Understanding Monetization in DeFi

The emergence of Decentralized Finance (DeFi), has fostered the creation of a financial ecosystem where smart contracts have replaced intermediaries. Not only do smart contracts run exchanges, lending platforms, and yield farming protocols, they also offer revenue options for developers, investors, and businesses. For DeFi projects, it is essential to discover monetization models for their smart contract projects in order to create sustainability while remaining trusted and transparent.

This blog will discuss many mechanisms for monetizing in DeFi from transaction fees through token models. It will also illustrate the importance of DeFi smart contract auditing firms, and explore a real-world example for DeFi smart contracts to understand how monetization operates.

Why Monetization in DeFi Matters

Traditional finance organizations get revenue via service fees, interest rates, and fee-based fund management. While this model improves efficiency, it also asks an essential question – how do DeFi projects generate revenue? The answer can be found in creative models based on deFi smart contract where automation plus decentralization replace traditional intermediaries and unlock new revenue potentials.

The answer lies in creative monetization frameworks based on smart contracts. Monetizing appropriately allows a project to grow, gain user adoption, and last a long time.

Common Monetization Models in DeFi Smart Contract Projects

- Transaction Fees

The most popular method is through transaction fee. For example, a decentralized exchange (DEXs) will charge around 0.3% per trade that bucks up liquidity providers and treasuries.

In addition, DeFi smart contracts coins like UNI or CAKE can earn value whenever the platform collects fees and users get rewarded.

- Staking and Yield Farming

Yield farming has recently gained traction as a method of locking tokens so that end-users can earn rewards. Many projects will also include withdrawal fees or performance fees.

We often recommend to clients that want a DeFi smart contract for yield farming, to select and hire an associate company that can develop reliable delivery contracts for yield farming in their project.

Professional services for yield farming will secure their project and ensure earnings are effectively distributed.

- Token Launch/Appreciation

Usually, native tokens are launched to assist funding and attract user engagement. If the project is utilized and becomes adopted the token will appreciate, providing monetary benefits for the project indirectly.

For example, Save or Compound governance tokens, all became of significant market value. The token value serves as a classic example of monetization through token economies in DeFi.

- Mining & liquidity incentives

Users are able to either validate or supply liquidity, utilizing DeFi smart contract mining and be rewarded for either one at the same time, so this is probably the most popular incentive method used in decentralized finance. By joining mining pools or staking systems, users not only use their own dollars in contribution, but earn a predictable return that makes it easier for them to join and contribute. Projects will sometimes establish dedicated mining pools and give mining fee discounts, making it easier for the users to earn a proper incentive while taking a portion of the transaction fees and returning a portion of the fees to the project’s treasury for sustainability. This half of the incentive process allows developers to reward participants and continue the credibility of the ecosystem.

- NFT & asset tokenization

Projects are using NFT-based smart contracts for much more than just financial applications, including those in gaming, art, entertainment, and tokenization of real-world assets. The projects can tokenize assets, create unique digital collectibles, and build NFT marketplaces with various user interaction options. A leading company not only has the technical know-how to help create these projects but also can guarantee that the smart contracts are secure, scalable, and can handle large transaction volumes.

- Monthly subscription & premium fees

Overall, there are several ways to monetize advanced DeFi applications in addition to simply charging transaction fees. Now there are many platforms that charge a premium for its advanced dashboard services, an automated trading bot, and to access a private liquidity pool, where users pay a recurring subscription for those services in exchange for some exclusive features. Products of this nature are available for professional trader’s institutions and power users who are more inclined to spending money in advanced tools/services that benefit their performance and profitability in the decentralized finance world.

Importance of Smart Contract Audits in Monetization

Revenue is critical, security is the lifeblood or backbone of DeFi. Exploits can cost millions of dollars and we’ve seen how devastating hacks can be in the past.

- A DeFi smart contract auditing company ensures the quality of code to a degree where the vulnerabilities are removed even before deployment.

- The cost of a DeFi smart contract audit differs based on the complexity of the project, but there is no doubt it is an essential investment to protect the funds and have faith.

Projects have nothing without audits, trust and they may even risk money too.

Real World DeFi Smart Contract Example

Take, for example, a decentralized exchange, Uniswap. Uniswap’s monetization strategy consists of-

- Trading fees on every swap made on its platform (0.3% rate)

- Additionally, dividing rewards among liquidity providers.

- Value is preserved in its governance token.

This is a real example of a DeFi smart contract where monetization, tokenization and governance exist side-by-side.

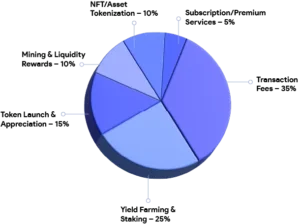

Statistics Monetization Distribution in DeFi

Role of Development Companies in DeFi Monetization

Not all projects have in-house qualified talent to design secure, scalable, and profitable smart contracts. This is where-

- An associative approach is beneficial as it brings together blockchain engineers, economists, and security experts to create efficient and secure smart contract solutions.

-

An associative platform can tailor tokenomics, create NFT-based revenue models, and implement yield farming solutions.

By working with experts, projects will stimulate earnings revenue potential while minimizing risk.

Challenges in Monetization

Despite all the opportunities, there are still challenges –

High audit costs – The cost of auditing the DeFi smart contract can be considerable for startups.

- Regulatory uncertainty – Different jurisdictions may restrict token-based monetization.

- Security risks – Without the ongoing audit from a DeFi smart contract auditing company, hacks can eliminate long-term revenue models.

- Market volatility – Token price volatility can impact long-term monetization.

Future of Monetization in DeFi Smart Contracts

The outlook is positive, with trends emerging-

- Cross-Chain Monetization – Using interoperability to increase user adoption.

- AI-Powered Smart Contracts– Dynamic smart contracts changing monetizations anywhere timeframe there is activity.

- NFT-Fi (NFT Finance) – Merging NFT’s and DeFi to create new yield and royalty opportunities.

Innovative monetization is happening beyond traditional finance as top developers create cutting-edge NFT solutions.

Monetization Models The Backbone of DeFi Success

Monetization is the driving force behind DeFi smart contract projects. It makes sure that decentralized ecosystems don’t just survive, but thrive, as they compete for attention in a crowded financial space. Monetization comes in many forms, whether it’s the form of transaction fees that create a consistent revenue stream, yield farming models that incentivize liquidity providers, NFT tokenization that allows for the creation of new digital assets, or mining codes which reward participants by validating network interactions and allowing users to draw income. Monetization models are as flexible as ideas are endless, which will allow DeFi projects to remain sustainable, scalable and attractive to both developers and investors.