Key Takeaways

- Gold-backed cryptocurrency represents the convergence of traditional safe-haven assets with blockchain innovation, creating gold-backed digital assets that combine stability with accessibility.

- Tokenized gold enables fractional ownership, 24/7 trading, and instant settlement through blockchain-based gold trading that eliminates traditional precious metals trading friction.

- A secure crypto exchange ecosystem for gold and crypto integration requires robust custodial security, transparent reserve proofs, and regulatory compliance to protect investor assets.

- Digital asset exchange platforms supporting crypto backed by physical gold are leading the tokenized real-world assets (RWA) revolution by bridging traditional finance with decentralized systems.

- Hybrid crypto exchange models enable trading gold-backed digital assets alongside traditional crypto pairs, providing diversification options within single secure digital asset trading platforms.

- Gold token exchange platform architecture must balance blockchain efficiency with custodial security for physical gold reserves to maintain asset backing integrity.

- Regulated crypto exchange ecosystems build trust through transparent reserve proof mechanisms, independent audits, and compliance with applicable financial regulations.

- The future of digital gold on blockchain includes expanded institutional adoption, DeFi integration, and mainstream acceptance as stable alternatives to volatile cryptocurrencies.

The intersection of precious metals and cryptocurrency represents one of the most significant evolutions in digital finance. As investors seek stability in volatile markets while embracing blockchain innovation, platforms that merge gold and crypto through secure exchange ecosystems are defining the next generation of digital asset investment. This convergence creates opportunities that neither traditional gold markets nor pure cryptocurrency exchanges could offer independently.

The Evolution of Digital Assets in the Modern Financial World

Digital assets have transformed from niche technological experiments to mainstream financial instruments commanding trillions in market value. This evolution reflects changing investor preferences, technological advancement, and growing recognition that blockchain technology offers genuine advantages for asset ownership, transfer, and verification.

From Traditional Assets to Blockchain-Based Digital Assets

Traditional assets including stocks, bonds, and precious metals have operated through centralized systems requiring intermediaries, settlement delays, and geographic restrictions. Blockchain technology eliminates many of these constraints, enabling direct ownership, instant transfers, and global accessibility. This transition represents fundamental infrastructure improvement rather than mere digitization.

The emergence of digital asset exchange platforms has accelerated this transition by providing accessible on-ramps for investors seeking blockchain-native versions of traditional assets. Understanding exchange market dynamics reveals the scale of this transformation and the opportunities it creates for investors and platform operators alike.

Why the Future of Digital Assets Is Moving Toward Asset-Backed Models

Pure cryptocurrency volatility has driven demand for asset-backed alternatives that maintain blockchain benefits while offering stability. Gold-backed digital assets address this need by connecting digital token value to physical reserves with millennia of proven worth. This model attracts both crypto-native investors seeking stability and traditional investors seeking blockchain accessibility.

Asset-backed models also satisfy regulatory expectations better than unbacked tokens, creating clearer compliance pathways. As institutional adoption increases, the preference for tokens with identifiable underlying value continues strengthening the case for gold and crypto integration approaches.

Market Principle: Asset-backed tokens derive value from underlying reserves rather than purely speculative demand. This fundamental difference creates different risk profiles and investment characteristics that informed investors should understand before allocating capital.

Understanding Gold-Backed Cryptocurrency and Tokenized Gold

Gold-backed cryptocurrency represents the practical application of tokenization principles to humanity’s oldest store of value. Understanding how tokenized gold functions provides foundation for evaluating platforms and making informed investment decisions in this emerging asset class.

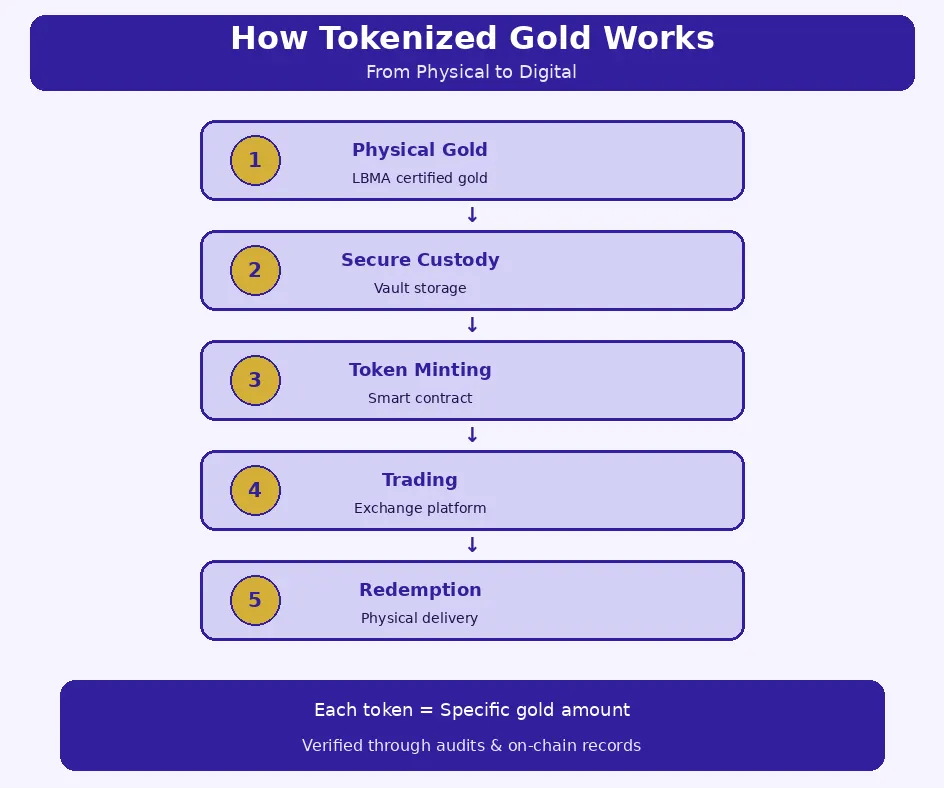

What Is Tokenized Gold and How It Works on Blockchain

Tokenized gold converts ownership rights in physical gold into digital tokens recorded on blockchain networks. Each token represents a specific gold amount, typically measured in grams or troy ounces. The tokenization process creates a digital representation that can be divided, transferred, and traded while the underlying gold remains in secure custody.

Role of Physical Gold in Gold-Backed Digital Assets

Physical gold provides the intrinsic value foundation for gold-backed digital assets. Real gold bars stored in audited vaults back circulating tokens, creating a one-to-one relationship between digital representation and physical reserve. This backing distinguishes gold tokens from unbacked cryptocurrencies, providing tangible value that exists independent of market sentiment.

Custodial arrangements typically involve LBMA-certified vaults with independent auditing, insurance coverage, and segregated storage. The quality and credibility of physical gold custody directly impacts token reliability and investor confidence.

Smart Contracts in Gold Token Issuance

Smart contracts automate gold token issuance, managing the minting process when gold deposits occur and burning tokens upon redemption. These programmable contracts ensure consistent rules application, transparent supply management, and verifiable issuance that matches physical holdings. Building crypto exchanges with smart contract capabilities enables automated, trustless gold token operations.

Benefits of Gold-Backed Crypto Over Traditional Cryptocurrencies

Gold-backed cryptocurrency offers distinct advantages over unbacked tokens, primarily through stability characteristics inherited from physical gold while maintaining blockchain benefits that traditional gold ownership lacks.

Stability Through Physical Gold Reserves

Physical gold reserves provide price stability that pure cryptocurrencies cannot match. While crypto backed by physical gold still experiences price movement reflecting gold market conditions, this volatility typically measures in single-digit percentages rather than the double or triple-digit swings common in unbacked cryptocurrency markets. This stability makes gold tokens suitable for value preservation alongside growth-oriented crypto holdings.

Transparency and On-Chain Asset Verification

Blockchain enables unprecedented transparency in gold ownership and verification. Token holders can verify total supply, track issuance history, and confirm their ownership through immutable on-chain records. Combined with off-chain audit reports, this creates comprehensive verification capabilities that traditional gold investment vehicles cannot match.

Gold-Backed Crypto vs Traditional Cryptocurrency

| Factor | Gold-Backed Crypto | Traditional Crypto |

|---|---|---|

| Value Backing | Physical gold reserves | Network utility/speculation |

| Volatility | Low to moderate | High |

| Intrinsic Value | Yes (gold backing) | Debatable |

| Redemption | Physical gold possible | Not applicable |

| Regulatory Clarity | Generally clearer | Often uncertain |

How Bullionz Bridges Gold and Crypto in a Secure Exchange Ecosystem

Bullionz represents an innovative approach to merging traditional precious metals with cryptocurrency through a comprehensive digital asset exchange platform. By creating unified infrastructure for both asset classes, it enables seamless trading and portfolio management spanning gold and crypto markets.

Integrating Tokenized Real-World Assets Into Crypto Trading

Integration of tokenized real-world assets (RWA) into crypto trading environments requires specialized infrastructure balancing blockchain efficiency with physical asset custody requirements. Successful integration creates platforms where traders can move between crypto and gold-backed assets within unified ecosystems.

Gold Token Exchange Platform Architecture

Gold token exchange platform architecture must support both traditional exchange functions and unique gold token requirements. This includes integration with custody systems, real-time reserve verification, redemption processing, and compliance reporting. Understanding exchange platform fundamentals provides foundation for appreciating specialized gold trading requirements.

Liquidity Management for Gold-Backed Tokens

Liquidity management for gold-backed tokens involves balancing trading pool depth with reserve requirements. Unlike unbacked tokens where supply is purely digital, gold tokens must maintain physical backing, constraining supply management approaches. Effective platforms implement market making strategies that ensure trading liquidity while preserving one-to-one gold backing integrity.

Hybrid Crypto Exchange Model for Digital Gold Trading

Hybrid crypto exchange models combine elements of centralized infrastructure with decentralized features, creating optimal environments for digital gold on blockchain trading. These models leverage centralized custody security with blockchain settlement transparency.

Trading Gold-Backed Digital Assets Alongside Crypto Pairs

Trading gold-backed digital assets alongside traditional crypto pairs enables portfolio diversification within single platforms. Investors can allocate between volatile growth assets and stable gold exposure, rebalancing as market conditions change. This integration eliminates friction from using separate platforms for different asset types.

Fiat and Crypto Accessibility for Digital Gold Investors

Comprehensive accessibility requires both fiat currency on-ramps and crypto-to-gold trading pairs. Traditional investors can enter through familiar fiat channels, while crypto-native users can diversify directly from existing holdings. This dual accessibility expands potential user bases and improves platform liquidity through diverse participant pools.

Security Framework Behind Gold-Backed Digital Asset Exchanges

Security for gold-backed exchanges must address both digital asset protection and physical gold custody. This dual requirement creates comprehensive security frameworks spanning blockchain infrastructure and traditional vault security.

Blockchain Security for Asset-Backed Tokens

Blockchain security for asset-backed tokens includes smart contract auditing, key management protocols, and network security measures. The immutable nature of blockchain creates both security benefits and risks, as vulnerabilities in token contracts cannot be easily corrected post-deployment.

Smart Contract Audits and Risk Management

Smart contract audits from reputable security firms identify vulnerabilities before deployment. Risk management extends beyond audits to include bug bounty programs, gradual rollouts, and emergency pause mechanisms. These practices protect both the digital token layer and the physical assets they represent.

Custodial Security for Physical Gold Reserves

Custodial security for physical gold involves LBMA-certified vaults, segregated storage, comprehensive insurance, and regular independent audits. Security extends to chain-of-custody documentation, serial number tracking for individual bars, and protocols preventing unauthorized access or movement of reserve gold.

Compliance and Trust in Regulated Crypto Exchange Ecosystems

Regulated crypto exchange ecosystems build user trust through compliance with applicable financial regulations, transparent operations, and demonstrated accountability. Regulatory alignment becomes increasingly important as institutional investors enter gold-backed token markets.

Transparent Reserve Proof Mechanisms

Transparent reserve proof mechanisms demonstrate that physical gold holdings match circulating token supply. This includes regular attestations from independent auditors, real-time reporting through blockchain oracles, and user-verifiable proof systems. Transparency distinguishes credible platforms from those making unverified claims.

Regulatory Alignment for Tokenized Gold Assets

Regulatory alignment involves compliance with applicable securities laws, commodity regulations, and anti-money laundering requirements. Different jurisdictions apply varying frameworks to gold tokens, requiring platforms to navigate complex regulatory landscapes while maintaining operational efficiency. Exploring cross-border transaction capabilities reveals how compliant platforms enable global access.

Gold Token Lifecycle: From Physical Gold to Digital Asset

| Step | Phase | Process | Verification |

|---|---|---|---|

| 1 | Gold Acquisition | LBMA gold sourced | Origin certification |

| 2 | Custody Deposit | Vault storage secured | Custodian receipt |

| 3 | Token Minting | Smart contract issuance | On-chain confirmation |

| 4 | Trading | Exchange transactions | Blockchain records |

| 5 | Redemption | Token burn, gold release | Delivery confirmation |

| 6 | Audit | Regular reserve verification | Third-party attestation |

Role of Tokenized Real-World Assets in the Future of Digital Assets

Tokenized real-world assets (RWA) represent the next major phase of blockchain adoption, connecting traditional asset classes with decentralized infrastructure. Gold tokenization leads this movement, demonstrating how physical assets can gain blockchain benefits without sacrificing underlying value.

Why Tokenized Gold Is Leading the RWA Revolution

Gold leads RWA tokenization because of its established value recognition, standardized quality metrics, and existing infrastructure for custody and verification. Unlike real estate or art which require complex valuation, gold has transparent, globally-accepted pricing that simplifies token backing verification.

Connecting Traditional Precious Metals With Crypto Markets

Connecting crypto and precious metals trading creates new market dynamics where traditional gold investors access blockchain efficiency and crypto traders gain exposure to stable, proven assets. This connection expands both markets by attracting participants who previously focused exclusively on one asset class.

Enhancing Market Accessibility Through Blockchain

Blockchain enhances gold market accessibility through fractional ownership, eliminating minimum investment barriers that exclude smaller investors from traditional gold markets. Digital gold on blockchain enables ownership of gram quantities rather than requiring full ounce or bar minimums, democratizing precious metals investment.

Future Trends in Digital Asset Exchange Platforms

Future secure digital asset trading platform evolution will incorporate expanded RWA offerings, improved interoperability, and deeper integration with traditional financial systems. These trends will blur boundaries between crypto and traditional finance.

Build a Secure Gold-Backed Crypto Exchange Platform

Partner with our crypto exchange development experts to launch a secure, scalable platform for gold-backed digital assets and next-gen crypto trading ecosystems.

Launch Your Exchange Now

Expansion of Gold-Backed Digital Currencies

Gold-backed digital currency expansion will include institutional-grade products, central bank exploration of gold-backed CBDCs, and retail products spanning multiple blockchain networks. This expansion reflects growing recognition that gold backing provides stability that pure algorithmic approaches cannot guarantee.

Growth of Secure and Hybrid Exchange Ecosystems

Growth in secure crypto exchange ecosystem models will emphasize hybrid approaches combining centralized security with decentralized verification. These ecosystems will support diverse asset types including gold tokens, other RWAs, and traditional cryptocurrencies within unified platforms.

Important Notice: Gold-backed cryptocurrency investments carry risks including custodial risk, smart contract vulnerabilities, regulatory uncertainty, and potential deviation between token price and underlying gold value. Verify issuer credibility, audit history, and redemption mechanisms before investing. Past gold price performance does not guarantee future results.

Gold Token Platform Selection Criteria

When evaluating gold-backed token platforms, consider:

- Reserve Verification: Independent audits and proof-of-reserves mechanisms

- Custodian Quality: LBMA-certified vaults with insurance coverage

- Smart Contract Security: Audited contracts from reputable firms

- Redemption Options: Clear physical gold redemption policies

- Regulatory Compliance: Appropriate licensing and reporting

- Trading Liquidity: Sufficient market depth for efficient trading

The Future of Secure Digital Asset Trading With Gold-Backed Crypto

The future of secure digital asset trading increasingly includes gold-backed cryptocurrency as standard portfolio components. This evolution reflects maturing market understanding that stability and growth assets serve complementary roles in diversified digital portfolios.

How Bullionz Is Shaping the Next Generation of Digital Asset Exchanges

Bullionz contributes to next-generation exchange evolution by demonstrating viable gold and crypto integration within unified platforms. This approach influences broader market direction by proving that asset-backed tokens can coexist productively with traditional crypto assets in secure exchange environments.

The platform’s architecture establishes patterns for integrating physical asset custody with blockchain trading, creating blueprints that future platforms may adopt for other RWA categories. Working with experienced exchange specialists enables implementation of similar hybrid capabilities.

Long-Term Impact of Gold and Crypto Integration on Global Finance

Long-term gold and crypto integration impacts include expanded access to precious metals investment, new portfolio construction approaches, and potential evolution of monetary systems incorporating both digital and physical value bases. This integration may eventually influence how institutions, governments, and individuals conceptualize and hold value reserves.

The convergence also creates opportunities for financial innovation including gold-backed lending protocols, yield-generating gold positions, and sophisticated derivatives combining precious metals with cryptocurrency market dynamics. These innovations extend value creation beyond simple ownership to active financial instrument utilization.

Gold Investment Methods Comparison

| Method | Accessibility | Liquidity | DeFi Compatible |

|---|---|---|---|

| Physical Gold | Limited | Low | No |

| Gold ETFs | Moderate | High | No |

| Tokenized Gold | High | High | Yes |

| Gold Futures | Limited | High | No |

Frequently Asked Questions

Gold-backed cryptocurrency is a digital token whose value is tied to physical gold reserves held in secure vaults. Each token represents a specific amount of gold (typically one gram or one ounce), providing the stability of precious metals combined with the accessibility and transferability of blockchain technology. This hybrid approach offers investors the benefits of both traditional gold ownership and modern digital assets.

Tokenized gold works by representing physical gold as digital tokens on a blockchain network. When gold is deposited into secure custody, smart contracts mint corresponding tokens that can be traded, transferred, or redeemed. The blockchain provides transparent ownership records, while the physical gold backing ensures each token maintains intrinsic value tied to real-world precious metal reserves.

Gold-backed cryptocurrency offers different risk characteristics than regular crypto. While both face smart contract and platform risks, gold-backed tokens have intrinsic value tied to physical reserves, potentially reducing volatility. However, they introduce custodial risks related to gold storage. The safety depends on the issuer’s credibility, audit transparency, and the security of both blockchain infrastructure and physical gold vaults.

Bullionz is a digital asset ecosystem that bridges traditional precious metals with cryptocurrency through a secure exchange platform. It enables users to trade tokenized gold alongside crypto pairs, providing hybrid investment options. The platform combines physical gold backing with blockchain transparency, creating an integrated environment for both traditional precious metal investors and crypto traders seeking asset-backed stability.

Tokenized real-world assets (RWA) are blockchain representations of physical assets like gold, real estate, art, or commodities. Tokenization converts ownership rights into digital tokens, enabling fractional ownership, easier trading, and global accessibility. RWAs bridge traditional finance with DeFi, allowing investors to gain exposure to real-world value while benefiting from blockchain efficiency and transparency.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.