The global BFSI software market is accelerating as banks, insurers and fintechs invest heavily in core modernization, cloud migration, payments, open banking and AI. This article compiles market size estimates, growth rates, investment and technology adoption statistics, regional highlights (including India’s digital payments boom), cybersecurity and regulatory impacts, and actionable recommendations for product teams and vendors.

Global Market Size Overview of BFSI Software Market Growth

1. Global software market (context)

The global software market, the broad backdrop for all vertical software including BFSI solutions, was estimated at USD 730.70 billion in 2024, with forecasts projecting roughly USD 1.40 trillion by 2030 (CAGR ~11.3%). This sets the macro tailwind for enterprise and financial-services software vendors.[1]

2. Overall banking technology spend

Banks collectively invest at scale in technology: recent industry analysis estimates that banks spend roughly USD 600–650 billion per year on technology and IT-related activities, underscoring why financial institutions remain a top software buyer segment. This figure includes software, services, and major transformation budgets.[2]

3. Core banking software market

Core banking, the foundational back-office systems that many banks are modernizing is a multi-billion dollar vertical. One reputable market forecast values the core banking software market in 2024 between about USD 12–17 billion, with projections ranging up to USD ~65 billion by the early 2030s depending on scope and timeframe (common CAGRs reported: ~10–18%). This reflects high demand for cloud-native cores and composable architectures.[3]

4. Open banking & API platform market

Open banking APIs, consent platforms, aggregators and related services is one of the fastest-growing BFSI software market growth. Multiple market studies estimate the open banking market at roughly USD 30–32 billion in 2024, with steep expansion forecasts to around USD 130–135 billion by 2030 (implying CAGRs in the mid-20% range), driven by API adoption, PSD2-style regulation, and embedded finance.[4]

5. Payments-modernization and high-throughput rails

Payments modernization is a major software demand driver. India’s UPI (Unified Payments Interface) demonstrates scale: UPI processed ~172 billion transactions in 2024, a huge volume growth that fuels demand for high-throughput payment platforms, fraud detection, tokenization and reconciliation software. Use-case success stories like UPI often shape vendor roadmaps worldwide.[5]

6. Why numbers vary across reports

Market estimates differ because each study defines the market differently (software licensing only vs. software + services vs. cloud consumption), uses different base years, and scopes (global vs. region vs. solution). When quoting a figure, check whether it includes professional services, managed services, cloud consumption and/or transaction-based platform revenue. (Reference: industry report comparisons and methodology notes).

7. Regional scale & pockets of acceleration

- North America & Western Europe: largest per-capita software spend and core modernization programs. (see banking spend data).

- APAC (esp. India): payments-led digitalization (UPI), strong fintech adoption and cloud-first initiatives.

- EMEA & MENA: rising open-banking regulation, fintech hubs and cross-border payment modernization.

8. Quick facts (at-a-glance)

- Global software market (2024): USD 730.70B.

- Banking technology annual spend: ~USD 600–650B.

- Core banking market (2024): ~USD 12–17B (varies by report).

- Open banking market (2024): ~USD 30–32B; ~USD 130–135B by 2030 (high growth).

- UPI transactions (India, 2024): ~172 billion processed.

9. What this overview implies for product strategy

- Target open-banking platforms, payments orchestration, AML/KYC, and cloud-native core modules are high-growth pockets.

- Design for recurring revenue models (SaaS + managed services) and interoperability (APIs, adapters) buyers prize modular, low-risk integration.

Year-on-Year Growth Trends in BFSI / Core Banking / Open-Banking Software Markets

| Market / Segment | Base Value | Forecast Value | CAGR |

|---|---|---|---|

| Global Core Banking Software (Overall) | USD 12.37 B (2024) | USD 21.61 B (2030) | ~10.2% (2025–2030) [6] |

| Core Banking – Cloud Deployment | USD 5,107.2 M (2024) | USD 9,584.6 M (2030) | ~11.5% |

| Core Banking – On-Premise Deployment | USD 7,259.1 M (2024) | USD 12,024.0 M (2030) | ~9.2% |

| Core Banking (Alternative Forecast) | USD 12.51 B (2024) | USD 33.10 B (2034) | ~10.22% (2025–2034) |

| Digital Transformation in BFSI (Broad) | USD 93.04 B (2024) | USD 253.29 B (2035) | ~9.53% (2025–2035) |

Key Industry Adoption Rate Statistics in BFSI Software Market Growth

Cloud Adoption in Financial Services

- As of 2023, 91% of banks and insurance companies worldwide surveyed had initiated their cloud journey.[7]

- This marks a dramatic rise from 37% in August 2020.

- However, as of the same survey over 50% of firms admitted that only a minimal portion of their core business applications have actually been migrated to the cloud.[8]

- Many cloud-migrations remain partial (front-end, non-core apps), highlighting that while “cloud adoption” is widespread, full cloud-native transformation is still in progress.

Implication: Cloud is broadly accepted across BFSI firms almost universal survey initiation but large shares have not yet moved all core workloads. Cloud adoption is clearly a major strategic direction globally.

Overall ICT / Digital Transformation Adoption in BFSI

- According to a 2025 report by QKS Group, the BFSI sector’s ICT (Information & Communications Technology) adoption encompassing digital infrastructure, cloud, automation, risk, data, etc. is projected to grow at a CAGR of 13.63% through 2030.[9]

- This suggests strong momentum: more BFSI players globally are committing investment to digital transformation, implying rising adoption rates of software, infrastructure, analytics, and other tech-enabled services.

Adoption of AI / Advanced Technologies in BFSI Software Market Growth

- The market for AI in BFSI reflecting adoption of AI-powered tools, automation, and analytics, ML was estimated at USD 26.2 billion in 2024 and is forecast to grow at a CAGR of 22% between 2025 and 2034.[10]

- This implies rapidly increasing uptake of AI-based modules (fraud detection, risk, customer analytics, personalization) across the BFSI software market growth industry globally.

Digital Transformation & Software Adoption More Broadly

- According to a report on the global digital transformation in BFSI software market growth, the market reflecting adoption of digital/banking software, transformation initiatives, modernization was valued at USD 93.04 billion in 2024.[11]

- The same report projects growth to ~USD 419.45 billion by 2034, which corresponds to a CAGR of ~16.25% (2025-2034).

- This indicates a broad, fast-rising adoption of digital transformation across banks, insurers, fintechs not limited to cloud or AI, but including full-stack BFSI software market growth, modernization, digitized operations, fintech interfaces and more.

Investment & Funding Trends in BFSI / FinTech / BFSI-Software

Global Funding Overall Picture

- According to KPMG’s 2024 fintech report, global fintech investment dropped to USD 95.6 billion across 4,639 deals in 2024, the lowest level since 2017.[12]

- This marks a decline from 2023’s USD 119.8 billion over 5,382 deals.

- The downturn affected venture-capital, private equity, and M&A deals: PE investment reportedly plunged from about USD 10.5 billion in 2023 to just USD 2.6 billion in 2024. VC investment also fell from ~USD 49.2 billion to ~USD 43.4 billion.

Sector-wise / Segment-wise Funding Focus

- Within fintech/BFSI funding in 2024, the payments sector claimed the largest share, USD 31 billion, up from USD 17.2 billion in 2023.

- Other sectors that saw growth:

- RegTech: investment rose to ~USD 7.4 billion in 2024 (from USD 4.4 billion in 2023).

- Digital assets & currencies: 2024 saw ~USD 9.1 billion invested globally in that sub-segment.[13]

- Emerging interest in InsurTech and other adjacent BFSI/BFSI-software segments (including compliance, regtech, fintech infrastructure) signals that investors are diversifying beyond just payments.[14]

Technology Adoption Statistics in BFSI Software Market Growth & Financial Services

Cloud Adoption & Digital-Infrastructure Adoption

- According to Capgemini Research Institute’s “World Cloud Report – Financial Services,” 91% of banks and insurers globally have “initiated their cloud journey” as of 2023–2024.[15]

- Despite that, more than 50% of those firms report that only a minimal portion of their core business applications have actually migrated to the cloud.

- In the same report, 84% of traditional banks and insurers said their main goal for cloud adoption is to improve operational efficiency.

- However, only about 12% of financial-services organizations globally qualify as “cloud innovators” meaning they have embraced advanced cloud strategies (likely cloud-native, hybrid/multi-cloud, modern architectural practices).

- This suggests that while cloud adoption is nearly universal at a basic level, deep cloud transformation (core banking, cloud-native architecture, large scale migration) is still limited to a minority.

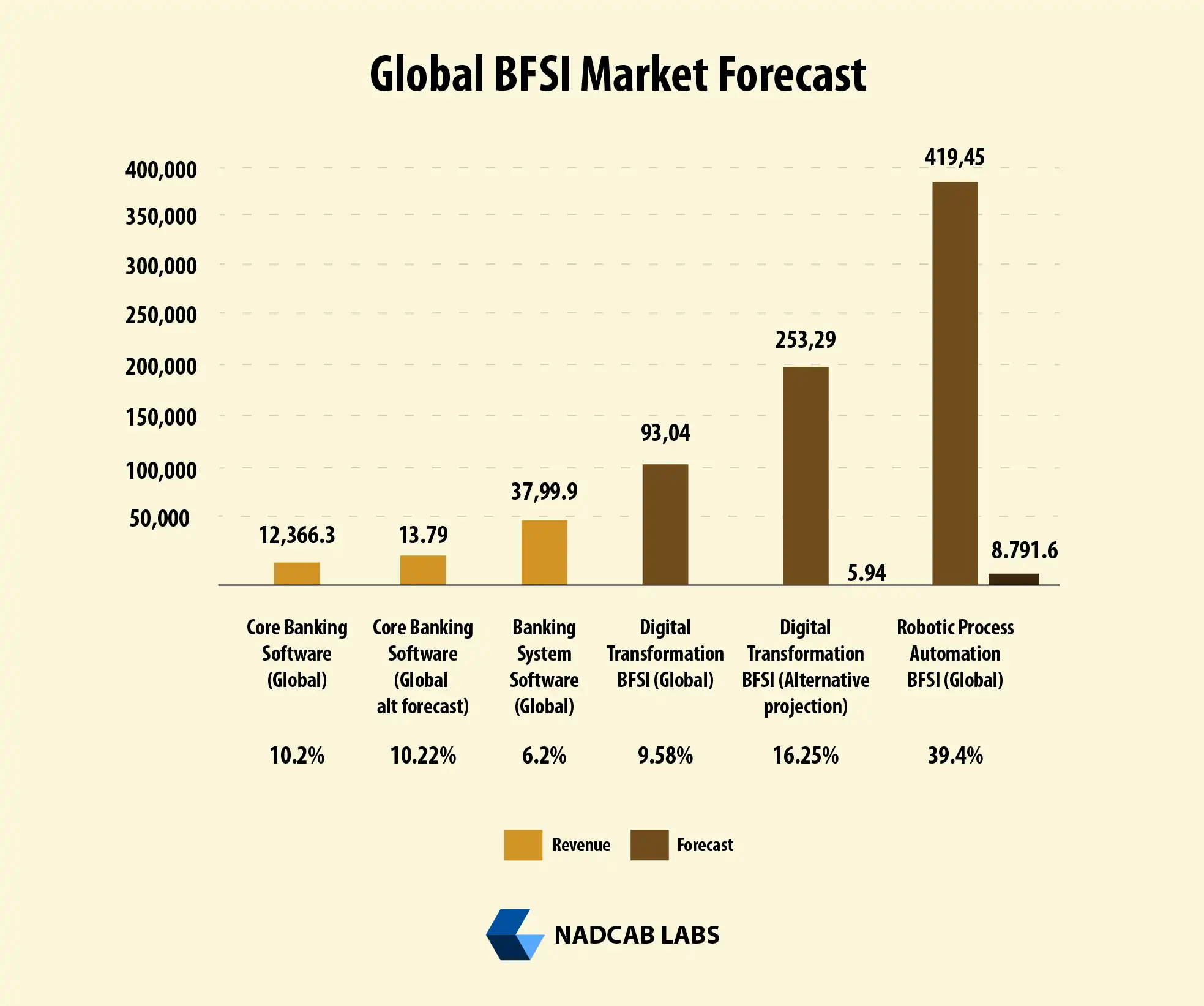

Global BFSI Software Market Growth / Related Markets Revenue Forecast Table

The BFSI software market growth ecosystem continues to expand rapidly as banks, fintechs, and financial institutions accelerate digital transformation. Core banking, system software, and digital-BFSI software market growth solutions all show strong upward trends, with multiple segments projected to double in market value over the next decade. The following table highlights key global revenue forecasts from trusted industry reports, offering a clear view of how BFSI-focused technologies will scale worldwide.

| Market / Segment | Base Value | Forecast / Target Year | Projected Revenue | CAGR |

|---|---|---|---|---|

| Core Banking Software (Global) | USD 12,366.3 M (2024) | 2030 | USD 21,608.6 M | ~10.2% (2025–2030) [16] |

| Core Banking Software (Global – Alt Forecast) | USD 13.79 B (2025) | 2034 | USD 33.10 B | ~10.22% (2025–2034) [17] |

| Banking System Software (Global) | USD 37,959.9 M (2023) | 2030 | USD 57,781.1 M | ~6.2% (2024–2030) [18] |

| Digital Transformation in BFSI (Global) | USD 93.04 B (2024) | 2035 | USD 253.29 B | ~9.53% (2025–2035) [19] |

| Digital Transformation in BFSI (Alt Projection) | USD 93.04 B (2024) | 2034 | USD 419.45 B | ~16.25% (2025–2034) |

| Robotic Process Automation (RPA) in BFSI (Global) | USD 860.7 M (2023) | 2030 | USD 8,791.6 M | ~39.4% (2024–2030) |

Main Market Drivers for BFSI Software Adoption

1. Digitalization of Financial Services & Shift to Digital Banking

- Financial institutions worldwide are increasingly embracing digital banking platforms to modernize operations, reduce reliance on physical branches, and meet rising customer demand for convenience. This broad digital transformation is among the top drivers for BFSI software market growth.

- The proliferation of mobile and online banking thanks to widespread smartphone use and internet adoption has pushed banks and insurers to adopt software that supports real-time, mobile-friendly services, which in turn drives demand for core banking, mobile banking, payment gateways, and related software modules.[20]

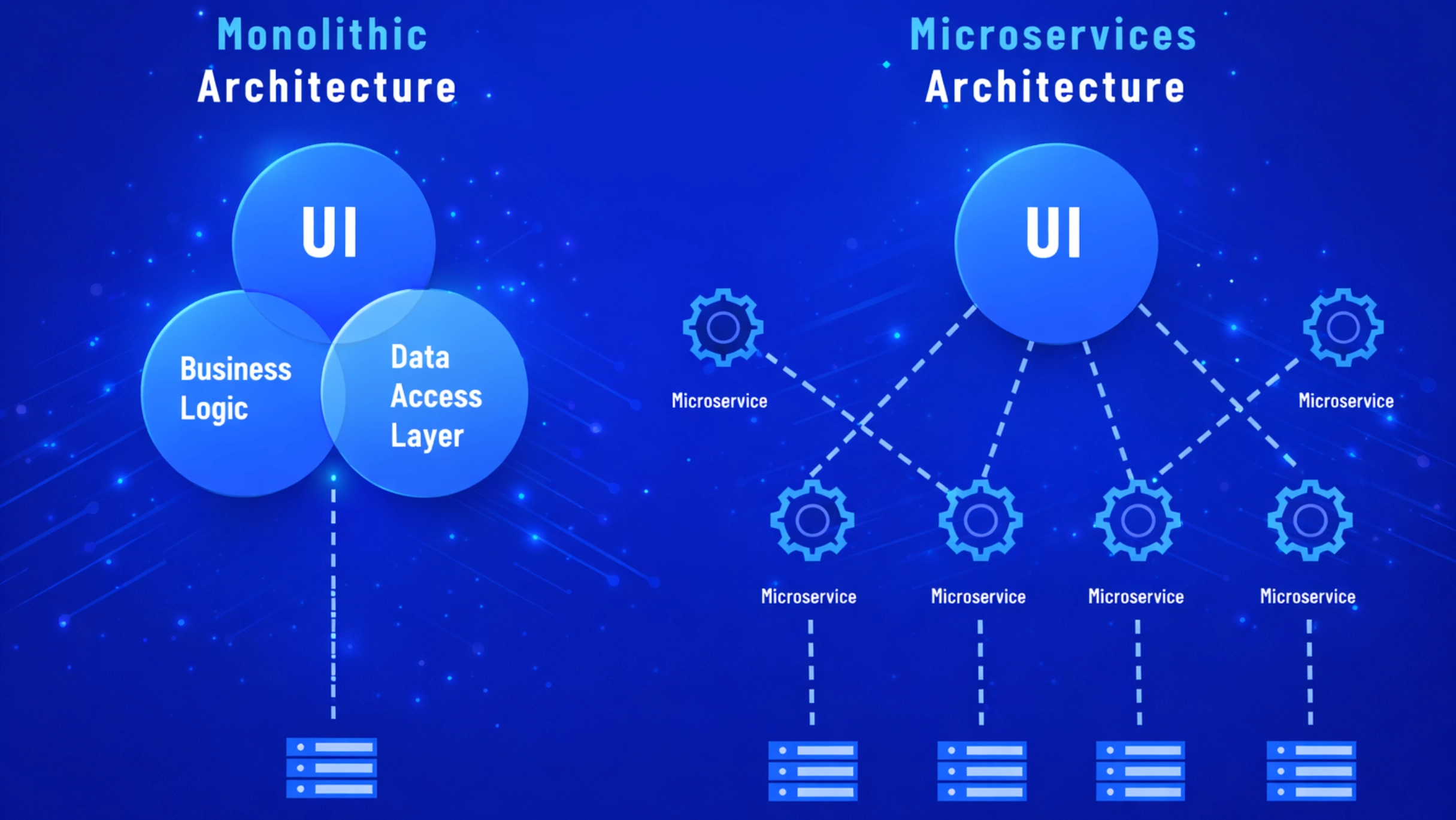

2. Cloud Adoption & Infrastructure Modernization

- Many financial institutions are migrating to cloud-based platforms and cloud-native BFSI software market growth, attracted by scalability, flexibility, and cost-efficiency compared to legacy on-premise infrastructure.

- Cloud makes it easier for banks to deploy advanced services (data analytics, AI/ML, real-time payments, omnichannel services), and to scale infrastructure rapidly as usage increases (e.g. more users, more transactions, data load, compliance needs).[21]

3. Rising Demand for Analytics, Fraud Detection, & Risk Management Tools

- As digital transactions surge, the need for analytics, fraud detection, risk monitoring and compliance increases driving adoption of BFSI software market growth with built-in analytics, real-time monitoring, risk-management and fraud-prevention capabilities.

- Many new software products are analytics- or AI-enabled (e.g. predictive analytics, fraud-detection, compliance analytics), which help institutions manage risk, improve decision-making (credit, underwriting, compliance), automate tasks, and respond quickly to dynamic threats or regulatory changes.

4. Regulatory & Compliance Pressure

- Stricter regulatory requirements regarding data security, operational resilience, compliance reporting, fraud control, and auditability force banks and insurers to adopt software solutions that help meet those obligations.[22]

- As regulatory frameworks evolve (especially in regions with high oversight), institutions often prefer end-to-end software platforms that integrate compliance, security, reporting, and risk-management boosting software demand.

5. Demand for Customer-Centric, Real-Time & Omnichannel Services

- Customers now expect seamless, 24/7 banking services mobile banking, instant payments, online account opening, digital wallets which require robust software infrastructure on the BFSI software market growth side. This drives investment in software that enables these services.

- To stay competitive (especially against fintech disruptors), traditional banks and insurance companies are forced to modernize their systems, deploy new platforms, integrate API-first modules, and offer digital-first products increasing demand for modern BFSI software market growth stacks.[23]

6. Growth of FinTech, Partnerships & Outsourcing Opportunities

- As fintech firms grow and collaborate or compete with traditional banks, there’s increased demand for modular, interoperable, cloud-native, scalable BFSI software that can integrate fintech services, APIs, payment rails, lending, digital wallets, etc.

- Banks and insurers are more willing to outsource components of their technology stack (e.g. fraud detection, core banking, mobile banking infrastructure) to specialized software vendors, driving BFSI software market growth.

7. Global Expansion Emerging Markets & Regional Digital Growth

- In regions undergoing rapid digital transformation (especially in Asia-Pacific, parts of Africa, Latin America), growing smartphone/internet penetration, financial inclusion efforts, and regulatory support for digital banking fuel demand for BFSI software market growth.[24]

- As emerging economies adopt digital payment systems and modern banking infrastructure, demand rises for scalable, cloud-based, flexible BFSI software suitable for high-volume, low-cost operations.

Enterprise Adoption Metrics & Cost / Efficiency Impact Statistics

Key Metrics & Cost-Efficiency Gains

- According to KPMG’s 2023/2024 “cost-transformation” survey of banks, about 82% of banks reported that achieving sustainable cost reductions remains challenging despite technology investments.[25]

- However, many banks expect 10% in cost efficiencies over the next 12 months, and 20–30% cost reduction over 3 years through digital & process transformations including software, automation, cloud, and operational streamlining.

- Adoption of cloud-based infrastructure and banking software (SaaS / cloud-native core banking) has enabled banks to reduce infrastructure and maintenance costs substantially: some studies show 20–30% reduction in total IT spending, and significant cuts in capital expenditure (CapEx) when moving away from on-premises hardware.

- In addition to cost savings, cloud/software adoption translated into operational efficiency improvements: e.g. faster new-product rollout, better scalability, and reduced manual workload.

Example Cost & Efficiency Impact Snapshot

| Impact Area | Reported Improvement |

|---|---|

| Bank cost reduction target (short-term) | ~10% over 12 months |

| Medium-term cost reduction potential | 20–30% over 3 years |

| IT / Infrastructure cost reduction via cloud/SaaS | ~20–30% (some institutions) |

| Time to launch new products/services (post-digital transformation) | Up to 50–80% faster depending on scale/scope [26] |

- It’s worth noting that while many banks aim for efficiency gains, only a minority according to some reports have been able to fully realize top-level cost reduction goals. E.g. One survey shows only 24% of banks have successfully met their cost-reduction targets.

- Cloud and software adoption also influences “cost-to-serve” (CTS) and “full-time equivalent (FTE) per customer” metrics: automation, digitization, and streamlined operations help banks handle more customers per staff member, reducing per-customer servicing cost.

Insight – Trade-off and Cultural/Operational Challenges

- According to KPMG, even with these initiatives, many banks face “deep cultural challenges” in embedding cost-reduction across the organization. Without proper governance, incentives, and accountability, cost-savings can be hard to sustain.

- That means software adoption alone isn’t a magic bullet; success depends on aligning organizational culture, processes, change management, and value streams front-to-back (retail, operations, compliance, risk, support).

Case Study Highlights with Numbers

While large-scale public case studies with full numbers are rare (due to confidentiality), some industry reports and analyses provide indicative results:

- A 2025 report on banking digital transformation and simplified onboarding: by building shared onboarding platforms (for consumer, commercial, and international banking), one institution achieved cost savings of 50–80% (depending on product/region) while simplifying customer interactions.

- For SaaS-based core banking software: according to the 2024 market data, the global SaaS-based core banking market was valued at USD 11.21 billion indicating significant enterprise-level adoption.[27]

- Reports on cloud adoption in BFSI software market growth indicate that many financial institutions have realized reduced infrastructure and maintenance costs by up to 20–30%, and improved scalability and operational efficiency especially relevant for banks with high transaction volumes or seasonal peaks.

- According to a 2025 industry overview, in modernized banks that adopted cloud and digital-first strategies, the shift helped them scale operations dynamically, improve risk-management capabilities (via better data / analytics), and respond faster to regulatory changes.

Market Share Distribution & Platform / Deployment Mix

From recent market research on global core banking & BFSI-software:

- In the SaaS-based core banking software market (2024), North America accounted for 44.07% share making it the regional leader.

- By deployment type globally (as of 2025), cloud-based (cloud / SaaS) solutions are growing faster: many institutions shifting from on-premise to cloud, driven by cost-efficiency, scalability, and flexibility.

- In the broader digital-transformation in BFSI software market growth: the market (global) is projected to grow from ~USD 93.04 billion in 2024 to ~USD 419.45 billion by 2034 (CAGR ~16.25%), indicating growing overall share of digital software, automation, cloud, analytics among banking expenditures.

Device / Platform / Deployment-Mode Usage Statistics

Because “device usage” (mobile app, web, cloud) data for entire banking enterprises tends to be private, publicly available data is limited; however:

- As per the global report referenced, by 2025 a large proportion of banks’ workloads and services are moving to cloud: hybrid cloud deployments or SaaS are becoming norm.

- The shift toward cloud/SaaS enables banks to support high-volume, multi-channel banking (mobile, online, API-based fintech integration) , a trend many markets are seeing.

What These Numbers Mean for the Future of BFSI Software Market Growth

The data clearly shows that BFSI software market growth is no longer a support toolit’s the backbone of modern financial transformation. With banks targeting 10–30% cost reductions, regions like North America capturing 44% market share in cloud banking, and global digital-BFSI spending expected to surge toward USD 400+ billion, the shift is undeniable. Institutions that modernize now gain agility, operational efficiency, and a competitive edge; those that delay risk higher costs, compliance pressure, and outdated customer experiences. In a market reshaped by cloud, automation, analytics, and AI, the winners will be the enterprises that embrace innovation early and strategically.

People Also Ask

The global BFSI software market growth market is valued in billions, with rapid growth driven by digital transformation, cloud adoption, and AI integration. It’s expected to reach over USD 400 billion by 2034, reflecting strong demand across banks and financial institutions.

North America leads with the highest adoption of cloud and SaaS-based banking solutions, followed by Europe and Asia-Pacific. Emerging markets are rapidly adopting digital platforms, mobile banking, and fintech integrations, contributing significantly to global growth.

Digital transformation boosts demand for modern banking solutions, including cloud-based core systems, automation, analytics, and AI-powered tools. Banks adopt these to enhance efficiency, customer experience, and regulatory compliance while reducing operational costs.

Major drivers include digitalization, cloud adoption, AI and automation, fraud detection, regulatory compliance, customer-centric services, fintech partnerships, and expansion in emerging markets. Together, these factors push BFSI institutions to invest in modern software solutions.

Banks adopting cloud, automation, and SaaS-based solutions report 10–30% cost reduction over 1–3 years. Operational efficiency improves, including faster product launches, optimized staffing, and reduced infrastructure maintenance.

AI and automation streamline operations, improve fraud detection, enable predictive analytics, enhance customer support, and reduce manual workload. These technologies help banks make faster, data-driven decisions while cutting costs and risks.

Cloud adoption enables scalability, flexibility, and cost savings. It allows banks to deploy new products quickly, handle large transaction volumes, integrate fintech services, and modernize legacy systems for better efficiency and security.

Rapid growth is seen in cloud-based core banking, digital transformation platforms, and robotic process automation (RPA). These segments deliver efficiency, agility, and improved customer experience, attracting both traditional banks and fintech players.

Modern BFSI software market growth enables 24/7 mobile banking, instant payments, real-time account management, and personalized services. Automation and analytics allow faster onboarding, efficient query resolution, and seamless omnichannel interactions for end-users.

Investing in modern BFSI software market growth ensures operational efficiency, cost savings, regulatory compliance, and digital readiness. Early adoption gives competitive advantage, supports scalability, and prepares institutions for evolving customer demands and emerging technologies.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.