The debate around dApps vs traditional apps has moved beyond theoretical blockchain discussions into boardrooms and product strategy meetings across the globe. As organizations in the USA, UK, UAE, and Canada evaluate their technology roadmaps, understanding the difference between dApps and traditional apps has become essential for informed decision-making. With over eight years of hands-on experience building and consulting on both centralized and decentralized solutions, our team has witnessed firsthand how decentralized applications are reshaping industries while traditional applications continue to dominate mainstream usage. This guide breaks down every critical dimension of the comparison, from architecture and security to scalability, cost, and the evolving Web3 landscape, giving you the practical clarity needed to choose the right approach for your next project.

What Are Decentralized Applications?

Decentralized applications, commonly called dApps, are software programs that run on peer-to-peer blockchain networks rather than a single centralized server. Unlike traditional applications where a company controls the backend infrastructure, blockchain based applications distribute their logic and data across a network of nodes. The backend of a dApp is powered by smart contracts, which are self-executing code stored on the blockchain. These contracts enforce rules, process transactions, and manage application state without requiring a trusted intermediary.

What makes dApps fundamentally different is their open-source nature and token-based incentive systems. Most decentralized apps operate transparently, allowing anyone to audit the underlying code. Platforms like Ethereum, Solana, and Polygon host thousands of dApps spanning finance, gaming, supply chain, and identity management. In the UK and UAE, regulatory frameworks are evolving to accommodate these Web3 applications, while the USA and Canada continue refining guidelines for blockchain-based services. For businesses evaluating how dApps are different from traditional apps, the core distinction starts here: no single entity controls the application.

What Are Traditional Apps?

Traditional applications follow a client-server model where all processing, data storage, and business logic reside on centralized servers owned and operated by a single organization. When you use an app like Instagram, Uber, or a banking platform, your requests travel to company-controlled servers that execute backend logic, access databases, and return results. This centralized model has powered the internet for decades, delivering fast and reliable experiences to billions of users across the globe.[1]

The traditional app architecture typically involves a frontend (web or mobile), a backend server running business logic, and a centralized database. Companies retain full control over updates, data policies, and access permissions. This model enables rapid iteration, straightforward scaling through cloud providers like AWS or Azure, and polished user experiences. For enterprises in the USA, UK, Canada, and UAE, centralized apps remain the default for most consumer-facing products because of their speed, reliability, and mature ecosystem of tools and frameworks. Understanding what is dApp vs traditional app begins with recognizing this fundamental difference in who owns and manages the infrastructure.

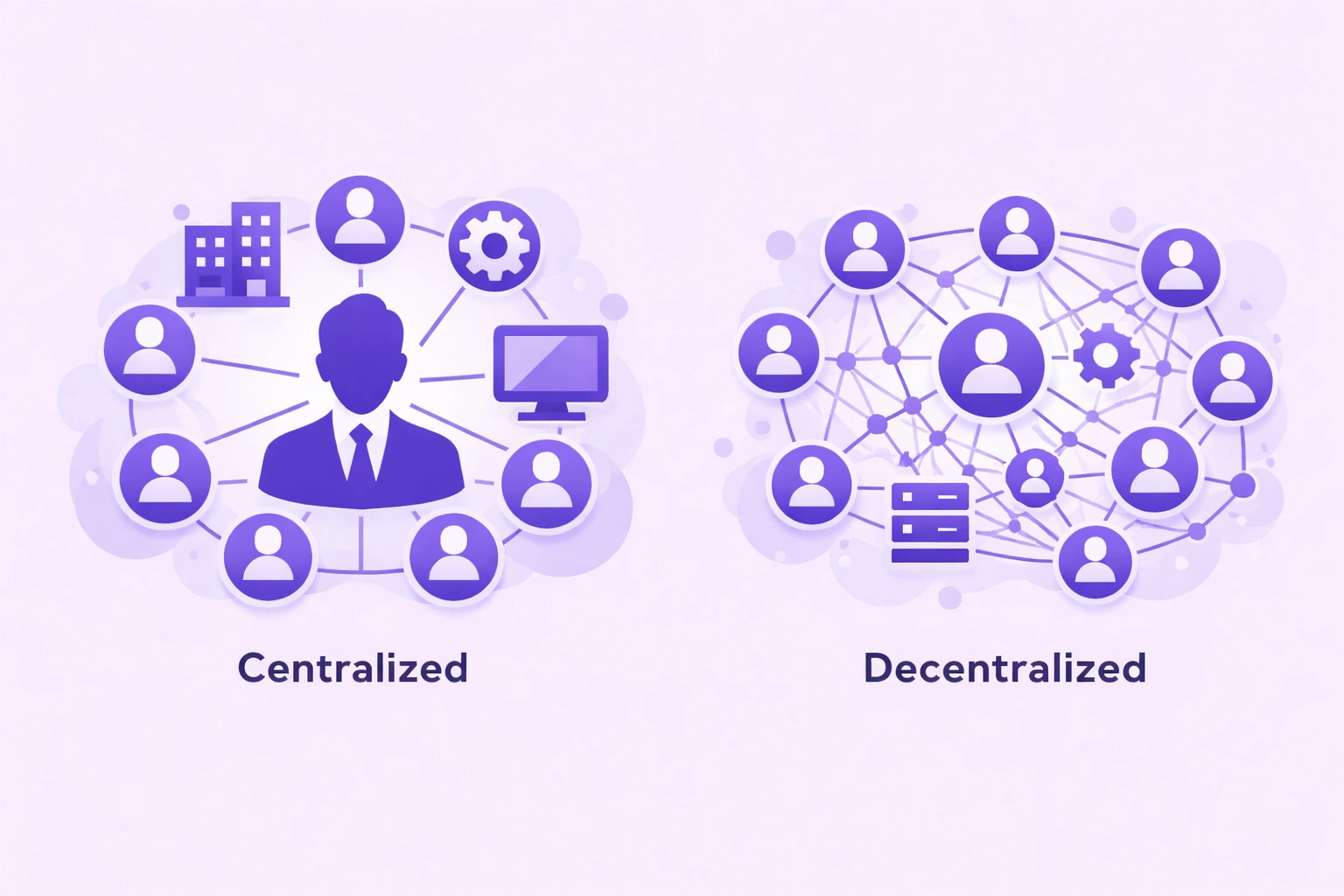

How dApps and Traditional Apps Differ in Architecture?

The architecture of centralized vs decentralized apps represents two fundamentally different engineering philosophies. Here are the three core architectural layers that separate these models.

Frontend Layer

- dApps use web interfaces connected to blockchain via wallet providers like MetaMask

- Traditional apps connect directly to proprietary backend APIs and servers

- Both can use React, Angular, or similar frameworks for the user interface

Backend / Logic Layer

- dApps rely on smart contracts deployed on Ethereum, Solana, or other chains

- Traditional apps run backend logic on Node.js, Python, Java, or .NET servers

- Smart contracts are immutable once deployed; server code can be updated instantly

Data Storage Layer

- dApps store critical data on-chain with supplementary data on IPFS or Arweave

- Traditional apps use centralized databases like PostgreSQL, MongoDB, or MySQL

- On-chain data is publicly verifiable; centralized databases are access-controlled

This architectural divergence has profound implications for everything from deployment workflows to maintenance costs. Traditional applications benefit from mature DevOps pipelines, CI/CD automation, and cloud-native scaling. Blockchain based applications, however, require careful smart contract auditing, gas fee optimization, and multi-chain compatibility planning. Teams building decentralized apps vs traditional apps must choose between the agility of centralized infrastructure and the trust guarantees of distributed networks. As the ecosystem matures, many projects adopt hybrid approaches, keeping user-facing logic on centralized servers while anchoring critical transactions on-chain.

Centralized vs Decentralized Control: Who Owns the Application?

Control and ownership in dApps is perhaps the most transformative distinction in this comparison. In the traditional model, the company that builds the application retains complete authority over its features, data, and monetization. Users agree to terms of service and have limited recourse if the company changes policies, restricts access, or shuts down the platform entirely. This centralized control model has enabled rapid product innovation but has also led to concerns about data privacy, censorship, and platform dependence.

Decentralized apps flip this model. Governance decisions in mature dApps are handled through token-based voting systems where users and stakeholders collectively decide on protocol upgrades, fee structures, and feature priorities. No single entity can unilaterally shut down a well-distributed dApp. This is particularly appealing for industries in the UAE and UK where regulatory transparency is valued, and for Canadian and American markets where data sovereignty concerns are growing. Understanding centralized vs decentralized apps at the ownership level is crucial for any business weighing long-term platform risk against operational convenience.

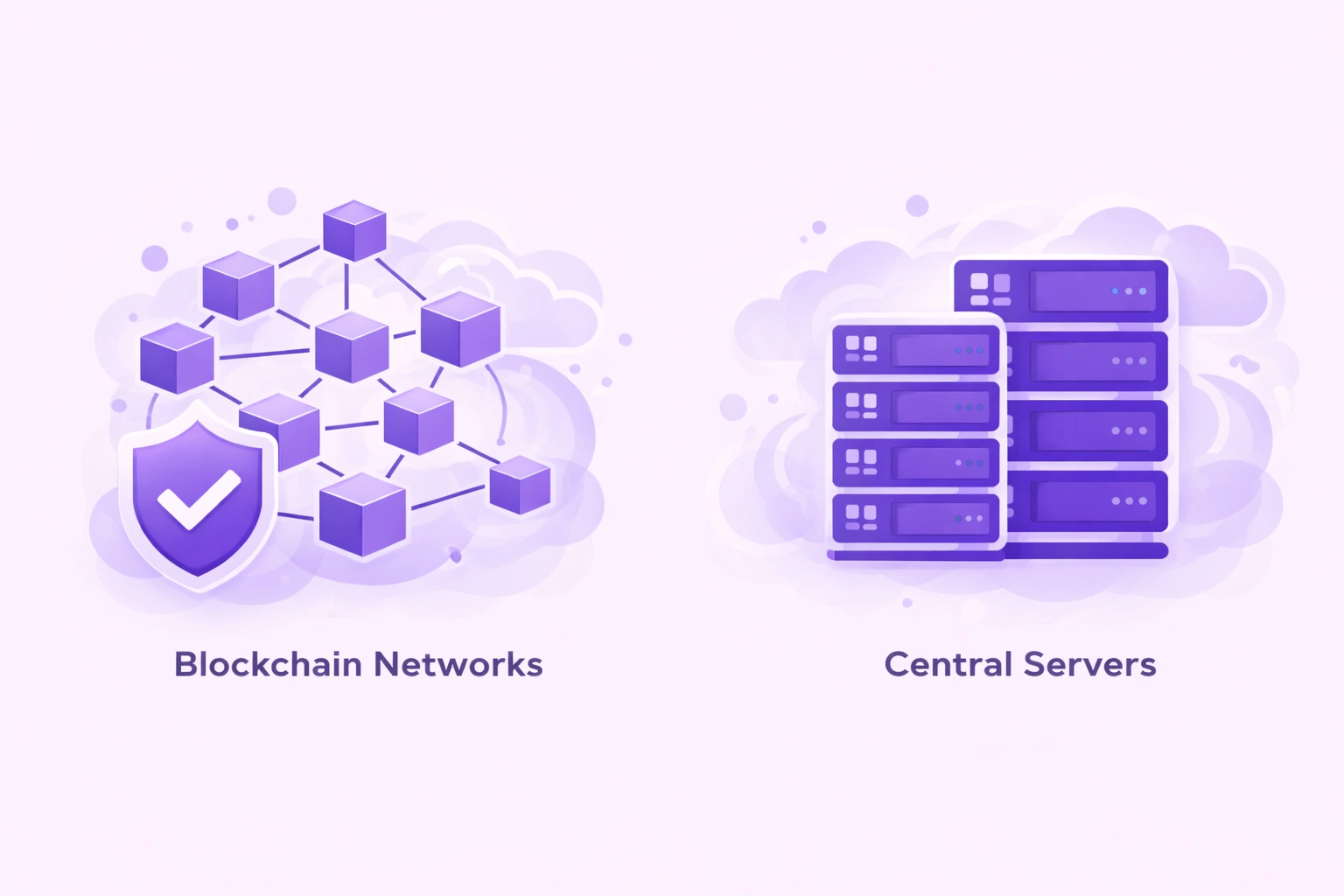

Role of Blockchain in dApps

Blockchain serves as the foundational infrastructure that makes decentralized applications possible. It provides a distributed, tamper-resistant ledger where every transaction is recorded, validated, and permanently stored across a network of independent nodes. This eliminates the need for a central authority to verify actions, which is why blockchain based applications can function without intermediaries. The consensus mechanisms, whether Proof of Work, Proof of Stake, or newer models, ensure that all participants agree on the state of the application.

For businesses evaluating Web3 applications vs Web2 applications, understanding blockchain’s role is non-negotiable. The blockchain determines transaction speed, gas costs, security guarantees, and the ecosystem of tools available to builders. Ethereum remains the most popular platform for dApps, but chains like Solana, Avalanche, and Polygon offer alternatives with different tradeoff profiles. In our eight-plus years of working with clients across the USA and UK, we have seen blockchain selection directly impact project success. The chain is not just infrastructure; it is a strategic choice that shapes everything from user experience to regulatory compliance.

Smart Contracts vs Backend Logic in Traditional Apps

Smart contract based apps represent a paradigm shift in how application logic is written, deployed, and executed. In traditional applications, backend logic runs on servers controlled by the organization. Developers can push updates, fix bugs, and modify behavior in real time. The server environment offers full flexibility, access to third-party APIs, and the ability to handle complex business workflows with established programming languages and frameworks.

Smart contracts, on the other hand, are immutable once deployed to the blockchain. This means the code that governs a dApp cannot be altered without deploying a new contract and migrating state, a process that is both technically challenging and carries governance implications. While immutability ensures trust and predictability, it also means that any bugs in the code become permanent vulnerabilities. This is why smart contract audits are a critical investment before launch. For companies in the USA, Canada, UK, and UAE, the choice between smart contracts and backend logic often comes down to the balance between trust guarantees and operational agility.

Data Storage Models: On-Chain vs Centralized Databases

On-Chain Storage: Critical transaction data lives directly on the blockchain, fully transparent and immutable. Every node in the network stores a copy, ensuring resilience against data loss or tampering.

Off-Chain / IPFS: Large files such as images, documents, and metadata are stored on decentralized file systems like IPFS or Arweave, with content hashes recorded on-chain for verification.

Centralized Databases: Traditional apps use SQL or NoSQL databases managed by the organization. Data access is controlled, enabling fast queries but creating a single point of failure.

Hybrid Models: Many modern dApps combine on-chain and off-chain storage, keeping financial transactions on the blockchain while storing UI-related data on conventional servers for speed.

Cost Implications: On-chain storage is expensive due to gas fees, making it impractical for large datasets. Centralized databases offer cost-efficient storage at scale, especially on cloud platforms.

Data Privacy: On-chain data is public by default, raising privacy concerns. Traditional databases offer granular access control, making them preferable for GDPR compliance in the UK and EU markets.

The data storage question is central to the difference between dApps and traditional apps because it directly affects privacy, cost, performance, and regulatory compliance. Organizations handling sensitive user data, particularly in healthcare and finance across the USA and Canada, must carefully evaluate whether on-chain transparency aligns with their compliance obligations or whether a centralized database provides the necessary access controls and encryption standards.

Security Comparison: dApps vs Traditional Apps

The dApps vs traditional apps security comparison reveals that both models face significant but entirely different threat landscapes. Traditional applications are vulnerable to centralized attack vectors, including server breaches, SQL injection, DDoS attacks, and insider threats. A single compromised server can expose millions of user records, as major breaches at companies across the USA and UK have demonstrated. However, traditional apps benefit from mature security tools, rapid patching capabilities, and established incident response frameworks.

| Security Dimension | dApps | Traditional Apps |

|---|---|---|

| Data Breach Risk | Low (distributed storage) | High (centralized database) |

| Smart Contract Bugs | High risk; immutable code | Not applicable |

| Patching Speed | Slow (contract redeployment) | Fast (server-side updates) |

| DDoS Vulnerability | Very low (no central server) | High (single server target) |

| Transaction Reversibility | Irreversible by design | Reversible by admin |

| Audit Requirements | Smart contract audits critical | Standard security audits |

dApps eliminate many centralized attack vectors but introduce smart contract vulnerabilities that can be catastrophic when exploited. The immutable nature of blockchain means that once funds are stolen through a contract exploit, recovery is nearly impossible. Both models demand rigorous security investment, but the strategies and tools differ significantly.

Transparency and Trust in Decentralized Applications

Transparency is one of the most compelling advantages of dApps over traditional apps. Every transaction on a public blockchain is recorded in an open ledger that anyone can inspect. Smart contract source code is typically verified and published, allowing users, investors, and regulators to audit the exact rules governing the application. This radical transparency eliminates the “black box” problem that plagues centralized applications, where users must trust the organization’s claims about how their data is handled and how processes operate behind the scenes.

For industries such as financial services in the UAE, supply chain management in the UK, and healthcare data sharing in Canada, this verifiable trust layer is incredibly valuable. Instead of relying on third-party auditors or corporate assurances, stakeholders can independently verify that an application is operating exactly as promised. This is a fundamental shift in the trust model, moving from “trust us” to “verify it yourself,” and it represents one of the strongest arguments in the broader dApps vs centralized apps discussion.

Scalability issues in dApps remain one of the most significant barriers to mainstream adoption. The throughput gap between blockchain networks and centralized cloud infrastructure is substantial. While Layer 2 solutions and alternative consensus mechanisms are rapidly closing this gap, businesses processing high-volume transactions in markets like the USA and UK still find traditional infrastructure more practical for latency-sensitive operations. The ongoing scalability improvements in blockchain technology will be a decisive factor in the future of dApps vs traditional apps.

Performance and Speed: Blockchain Networks vs Central Servers

Performance is where the gap between decentralized apps vs traditional apps is most immediately felt by end users. Traditional applications deliver near-instantaneous responses because requests travel directly to optimized servers located in data centers worldwide, often with sub-100-millisecond latency. Cloud providers offer content delivery networks (CDNs), edge computing, and auto-scaling that ensure consistent performance regardless of traffic spikes. Users of services like Amazon, Netflix, or banking apps expect and receive this level of responsiveness.

dApps face inherent performance constraints because every state-changing transaction must be validated by the network’s consensus mechanism. On Ethereum, this means waiting for block confirmation, which can take 12 to 15 seconds. During network congestion, gas fees spike and confirmation times increase further. While read operations can be fast through indexed data services like The Graph, write operations will always carry blockchain latency. For products targeting performance-sensitive markets in the USA and Canada, this latency trade-off is a critical design consideration when choosing between dApps vs traditional apps.

Cost and Technical Complexity Compared

Building and maintaining applications comes with significant cost differences depending on the chosen architecture. When comparing dApps vs centralized apps from a financial and technical perspective, several factors come into play: the scarcity of blockchain engineers, the cost of smart contract audits, gas fees for on-chain transactions, and the complexity of managing decentralized infrastructure. Traditional apps, while also expensive to build at scale, benefit from a much larger talent pool and well-established tooling.

| Cost Factor | dApps | Traditional Apps |

|---|---|---|

| Talent Availability | Scarce; Solidity/Rust expertise is premium-priced | Abundant; large pool of JS, Python, Java engineers |

| Security Audits | $15K – $100K+ per smart contract audit | $5K – $30K for standard penetration testing |

| Infrastructure Costs | Gas fees per transaction; node hosting | Cloud hosting with predictable monthly billing |

| Iteration Speed | Slow; contract redeployment and migration needed | Fast; continuous deployment pipelines |

| Time to Market | 6-18 months (with audits) | 3-9 months (standard product) |

For startups and enterprises in the UAE and UK exploring blockchain based applications, the total cost of ownership for a dApp can be 2-3x that of a comparable traditional application. However, the long-term savings from reduced intermediary fees and automated trust mechanisms can offset this initial investment in the right use cases.

User Experience Differences Between dApps and Traditional Apps

User experience remains one of the most significant disadvantages of dApps compared to their traditional counterparts. Traditional applications offer polished onboarding flows, intuitive interfaces, and seamless interactions that users have come to expect. Login with email and password, one-click payments, and instant feedback loops are standard. The entire UX ecosystem, from design systems to A/B testing frameworks, has been refined over two decades of web and mobile product design.

dApps require users to set up cryptocurrency wallets, manage private keys, understand gas fees, and approve transactions through multi-step confirmation flows. For mainstream users in the USA, UK, and Canada, this friction creates a steep learning curve. The blockchain industry recognizes this challenge, and solutions like account abstraction, social logins for wallets, and gasless transactions are actively being built to bridge the gap. Until these innovations reach maturity, however, the user experience of dApps vs traditional apps will continue to favor centralized applications for mass-market products.

Real-World Examples of dApps and Traditional Applications

Uniswap (dApp) vs Coinbase (Traditional)

Uniswap enables peer-to-peer token swaps without intermediaries, while Coinbase operates as a centralized exchange managing order books and custody on behalf of users across the USA and UK.

Aave (dApp) vs Traditional Banks

Aave offers permissionless lending and borrowing through smart contracts, in contrast to traditional banking institutions in Canada and the UAE that require credit checks and centralized approval processes.

OpenSea (dApp) vs eBay (Traditional)

OpenSea facilitates NFT trades on-chain with transparent ownership records, while eBay uses centralized listings, payment processing through PayPal, and company-controlled dispute resolution.

Brave Browser (dApp) vs Chrome (Traditional)

Brave rewards users with BAT tokens for viewing ads, giving control back to users. Chrome collects browsing data for targeted advertising managed entirely by Google’s centralized infrastructure.

These examples of dApps and traditional apps illustrate that decentralized alternatives exist across virtually every major industry. The question is not whether one model will replace the other, but which approach delivers the most value for a specific use case, user base, and regulatory environment.

Choosing Between dApps and Traditional Apps: 3-Step Selection Framework

Step 1: Assess Trust Requirements

- Does your product require verifiable transparency for users or regulators?

- Are intermediaries adding cost or friction to your business model?

- Is censorship resistance critical to your value proposition?

Step 2: Evaluate Performance Needs

- What throughput does your application demand at peak usage?

- Can your users tolerate blockchain confirmation latency?

- Are real-time interactions essential to the core user experience?

Step 3: Calculate Total Cost of Ownership

- Factor in smart contract audits, gas fees, and blockchain expertise premiums

- Compare long-term savings from removing intermediary fees

- Account for time-to-market differences in your competitive landscape

Advantages and Limitations of dApps

Understanding the full spectrum of strengths and weaknesses is essential for any business asking are dApps better than traditional apps. The advantages of dApps over traditional apps are compelling in specific scenarios: trustless operations eliminate the need for intermediaries, reducing friction and cost in financial transactions. Censorship resistance ensures that no single authority can shut down or alter the application unilaterally. Data immutability guarantees that records cannot be tampered with after recording, which is critical for audit trails, supply chains, and legal compliance across markets in the USA, UK, UAE, and Canada.

However, the disadvantages of dApps are equally important to acknowledge. Scalability limitations restrict throughput for high-traffic applications. User experience barriers, including wallet management and gas fees, create onboarding friction. Smart contract bugs can lead to irreversible financial losses. Regulatory uncertainty in many jurisdictions creates compliance risks. And the talent shortage for blockchain engineers drives up project costs. The honest assessment is that dApps are not universally better; they are strategically superior in use cases where trust, transparency, and decentralized ownership outweigh the need for speed, simplicity, and rapid iteration.

Compliance and Governance Checklist for dApp Projects

☑ KYC/AML Compliance: Determine whether your dApp requires Know Your Customer and Anti-Money Laundering procedures based on target market regulations in the USA, UK, UAE, and Canada.

☑ Data Privacy (GDPR/CCPA): Evaluate how on-chain data transparency intersects with data protection regulations, especially the right to erasure that conflicts with blockchain immutability.

☑ Smart Contract Audit: Commission at minimum two independent security audits from reputable firms before mainnet deployment. Budget $15K to $100K+ depending on complexity.

☑ Token Classification: Assess whether any tokens issued by your dApp could be classified as securities under local law, particularly SEC guidelines in the USA and FCA rules in the UK.

☑ Governance Model: Define clear governance structures, whether DAO-based or multisig, to manage protocol upgrades, treasury, and dispute resolution transparently.

☑ Incident Response Plan: Establish a protocol for responding to smart contract exploits, including emergency pause mechanisms, communication plans, and fund recovery strategies.

Future of dApps vs Traditional Apps in the Web3 Era

The future of dApps vs traditional apps is not a zero-sum competition but a convergence story. Web3 applications vs Web2 applications are increasingly blending as traditional companies integrate blockchain elements into their existing platforms. Major financial institutions in the USA and UK are exploring tokenized assets and on-chain settlement. UAE-based enterprises are piloting blockchain for supply chain transparency. Canadian regulators are creating frameworks that accommodate both centralized and decentralized financial services. This convergence signals that the next generation of applications will combine the reliability of centralized infrastructure with the trust guarantees of blockchain technology.

Several trends will shape this evolution: account abstraction will simplify wallet management, making dApps accessible to mainstream users. Layer 2 networks will continue improving scalability, narrowing the throughput gap with centralized systems. Cross-chain interoperability protocols will enable dApps to operate seamlessly across multiple blockchains. And regulatory clarity in key markets will provide the legal certainty businesses need to invest confidently in decentralized infrastructure. The organizations that will thrive are those building flexible architectures today that can incorporate decentralized components as the technology and regulation mature.

Conclusion

The comparison of dApps vs traditional apps comes down to understanding where each model delivers the greatest value. Traditional applications offer speed, polished user experiences, and mature infrastructure that makes them ideal for mass-market consumer products. Decentralized apps provide trustless operations, transparent governance, and censorship resistance that make them powerful for use cases where intermediaries create friction or trust deficits. Neither model is universally superior; the best choice depends on your specific business requirements, target audience, regulatory environment, and technical capabilities.

For organizations operating across the USA, UK, UAE, and Canada, the strategic approach is to evaluate both models against concrete business outcomes rather than adopting technology for its own sake. With blockchain infrastructure maturing rapidly and traditional platforms increasingly incorporating decentralized features, the most successful products of the next decade will likely combine elements of both. Whether you are building from scratch or modernizing an existing platform, understanding how dApps are different from traditional apps positions you to make informed architectural decisions that serve your users and your business for years to come.

Ready to Build Your Next-Gen Application?

Our team has 8+ years of expertise in both decentralized and traditional application architecture. Let us help you choose and build the right solution.

Frequently Asked Questions

Decentralized apps (dApps) run on peer-to-peer blockchain networks and use smart contracts to execute logic without relying on a single authority. Traditional apps operate on centralized servers managed by a company or organization. The core difference between dApps and traditional apps lies in control, data ownership, and infrastructure. While traditional applications store user data on proprietary servers, dApps distribute data across nodes, offering greater transparency. Businesses across the USA, UK, UAE, and Canada are evaluating both models to determine which aligns best with their product goals and compliance needs.

Whether dApps are better than traditional apps depends entirely on the use case. dApps excel where transparency, censorship resistance, and user ownership are priorities, such as decentralized finance (DeFi) and supply chain verification. However, traditional apps offer faster performance, smoother user experiences, and lower operational costs. For consumer-facing products requiring high speed and scalability, centralized apps remain the practical choice. The advantages of dApps over traditional apps become most apparent in trust-sensitive industries where intermediaries add friction or cost.

Smart contracts are self-executing programs stored on a blockchain that automatically enforce rules and process transactions when predefined conditions are met. In decentralized apps, smart contracts replace the backend server logic found in traditional applications. When a user interacts with a dApp, the frontend sends a transaction to the blockchain, where the smart contract executes the corresponding function. This removes the need for intermediary servers, reduces single points of failure, and ensures that application rules are transparent, immutable, and verifiable by anyone on the network.

The dApps vs traditional apps security comparison reveals distinct risk profiles. Traditional apps face threats like server breaches, DDoS attacks, and insider manipulation because data is centralized. dApps distribute data across a blockchain, making mass data theft significantly harder. However, dApps introduce unique risks, including smart contract vulnerabilities and irreversible transactions. Once deployed, flawed smart contract code can be exploited. Traditional apps can patch bugs quickly, while blockchain-based applications require more complex upgrade mechanisms. Both models demand rigorous security audits, but the threat vectors differ substantially.

Scalability remains one of the biggest challenges facing decentralized applications. Unlike centralized server applications that can scale horizontally by adding more servers, dApps depend on blockchain networks where every transaction must be validated by multiple nodes. This consensus process limits throughput. For instance, Ethereum processes roughly 15-30 transactions per second compared to thousands for traditional systems. Layer 2 solutions, sharding, and alternative blockchains like Solana and Polygon are addressing these scalability issues in dApps, but the gap with centralized infrastructure remains a practical consideration for high-volume applications.

Examples of dApps and traditional apps span multiple industries. Popular dApps include Uniswap (decentralized exchange), Aave (lending protocol), OpenSea (NFT marketplace), and Brave Browser (privacy-focused browsing with BAT rewards). Traditional counterparts include Coinbase (centralized exchange), banks offering conventional loans, eBay (centralized marketplace), and Google Chrome. In the UAE and UK, blockchain-based applications for real estate tokenization and cross-border payments are gaining traction. Meanwhile, businesses in the USA and Canada continue to rely heavily on traditional app architecture for e-commerce, healthcare, and fintech.

The future of dApps vs traditional apps points toward hybrid models that combine the strengths of both approaches. Web3 applications vs Web2 applications will likely converge as blockchain infrastructure matures and user experience improves. Enterprise adoption in markets like the USA, UK, UAE, and Canada is accelerating, with companies integrating blockchain elements into existing centralized platforms. Regulatory clarity, improved scalability through Layer 2 networks, and better wallet interfaces will drive mainstream adoption. Rather than full replacement, decentralized apps will complement traditional systems, especially in finance, identity management, and supply chain operations.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.