Key Takeaways

- UAE crypto regulation is activity-based, not brand or technology-based.

- A clear scope definition is mandatory; undefined or flexible scopes are rejected.

- Each exchange activity is supervised by only one UAE regulator.

- Governance and decision authority outweigh technology in licensing decisions.

- AML, KYC, and monitoring must be fully live before launch.

- Travel Rule enforcement is mandatory, and non-compliant transfers must be blocked.

- Custody failures are regulatory breaches, not technical errors.

- Exchanges are regulated as market operators, with listing and surveillance obligations.

- Licensing is proof-based, and compliance continues after approval.

Step 1- Define the Exact Exchange Activity (Foundation Layer)

In the United Arab Emirates, crypto exchange regulation is strictly activity-based, rather than being brand-based or technology-based. Regulators do not license “crypto exchanges” in a generic sense. Instead, they authorize specific virtual asset activities, each carrying distinct regulatory obligations, licensing categories, capital requirements, and system controls. Defining the exact scope of operations is, therefore, the foundational step in building a compliant crypto exchange and obtaining a Crypto Exchange License in the UAE, which requires clear activity definition, regulator alignment, and proof-based compliance readiness.

Before submitting any licensing application, the exchange must formally document what services it provides, to whom, and under what operational boundaries. Any ambiguity at this stage will result in delays, scope reductions, or outright rejection by regulators such as VARA (Dubai), FSRA (ADGM), or DFSA (DIFC).[1]

Core Activity Classification

The first decision is identifying the exact virtual asset services the platform will perform. Common regulated activities include-

- Spot exchange operations (order book–based trading between buyers and sellers)

- Brokerage services (acting as principal or agent for trades)

- OTC desk operations (bilateral, off-order-book transactions)

- Custody and safekeeping of virtual assets

- Staking or yield-generating services

- Lending and borrowing platforms

- Derivatives or margin trading (subject to stricter regulatory regimes)

Each activity is regulated differently. For example, a spot exchange without custody obligations faces a different control framework than a custodial exchange offering staking or lending products. Combining multiple activities significantly increases regulatory scrutiny and compliance complexity.

Client Classification and Market Access

The second dimension is client segmentation. UAE regulators distinguish clearly between-

- Retail users

- Professional or institutional clients

- Mixed user bases

Retail-facing exchanges are subject to enhanced consumer protection requirements, stricter disclosures, marketing controls, and suitability assessments. Institutional-only platforms may benefit from greater flexibility but face higher governance and risk management expectations.

Equally important is geographic scope. The exchange must specify whether it will serve-

- UAE residents only

- Non-UAE residents

- A global user base with geo-fencing controls

Cross-border service provision triggers additional AML, sanctions, and Travel Rule obligations and often requires demonstrating international regulatory alignment.

Fiat Integration and Payment Rails

Fiat involvement is a critical licensing determinant. Regulators require explicit disclosure of whether the platform will support-

- AED wallets

- Bank transfers

- Debit or credit card payments

- Third-party payment service providers

Any fiat on-ramp or off-ramp introduces additional oversight, often involving federal AML alignment, local banking relationships, and payment system compliance. Crypto-to-crypto exchanges without fiat exposure are assessed differently from platforms that handle customer money.

Regulatory Impact of Activity Definition

The defined activity scope directly determines-

- Which regulator has jurisdiction

- Which license category applies

- Which compliance systems are mandatory

- Capital adequacy and insurance requirements

- Technology and custody controls

UAE regulators will not approve an application that attempts to “leave room for future expansion” without prior approval. Scope creep is not permitted. Every regulated activity must be pre-declared, justified, and supported by operational evidence.

Step 2- Select the Regulatory Jurisdiction (Control Boundary)

Selecting the correct regulatory authority is mandatory under UAE crypto exchange regulations, as only one regulator supervises each licensed activity. Once the exchange activity is precisely defined, the next step is selecting one, and only one, regulatory jurisdiction within the UAE. The UAE operates under a multi-regulator model, where each authority has exclusive control within its legal boundary. Multiple UAE crypto regulators cannot simultaneously regulate an exchange for the same activity.

This decision establishes the entire compliance architecture, including reporting lines, audit requirements, technology standards, and enforcement authority.

Dubai (Outside DIFC)- Virtual Assets Regulatory Authority (VARA)

Exchanges operating in mainland Dubai must obtain a VARA crypto exchange license, which governs retail and institutional virtual asset activities outside DIFC. VARA’s framework is purpose-built for crypto markets and applies to both retail and institutional platforms.

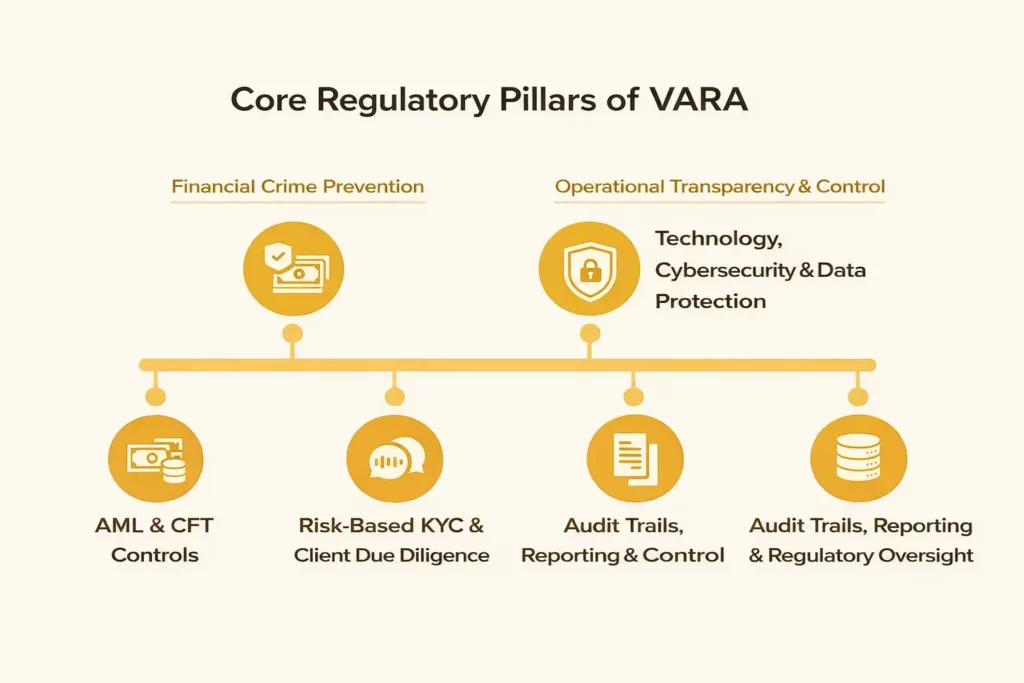

VARA focuses heavily on-

- Market conduct and integrity

- Custody and asset segregation

- AML/CFT and Travel Rule compliance

- Technology risk and cybersecurity

- Consumer protection for retail users

VARA is typically the preferred jurisdiction for exchanges targeting UAE retail participation or broad market access.

Dubai International Financial Centre (DIFC)- Dubai Financial Services Authority (DFSA)

The DIFC is a separate legal jurisdiction with a common-law framework. Crypto activities inside DIFC are regulated by the DFSA and are treated more like traditional financial market infrastructure.

The DFSA framework emphasizes-

- Detailed disclosures

- Prudential risk management

- Institutional-grade governance

- Financial instrument classification

DIFC is generally suited for platforms focused on professional clients, tokenized securities, or integration with global financial institutions.[2]

Abu Dhabi Global Market (ADGM)- Financial Services Regulatory Authority (FSRA)

An ADGM crypto exchange license is commonly chosen by institutional platforms, custodians, and market infrastructure providers. ADGM’s FSRA was one of the earliest regulators to introduce a comprehensive crypto regime. It is widely recognized for its institutional and infrastructure-focused approach.

FSRA places strong emphasis on-

- Custody and safekeeping controls

- Market infrastructure resilience

- Risk management frameworks

- Capital adequacy and governance maturity

ADGM is often chosen by custodians, market makers, and institutional exchanges.

Federal / Onshore UAE Considerations

Certain activities, particularly payment processing, banking integration, and AML reporting,may fall under federal oversight. While licensing remains with VARA, DFSA, or FSRA, exchanges must align with federal requirements for financial crime prevention and reporting to national authorities.

Selecting the wrong jurisdiction or attempting regulatory arbitrage is one of the most common causes of licensing failure in the UAE.

| Jurisdiction | Regulator / Licensing Entity | Operational Licensing Regime | Required Corporate Structure | Licensing Costs | Key Licensing Categories | Target Users | Key Focus |

|---|---|---|---|---|---|---|---|

| Dubai (Mainland) | VARA | Yes | Full corporate setup with governance roles | Moderate | Broker-dealer, Exchange/MTE, Custody, NFTs | Retail & Institutional | AML/CFT, consumer protection, custody |

| Dubai International Financial Centre (DIFC) | DFSA | Yes | Standard corporate governance with institutional compliance | High | Broker-dealer, Exchange/MTE, Custody | Institutional | Institutional governance, disclosure |

| Abu Dhabi Global Market (ADGM) | FSRA | Yes | Strong corporate governance with risk & compliance functions | Moderate-High | Broker-dealer, Exchange/MTE, Custody | Institutional | Custody controls, capital adequacy |

Step 3- Corporate & Governance Architecture

UAE crypto regulators prioritize people, accountability, and decision-making authority over software or platform features. A technically advanced exchange with weak governance will not be licensed.

The applicant entity must demonstrate a robust corporate and governance structure that ensures regulatory compliance, risk oversight, and operational control.

Mandatory Governance Roles

At a minimum, the exchange must formally appoint and document the following roles-

- Shareholders and Ultimate Beneficial Owners (UBOs)

Full transparency is required, including ownership percentages, source of funds, and control rights. - Board of Directors

The board must have clearly defined oversight responsibilities, including risk governance, compliance supervision, and strategic control. - Chief Executive Officer (CEO)

The CEO holds ultimate regulatory accountability for the exchange’s operations. - Compliance Officer

Responsible for adherence to licensing conditions, regulatory filings, and internal compliance monitoring. - Money Laundering Reporting Officer (MLRO)

Responsible for AML/CFT systems, suspicious transaction reporting, and liaison with the UAE Financial Intelligence Unit. - Risk and Security Functions

Accountable for operational risk, cybersecurity, custody risk, and incident management.

Governance Expectations

Each role must have-

- Clearly documented responsibilities

- Defined decision-making authority

- Functional independence where required

- Demonstrable experience and competence

Regulators assess not only titles, but actual control. Nominee directors, figurehead officers, or shell governance structures are explicitly rejected. The exchange must prove that governance is operational, empowered, and actively engaged in oversight.

In the UAE regulatory environment, governance is the first line of defense. Without it, no exchange, regardless of technology or funding ,will be approved.

Step 4- AML / CFT Compliance Layer (Core Mandatory System)

Under UAE law, AML requirements for crypto exchanges must be fully operational before onboarding any users. In the UAE, all crypto exchanges are classified as regulated reporting entities, regardless of size, user volume, or asset type. Anti–Money Laundering (AML) and Counter-Terrorist Financing (CFT) compliance is therefore not optional, phased, or post-launch. This layer must be fully operational before onboarding the first user.

UAE regulators do not assess AML/CFT as a policy document alone. They evaluate live systems, workflows, decision logic, escalation paths, and auditability. An exchange without real-time AML controls is considered operationally unfit for licensing.

Customer Due Diligence (CDD) Framework

Every exchange must implement a risk-based customer due diligence framework aligned with UAE AML laws and FATF standards.

For individual users, the system must support-

- Government-issued identity verification

- Liveness and anti-spoofing checks

- Address and nationality assessment

- Sanctions and PEP screening at onboarding

For institutional or corporate clients, enhanced onboarding is mandatory, including-

- Business registration verification

- Ultimate beneficial owner (UBO) identification

- Ownership and control structure analysis

- Nature of business and source-of-funds assessment

The onboarding process must be tiered based on risk classification, with clearly defined thresholds for transaction limits, withdrawal permissions, and feature access.

Enhanced Due Diligence (EDD)

Users classified as high risk, including those from higher-risk jurisdictions, complex corporate structures, or elevated transaction profiles, must undergo enhanced due diligence. This includes-

- Additional identity or corporate verification

- Deeper source-of-wealth analysis

- Senior compliance approval

- Ongoing monitoring at a higher frequency

Risk scoring must be dynamic, not static. Regulators expect risk levels to adjust as user behavior evolves.

Transaction Monitoring Systems

Transaction monitoring must operate in real time and be behavior-based, not rule-only.

Mandatory monitoring capabilities include-

- Velocity monitoring (frequency of transactions)

- Volume analysis (size relative to user profile)

- Pattern recognition (structuring, layering, circular flows)

- Detection of abnormal behavior against historical baselines

Automated alerts must feed into manual review workflows, where compliance analysts can-

- Investigate flagged activity

- Request additional information

- Escalate cases internally

- Freeze or restrict accounts when necessary

All decisions must be logged and auditable.

Sanctions Screening and Jurisdictional Controls

Exchanges must implement continuous sanctions and watchlist screening, not just one-time checks. This includes-

- Screening against prohibited individuals and entities

- Jurisdictional risk controls for sanctioned or restricted regions

- Periodic re-screening of the entire user base

Geo-blocking and IP-based controls must align with sanctions enforcement.

Suspicious Transaction Reporting (STR)

A formal internal escalation framework is mandatory. When suspicious activity is identified-

- The MLRO must review and assess the case

- A decision must be documented

- Where required, a report must be filed with the UAE Financial Intelligence Unit (FIU)

Complete audit trail retention is required, covering alerts, investigations, decisions, and reports.

AML/CFT compliance in the UAE is a live operating system, not a compliance checklist.

Step 5- Travel Rule & Transfer Compliance

For crypto asset transfers involving other Virtual Asset Service Providers (VASPs), UAE regulators require full compliance with the FATF Travel Rule. This applies to transfers above defined regulatory thresholds and is increasingly enforced during licensing and supervision.

Mandatory Data Collection

For applicable transfers, the exchange must collect-

- Originator information (name, account, identifier)

- Beneficiary information (name, receiving VASP, wallet identifier)

- Transaction metadata linked to the transfer

This information must be accurate, complete, and linked to the transaction lifecycle.

Secure Data Transmission

Collected Travel Rule data must be-

- Securely transmitted to the counterparty VASP

- Protected against unauthorized access

- Retained in compliance with data protection and record-keeping rules

Manual or ad-hoc sharing methods are not acceptable for regulated exchanges.

Counterparty VASP Risk Assessment

The exchange must maintain a counterparty VASP risk evaluation framework, assessing-

- Regulatory status of the counterparty

- Jurisdictional risk

- AML maturity and compliance posture

Transfers involving unregulated or high-risk VASPs must be restricted, delayed, or escalated.

Exception Handling and Enforcement

The system must support-

- Flagging of non-compliant or incomplete transfers

- Automated blocking or manual intervention

- Clear exception handling procedures approved by compliance leadership

Regulators expect evidence that the Travel Rule is enforced in practice, not merely supported in theory.[3]

Step 6- Asset Custody & Wallet Architecture Compliance

In the UAE, crypto custody is regulated as financial asset protection, not as a technical wallet feature. Any loss, misuse, or commingling of client assets is treated as a regulatory failure, regardless of whether the root cause is technical, operational, or human.[4]

Asset Segregation Requirements

The exchange must maintain strict segregation between-

- Client assets

- Company operational funds

- Treasury or liquidity accounts

This segregation must be enforced both-

- On-chain (wallet structure)

- Off-chain (internal ledgers and accounting systems)

Wallet Architecture Design

A formally documented wallet policy is mandatory, defining-

- Hot wallets for operational liquidity

- Warm wallets for controlled transfers

- Cold wallets for long-term storage

| Wallet Type | Purpose | Risk Level | Controls |

|---|---|---|---|

| Hot Wallet | Liquidity | High | Limits + Monitoring |

| Warm Wallet | Transfers | Medium | Manual approval |

| Cold Wallet | Storage | Low | MPC / Multi-sig |

Each wallet tier must have-

- Clearly defined use cases

- Access restrictions

- Transfer limits

Access Controls and Authorization

Custodial access must be protected through-

- Multi-party authorization (e.g., multi-sig or MPC)

- Role-based access controls

- Separation of duties between operations, security, and compliance

No single individual should have unilateral control over client assets.

Withdrawal Governance

Withdrawal workflows must include-

- Automated risk checks

- Transaction limits based on user risk tier

- Manual approval for high-risk or high-value withdrawals

- Real-time monitoring and logging

Reconciliation and Auditability

The exchange must perform continuous reconciliation between-

- On-chain balances

- Internal ledgers

- Customer account records

Any discrepancy must trigger investigation and escalation.

From a UAE regulatory perspective, custody integrity is non-negotiable. The regulator does not accept “technical error” as an excuse for asset loss.

Step 7- Market Integrity & Exchange Control Framework

Under UAE regulatory frameworks, a crypto exchange is classified as a market operator, not merely a technology provider or order-matching platform. As a result, regulators impose strict market integrity, fairness, and abuse-prevention obligations similar to those applied to traditional financial exchanges.

The primary objective of this layer is to ensure fair price discovery, equal access, and protection against abusive trading practices. Failure in market integrity controls can lead to enforcement action, license restrictions, or suspension.

Token Listing Governance

Every exchange must operate a formal token listing and delisting governance framework. Token admission to the market is treated as a regulated decision, not a commercial one.

Mandatory components include-

- Due diligence processes assessing the token’s technology, use case, governance, issuer background, and risk profile

- Legal and regulatory risk assessment, including securities classification considerations

- Approval by a designated internal committee with documented decision authority

- Ongoing post-listing monitoring

- Clearly defined delisting criteria for non-compliance, security risks, or market integrity concerns

Token listings without documented review and approval processes are considered a breach of market operator obligations.

Conflict of Interest Management

Exchanges must identify, manage, and mitigate actual and potential conflicts of interest across all business functions.

This includes-

- Separation between listing decisions and commercial revenue teams

- Controls preventing preferential treatment of certain users or market participants

- Policies governing employee trading, insider access, and information asymmetry

Conflicts must be either prohibited or fully disclosed, with enforcement mechanisms in place.

Proprietary Trading Controls

Regulators closely scrutinize whether an exchange engages in proprietary trading on its own platform.

Exchanges must-

- Explicitly prohibit proprietary trading, or

- Clearly disclose such activity and implement strong segregation, transparency, and monitoring controls

Undisclosed proprietary trading is treated as market abuse and a serious regulatory violation.

Market Manipulation Detection

Exchanges are required to deploy market surveillance systems capable of detecting abusive trading behaviors, including-

- Wash trading

- Spoofing and layering

- Pump-and-dump schemes

- Circular or coordinated trading patterns

Surveillance systems must operate in real time and integrate with-

- Order book data

- Trade execution data

- User behavioral profiles

Alerts must feed into manual investigation workflows, with escalation to compliance and risk teams where required.

Fair Access and Price Discovery

The exchange must demonstrate that-

- All users receive fair and non-discriminatory access to the trading system

- Matching engine logic is transparent, deterministic, and documented

- Latency advantages or preferential execution are not permitted unless clearly disclosed and approved

Price discovery must reflect genuine market supply and demand, free from artificial distortion.

From a regulatory standpoint, market integrity failures undermine the credibility of the entire financial system, making this layer non-negotiable.

Step 8- Technology & Cybersecurity Compliance Layer

UAE regulators assess exchange technology as critical operational risk infrastructure, not as a neutral software stack. Technology failures that affect market integrity, custody, or user access are treated as regulatory incidents.

The exchange must demonstrate that its technology environment is secure, resilient, auditable, and well-governed.

Identity, Authentication, and Access Management

Mandatory expectations include-

- Secure user authentication mechanisms (including multi-factor authentication)

- Role-based access controls for internal systems

- Principle of least privilege across all environments

- Strong controls for administrative and privileged access

Unauthorized access incidents are considered systemic risk events.

Logging, Monitoring, and Audit Trails

The platform must generate comprehensive logs covering-

- User actions

- Administrative activity

- System changes

- Security events

- Trade execution and order handling

Logs must be-

- Tamper-resistant

- Time-synchronized

- Retained for regulatory review

Regulators expect the ability to reconstruct events end-to-end.

Change Management Controls

All changes to production systems must follow formal change management procedures, including-

- Change requests and approvals

- Risk impact assessment

- Testing and rollback plans

- Post-deployment validation

Uncontrolled or undocumented changes are treated as governance failures.

Incident Detection and Response

The exchange must maintain a documented incident detection and response framework, covering-

- Cybersecurity incidents

- System outages

- Data breaches

- Operational failures

The framework must define-

- Incident classification

- Response timelines

- Internal escalation

- Regulatory notification requirements

Security incidents must be reported, documented, investigated, and remediated.

Data Protection and Privacy

Exchanges must implement controls to protect-

- Personal data

- Financial information

- Transaction records

This includes encryption, access restrictions, and compliance with applicable data protection laws.

Business Continuity and Disaster Recovery (BCP/DR)

A formal business continuity and disaster recovery plan is mandatory. Regulators require-

- Defined recovery time objectives (RTOs)

- Backup infrastructure

- Regular testing of recovery procedures

- Evidence of operational resilience

Technology resilience is a licensing prerequisite, not a post-launch enhancement.

Step 9- Consumer Protection & Disclosure Layer

For exchanges offering services to retail users, consumer protection is a central regulatory priority. UAE regulators assess not only backend systems, but also user experience, disclosures, and communications.

Risk Disclosures

Exchanges must provide clear, prominent, and understandable risk disclosures, explaining-

- Price volatility

- Market risks

- Technology risks

- Custody risks

- Regulatory limitations

Disclosures must be accessible before account activation and trading.

Fee Transparency

All fees must be-

- Clearly disclosed

- Easily accessible

- Presented without hidden conditions

This includes trading fees, withdrawal fees, spreads, and third-party charges.

Asset Ownership Clarity

The exchange must clearly explain-

- Whether assets are held in custody

- Who controls private keys

- User rights in the event of insolvency

Misrepresentation of asset ownership is treated as consumer deception.

Complaints and Support Handling

A formal complaint handling mechanism is mandatory, including-

- Defined intake channels

- Resolution timelines

- Escalation paths

- Record retention

Support teams must be trained and monitored.

Marketing and UI Compliance

Regulators assess-

- Website content

- Mobile app interfaces

- Marketing materials

- Promotional claims

Misleading design, exaggerated claims, or risk-minimizing language is considered a compliance breach, even if technically accurate elsewhere.

From a regulatory perspective, consumer trust is part of market stability.

Build a Fully Compliant Crypto Exchange

Build a VARA / ADGM-Compliant crypto Exchange

Step 10- Licensing Submission Package (Regulatory Evidence Set)

The process of securing a Crypto Exchange License in UAE is not form-driven; it is a full operational readiness assessment conducted by the regulator. Regulators expect a complete, internally consistent submission package that demonstrates the exchange’s ability to operate safely, compliantly, and at scale from day one.

A fragmented or incomplete submission is treated as evidence of weak governance and results in prolonged review cycles or outright rejection.[5]

Core Components of the Licensing Submission

A complete licensing package must include, at a minimum-

Business Model and Activity Definition

A precise description of all regulated activities, client segments, geographic scope, and fiat exposure. This must align exactly with the requested license category and declared regulatory jurisdiction.

Governance and Management Framework

Detailed disclosure of ownership structure, ultimate beneficial owners, board composition, senior management roles, reporting lines, and decision-making authority. Fitness and propriety assessments for key individuals are mandatory.

AML / CFT Policy Framework

Documented AML, CFT, and sanctions compliance policies, including customer due diligence, transaction monitoring, escalation procedures, and suspicious transaction reporting processes. Policies must map directly to implemented systems.

Risk Management Framework

A structured framework covering operational risk, market risk, liquidity risk, custody risk, technology risk, and regulatory risk. Risk identification, mitigation, and escalation mechanisms must be clearly defined.

Custody and Wallet Policy

Formal documentation describing asset segregation, wallet architecture, access controls, authorization mechanisms, reconciliation procedures, and incident handling for asset protection.

Technology and Cybersecurity Documentation

System architecture diagrams, security controls, access management policies, logging and monitoring capabilities, change management processes, and incident response procedures.

Token Listing and Market Governance Policy

Defined processes for token due diligence, approval, ongoing monitoring, conflict management, and delisting.

Financial Projections and Capital Planning

Projected financial statements, capital adequacy analysis, operational expense modeling, and liquidity planning aligned with the declared activity scope.

Operational Readiness Evidence

Demonstrable proof that all critical systems and controls are live, tested, and functional,not planned or conceptual.

Regulators assess the consistency between documents, systems, and actual operations. Any disconnect materially weakens the application.

Step 11- Operational Readiness Validation (Proof of Control)

Before granting approval or permitting go-live, UAE regulators require evidence-based validation that the exchange’s compliance and operational systems function in real-world conditions.

This stage focuses on demonstration, not explanation.

Mandatory Readiness Demonstrations

The exchange must be able to prove that-

- KYC and onboarding processes operate end-to-end, including identity verification, risk scoring, and onboarding restrictions

- Transaction monitoring systems flag genuine activity, generate alerts, and support manual investigations

- Custody and wallet controls prevent unauthorized access and withdrawals, with proper approval workflows

- Incident detection and response procedures have been tested, including escalation and recovery

- Data retention and audit trails function as designed, with retrievable historical records

- Regulatory reporting workflows are operational, including internal escalation and external reporting readiness

Regulators validate whether AML requirements for crypto exchanges function in live transaction scenarios, not just on paper.

An exchange that cannot demonstrate live operational control will not be approved, regardless of documentation quality.

Step 12- Post-Launch Continuous Compliance Framework

In the UAE, licensing marks the beginning, not the completion, of regulatory oversight. Crypto exchanges operate under continuous supervision, with ongoing obligations that extend throughout the life of the license.

Compliance failures after approval are treated more severely than pre-license gaps.

Ongoing Regulatory Obligations

Licensed exchanges must maintain-

- Periodic independent audits, covering financial, technology, security, and compliance controls

- Regular regulatory reporting, including operational metrics, risk events, and compliance updates

- KYC refresh cycles, ensuring customer data remains accurate and risk classifications are current

- Pre-approval for new products or services, including expansions of activity scope

- Ongoing token reviews, assessing market integrity, risk, and regulatory alignment

- Policy and control updates, aligned with regulatory changes, guidance, and enforcement actions

Regulators expect proactive compliance management, not reactive remediation.

Failure to maintain continuous compliance can result in-

- License conditions or restrictions

- Financial penalties

- Suspension or revocation of authorization

Simplified Architecture Summary- UAE Crypto Exchange Compliance Model

Every Crypto Exchange License in UAE is issued only when all regulatory layers operate together as a unified compliance system.-

- Regulatory Jurisdiction Selection

Clear determination of the applicable regulator and legal boundary. - Governance and Accountability

Transparent ownership, empowered leadership, and defined decision authority. - AML, Transaction Monitoring, and Regulatory Reporting

Real-time financial crime prevention and reporting infrastructure. - Custody, Market Integrity, and Technology Controls

Asset protection, fair market operation, and resilient systems. - Continuous Supervision and Audit Readiness

Ongoing compliance, testing, and regulatory engagement.

Each layer depends on the integrity of the one below it.

If any layer fails, the exchange fails.

Frequently Asked Questions

To obtain a crypto exchange license in the UAE, you must first define your exact virtual asset activities, select the correct regulator (VARA, DFSA, or FSRA), establish a compliant corporate and governance structure, and implement fully operational AML, KYC, custody, and market integrity systems. UAE regulators approve licenses only after verifying real operational readiness, not just documentation.

Crypto exchanges in the UAE are licensed by one of three regulators based on jurisdiction:

VARA for exchanges operating in mainland Dubai

DFSA for exchanges within the Dubai International Financial Centre (DIFC)

FSRA for exchanges in Abu Dhabi Global Market (ADGM)

Each crypto activity is supervised by only one regulator, and overlapping supervision is not permitted.

UAE crypto regulation is strictly activity-based, not platform-based or technology-based. Regulators license specific virtual asset activities such as exchange trading, brokerage, custody, staking, or lending. Any undefined or flexible activity scope is rejected during the licensing process.

No. AML, KYC, and transaction monitoring systems must be fully live before launch. UAE regulators require real-time customer due diligence, sanctions screening, transaction monitoring, and suspicious transaction reporting. An exchange without operational AML/CFT systems is considered unfit for licensing.

UAE crypto exchanges must comply with the FATF Travel Rule, requiring the collection and secure transmission of sender and recipient information for applicable virtual asset transfers. Non-compliant transfers must be blocked or escalated, and exchanges must assess the regulatory risk of counterparty VASPs.

Yes, but only under strict custody and asset segregation rules. Client assets must be segregated from company funds, protected through multi-party authorization, and continuously reconciled. Any custody failure is treated as a regulatory breach, not a technical error.

UAE regulators treat crypto exchanges as market operators, requiring controls such as:

Formal token listing and delisting governance

Market surveillance for wash trading, spoofing, and manipulation

Conflict of interest management

Fair access and transparent price discovery

Failure in market integrity controls can lead to license suspension or enforcement action.

Timelines vary based on activity scope and readiness, but most licensing processes take 6 to 12 months. Delays typically occur due to unclear activity definitions, incomplete AML systems, weak governance structures, or a lack of operational proof during regulatory validation.

Only with prior regulatory approval. UAE regulators do not allow scope expansion without re-approval. Any new activity such as adding custody, staking, derivatives, or retail users, requires updated documentation, system validation, and regulator consent before launch.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.