Cryptocurrencies have changed far more than the way we pay for things. They’ve introduced entirely new finance models, where users control their assets instead of handing them to banks or middlemen. One of the most transformative creations in this shift is the Decentralized Exchange (DEX).

Unlike centralized platforms such as Binance or Coinbase, a DEX allows people to trade directly with one another. There’s no single authority holding funds, no need to request permission, and no custodian acting as a gatekeeper.

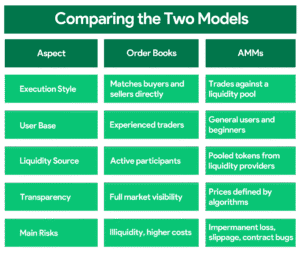

But not all decentralized exchanges operate in the same way. Behind every DEX sits a system that determines how trades are processed. Broadly speaking, there are two key designs: Order Books and Automated Market Makers (AMMs). Both approaches are essential, both carry their own advantages and drawbacks, and together they explain how decentralized trading really works.

What Makes a DEX Different?

A decentralized exchange is a marketplace. Instead of a company matching trades or holding your balance, a DEX uses smart contracts, pieces of code on the blockchain, to manage everything automatically. Once a trade is confirmed, the contract executes it according to predefined rules, without bias or interference.

This system has three big benefits: transparency, security, and autonomy. You can always verify the rules, you keep custody of your funds until the trade happens, and you don’t depend on a central operator to approve your activity.

Still, the way orders are handled differs depending on whether the exchange relies on an order book or an AMM.

Order Books- The Traditional Framework

Order books are the backbone of most traditional financial markets, from Wall Street stock exchanges to centralized crypto platforms.

How Order Books Function

An order book is essentially a running list of offers. On one side are the buy orders (bids), and on the other, the sell orders (asks). When the two match, a trade goes through.

Take a simple example: Alice places an order to buy one ETH at $1,800. Bob has an open sell order for one ETH at the same price. The system connects their orders, and the trade completes.

Why Order Books Work Well

- They offer market depth visibility. Traders can see the size and price of offers waiting to be filled.

- They provide flexibility. Participants can set exact prices instead of accepting whatever the system offers.

- They feel familiar. Many traders already know this model from stock or forex markets.

Challenges with Order Books

However, order books aren’t perfect. If there aren’t enough active traders, orders may sit unfilled for long periods. This lack of liquidity discourages participation, especially on smaller exchanges.

They can also feel overwhelming to beginners. The constant movement of numbers, charts, and queues makes order books better suited to experienced traders than casual users. On top of that, implementing order books directly on-chain can be expensive because every update requires a transaction fee.

Automated Market Makers- A New Approach

Automated Market Makers changed the trajectory of decentralized trading. Instead of depending on people to place orders, AMMs rely on liquidity pools and mathematical formulas.

The Mechanics of AMMs

In an AMM-based DEX, users called liquidity providers deposit pairs of tokens into a pool, for instance, ETH and USDT. When a trader wants to swap ETH for USDT, they interact directly with the pool. A formula determines the price, usually the constant product formula (x*y=k), which keeps the pool balanced.

This means you don’t need to wait for someone else to be on the other side of your trade. The pool is always available, as long as tokens remain in it.

Advantages of AMMs

- They ensure continuous liquidity, a pool is ready whenever a trade is initiated.

- They are easy to use. A simple swap button replaces complex order management.

- They create earning opportunities for liquidity providers, who earn a share of trading fees.

Limitations of AMMs

Despite their strengths, AMMs introduce risks. Liquidity providers face something known as impermanent loss, a reduction in value when token prices shift significantly. Traders, meanwhile, may encounter slippage, where the price changes during the trade because of the formula’s sensitivity to pool size. And, as with all DeFi platforms, there’s the possibility of smart contract vulnerabilities if the code isn’t thoroughly secured.

Market Adoption- Who Leads?

AMMs have propelled the growth of DeFi by making trading simpler and more approachable. Platforms like Uniswap, PancakeSwap, and SushiSwap are proof of this model’s success, offering intuitive interfaces that anyone can use.

That said, order books remain highly relevant. Professional traders prefer them for strategies that require precision and lower slippage. In fact, some of the most innovative exchanges, such as dYdX, are experimenting with hybrid systems that combine the control of order books with the efficiency of AMMs.

Hybrid Models- The Middle Ground

Hybrid models merge both approaches. They maintain an order book to serve advanced traders while running liquidity pools for quick swaps. This dual system reduces liquidity risks and expands the platform’s appeal.

For instance, dYdX uses an off-chain order book with on-chain settlement, offering speed without compromising decentralization. Such models show how exchanges can adapt to the needs of diverse user groups and remain competitive in the long run.

Launch a Powerful DEX Platform with Nadcab Labs

Building a decentralized exchange requires more than technical knowledge—it requires an understanding of how traders behave and what markets demand. At Nadcab Labs, we help businesses design DEX platforms that are both secure and scalable.

Whether you’re envisioning a traditional order book-based platform, a simplified AMM-driven exchange, or a hybrid solution, our team delivers end-to-end support. Our expertise covers:

- Custom decentralized exchange development

- Smart contract design and auditing

- Liquidity pool architecture and management

- Cross-chain integration for broader token access

By blending technical precision with user-focused design, Nadcab Labs ensures that every project is built for long-term growth and reliability.

Quick DEXs FAQ Guide

Learn how DEXs work with Order Books and AMMs, their differences, risks, and benefits in this short FAQ.

Which model is better for trading in low-liquidity situations?

AMMs work better in low-liquidity markets as trades can still occur if pools exist. Order Books may face wide spreads and fewer matches without active traders, limiting execution opportunities for smaller or emerging markets.

What types of risks exist for AMMs versus Order Book DEXs?

AMMs expose liquidity providers to impermanent loss, while Order Books risk slippage and low trade execution during thin markets. Each model requires understanding market conditions before choosing a trading strategy.

How does an Order Book-based decentralized exchange operate?

It keeps buy and sell orders on-chain or off-chain, matching them through smart contracts. This system provides transparent, secure transactions without intermediaries, giving traders control over price and order execution in a decentralized environment.

How do Automated Market Makers in DEXs calculate token prices?

AMMs use formulas like x × y = k to adjust prices based on token supply and demand. This automated process allows trades without relying on traditional order matching or centralized market makers.

Can decentralized exchanges use both Order Book and AMM models?

Yes, hybrid DEXs combine Order Books for precise pricing and AMMs for constant liquidity. This approach improves flexibility, user choice, and trading efficiency across different cryptocurrency markets.

What’s the key difference between Order Book and AMM DEX models?

Order Book DEXs match buyers and sellers directly, while AMMs use liquidity pools with algorithms to set prices. AMMs ensure trades continue if liquidity exists, whereas Order Books depend heavily on active traders for execution.