A Leading Crypto Trading Platform

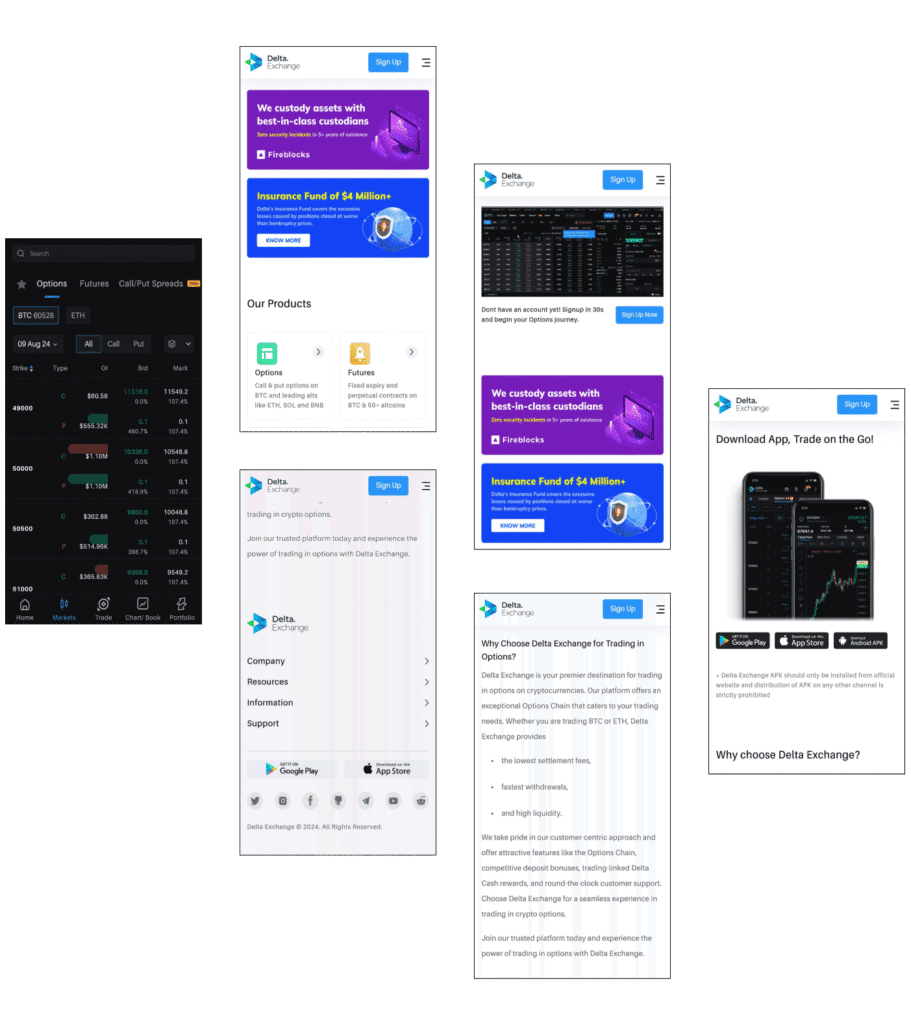

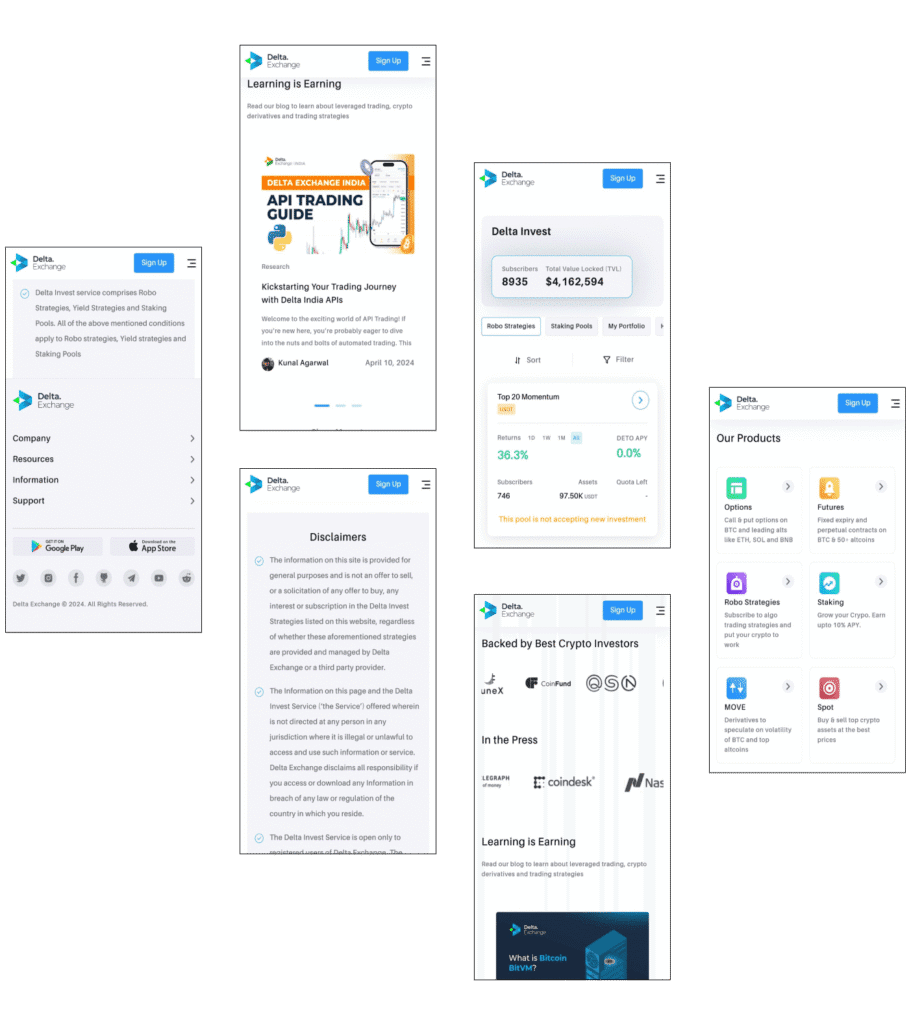

Delta Exchange is a top-tier trading platform specializing in crypto futures and options, focusing primarily on Bitcoin (BTC) and Ethereum (ETH). Designed for both novice and expert traders, Delta Exchange delivers a comprehensive suite of trading tools and features to enhance the trading experience. The platform supports a wide array of derivatives, including perpetuals and options with daily and weekly expiries, catering to various trading strategies. Delta Exchange aims to be a leading player in the Decentralized Finance (DeFi) ecosystem.

Get Started with this product

Delta Exchange delivers lightning-fast trade execution with low latency, crucial for real-time market reactions. Optimized infrastructure ensures minimal slippage and accurate order fulfillment, allowing traders to capitalize on volatile crypto movements efficiently. This high-speed performance improves trading precision and offers a seamless, responsive experience for both retail and institutional users.

Delta Exchange simplifies crypto-fiat conversions by supporting direct bank transfers via UPI, NEFT, IMPS, and cards. Users can easily deposit or withdraw funds in local currency, enabling smoother liquidity access and hassle-free asset management. This integration bridges the gap between traditional finance and crypto trading, enhancing user convenience and onboarding.

Delta Exchange offers deep liquidity and tight spreads across major crypto pairs, enabling high-volume trades with minimal slippage. This ensures efficient, low-cost order execution, giving both short- and long-term traders fast entries, exits, and optimal pricing in dynamic market conditions.

Delta Exchange provides cutting-edge tools like real-time data, charting systems, technical indicators, and a strategy builder. These features empower traders to analyze market trends, test strategies, and make informed decisions. Designed for beginners and professionals alike, the platform supports precise, analytical trading in an ever-changing crypto environment.

Delta Exchange supports isolated, cross, and portfolio margining to match diverse trading styles. Isolated margin limits risk to specific positions, while cross margin utilizes total account balance. Portfolio margin aggregates risk for better capital efficiency. These options provide flexibility, reduce liquidation risks, and cater to varying risk appetites and strategies.

Delta Exchange enforces enterprise-grade security with multi-factor authentication and manual withdrawal reviews. User data and funds are protected through strict access controls and fraud-prevention protocols. These robust measures ensure a safe trading environment, giving users confidence and peace of mind while managing and growing their digital assets.

Basket Orders let Delta Exchange users place multiple trades in a single action. This feature streamlines complex strategies and improves efficiency by allowing traders to execute predefined sets of trades simultaneously. Ideal for portfolio diversification or algorithmic execution, basket orders save time and reduce manual trading errors.

MOVE contracts on Delta Exchange let users profit from volatility without guessing market direction. These options combine call and put strategies with the same strike, offering gains from large price swings. Available in daily and weekly expiries, MOVE contracts enhance strategy flexibility and provide a powerful tool for trading uncertain market conditions.

Delta Exchange required a sophisticated trading platform capable of handling high-volume cryptocurrency trading with a focus on futures and options. Key requirements included advanced trading features that cater to both casual and professional traders, such as versatile margining options, including isolated, portfolio, and cross margin modes. The platform needed to support a wide range of cryptocurrencies and trading strategies, offering both fixed expiry and perpetual contracts with daily and weekly expiry options. Additionally, seamless integration with traditional financial systems was essential for enabling fiat deposits and withdrawals, ensuring that users could easily convert their crypto assets to and from their bank accounts.

Security was a top priority, requiring enterprise-grade measures such as multi-factor authentication and manual withdrawal reviews to safeguard users’ assets and personal information. Delta Exchange also sought to deliver high liquidity and tight spreads to facilitate large trades with minimal slippage. The platform had to be robust enough to handle significant trading volumes while maintaining fast transaction processing times. Overall, Delta Exchange aimed to create a reliable and efficient trading environment that meets the diverse needs of the crypto trading community.

Proof of Work secures blockchains by making miners solve puzzles to validate transactions. The first solver earns rewards, ensuring security and decentralization. Despite high energy use, PoW powers Bitcoin and other networks, preventing fraud and double-spending while maintaining trust in distributed ledgers.

Proof of Stake selects validators based on the number of coins they stake as collateral. Unlike PoW, it consumes less energy and improves scalability. Validators earn rewards for confirming transactions. PoS promotes network security, decentralization, and long-term commitment, and is used in networks like Ethereum 2.0 for efficient consensus.

PBFT allows distributed systems to reach consensus even when some nodes are faulty or malicious. It works by having nodes exchange messages and agree on the state of transactions, functioning securely as long as fewer than one-third of nodes are compromised. PBFT is ideal for permissioned blockchains requiring consistency and fault tolerance.

In PoA, trusted authorities validate transactions and generate new blocks based on their reputation, not computational power or stake. This system enables fast, low-cost transactions, making it ideal for private or consortium blockchains. PoA delivers efficiency and governance while maintaining centralized control among verified participants.

PoET selects block validators based on a randomized waiting period. The first node to complete its wait earns the right to produce the next block. It minimizes energy use compared to PoW and is well-suited for private blockchains needing fairness and efficiency without high computational demand.

PoST combines storage allocation (proof of space) with a time delay (proof of time) to validate transactions. Participants use disk space rather than compute power, making it energy-efficient. Used by networks like Chia, PoST enables secure, sustainable blockchain participation while promoting decentralized storage and minimal resource consumption.

DPoS allows token holders to vote for delegates who validate blocks and maintain the network. This improves speed, scalability, and governance compared to traditional PoS. Used by platforms like EOS and TRON, DPoS ensures efficient block production while maintaining community involvement through representative consensus.

Delta Exchange supports Proof of Capacity for energy-efficient blockchain participation. In PoC, miners use hard drive space instead of computation to validate transactions. The more storage allocated, the better the chances to generate blocks. This approach reduces energy consumption, supporting decentralized consensus mechanisms for modern blockchain networks.

Visual identity and design elements

Primary font family and usage

Brand colors

#040404

#f1f1f1

Delta Exchange’s approach to developing its trading platform involved a strategic focus on delivering a seamless and secure trading experience for users interested in cryptocurrency futures and options. The project began with a thorough analysis of market needs and user requirements, which highlighted the necessity for high liquidity, low fees, and a user-friendly interface. To address these needs, Delta Exchange implemented advanced blockchain technology to ensure transparency and security. The platform was designed to handle high transaction volumes efficiently, incorporating robust trading features such as versatile margining options and sophisticated analytics tools. The development team adopted an agile methodology, allowing for iterative improvements and rapid adaptation to emerging market trends and user feedback. Integration of blockchain technology facilitated real-time transaction processing and reduced settlement times. Additionally, the platform’s infrastructure was built to support scalability, enabling it to handle increasing trading volumes without compromising performance.

Delta Exchange successfully achieved its goals of providing a high-performance trading platform with robust features and competitive advantages. The platform’s launch saw significant uptake, with high trading volumes and increased user engagement. The implementation of advanced blockchain technology ensured that transaction processing was both transparent and secure, addressing key concerns of traders. The platform’s low fees and high liquidity attracted a broad user base, contributing to its rapid growth in the crypto trading sector. The agile development approach allowed Delta Exchange to continuously refine its features, incorporating user feedback to enhance the overall trading experience. The platform’s emphasis on security and reliability led to high user satisfaction and trust, establishing it as a preferred choice among traders.

One of the primary challenges faced by Delta Exchange was ensuring that the platform could handle high transaction volumes while maintaining performance and reliability. As the popularity of cryptocurrency trading surged, Delta Exchange needed to scale its infrastructure to accommodate increased trading activity. Managing this scalability required careful planning and robust technological solutions to prevent system slowdowns or failures.

Security was a critical challenge due to the high value and sensitivity of cryptocurrency assets. Delta Exchange needed to implement stringent security measures to protect user funds and data from potential threats. This involved deploying enterprise-grade multi-factor authentication, encryption protocols, and regular security audits. Additionally, Delta Exchange had to navigate the complex regulatory landscape of the cryptocurrency market.

Providing an exceptional user experience in a competitive market was another significant challenge. Delta Exchange aimed to offer a platform that was not only feature-rich but also intuitive and easy to navigate. The development team had to strike a balance between implementing advanced trading features and ensuring that the platform remained user-friendly. Additionally, Delta Exchange faced intense competition from other crypto trading platforms, each offering unique features and advantages.

Trade cryptocurrencies securely with delta-exchange: low fees, diverse assets, advanced tools, and top-notch.