Cryptocurrency has rapidly grown from a niche concept into a major component of global finance. The idea of owning digital assets, trading tokens, or participating in decentralized finance (DeFi) can feel exciting but for beginners, it can also be overwhelming. Terms like “private keys,” “blockchain,” “wallet security,” and “transaction fees” can feel like a foreign language. One small mistake can have costly consequences, which is why many new investors hesitate to start.

Enter digital wallets, a solution designed to simplify crypto for beginners. By managing the technical aspects for you, custodial wallets make it easy to store, trade, and grow your digital assets safely. Imagine a trusted bank for your crypto, but with faster transactions, mobile access, and integrated trading features.

In this article, we will explore:

- What custodial wallets are and how they work

- Why beginners prefer them

- Benefits, risks, and best practices

- Real-world use cases and emerging trends

- Professional guidance for a smoother crypto journey

- FAQs to answer common beginner questions

By the end, you’ll understand why these wallets are a great starting point for anyone entering the world of crypto.

What Custodial Wallets Really Are and How They Work

A custodial wallet is a type of centralized wallet where a trusted provider manages your private keys. This means the wallet provider controls access to your funds and handles security, while you focus on buying, holding, trading, or staking crypto.

Unlike non-custodial wallets, where users have full control over keys and are solely responsible for security, these wallets reduce risk for beginners. Losing a private key in a non-custodial wallet can mean losing your crypto forever, but custodial wallets typically allow account recovery through identity verification or email.

Custodial wallets often integrate with exchanges, allowing users to trade, swap, or stake digital assets directly from the wallet. This combination of accessibility and convenience is why they are popular among beginners.

Real-world example: Platforms like Coinbase, Binance, and Kraken are examples of wallets with integrated trading and portfolio management features. Beginners can buy crypto, track prices, and stake tokens all in one place without dealing with private key management.

Why New Crypto Investors Are Choosing Custodial Wallets

Simple, Stress-Free Setup

One of the biggest hurdles for beginners is technical complexity. Non-custodial wallets require understanding blockchain mechanics, securing private keys, and navigating backup procedures. Digital wallets simplify this process. You can create an account, deposit funds, and start trading or holding crypto within minutes.

Keys Managed by Experts

Private keys are critical for accessing digital assets. Losing them can mean permanent loss. With a custodial wallet, the provider manages your keys securely, allowing beginners to avoid this stress.

Easy Account Recovery

Forgot your password? Most wallets provide account recovery via email, phone, or identity verification. This safety net is something non-custodial wallets don’t provide, giving beginners peace of mind.

Integrated Features for Beginners

Many custodial wallets integrate trading, staking, and portfolio tracking in one place. Beginners can monitor multiple crypto activities seamlessly without switching apps or worrying about technical mistakes.

Curious About How Crypto Wallets Work in Real Life?

See Your Crypto Wallet in ActionThe Key Advantages of Custodial Wallets for Beginners

Global Accessibility

Custodial wallets are available worldwide, allowing investors in regions with limited banking infrastructure to participate in cryptocurrency markets. Even users without access to traditional financial institutions can enter the crypto ecosystem using a smartphone or computer.

Instant Transactions

Integrated exchange features enable fast buying, selling, and swapping of tokens. Beginners benefit from quick transactions that allow them to respond to market movements efficiently.

Support and Guidance

Most wallets offer tutorials, guides, and customer support. Beginners gain confidence knowing help is available if they face issues, reducing the chances of errors.

Staking and Rewards

Some wallets allow users to stake tokens or earn interest without managing keys themselves. This provides a low-risk way for beginners to grow their crypto holdings while learning about the broader ecosystem.

Mobile Convenience

Many wallets are mobile-friendly. Beginners can trade, stake, or check balances on the go, making it easy to engage with crypto markets without being tied to a computer.

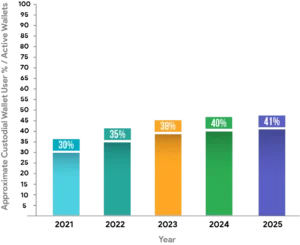

Custodial Wallets Usage Trends From 2021 to 2025

Potential Drawbacks You Should Know About

Limited Control

By using a custodial wallet, you trust the provider with your private keys. If the provider faces a security breach, technical failure, or mismanagement, your funds could be at risk. This is why selecting a reputable cryptocurrency wallet provider is essential.

Counterparty Risk

Even with strong security measures, wallets carry counterparty risk. You are essentially trusting a third party to secure your funds. Awareness of this risk helps beginners make informed decisions.

Fees

Some wallets charge fees for withdrawals, transfers, or premium services. Beginners should review the fee structure carefully to avoid surprises.

Dependence on Provider Security

While providers employ strong security measures, users still need to follow best practices like enabling two-factor authentication (2FA) and monitoring account activity. Security is shared, not guaranteed.

Privacy Considerations

Custodial wallets may require identity verification, which means some personal information is stored with the provider. Beginners should understand the trade-off between convenience and privacy.

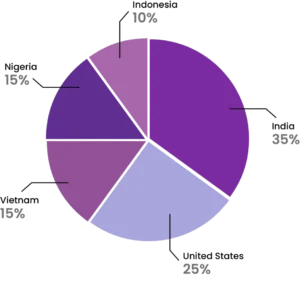

Which Countries Are Embracing Custodial Wallets?

How to Use Custodial Wallets Safely and Smartly

Even when the provider manages keys, beginners should follow these steps:

- Enable two-factor authentication (2FA) to add an extra layer of protection.

- Use strong, unique passwords for your wallet and associated accounts.

- Regularly monitor account activity for any unusual transactions.

- Stick with trusted cryptocurrency wallet providers with a good track record.

- Avoid sharing login credentials, recovery codes, or verification details with anyone.

These practices ensure a safer experience and reduce the chances of hacking or loss.

Practical Ways Beginners Can Leverage Custodial Wallets

- First-Time Investors

Custodial wallets offer an easy entry point for beginners to buy their first crypto, explore market dynamics, and learn without technical stress.

- Active Traders

Traders benefit from quick access to funds and integrated exchange features, which allow them to react to market movements in real time.

- Staking Participants

Beginner investors can earn rewards through staking programs without needing to understand smart contracts or private key management.

- Portfolio Tracking

Custodial wallets often include dashboards that allow users to monitor holdings, track price movements, and make informed decisions about buying or selling assets.

- Educational Opportunities

Some custodial wallets provide integrated learning resources, tutorials, and market insights, helping beginners understand the crypto ecosystem while managing their portfolios.

Turn Your Vision into a Reliable Crypto Wallet

Create Secure Crypto WalletsNew Trends Shaping Custodial Wallet Adoption

- DeFi Integration

Modern custodial wallets now integrate with decentralized finance (DeFi) platforms. Beginners can lend, borrow, or participate in yield farming safely without complex technical setups.

- Multi-Asset Support

New wallets support a wide range of cryptocurrencies and tokens, allowing beginners to diversify their portfolios without juggling multiple platforms.

- Mobile First Design

Mobile-friendly apps let users manage crypto portfolios anywhere, from buying Bitcoin to checking staking rewards.

- Compliance and Regulation

Reputable providers comply with local regulations, offering safer and more transparent services. This is especially reassuring for beginners navigating crypto for the first time.

- Enhanced Security Features

Some centralized wallets now include biometric access, hardware wallet integration, and insurance coverage for digital assets, improving beginner confidence in security.

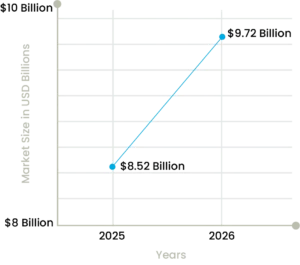

Custodial Wallet Market Projections – 2025 vs 2026

How Expert Guidance Can Make Your Crypto Journey Easier

Starting in crypto without guidance can be confusing. Experts like Nadcab Labs help beginners:

- Set up wallets securely

- Manage crypto investments efficiently

- Understand best practices for security and portfolio growth

Professional support reduces mistakes, builds confidence, and allows new users to focus on learning and growing their assets.

Making Crypto Simple and Secure with Custodial Wallets

Custodial wallets simplify crypto for beginners by providing convenience, security, and integrated features. While you give up some control and face counterparty risks, choosing a trustworthy provider mitigates these concerns. With proper precautions and guidance from experts like Nadcab Labs offer a safe, accessible, and user-friendly entry point into the crypto world.

They allow beginners to focus on learning, trading, and growing their portfolio, without the stress of technical complexities. For anyone just starting in crypto are a practical and reliable choice.

What is a custodial wallet?

A custodial wallet is a digital wallet where a provider manages your private keys. It allows beginners to store, send, and receive crypto safely. You don’t have to worry about technical security.

Do custodial wallets charge fees?

Some custodial wallets charge for withdrawals, transfers, or premium services. Beginners should check the fee structure before using the wallet. Knowing fees helps avoid surprises.

Are custodial wallets safe for beginners?

Yes, custodial wallets are generally secure if you use a reputable provider. Enabling two-factor authentication adds extra protection. Beginners can manage crypto without stress.

Can I recover my account if I forget my password?

Most custodial wallets allow recovery via email, phone, or identity verification. This safety net prevents permanent loss of access. It makes them easier to use than non-custodial wallets.

Can I trade or stake crypto using a custodial wallet?

Yes, many custodial wallets integrate with exchanges and staking platforms. Beginners can trade or earn rewards easily. No technical expertise is required.

Difference between custodial and non-custodial wallets

Custodial wallets offer convenience and provider-managed keys but less control. Non-custodial wallets give full control but require handling all security. The choice depends on your experience level.