., and must follow securities laws.

- Soft Cap vs. Hard Cap: These terms define fundraising targets for a token sale.

- Soft Cap: This is the minimum amount of money a project needs to move forward and continue development. If the soft cap isn’t reached, a trustworthy project usually refunds investors.

- Hard Cap: This is the maximum amount a project plans to raise during the Initial Coin Offering (ICO). Once this limit is reached, no more funds are accepted, helping control the token supply and avoid oversaturation.

- ICO vs. IEO vs. IDO: These are different models for conducting a token sale.

- Initial Coin Offering (ICO): In this model, the project team sells tokens directly on its own platform, keeping full control over the process. It has low intermediary fees but offers minimal investor protection and regulation, which can make it risky and prone to scams.

- Initial Exchange Offering (IEO): Here, a centralized cryptocurrency exchange manages the token sale and checks the project’s legitimacy. This increases investor trust, gives access to the exchange’s large user base, and ensures immediate liquidity after the sale. However, the project must pay high listing fees and share revenue with the exchange.

- Initial DEX Offering (IDO): Tokens are launched on a decentralized exchange (DEX) using digital contracts and liquidity pools. This approach follows DeFi principles of decentralization, provides instant liquidity, and usually has lower fees than an IEO. Oversight depends on the launchpad, placing it between the ICO and the IEO in terms of regulation and security.

Essential Terms for Founders

Founders should be familiar with several additional terms:

- Whitepaper: A detailed document that explains the project’s goals, technology, business plan, token economics, use of funds, and team members. It serves as the main source of information for potential investors.

- Know Your Customer (KYC) / Anti-Money Laundering (AML): Procedures used to verify participants’ identities and prevent illegal activities. IEOs usually enforce strict KYC/AML rules, while ICOs and some IDOs may have looser checks.

- Digital Contracts: Self-executing contracts with terms written directly into blockchain code. They automate token sales, distribution, and compliance.

- Vesting Period: A set period during which tokens owned by team members or early investors are locked and cannot be sold. This prevents immediate selling after the ICO, aligns the team’s interests with the project’s long-term success, and reduces investor risk.

- Liquidity Pool: In IDOs, this is a fund locked in a digital contract on a DEX that allows the new token to be traded immediately after the sale.

Tokenomics and Investor Insights

Tokenomics and transparent documentation are crucial for the success of an Initial Coin Offering (ICO) by building investor trust, ensuring project sustainability, and aligning the interests of all stakeholders. A well-designed model demonstrates long-term viability beyond mere speculation.

The Role of Tokenomics

Tokenomics (token economics) is the economic model that governs a digital token’s creation, distribution, and use within an ecosystem. It influences supply, demand, and overall value.

- Trust and Transparency: Clear tokenomics demonstrate a well-organized project and help reduce concerns about manipulation or token inflation.

- Long-Term Sustainability: Strong tokenomics balance the project’s funding needs with the community’s interest in a stable and valuable token, ensuring the project can succeed well beyond the initial sale.

- Incentive Alignment: Effective tokenomics align the goals of developers, investors, and users, encouraging behaviors such as active participation in the network and long-term token holding.

Key Components and Investor Insights

Investors scrutinize specific aspects of the Initial Coin Offering (ICO) to make informed decisions:

- Whitepapers: The whitepaper is the main document and business plan of an ICO. A clear, detailed, and professional whitepaper should explain the project’s vision, technology, token utility, and legal disclaimers. It acts as the primary source of information to reduce knowledge gaps and signal legitimacy. A lack of detail or transparency is a major warning sign.

- Token Allocation and Distribution: This shows how all tokens are divided among the team, advisors, early investors, the public, and project reserves.

- Fairness: Transparent and fair distribution prevents a few large holders, or “whales,” from controlling the market and causing sudden price drops.

- Clarity: The whitepaper should clearly state the total supply, circulating supply at launch, and the schedule for releasing tokens over time.

- Vesting Schedules: These are time-locked periods for tokens given to founders, team members, and early investors. Vesting stops insiders from selling large amounts immediately after the Initial Coin Offering (ICO), showing commitment to the project’s long-term success and protecting public investors.

- Investor Rights and Governance: Tokens can give holders rights, such as voting on project decisions (governance tokens).

- Empowerment: Voting rights let investors participate in the project’s direction, fostering ownership, engagement, and loyalty.

- Accountability: A clear governance model in the whitepaper shows that decisions are not made unilaterally, increasing transparency and accountability for the project team.

ICO Market Trends and the Future of Fundraising

The Initial Coin Offering (ICO) market is a more mature, regulated, and professional fundraising landscape than its volatile early years. Key trends include a strong focus on regulatory compliance, integration with the broader Web3 ecosystem, and a move toward real-world asset (RWA) tokenization, attracting more institutional investors.

Current Market Trends:-

- Maturation and Professionalism: The “wild west” era of Initial Coin Offering (ICO) is over. Successful projects now require detailed whitepapers, experienced teams, and working prototypes. In 2025, the average ICO raises about $5.4 million, reflecting measured but steady investor confidence.

- Regulatory Clarity: Authorities like the EU, with its MiCA framework, and the US SEC are providing clear guidelines, increasing investor protection and project legitimacy. Following KYC (Know Your Customer) and AML (Anti-Money Laundering) rules is now standard, improving the chances of a successful ICO.

- Rise of Alternatives: While Initial Coin Offering (ICO) remains relevant, other fundraising models—such as Initial Exchange Offerings (IEOs), Initial DEX Offerings (IDOs), and Security Token Offerings (STOs)—have become popular. STOs, in particular, are emerging as a regulated way to represent ownership in real-world assets.

- Focus on Utility and Tokenomics: Projects are increasingly focusing on real use cases and strong tokenomics to create lasting value, moving away from tokens that exist solely for speculation.

Web3 Adoption and Enterprise Initial Coin Offering (ICO):-

- Web3 Integration: Modern Initial Coin Offering (ICO) are built around Web3 principles, including decentralization, community governance, and transparency. Projects use blockchain’s open and verifiable nature, along with digital contracts and public ledgers, to build trust with investors.

- Community-Driven Models: Initial Coin Offering (ICO) encourages strong global community involvement. Early participants often become advocates and contributors, aligning the interests of developers and users.

Enterprise Adoption (Tokenization): Large companies are increasingly exploring the tokenization of financial and real-world assets, such as real estate, commodities, and company shares. This brings a more traditional, asset-backed approach to crypto, attracting institutional investors who were previously cautious due to regulatory uncertainty.

Opportunities and Challenges:-

| Topic | Opportunities | Challenges |

|---|---|---|

| Global Accessibility | Access to a worldwide pool of investors, beyond traditional financial limits. | Regulatory requirements differ by region, creating compliance risks. |

| Rapid Capital Formation | Funds can be raised faster than traditional methods, accelerating project development. | Market volatility can affect the value of raised funds. |

| Innovation & Niche Funding | Enables financing for innovative projects or niche industries that might not attract VC support. | High failure rate—many projects do not deliver a functional product. |

| Liquidity | Tokens can be traded on secondary markets soon after the sale, offering early exit options. | Digital contract vulnerabilities and potential scams require careful security audits. |

Comparison with Traditional Fundraising Methods:-

| Feature | Initial Coin Offerings (ICO) | Traditional Fundraising (e.g., IPOs, VCs) |

|---|---|---|

| Regulation | Generally less regulated, though oversight is increasing. | Heavily regulated by government authorities (e.g., SEC). |

| Intermediaries | Fewer intermediaries; projects sell directly to investors. | Multiple intermediaries are involved, such as investment banks and brokers. |

| Investor Base | Open to a global public audience. | Usually limited to accredited, institutional, or regional investors. |

| Fundraising Speed | Can be completed in weeks or months. | Often takes 12–18 months or longer. |

| Investor Rights | Investors receive tokens (utility or governance), usually not equity or ownership. | Investors receive shares with ownership, equity, and voting rights. |

| Stage of Company | Mostly early-stage startups, often pre-product. | Typically, mature companies have established business models and financial histories. |

ICO Platform Architecture and Technical Design

The architecture of an Initial Coin Offering (ICO) platform is a hybrid system combining a user-facing application layer (off-chain) with core transaction and fund management logic on a secure blockchain network (on-chain), managed primarily through digital contracts.

End-to-End Platform Architecture

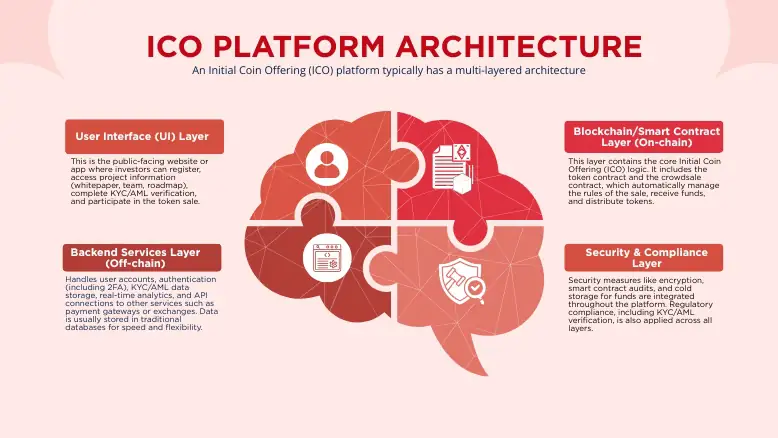

An Initial Coin Offering (ICO) platform typically has a multi-layered architecture:

- User Interface (UI) Layer: This is the public-facing website or app where investors can register, access project information (whitepaper, team, roadmap), complete KYC/AML verification, and participate in the token sale.

- Backend Services Layer (Off-chain): Handles user accounts, authentication (including 2FA), KYC/AML data storage, real-time analytics, and API connections to other services such as payment gateways or exchanges. Data is usually stored in traditional databases for speed and flexibility.

- Blockchain/digital Contract Layer (On-chain): This layer contains the core Initial Coin Offering (ICO) logic. It includes the token contract and the crowdsale contract, which automatically manage the rules of the sale, receive funds, and distribute tokens.

- Security & Compliance Layer: Security measures like encryption, digital contract audits, and cold storage for funds are integrated throughout the platform. Regulatory compliance, including KYC/AML verification, is also applied across all layers.

Digital Contracts and Fund Flow Design

Digital contracts are the backbone of the Initial Coin Offering (ICO) platform, ensuring transparency, automation, and trustlessness.

- Token Contract: Defines the token’s key properties, including its name, symbol, total supply, and standard (such as ERC-20 on Ethereum or BEP-20 on BNB Chain).

- Crowdsale Contract: Sets the specific rules for the Initial Coin Offering (ICO), including:

- Sales Stages: Manages different phases, like pre-sale and public sale, with varying pricing or access rules.

- Caps: Enforces fundraising limits, including the minimum (soft cap) and maximum (hard cap). If the soft cap is not reached, funds are automatically refunded.

- Vesting Schedules: Gradually release tokens for the team or early investors over a set period to prevent sudden sell-offs.

- Whitelisting/Access Control: Restricts participation to approved, KYC-verified investor addresses only.

The fund flow is automated by the digital contract:

- An investor connects their wallet and sends cryptocurrency (like ETH) to the digital contract’s address.

- The digital contract checks the transaction against the rules, including sale dates, fundraising caps, and whitelist status.

- If the transaction meets all requirements, the digital contract automatically mints the appropriate number of tokens and transfers them instantly to the investor’s wallet.

- The collected funds (ETH) are securely stored in the digital contract or moved to a project wallet, ideally using a multi-signature cold storage solution for added security.

On-Chain vs. Off-Chain Models

Most modern Initial Coin Offering (ICO) platforms use a hybrid approach to balance security, speed, and cost.

| Feature | On-Chain (Blockchain Layer) | Off-Chain (Backend / UI Layer) |

|---|---|---|

| Function | Core business logic, fund management, token issuance, permanent record-keeping | User experience, data processing, authentication, analytics, KYC data storage |

| Speed / Cost | Slower execution, potentially high gas fees | Faster processing, minimal or zero transaction fees, high scalability |

| Security / Trust | High security, immutable, trustless (based on cryptographic verification) | Depends on platform security controls; requires trust in the operator |

| Transparency | Fully public and verifiable on the blockchain ledger | Limited transparency; data visible only to platform operators and regulators |

| Flexibility | Difficult to modify once deployed; changes require redeployment | Highly flexible; logic and UI can be updated quickly |

| Data Privacy | All data is public by default (privacy must be engineered) | Supports private and sensitive data storage (e.g., KYC/AML records) |

| Failure Risk | Digital contract bugs can be irreversible without safeguards | Bugs can usually be patched or rolled back |

| Compliance Handling | Limited native support for KYC/AML enforcement | Strong support for regulatory compliance and identity management |

Multi-Chain Architecture

Multi-chain support is becoming increasingly common, allowing Initial Coin Offering (ICO) to launch on multiple blockchain networks such as Ethereum, BNB Chain, and Polygon. This broadens the investor base, can lower transaction costs for participants, and improves scalability. To achieve this, developers must create and deploy compatible digital contracts on each blockchain and design a frontend interface that works smoothly with multiple networks and wallets, like MetaMask or Trust Wallet.

- Interoperability: Bridges or API integrations are used to enable assets and data to interact across different blockchains when necessary.

- Token Standards: Tokens must follow the specific standards of each network, such as ERC-20 on Ethereum or BEP-20 on BNB Chain.

Technology Stack and Development Best Practices

A robust Initial Coin Offering (ICO) technology stack in 2025 emphasizes security, scalability, and user experience, commonly leveraging Ethereum or Solana for the blockchain layer, a MEAN/MERN stack for frontend/backend, and rigorous digital contract auditing.

Initial Coin Offering (ICO) Technology Stack and Best Practices:-

Best Blockchains:-

Choosing the right blockchain is crucial for an Initial Coin Offering (ICO). Some of the top options include:

- Ethereum: The leading platform for decentralized finance (DeFi) and dApps, thanks to its strong ecosystem, large community, and proven reliability. Most tools and best practices are designed for Ethereum.

- Solana: Known for very high performance—up to 65,000 transactions per second—and low transaction fees, making it ideal for projects that prioritize speed and scalability.

- BNB Chain: Provides a balance of low costs and high throughput, making it suitable for projects that need efficient and fast transactions.

- Layer 2 Solutions (Arbitrum, Optimism): These enhance scalability and reduce gas fees while maintaining the security of the Ethereum mainnet.

Solidity vs. Vyper:

Both are high-level programming languages used for writing digital contracts on the Ethereum Virtual Machine (EVM), and many projects combine them for different purposes.

- Solidity: The industry standard, with a large developer community, extensive tools, and flexibility for building complex applications. Its syntax is similar to JavaScript or C++, and it supports features like inheritance.

- Vyper: A Python-based alternative designed for security, simplicity, and easier auditing. It intentionally limits features—such as no inheritance or function overloading—to reduce potential vulnerabilities and make the code easier to review.

Frontend/Backend Stack:

A typical Initial Coin Offering (ICO) architecture uses a traditional off-chain stack for the user interface and business logic, which interacts with the blockchain.

- Frontend: Frameworks like React.js, Vue.js, or Angular create dynamic user interfaces. Next.js is often used for better performance and SEO.

- Backend: Server-side logic and APIs are commonly built with Node.js (using Express.js or NestJS), Python (Django or Flask), or Golang, thanks to their performance and libraries for blockchain integration.

- Blockchain Interaction Libraries: JavaScript libraries like Web3.js and Ethers.js connect the frontend and backend to the Ethereum blockchain.

- Database/Storage: PostgreSQL or MongoDB handle structured data, Redis is used for caching, and decentralized storage solutions like IPFS ensure data integrity.

digital Contract Testing:

Rigorous testing and auditing are essential for a secure Initial Coin Offering (ICO).

- Tools/Frameworks: Hardhat, Foundry, and the Truffle Suite offer environments for testing, debugging, and deploying digital contracts.

- Techniques & Best Practices:

- Unit & Integration Testing: Test individual functions and how they work with other components.

- Static Analysis: Use automated tools like Slither or MythX to detect common vulnerabilities early.

- Fuzz Testing: Test contracts with unexpected inputs using tools like Echidna to uncover edge-case vulnerabilities.

- Formal Verification: Mathematically prove that critical contracts behave as intended, ensuring the highest level of security.

- Third-party Audits: Hire reputable security firms, such as CertiK or OpenZeppelin, for a thorough review before deploying on the mainnet to catch complex logic errors.

- Secure Coding Patterns: Use audited libraries (like OpenZeppelin), implement reentrancy guards, and strictly manage access permissions.

Oracles:

Oracles link digital contracts to real-world data or off-chain systems.

- Chainlink: The most widely used decentralized oracle network, offering reliable, tamper-proof data feeds for prices and external events, which are essential for DeFi and many dApps.

- Other Solutions: Other blockchain-specific oracle services exist, but Chainlink remains the leading option in terms of security and adoption.

DevOps and Cloud Infrastructure:

- DevOps: Incorporate automated testing and security checks into CI/CD pipelines for continuous monitoring. Tools like Git-Chain can manage versioning, while DappMetrics provides real-time analytics.

- Cloud Infrastructure: Many Initial Coin Offering (ICO) platforms use a hybrid approach, hosting the frontend and backend on cloud services such as AWS, Google Cloud, or Azure, while connecting to the decentralized blockchain network. This setup balances performance with decentralization.

Investor Dashboards:

An investor dashboard is a user-friendly interface designed for a clear and intuitive experience.

Key Features:

-

- KYC/AML Integration: Ensures regulatory compliance during the token sale.

- Real-time Analytics: Shows token price, total funds raised, and the investor’s personal holdings.

- Wallet Integration: Supports seamless connection with popular wallets like MetaMask using libraries such as WalletConnect.

- Staking/Claiming: Enables investors to stake tokens or claim purchased tokens and rewards.

- Security: Implements strong protections, including multi-factor and biometric authentication.

What are the Key Security Risks and Failure Points in an ICO?

The UK’s Information Commissioner’s Office (ICO) highlights that internal complacency regarding data protection is a key cybersecurity risk, rather than threats from external hackers alone. Recent fines and enforcement actions reveal that most serious data breaches result from failures in basic security practices, governance, and incident response.

Key Security and Risk Areas

The Initial Coin Offering (ICO) requires organizations to implement “appropriate technical and organisational measures” to secure personal data, the adequacy of which is assessed based on the nature of the data and the severity of potential risks.

Key areas of focus include:

- Risk Management and Assessment: Organizations must identify, evaluate, and understand security risks to personal data and related systems. This includes conducting regular vulnerability scans, penetration tests, and risk assessments, and taking action based on the results.

- Authentication and Access Control: Weak authentication is a common failure. The Initial Coin Offering (ICO) stresses the importance of strong password policies, limiting privileged access to those who need it, and implementing multi-factor authentication (MFA) on all critical systems.

- System and Software Management: Using outdated or unsupported operating systems and failing to apply security patches promptly are major weaknesses that attackers exploit.

- Incident Response and Monitoring: Organizations need processes to detect, investigate, and respond to security incidents. The Initial Coin Offering (ICO) has issued large fines for slow responses, noting that delays—such as taking 58 hours to isolate a compromised device—can greatly increase damage. Breaches must be reported to the ICO within 72 hours if they pose a likely risk to individuals’ rights and freedoms.

- Staff Training and Governance: Insufficient data protection and security training for employees is a common compliance gap. Senior management must allocate proper resources for security and ensure ongoing oversight and review of security systems.

Common Failure Points and Penalties

Recent Initial Coin Offering (ICO) enforcement actions illustrate specific, preventable failures that lead to significant fines and reputational damage:

| Organization | Fine Amount | Key Failures Leading to Breach |

|---|---|---|

| Capita | £14 million | Slow incident response (58-hour delay in containment); failure to prevent privilege escalation and lateral movement; identified vulnerabilities from pen tests were not remediated. |

| Advanced | £3.07 million | Failure to implement multi-factor authentication (MFA) on customer accounts, inadequate vulnerability scanning, and ad-hoc patch management. |

| 23andMe | £2.31 million | Inadequate security measures, including the lack of MFA, allowed attackers to use weak credentials (credential stuffing) to access sensitive genetic and personal data. |

| Interserve | £4.4 million | Use of unsupported operating systems; failure to run up-to-date anti-virus; too many people with privileged access; and inadequate staff training. |

These cases demonstrate a shift in Initial Coin Offering (ICO) strategy, focusing on major data breaches with significantly higher financial penalties, especially when basic preventative controls were missing. The takeaway is clear: internal complacency in data protection compliance poses the greatest risk.

What Are the Legal Compliance and Regulatory Requirements for an ICO?

Initial Coin Offerings (ICO) are subject to a complex and evolving landscape of global legal, compliance, and regulatory requirements, primarily centered on token classification, Anti-Money Laundering (AML), and Know Your Customer (KYC) standards, and adherence to major frameworks like the SEC and the EU’s MiCA regulation.

Global Legality and Regulatory Overview

The legality of Initial Coin Offering (ICO) varies significantly by jurisdiction. Some countries, like China and South Korea, have implemented outright bans, while others, such as Switzerland, Singapore, and the UAE, have adopted more supportive or clear regulatory approaches. The core challenge for global legality is that a token issued in one country might be treated differently in another.

- Prohibition: Certain nations view Initial Coin Offering (ICO) as a risk to financial stability and have banned them entirely.

- Case-by-case Analysis: Many jurisdictions, like the UK, require a case-by-case analysis to determine if an Initial Coin Offering (ICO) falls under existing securities laws.

- Specific Frameworks: Regions like the EU are implementing specific crypto-asset regulations (MiCA) to provide legal certainty.

AML/KYC Requirements

AML (Anti-Money Laundering) and KYC (Know Your Customer) obligations are a universal and critical component of compliance. Most jurisdictions require entities involved in crypto-asset services, including Initial Coin Offering (ICO) issuers, to implement robust AML/KYC programs to prevent illicit activities like fraud, money laundering, and terrorist financing.

- Customer Due Diligence (CDD): Service providers must obtain and verify client identities and business activities.

- Transaction Monitoring: Ongoing monitoring for suspicious activities is crucial.

- Reporting Obligations: Businesses must report suspicious transactions to relevant financial intelligence units.

Security vs. Utility Tokens

The classification of a token as a security or a utility token is the single most important legal distinction, as it dictates the applicable regulatory framework.

- Utility Tokens: Primarily provide access to a product or service within a blockchain ecosystem. They are not intended as investments with an expectation of profit from the efforts of others and generally face lighter regulation, though they still must comply with consumer protection and AML laws.

- Security Tokens: Represent ownership or an investment interest in an asset, enterprise, or profit-sharing scheme, similar to stocks or bonds. They are subject to stringent financial securities laws, requiring formal registration or an exemption before being offered to the public. The SEC uses the Howey Test to determine if a token is an investment contract (and thus a security).

SEC and MiCA Regulations

- SEC (U.S. Securities and Exchange Commission): The SEC generally presumes most tokens issued in an Initial Coin Offering (ICO) are securities and applies the Howey Test to decide. Issuers must register the offering or find an applicable exemption (e.g., Regulation D for accredited investors) to avoid severe penalties. The SEC enforces compliance rigorously, often through “Regulation by Selective Enforcement.

- MiCA (Markets in Crypto-Assets Regulation): The EU’s comprehensive framework creates uniform rules for crypto-assets not currently covered by existing financial legislation. MiCA mandates transparency, disclosure (through “white papers”), and authorization for issuers and service providers (CASPs). It includes specific rules for asset-referenced tokens (ARTs) and e-money tokens (EMTs).

Licensing, Cross-Border Compliance, and Legal Due Diligence

- Licensing: Initial Coin Offering (ICO) or the platforms facilitating them may require specific licenses depending on their operations and jurisdiction, such as a Virtual Asset Service Provider (VASP) registration or an investment firm license.

- Cross-Border Compliance: This is highly challenging due to the borderless nature of blockchain and the varied national laws. Companies often establish a legal presence in each target jurisdiction and adhere to local authorization requirements, as MiCA, for instance, does not currently offer a third-country equivalence.

- Legal Due Diligence: Essential before launching an Initial Coin Offering (ICO), due diligence involves:

- Conducting a legal analysis of the token’s classification in all relevant jurisdictions.

- Verifying all representations made in the white paper are accurate.

- Auditing digital contracts and security measures.

- Implementing a robust, automated KYC/AML system.

- Ensuring appropriate regulatory filings or exemptions are secured.

How Do You Plan and Execute a Successful ICO Launch?

Launching a successful Initial Coin Offering (ICO) requires careful planning across legal, technical, and marketing areas. Key elements include a clear project vision, a credible team, regulatory compliance, robust technology, and strong community engagement.

Step-by-Step Launch Guide (3–6 Months):-

Phase 1: Preparation (1–3 Months Before Launch)

- Project & Tokenomics: Define goals, problem solved, and token utility. Plan supply, distribution, pricing, vesting, and governance.

- Legal & Compliance: Consult legal experts, ensure AML/KYC adherence, choose a jurisdiction, and prepare documentation.

- Core Documentation: Draft a detailed whitepaper and a simpler litepaper for marketing.

- Technical Infrastructure: Develop token (e.g., ERC-20) and digital contracts.

- Website & Dashboard: Build a secure, user-friendly hub with team info, roadmap, and token sale access.

- Testing & Audits: Run testnets and third-party digital contract audits.

Phase 2: Pre-Launch Marketing (1–2 Months Before Launch)

- Community Building: Engage users on Telegram, Discord, Reddit, and Twitter.

- Marketing Campaign: Execute content marketing, social media, influencer partnerships, and referral/bounty programs.

- Pre-Sale (Optional): Offer early investors discounted tokens for initial capital and momentum.

Phase 3: Launch & Execution

- Go Live: Start the public sale, ensuring smooth transactions and clear communication.

- Monitor: Track sales performance, activity, and community sentiment.

- Token Generation Event (TGE): Activate tokens on the blockchain upon soft cap achievement.

Phase 4: Post-ICO Activities

- Token Distribution: Deliver tokens according to vesting schedules.

- Exchange Listing: List on reputable DEXs/CEXs for liquidity.

- Development & Scaling: Use funds for roadmap milestones and provide regular updates.

- Community Management: Maintain engagement, support, and transparency.

Team Essentials

- Founders/Leads: Define vision and strategy.

- Blockchain Developers: Build, test, and deploy digital contracts.

- Legal/Compliance Experts: Ensure regulatory adherence.

- Marketing & Community Managers: Manage campaigns and engagement.

- Advisors: Provide guidance and credibility.

Pre-Launch Checklist

- Clear project goals and a unique value proposition

- Robust tokenomics (supply, utility, distribution, vesting)

- Comprehensive whitepaper and engaging website

- Audited digital contracts

- Legal & regulatory compliance (KYC/AML)

- Strong marketing and PR strategy

- Active community channels

- MVP or prototype to build trust

What Are the Costs, Pricing, and ROI Optimization Considerations for an ICO?

The overall cost to launch an Initial Coin Offering (ICO) typically ranges from $40,000 to over $200,000, with significant variation based on complexity, development approach, and compliance needs. Return on Investment (ROI) is heavily influenced by strategic tokenomics and robust marketing efforts.

Initial Coin Offering (ICO) Cost Breakdown

| Cost Component | Estimated Range |

|---|---|

| ICO Platform Development | $15,000 – $50,000+ |

| Legal & Compliance | $15,000 – $50,000+ |

| Marketing & PR Campaigns | $20,000 – $100,000+ per month |

| Whitepaper Drafting | $5,000 – $20,000 |

| Digital Contract Audits | $5,000 – $30,000 |

| Post-Launch Maintenance | $500 – $10,000+ per month (for white-label solutions) |

White-Label vs. Custom Platforms

- White-Label Solutions are ready-made platforms that typically cost between $15,000 and $30,000, offering rapid deployment and lower upfront investment. They’re well-suited for startups with limited budgets or the need to enter the market quickly. However, customization is limited, ongoing licensing or subscription fees may apply, and long-term ROI could be lower due to reliance on the vendor and lack of unique features.

- Custom Platforms demand a higher initial investment—often $50,000 to $200,000 or more—and a longer development timeline. In return, they provide full control over features, design, and scalability, enabling the creation of a unique product with no recurring licensing costs. This flexibility can deliver greater long-term ROI and strategic independence.

Legal and Compliance Costs

Ensuring regulatory compliance is essential to avoid significant penalties, though it can be costly. Expenses vary depending on jurisdiction and the complexity of the project:

- Legal Consultation: Obtaining expert legal advice typically ranges from $3,000 to $15,000.

- Compliance Processes: Implementing thorough procedures—such as Know Your Customer (KYC) and Anti-Money Laundering (AML)—can cost between $5,000 and $25,000 or more.

- EU Regulations: For projects under frameworks like MiCA (Markets in Crypto-Assets), total compliance costs can reach $150,000 to $500,000.

Marketing Budget

Marketing is often the largest recurring expense and is critical for attracting investors, growing awareness, and building a strong community.

- Campaign Costs: Budgets typically range from $20,000 to $100,000 or more, depending on scope and channels.

- Key Strategies: Effective approaches include social media campaigns, content creation, influencer collaborations, and public relations efforts.

- Community Engagement: Maintaining an active presence on platforms like Telegram and Discord is essential, serving as a key signal of credibility and project momentum.

Tokenomics Impact on ROI

Strong tokenomics are critical for maximizing ROI and investor confidence:

- Utility and Scarcity: Tokens with clear use cases within the ecosystem, combined with mechanisms like limited supply or token burning, can drive demand and enhance value.

- Distribution and Vesting: Thoughtful allocation and vesting schedules prevent immediate sell-offs, encouraging long-term holding and boosting investor trust.

- Transparency: Clear, well-documented token models and allocation in the whitepaper attract serious investors, build credibility, and positively influence perceived value and ROI.

Post-Launch Maintenance Costs

Expenses continue after launch and typically include:

- Ongoing Platform Support: Regular bug fixes, updates, and security patches. For white-label solutions, these may be included in subscription fees; for custom platforms, they fall under the internal development team’s responsibilities.

- Community Management: Maintaining active engagement, moderating channels, and managing investor relations.

- Operational & Legal: Ongoing legal compliance, audits, and general business operations to ensure smooth and compliant project functioning.

What Are the Key ICO Use Cases and Industry Applications?

Initial Coin Offerings (ICO) are a modern crowdfunding method for blockchain-based projects, providing a way to raise capital by selling digital tokens to investors. These tokens can be utility tokens, granting access to a future product or service, or security tokens, which may represent an ownership stake and are subject to securities regulations.

Key Use Cases and Industry Applications

- FinTech and Decentralized Finance (DeFi): ICOs provide the initial capital needed for new DeFi protocols and platforms, enabling the development of a more transparent and inclusive global financial ecosystem. Applications include decentralized lending, borrowing, and insurance platforms like Nexus Mutual, which uses digital contracts to offer coverage against protocol failures. The tokens issued often govern these platforms or provide utility within them.

- Gaming and the Metaverse: Initial Coin Offering (ICO) and related token sales fund the creation of play-to-earn (P2E) games and virtual worlds.

- P2E Games: Games such as Axie Infinity allow players to earn native tokens (AXS and SLP) and trade in-game assets (which are NFTs) as valuable digital assets.

- Metaverse Platforms: Projects like Decentraland (MANA token) and The Sandbox (SAND token) used token sales to develop virtual worlds where users can buy, sell, and build on virtual land represented by NFTs.

- NFT-Based Models: ICOs or Initial NFT Offerings (INOs) are used to launch projects where NFTs represent unique digital or physical assets.

- Digital Art & Collectibles: The initial sale of NFT collections, such as CryptoPunks, established early markets for digital art and collectibles.

- Event Ticketing: NFTs are used for event tickets to provide unique, tamper-proof ownership records, reducing fraud.

- DAO Governance: Tokens acquired through an Initial Coin Offering (ICO) often come with voting rights, allowing holders to participate in the governance of decentralized autonomous organizations (DAOs). This model is used in projects like MakerDAO, which governs the DAI stablecoin.

- Enterprise Fundraising: ICOs offer an alternative to traditional venture capital (VC) funding for early-stage blockchain startups, allowing them to raise capital globally with less complexity than an Initial Public Offering (IPO). Due to regulatory concerns, private Initial Coin Offering (ICO) targeting large institutions is increasingly common.

- Real Estate Tokenization: High-value physical assets, such as real estate, can be tokenized into digital tokens, allowing for fractional ownership and increased liquidity. ICOs facilitate the initial distribution of these asset-backed tokens to a wider range of investors.

- Cross-Border Payments: Blockchain technology, often funded through Initial Coin Offering (ICO), underpins a new financial infrastructure that aims to make cross-border payments faster, cheaper, and more transparent by bypassing traditional intermediary banks.

Note: The ICO market carries significant risks due to regulatory ambiguity and the potential for fraud. Thorough due diligence is crucial for all participants.

How to Choose the Right ICO Vendors and Development Partners?

Selecting the right partner for an Initial Coin Offering (ICO) or similar crypto project requires a comprehensive strategy that prioritizes experience, security, and long-term viability.

How to Select the Right Development Company

- Experience & Portfolio: Look for companies with a demonstrable history in blockchain and crypto projects, not just general software development. Review their past ICO platforms and the success of the tokens launched.

- Technical Proficiency: Ensure they are proficient in the core technologies required for your project, such as digital contract languages (e.g., Solidity), blockchain platforms (e.g., Ethereum, Solana), and security best practices.

- Regulatory Knowledge: They should be aware of the regulatory landscape for Initial Coin Offering (ICO) in relevant jurisdictions and guide you on compliance to avoid future legal issues.

- Transparent Communication: A reliable partner maintains clear and regular communication channels, providing consistent updates and being responsive to queries.

Questions to Ask Potential Vendors

- “Can you provide case studies of previous, successful Initial Coin Offering (ICO) projects you’ve worked on?”

- “What security audit procedures do you have in place for digital contracts and the platform?”

- “How do you handle potential regulatory changes during and after the development process?”

- “What is your communication plan, and how often can we expect project updates?”

- “What does your post-launch support and maintenance package include?”

Red Flags

- Guaranteed Success/ROI: No legitimate development company can guarantee the financial success or ROI of an Initial Coin Offering (ICO).

- Lack of Security Focus: If a vendor minimizes the importance of rigorous security audits and testing, consider this a major red flag.

- Generic Contracts: Vague service agreements that don’t clearly outline deliverables, timelines, and payment terms should be avoided.

- Unrealistic Promises: Be wary of partners promising unreasonably fast development timelines or extremely low costs for complex solutions.

Custom vs. White-Label Platforms

- Custom Development: Offers a unique platform tailored exactly to your specific needs and brand identity. This provides greater control and differentiation, but comes at a higher cost and longer development time.

- White-Label Solutions: These are pre-built, ready-to-launch platforms that can be quickly branded and deployed. They are more cost-effective and faster to market, but offer less flexibility and differentiation from other projects that might use the same template.

Cost vs. Quality

Prioritize quality over minimizing initial costs. A cheap, poorly developed platform is susceptible to security breaches, operational failures, and regulatory non-compliance, which can lead to catastrophic losses and damage to your project’s reputation. A higher investment in a quality, secure platform is an essential safeguard.

Post-Launch Support Expectations

- Ongoing Maintenance: Expect necessary updates, bug fixes, and performance monitoring after the launch.

- Security Audits: Regular post-launch security checks and vulnerability patches are critical in the ever-evolving threat landscape.

- Technical Support: Clear channels for technical support for any issues that may arise with the platform.

- Scalability Planning: The partner should have a plan to help the platform scale as your user base and transaction volume grow.

ICO Glossary

A concise reference of commonly used terms in Initial Coin Offerings (ICOs), helping founders, developers, and investors quickly understand key concepts, technical terms, and regulatory language used throughout the ICO lifecycle.

| Term | Full Form | Definition |

|---|---|---|

| AML | Anti-Money Laundering | Regulatory processes designed to prevent illegal activities such as money laundering and terrorist financing. |

| ART | Asset-Referenced Token | A MiCA-defined token whose value is linked to multiple assets like commodities or currencies. |

| Audit | Digital Contract Audit | A professional security review of digital contract code to identify vulnerabilities and logic flaws. |

| BEP-20 | Binance Smart Chain Evolution Proposal 20 | Token standard used on BNB Chain, similar to Ethereum’s ERC-20 standard. |

| Token Burn | Token Burning Mechanism | Permanent removal of tokens from circulation to reduce supply and increase scarcity. |

| Cap | Soft Cap / Hard Cap | Soft cap is the minimum fundraising goal; hard cap is the maximum amount accepted. |

| CASP | Crypto-Asset Service Provider | A regulated entity under MiCA providing crypto services like exchange or custody. |

| Cold Storage | — | Offline storage of private keys or funds for enhanced security. |

| Crowdsale Contract | — | Digital contract that governs the ICO process, including accepting funds and distributing tokens. |

| DYOR | Do Your Own Research | A principle encouraging investors to independently verify project claims. |

| EMT | E-Money Token | A crypto-asset pegged to a single fiat currency under MiCA regulations. |

| ERC-20 | Ethereum Request for Comment 20 | Ethereum’s most widely used standard for fungible tokens. |

| Escrow | — | A mechanism that securely holds funds until predefined conditions are met. |

| Formal Verification | — | Mathematical proof that a digital contract behaves exactly as intended. |

| Governance Token | — | A token granting holders voting rights over protocol or DAO decisions. |

| Hardhat | — | Ethereum development environment for compiling, testing, and deploying digital contracts. |

| INO | Initial NFT Offering | A fundraising event where NFTs are sold instead of fungible tokens. |

| Interoperability | — | The ability of different blockchains to communicate and exchange data or assets. |

| KYC | Know Your Customer | An identity verification process is required for regulatory compliance. |

| Liquidity Pool | — | A pool of tokens locked in digital contracts to enable trading on DEXs. |

| MiCA | Markets in Crypto-Assets Regulation | The EU’s comprehensive regulatory framework for crypto-assets. |

| Minting | Token Minting | The creation of new tokens on a blockchain. |

| Multi-Sig Wallet | Multi-Signature Wallet | A wallet requiring multiple approvals before funds can be accessed. |

| Oracle | Blockchain Oracle | A service that supplies digital contracts with off-chain data. |

| Pausable Contract | — | A digital contract that can be temporarily halted in emergencies. |

| Pre-Sale | Private Sale / Pre-Sale | Early fundraising rounds were conducted before the public ICO. |

| Rug Pull | — | A scam where founders abandon the project and steal investor funds. |

| Security Token | — | A regulated token representing ownership, profit rights, or dividends. |

| STO | Security Token Offering | A regulated fundraising event involving security tokens. |

| TGE | Token Generation Event | The moment when tokens are created and become transferable. |

| Tokenomics | Token Economics | The economic design of a token, including supply, utility, and incentives. |

| Utility Token | — | A token used to access services or features within a blockchain ecosystem. |

| VASP | Virtual Asset Service Provider | A regulated entity providing crypto services like exchanges or custody. |

| Vesting Period | Token Vesting Period | A time-based lock releases tokens gradually to prevent dumping. |

| Whitepaper | — | A detailed document outlining a project’s vision, technology, roadmap, and tokenomics. |

| Whitelisting | — | Restricting ICO participation to approved (often KYC-verified) wallet addresses. |

Frequently Asked Questions

Yes, ICOs are still relevant in 2026, but they have evolved into a more regulated and professional fundraising method. They allow startups to raise global capital, launch tokenized projects, and build strong communities. Modern ICO coins focus on compliance, real utility, and transparent tokenomics rather than speculative hype.

Legality depends on where you are in the world. Some countries, like China and South Korea, have banned ICOs completely. Others, such as Switzerland, Singapore, and the UAE, allow them under specific regulations. Investors must understand local laws, token classification, and regulatory compliance before participating. Doing your homework can save a lot of legal headaches.

A whitepaper is the soul of an ICO. It explains the project’s vision, technology, roadmap, tokenomics, and legal disclaimers. A strong whitepaper inspires confidence, reduces ambiguity, and is a key tool for investors to assess a project’s viability. Poorly written or vague whitepapers are red flags signaling potential scams or underprepared teams.

ICOs can offer high growth potential, but they also come with significant risks. These risks include fraudulent or scam projects, unclear or weak regulatory oversight, sharp price volatility, vulnerabilities in digital contracts, and the possibility that the project may fail or face long delays. To reduce these risks, investors should conduct thorough due diligence, carefully review the whitepaper, verify the credibility of the team, assess the project’s technology, and only invest funds they can afford to lose.

Common warning signs of a risky or fraudulent project include promises of guaranteed returns or unrealistically high profits, which are never realistic in legitimate investments. Anonymous or unverifiable team members, poorly written whitepapers with missing technical or business details, and a lack of active or transparent community engagement are also major red flags. Additionally, projects with no working prototype, demo, or publicly accessible code repository should be approached with caution. When several of these issues appear together, it is usually best to avoid the project altogether.

Typically, no. Most ICO tokens are utility or governance tokens, giving access to services or voting rights rather than company ownership. Only security tokens represent an investment stake and are heavily regulated. Understanding this distinction is crucial to avoiding unrealistic expectations.

Utility tokens provide access to a platform or service—for example, using a token to pay for decentralized storage or participate in governance. Security tokens, on the other hand, represent ownership, profit rights, or dividends in a project and are subject to financial regulations. Knowing this distinction is key to legal compliance and investment decisions.

The soft cap is the minimum fundraising goal a project needs to continue. If the ICO fails to meet this goal, many reputable projects refund investor funds. This protects investors and ensures only viable projects proceed, but always verify the ICO’s refund policy beforehand.

Regulators increasingly classify ICOs based on token type. Many treat tokens as securities if they meet certain investment criteria (like the Howey Test in the U.S.), requiring registration or exemptions. Compliance with KYC, AML, and local securities laws is essential for legal ICO launches.

ICOs allow startups to raise funds quickly and globally, bypassing traditional banks and venture capital intermediaries. They also build early communities, provide liquidity for investors, and can validate product demand through token adoption. In short, ICOs can accelerate innovation while giving investors a stake in a new ecosystem.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.