Key Takeaways

- APR in decentralized exchanges measures the annualized return on deposited assets without factoring in compound interest, making it essential for comparing yield opportunities across DeFi platforms.

- Liquidity pool APR derives primarily from trading fees collected by the protocol and distributed proportionally to liquidity providers based on their share of the pool.

- Smart contracts automate APR calculations and reward distributions, ensuring transparent, trustless, and real-time yield tracking for all participants.

- The distinction between APR and APY is critical for DeFi users since APY accounts for compounding effects that can significantly increase actual returns.

- High APR figures often indicate unsustainable token emission models that may lead to inflationary pressure and diminishing real returns over time.

- Trading volume and total value locked directly influence APR fluctuations, meaning yields can change significantly based on market activity.

- Yield farming strategies can stack multiple APR sources by deploying LP tokens across various protocols, though this introduces additional smart contract risk.

- Evaluating sustainable APR requires analyzing tokenomics, protocol revenue sources, historical performance, and long-term incentive structures rather than focusing solely on headline numbers.

The decentralized finance ecosystem has transformed how people interact with financial services, offering alternatives to traditional banking through blockchain technology and smart contracts. At the heart of this transformation lies a critical metric that every DeFi participant must understand: the Annual Percentage Rate, commonly known as APR. Whether you are exploring liquidity provision, yield farming, or staking opportunities on decentralized exchanges, understanding how APR works in DEX environments will help you make informed decisions and optimize your crypto portfolio returns.

Understanding APR in Decentralized Exchanges

Decentralized exchanges operate fundamentally differently from their centralized counterparts, relying on automated market makers and liquidity pools rather than traditional order books. This architectural difference creates unique opportunities for users to earn passive income by contributing liquidity to these platforms. APR in decentralized exchanges serves as the primary benchmark for measuring these earning opportunities, allowing participants to evaluate and compare potential returns across different pools, protocols, and strategies.

The significance of understanding APR extends beyond simple profit calculations. It encompasses risk assessment, opportunity cost analysis, and strategic portfolio allocation. When you provide liquidity to a platform built for automated token trading, the APR figure represents your expected compensation for taking on various risks including impermanent loss, smart contract vulnerabilities, and market volatility.

What Is APR in DeFi Platforms

APR in DeFi platforms functions as a standardized measurement tool that expresses potential earnings as an annual percentage of your initial investment. Unlike traditional finance where APR typically applies to loans and credit products, the DeFi world has adapted this metric to represent yield opportunities for lenders, liquidity providers, and stakers. The DeFi APR meaning encompasses all forms of rewards distributed by protocols, including trading fees, governance token incentives, and protocol-native rewards.

The transparency inherent in blockchain technology means that APR calculations in DeFi are often verifiable directly on-chain. Users can audit smart contracts to understand exactly how rewards are computed and distributed, creating a level of financial transparency unavailable in traditional markets. This openness has helped establish trust in decentralized protocols while also exposing any manipulation attempts or unsustainable reward structures.

Definition of Annual Percentage Rate in Crypto

The Annual Percentage Rate in crypto represents the simple interest rate earned on deposited assets over a one-year period without accounting for compounding effects. When a DEX displays 50% APR for a liquidity pool, it indicates that depositors can expect to earn rewards equivalent to half their initial investment over twelve months, assuming rates remain constant and no compounding occurs. This definition mirrors traditional finance APR calculations but applies to the unique context of blockchain-based financial instruments.

Mathematically, APR calculations in crypto typically follow this formula: APR equals the total rewards distributed divided by total value deposited, multiplied by the time factor to annualize the result. For daily calculations, protocols multiply the daily rate by 365; for weekly snapshots, they multiply by 52. The simplicity of this calculation makes it accessible for users to verify independently using on-chain data.

| Calculation Method | Time Period | Formula | Best For |

|---|---|---|---|

| Daily Rate Annualized | 24 Hours | Daily Rate × 365 | High-frequency trading pools |

| Weekly Rate Annualized | 7 Days | Weekly Rate × 52 | Stable pools with moderate volume |

| Monthly Rate Annualized | 30 Days | Monthly Rate × 12 | Long-term liquidity positions |

| Epoch-Based | Protocol Defined | Epoch Rate × Epochs Per Year | Governance token distributions |

Why APR Matters in Decentralized Exchanges

APR serves as the universal language for comparing yield opportunities across the fragmented DeFi landscape. With thousands of pools across dozens of protocols, users need a standardized metric to evaluate where their capital can work most effectively. The crypto exchange APR becomes particularly important when considering opportunity costs, as capital deployed in one pool cannot simultaneously earn in another.

Beyond comparison, APR matters because it directly impacts the economic sustainability of decentralized exchanges themselves. Protocols must balance attractive APR rates to incentivize liquidity provision against the long-term health of their token economics. Unsustainable APR leads to rapid inflation, token dumping, and eventual protocol failure. Understanding this dynamic helps users identify which protocols are building for longevity versus which are optimizing for short-term attention.

Industry Insight: Sustainable APR models typically range between 5% and 30% for established trading pairs, while rates exceeding 100% often indicate promotional periods or inflated token emissions that will likely decrease over time.

How APR Works in Decentralized Exchange Ecosystems

Understanding how APR works in DEX requires examining the complete lifecycle of value creation and distribution within these platforms. Unlike centralized exchanges where market makers earn through bid-ask spreads, decentralized exchanges distribute value through algorithmic mechanisms encoded in smart contracts. This fundamental shift creates new opportunities and challenges for participants seeking to maximize their returns.

The mechanics of how APR works in DEX environments involve multiple interacting components including liquidity pools, trading fees, reward emissions, and governance mechanisms. Each component contributes differently to the overall APR that users see displayed on protocol interfaces, and understanding these contributions helps users make more informed decisions about where to allocate their assets.

APR Calculation in DEX Platforms

DEX APR explained at its core involves tracking all value flowing to liquidity providers and expressing it as an annualized percentage. Most platforms calculate APR by monitoring trading fees accumulated over a period, adding any protocol token incentives, and then projecting these earnings across a full year. The resulting figure represents the expected return assuming current conditions persist, which they rarely do in the dynamic crypto markets.

Sophisticated platforms employ multiple APR metrics to provide clearer pictures. Base APR reflects earnings from trading fees alone, representing the organic demand for liquidity in that pool. Rewards APR captures additional token incentives distributed by the protocol. Combined APR sums these components to show total expected returns. This breakdown helps users understand what portion of their earnings depends on sustainable fee generation versus potentially inflationary token emissions.

Trading Fees and APR Distribution

Trading fees form the foundation of sustainable APR in DeFi platforms. When traders execute swaps through a liquidity pool, they pay a small percentage fee, typically ranging from 0.01% to 1% depending on the pool type and asset volatility. These fees accumulate in the pool and are distributed proportionally to liquidity providers based on their share of total liquidity. The more actively traded a pool becomes, the higher the fee-based APR climbs.

Distribution mechanisms vary across protocols. Some platforms automatically add fees to the liquidity pool, increasing the value of LP tokens without requiring any user action. Others accumulate fees in separate reward contracts that users must claim periodically. Understanding these mechanics matters because automatic reinvestment creates a compounding effect that simple APR figures do not capture, while separate claiming introduces gas costs that reduce net returns.

Liquidity Pool APR Mechanism

The liquidity pool APR mechanism operates through continuous calculation of trading activity relative to pool size. Smart contracts track every swap executed against the pool, calculate the applicable fee, and update the pool’s reserves accordingly. Liquidity providers earn proportionally to their share of pool tokens held, meaning larger positions earn more absolute rewards but the same percentage return as smaller positions.

Pool composition significantly affects APR dynamics. Pools containing volatile asset pairs typically offer higher APR because arbitrage opportunities create more trading volume, but they also expose providers to greater impermanent loss risk. Stable asset pools like stablecoin pairs generate lower APR but provide more predictable returns with minimal impermanent loss. Choosing between these options requires balancing yield expectations against risk tolerance, a key consideration when exploring various protocols powering automated market making.

Role of Smart Contracts in APR Rewards

Smart contracts serve as the trustless arbiters of APR reward distribution in decentralized exchanges. These self-executing programs encode the exact rules for calculating, accumulating, and distributing rewards without requiring human intervention. Every parameter affecting APR is defined in code, including fee percentages, emission schedules, allocation algorithms, and claiming mechanisms. This transparency allows users to audit exactly how their earnings are determined.

The immutable nature of deployed smart contracts provides both security and challenges. Once live, core APR parameters cannot be arbitrarily changed, protecting users from sudden adverse modifications. However, this immutability also means bugs or inefficiencies become permanent unless the protocol implements upgrade mechanisms. Modern DEX platforms increasingly adopt upgradeable proxy patterns that allow parameter adjustments through governance while maintaining core security guarantees.

APR Reward Distribution Lifecycle

| Stage | Process | Smart Contract Action | User Impact |

|---|---|---|---|

| 1 | Liquidity Deposit | Receives tokens, mints LP tokens, records share | Assets locked, earning begins |

| 2 | Trading Activity | Executes swaps, collects fees, updates reserves | Pool value increases with fees |

| 3 | Reward Emission | Releases tokens per block or epoch schedule | Additional incentives accumulate |

| 4 | APR Calculation | Computes fees plus rewards divided by TVL | Displayed rate updates dynamically |

| 5 | Reward Claiming | Transfers accumulated rewards to user wallet | Realized gains received |

| 6 | Withdrawal | Burns LP tokens, returns proportional assets | Principal plus earnings retrieved |

APR vs APY in DeFi Exchanges

One of the most common sources of confusion in decentralized finance involves the distinction between APR vs APY in DeFi platforms. Both metrics express returns as annual percentages, yet they represent fundamentally different earning scenarios that can result in substantially different actual returns. Misunderstanding this difference leads many users to make suboptimal decisions based on inflated expectations.

The crypto industry has not standardized which metric to display, meaning users must carefully read platform documentation to understand what figures represent. Some protocols display both metrics side by side, while others show only APY to make their rates appear more attractive. This inconsistency makes cross-platform comparisons challenging and underscores the importance of understanding both measurements thoroughly.

Key Differences Between APR and APY

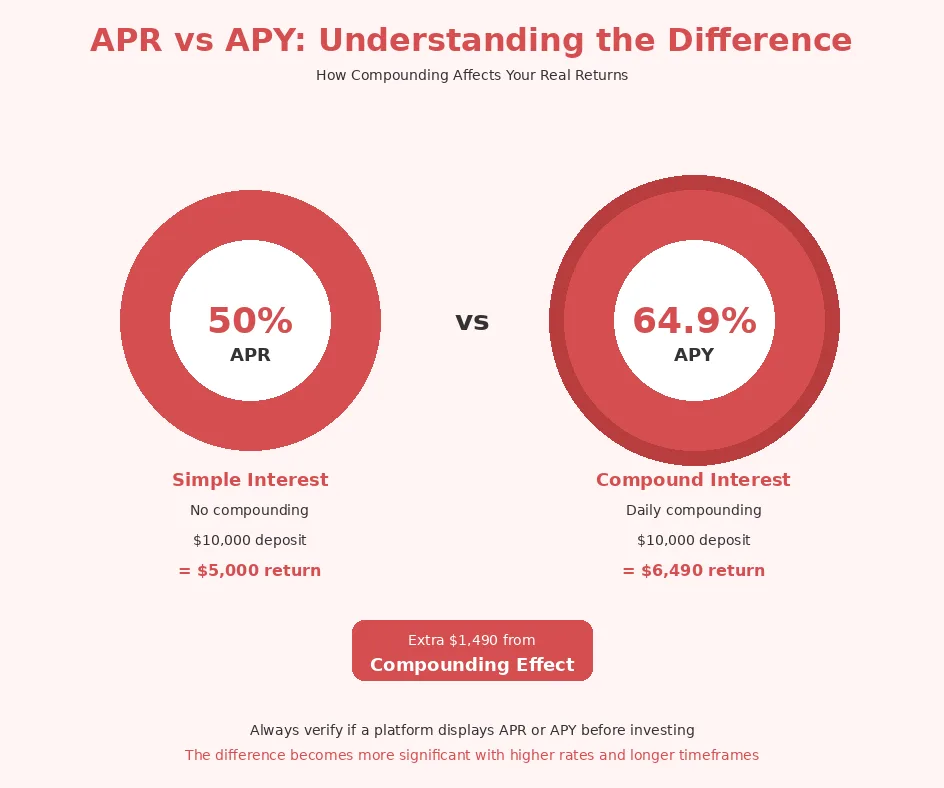

The fundamental difference between APR and APY centers on compounding treatment. APR assumes simple interest where earnings are not reinvested, while APY incorporates compound interest where earnings themselves generate additional returns. For the same underlying rate, APY will always equal or exceed APR, with the gap widening as compounding frequency increases.

Consider a 50% APR with daily compounding: the resulting APY equals approximately 64.9%. This 15 percentage point difference becomes significant for larger investments over longer time horizons. When evaluating yield opportunities, users must ensure they compare like with like, either APR to APR or APY to APY, to make meaningful assessments.

Simple Interest vs Compound Interest in DeFi

Simple interest calculations in DeFi assume rewards are claimed and not reinvested into the earning position. If you deposit $10,000 at 50% APR, simple interest provides $5,000 in rewards over one year regardless of when you claim. The principal remains constant throughout the earning period, and rewards accumulate linearly based on initial deposit size.

Compound interest changes this dynamic significantly. Using the same example with daily compounding at 50% APR converts to 64.9% APY, meaning $6,490 in annual returns rather than $5,000. This extra $1,490 comes from reinvesting daily earnings back into the principal, allowing those earnings to generate their own returns. The magic of compounding makes auto-compounding protocols particularly attractive for long-term positions, something worth considering when researching how annual yields function in automated markets.

| Characteristic | APR (Annual Percentage Rate) | APY (Annual Percentage Yield) |

|---|---|---|

| Interest Type | Simple interest only | Compound interest included |

| Compounding Effect | Not considered | Fully reflected |

| 50% Rate Example | Returns $5,000 on $10,000 | Returns up to $6,490 with daily compounding |

| Display Value | Always lower or equal | Always higher or equal |

| Best For Comparison | When rewards are claimed regularly | When rewards are auto-compounded |

| User Action Required | Manual reinvestment for compounding | Automatic if protocol supports |

Which Metric Is Better for DEX Users

Neither metric is inherently better; rather, the appropriate choice depends on your intended strategy and the protocol mechanics. For positions where you plan to claim and sell rewards regularly, APR provides a more accurate projection of expected earnings. For long-term positions in protocols with auto-compounding features, APY better reflects actual returns.

Practical considerations also influence which metric matters more. High gas costs on networks like Ethereum can make frequent manual compounding economically unfeasible, effectively converting any APY projection back to APR reality. Layer 2 solutions and alternative blockchains with lower transaction costs make compounding more practical, allowing users to capture returns closer to advertised APY figures.

Role of APR for Liquidity Providers in DEX

Liquidity providers form the backbone of decentralized exchange functionality, supplying the assets that enable seamless token swaps without counterparty matching. In exchange for accepting the risks inherent in liquidity provision, including impermanent loss and smart contract exposure, providers earn APR through multiple reward mechanisms. Understanding these mechanisms helps providers optimize their strategies and manage expectations appropriately.

The role of APR extends beyond simple compensation calculation. It serves as a market signal indicating demand for liquidity in specific trading pairs. Higher APR typically reflects either increased trading activity generating more fees or protocol incentives attempting to attract liquidity to underserved pools. Savvy providers use APR signals to identify opportunities before they become crowded and yields compress.

Liquidity Pool APR Explained

Liquidity pool APR, explained in straightforward terms, represents the annualized return earned by depositing token pairs into automated market maker pools. When you provide liquidity, you receive LP tokens representing your proportional share of the pool. Your APR derives from trading fees charged on every swap executed against that pool, distributed according to your ownership percentage.

The composition of liquidity pool APR varies significantly across different pool types. Constant product market makers like Uniswap v2 charge uniform fees across all trades, while concentrated liquidity protocols like Uniswap v3 allow providers to earn higher APR by focusing liquidity within specific price ranges. Stable swap pools using different algorithms often feature lower base fees but higher efficiency, resulting in competitive APR despite smaller per-trade earnings.

APR for Liquidity Providers

APR for liquidity providers comprises two primary components: fee-based earnings and incentive rewards. Fee earnings represent the most sustainable form of APR since they derive directly from protocol utility and user demand. When traders actively swap tokens through your liquidity, the fees they pay flow to your position proportionally. This creates a positive correlation between protocol adoption and provider returns.

Incentive rewards supplement fee earnings through token distributions designed to attract and retain liquidity. New protocols frequently offer elevated incentive APR to bootstrap initial liquidity, gradually reducing emissions as organic fee generation grows. Established protocols may target incentives toward strategic pairs that need additional depth or toward long-term stakers through boosted rewards programs.

Token Incentives and Reward APR

Token incentives and reward APR represent the variable component of liquidity provider earnings that protocols control directly. By distributing governance tokens or native platform tokens to liquidity providers, protocols can dramatically increase displayed APR figures and attract capital. These incentives typically follow predetermined emission schedules that decrease over time as protocols mature.

The sustainability of token incentive APR depends heavily on underlying tokenomics. Protocols with reasonable emission schedules tied to revenue sharing or buyback mechanisms can maintain incentive programs indefinitely. Those relying purely on inflation eventually face token price deterioration that erodes real APR value even as nominal figures remain high. Evaluating incentive sustainability requires analyzing emission schedules, token utility, and protocol revenue models.

Risk Assessment: When evaluating high APR opportunities, calculate the token emission rate required to maintain advertised yields. If a protocol must mint tokens worth more than its trading fee revenue to sustain APR, the model likely depends on continuous new capital inflow to remain solvent.

Impact of APR on Liquidity Depth

APR directly influences liquidity depth through market-driven capital allocation. Higher APR pools attract more providers seeking better returns, increasing total liquidity available for trading. This depth improvement benefits traders through reduced slippage and better execution prices, creating a positive feedback loop where improved trading experience drives more volume, generating additional fees that support the elevated APR.

The relationship works bidirectionally as well. When APR decreases due to reduced trading activity or increased competition among providers, capital may migrate to higher-yielding opportunities elsewhere. This liquidity exodus can trigger cascading effects where reduced depth leads to worse trade execution, driving traders away and further compressing the fee generation that determines APR. Managing this dynamic represents a key challenge for protocol designers.

APR in Yield Farming and Staking on DEX

Beyond basic liquidity provision, decentralized exchanges offer additional yield opportunities through farming and staking mechanisms. Yield APR in decentralized exchanges reaches its highest levels in these advanced strategies that stack multiple earning layers. Understanding how these mechanisms work and their associated risks enables users to pursue enhanced returns while maintaining appropriate risk management.

The distinction between farming and staking often blurs in DeFi contexts, but generally farming involves deploying LP tokens to earn additional rewards while staking involves locking single assets for protocol benefits. Both strategies amplify APR potential but introduce additional complexity and risk layers that basic liquidity provision avoids.

Yield Farming APR in Decentralized Exchanges

Yield farming APR in decentralized exchanges represents the combined returns from providing liquidity and then deploying those LP tokens in farming contracts for additional rewards. This two-step process multiplies earning potential but also multiplies risk exposure. Your base liquidity position earns trading fees while your staked LP tokens earn farming rewards, with total APR summing both components.

Advanced yield farming strategies may involve multiple layers of composition where farming rewards themselves get deployed into other protocols, creating recursive yield structures. While these approaches can generate impressive headline APR figures, they also compound smart contract risk exponentially. Each additional protocol in the chain represents another potential point of failure that could result in total loss of deposited funds.

Farming Rewards and Token Emissions

Farming rewards typically derive from protocol token emissions allocated to incentivize specific behaviors. Protocols mint new tokens according to predetermined schedules and distribute them to farmers based on their share of staked LP tokens. The emission rate, token price, and total stake determine the resulting APR. Higher emissions increase nominal APR but create selling pressure that can depress token prices.

Sustainable farming models tie emission rates to protocol revenue or implement token burns that offset inflation. The best protocols generate sufficient fee revenue to buy back and burn emitted tokens, creating balanced tokenomics where farming incentives do not permanently dilute existing holders. Evaluating this balance requires analyzing protocol documentation, treasury management, and historical emission patterns.

DEX Staking APR Models

DEX staking APR models vary significantly across protocols, each offering different risk-reward profiles. Single-asset staking allows users to lock platform tokens without impermanent loss risk while earning protocol-distributed rewards. These models often include governance rights alongside financial returns, creating utility value beyond pure yield.

Protocol revenue sharing represents the most sustainable staking model where stakers receive a portion of trading fees generated by the platform. This model aligns staker interests with protocol success and provides returns that scale with adoption rather than relying on token inflation. The launch of new trading platforms and token launch mechanisms integrated with exchanges has expanded staking opportunities across the ecosystem.

Locked vs Flexible Staking APR

Locked staking typically offers higher APR in exchange for committing assets for fixed periods ranging from weeks to years. This commitment provides protocols with predictable liquidity while demonstrating staker conviction. Lock periods often come with boost multipliers that can double or triple base APR for the longest commitments.

Flexible staking sacrifices some APR potential for liquidity optionality. Users can withdraw at any time without penalty but earn lower base rates. This model suits users who value liquidity access over maximum yields or who anticipate needing their capital for other opportunities. Many protocols offer both options, allowing users to balance their portfolios according to individual preferences.

| Feature | Locked Staking | Flexible Staking |

|---|---|---|

| APR Range | Higher (often 2-4x base rate) | Lower (base rate only) |

| Withdrawal | Fixed period or penalty for early exit | Anytime without penalty |

| Risk Profile | Higher due to illiquidity | Lower with exit flexibility |

| Best For | Long-term holders with conviction | Active traders needing liquidity |

| Governance Power | Often boosted voting rights | Standard or reduced voting |

Factors Affecting APR in Decentralized Exchanges

APR in decentralized exchanges fluctuates constantly based on numerous interacting factors. Understanding these drivers helps users anticipate changes, identify opportunities, and avoid being surprised by sudden yield compression. The dynamic nature of DeFi means static APR expectations rarely match reality, making ongoing monitoring and strategy adjustment essential for optimizing returns.

The factors affecting APR range from macro market conditions to protocol-specific mechanics. External forces like overall crypto market sentiment and regulatory news impact trading volumes across all platforms, while internal factors like governance decisions and emission schedules create protocol-specific effects. Successful DeFi participants develop frameworks for analyzing both categories when evaluating opportunities.

Market Volatility and APR Fluctuations

Market volatility drives APR fluctuations through multiple mechanisms. High volatility periods typically generate increased trading activity as traders seek to capitalize on price movements, arbitrage opportunities expand, and rebalancing needs intensify. This surge in volume translates directly to higher fee generation and elevated APR for liquidity providers positioned in active pools.

However, volatility also increases impermanent loss exposure, potentially offsetting APR gains for providers in volatile pairs. The relationship between volatility and net returns is nuanced: moderate volatility tends to benefit providers through increased activity without excessive impermanent loss, while extreme volatility can result in net losses despite high nominal APR. Understanding this balance helps providers select appropriate pools for different market conditions.

Trading Volume and Liquidity Pool Size

The ratio between trading volume and liquidity pool size fundamentally determines fee-based APR. A pool processing $10 million in daily volume with $100 million in liquidity generates 10% utilization, while the same volume against $1 billion in liquidity yields only 1% utilization. Higher utilization rates translate directly to higher APR for providers, assuming fee percentages remain constant.

This dynamic creates interesting strategic considerations. Smaller pools with moderate volume can offer higher APR than larger pools with proportionally similar activity. However, smaller pools also present higher slippage for traders, potentially limiting volume growth. The equilibrium point where volume and liquidity balance creates sustainable APR varies by asset pair and market conditions.

Token Supply, Demand, and Incentives

Token supply dynamics directly impact the real value of incentive-based APR. Even when nominal emission rates remain constant, changes in token price alter the actual dollar-denominated returns providers receive. Rapid token supply growth through aggressive emissions can suppress prices, while limited supply with strong demand supports token values and maintains attractive real APR.

Demand factors include token utility, governance value, and speculation. Tokens with genuine utility like fee discounts, governance power, or access rights maintain demand that supports prices despite emission pressure. Pure speculative demand proves unreliable long-term, making utility-driven tokenomics essential for sustainable APR models.

APR Model Selection Criteria

When evaluating different APR opportunities across decentralized exchanges, consider these essential factors:

- Source Composition: Prioritize pools where 50% or more of APR derives from trading fees rather than token emissions

- Historical Stability: Review APR trends over 30-90 days to identify patterns and sustainability indicators

- Emission Schedule: Understand when incentive rates will decrease and plan positions accordingly

- Lock Requirements: Ensure any time commitments align with your liquidity needs and market outlook

- Protocol Maturity: Established protocols with audited contracts present lower smart contract risk

- Exit Liquidity: Verify sufficient trading volume exists to exit positions without significant slippage

Risks Associated With High APR in DeFi Platforms

High APR opportunities in DeFi platforms often come with proportionally elevated risks that users must carefully evaluate. The adage that higher returns require higher risk holds particularly true in decentralized finance, where the absence of regulatory protections and deposit insurance means users bear full responsibility for their investment decisions. Understanding these risks enables informed participation rather than blind yield chasing.

The risk categories span technical, economic, and operational dimensions. Smart contract vulnerabilities can result in total fund loss through exploits, while economic risks like impermanent loss and token devaluation erode returns gradually. Operational risks including governance attacks and protocol mismanagement add additional layers of uncertainty that headline APR figures fail to capture.

Unsustainable APR in Decentralized Exchanges

Unsustainable APR in decentralized exchanges represents one of the most common pitfalls for DeFi participants. Protocols offering triple-digit or even quadruple-digit APR almost universally rely on mechanisms that cannot persist indefinitely. Recognizing the signs of unsustainability helps users capture elevated yields during promotional periods while avoiding positions that may collapse dramatically.

The sustainability question centers on where yield originates. Yield can come from genuine economic activity like trading fees, from token emissions that dilute existing holders, or from new user deposits in Ponzi-like structures. Only the first source represents truly sustainable APR; the others eventually exhaust available value and collapse, often rapidly and without warning.

Inflationary Token Rewards

Inflationary token rewards create a mathematical inevitability where yield-bearing positions eventually become worthless in real terms. When protocols print tokens to pay APR, each new token dilutes existing supply. If annual emissions equal 100% of circulating supply, token price must decline correspondingly to maintain market cap equilibrium, meaning 100% APR in rapidly inflating tokens may yield zero or negative real returns.

Identifying inflationary dynamics requires examining tokenomics documentation, emission schedules, and circulating supply growth rates. Protocols transparently publishing this information allow users to calculate inflation-adjusted returns. Those obscuring tokenomics data should trigger immediate caution, as the most aggressively inflationary models often hide their mechanics behind complexity or incomplete disclosure.

Short-Term Yield Traps

Short-term yield traps lure users with exceptionally high initial APR that disappears shortly after deposits enter. Some protocols intentionally structure incentives to attract liquidity with unsustainable rates, then dramatically reduce rewards once sufficient TVL accumulates. Users entering late or failing to monitor rate changes find themselves locked into positions earning far less than expected.

Avoiding yield traps requires ongoing vigilance and clear exit criteria. Setting personal thresholds for acceptable APR and exiting positions when rates fall below targets protects against gradual deterioration. Monitoring protocol announcements and governance proposals for upcoming emission changes provides early warning for planned reductions.

Critical Warning: Never invest more than you can afford to lose completely in any DeFi protocol. Smart contract exploits, rug pulls, and protocol failures have resulted in billions of dollars in user losses across the industry. Diversification across protocols and chains provides the best protection against catastrophic single-point failures.

Smart Contract and Protocol Risks

Smart contract risks represent the technical foundation of DeFi danger. Even well-intentioned protocols with sustainable economics can suffer catastrophic losses through code vulnerabilities that hackers exploit. Billions of dollars have been drained from DeFi protocols through flash loan attacks, reentrancy exploits, and logic errors that audits failed to catch. No amount of APR compensates for losing your entire principal to an exploit.

Protocol risks extend beyond pure code vulnerabilities to include governance manipulation, admin key compromises, and economic attacks. Protocols with centralized control points create single points of failure that bad actors can target. Truly decentralized protocols distribute these risks but may sacrifice efficiency and adaptability. Evaluating the tradeoffs between centralization and security represents a crucial due diligence component.

How to Evaluate Sustainable APR in DEX Platforms

Evaluating sustainable APR requires looking beyond headline numbers to understand the underlying mechanics driving returns. This analysis involves examining protocol revenue sources, tokenomics design, historical performance, and competitive positioning. Developing a systematic evaluation framework helps users identify genuinely attractive opportunities while filtering out unsustainable schemes.

The evaluation process should consider both quantitative metrics and qualitative factors. Numbers like TVL growth, trading volume trends, and emission schedules provide objective data points. Qualitative factors like team reputation, audit history, community engagement, and roadmap execution add context that numbers alone cannot capture.

Identifying Healthy APR Models

Healthy APR models share common characteristics that distinguish them from unsustainable alternatives. They generate meaningful revenue from genuine protocol usage rather than relying primarily on token emissions. Their emission schedules decline gradually rather than dropping precipitously. They maintain transparent accounting that allows users to verify yield sources and project future returns accurately.

The healthiest models often feature lower nominal APR than aggressive competitors but deliver superior risk-adjusted returns over time. A protocol offering steady 15% APR from trading fees will likely outperform one promising 500% APR from inflationary emissions when measured over a full market cycle. Patience and disciplined evaluation reward users who resist the temptation of unsustainable yields.

Long-Term Liquidity Incentives

Long-term liquidity incentives demonstrate protocol commitment to sustainable growth over short-term TVL metrics. Programs spanning multiple years with gradually declining emissions indicate thoughtful tokenomics designed for longevity. These structures attract committed liquidity providers seeking reliable returns rather than mercenary capital chasing promotional rates.

Evaluating long-term incentive programs requires examining emission schedules, vesting requirements, and adjustment mechanisms. The best programs include governance controls allowing community input on incentive allocation while preventing sudden unilateral changes that could harm existing participants. Building effective crypto exchanges requires balancing user incentives with sustainable economics.

Transparent APR Calculations

Transparent APR calculations allow users to independently verify displayed rates and understand exactly how their returns are determined. The best protocols publish detailed documentation explaining APR computation methods, data sources, and update frequencies. This transparency enables users to spot errors, understand fluctuations, and make informed decisions based on accurate information.

Red flags include opaque calculation methods, inconsistent displayed rates across different interfaces, and APR figures that cannot be reconciled with on-chain data. Protocols hiding their calculation methodology may be inflating numbers through favorable assumptions or outright misrepresentation. When documentation proves insufficient, direct smart contract analysis reveals the ground truth of reward distribution mechanics.

Best Practices for DeFi Users

Successful DeFi participation requires developing and following best practices that manage risk while capturing yield opportunities. These practices span technical security measures, portfolio management strategies, and ongoing education commitments. Treating DeFi involvement as a discipline rather than a gambling opportunity dramatically improves long-term outcomes.

Start with security fundamentals: use hardware wallets, verify contract addresses before approving transactions, and limit approvals to necessary amounts. Diversify across protocols, chains, and asset types to prevent any single failure from devastating your portfolio. Stay informed about protocol developments, security incidents, and market conditions that could impact your positions. Continuous learning and adaptation characterize successful DeFi participants across market cycles.

| Practice Area | Recommended Action | Risk Mitigated |

|---|---|---|

| Security | Use hardware wallets and verify all transactions | Phishing and wallet compromise |

| Due Diligence | Research protocols thoroughly before depositing | Rug pulls and scam protocols |

| Diversification | Spread capital across multiple protocols | Single point of failure |

| Monitoring | Track positions and APR changes regularly | Yield deterioration |

| Exit Planning | Define exit criteria before entering positions | Emotional decision-making |

Future of APR in Decentralized Exchanges

The future of APR in decentralized exchanges points toward increased sophistication, sustainability, and integration with broader financial systems. As the DeFi industry matures beyond its speculative roots, APR models are evolving to prioritize long-term viability over short-term attention capture. This maturation benefits users through more predictable, sustainable yield opportunities.

Technological innovations including layer 2 scaling, cross-chain interoperability, and advanced AMM designs continue reshaping how APR is generated and distributed. These improvements promise higher capital efficiency, reduced transaction costs, and more responsive reward mechanisms that better align protocol incentives with user interests.

Evolving Reward Models in DeFi

Reward models in DeFi are evolving away from simple token emissions toward more sophisticated mechanisms that better align incentives. Vote-escrowed models that require long-term token locking for maximum rewards have gained popularity, reducing mercenary liquidity and creating more stable protocol communities. Real yield models distributing actual protocol revenue rather than inflationary tokens represent another maturation step.

Future innovations may include dynamic APR adjustment based on market conditions, personalized reward optimization through AI analysis, and cross-protocol yield coordination that maximizes returns across the DeFi ecosystem. These advancements will make APR comparison more complex but ultimately more rewarding for users willing to engage with sophisticated strategies.

APR Optimization in Next-Gen DEX Platforms

Next-generation DEX platforms are implementing APR optimization features that automate what previously required manual intervention. Auto-compounding vaults automatically reinvest rewards to capture compound interest effects, converting displayed APR closer to actual APY returns. Yield aggregators scan multiple protocols to identify and execute optimal strategies, democratizing access to sophisticated yield optimization.

Concentrated liquidity innovations allow providers to earn higher APR by focusing capital within active price ranges rather than spreading thin across entire price spectrums. While these mechanisms require more active management, they enable experienced users to dramatically outperform passive strategies. The gap between optimized and unoptimized APR continues widening as protocols develop more sophisticated reward mechanisms.

Conclusion

Understanding APR in decentralized exchanges empowers participants to navigate the DeFi landscape with confidence and clarity. From basic definitions of Annual Percentage Rate in crypto through advanced evaluation frameworks for sustainable yields, this knowledge forms the foundation for successful liquidity provision, yield farming, and staking strategies. The distinction between APR and APY, the factors driving yield fluctuations, and the risks associated with high-APR opportunities all contribute to informed decision-making.

The DeFi ecosystem continues evolving rapidly, introducing new APR models and optimization opportunities alongside novel risks. Staying informed about these changes, maintaining strong security practices, and developing systematic evaluation frameworks will serve you well as the industry matures. Whether you seek modest, sustainable returns or pursue more aggressive yield strategies, understanding how APR works in DEX environments provides the critical context needed to achieve your financial objectives while managing downside risks appropriately.

As decentralized finance grows toward mainstream adoption, the role of APR as the universal yield metric will only become more significant. Users who develop deep understanding of these mechanics today position themselves advantageously for tomorrow’s opportunities. The journey from APR novice to informed participant requires ongoing learning and adaptation, but the rewards of financial sovereignty and optimized returns justify the investment.

Frequently Asked Questions

APR in decentralized exchanges refers to the Annual Percentage Rate, which represents the yearly return on your deposited or staked assets without accounting for compounding effects. In the context of DEX platforms, APR indicates what percentage of your initial investment you can expect to earn over a year through trading fees, liquidity rewards, or staking incentives. This metric helps users compare potential earnings across different liquidity pools and DeFi protocols.

APR calculation in DEX platforms typically involves dividing the total rewards distributed over a period by the total value locked in a pool, then annualizing the result. For liquidity pools, this includes trading fees collected and distributed to liquidity providers, plus any additional token incentives offered by the protocol. The formula generally multiplies daily or weekly returns by 365 or 52 respectively to project annual earnings.

The primary difference between APR and APY in DeFi lies in how they treat compounding. APR represents simple interest without reinvestment of earnings, while APY (Annual Percentage Yield) includes the effect of compound interest where earned rewards are automatically reinvested. APY will always be equal to or higher than APR because it accounts for earnings on your earnings, making it crucial for DeFi users to understand which metric a platform displays.

Extremely high APR figures on DEX platforms often result from newly launched pools with heavy token emission incentives designed to attract initial liquidity. These inflated rates are typically unsustainable because they rely on continuous token minting, which creates inflation and can dilute the value of rewards over time. Users should approach triple-digit APR figures with caution, as they frequently indicate either short-term promotional rates or potentially risky protocols.

Higher APR is not always better for liquidity providers because elevated rates often come with increased risks including impermanent loss, smart contract vulnerabilities, and token devaluation. A sustainable APR that remains consistent over time typically offers better long-term returns than volatile high-APR opportunities that may collapse quickly. Experienced liquidity providers often prioritize protocol security, token stability, and realistic yield expectations over headline APR numbers.

Trading volume directly impacts APR in liquidity pools because higher transaction activity generates more trading fees distributed among liquidity providers. When a pool experiences substantial trading volume relative to its total liquidity, each provider receives a larger share of fees, boosting APR. Conversely, pools with low trading activity or excessive liquidity may dilute fee earnings, resulting in lower APR for individual providers.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.