Key Takeaways

- DeFi peer to peer systems eliminate traditional financial intermediaries by enabling direct transactions between participants through blockchain technology and smart contracts.

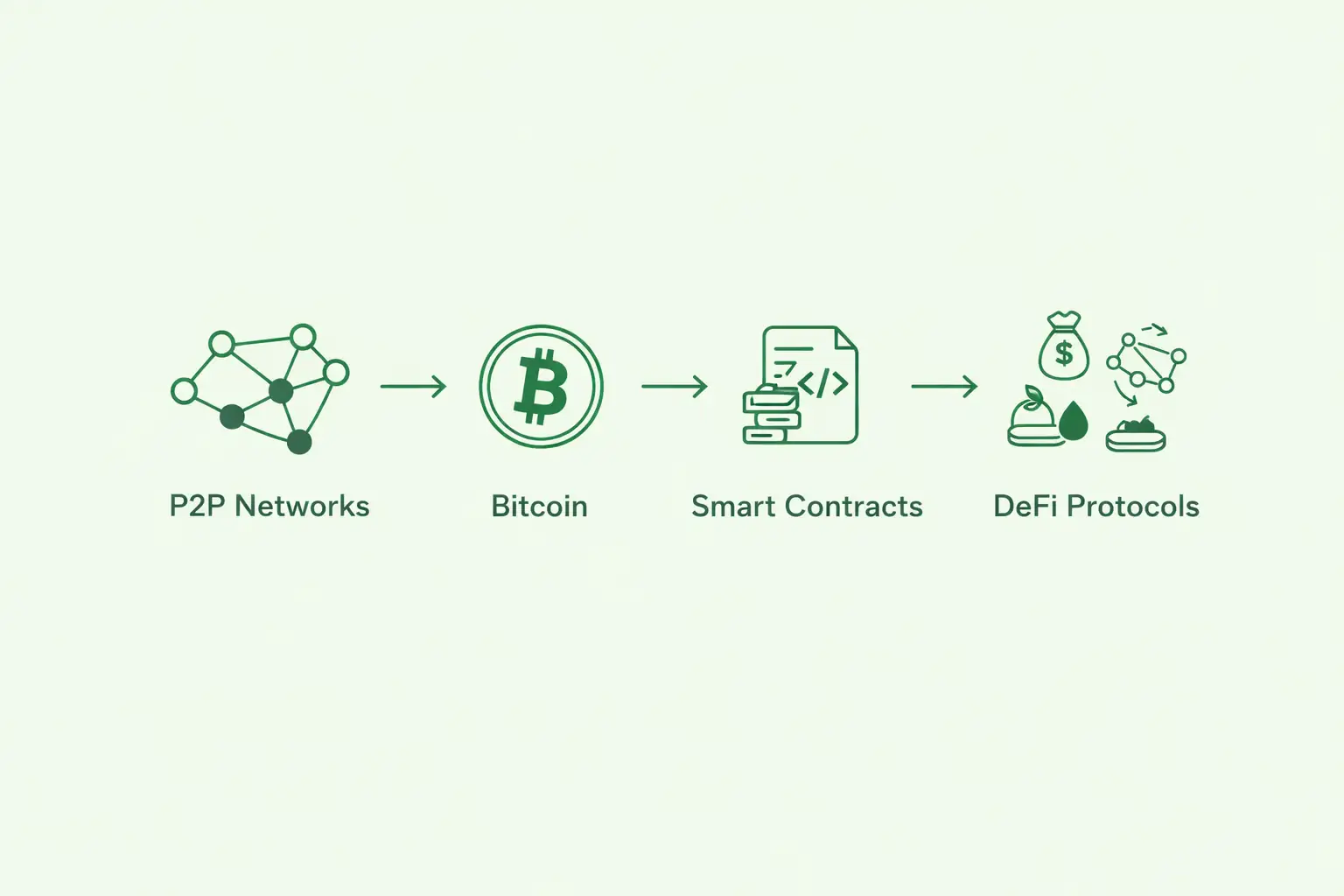

- The peer to peer foundation of DeFi traces back to early file sharing networks and Bitcoin, which demonstrated the viability of decentralized coordination without central authorities.

- Smart contracts serve as the technological backbone enabling automated, trustless peer to peer interactions in DeFi protocols across lending, borrowing, and trading functions.

- Peer to peer DeFi lending platforms allow users to lend and borrow assets directly with one another, earning yields without traditional banking intermediaries extracting profits.

- Decentralized exchanges embody peer to peer trading principles by matching buyers and sellers directly through automated market makers or order book systems on blockchain.

- Trustless transaction mechanisms in peer to peer DeFi rely on cryptographic proofs and blockchain immutability rather than reputation or institutional trust.

- Liquidity provision in peer to peer DeFi protocols enables anyone to become a market maker by contributing capital to liquidity pools and earning proportional trading fees.

- The transparency inherent in peer to peer DeFi systems allows all participants to verify transactions, audit smart contracts, and understand protocol mechanics without relying on proprietary black boxes.

- While peer to peer DeFi offers revolutionary benefits, it also introduces unique risks including smart contract vulnerabilities, impermanent loss, and the absence of traditional customer protection mechanisms.

- The evolution of peer to peer principles in DeFi continues toward more sophisticated models incorporating DAOs in DeFi Space for governance, cross-chain interoperability, and enhanced capital efficiency.

The revolutionary transformation of financial services through decentralized finance traces its philosophical and technological lineage directly to peer to peer systems that challenged centralized control long before blockchain technology emerged. Understanding the peer to peer roots of DeFi provides essential context for comprehending why this movement represents not merely a technological innovation but a fundamental reimagining of how financial value and services can be exchanged among participants. The core principle underlying both early peer to peer networks and modern DeFi platforms remains consistent: enabling direct interaction between parties without requiring trusted intermediaries to facilitate, validate, or profit from those interactions.

Traditional financial systems have historically concentrated power, control, and economic benefits within institutional intermediaries including banks, payment processors, exchanges, and clearinghouses. These centralized entities serve as gatekeepers who determine who can access financial services, extract fees from transactions, maintain exclusive control over transaction data, and possess unilateral authority to freeze accounts or reverse transactions. The peer to peer model fundamentally challenges this paradigm by distributing these functions across network participants, replacing institutional trust with cryptographic verification, and creating open systems where anyone can participate without requiring permission from central authorities.

The significance of peer to peer foundations extends beyond mere technological architecture to encompass profound implications for financial inclusion, economic sovereignty, and the democratization of finance. By eliminating intermediaries who historically profited from their gatekeeping positions, peer to peer DeFi systems enable more efficient capital allocation, reduce transaction costs, and create opportunities for individuals previously excluded from traditional financial services. The transparency inherent in blockchain-based peer to peer systems further empowers participants by making protocol rules, transaction histories, and operational mechanics visible to anyone, contrasting sharply with the opacity that characterizes much of traditional finance.

What Peer to Peer Finance Means in DeFi?

Peer to peer finance in the DeFi context refers to financial interactions occurring directly between network participants without intermediary institutions facilitating transactions, holding custody of assets, or enforcing agreement terms. This model leverages blockchain technology to create trustless environments where parties can transact with confidence even without knowing or trusting their counterparties, as the underlying protocol ensures that agreements execute exactly as programmed through immutable smart contracts. Unlike traditional peer to peer lending platforms that still rely on centralized platforms to match borrowers with lenders and enforce repayment, true peer to peer DeFi operates through decentralized protocols that remove even platform operators from transaction flows.

The mechanics of peer to peer DeFi diverge fundamentally from both traditional finance and earlier peer to peer lending platforms. In traditional systems, banks act as intermediaries accepting deposits from savers and lending to borrowers, assuming credit risk while extracting the spread between deposit rates and lending rates. Early peer to peer lending platforms like LendingClub or Prosper improved upon this by connecting lenders directly with borrowers through online marketplaces, but these platforms still maintained centralized control over user verification, credit assessment, fund custody, and repayment enforcement. DeFi peer to peer systems eliminate even these residual intermediaries, with smart contracts automatically matching suppliers and consumers of capital, managing collateral, enforcing liquidations, and distributing yields without human intervention or centralized platform control.

The peer to peer architecture in DeFi manifests across multiple financial functions beyond lending. Decentralized exchanges facilitate peer to peer trading where buyers and sellers interact directly through smart contracts rather than through centralized order books controlled by exchange operators. Liquidity pools enable peer to peer market making where anyone can provide capital to facilitate trading and earn proportional fees. Prediction markets, insurance protocols, derivatives platforms, and yield aggregators all implement peer to peer principles by connecting parties with complementary needs through decentralized protocols rather than centralized intermediaries. This comprehensive reimagining of financial infrastructure around peer to peer principles represents DeFi’s most profound innovation.

Origins of Peer to Peer Systems Before DeFi

The conceptual and technological foundations for peer to peer DeFi emerged from earlier waves of decentralized systems that challenged centralized control across various domains. The first major peer to peer networks appeared in the late 1990s and early 2000s with file sharing platforms like Napster, Gnutella, and BitTorrent. These systems demonstrated that valuable services could operate without central servers by distributing functionality across user devices that simultaneously consumed and provided resources. While these early implementations faced legal challenges and technical limitations, they proved that decentralized coordination was feasible at scale and established the viability of systems where participants contributed resources in exchange for access to shared networks.

Bitcoin represented the crucial breakthrough that made peer to peer finance practically achievable by solving the double spending problem without requiring trusted third parties. Prior to Bitcoin, digital currency schemes faced a fundamental challenge: how to prevent users from spending the same digital tokens multiple times without a central authority tracking all transactions and account balances. Bitcoin’s innovation combined cryptographic techniques, distributed consensus mechanisms, and economic incentives to create a peer to peer electronic cash system where network participants collectively maintained transaction history and prevented double spending through proof of work mining. This breakthrough demonstrated that valuable financial assets could exist and transfer in purely peer to peer environments, establishing the technological foundation upon which DeFi would later build.

Between Bitcoin’s emergence and the rise of DeFi, various projects explored peer to peer applications beyond simple value transfer. Namecoin applied blockchain technology to decentralized domain name systems. Colored coins and counterparty attempted to create tokens representing various assets on the Bitcoin blockchain. OpenBazaar envisioned peer to peer marketplaces for goods and services without intermediary platforms extracting fees or controlling listings. These experiments, while often limited in adoption, established important precedents and identified technical challenges that would inform subsequent DeFi innovations. The collective lessons from these early peer to peer systems including both successes and failures created the knowledge base and technological toolkit that enabled Ethereum and later platforms to support the sophisticated smart contract-based peer to peer financial protocols we now recognize as DeFi.

How Blockchain Enabled Peer to Peer DeFi Models

Blockchain technology provides the essential infrastructure enabling true peer to peer financial interactions by creating shared, immutable ledgers that record transactions transparently without requiring trusted central authorities. The distributed nature of blockchain networks means that no single entity controls the transaction history or can unilaterally modify records, creating a foundation of shared truth that allows participants to transact confidently without needing to trust specific counterparties or intermediaries. This technological breakthrough solves fundamental coordination problems that previously made peer to peer finance impractical, as participants lacked reliable mechanisms to verify transaction legitimacy, prevent fraud, or enforce agreements without recourse to centralized arbitrators.

The immutability property of blockchains proves particularly crucial for peer to peer DeFi applications. Once transactions are confirmed and incorporated into the blockchain, they become computationally infeasible to reverse or alter, providing participants with strong guarantees about transaction finality. This immutability eliminates the need for settlement periods, chargebacks, or dispute resolution processes that characterize traditional finance, enabling instant final settlement of peer to peer transactions. Furthermore, blockchain immutability creates audit trails that allow anyone to verify transaction histories, smart contract behavior, and protocol operations, fostering transparency that builds trust in systems even without trusting specific operators or participants.

Blockchain networks also enable permissionless participation, a defining characteristic of peer to peer DeFi that distinguishes it from both traditional finance and earlier peer to peer platforms. Anyone with internet access can interact with blockchain-based DeFi protocols without requiring approval from gatekeepers, submitting to identity verification, or meeting minimum balance requirements. This openness democratizes access to financial services, enabling global participation regardless of geography, wealth, or institutional relationships. The combination of shared ledgers, immutability, transparency, and permissionless access creates the technological substrate upon which sophisticated peer to peer financial protocols can operate at scale, processing billions in transactions without centralized intermediaries or trusted third parties.

Role of Smart Contracts in Peer to Peer DeFi

Smart contracts serve as the programmable infrastructure that transforms blockchain networks from simple value transfer systems into comprehensive peer to peer financial platforms capable of supporting complex interactions. These self-executing programs deployed on blockchains automatically enforce agreement terms, manage collateral, execute liquidations, distribute yields, and coordinate activities among multiple parties without requiring human intervention or centralized administration. By encoding financial logic directly into blockchain code, smart contracts eliminate the need for intermediaries to interpret agreements, judge compliance, or enforce outcomes, creating truly autonomous peer to peer financial systems where protocol rules execute deterministically according to predefined logic.

The trustless nature of smart contract execution represents their most transformative property for peer to peer DeFi. When users interact with smart contracts, they can verify exactly how those contracts will behave under all circumstances by reviewing the underlying code, which executes identically regardless of who initiates transactions or what external interests might prefer different outcomes. This transparency and determinism eliminate the need to trust counterparties, protocol operators, or administrators to act honestly or competently, as the code itself guarantees outcomes. Smart contracts thus enable strangers to engage in complex financial transactions with confidence, knowing that agreements will execute precisely as programmed without possibility of deviation, discrimination, or manipulation.

The composability of smart contracts creates additional value for peer to peer DeFi ecosystems by enabling protocols to integrate seamlessly with one another. Developers can build new applications that leverage existing smart contracts as building blocks, creating sophisticated financial products through combinations of simpler protocols. A user might deposit assets into a lending protocol, use the receipt tokens as collateral in a derivatives platform, and deploy the borrowed funds into a yield farming strategy, all through composable smart contracts that interact automatically. This composability accelerates innovation, enables capital efficiency, and creates network effects where each new protocol enhances the utility of existing ones, distinguishing peer to peer DeFi from siloed traditional financial systems where interoperability requires extensive negotiation and technical integration work.

Eliminating Intermediaries Through DeFi Peer to Peer Networks

The elimination of intermediaries represents the defining characteristic distinguishing peer to peer DeFi from traditional financial systems and even from earlier peer to peer lending platforms. Traditional finance relies on extensive intermediary infrastructure including banks that hold deposits and extend credit, payment processors that facilitate transfers, exchanges that enable trading, clearinghouses that settle transactions, and regulators that oversee activities. Each intermediary extracts fees, imposes conditions, maintains exclusive control over critical functions, and creates dependencies that centralize power within institutional gatekeepers. DeFi peer to peer networks replace these intermediaries with decentralized protocols that distribute their functions across network participants while eliminating rent extraction and central control points.

Consider how peer to peer DeFi lending eliminates the traditional banking intermediary. In conventional systems, banks accept deposits from savers who earn minimal interest, then lend those funds to borrowers at significantly higher rates, capturing the spread as profit while assuming credit risk. This intermediation serves useful functions including credit assessment, risk management, and regulatory compliance, but also concentrates power and profits within banking institutions while excluding individuals who fail to meet banking criteria. Peer to peer DeFi lending protocols eliminate banks entirely by allowing lenders to deposit assets into smart contract-managed pools where borrowers can access capital by providing collateral, with interest rates determined algorithmically based on supply and demand rather than by institutional decisions.

The disintermediation extends beyond lending to encompass virtually all financial services. Decentralized exchanges eliminate traditional exchange operators who match orders, maintain custody of user funds, and profit from trading fees. Instead, peer to peer trading occurs through automated market makers where liquidity providers contribute capital to pools that facilitate trades algorithmically. Stablecoins eliminate banks and payment processors from cross-border transfers, enabling peer to peer value transmission at negligible cost. Derivatives protocols allow parties to create synthetic exposure to assets without involving brokers or clearinghouses. Insurance platforms enable peer to peer risk pooling without insurance companies extracting premiums. This comprehensive disintermediation fundamentally redistributes economic value from institutional intermediaries to protocol users and infrastructure providers.

Peer to Peer Lending and Borrowing in DeFi

Peer to peer lending protocols represent one of the earliest and most significant applications of DeFi principles, enabling direct capital allocation between lenders and borrowers without banking intermediaries. These protocols typically employ overcollateralized lending models where borrowers must deposit collateral exceeding their loan value to protect lenders from default risk. When a user deposits assets into a lending pool, those funds become available for others to borrow, with interest rates adjusting automatically based on utilization rates to balance supply and demand. Lenders earn interest proportional to their contribution to lending pools, while borrowers pay interest to access liquidity without selling their collateral assets, creating a peer to peer market for capital that operates continuously without human intervention.

The mechanics of peer to peer DeFi lending diverge fundamentally from traditional models in several crucial respects. First, lending and borrowing occur through smart contracts rather than through institutional decision-making, eliminating subjective credit assessments and enabling permissionless access. Anyone can lend by depositing assets into protocols, and anyone can borrow by providing sufficient collateral, with no credit checks, documentation requirements, or institutional approval processes. Second, interest rates emerge organically from supply and demand dynamics rather than from institutional pricing decisions, with algorithms adjusting rates continuously to maintain target utilization levels. Third, collateral management and liquidation occur automatically through smart contracts, which monitor collateral values and trigger liquidations when collateralization ratios fall below minimum thresholds.

The evolution of peer to peer lending in DeFi has produced increasingly sophisticated models that enhance capital efficiency and expand functionality. Early protocols like Compound and Aave pioneered basic lending and borrowing with dynamic interest rates and automated liquidations. Subsequent innovations introduced flash loans that enable uncollateralized borrowing within single transactions, rate switching between stable and variable interest models, isolation mode that limits contagion risks from exotic collateral, and credit delegation where trusted parties can borrow against others’ collateral. These enhancements demonstrate how peer to peer DeFi lending continues evolving beyond simple capital matching toward comprehensive credit markets that rival traditional banking functionality while maintaining the transparency, efficiency, and accessibility advantages inherent in peer to peer architectures.

Decentralized Exchanges and Peer to Peer Trading Roots

Decentralized exchanges embody peer to peer trading principles by enabling direct asset swaps between users without centralized exchange operators controlling order matching, custody, or trade execution. The evolution of decentralized exchange designs illustrates how peer to peer principles adapt to address specific challenges within DeFi contexts. Early decentralized exchanges attempted to replicate traditional order book models on-chain, where buyers and sellers submitted limit orders that matched when prices aligned. However, this approach faced significant challenges including high transaction costs from on-chain order placement and cancellation, limited liquidity due to fragmentation across multiple order books, and poor user experiences compared to centralized alternatives.

The breakthrough that enabled practical peer to peer trading came through automated market maker designs pioneered by protocols like Uniswap. Rather than matching individual buyers and sellers through order books, automated market makers maintain liquidity pools containing paired assets where trades execute against pooled liquidity according to mathematical formulas. Users who want to trade simply swap one asset for another with the pool, with prices determined algorithmically based on pool composition. This model transforms trading from a matching problem requiring counterparty discovery into a liquidity provision problem where anyone can contribute capital to pools and earn fees from trades. The peer to peer nature manifests in liquidity provision rather than in direct buyer-seller matching, with traders interacting with smart contract-managed pools funded by distributed liquidity providers.

The advantages of peer to peer decentralized trading extend beyond eliminating exchange operators to encompass fundamental improvements in market access and capital efficiency. Anyone can create trading pairs for any tokens without requiring exchange approval or meeting listing requirements, enabling long-tail asset trading impossible on centralized platforms. Liquidity providers earn fees proportional to their contribution, democratizing market making activities previously restricted to institutional participants. Composability enables sophisticated trading strategies that combine swaps with lending, derivatives, and other DeFi primitives. However, automated market makers also introduce unique challenges including impermanent loss for liquidity providers, capital inefficiency in certain price ranges, and susceptibility to front-running attacks, driving continued innovation in decentralized exchange designs.

Trustless Transactions in DeFi Peer to Peer Systems

Trustless transaction execution represents the foundational principle enabling peer to peer DeFi systems to function without requiring participants to trust counterparties, protocol operators, or centralized authorities. In traditional finance, trust permeates every interaction: users trust banks to maintain accurate balances and honor withdrawals, trust payment processors to complete transfers, trust exchanges to facilitate trades honestly, and trust legal systems to enforce agreements when disputes arise. This trust requirement creates dependencies on institutional intermediaries who must maintain reputations, comply with regulations, and possess resources to cover potential failures. Peer to peer DeFi eliminates these trust requirements by replacing institutional guarantees with cryptographic proofs and smart contract automation that ensure correct execution regardless of participant intentions or behaviors.

The mechanisms enabling trustless transactions combine multiple blockchain properties into comprehensive security models. Cryptographic signatures prove transaction authorization, ensuring that only rightful owners can transfer their assets without requiring intermediaries to verify identities or ownership. Blockchain immutability guarantees that confirmed transactions cannot be reversed or modified, eliminating the need for settlement periods or dispute resolution mechanisms. Smart contract determinism ensures that protocols behave exactly as programmed, executing identically for all users without possibility of discrimination, favoritism, or manipulation. Transparent code allows anyone to verify how protocols will behave under all circumstances, replacing opaque institutional processes with auditable logic that any participant can review.

The practical implications of trustless peer to peer transactions prove profound for financial inclusion and efficiency. Individuals previously excluded from traditional finance due to lack of credit history, documentation, or institutional relationships can access peer to peer DeFi services permissionlessly, as protocols evaluate only objective criteria like collateral value rather than subjective assessments of trustworthiness. Transaction costs decrease dramatically when intermediaries need not maintain extensive compliance, fraud prevention, and risk management infrastructure. Settlement occurs instantly rather than requiring days or weeks for clearance through traditional systems. Cross-border transactions flow freely without requiring correspondent banking relationships or regulatory approvals. These benefits demonstrate how trustless architecture fundamentally transforms financial accessibility and efficiency beyond what traditional systems can achieve.

Liquidity Creation in Peer to Peer DeFi Protocols

Liquidity represents the lifeblood of financial markets, determining how easily assets can be bought or sold without significantly impacting prices. Traditional financial systems concentrate liquidity provision within institutional market makers who use proprietary capital and sophisticated strategies to quote bid-ask prices across various assets. These institutional players benefit from advantages including access to wholesale funding, advanced technology infrastructure, regulatory relationships, and market information asymmetries that enable profitable market making while excluding retail participants. Peer to peer DeFi protocols democratize liquidity provision by enabling anyone to contribute capital to liquidity pools and earn proportional shares of trading fees, fundamentally redistributing market making profits from institutions to broader participant bases.

The mechanics of peer to peer liquidity provision vary across different protocol designs but generally involve depositing paired assets into smart contract-managed pools that facilitate trading through automated pricing algorithms. In constant product market maker models like those pioneered by Uniswap, liquidity providers deposit equal values of two assets into pools where trades execute according to the formula x multiplied by y equals k, ensuring that the product of pool reserves remains constant. Providers receive liquidity tokens representing their pool shares, which accrue value as trading fees accumulate within pools. When providers wish to exit, they redeem liquidity tokens for their proportional share of accumulated fees plus their original capital, adjusted for any changes in relative asset prices.

The evolution of peer to peer liquidity models continues toward greater capital efficiency and customization. Concentrated liquidity designs allow providers to focus their capital within specific price ranges where trading occurs most frequently, dramatically improving capital efficiency compared to distributing liquidity across all possible prices. Multiple fee tiers enable market-driven optimization where stable pairs use lower fees while volatile pairs compensate for higher risk with elevated fee structures. Dynamic fee adjustment algorithms respond to volatility conditions, increasing fees during turbulent periods to protect liquidity providers. Single-sided liquidity provision eliminates the requirement to deposit paired assets, reducing barriers to participation. These innovations demonstrate how peer to peer DeFi continues refining liquidity mechanisms to better serve both traders seeking efficient execution and providers seeking attractive risk-adjusted returns.

Security and Transparency in Peer to Peer DeFi

Security considerations in peer to peer DeFi systems differ fundamentally from traditional financial security models. Rather than relying on institutional security measures like fraud departments, insurance funds, or legal recourse, peer to peer DeFi security depends primarily on smart contract correctness, cryptographic integrity, and network consensus mechanisms. This architecture creates both advantages and challenges. On the positive side, peer to peer protocols eliminate entire categories of risks associated with centralized intermediaries including institutional fraud, mismanagement, selective enforcement, and single points of failure. Smart contracts execute identically for all users without possibility of discrimination or unauthorized deviation, providing strong guarantees about protocol behavior.

However, the peer to peer model also introduces unique security challenges that require careful attention. Smart contract vulnerabilities represent the most significant risk category, as bugs in protocol code can enable attackers to drain funds, manipulate prices, or corrupt protocol state. Unlike traditional systems where bugs might cause inconvenience but institutions can reverse fraudulent transactions, smart contract exploits often result in permanent, irreversible losses with no institution to provide recourse. The immutability that provides security benefits in normal operations becomes a liability when vulnerabilities exist. This reality necessitates extensive security measures including professional audits, formal verification, bug bounties, gradual rollouts with limited capital exposure, and conservative design patterns that prioritize security over functionality.

Transparency serves as both a security feature and a fundamental characteristic distinguishing peer to peer DeFi from traditional finance. All transactions, smart contract code, protocol parameters, and operational data exist publicly on blockchains where anyone can audit and verify correctness. This radical transparency enables community-driven security where thousands of developers and researchers can review code for vulnerabilities, monitor protocol behavior for anomalies, and alert communities to emerging risks. The transparency also builds trust by eliminating the opacity that characterizes much of traditional finance, where institutions maintain exclusive control over operational details and transaction data. Users can verify exactly how protocols will behave, audit treasury management, and understand fee structures without relying on institutional disclosures that may be incomplete or misleading.

Advantages of Peer to Peer Roots in DeFi

The peer to peer foundation of DeFi confers numerous advantages that collectively explain why this model has attracted billions in capital and millions of users despite operating outside traditional regulatory frameworks. Financial inclusion stands as perhaps the most socially significant advantage, as peer to peer protocols enable anyone with internet access to access financial services without requiring bank accounts, credit histories, or institutional relationships. This openness proves particularly valuable for individuals in regions with underdeveloped financial infrastructure, those excluded from traditional banking due to poverty or discrimination, and anyone seeking to escape capital controls or restrictive financial regulations. The permissionless nature of peer to peer DeFi democratizes financial access in ways that traditional systems cannot match.

Economic efficiency represents another crucial advantage of peer to peer architecture. By eliminating intermediaries who extract profits from their gatekeeping positions, DeFi protocols can offer superior rates to both lenders and borrowers compared to traditional banking. Lenders earn higher yields as they capture returns that would otherwise flow to banking institutions, while borrowers access capital at lower rates due to reduced overhead and rent extraction. Trading costs decrease dramatically on decentralized exchanges compared to traditional platforms, with many protocols charging fractions of a percent rather than the multi-percent fees common in traditional securities trading. Cross-border transfers occur at negligible cost rather than the substantial fees and delays associated with international wire transfers through correspondent banking networks.

The innovation velocity enabled by peer to peer DeFi infrastructure provides additional advantages that accelerate ecosystem evolution. Developers can compose existing protocols into novel applications without requiring permission or extensive integration negotiations, dramatically reducing the time and cost to launch new financial products. Open source development models enable global collaboration where anyone can contribute improvements, audit code for vulnerabilities, or fork projects to pursue alternative directions. Rapid experimentation with different mechanism designs, economic models, and user experiences produces continuous innovation that would be impossible in traditional finance where regulatory barriers, institutional inertia, and competitive dynamics inhibit experimentation. This combination of composability, open source development, and permissionless innovation creates network effects where each new protocol enhances the entire ecosystem’s utility and value.

Limitations and Risks of Peer to Peer DeFi Models

Despite their revolutionary potential, peer to peer DeFi systems face significant limitations and risks that constrain adoption and create potential vulnerabilities. Smart contract risk represents the most fundamental challenge, as bugs or design flaws in protocol code can enable catastrophic exploits resulting in permanent loss of user funds. The immutability that provides security benefits in normal operations becomes a liability when vulnerabilities exist, as there is no central authority to reverse fraudulent transactions or reimburse victims. Even thoroughly audited contracts can contain subtle bugs that sophisticated attackers exploit, and the composability that enables innovation also creates attack surfaces where vulnerabilities in one protocol can cascade through integrated systems.

User experience challenges inhibit mainstream adoption of peer to peer DeFi. The technical complexity of managing private keys, understanding gas fees, evaluating smart contract risks, and navigating multiple protocols creates substantial friction compared to traditional financial applications. Irreversible transactions mean that user errors result in permanent loss with no customer service to provide assistance or reverse mistakes. The volatility of cryptocurrency assets used within DeFi protocols creates additional complexity, as users must manage not only protocol-specific risks but also broader market exposure. These usability barriers effectively exclude many potential users who lack technical sophistication or risk tolerance to navigate peer to peer DeFi systems safely.

| Risk Category | Description | Mitigation Approaches |

|---|---|---|

| Smart Contract Vulnerabilities | Bugs enabling exploits, fund theft, or protocol corruption | Extensive audits, formal verification, bug bounties, gradual rollouts |

| Impermanent Loss | Loss relative to holding assets from price divergence in liquidity pools | Concentrated liquidity, dynamic fees, single-sided provision |

| Oracle Manipulation | Price feed corruption enabling liquidation or arbitrage exploits | Decentralized oracles, time-weighted averages, multiple data sources |

| Regulatory Uncertainty | Potential legal liability or protocol shutdowns from regulatory action | Progressive decentralization, legal structuring, compliance frameworks |

| Governance Attacks | Malicious proposals or token accumulation to control protocols | Timelock delays, governance token distribution, voting mechanisms |

| Scalability Limitations | High transaction costs and congestion during peak usage periods | Layer 2 solutions, alternative blockchains, batching techniques |

Regulatory uncertainty casts a long shadow over peer to peer DeFi, as governments worldwide grapple with how to regulate decentralized protocols that lack clear operators or control points. The absence of intermediaries that traditionally serve as regulatory enforcement points creates challenges for authorities seeking to implement existing financial regulations, while the global, permissionless nature of peer to peer protocols complicates jurisdictional questions. Participants face legal uncertainty around tax treatment, securities law compliance, and potential liability for governance participation. These ambiguities deter institutional adoption, constrain integration with traditional finance, and create ongoing risks that regulatory actions could disrupt established protocols or create legal exposure for users.

How Peer to Peer DeFi Differs From Traditional Finance?

The contrasts between peer to peer DeFi and traditional financial systems extend across every dimension of financial service provision, from fundamental architecture to practical user experiences. Traditional finance operates through hierarchical intermediary structures where banks, payment processors, exchanges, and other institutions maintain exclusive control over critical functions including custody, transaction processing, and service provision. These intermediaries profit from their gatekeeping positions while imposing conditions on participation, maintaining opacity around operations, and retaining unilateral authority to modify terms, freeze accounts, or deny service. Peer to peer DeFi inverts this model by distributing these functions across network participants through open protocols that operate transparently without central control or permission requirements.

The trust models underlying the two systems diverge fundamentally. Traditional finance requires trusting institutions to maintain accurate records, honor commitments, follow regulations, and act in customer interests even when doing so conflicts with institutional profits. This trust requirement creates dependencies on reputation, regulation, and legal recourse to ensure acceptable behavior. Peer to peer DeFi replaces institutional trust with cryptographic verification and smart contract automation, creating trustless systems where participants need not trust counterparties, protocol operators, or administrators because mathematical guarantees and transparent code ensure correct execution. This shift from trust-based to verification-based systems represents perhaps the most profound philosophical difference between traditional and peer to peer models.

Operational differences manifest across every aspect of financial interaction. Traditional systems maintain private transaction records accessible only to involved parties and institutions, while peer to peer DeFi records all transactions publicly on blockchains. Traditional finance requires days or weeks for settlement through clearinghouse processes, while peer to peer transactions settle instantly with finality. Access to traditional financial services depends on meeting institutional criteria and approval processes, while peer to peer protocols enable permissionless participation without identity verification or institutional relationships. Traditional systems operate within business hours and geographic boundaries, while peer to peer protocols function continuously and globally without restrictions. These operational distinctions reflect fundamentally different design philosophies and create vastly different user experiences and capabilities.

Evolution of Peer to Peer Finance Into Modern DeFi

The evolution from early peer to peer concepts to modern DeFi reflects continuous refinement of both technological capabilities and organizational models. Early peer to peer file sharing networks demonstrated decentralized coordination but lacked economic mechanisms to incentivize resource contribution and prevent free-riding. Bitcoin added economic incentives through mining rewards and transaction fees, creating sustainable peer to peer networks where participants contributed computational resources in exchange for financial compensation. Ethereum extended this model to support arbitrary smart contracts, enabling peer to peer financial services beyond simple value transfer. Each evolutionary step built upon previous innovations while addressing limitations and expanding capabilities.

The emergence of DeFi-specific innovations accelerated the evolution toward increasingly sophisticated peer to peer financial systems. Automated market makers solved liquidity provision challenges that plagued early decentralized exchanges, enabling practical peer to peer trading. Overcollateralized lending protocols addressed credit risk in peer to peer lending without requiring traditional credit assessments. Flash loans demonstrated novel possibilities enabled by atomic transaction execution. Yield aggregators automated complex strategies across multiple protocols. Liquid staking derivatives enabled peer to peer staking while maintaining liquidity. Each innovation expanded the scope of peer to peer finance while improving capital efficiency, user experience, and protocol sustainability.

The integration of DAOs in DeFi Space represents the latest evolutionary stage, adding decentralized governance to complement peer to peer financial services. Rather than protocols controlled by centralized teams, modern DeFi increasingly embraces community governance where token holders collectively make decisions about protocol parameters, upgrades, and treasury management. This evolution toward fully decentralized organizations aligns governance models with the peer to peer principles underlying DeFi financial services, creating comprehensive ecosystems where both financial transactions and organizational decision-making occur through decentralized coordination. The progression toward more sophisticated governance mechanisms including delegation systems, quadratic voting, and conviction voting continues refining how peer to peer organizations can make collective decisions effectively.

Future of Peer to Peer Roots in the DeFi Ecosystem

The future trajectory of peer to peer DeFi points toward increasingly sophisticated systems that address current limitations while expanding capabilities and accessibility. Scalability solutions including Layer 2 networks, sharding, and alternative consensus mechanisms promise to dramatically reduce transaction costs and increase throughput, enabling peer to peer protocols to serve mainstream adoption levels without prohibitive fees or congestion. These scaling improvements will particularly benefit smaller users currently priced out of many DeFi activities by high gas fees, democratizing access and enabling use cases like micropayments, frequent trading, and small-scale lending that remain impractical on current infrastructure.

Cross-chain interoperability will expand peer to peer DeFi beyond single-blockchain limitations, enabling seamless value transfer and protocol interaction across multiple networks. Bridge protocols, cross-chain messaging standards, and multi-chain liquidity aggregators will create unified peer to peer financial ecosystems where users can access optimal rates and services regardless of which blockchain hosts specific protocols. This interoperability will reduce fragmentation, improve capital efficiency, and enable more sophisticated applications that leverage unique capabilities of different blockchain networks. The evolution toward truly chain-agnostic peer to peer finance will strengthen network effects and improve user experiences by eliminating the need to maintain separate positions across multiple isolated blockchain ecosystems.

The integration of advanced technologies including zero-knowledge proofs, multi-party computation, and trusted execution environments will enhance privacy and security within peer to peer DeFi systems. Privacy-preserving protocols will enable confidential transactions and selective disclosure where users can prove specific attributes without revealing unnecessary information, addressing privacy concerns that limit current adoption while maintaining the transparency benefits crucial for security and compliance. Improved security measures including formal verification, automated vulnerability detection, and enhanced oracle designs will reduce smart contract risks that currently represent the primary threat to peer to peer DeFi users. These technological advances will mature peer to peer DeFi toward enterprise-grade reliability while maintaining its core principles of decentralization, transparency, and permissionless access.

Regulatory clarity and institutional adoption will shape how peer to peer DeFi integrates with traditional finance in coming years. As regulatory frameworks evolve to address decentralized protocols, compliant peer to peer DeFi implementations may emerge that satisfy institutional requirements while preserving core peer to peer principles. Hybrid models might combine permissionless base layers with permissioned access layers that implement identity verification and transaction monitoring for institutional participants. The challenge will be maintaining the benefits of peer to peer architecture including efficiency, accessibility, and transparency while accommodating legitimate regulatory interests in preventing illicit finance and protecting consumers. Successfully navigating this balance could unlock mainstream adoption that brings peer to peer DeFi benefits to billions of users globally. For those interested in building within this evolving ecosystem, understanding decentralized finance fundamentals provides essential context.

Ready to Build Peer to Peer DeFi Solutions?

Connect with blockchain experts to design and launch innovative peer to peer financial protocols.

Navigating the complex landscape of peer to peer DeFi requires deep expertise in blockchain architecture, smart contract security, economic mechanism design, and decentralized governance models. Nadcab Labs brings over 8 years of specialized experience in blockchain technology and decentralized finance, having contributed to numerous successful implementations of peer to peer protocols, DAO governance systems, and comprehensive DeFi platforms. Our team possesses comprehensive understanding of the technological foundations enabling peer to peer financial services, from smart contract development and security auditing to tokenomics design and protocol optimization. This extensive experience positions us as trusted advisors and technical partners for projects seeking to build, launch, or enhance peer to peer DeFi protocols.

Our expertise encompasses the full spectrum of peer to peer DeFi applications including lending protocols, decentralized exchanges, automated market makers, yield optimization strategies, and governance systems. We have witnessed the evolution of peer to peer finance from early experiments to today’s sophisticated multi-billion dollar ecosystems, providing us with unique insights into what designs succeed, what challenges commonly arise, and how to navigate the complex trade-offs between decentralization, security, efficiency, and user experience. Whether you are launching a new peer to peer protocol from scratch, enhancing an existing platform with advanced features, or transitioning toward progressive decentralization and community governance, Nadcab Labs offers the technical depth and strategic guidance necessary to achieve your objectives.

Beyond technical implementation, we provide comprehensive support including smart contract security auditing, economic modeling and simulation, governance framework design, regulatory guidance, community building strategies, and ongoing optimization as protocols scale and evolve. Our commitment to excellence, innovation, and the core principles of decentralized finance ensures that projects built with our expertise establish peer to peer systems that genuinely empower users while maintaining security, efficiency, and long-term sustainability. As active thought leaders contributing to the advancement of DeFi standards and best practices, we bring cutting-edge knowledge and forward-thinking approaches to every engagement. Trust Nadcab Labs to transform your vision of peer to peer finance into reality, backed by proven expertise, unwavering dedication to quality, and deep commitment to advancing the decentralized finance revolution.

Frequently Asked Questions

Capital requirements vary significantly across different protocols and chains. On Ethereum mainnet, high gas fees often make interactions economically viable only for positions of several hundred dollars or more. However, Layer 2 solutions and alternative blockchains offer much lower transaction costs, enabling participation with as little as a few dollars in some cases. For lending and borrowing, consider that you need sufficient collateral to meet minimum collateralization ratios, typically 150% or higher of borrowed value. Liquidity provision usually requires paired assets of equal value. Start with amounts you can afford to lose completely while learning the systems, as the learning curve and smart contract risks make early experimentation inherently risky.

Unlike traditional banks where deposits are often insured and institutions may reimburse fraud victims, DeFi protocols generally offer no such protections. If a smart contract vulnerability is exploited and funds are stolen, you will likely lose your capital permanently with no recourse for recovery. Some protocols maintain insurance funds or have secured coverage through decentralized insurance platforms, but this is not universal. The immutability that makes DeFi trustless also means that malicious transactions cannot be reversed. This harsh reality makes security research absolutely essential before committing significant capital to any protocol. Always verify that protocols have been extensively audited by reputable firms, check their track record and time in operation, start with small test amounts, and never invest more than you can afford to lose completely.

No, blockchain transactions are essentially irreversible once confirmed. If you send funds to the wrong address, interact with a malicious contract, or make any other error, there is no customer service to contact and no way to undo the transaction. This finality is a feature of blockchain design that prevents double spending and enables trustless operation, but it creates harsh consequences for mistakes. Common errors include sending tokens to contract addresses instead of user addresses, approving unlimited token spending to malicious contracts, and fat-finger errors in transaction amounts. The best protection is extreme caution: always double-check addresses, start with small test transactions, use hardware wallets for security, and take time to understand exactly what you are approving before signing transactions. Consider DeFi interactions permanent and irreversible.

Tax treatment of DeFi activities remains complex and varies by jurisdiction, with many details still unclear or evolving. In most developed countries, cryptocurrency transactions are taxable events, meaning each swap, lending operation, liquidity provision, or yield claim could trigger tax obligations. The high frequency of transactions in active DeFi participation can create substantial record-keeping burdens and complicated tax calculations. Some jurisdictions tax unrealized gains from token price appreciation in liquidity pools, while others only tax realized gains upon withdrawal. Earned interest and rewards typically count as income at fair market value when received. The lack of clear guidance and the pseudonymous nature of blockchain transactions creates compliance challenges. Consult qualified tax professionals familiar with cryptocurrency taxation in your jurisdiction, maintain detailed transaction records, and consider using specialized crypto tax software to track and calculate obligations accurately.

Legal status varies dramatically across jurisdictions and continues evolving as regulators worldwide grapple with how to address decentralized finance. Some countries embrace DeFi innovation with clear regulatory frameworks, others prohibit cryptocurrency activities entirely, and many fall into uncertain middle grounds where laws remain ambiguous or unenforced. Even in permissive jurisdictions, specific DeFi activities might face restrictions. Securities laws could apply to governance tokens, money transmission regulations might affect certain protocols, and tax compliance remains universally expected. The permissionless nature of blockchain means technical access is generally unrestricted, but legal access and compliance obligations vary by location. Research your specific jurisdiction’s stance on cryptocurrency and DeFi, consult legal professionals if engaging significantly, and be aware that regulatory landscapes change rapidly. What is permitted today might face restrictions tomorrow as regulatory frameworks evolve.

DeFi’s permissionless nature creates fertile ground for scams ranging from malicious smart contracts to elaborate Ponzi schemes. Essential protections include verifying contract addresses through official sources before interacting, checking that contracts are verified on blockchain explorers and have been audited by reputable firms, being extremely suspicious of returns that seem too good to be true, never sharing private keys or seed phrases with anyone, using hardware wallets for significant holdings, and being wary of urgent pressure to act quickly. Legitimate projects do not send unsolicited messages or demand immediate action. Research team backgrounds, check community sentiment across multiple sources, start with small test amounts before committing significant capital, and remember that high yields almost always involve high risks. The same features that make DeFi powerful also make it dangerous for the uninformed and careless.

Impermanent loss refers to the opportunity cost liquidity providers experience when token prices diverge compared to simply holding those tokens. When you provide liquidity to automated market makers, you deposit paired assets that get rebalanced as prices change through arbitrage trading. If one token appreciates significantly relative to the other, you end up with more of the cheaper token and less of the expensive one compared to what you would have held if you never provided liquidity. The loss is impermanent because it only crystallizes when you withdraw; if prices revert, the loss can disappear. However, in trending markets, impermanent loss can substantially reduce or even eliminate profits from trading fees. Consider it seriously when providing liquidity, particularly for volatile pairs. Stable pairs experience minimal impermanent loss, while volatile pairs can see substantial losses that exceed earned fees. Calculate potential scenarios before committing capital.

Time horizons in DeFi vary widely based on strategy and protocol characteristics. Short-term trading and arbitrage might involve positions held for minutes or hours. Yield farming strategies often involve weekly or monthly position adjustments as rewards programs change. Long-term lending or liquidity provision could extend months or years. Consider that withdrawing funds incurs transaction costs, so frequent position changes can erode profits through gas fees, particularly on Ethereum mainnet. Many protocols offer higher rewards for longer lockup periods, trading liquidity for enhanced yields. From a risk management perspective, shorter durations limit exposure to smart contract vulnerabilities and protocol failures, while longer positions allow more time for returns to compound. Balance your need for liquidity, the costs of position management, reward optimization, and risk tolerance when determining appropriate time horizons. Always maintain sufficient liquidity outside DeFi for emergencies.

While you do not need to be a developer, safe DeFi participation does require technical literacy beyond basic cryptocurrency knowledge. You should understand how to use blockchain explorers to verify transactions and check contract details, recognize the difference between contract addresses and wallet addresses, understand what you are approving when signing transactions, evaluate audit reports and identify red flags, manage private keys securely using hardware wallets, and recognize common attack vectors like phishing and approval exploits. Reading smart contract code is beneficial but not essential if you rely on reputable audits and community verification. Many beginners dive into DeFi with insufficient preparation and suffer losses from preventable mistakes. Invest significant time in education before risking substantial capital. Use testnets to practice without financial risk, start with tiny amounts on mainnet, gradually increase position sizes as competence grows, and never stop learning as the ecosystem evolves continuously with new risks emerging constantly.

Institutional participation in DeFi is growing but faces significant challenges around compliance, custody, and risk management. Many institutions are legally prohibited from using protocols that lack proper regulatory oversight or cannot provide adequate reporting. Custody requirements often mandate institutional-grade solutions rather than self-custody through private keys. Tax and accounting complexities multiply at institutional scale with frequent transactions across multiple protocols. Some institutions access DeFi through specialized funds or custodians offering compliant wrappers around DeFi protocols, while others work with permissioned versions of DeFi protocols that implement identity verification and transaction monitoring. As regulatory clarity improves and infrastructure matures, institutional participation will likely increase significantly, bringing substantial capital but also potentially changing DeFi’s character as protocols adapt to institutional requirements. The tension between DeFi’s permissionless ethos and institutional compliance needs remains unresolved.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.