The cryptocurrency market has evolved dramatically over the past decade, introducing revolutionary trading mechanisms that challenge traditional finance. Whether you’re executing your first crypto trade or managing a sophisticated trading strategy, understanding the fundamental difference between liquidity pools and order books is essential. These two models represent distinct philosophies in how digital assets are exchanged, each with unique advantages, limitations, and use cases that directly impact your trading experience.

Key Takeaways

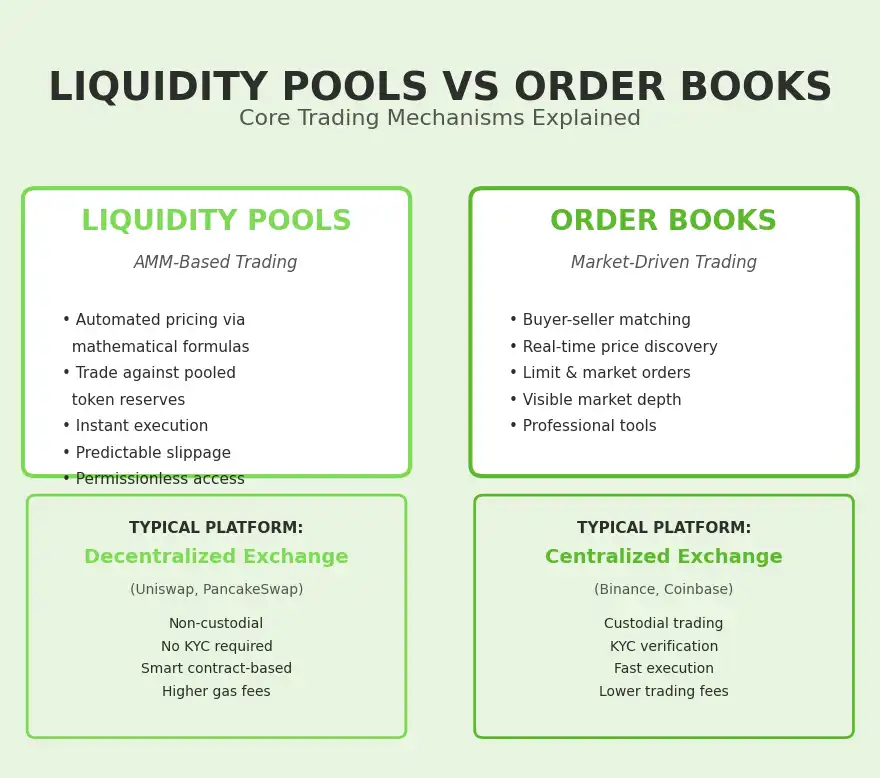

- Order books match buyers and sellers directly through limit and market orders, offering precise control over trade execution and better price discovery in liquid markets, while liquidity pools use automated market makers (AMMs) to facilitate instant swaps against pooled token reserves.

- Decentralized exchanges (DEXs) predominantly rely on liquidity pools because they eliminate the need for continuous order matching on-chain, reducing gas costs and enabling permissionless trading, whereas centralized exchanges (CEXs) favor order books for their efficiency in handling high-frequency trading and large order volumes.

- Liquidity providers in AMM pools earn passive income from trading fees but face impermanent loss risk when token prices diverge significantly, making pool selection and market timing critical factors for profitability.

- Slippage behaves differently across both models: liquidity pools calculate slippage predictably based on pool depth and trade size, while order book slippage depends on available liquidity at various price levels and can spike during market volatility.

- The choice between liquidity pools vs order books crypto trading models depends on multiple factors including trade size, desired execution speed, preference for decentralization, and tolerance for price impact and trading fees.

- Hybrid exchange architectures are emerging as the next evolution, combining order book precision for high-liquidity pairs with liquidity pool flexibility for long-tail assets, addressing limitations inherent in single-model approaches.

- Understanding how crypto trading works in DEX vs CEX environments requires knowledge of smart contract interactions, wallet custody models, transaction finality, and the trade-offs between decentralization and performance.

- For beginners, liquidity pools offer simpler trading interfaces with straightforward swap mechanisms, while order books provide better educational value for understanding traditional market dynamics and advanced trading strategies.

- Market depth and liquidity concentration differ fundamentally: order books display explicit depth across price levels, while liquidity pools distribute liquidity along a pricing curve, affecting how large trades impact market prices.

- The security models vary significantly with liquidity pools relying on audited smart contracts and decentralized governance, while order book exchanges require trust in centralized infrastructure or complex decentralized order matching protocols.

How Crypto Trading Really Works

Cryptocurrency trading operates on fundamentally different principles than traditional stock markets, primarily due to the decentralized and 24/7 nature of blockchain networks. At its core, crypto trading involves exchanging one digital asset for another or converting crypto to fiat currency. The mechanism by which this exchange occurs varies dramatically depending on whether you’re using a centralized exchange (CEX) or decentralized exchange (DEX), and whether the platform employs order books or liquidity pools.

When you initiate a crypto trade, several processes occur simultaneously. Your request must be matched with available liquidity, a price must be determined, the transaction must be validated, and assets must be transferred. The speed, cost, and reliability of these steps depend entirely on the trading model implemented by your chosen platform. Understanding these underlying mechanisms empowers traders to select platforms and strategies aligned with their specific needs.

Core mechanisms behind crypto trading platforms

Every crypto trading platform operates on one of two fundamental mechanisms. The first is the order book system, borrowed from traditional finance, where the exchange maintains a ledger of buy and sell orders at various price points. When orders match, trades execute automatically. This system requires sophisticated matching engines, typically handling thousands of orders per second on major centralized exchanges. The order book provides transparency regarding market depth and allows traders to see exactly where buy and sell pressure exists.

The second mechanism is the liquidity pool model, a blockchain-native innovation that emerged with decentralized finance. Instead of matching individual orders, liquidity pools aggregate tokens from multiple providers into smart contract-controlled reserves. Traders swap directly against these pools, with prices determined algorithmically based on the relative quantities of tokens in the pool. This approach eliminates the need for order matching, making it ideal for blockchain environments where every operation has gas costs. For those looking to establish trading platforms, understanding these core mechanisms is foundational to architecture decisions.

Why trading models matter for liquidity and price discovery

The trading model you choose directly impacts two critical market functions: liquidity provision and price discovery. Liquidity refers to how easily you can buy or sell an asset without significantly affecting its price. In order book systems, liquidity comes from traders placing limit orders, creating depth at various price levels. Deep order books with many orders near the current market price offer better liquidity and tighter spreads.

Price discovery, the process by which markets determine fair asset values, functions differently across models. Order books facilitate price discovery through continuous bidding between buyers and sellers. The current market price represents the equilibrium where supply meets demand. Liquidity pools, conversely, use mathematical formulas to calculate prices. While this ensures trades can always execute, it can lag behind true market sentiment during rapid price movements. The liquidity pools vs order books differences in price discovery mechanisms explain why the same asset might trade at slightly different prices across platforms, creating arbitrage opportunities.

Trading model selection fundamentally shapes market efficiency, user experience, and capital requirements for sustainable operations.

What Are Liquidity Pools in Crypto Trading?

Liquidity pools represent one of the most significant innovations in decentralized finance, fundamentally changing how cryptocurrency trading operates without intermediaries. A liquidity pool is essentially a smart contract containing reserves of two or more tokens, locked in a protocol to facilitate trading. Unlike traditional exchanges where you trade directly with other users, liquidity pools allow you to trade against the pooled funds. This model eliminates the need for buyers and sellers to be matched at the exact same moment, enabling continuous trading availability.

The genius of liquidity pools lies in their simplicity and permissionless nature. Anyone can become a liquidity provider by depositing token pairs into a pool, and anyone can trade against that pool at any time. This democratization of market making was previously impossible in traditional finance, where providing liquidity required substantial capital and sophisticated infrastructure. Liquidity pools have enabled thousands of token pairs to have active markets that would never have attracted traditional market makers.

Crypto Liquidity Pools Explained

To truly grasp crypto liquidity pools explained, imagine a large container holding equal values of two different tokens. When someone wants to swap Token A for Token B, they add Token A to the pool and receive Token B in return. The critical innovation is the automated market maker algorithm that determines exchange rates. The most common formula is the constant product formula (x * y = k), where x and y represent the quantities of the two tokens, and k remains constant.

As trades occur, the ratio of tokens in the pool changes, which automatically adjusts the price. If someone buys a large amount of Token B, the pool will have less Token B and more Token A, making Token B more expensive for the next trader. This creates a self-balancing mechanism that responds to market demand. The pool charges a small fee on each transaction, typically 0.3%, which is distributed proportionally among all liquidity providers. This fee structure incentivizes users to supply liquidity, ensuring pools remain well-funded.

Role of automated market makers in liquidity pools

Automated market makers (AMMs) are the algorithmic backbone of liquidity pools, replacing traditional market makers with mathematical formulas. An AMM continuously quotes prices for any trade size, eliminating the need for counterparties. The most widely used AMM model is Uniswap’s constant product formula, but variations exist. Curve Finance uses a different formula optimized for stablecoin swaps, while Balancer allows pools with multiple tokens and weighted ratios.

The AMM’s role extends beyond simple price calculation. It ensures that pools cannot be completely drained by making prices exponentially expensive as token reserves deplete. If someone tried to buy all of Token B from a pool, the price would increase so dramatically that it becomes economically impossible. This built-in protection mechanism is crucial for pool stability. AMMs also enable features like flash swaps and complex routing through multiple pools, creating a sophisticated decentralized trading ecosystem.

How liquidity providers keep trading active

Liquidity providers are the lifeblood of pool-based trading systems. These individuals or entities deposit token pairs into pools, receiving LP (liquidity provider) tokens representing their share of the pool. For example, if you deposit $1,000 worth of ETH and $1,000 worth of USDC into an ETH/USDC pool, you’ll receive LP tokens proportional to your contribution. These tokens can later be redeemed for your share of the pool plus accumulated fees.

The incentive structure for liquidity providers includes trading fees and, often, additional rewards through liquidity mining programs. However, providers must understand impermanent loss, a phenomenon where price divergence between pooled tokens can result in lower value compared to simply holding the tokens. Despite this risk, successful liquidity provision can be highly profitable, especially in pools with high trading volume relative to total value locked (TVL). Providers must constantly evaluate fee earnings against potential impermanent loss when selecting pools.

How Liquidity Pools Work on Decentralized Exchanges

Decentralized exchanges leverage liquidity pools because they perfectly align with blockchain architecture. On a DEX like Uniswap or PancakeSwap, the entire trading process occurs through smart contract interactions. When you initiate a swap, your wallet communicates with the pool’s smart contract, which calculates the output amount, executes the token exchange, and updates pool reserves. All of this happens transparently on-chain, creating an immutable record of every transaction.

The decentralized nature means no single entity controls the pool or can freeze your funds. Smart contracts are typically open-source and audited, allowing anyone to verify their security and functionality. This transparency and non-custodial approach appeal to users who prioritize self-sovereignty over their assets. However, it also means users bear responsibility for transaction parameters. Setting incorrect slippage tolerances or approving malicious contracts can result in unfavorable trades or lost funds.

Token pairs and smart contract-based pricing

Every liquidity pool operates on specific token pairs, most commonly pairing volatile tokens with stablecoins or major cryptocurrencies like ETH or BTC. The smart contract maintains reserves of both tokens and uses the AMM formula to determine exchange rates. When you want to swap Token A for Token B, the contract calculates how much Token B you’ll receive based on current reserves and your input amount. This calculation happens instantly and deterministically.

Smart contract-based pricing eliminates manipulation possibilities inherent in centralized price feeds. The price is purely a function of pool composition and mathematical formulas, not subject to human intervention. However, this also means prices can temporarily diverge from broader market rates, especially in smaller pools. Arbitrageurs typically correct these discrepancies quickly by trading between pools and exchanges, but brief price inefficiencies create opportunities and risks. Those interested in deeper liquidity concepts should explore how pool depth affects pricing stability.

Liquidity pools vs order books for beginners

For newcomers to cryptocurrency trading, liquidity pools often provide a gentler introduction than complex order book interfaces. The user experience is straightforward: select the tokens you want to swap, enter an amount, review the quoted price including fees and slippage, and confirm the transaction. There’s no need to understand bid-ask spreads, limit orders, or order types. This simplicity has made DEXs with liquidity pools incredibly popular among retail traders.

However, beginners should recognize that simplicity can mask complexity. While executing a swap is easy, understanding impermanent loss, slippage, gas fees, and token approvals requires education. Additionally, the lack of customer support on decentralized platforms means mistakes can be costly. Order books, despite their steeper learning curve, offer more transparency about where your order sits in the market and provide tools like limit orders that can protect against unfavorable execution.

What Is Order Book Trading in Crypto Exchanges?

Order book trading represents the traditional approach to asset exchange, adapted for cryptocurrency markets. An order book is essentially a real-time list of buy orders (bids) and sell orders (asks) for a specific trading pair, organized by price level. This system has been used in stock markets, commodity exchanges, and forex markets for decades. In crypto, order book exchanges provide a familiar environment for traders transitioning from traditional finance while offering the unique characteristics of 24/7 global cryptocurrency markets.

The order book displays market depth and liquidity at various price points, allowing sophisticated traders to gauge market sentiment and make informed decisions. When you place a market order, it matches against the best available price in the order book. Limit orders allow you to specify your desired price, joining the order book until someone matches your order. This model provides granular control over trade execution, making it preferred by professional traders and institutions who value precision over simplicity.

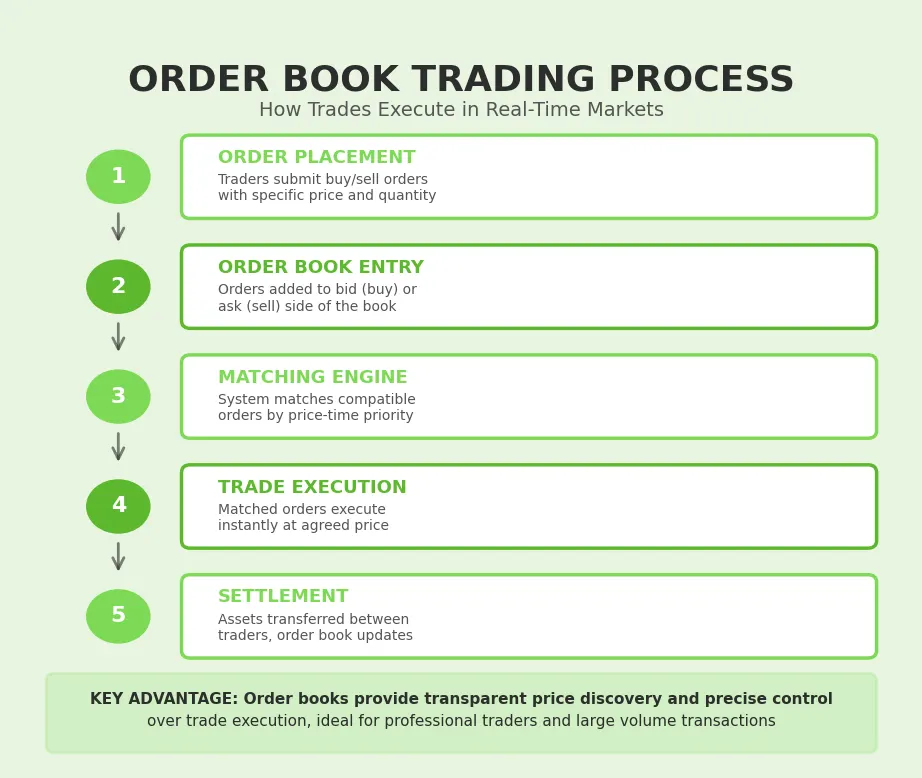

How Order Books Work in Crypto Exchanges

The mechanics of order book trading crypto involve continuous order placement, cancellation, and matching. When you submit a limit order to buy Bitcoin at $65,000, that order enters the order book at that price level. If someone places a market sell order or a limit sell order at $65,000 or lower, the matching engine pairs these orders and executes the trade. The entire process occurs in milliseconds on efficient centralized exchanges.

Order books are typically displayed in two sections: the buy side (bids) showing prices traders are willing to pay, and the sell side (asks) showing prices sellers want. The difference between the highest bid and lowest ask is the spread, a key indicator of market liquidity. Narrow spreads indicate liquid markets with many active traders, while wide spreads suggest lower liquidity and higher trading costs. The order book constantly updates as new orders arrive and existing orders fill or cancel.

Buy and sell orders in real-time markets

In real-time order book markets, several order types enable different trading strategies. Market orders execute immediately at the best available price, prioritizing speed over price certainty. Limit orders let you specify your exact price, but execution isn’t guaranteed if the market doesn’t reach your price level. Stop-loss orders automatically sell when prices drop to a certain level, protecting against losses. Advanced traders use combinations of these orders to implement complex strategies.

The real-time nature of order books means market conditions constantly change. A large buy order can rapidly consume sell orders at multiple price levels, causing price spikes. Similarly, a wave of sell orders can overwhelm buy-side liquidity, triggering sharp declines. This dynamic creates opportunities for skilled traders but also risks for the unprepared. Understanding order flow and market depth is essential for anyone seriously engaging with order book trading crypto platforms.

Order matching and price formation

Order matching engines are sophisticated systems that pair compatible buy and sell orders according to price-time priority. When multiple orders exist at the same price level, the earliest order receives priority. This fair matching system ensures that patient traders who placed limit orders first get rewarded. The matching engine must handle enormous transaction volumes while maintaining low latency, especially during volatile periods when order flow spikes dramatically.

Price formation in order book systems reflects pure market dynamics. The last traded price becomes the current market price, constantly updating as new trades execute. This transparent price discovery process means order book prices generally reflect true market sentiment more accurately than algorithmically-determined prices. However, on exchanges with lower volume, price formation can be manipulated through spoofing or wash trading, highlighting the importance of trading on reputable platforms with robust surveillance systems.

Order Book Trading in Centralized and Decentralized Platforms

Order books exist in both centralized and decentralized contexts, though implementation differs significantly. Centralized exchanges (CEXs) like Binance, Coinbase, and Kraken run order books on proprietary servers using high-performance databases. These systems can process millions of orders per second with minimal latency. Users deposit funds into exchange-controlled wallets, and all trading occurs off-chain in the exchange’s internal ledger. Only deposits and withdrawals touch the blockchain.

Decentralized order book exchanges face unique challenges. Recording every order placement and cancellation on-chain would be prohibitively expensive and slow. Solutions include hybrid models where order books exist off-chain but settlements happen on-chain, as seen with protocols like 0x. Others use layer-2 scaling solutions or specialized blockchains optimized for trading. These approaches attempt to capture order book benefits while maintaining decentralization, though trade-offs inevitably exist between speed, cost, and decentralization.

Traditional exchange structure vs blockchain-based trading

Traditional centralized exchanges operate with familiar infrastructure: users create accounts, complete KYC verification, deposit funds, and trade on the platform’s order book. The exchange maintains custody of all assets, providing convenience but requiring trust. These platforms offer features like margin trading, futures contracts, and advanced charting tools. For users prioritizing trading speed, complex order types, and deep liquidity, centralized order book exchanges remain superior. Exploring comprehensive exchange platform guides reveals the architectural considerations behind these systems.

Blockchain-based order book trading introduces transparency and self-custody but sacrifices some performance. Every trade settles on-chain, creating an immutable record and eliminating counterparty risk from exchange insolvency. However, blockchain throughput limitations mean these platforms handle lower transaction volumes. Gas fees can make small trades uneconomical. The benefits of transparency and security appeal to users willing to accept these limitations, particularly those trading larger amounts where percentage-based fees matter less than absolute security.

Order book trading crypto market dynamics

Market dynamics in order book trading crypto environments differ from traditional markets in several ways. Cryptocurrency markets operate continuously without trading hours, creating constant price action and opportunities. This 24/7 nature means liquidity can vary significantly depending on time zones and global events. Asian trading hours might see different liquidity profiles than European or American hours, affecting spreads and slippage.

Volatility in crypto markets far exceeds traditional assets, with price swings of 10% or more occurring regularly. This volatility creates both opportunities and risks in order book trading. During extreme volatility, order books can thin rapidly as traders cancel orders, leading to flash crashes or spikes. Additionally, the interconnected nature of crypto exchanges means price movements cascade across platforms as arbitrage bots exploit price discrepancies. Understanding these unique dynamics is essential for successful order book trading in cryptocurrency markets.

Order book depth and liquidity distribution directly determine execution quality and price stability during market stress.

Liquidity Pools vs Order Books: Key Differences

The fundamental distinction between liquidity pools vs order books extends far beyond their technical implementation. These models represent different philosophies about how markets should function, who provides liquidity, how prices are discovered, and what trade-offs users accept. Understanding these differences enables traders to select appropriate platforms for their specific needs and helps developers design exchanges that serve their target markets effectively.

Each model excels in different scenarios. Order books dominate in high-frequency trading environments where precise execution and minimal slippage are paramount. Liquidity pools shine when permissionless access and continuous liquidity availability matter more than perfect price discovery. Neither model is universally superior; context determines which approach delivers better outcomes. The liquidity pools vs order books crypto trading debate continues evolving as hybrid models attempt to capture benefits from both systems.

| Feature | Liquidity Pools | Order Books |

|---|---|---|

| Price Determination | Algorithmic (AMM formulas) | Market-driven (supply/demand) |

| Liquidity Source | Pooled reserves from LPs | Individual buy/sell orders |

| Trade Execution | Instant against pool | Matched orders (may wait) |

| Slippage Predictability | Calculated before execution | Depends on order book depth |

| Best For | Moderate trades, DeFi integration | Large trades, professional traders |

| Complexity | Simple interface, complex risks | Complex interface, transparent risks |

| Typical Platform | Uniswap, PancakeSwap, Curve | Binance, Coinbase, Kraken |

Liquidity Pools vs Order Books Differences Explained

Diving deeper into the liquidity pools vs order books differences reveals how architectural choices cascade through every aspect of trading experience. The most profound difference lies in liquidity provision philosophy. Order books require active market participants willing to place limit orders and wait for matches. This works well for popular trading pairs but struggles with long-tail assets that don’t attract sufficient maker interest. Liquidity pools democratize market making, allowing anyone to provide liquidity and earn fees proportional to their contribution.

Another critical difference involves capital efficiency. In order books, capital sits idle in limit orders until matched, and only exactly-priced orders execute. Liquidity pools put all deposited capital to work continuously, with every swap utilizing pool reserves. However, this comes at the cost of impermanent loss, where liquidity providers may end up with less value than if they’d simply held their tokens. Order book market makers face no impermanent loss but must actively manage their positions, canceling and replacing orders as market conditions change.

Pricing mechanism and trade execution

The pricing mechanism fundamentally distinguishes these models. Order books use price-time priority, matching the best-priced orders first and breaking ties by timestamp. This creates transparent price discovery where market sentiment directly determines prices. You can see exactly how many orders exist at each price level and calculate potential slippage for your trade size. This transparency helps professional traders execute sophisticated strategies.

Liquidity pools use deterministic mathematical formulas to calculate prices. The constant product formula (x * y = k) means prices adjust along a curve as pool composition changes. This mechanism ensures trades always execute at some price, even for illiquid pairs. However, large trades relative to pool size incur significant price impact. The formula’s predictability is both strength and weakness: it eliminates price manipulation but also creates predictable opportunities for informed traders to extract value through arbitrage or front-running.

Market liquidity and slippage comparison

Slippage behavior differs markedly between systems. In order books, slippage occurs when your order size exceeds available liquidity at the best price, forcing execution at progressively worse prices. A large market buy order might consume multiple price levels, with each incremental unit costing more. You can mitigate this through limit orders, though you sacrifice guaranteed execution. During volatile periods or for illiquid pairs, order book slippage can be severe and unpredictable.

Liquidity pool slippage is mathematically predictable. DEX interfaces calculate and display expected slippage before you confirm transactions. The AMM formula determines exactly how much price impact your trade causes. While this predictability is valuable, it doesn’t eliminate slippage; large trades still move prices substantially. The advantage is transparency: you know the slippage upfront and can adjust trade size or split orders across multiple pools. Managing exchange liquidity effectively requires understanding these slippage dynamics across different trading models.

AMM Liquidity Pools vs Order Book Trading

The comparison between AMM liquidity pools and order book trading systems highlights automation versus manual precision. AMMs are programmed financial primitives that function autonomously once deployed. They require no ongoing intervention to provide liquidity or quote prices. This automation enables permissionless innovation: anyone can create a new pool for any token pair without seeking approval. The composability of AMM pools with other DeFi protocols creates powerful possibilities for yield farming, flash loans, and complex trading strategies.

Order book trading rewards active participation and market knowledge. Successful traders constantly monitor market conditions, adjusting orders based on news, technical patterns, and order flow. This active approach demands more attention but offers more control. You can place orders at specific prices, use stop-losses to protect positions, and employ sophisticated strategies like iceberg orders or time-weighted average pricing. The manual nature creates opportunities for skill differentiation: experienced traders consistently outperform novices.

Automation vs manual order placement

Automation in liquidity pools means passive income potential for liquidity providers. Once you deposit tokens, the pool automatically handles all trades, collecting fees without requiring your intervention. This passive approach appeals to long-term holders willing to accept impermanent loss risk in exchange for fee generation. The automation extends to price adjustments: the AMM algorithm continuously updates prices as trades occur, maintaining the mathematical relationship defined by the formula.

Manual order placement in order books requires active management but provides precise control. You decide exactly when and at what price to buy or sell. This control is valuable during volatile markets where you might want to set limit orders far from current prices to catch sudden moves. Professional traders often use trading bots to automate order placement while maintaining the precision of order book systems. These bots can implement complex strategies impossible in AMM environments, like market-making with tight spreads across multiple pairs.

Efficiency during high market volatility

High volatility reveals the strengths and weaknesses of each system. Liquidity pools maintain continuous operation during volatility, ensuring trades always execute. However, rapid price movements can cause significant slippage as arbitrageurs rush to rebalance pools with external markets. The lag between pool prices and broader market prices during volatile periods creates profit opportunities for sophisticated traders but costs for regular users. Additionally, gas fees on Ethereum-based DEXs can spike during volatility, making small trades uneconomical.

Order books during extreme volatility can experience liquidity withdrawal as market makers cancel orders to avoid adverse selection. This creates wider spreads and potentially larger slippage. However, deep, well-maintained order books on major centralized exchanges typically handle volatility better than smaller liquidity pools. The ability to place stop-loss orders protects traders from extreme losses, while the transparency of order book depth helps assess execution quality before trading. During flash crashes, order book exchanges sometimes implement circuit breakers, while AMM pools continue operating with potentially extreme prices.

DEX Liquidity Pools vs CEX Order Books

The debate around how crypto trading works in DEX vs CEX environments often centers on the trade-off between decentralization and performance. Decentralized exchanges using liquidity pools prioritize self-custody, permissionless access, and censorship resistance. Users maintain control over their private keys throughout the trading process, eliminating counterparty risk from exchange insolvency. Centralized exchanges using order books optimize for speed, liquidity, and feature richness, offering institutional-grade trading infrastructure at the cost of requiring trust in a centralized entity.

This architectural divergence creates distinct user experiences and use cases. DEX liquidity pools serve traders who value privacy, distrust centralized entities, or want exposure to newly-launched tokens not yet listed on major exchanges. CEX order books cater to high-volume traders, institutions, and users who prioritize trading efficiency over ideological considerations. Understanding these environments helps traders select appropriate platforms based on their specific requirements and risk tolerance.

Liquidity Pools in Decentralized Exchanges

Decentralized exchanges built on liquidity pools represent the purest expression of DeFi principles. Platforms like Uniswap, SushiSwap, and PancakeSwap operate entirely through smart contracts, with no company controlling user funds or able to prevent trades. Anyone anywhere can access these platforms using just a compatible wallet, without registration, verification, or permission. This openness has democratized access to financial markets, particularly benefiting users in jurisdictions with restrictive banking systems.

The permissionless nature extends to token listings. Anyone can create a liquidity pool for any token pair, enabling markets for thousands of assets that would never meet centralized exchange listing requirements. This freedom creates both opportunities and risks: innovative projects gain immediate market access, but scam tokens also proliferate. Users must exercise due diligence, as DEXs typically don’t vet tokens or protect users from fraudulent projects. The responsibility for security and verification rests entirely with individual users.

Permissionless trading and smart contract control

Permissionless trading means no gatekeepers determine who can participate. You don’t need to prove your identity, disclose your location, or meet minimum balance requirements. This accessibility is revolutionary but comes with responsibilities. Without centralized customer support, mistakes are often irreversible. Sending tokens to wrong addresses, approving malicious contracts, or falling victim to phishing scams can result in permanent loss. The permissionless ethos requires users to become self-sovereign, understanding security basics and taking full ownership of their actions.

Smart contract control replaces human administrators with code-based governance. Liquidity pool parameters, fee structures, and upgrade mechanisms are typically controlled by decentralized governance tokens. This distributed control prevents any single party from arbitrarily changing rules or freezing funds. However, smart contract vulnerabilities present serious risks. Bugs or exploits can drain pools worth millions, as history has repeatedly demonstrated. Successful DEX usage requires verifying contract audits, understanding governance mechanisms, and accepting the risks inherent in experimental financial technology.

Order Books in Centralized Exchanges

Centralized exchanges running order books represent the mainstream of crypto trading, handling the vast majority of global trading volume. These platforms combine cryptocurrency trading with traditional exchange infrastructure, offering deep liquidity, advanced trading features, and institutional-grade reliability. Major centralized exchanges have evolved into comprehensive financial platforms, providing spot trading, derivatives, staking, lending, and fiat on-ramps. This feature richness makes them one-stop shops for crypto users.

The centralized model enables performance impossible on public blockchains. Trades execute in milliseconds with minimal fees, and order books handle millions of transactions per second. This efficiency attracts professional traders, market makers, and institutions whose strategies depend on fast execution and tight spreads. Additionally, centralized exchanges can offer customer support, insurance funds, and regulatory compliance, providing comfort to users who prioritize these protections over absolute self-sovereignty.

Custodial trading and high-frequency execution

Custodial trading means the exchange controls your assets while they’re on the platform. You deposit funds into exchange wallets, and all trading occurs in the exchange’s internal ledger. This arrangement enables instant trades without blockchain confirmation delays. However, it requires trusting the exchange’s security, solvency, and integrity. High-profile exchange hacks and failures have cost users billions, highlighting custodial risk. Reputable exchanges implement cold storage, insurance, and audit systems to mitigate these risks, but the fundamental trust requirement remains.

High-frequency execution capabilities attract algorithmic traders and market makers who provide liquidity to order books. These participants can place, modify, and cancel thousands of orders per second, maintaining tight spreads and deep markets. The resulting liquidity benefits all users through better prices and lower slippage. However, this sophisticated trading environment can disadvantage retail traders competing against algorithms. Some exchanges implement maker-taker fee structures to incentivize liquidity provision, while others explore mechanisms to level the playing field between retail and professional traders.

| Aspect | DEX Liquidity Pools | CEX Order Books |

|---|---|---|

| Custody | Non-custodial (user controls keys) | Custodial (exchange holds funds) |

| Access | Permissionless, no KYC | Requires registration and KYC |

| Speed | Limited by blockchain confirmation | Instant off-chain execution |

| Liquidity | Pool-based, variable depth | Deep for major pairs |

| Fees | Trading fee + gas costs | Trading fee only (often lower) |

| Token Variety | Unlimited (any ERC-20 token) | Curated selection |

| Risk | Smart contract risk, impermanent loss | Counterparty risk, regulatory risk |

Choosing the Right Crypto Trading Model

Selecting between liquidity pools and order books isn’t a binary choice but rather a strategic decision based on your specific circumstances. Your trading frequency, typical trade size, technical sophistication, risk tolerance, and philosophical preferences all influence which model suits you best. Many experienced traders use both systems for different purposes: centralized exchanges for high-volume trading and fiat conversion, and decentralized liquidity pools for accessing new tokens or maintaining privacy.

The optimal choice also depends on market conditions and specific trading pairs. Major pairs like BTC/USDT or ETH/USDT typically offer superior liquidity and tighter spreads on centralized order book exchanges. Newly-launched tokens or exotic pairs may only have meaningful liquidity in decentralized pools. Understanding these contextual factors and matching them to your needs separates successful traders from those who struggle with suboptimal platform choices.

Best Crypto Trading Model: Liquidity Pool or Order Book?

Determining the best crypto trading model requires honest assessment of your priorities. If you value self-custody, privacy, and permissionless access above all else, decentralized liquidity pools align with your values despite potential disadvantages in fees and slippage. If you prioritize execution speed, advanced trading tools, and deep liquidity, centralized order book exchanges better serve your needs. Most users find value in both approaches, using each for its strengths.

Consider also your technical comfort level. Liquidity pools require understanding wallet management, gas fees, slippage settings, and smart contract interactions. Mistakes can be costly and irreversible. Order book exchanges, particularly centralized ones, offer familiar interfaces with customer support safety nets. However, they require trusting the exchange with your funds and accepting KYC requirements. Neither model is objectively superior; the best choice depends entirely on your specific situation and requirements.

Factors influencing trader preferences

Several key factors influence trader preferences between these models. Trade size matters significantly: larger traders generally prefer order books where they can use limit orders to minimize slippage, while smaller traders might find liquidity pools more accessible. Trading frequency also plays a role. Active day traders benefit from order book features like stop-losses and margin trading, while occasional buyers might prefer the simplicity of pool-based swaps.

Geographic location and regulatory environment influence preferences too. Users in jurisdictions with restrictive crypto regulations often rely on decentralized liquidity pools to maintain access. Conversely, users in crypto-friendly regions with strong consumer protections might prefer regulated centralized exchanges. Your tax situation, investment horizon, and interest in earning passive income through liquidity provision all factor into the decision. Successful crypto participants regularly reassess these factors as their circumstances and the market evolve.

Matching trading models with user experience

User experience varies dramatically between models. Liquidity pool DEXs typically offer minimalist interfaces focused on simple token swaps. You connect your wallet, select tokens, enter an amount, and confirm the transaction. This streamlined experience removes cognitive load but also hides complexity. Understanding what you’re actually agreeing to when you approve token contracts or set slippage tolerance requires education. The lack of hand-holding empowers but also endangers uninformed users.

Order book exchanges provide feature-rich interfaces with charts, order forms, trade history, and market depth visualizations. This information density helps informed decision-making but overwhelms beginners. Many centralized exchanges offer simplified interfaces for casual users alongside professional trading views. The ability to gradually increase complexity as you learn makes order book platforms excellent educational environments. However, the custodial nature means you must trust the platform’s security and integrity, a different kind of risk than smart contract vulnerabilities. Reviewing successful trading platform implementations provides practical insights into user experience optimization.

| Trader Profile | Recommended Model | Reasoning |

|---|---|---|

| Day Trader | Order Book (CEX) | Needs speed, low fees, advanced orders, leverage options |

| Privacy-Focused User | Liquidity Pool (DEX) | No KYC, non-custodial, censorship-resistant |

| Long-Term Holder | Either (based on preference) | Infrequent trading, can provide liquidity or stake on CEX |

| New Token Explorer | Liquidity Pool (DEX) | Early access to new projects, permissionless listings |

| Institutional Trader | Order Book (CEX) | Requires deep liquidity, OTC services, regulatory compliance |

| Yield Farmer | Liquidity Pool (DEX) | Earn fees as LP, integrate with yield strategies |

| Complete Beginner | Order Book (CEX with simple mode) | Customer support, fiat on-ramps, user-friendly with safeguards |

Liquidity Pools vs Order Books for Beginners

For newcomers to cryptocurrency, understanding liquidity pools vs order books for beginners starts with recognizing that both systems have learning curves, just different kinds. Liquidity pools offer operational simplicity but conceptual complexity. The actual process of swapping tokens is straightforward, but understanding what’s happening behind the scenes requires grasping concepts like automated market makers, impermanent loss, and slippage tolerance. Order books present operational complexity but conceptual familiarity. The trading interface may seem daunting initially, but the underlying concepts mirror traditional stock trading.

Most cryptocurrency educators recommend beginners start with reputable centralized exchanges offering simple interfaces and customer support. This provides a safe environment to learn basic concepts without the added complexity of wallet management and smart contract interactions. Once comfortable with basic trading, exploring decentralized liquidity pools introduces DeFi concepts and self-custody principles. This progressive approach builds knowledge systematically while minimizing costly mistakes.

Simplifying Crypto Trading Models

Breaking down crypto trading models into simple mental models helps beginners develop intuition. Think of order books as a marketplace where you can see all available offers and choose which to accept. If you want to buy apples and someone is selling apples at a price you like, you complete the trade. If nobody is selling at your desired price, you can make an offer and wait for someone to accept it. This straightforward supply-and-demand model matches how humans naturally think about trading.

Liquidity pools are more like a vending machine that always has inventory and always quotes a price, though that price changes based on how much people have been buying or selling. You can’t negotiate or place special orders, but you’re guaranteed instant service. The vending machine’s prices automatically adjust to maintain balance in its inventory. This always-on, instant-quote model trades flexibility for convenience. Both systems work; they just serve different needs and appeal to different users.

Understanding risks, rewards, and usability

Every trading model carries specific risks that beginners must understand. Order book risks include price volatility causing unexpected execution prices if you use market orders, exchange counterparty risk where the platform could be hacked or become insolvent, and the temptation to overtrade due to easy access to advanced features like leverage. The main reward is precise control over your trades and access to deep liquidity on major pairs.

Liquidity pool risks include smart contract vulnerabilities that could result in total loss, impermanent loss when providing liquidity, high gas fees making small trades uneconomical, and slippage on larger trades or in shallow pools. Rewards include access to any token with existing liquidity, privacy and self-custody, and the ability to earn passive income as a liquidity provider. Understanding this risk-reward profile for each model helps beginners make informed choices aligned with their comfort levels and goals.

Learning how crypto trading works step by step

A structured learning path helps beginners master crypto trading effectively. Start by understanding basic cryptocurrency concepts: what blockchain is, how wallets work, and the difference between custodial and non-custodial storage. Next, practice small trades on a reputable centralized exchange to understand the mechanics of buying and selling without worrying about gas fees or smart contracts. Use this experience to learn about market orders, limit orders, and how spreads work.

Once comfortable with centralized trading, set up a non-custodial wallet and explore a major decentralized exchange like Uniswap with small amounts. This introduces you to transaction signing, gas fees, slippage settings, and token approvals. Compare the experience to centralized trading: notice the differences in speed, cost, and complexity. This hands-on comparison builds real understanding that reading alone cannot provide. Gradually increase complexity as you gain confidence, always using amounts you can afford to lose while learning.

Start with small trades to understand mechanics and risks before committing significant capital to any trading model or platform.

Final Thoughts on Liquidity Pools vs Order Books

The liquidity pools vs order books debate represents more than a technical discussion about trading mechanisms; it reflects fundamental questions about how financial markets should operate in a decentralized digital age. Order books bring time-tested efficiency and precision, refined through decades of use in traditional markets. Liquidity pools introduce blockchain-native innovation, enabling permissionless market making and continuous liquidity. Neither model will completely replace the other; instead, they’ll coexist and evolve, each serving distinct needs within the broader cryptocurrency ecosystem.

Understanding both models empowers you to navigate the crypto trading landscape effectively. You can choose platforms strategically based on your specific needs for each trade, rather than limiting yourself to a single approach. As the industry matures, expect to see more sophisticated hybrid models that combine the best aspects of each system, potentially creating trading experiences superior to what either model alone can provide. The future of crypto trading likely involves flexibility, allowing users to seamlessly access whichever mechanism best serves their immediate needs.

The Future of Crypto Trading Models

The evolution of crypto trading models is accelerating as developers address current limitations and experiment with novel approaches. We’re seeing concentrated liquidity models like Uniswap V3 that allow liquidity providers to specify price ranges, improving capital efficiency dramatically. Order book DEXs are leveraging layer-2 solutions and optimistic rollups to reduce costs while maintaining decentralization. Hybrid platforms combine liquidity pools for long-tail assets with order books for major pairs, offering flexibility that single-model exchanges cannot match.

Emerging technologies like zero-knowledge proofs may enable private order books on public blockchains, combining the best aspects of centralized and decentralized trading. Cross-chain liquidity aggregators are making it easier to access the best prices across multiple pools and exchanges simultaneously. As blockchain scalability improves through technologies like sharding and faster consensus mechanisms, the performance gap between centralized and decentralized systems will narrow. The next generation of traders will have access to trading tools that current systems can barely imagine.

Evolving exchange designs and hybrid models

Hybrid exchange designs are already emerging as developers recognize that different trading scenarios benefit from different mechanisms. Some platforms use order books for their most liquid pairs while employing AMMs for less popular tokens. Others implement dynamic systems that automatically route orders through whichever mechanism offers the best execution for specific trade parameters. This intelligent routing optimizes for factors like price impact, execution speed, and total cost including fees.

The most sophisticated future exchanges may seamlessly integrate order books, liquidity pools, and yet-to-be-invented mechanisms, presenting users with a unified interface that abstracts away the underlying complexity. Imagine an exchange that automatically determines whether your trade should execute against an order book, liquidity pool, or through peer-to-peer negotiation based on optimizing for your specified priorities. This level of intelligent automation could democratize access to professional-grade execution while maintaining the simplicity that attracts mainstream users. The crypto trading platforms of tomorrow will likely be unrecognizable compared to today’s offerings, much as today’s platforms would seem miraculous to early cryptocurrency users.

Frequently Asked Questions

The primary difference lies in how trades are executed. Order books match buyers and sellers directly through limit and market orders, with prices determined by supply and demand in real-time. Liquidity pools, on the other hand, use automated market makers (AMMs) and smart contracts to facilitate trades against pooled assets, with prices calculated algorithmically based on token ratios. This fundamental distinction affects everything from price discovery to trade execution speed and slippage.

Liquidity pools operate through smart contracts that hold token pairs deposited by liquidity providers. When traders want to swap tokens, they trade directly against the pool rather than with another trader. The AMM algorithm automatically adjusts prices based on the ratio of tokens in the pool, following formulas like the constant product formula (x * y = k). Liquidity providers earn fees from each trade proportional to their share of the pool, incentivizing them to keep the pool well-funded.

For absolute beginners, liquidity pools on decentralized exchanges often provide a simpler trading experience since there’s no need to understand bid-ask spreads, limit orders, or market depth. You simply swap one token for another at the displayed price. However, order book exchanges offer more control over trade execution and are better for learning traditional trading concepts. The choice depends on whether you prioritize simplicity and decentralization or precision and advanced trading features.

Most centralized exchanges (CEXs) primarily use order book systems because they offer better price discovery, lower slippage for large trades, and support for advanced order types like stop-loss and limit orders. The centralized infrastructure allows for high-frequency trading and rapid order matching. Some hybrid centralized platforms are beginning to incorporate liquidity pool features for specific trading pairs, but traditional order books remain the dominant model for CEXs due to their efficiency and trader familiarity.

Liquidity providers face several key risks, with impermanent loss being the most significant. This occurs when token prices diverge from their initial ratio, potentially resulting in less value than simply holding the tokens. Other risks include smart contract vulnerabilities, rug pulls on unaudited platforms, and reduced returns during low trading volumes. Additionally, extreme market volatility can amplify impermanent loss, and liquidity can become locked during high-demand periods on some platforms.

Slippage in liquidity pools is predictable and calculated before trade execution based on the pool’s current size and the trade amount. Larger trades relative to pool size result in higher slippage due to the AMM pricing curve. In order book systems, slippage depends on available liquidity at different price levels and can be less predictable during volatile periods. Generally, deep order books with high liquidity experience lower slippage than smaller liquidity pools, but well-funded pools can offer competitive rates for moderate-sized trades.

Yes, decentralized exchanges can implement order book systems, though it’s technically more challenging than liquidity pools. On-chain order books require every order placement and cancellation to be recorded as a blockchain transaction, which can be slow and expensive. Some DEXs use hybrid models with off-chain order books and on-chain settlement, or layer-2 solutions to reduce costs. Projects like dYdX and Serum have successfully implemented decentralized order book trading, combining the benefits of order books with blockchain transparency.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.