Key Takeaways

- A crypto payment gateway enables businesses to accept crypto payments by processing, verifying, and settling cryptocurrency transactions between customers and merchants.

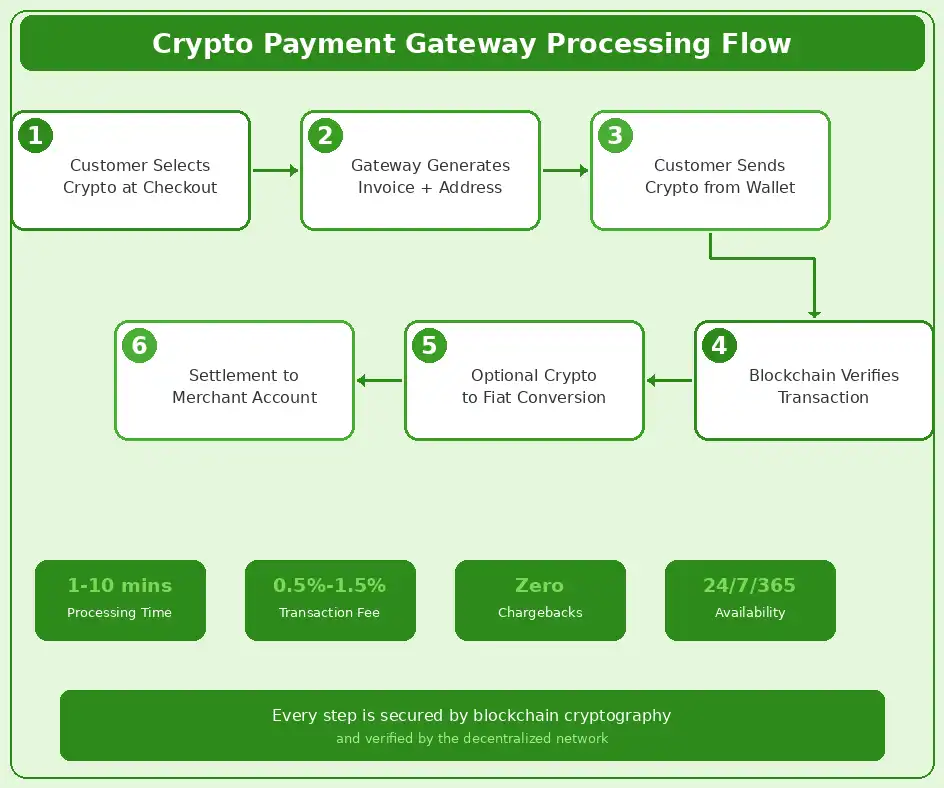

- Crypto payment processing follows a clear lifecycle: customer initiates payment, blockchain verifies the transaction, optional crypto-to-fiat conversion occurs, and funds settle to the merchant.

- Businesses can choose from hosted, self-hosted, or decentralized crypto payment gateways depending on their technical capacity, control requirements, and compliance needs.

- A Bitcoin payment gateway and Ethereum payment gateway are the most commonly supported options, with many platforms also offering multi-currency crypto payment solutions.

- Key benefits include lower fees (0.5% to 1.5% vs 2.5% to 3.5% for cards), faster cross-border settlements, elimination of chargebacks, and access to a global customer base.

- Crypto payment gateway integration for eCommerce platforms is straightforward through plugins and APIs, with most setups completed in under an hour for hosted solutions.

- Volatility management, regulatory compliance, and security architecture are the three primary challenges that businesses must address when implementing blockchain-based payments.

- The best crypto payment gateway for business combines strong security, multi-coin support, instant fiat conversion, transparent fees, and seamless integration with existing systems.

Cryptocurrency is no longer just an investment vehicle. It is becoming a practical payment method for businesses across industries, from online retail and SaaS platforms to hospitality, gaming, and professional services. At the centre of this shift is the crypto payment gateway, the technology that makes it possible for merchants to accept crypto payments from customers around the world. This guide explains what a cryptocurrency payment gateway is, how crypto payment processing works at every stage, and what businesses need to know to choose and integrate the right solution.

What Are Crypto Payment Gateways

A crypto payment gateway is a technology service that enables businesses to accept, process, and settle payments made in digital currencies. Think of it as the cryptocurrency equivalent of traditional payment processors like Stripe or PayPal, but instead of handling credit card or bank transactions, it handles blockchain-based payments. These gateways connect the customer’s cryptocurrency wallet to the merchant’s payment infrastructure, ensuring that the transaction is verified, converted (if needed), and settled efficiently.

Definition of a Crypto Payment Gateway

In simple terms, a cryptocurrency payment gateway is a payment processing platform that allows merchants to accept digital currencies as payment for goods and services. It handles the entire transaction flow: from generating a payment request and verifying the transaction on the blockchain, to converting cryptocurrency to fiat currency and settling funds to the merchant’s preferred account. The gateway abstracts the complexity of blockchain technology, giving merchants a clean, simple interface to manage crypto payments without needing deep technical knowledge.

Role of Cryptocurrency Payment Gateways in Digital Payments

Cryptocurrency payment gateways play a critical role in the digital payment ecosystem by bridging the gap between traditional commerce and the blockchain economy. They make it possible for any business, whether an online store, a subscription service, or a freelance platform, to accept crypto payments without directly interacting with blockchain networks. By handling verification, conversion, and settlement, they reduce friction for both merchants and customers, accelerating the real-world utility of digital currencies.

Why Businesses Are Adopting Crypto Payment Solutions

The shift toward crypto payment solutions for businesses is driven by practical advantages: lower processing fees, faster international settlements, zero chargebacks, and access to a growing segment of crypto-native customers. For businesses operating across borders, blockchain-based payments eliminate intermediary banks and their associated delays and costs. As consumer adoption of digital currencies grows, businesses that fail to offer crypto as a checkout option risk losing a valuable segment of their customer base.

Growing Demand for Crypto Payments

The demand for crypto payments has grown steadily over the past several years. Major retailers, online marketplaces, and service platforms are increasingly integrating cryptocurrency checkout options. This growth is fueled by expanding crypto ownership worldwide, the maturity of stablecoins as a practical medium of exchange, and improving regulatory clarity in key financial markets. Businesses that offer the ability to accept crypto payments position themselves at the forefront of this evolution.

Blockchain-Based Payments for Global Transactions

One of the most compelling use cases for blockchain-based payments is international commerce. Traditional cross-border transactions involve multiple intermediaries, currency conversions, and processing delays that can take three to five business days. A blockchain payment gateway processes the same transaction in minutes, with a fraction of the fees. This efficiency is particularly valuable for businesses serving customers in regions with limited banking infrastructure or restrictive capital controls.

How Crypto Payment Gateways Work

Understanding how crypto payment gateways work is essential for any business considering this technology. The process is straightforward, but it involves several layers of blockchain technology, security protocols, and optional financial conversion that work together to create a seamless payment experience.

Step-by-Step Crypto Payment Processing

The crypto payment processing lifecycle follows a clear, predictable flow. Each stage is designed to ensure accuracy, security, and speed. Here is how does a crypto payment gateway work in practice, broken down step by step.

Customer Initiates a Crypto Payment

The process begins when a customer selects cryptocurrency as their payment method at checkout. The gateway generates a unique invoice with the exact amount owed in the selected cryptocurrency (e.g., 0.0015 BTC), a destination wallet address, and a QR code for easy mobile scanning. The customer sends the payment from their personal wallet, and the gateway begins monitoring the blockchain for the incoming transaction.

Transaction Verification on Blockchain

Once the customer broadcasts the transaction, it enters the blockchain’s memory pool (mempool) and awaits confirmation. Depending on the cryptocurrency and the network’s current load, the transaction is picked up by miners or validators, verified through the consensus mechanism, and added to a block. Most gateways accept the transaction after one to three confirmations, which typically takes a few minutes for Bitcoin and seconds for networks like Solana or Polygon.

Crypto to Fiat Conversion (Optional)

If the merchant prefers to receive payment in fiat currency rather than holding cryptocurrency, the gateway automatically converts the received crypto at the prevailing market rate. This instant conversion shields the merchant from price volatility and ensures they receive the exact fiat equivalent of the sale. The converted funds are then queued for settlement to the merchant’s bank account.

Settlement to Merchant Wallet or Bank

The final step is settlement. If the merchant has opted for crypto settlement, the funds are transferred directly to their designated wallet. If fiat settlement was chosen, the converted amount is deposited into the merchant’s linked bank account, typically within one to two business days. Some gateways offer daily settlement batches, while others provide real-time or on-demand payouts.

Crypto Payment Processing Lifecycle

| Stage | Action | Key Detail | Time |

|---|---|---|---|

| 1. Payment Initiation | Customer selects crypto at checkout | Invoice with amount, address, QR code | Instant |

| 2. Transaction Broadcast | Customer sends crypto from wallet | Transaction enters blockchain mempool | Seconds |

| 3. Blockchain Verification | Network validates the transaction | 1-3 confirmations required | 1-10 minutes |

| 4. Conversion (Optional) | Gateway converts crypto to fiat | Real-time market rate applied | Instant |

| 5. Settlement | Funds sent to merchant wallet or bank | Crypto: instant / Fiat: 1-2 days | Instant to 2 days |

Role of Blockchain in Crypto Payment Processing

Blockchain technology is the foundation that makes crypto payment processing possible. It provides the decentralized, tamper-proof infrastructure for verifying transactions without relying on banks or card networks. Every crypto payment is recorded on a public ledger, making it transparent, traceable, and irreversible once confirmed.

Decentralized Payment System Explained

A digital currency payment system built on blockchain operates without a central authority. Transactions are validated by a distributed network of nodes, eliminating single points of failure and reducing the risk of censorship or interference. This decentralized architecture is what gives crypto payments their resilience, speed, and global accessibility.

Smart Contract Payments and Automation

Smart contracts enable automated payment logic that executes when pre-defined conditions are met. For example, a smart contract can release payment to a freelancer automatically when a project milestone is completed and verified. This capability is especially powerful for subscription services, escrow arrangements, and B2B transactions where conditional payments add efficiency and trust.

Types of Crypto Payment Gateways

Crypto payment gateways come in several architectural models, each suited to different business needs. Understanding the trade-offs between hosted, self-hosted, and decentralized options is essential for choosing the right fit.

Hosted Crypto Payment Gateways

Hosted gateways are managed entirely by the provider. The merchant integrates the gateway via a plugin or API, and the provider handles all infrastructure, security, compliance, and wallet management. This is the most popular model for small and mid-sized businesses because it minimizes technical burden and allows quick setup.

Benefits of Hosted Cryptocurrency Payment Gateways

The primary advantages of hosted gateways include rapid integration (often under an hour), managed security and compliance, automatic updates, and customer support from the provider. Merchants do not need to manage private keys or blockchain nodes, making it the lowest-barrier entry point to accepting crypto. For businesses exploring their top-rated crypto gateway options, hosted solutions offer the fastest path to launch.

Self-Hosted Crypto Payment Gateways

Self-hosted gateways give the merchant full control over the payment infrastructure. The merchant runs the gateway software on their own servers, manages their own wallets and private keys, and handles compliance independently. This model is preferred by enterprises and businesses with strict data sovereignty requirements.

Full Control Over Crypto Payments

With a self-hosted solution, the merchant retains complete custody of funds and full control over the payment flow. There is no dependency on a third party for uptime or fund access. However, this control comes with responsibility: the merchant must maintain server infrastructure, implement security measures, and stay current with blockchain updates and regulatory changes.

Decentralized Crypto Payment Gateways

Decentralized gateways operate entirely on blockchain smart contracts without a central service provider. Transactions are processed peer-to-peer, with the smart contract handling verification, conversion (via decentralized exchanges), and settlement automatically.

Blockchain Payment Gateway Without Intermediaries

A fully decentralized blockchain payment gateway eliminates all intermediaries. The customer pays directly to the merchant’s wallet through a smart contract that verifies the amount and conditions. This model offers maximum transparency and censorship resistance, though it currently lacks the fiat conversion and compliance features that many regulated businesses require.

Gateway Types Comparison

| Feature | Hosted | Self-Hosted | Decentralized |

|---|---|---|---|

| Setup Time | Minutes to hours | Days to weeks | Minutes (smart contract) |

| Fund Custody | Provider holds funds | Merchant holds funds | No custodian (peer-to-peer) |

| Fiat Conversion | Yes (automatic) | Optional (merchant manages) | Via DEX (limited) |

| Technical Expertise | Low | High | Moderate |

| Compliance | Provider manages | Merchant manages | Minimal (regulatory gap) |

| Best For | SMBs, eCommerce | Enterprises, regulated sectors | Crypto-native businesses |

Popular Cryptocurrencies Supported by Payment Gateways

The range of cryptocurrencies supported by a payment gateway directly affects its usefulness to merchants and customers. The most widely supported currencies are Bitcoin and Ethereum, but multi-currency solutions are becoming the standard.

Bitcoin Payment Gateway

Bitcoin remains the most widely accepted cryptocurrency in payment gateways. A Bitcoin payment gateway processes BTC transactions using the Bitcoin blockchain, offering merchants access to the largest and most established crypto user base. Bitcoin’s widespread recognition and deep liquidity make it the default option for any business looking to accept crypto payments.

Bitcoin for Secure Crypto Transactions

Bitcoin’s security is backed by the most powerful proof-of-work network in existence. Transactions are confirmed by a global network of miners, making them virtually irreversible once included in a block. For merchants, this means zero chargeback risk and a payment that cannot be fraudulently reversed after goods or services are delivered.

Ethereum Payment Gateway

An Ethereum payment gateway supports ETH and ERC-20 token payments, opening the door to a vast ecosystem of digital assets. Ethereum’s programmability makes it ideal for businesses that want to leverage smart contracts for automated payment logic, subscription billing, or conditional escrow arrangements.

Ethereum and Smart Contract-Based Payments

Smart contract-based payments on Ethereum allow for programmable, self-executing transactions. A merchant can set up a contract that automatically releases funds upon delivery confirmation, splits payments between multiple parties, or triggers recurring billing cycles. This level of automation reduces administrative overhead and increases trust between parties.

Multi-Currency Crypto Payment Solutions

The best crypto payment gateway for business supports dozens or even hundreds of digital assets, including stablecoins (USDT, USDC, DAI), Layer 1 tokens (SOL, AVAX, ADA), and popular Layer 2 tokens. Multi-currency crypto payment solutions let merchants cast the widest net, giving customers the freedom to pay with their preferred digital currency.

Accept Crypto Payments in Multiple Digital Assets

Offering multi-asset acceptance is a competitive advantage. A customer who holds Litecoin should be able to pay just as easily as one holding Ethereum. Gateways that support broad asset coverage handle the conversion and settlement complexity behind the scenes, so the merchant receives their preferred currency regardless of what the customer pays with. Businesses seeking this capability should explore leading multi-currency payment solutions to find the right fit.

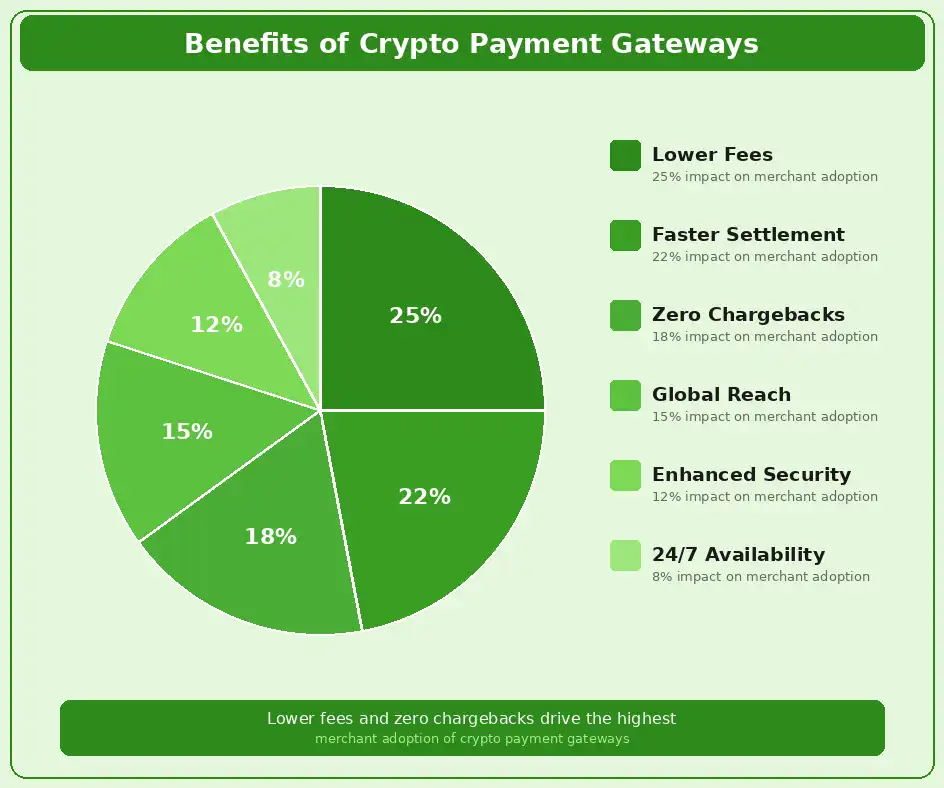

Benefits of Using Crypto Payment Gateways

The benefits of crypto payment gateways extend well beyond novelty. They offer concrete financial, operational, and strategic advantages that are driving adoption across industries. Here are the primary benefits.

Faster and Low-Fee Crypto Transactions

Crypto transactions, particularly on modern Layer 2 networks, settle in seconds to minutes, compared to the hours or days required by traditional payment processors. Processing fees for crypto payments typically range from 0.5% to 1.5%, a significant saving over the 2.5% to 3.5% charged by credit card networks.

Reducing Transaction Costs with Blockchain

By removing intermediary banks and card networks from the transaction flow, blockchain-based payments cut out the layers of fees that accumulate in traditional payment processing. For high-volume businesses, this difference can translate to thousands or tens of thousands in annual savings. This cost efficiency is one of the most tangible benefits of crypto payment gateways.

Enhanced Security in Crypto Payments

Every crypto transaction is cryptographically signed, verified by the blockchain network, and recorded on an immutable ledger. This eliminates common fraud vectors like chargebacks, unauthorized transactions, and payment disputes. A secure crypto payment gateway adds additional layers including encryption, multi-signature wallets, and real-time monitoring.

Secure Crypto Payment Gateway Features

Key security features to look for include end-to-end encryption, cold storage for pooled funds, multi-factor authentication for merchant dashboards, IP whitelisting for API access, and compliance with data protection regulations. The combination of blockchain-level security and application-level safeguards creates a layered defense that outperforms traditional payment security models.

Global Reach and Cross-Border Crypto Payments

Crypto payment gateways are inherently borderless. A merchant can accept payments from a customer anywhere in the world without worrying about currency conversion, banking hours, or international wire transfer delays. This global reach is particularly valuable for digital goods sellers, SaaS platforms, and businesses with international customer bases.

Eliminating Currency Conversion Barriers

Traditional international payments involve currency conversion at unfavourable rates, with fees charged at multiple stages of the process. Crypto eliminates these barriers. A customer in one country pays in Bitcoin, the gateway converts it to the merchant’s local currency, and the merchant receives the exact amount with minimal fees and no exchange rate surprises.

Crypto Payment Gateway Integration for Businesses

Crypto payment gateway integration is increasingly straightforward, with most providers offering tools designed for non-technical merchants alongside robust APIs for businesses with custom requirements.

Crypto Payment Gateway for eCommerce Platforms

A crypto payment gateway for eCommerce is typically integrated through a plugin that connects directly to the store’s checkout flow. Platforms like Shopify, WooCommerce, Magento, and BigCommerce all support crypto payment plugins from major gateway providers. The integration adds cryptocurrency as a checkout option alongside traditional payment methods, giving customers choice without disrupting the existing purchase flow.

Accept Crypto Payments in Online Stores

For online store owners, the integration process typically involves installing the gateway’s plugin, connecting your merchant account, configuring settlement preferences (crypto or fiat), and enabling the payment option at checkout. Most hosted gateway integrations can be completed in under an hour. The result is a seamless checkout experience where customers can pay with Bitcoin, Ethereum, or any supported cryptocurrency just as easily as they would with a credit card.

API-Based Crypto Payment Gateway Integration

For businesses with custom platforms, mobile apps, or unique payment workflows, API-based crypto payment gateway integration offers maximum flexibility. Gateway APIs provide endpoints for creating invoices, monitoring transaction status, triggering conversions, and managing settlements programmatically.

Seamless Blockchain Payment System Setup

A well-documented API makes it possible to embed crypto payment functionality into virtually any digital platform. RESTful APIs with webhook notifications allow real-time transaction tracking and automated order fulfillment. SDKs in popular programming languages (Python, JavaScript, PHP) further simplify the integration. For businesses that need a reliable payment gateway integration partner, choosing a provider with comprehensive documentation and responsive technical support is critical.

Challenges and Risks in Crypto Payment Gateways

While the advantages are significant, businesses should also be aware of the challenges and risks associated with implementing a crypto payment processor. Informed decision-making requires understanding both sides.

Volatility in Cryptocurrency Payments

The most commonly cited risk is price volatility. Cryptocurrency prices can fluctuate significantly within minutes, meaning the value of a payment could change between the time it is initiated and the time it settles. This is a real concern for merchants who choose to hold crypto rather than converting to fiat.

Managing Price Fluctuations

The most effective way to manage volatility is instant fiat conversion, which most reputable gateways offer as a standard feature. By converting crypto to fiat at the moment of transaction, the merchant locks in the sale price and eliminates exposure to market movements. Accepting stablecoin payments (USDT, USDC) is another strategy, as these assets are pegged to fiat currencies and experience minimal price fluctuation.

Regulatory and Compliance Considerations

Crypto payment regulations vary significantly by jurisdiction and are evolving rapidly. Businesses must ensure they comply with local anti-money laundering (AML) laws, know-your-customer (KYC) requirements, and tax reporting obligations related to cryptocurrency transactions.

Legal Aspects of Crypto Payment Processing

Working with a crypto payment processor that maintains its own regulatory licenses and compliance infrastructure can simplify this burden for merchants. Reputable gateways handle KYC/AML on behalf of their merchants, maintain transaction records for audit purposes, and stay current with regulatory changes across the jurisdictions they serve.

Choosing the Best Crypto Payment Gateway for Business

Selecting the best crypto payment gateway for business requires evaluating several factors systematically. The right choice depends on your industry, transaction volume, technical capability, and geographic footprint.

Key Features to Look for in a Crypto Payment Processor

A strong crypto payment processor should offer multi-currency support, instant fiat conversion, robust API documentation, regulatory compliance, responsive customer support, and transparent fee structures. Advanced features like recurring billing, invoicing, and customizable checkout experiences add significant value for businesses with complex payment needs.

Security, Scalability, and Supported Coins

Security should be the top priority. Look for gateways that use cold storage, multi-signature wallets, and real-time threat detection. Scalability matters for growing businesses: the gateway should handle increasing transaction volumes without degradation. And the range of supported coins should align with your customer base’s preferences.

Factors Affecting Crypto Payment Gateway Selection

Beyond features, practical factors like processing fees, settlement speed, integration complexity, and the quality of merchant dashboard and analytics tools all influence the decision. A gateway that is technically powerful but difficult to integrate or monitor is not the right choice for most businesses.

Fees, Integration, and User Experience

Compare processing fees (typically 0.5% to 1.5%), settlement fees, and any monthly subscription costs. Evaluate the integration experience: does the provider offer plugins for your platform, clear API documentation, and sandbox environments for testing? And assess the merchant dashboard: does it provide real-time analytics, transaction search, and easy access to settlement reports?

Gateway Selection Criteria Framework

| Criteria | Small Business | Mid-Market | Enterprise |

|---|---|---|---|

| Gateway Type | Hosted | Hosted or API-based | Self-hosted or Custom |

| Coins Supported | BTC, ETH, USDT | 20+ coins, stablecoins | 100+ coins, custom tokens |

| Fee Priority | Low flat fees | Volume-based pricing | Custom negotiated rates |

| Integration | Plugin-based | API + plugins | Full API, SDK, white-label |

| Compliance | Provider-managed | Shared responsibility | In-house compliance team |

Crypto Payment Gateway for Enterprises

Enterprise-grade crypto payment gateway solutions go beyond standard checkout integrations. They involve custom architecture, white-label options, and deep integration with existing financial systems and compliance workflows.

Custom Crypto Payment Gateway Solutions

Custom solutions are built from the ground up to match an enterprise’s specific transaction flows, supported currencies, settlement preferences, and compliance requirements. These gateways integrate with ERP systems, CRM platforms, and accounting software, providing a unified financial infrastructure that treats crypto payments as a native part of the business’s payment ecosystem.

Tailored Blockchain Payment Gateway Architecture

A tailored architecture considers the enterprise’s transaction volume, geographic spread, regulatory environment, and technical stack. It may include dedicated blockchain nodes for faster confirmation monitoring, custom wallet management systems, multi-tier security protocols, and advanced analytics dashboards. For organizations evaluating enterprise-grade crypto gateway solutions, the architecture must scale without compromising speed or security.

White Label Crypto Payment Gateway

A white-label crypto payment gateway allows businesses to offer crypto payment processing under their own brand. The underlying technology is provided by the gateway vendor, but the merchant-facing interface, branding, and customer experience are fully customized. This approach is popular among fintech companies, payment aggregators, and financial institutions that want to offer crypto services without building the entire infrastructure from scratch.

Faster Launch for Crypto Payment Processing

White-label solutions dramatically reduce time-to-market. Instead of months of engineering, a business can launch a fully branded crypto payment processor in weeks. The vendor handles the blockchain infrastructure, wallet management, and compliance backend, while the business focuses on customer acquisition and market positioning.

Building a crypto exchange or payment platform that earns merchant trust requires secure wallet architecture, real-time conversion engines, and regulatory compliance built into every layer of the system.

Crypto Payment Gateways vs Traditional Payment Processors

| Factor | Crypto Payment Gateway | Traditional Payment Processor |

|---|---|---|

| Transaction Fees | 0.5% to 1.5% | 2.5% to 3.5% |

| Settlement Speed | Minutes (crypto) / 1-2 days (fiat) | 2-5 business days |

| Chargebacks | None (irreversible transactions) | Common (costly disputes) |

| Cross-Border | Seamless, no currency barriers | Complex, additional fees |

| Operating Hours | 24/7/365 | Business hours dependent |

| Privacy | Pseudonymous (wallet-based) | Requires full personal data |

Future of Crypto Payment Gateways

The trajectory for crypto payment gateways points toward mainstream adoption. As digital currency payment systems mature, they are expected to become a standard component of the global payments infrastructure alongside cards, bank transfers, and mobile wallets.

Growth of Blockchain-Based Payment Solutions

The growth of blockchain-based payments is being accelerated by several converging forces: increasing consumer crypto ownership, the proliferation of stablecoins as practical payment instruments, improving Layer 2 scaling solutions that reduce fees and increase speed, and progressive regulatory frameworks that give businesses confidence to adopt crypto.

Adoption Trends in Digital Currency Payment Systems

Adoption trends show steady growth across retail, e-commerce, B2B, and subscription-based business models. Major payment networks are beginning to integrate crypto rails. Central bank digital currencies (CBDCs) are being piloted in multiple countries, further validating the digital payment paradigm. These trends suggest that businesses investing in crypto payment infrastructure now will be well-positioned as the market matures.

Innovations in Decentralized Crypto Payments

Innovation in decentralized crypto payments is advancing rapidly. Cross-chain payment protocols, account abstraction for simplified wallet interactions, and intent-based transaction systems are all making decentralized payments more accessible to everyday users and merchants.

Role of DeFi in Crypto Payment Gateways

DeFi protocols are increasingly being integrated into crypto payment gateways to offer features like yield on idle merchant balances, decentralized exchange-based conversion, and lending-backed payment options. These innovations blur the line between payment processing and financial services, creating a new category of integrated financial infrastructure for businesses.

Launch a Secure Crypto Payment Gateway for Your Business

Accept secure, fast, and low-fee crypto payments with a scalable crypto payment gateway built for modern businesses.

Launch Your Exchange Now

Conclusion

Crypto payment gateways represent a fundamental shift in how businesses can accept, process, and settle payments. From the straightforward processing lifecycle to the choice between hosted, self-hosted, and decentralized architectures, the options available today are mature, secure, and practical for businesses of all sizes.

Whether you are an eCommerce store looking to add Bitcoin and Ethereum to your checkout, a SaaS platform exploring crypto payment solutions for businesses, or an enterprise building a custom digital currency payment system, the technology and infrastructure to support your goals already exist. The key is choosing the right crypto payment gateway, one that matches your security requirements, integrates cleanly with your existing systems, and scales with your growth.

Crypto payments are not a future concept. They are a present reality that is reshaping global commerce. The businesses that embrace this shift today will have a meaningful competitive advantage as digital currency adoption continues to accelerate.

Frequently Asked Questions

A crypto payment gateway is a digital payment processing service that allows businesses to accept cryptocurrency transactions from customers. It acts as a bridge between the customer’s crypto wallet and the merchant’s account, facilitating the transfer, verification, and settlement of digital currency payments. These gateways can also convert cryptocurrency to fiat currency in real time, protecting merchants from price volatility.

When a customer chooses to pay with cryptocurrency, the gateway generates a unique payment request and wallet address. The customer sends the specified amount from their wallet, and the blockchain network verifies the transaction through its consensus mechanism. Once confirmed, the gateway settles funds to the merchant either in cryptocurrency or in fiat currency after automatic conversion, completing the payment cycle within minutes.

Crypto payment gateways offer businesses lower transaction fees compared to traditional card processors, faster settlement times (especially for cross-border payments), and access to a global customer base without currency conversion friction. They also provide enhanced security through blockchain-based verification, eliminate chargebacks, and offer merchants the flexibility to receive settlements in crypto or fiat currency.

Yes, most modern crypto payment gateways offer automatic crypto-to-fiat conversion at the time of the transaction. This feature protects merchants from cryptocurrency price fluctuations by instantly converting the received crypto into their preferred fiat currency. The converted amount is then settled to the merchant’s bank account, typically within one to two business days.

Accepting crypto payments through a reputable gateway is generally very safe. Blockchain transactions are cryptographically secured, immutable, and publicly verifiable, making fraud and chargebacks virtually impossible. Reputable gateways add layers of security including encryption, multi-signature wallets, and compliance with regulatory standards. The key is choosing a gateway with a proven security track record.

Most crypto payment gateways support Bitcoin and Ethereum as their primary currencies, along with popular stablecoins like USDT and USDC. Many also support a broader range of altcoins including Litecoin, Ripple (XRP), Solana, and Polygon. The best gateways offer multi-currency support, allowing merchants to accept dozens or even hundreds of different digital assets through a single integration.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.