Key Takeaways

- The matching engine ensures fast and fair trade execution by efficiently connecting buyers and sellers.

- Real-time order execution depends on advanced matching engine algorithms for high accuracy and speed.

- Common matching engine algorithms such as FIFO, Pro-Rata, and TWAP optimize trade priority and market fairness.

- Centralized and decentralized matching engines impact execution speed, liquidity, and security in different ways.

- Effective order execution improves market liquidity, reduces slippage, and builds investor trust.

- Choosing the right matching engine is essential for high-volume trading platforms and smooth execution.

- Matching engines and order execution together drive transparency, reliability, and efficiency in financial markets.

What Is a Matching Engine & Order Execution?

A matching engine is the core software system in a trading exchange that matches buy and sell orders based on predefined rules. It acts as the central brain of any trading platform, enabling instantaneous execution and price discovery.

Order execution is the process of completing a buy or sell order for a digital asset after a trader places it on a trading platform. The system routes the order to available liquidity, matches it at the most suitable price, and finalizes the transaction with speed and accuracy. Advanced execution systems help ensure smooth trade completion even during rapid market movements.

Core of a Matching Engine

The order book serves as the backbone of a matching engine, providing a real-time, structured view of all open buy and sell orders for a specific asset. This dynamic ledger organizes orders by price levels and continuously updates as new orders are placed, executed, or canceled. By maintaining an accurate and transparent order book, trading platforms ensure efficient trade execution, price discovery, and market liquidity.

Bid Side– The bid side of the order book lists all active buy orders, sorted from the highest to the lowest price. Each entry specifies the maximum price a buyer is willing to pay and the quantity they wish to purchase. This side reflects overall market demand and plays a crucial role in determining the speed and efficiency of order matching.

Ask Side– The ask side lists all active sell orders, organized from the lowest to the highest price. Each sell order details the minimum price a seller is willing to accept along with the quantity available. This side represents market supply and ensures that sellers can achieve optimal execution prices.

Matching Engine for Crypto & Stock Markets

In both crypto and stock exchanges, the matching engine receives incoming orders, checks price and quantity compatibility, and pairs them efficiently. The engine ensures trades occur at fair market prices, following principles such as FIFO (First In, First Out) or other execution priorities.

The Role of Matching Engines in Trade Execution

Without a matching engine, brokers would struggle with manual order routing, causing delays, mismatched trades, and market inefficiencies. A well-optimized engine improves trading efficiency, lowers latency, and supports complex order types such as conditional, limit, or stop-loss orders, which are commonly executed by automated crypto trading bots.

Types of Matching Engines

Matching engines are not one-size-fits-all. The choice between centralized and decentralized engines affects order execution speed, liquidity, and security.

Centralized vs Decentralized Matching Engines

- Centralized Matching Engine- Operates under a single authority, typically in stock and crypto exchanges. Offers high speed, controlled liquidity, and regulatory compliance. Ideal for institutional trading and high-volume environments.

- Decentralized Matching Engine- Operates on a blockchain or peer-to-peer network, prioritizing transparency, decentralization, and user trust. Often slightly slower due to network propagation, but critical for crypto-native exchanges.

How Each Engine Type Affects Order Execution

- Speed- Centralized engines execute trades in microseconds, while decentralized engines depend on network consensus.

- Security- Decentralized engines reduce single-point failure risks but may face latency challenges.

- Liquidity & Fees- Centralized engines may offer higher liquidity pools and optimized fee structures for market participants.

Matching Engine Algorithms

The matching engine algorithms dictate how orders are prioritized and executed. Understanding them is crucial for both investors and traders seeking optimal order execution.

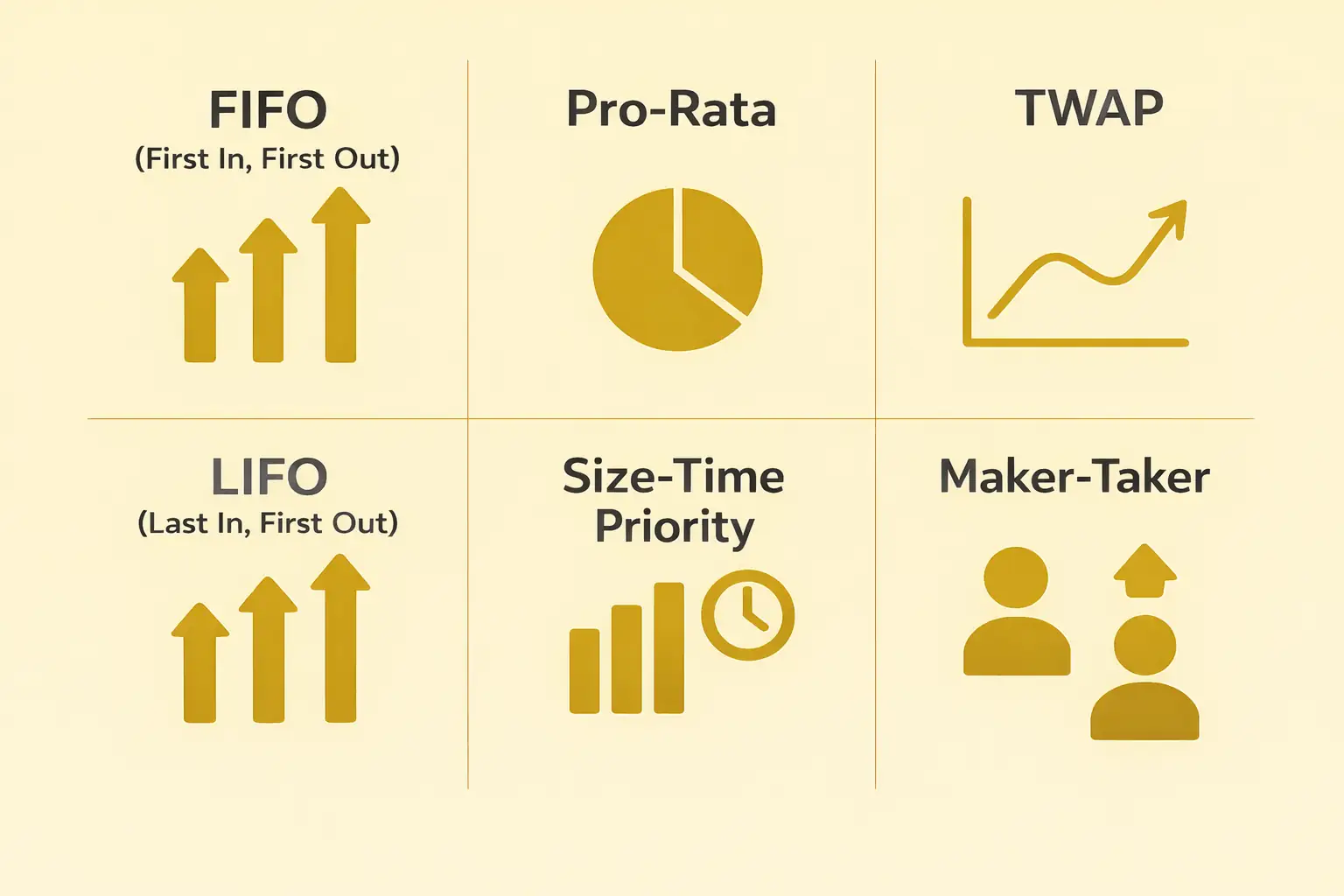

Most Used Matching Engine Algorithms in Modern Exchanges

- FIFO (First In, First Out)- Orders are executed in the sequence they arrive, ensuring fairness.

- Pro-Rata- Distributes available shares proportionally among incoming orders.

- TWAP (Time-Weighted Average Price)- Spreads execution over a set period to minimize market impact.

- LIFO (Last In, First Out)- Prioritizes the most recent orders; less common but used in specific derivatives markets.

- Size-Time Priority- Considers both the size of the order and the time it was received.

- Maker-Taker- Incentivizes liquidity provision by offering rebates to makers and charging takers.

Each algorithm plays an important role in trade matching, speed, and price accuracy, directly influencing order execution outcomes.

Order Execution Process

The order execution process is the lifecycle of a trade from the moment an order is placed to its completion. Matching engines ensure accuracy, speed, and fair execution throughout this process.

Order Execution Process- From Placement to Completion

- Order Placement- Investors place market, limit, or conditional orders via broker platforms.

- Order Routing- Orders are sent to exchanges, ECNs, or internal liquidity pools for optimal execution.

- Matching Engine Execution- The engine pairs orders using algorithms that prioritize speed and price efficiency.

- Trade Confirmation- Execution details, including price and timestamp, are confirmed to the investor.

- Settlement- Trades are cleared and settled according to regulatory timelines.

How Matching Engines Enhance Speed, Accuracy, and Fairness

By gaining high-speed infrastructure, advanced algorithms, and risk management protocols, matching engines reduce slippage, prevent execution errors, and ensure the best execution for investors.

Stakeholders in Order Execution

Matching engines and order execution systems serve a wide array of market participants, each playing a crucial role in efficient trade matching and execution. Key stakeholders include-

- Investors & Traders- Individuals or institutions seeking fast, accurate, and cost-efficient trade execution.

- Brokers & Broker-Dealers- They facilitate order routing, ensure regulatory compliance, and deliver the best execution for clients.

- Market Makers- Provide liquidity, maintain continuous bid-ask quotes, and support price discovery.

- Electronic Communications Networks (ECNs)- Automatically match orders in real-time, enabling efficient order execution across venues.

Benefits of Matching Engines

High-performance matching engines transform trading efficiency by providing-

- Market Efficiency- Orders are matched quickly and fairly, reducing slippage and execution errors.

- Transparency- Real-time order book updates and execution reporting enhance trust for investors.

- Liquidity- Continuous buy and sell quotes from market makers improve fill rates for large and small trades.

- Cost Reduction- Faster execution reduces transaction costs and minimizes the impact of market volatility.

How High-Performance Engines Improve Trading Experience

Traders and investors benefit from robust order execution systems that integrate advanced algorithms, high-frequency trading protocols, and automated risk management. This enables precision, fairness, and optimal pricing even under high market demand.

Challenges and Mitigations in Matching Engines and Order Execution

Despite technological advancements, matching engines and order execution systems face challenges.

- Latency- Delays in processing can affect trade prices and execution speed.

- Market Volatility- Sudden market swings may increase slippage and execution risk.

- Cybersecurity Threats- High-tech trading platforms are vulnerable to attacks, requiring constant protection.

- Complex Orders- Large block trades or multi-leg strategies can stress order execution systems.

Mitigation Strategies

- Use low-latency infrastructure to reduce delays.

- Implement advanced algorithms for risk management and order segmentation.

- Maintain robust cybersecurity protocols to protect client assets and data.

- Leverage liquidity pools and smart routing to handle complex orders efficiently.

Choosing the Right Matching Engine

Selecting the ideal matching engine is critical for exchange performance and investor satisfaction. Consider:

- Speed- Low-latency engines ensure microsecond-level order execution.

- Security- Engine infrastructure must prevent breaches and ensure system integrity.

- Asset Compatibility- Support for multiple asset classes (crypto, stocks, derivatives) enhances versatility.

- Scalability- The system must handle growing trading volume without degradation in performance.

How Algorithm Selection Impacts Trade Quality

The choice of matching engine algorithms directly affects execution outcomes. For example, FIFO ensures fairness, while TWAP reduces market impact for large orders. Combining engine architecture with algorithm selection ensures optimal execution and trading efficiency.

Future Trends in the Matching Engine

The next-generation matching engines are integrating AI and machine learning to.

- Optimize order routing in milliseconds.

- Predict price movements and improve execution quality.

- Enhance risk management for complex trading strategies.

Distributed Ledger & Crypto Asset Market Impacts

Blockchain and crypto trading platforms introduce decentralized matching engines, improving transparency and reducing reliance on central authorities. These innovations are shaping the future of high-speed, reliable order execution, with evolving standards for fairness and efficiency.

Final Words

Matching engines and order execution systems are critical for modern trading platforms, ensuring trades are executed with speed, accuracy, and fairness. These systems allow investors, brokers, and market makers to achieve best execution while maintaining transparent pricing and liquid markets.

Key advantages include-

- Fast trade execution with minimal slippage, allowing traders to capture optimal prices.

- Accurate price discovery, supported by sophisticated matching engine algorithms.

- Enhanced market liquidity, enabling smooth trading across stocks, crypto, and other asset classes.

- Improved trading efficiency for high-frequency and complex order strategies, reducing latency and delays.

- Reliable order management with real-time monitoring, risk controls, and execution precision.

- Greater investor confidence through transparent and fair trade processing.

Frequently Asked Questions

The most widely used matching engine algorithms include FIFO (First-In-First-Out), Pro-Rata, TWAP, LIFO, and Maker-Taker. Each algorithm prioritizes orders differently to balance fairness, liquidity, and efficiency.

Fast order execution reduces slippage and ensures traders receive the expected price, especially during volatile market conditions. High-performance execution systems are essential for high-frequency trading and active traders.

A centralized matching engine offers faster execution and higher throughput, while a decentralized matching engine provides improved security and transparency. The best choice depends on trading volume, asset type, and regulatory requirements.

By continuously pairing buy and sell orders, matching engines keep markets active and liquid. This allows traders to enter and exit positions easily without causing large price movements.

Common order execution risks include latency, price slippage, system downtime, and cybersecurity threats. Advanced execution systems mitigate these risks using low-latency infrastructure, smart routing, and security protocols.

In crypto trading platforms, matching engines handle high-volume trades, multiple trading pairs, and volatile price movements. They ensure accurate order matching while supporting real-time order execution and transparency.

High latency can delay order execution and increase slippage. Low-latency matching engines process orders in microseconds, which is critical for active traders and high-volume markets.

Yes, modern matching engines are designed to support high-frequency trading by processing thousands of orders per second while maintaining accuracy and fairness.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.