Key Takeaways

- DeFi platforms allow users to trade, lend, borrow, and manage digital assets directly on blockchain networks without banks or intermediaries.

- Smart contracts automate DeFi operations such as lending, trading, staking, and governance, ensuring transparency and trust through code.

- Liquidity pools play a critical role in DeFi by enabling smooth trading, lending, and yield farming while rewarding liquidity providers.

- DeFi tokens support governance, rewards, and access control, giving users the power to vote on protocol upgrades and decisions.

- Oracles provide real-world data like asset prices and market conditions to smart contracts, ensuring accurate and reliable DeFi execution.

- Security is essential in DeFi and depends on audits, open-source code, risk management tools, and responsible user behavior.

- DeFi offers faster settlements, global access, transparency, and permissionless participation compared to traditional financial systems.

- The future of DeFi focuses on better user experience, cross-chain interoperability, stronger security, and mass adoption.

Decentralized Finance, commonly known as DeFi, is changing the way financial products are built and used. Instead of depending on banks or other middlemen, DeFi platforms allow people and businesses to lend, borrow, trade, and manage digital assets directly on the blockchain. Over the last few years, DeFi has grown from a small experiment into a powerful financial ecosystem used across the world.

However, building a successful DeFi platform is not as simple as writing a smart contract and launching it on a blockchain. DeFi systems handle real money, real users, and real risks. A small mistake in smart contract logic, security design, or system architecture can lead to loss of funds and loss of user trust. This is why security, scalability, and proper planning are the most important parts of DeFi.

This blog is written to help you clearly understand how DeFi platforms are actually built. It explains the core concepts of DeFi, how DeFi systems work behind the scenes, how to design secure and scalable architectures, and how to avoid common mistakes that cause DeFi projects to fail. Whether you are a startup founder, a business leader, or someone exploring decentralized finance for the first time, this guide will help you make better and safer decisions.

By focusing on real-world practices, proven security approaches, and long-term scalability, this guide aims to be a trusted and practical resource for building reliable DeFi platforms that can grow with users and market demand.

The Structural Foundation of Decentralized Finance

At its core, decentralized finance is built on the idea that financial rules can be enforced through code rather than institutions. Blockchain networks act as neutral settlement layers where transactions are recorded immutably, while digital contracts automate financial operations without requiring manual intervention.

In this structural model:

- Users maintain full control over their assets through non-custodial wallets.

- Transactions are settled directly on-chain.

- Financial logic executes automatically based on predefined conditions.

- All activity remains publicly verifiable and auditable.

This architecture reduces reliance on intermediaries, shortens settlement cycles, and increases transparency. However, it also introduces new design responsibilities related to security, governance, and risk management.

The Building Blocks of a DeFi Platform

Decentralized finance platforms operate as modular financial ecosystems rather than standalone applications. Each component performs a defined role within the broader system, enabling secure capital movement, automated enforcement of rules, and transparent governance across the protocol.

1. Digital Contracts and Protocol Logic

Digital contracts form the operational backbone of decentralized finance systems. These contracts encode financial logic such as asset transfers, collateral management, reward distribution, and governance execution. Once deployed, they operate autonomously under strict deterministic conditions, eliminating discretionary control and reducing counterparty risk. Proper contract design emphasizes modularity, upgrade safety, and invariant enforcement to protect system integrity.

2. Liquidity Infrastructure

Liquidity pools provide the capital foundation required for decentralized trading, lending, and yield mechanisms. Assets deposited into these pools enable continuous market activity while aligning incentives through fees or protocol rewards. Efficient liquidity design directly impacts price stability, capital efficiency, and user confidence within the ecosystem.

3. Tokenized Value and Governance Instruments

Tokens within DeFi ecosystems represent programmable economic value. Beyond transferability, tokens often support governance participation, protocol incentives, and access control. Governance-enabled tokens allow stakeholders to influence system parameters, upgrades, and treasury decisions, reinforcing decentralized control while introducing accountability.

4. Oracle and Data Integrity Layer

Accurate external data is critical to decentralized finance operations. Oracle networks deliver price feeds and market conditions required for contract execution. Robust oracle implementation includes deviation thresholds, staleness detection, and fallback mechanisms to prevent manipulation or incorrect system behavior.

5. Access and Interaction Interfaces

User-facing interfaces provide secure access to DeFi protocols while preserving self-custody. These interaction layers abstract underlying complexity, enabling wallet-based participation without compromising transparency or control.

Architecture of a DeFi Platform

A scalable and secure DeFi platform relies on a layered architectural approach, similar to enterprise financial systems but with blockchain-native components.

| Layer | What It Does | Example |

|---|---|---|

| Blockchain Layer | Records and finalizes all transactions securely and permanently. | Like a digital ledger or foundation that stores all financial activity. |

| Smart Contract (Digital Contract) Layer | Automates financial rules, transactions, and governance without human involvement. | Think of self-operating vending machines that execute actions automatically. |

| Liquidity Layer | Provides funds for trading, lending, staking, and earning rewards. | Like a shared money pool where users supply funds and earn interest. |

| Oracle Layer | Supplies real-world data such as prices and market information. | Like a trusted reporter feeding accurate data to smart contracts. |

| Risk & Control Layer | Manages liquidations, monitors risks, and protects platform stability. | Like security guards and alarm systems protecting user funds. |

| Backend Services | Processes data, analytics, APIs, and system logic for applications. | Like the engine room powering dashboards and DeFi apps. |

| Frontend Interface | Provides user interaction through wallets, dashboards, and controls. | Like a banking app where users manage assets and transactions. |

| Security Layer | Audits code, monitors threats, and prevents malicious attacks. | Like safes, locks, and cameras protecting the entire system. |

Each layer must be designed with scalability, security, and interoperability in mind to support long-term growth.

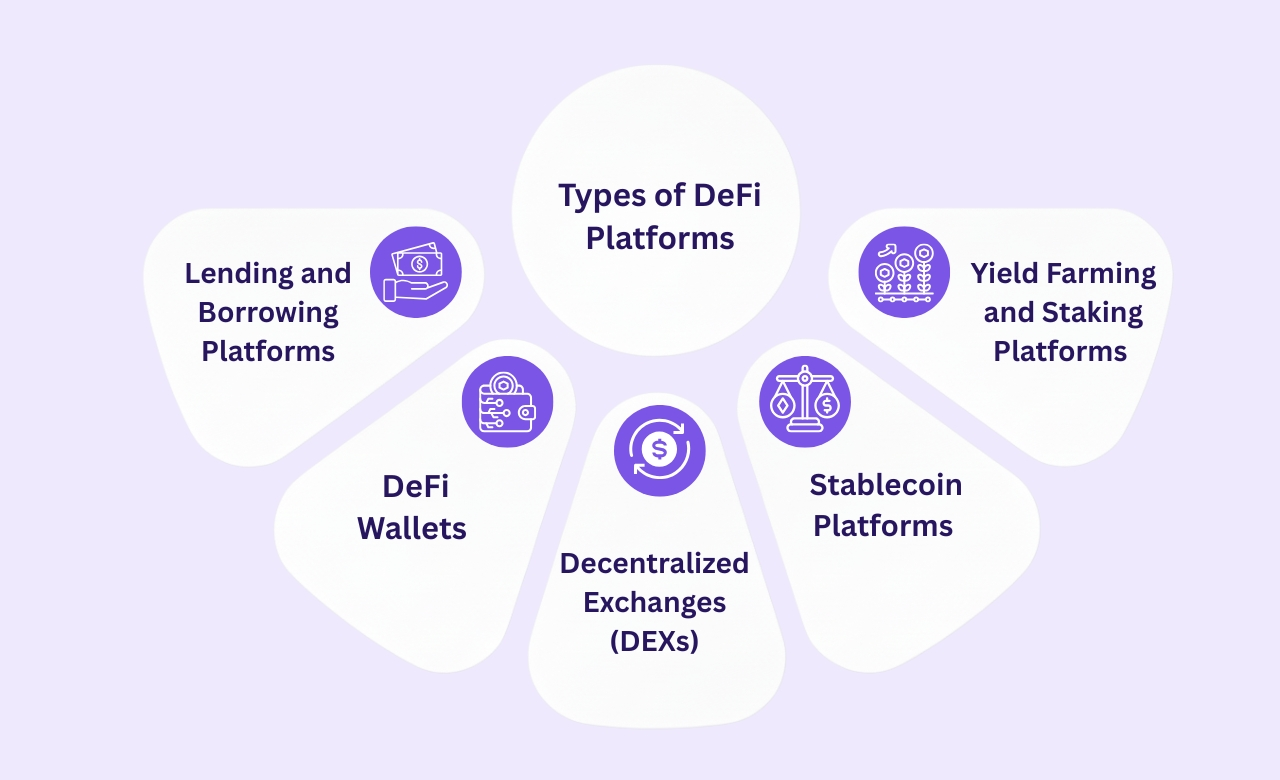

Types of DeFi Platforms and Use Cases

Decentralized finance solutions come in many forms, each serving a different purpose.

1. Decentralized Exchanges (DEXs)

Decentralized exchanges, or DEXs, let users trade digital assets directly from their wallets. Unlike traditional exchanges, DEXs do not hold your funds. This means you always remain in control of your money, while trades happen securely and transparently on the blockchain.

2. Lending and Borrowing Platforms

Lending and borrowing platforms allow users to earn interest or take out loans without relying on banks. By supplying their digital assets to the platform, users can automatically earn rewards, while those who need funds can borrow assets by locking their cryptocurrency as collateral. All transactions are handled by smart contracts, which ensure that every process is fair, transparent, and efficient, removing the need for any middlemen.

3. Yield Farming and Staking Platforms

Yield farming and staking platforms help users grow their digital assets. By locking tokens into these systems, users can earn rewards. The amount of reward usually depends on how long the tokens are locked and how actively the user participates. It’s a way to earn more from your existing assets while supporting the platform.

4. Stablecoin Platforms

Stablecoins are digital assets designed to maintain a steady value, unlike cryptocurrencies that often fluctuate. They are commonly used for payments, trading, or savings within decentralized finance ecosystems. Stablecoins provide a safe and predictable way to hold value in a decentralized system.

5. DeFi Wallets

DeFi wallets give users full control over their digital assets. With a DeFi wallet, you can store, send, and interact with cryptocurrencies safely. Unlike traditional bank accounts, you are the sole owner of your private keys, which means only you can access your funds.

Security and Safety in Decentralized Finance Platforms

Security is one of the most important topics in decentralized finance.

Since DeFi platforms handle real money, even small mistakes can lead to big losses. Understanding risks and safety measures is essential before using these platforms.

Common Decentralized Finance Risks:

- Smart contract bugs: Errors in the code can allow funds to be stolen or lost.

- Price manipulation: Some tokens can be manipulated, affecting trading and lending.

- Incorrect data from oracles: If external data feeds are wrong, smart contracts may behave incorrectly.

- User mistakes: Sending funds to the wrong address or losing private keys can result in permanent loss.

How Decentralized Finance Platforms Improve Safety:

- Regular smart contract audits: Experts check code for vulnerabilities before launch.

- Transparent code: Anyone can review how the platform works, increasing trust.

- Built-in risk controls: Protocols often include automatic safeguards to reduce losses.

- Community monitoring: Users can spot unusual activity and help keep the system secure.

User Responsibility:

- Always protect your digital wallet and private keys.

- Be careful with transactions, double-check addresses, and avoid sharing sensitive information.

By combining platform security measures with responsible user practices, DeFi can be both safe and exciting, offering a transparent way to manage and grow digital assets.

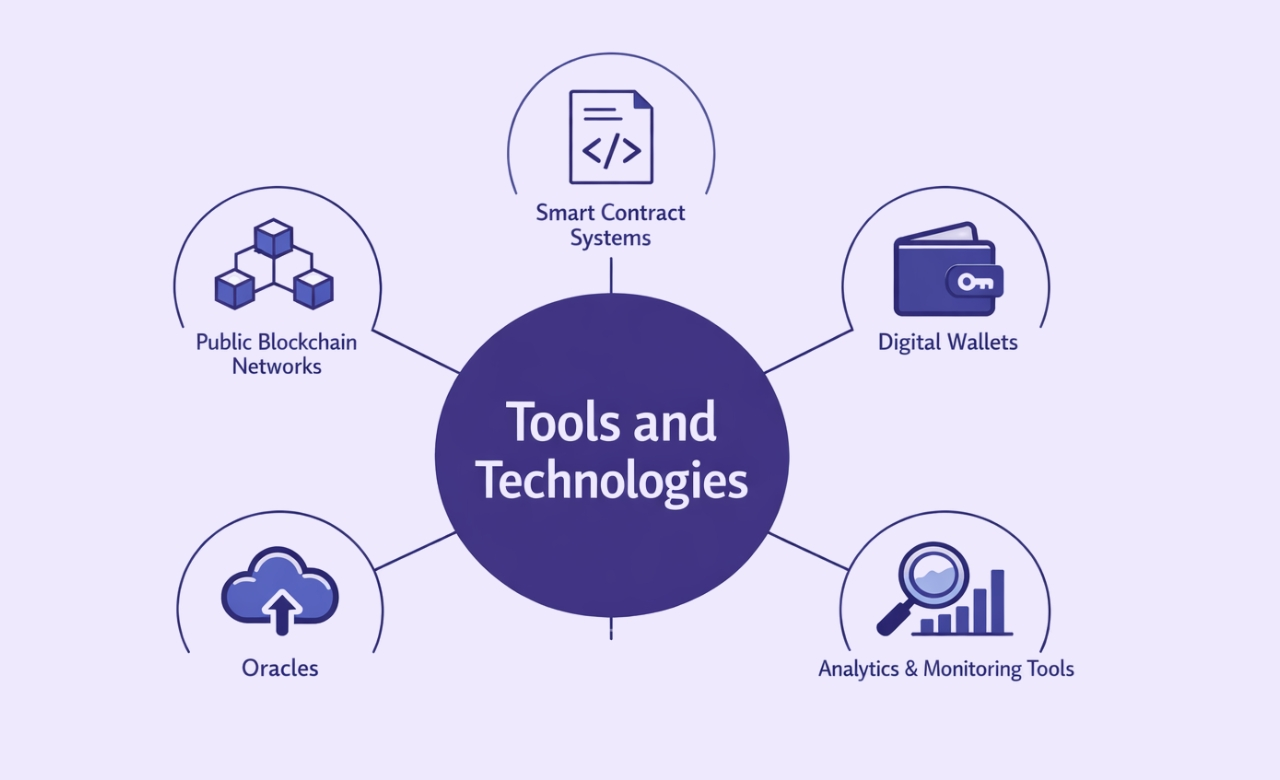

Tools and Technologies Used in DeFi Platforms

DeFi platforms rely on a connected ecosystem of technologies working together.

These include:

- Public Blockchain Networks:

These are the foundations of decentralized finance. Blockchains store and verify every transaction, ensuring transparency and security without the need for banks or central authorities. - Smart Contract Systems:

Smart contracts are self-executing programs that automatically handle transactions and enforce rules. They remove the need for intermediaries, making processes faster and more trustworthy. - Digital Wallets:

Wallets allow users to safely store, send, and interact with their digital assets. Users control their private keys, meaning they have full ownership of their funds. - Oracles:

Oracles provide real-world data, like price feeds, to smart contracts. This ensures that DeFi applications can make decisions based on accurate and up-to-date information. - Analytics and Monitoring Tools:

These tools help track platform performance, monitor transactions, and identify risks. They are essential for both users and developers to ensure smooth operation.

Each tool plays a role in keeping decentralized finance reliable and efficient.

Benefits of Using Decentralized Finance

DeFi platforms offer several advantages compared to traditional financial systems.

Key benefits include:

- Full Control Over Assets:

Users have complete ownership of their funds, managing them directly through digital wallets without relying on banks or intermediaries. - No Intermediaries:

Transactions happen automatically via smart contracts, reducing fees and eliminating delays caused by middlemen. - Transparent Transactions:

All activity is recorded on public blockchains, allowing anyone to verify transactions, creating trust and accountability. - Global Access:

Anyone with an internet connection can use DeFi platforms, breaking down geographical and financial barriers. - Faster Settlements:

Transactions are executed automatically and almost instantly, unlike traditional systems that can take days to process payments or loans. - Open Participation:

DeFi is open to everyone, regardless of background or financial status, making financial services more inclusive.

These benefits are why decentralized finance continues to grow worldwide.

Real-World Use of DeFi Platforms

DeFi platforms are used by:

- Individual Users:

People manage their digital assets, trade cryptocurrencies, earn interest, or participate in staking and yield farming without relying on banks. - Businesses:

Companies use DeFi solutions for faster, cheaper cross-border payments and efficient treasury management. - Communities:

Groups and organizations can run shared financial systems, such as community funds or decentralized cooperatives, in a transparent way. - Innovators:

Developers and entrepreneurs explore new financial models, creating innovative applications that expand the possibilities of decentralized finance.

As adoption increases, DeFi solutions continue to expand into new areas.

Recent research highlights DeFi’s growing adoption in areas such as lending, staking, and stablecoins, demonstrating its transformative potential in global finance, Springer[1]. As adoption continues to rise, DeFi solutions are expanding into new areas, opening up opportunities for individuals, businesses, and communities worldwide.

Challenges and Limitations of DeFi

While decentralized finance offers many exciting advantages, it also comes with its own set of challenges. Being aware of these limitations helps users make smarter and safer decisions.

Common Challenges in DeFi:

- Price Volatility:

Cryptocurrency prices can change rapidly, which can affect the value of assets, loans, and rewards. - Complex User Experience:

DeFi platforms can be confusing for beginners, with many steps like connecting wallets, managing private keys, and interacting with smart contracts. - Security Risks:

Vulnerabilities in smart contracts, oracles, and user mistakes can lead to potential losses, making it important to follow best practices. - Regulatory Uncertainty:

Rules around DeFi are still evolving in many countries, and unclear regulations can impact how platforms operate and how users interact with them.

Understanding these challenges helps users navigate the decentralized finance space more safely and make informed decisions while taking advantage of its opportunities.

Advanced DeFi Concepts and Strategies

Decentralized Finance (DeFi) is more than just lending, borrowing, and staking. As the ecosystem grows, advanced concepts, strategies, and technologies are shaping its future. Understanding these elements can help users and developers maximize opportunities while managing risks.

Decentralized Governance and DAOs

DeFi platforms often rely on decentralized governance to make decisions collectively instead of relying on a central authority. DAOs (Decentralized Autonomous Organizations) allow token holders to vote on important matters such as protocol upgrades, fee structures, or fund allocation.

Example: Platforms like MakerDAO let users participate in governance, ensuring the system evolves democratically and aligns with the community’s interests. Decentralized governance gives users a direct say in the platform’s future, increasing transparency and accountability.

Advanced DeFi Strategies: Liquidity Mining, Flash Loans, and More

Beyond basic operations, DeFi offers advanced strategies to help users maximize returns:

- Liquidity Mining: Think of it as renting your money to a neighborhood store. You provide assets to the “store” (liquidity pool), and in return, you earn a portion of the profits as rewards.

- Flash Loans: Imagine borrowing a library book for just a few hours, using it, and returning it immediately, without leaving anything behind. Flash loans are instant loans used to make quick moves in the market.

- Yield Optimization: This is like mixing different farming techniques to get the biggest harvest. You combine staking, lending, and farming your crypto to earn more rewards safely.

These strategies can be highly profitable but require careful planning, timing, and understanding of associated risks.

Cross-Chain and Interoperability Technologies

Modern DeFi platforms are increasingly enabling assets and data to move seamlessly across multiple blockchains. Cross-chain solutions reduce fragmentation, improve liquidity, and allow users to leverage opportunities on different chains.

Example: Protocols like Thorchain or Cosmos facilitate cross-chain asset transfers, making decentralized finance more connected and efficient.

DeFi Regulatory Landscape and Legal Challenges

As DeFi adoption grows, regulators are taking notice. Although decentralization makes oversight challenging, governments worldwide are introducing rules around:

- Compliance and KYC (Know Your Customer)

- Taxation on digital assets

- Consumer protection and anti-fraud measures

Understanding these regulatory landscapes helps users and developers operate safely while minimizing legal risks.

Impact of DeFi on Traditional Finance (TradFi) and Banking

DeFi is reshaping how financial services operate by:

- Reducing reliance on intermediaries

- Lowering transaction costs

- Providing global access to financial products

Banks and financial institutions are exploring ways to integrate DeFi solutions into their operations, signaling a gradual convergence between decentralized and traditional finance. This evolution highlights DeFi’s growing influence on the future of money and banking.

Advanced DeFi concepts and strategies are transforming the financial landscape. By understanding decentralized governance, advanced investment techniques, cross-chain technologies, and regulatory challenges, users can safely navigate the ecosystem and leverage new opportunities. Staying informed and cautious is key to maximizing the benefits of decentralized finance while minimizing risks.

DeFi Security, Risk Management, and Analytics

Ensuring security and effectively managing risks is crucial for anyone participating in DeFi. With millions of dollars flowing through decentralized platforms, users need tools and strategies to protect their assets while optimizing returns.

DeFi Insurance: Protecting Against Risks

DeFi insurance protocols are designed to safeguard users from unexpected losses, including:

- Smart Contract Failures: Coverage in case of coding errors or bugs in smart contracts.

- Hacking or Exploits: Protection against unauthorized access or malicious attacks on the platform.

- Market Volatility: Compensation for losses caused by sudden fluctuations in token prices.

Key Benefits of DeFi Insurance:

- Pooled funds from multiple participants create a decentralized safety net.

- Offers peace of mind for users engaging in advanced strategies like yield farming and staking.

- Encourages wider adoption by reducing perceived risk for new users.

DeFi Analytics and Portfolio Management Tools

Analytics and portfolio tools help users make smarter, data-driven decisions in the decentralized ecosystem:

- Track Performance: Monitor yields, rewards, and asset growth across different platforms.

- Evaluate Risk: Identify high-risk positions and exposure to volatile tokens.

- Dashboard Insights: View transaction histories, allocations, and real-time market data in one place.

- Optimized Decision Making: Helps both beginners and experienced users maximize returns while minimizing mistakes.

Why Analytics Matters:

- Supports informed participation in complex DeFi strategies.

- Reduces errors caused by mismanagement or lack of visibility.

- Enhances confidence when exploring new platforms or cross-chain opportunities.

By combining insurance protocols with advanced analytics, users can enjoy a safer, more predictable DeFi experience while leveraging the full potential of decentralized financial systems.

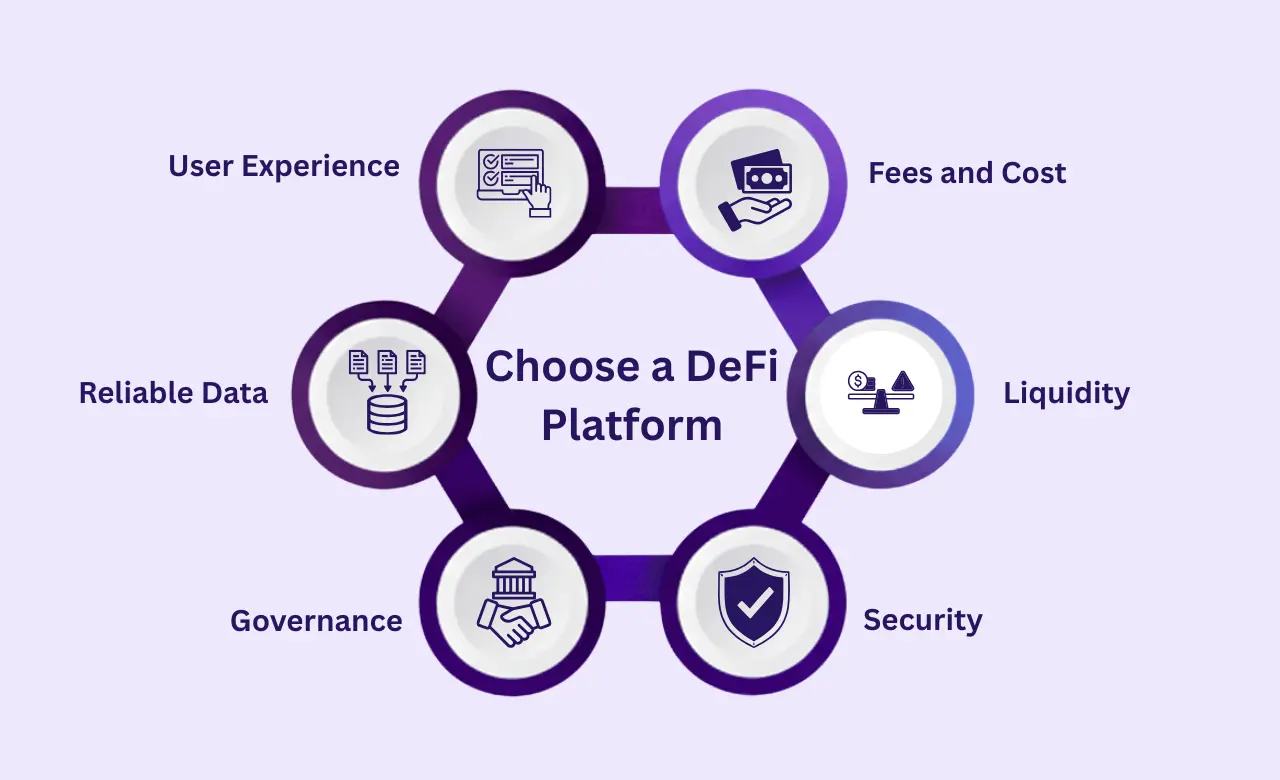

How to Evaluate and Choose a DeFi Platform

Selecting the right DeFi platform is crucial for both beginners and experienced users. With thousands of platforms available, it’s essential to focus on security, transparency, liquidity, and usability to ensure your funds are safe and your investment strategies are effective.

1. Security First

Security should be your top priority when choosing a DeFi platform. Consider the following:

- Audited Smart Contracts: Platforms with third-party audits are less likely to contain exploitable vulnerabilities.

- Transparent Code: Open-source code allows the community and experts to review the platform for potential risks.

- Built-in Risk Controls: Look for platforms that implement automatic safeguards, such as emergency withdrawal options or capped exposure limits.

2. Liquidity and Market Depth

High liquidity ensures smooth transactions and minimizes slippage during trades or withdrawals.

- Check the size of liquidity pools for the tokens you want to trade or lend.

- Platforms with diverse liquidity providers tend to be more stable and reliable.

- Consider the availability of cross-chain support if you plan to move assets across different blockchains.

3. Fees and Cost Structure

Transaction costs can impact your profitability, especially for frequent traders or small investors.

- Compare gas fees for transactions on Ethereum or other blockchains.

- Evaluate platform-specific fees for lending, borrowing, or swapping tokens.

- Some platforms provide fee rewards or incentives for active users—factor this into your decision.

4. Community and Governance

A strong community often indicates a trustworthy and well-maintained platform.

- Active Governance: Platforms with decentralized governance allow token holders to vote on proposals and protocol changes.

- Community Engagement: Active forums, social media presence, and responsive support show that the platform values user feedback.

- Reputation and Reviews: Research the platform’s track record, user testimonials, and any past security incidents.

5. Reliable Data and Oracles

Accurate market data is critical for decentralized finance activities like lending, borrowing, or yield farming.

- Ensure the platform uses trusted oracles for price feeds.

- Check that analytics dashboards provide real-time, transparent information about assets, pools, and market trends.

6. User Experience and Accessibility

Finally, usability can make a big difference, especially for beginners:

- A clean, intuitive interface reduces mistakes and makes navigation easier.

- Look for platforms with integrated wallets or easy wallet connectivity.

- Consider whether the platform offers educational resources or guides to help you get started safely.

Evaluating a DeFi platform is not just about returns, it’s about security, reliability, and transparency. By checking audits, liquidity, fees, governance, and data accuracy, users can confidently choose platforms that offer both safety and growth potential. Taking the time to perform this due diligence will protect your assets and enhance your overall DeFi experience.

Focus on how platforms are making DeFi easier for everyone

The future of DeFi focuses on:

- Easier User Experiences:

Platforms are working to simplify interfaces, making it easier for beginners to manage digital assets, lend, borrow, or trade without technical hurdles. - Cross-Chain Systems:

Future DeFi solutions will allow assets to move seamlessly between different blockchain networks, improving flexibility and connectivity. - Better Safety Standards:

Enhanced security protocols, more rigorous audits, and advanced risk management tools will make DeFi platforms safer for users. - Wider Adoption by Institutions:

As awareness grows, more businesses and financial institutions are likely to embrace DeFi solutions, expanding its reach and legitimacy.

As these developments continue, decentralized finance is expected to become more accessible, reliable, and integrated into everyday financial activities, opening new opportunities for individuals, businesses, and communities worldwide.

Looking to Launch a Secure DeFi Product?

Nadcab Labs designs and develops end-to-end DeFi platforms with a strong focus on security, performance, and scalability. From smart contracts to liquidity systems, we help you build DeFi solutions you can trust.

Navigating the World of DeFi

Decentralized Finance (DeFi) is reshaping the way people and businesses manage money by removing intermediaries and giving users full control over their assets. With transparent transactions and automated processes powered by blockchain and smart contracts, DeFi provides faster, more inclusive, and global financial solutions compared to traditional systems.

While DeFi offers many benefits, it also comes with challenges such as security risks, complex user experiences, and regulatory uncertainties. Understanding how DeFi platforms work, protecting digital wallets, and using trusted platforms are essential steps for anyone looking to participate safely and confidently in this evolving ecosystem.

Looking ahead, innovations like cross-chain systems, improved user interfaces, and stronger security measures will make DeFi more accessible and reliable. For individuals, businesses, and innovators, decentralized finance opens new opportunities to engage in a transparent, efficient, and inclusive financial world, making it a key part of the future of money.

Frequently Asked Questions

DeFi platforms implement security measures like audits, transparent code, and risk controls. However, users must also protect wallets and private keys, as mistakes or smart contract vulnerabilities can lead to losses.

Platforms earn revenue through transaction fees, lending interest, and sometimes token incentives. Users contributing assets or participating in governance may also receive rewards.

Oracles provide real-world data like asset prices or market conditions to smart contracts. Accurate oracles are essential for safe and fair operations within decentralized finance platforms.

While DeFi offers alternatives to some banking services, it is still evolving. Regulatory frameworks, user adoption, and security improvements are needed before it can fully replace traditional banks.

Liquidity pools are collections of digital assets locked in smart contracts. They allow trading, lending, and reward distribution. Users who contribute to pools often earn fees or incentives.

Smart contracts automatically execute transactions according to predefined rules. This reduces human error and the need for intermediaries, making fraud much harder compared to traditional systems.

Yes, many platforms have user-friendly interfaces. Beginners should start small, use guides, and choose reputable platforms to reduce risk.

Start by creating a secure digital wallet, learning about smart contracts, using small amounts of funds, following reputable platforms, and staying updated on security practices. Understanding risks and taking gradual steps is key to safe participation.

Cross-chain systems will allow assets and data to move seamlessly between different blockchains. This increases liquidity, connectivity, and interoperability, creating a more integrated financial ecosystem.

Examples include decentralized exchanges (DEXs) like Uniswap, lending platforms like Aave, yield farming protocols, stablecoins like USDC, and decentralized insurance systems. These platforms demonstrate practical use cases of DeFi technology.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.