At the core of every society lies one powerful element, trust. From ancient trade routes to today’s digital world, people have always made agreements built on promises like, “You give me this, I’ll give you that.” These simple exchanges have shaped relationships, businesses, and even civilizations.

But as the world went online, that face-to-face trust started to fade. Deals turned into data, and promises traveled through digital networks instead of handshakes.

That’s when a revolutionary idea changed everything smart contracts.

They’re not paper documents or legal jargon, but self-executing codes that automatically carry out agreements without needing a middleman.

To understand how this innovation began, we need to go back, before Bitcoin and blockchain, to the vision of a man who imagined a world where trust could be built into technology itself.

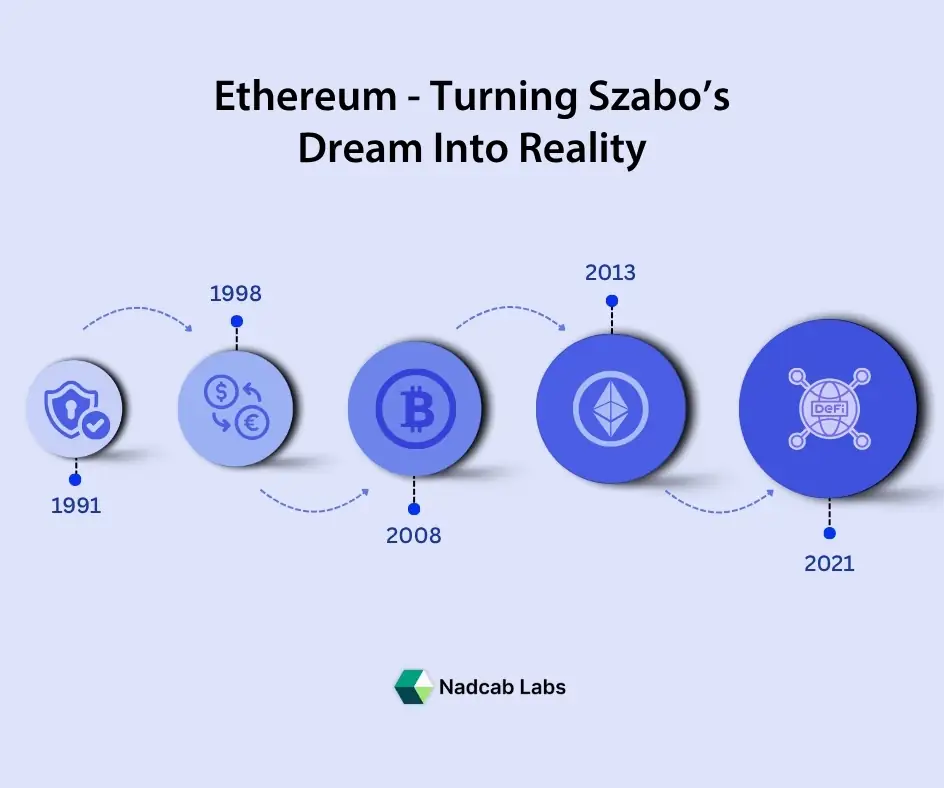

The History of Smart Contracts

Before anyone had even heard the word “blockchain,” Nick Szabo, a computer scientist, legal scholar, and cryptographer, was imagining a future that merged technology and law. In the early 1990s, Szabo coined the term “smart contract.”

He defined it as:

“A computerized transaction protocol that executes the terms of a contract.”

At a time when most people were still using dial-up internet, Szabo was thinking decades ahead. He saw how physical contracts depended on trust — lawyers, banks, brokers — and wondered if computers could automate that trust through code.

To explain his idea, he used a vending machine analogy.

When you put money into a vending machine, the machine automatically gives you a product. There’s no human overseeing the deal; the rules are already programmed. If you don’t insert enough coins, you get nothing. Simple, transparent, and fair.

Szabo envisioned this logic applied to digital transactions. Imagine a car rental contract where, once you send payment, a digital key automatically unlocks your rented vehicle — no paperwork, no intermediaries.

This concept was revolutionary, yet there was a catch. The internet back then wasn’t decentralized. There was no tamper-proof ledger to store or enforce these contracts securely. Szabo had the vision, but the world lacked the infrastructure to make it real.

He didn’t stop there, though. In 1998, he proposed “Bit Gold,” a digital currency idea that predated Bitcoin by more than a decade. Bit Gold incorporated many ideas that would later define blockchain: proof of work, decentralization, and digital scarcity.

Szabo’s theories planted the first seeds of what would become the modern crypto landscape, not just in finance, but in how society defines trust without intermediaries.

To explore this evolution further, you can read the evolution of smart contracts in blockchain.[1] It perfectly captures how Szabo’s early writings became the backbone of decentralized systems we use today.

The Missing Link – Pre-Blockchain Digital Currency Experiments

The 1990s and early 2000s were buzzing with digital currency experiments. Cryptographers and programmers were trying to create money for the internet age. Projects like eCash, Hashcash, and b-money introduced digital tokens and privacy concepts, but none could solve the trust problem — how to ensure that no one could double-spend or manipulate transactions.

Nick Szabo’s Bit Gold was close but not fully decentralized. It lacked a shared ledger to verify who owned what. Without a common, secure database, the dream of smart contracts remained an idea on paper.

Still, these experiments laid the foundation. They gave future innovators the building blocks — cryptography, consensus, and peer-to-peer systems — that would soon combine into a single, powerful creation: Bitcoin.

The Bitcoin Revolution – Trust in Code Begins

In 2008, under the pseudonym Satoshi Nakamoto, an unknown figure (or group) released the Bitcoin whitepaper:

“Bitcoin: A Peer-to-Peer Electronic Cash System.”

For the first time, the world saw a fully decentralized digital currency. No banks, no middlemen, just code, cryptography, and math. Bitcoin introduced a blockchain, a distributed ledger that recorded every transaction transparently and immutably.

It was trust, not in humans, but in mathematics.

Although Bitcoin was a technological marvel, it was limited. It could transfer value but couldn’t execute complex agreements. If Alice wanted to send Bob money only after a specific event occurred, Bitcoin couldn’t handle that logic natively.

This limitation left an open question: could we build a blockchain that not only records transactions but executes logic?

A system where code itself acts as the law?

That question would soon find its answer in the form of Ethereum.

Ethereum – Turning Szabo’s Dream Into Reality

In 2013, a 19-year-old programmer named Vitalik Buterin envisioned something revolutionary. He admired Bitcoin’s decentralized nature but saw that its scripting language was too limited for more advanced applications. His idea was simple yet profound: a general-purpose blockchain where anyone could program decentralized applications.

He called it Ethereum.

In his whitepaper, Buterin described Ethereum as a “world computer,” a platform capable of executing smart contracts that automatically perform actions when certain conditions are met.

Imagine a world where:

- A loan automatically repays itself through on-chain data.

- A digital identity system verifies users without passwords.

- A game runs entirely on blockchain, where players own their in-game assets permanently.

Ethereum made all of this possible. It introduced Solidity, a programming language that allowed developers to write contracts like:

if condition is met → execute function.

In essence, code became law.

Ethereum’s Ethereum Virtual Machine (EVM) allowed every node in the network to execute the same code, ensuring transparency and consensus. If a smart contract said, “Send 10 ETH when X happens,” the entire network verified and enforced it, without bias, error, or manipulation.

This was the birth of Web3, a decentralized internet where power shifts from corporations to individuals.

To learn more about Ethereum’s origins, check out a short history of Ethereum [2] , which details how Buterin and his team transformed the concept of smart contracts into the foundation of modern decentralized ecosystems.

The ICO Boom – Smart Contracts Go Mainstream

When Ethereum launched in 2015, it didn’t take long for developers and entrepreneurs to realize its potential. By 2017, the world witnessed an explosion of Initial Coin Offerings (ICOs), a fundraising mechanism powered entirely by smart contracts.

Projects could now issue tokens, collect funds, and distribute ownership automatically through blockchain code.

It was the democratization of investment: anyone, anywhere, could participate in funding innovation.

However, this newfound freedom also brought chaos. Many ICOs turned out to be scams or poorly executed ideas. The lack of regulation led to a wave of failures, reminding the world that while code is powerful, it still needs human oversight and integrity.

But through the turbulence, the foundation was set. Smart contracts had proven their potential to disrupt entire industries.

[Also Read: Launch Successful ICO in 2025]

Decentralized Finance – The Age of Automation

From 2018 onwards, the blockchain world shifted its focus from fundraising to functionality. Developers began using smart contracts to replicate traditional financial systems but without intermediaries.

This was the dawn of DeFi (Decentralized Finance).

Protocols like Uniswap, Aave, and Compound allowed users to trade, lend, and earn interest directly through smart contracts. There were no banks, no middlemen, just users and transparent code.

In DeFi, every transaction is traceable, every rule is visible, and every outcome is verifiable.

The power once concentrated in centralized institutions now lay in the hands of the global community.

Smart contracts weren’t just automating finance; they were redefining fairness.

NFTs and DAOs – Expanding the Purpose of Smart Contracts

Then came the next revolution: Non-Fungible Tokens (NFTs) and Decentralized Autonomous Organizations (DAOs).

NFTs allowed creators to tokenize art, music, and collectibles. Smart contracts ensured creators received automatic royalties every time their work was resold. Suddenly, artists had control over their creations again, something traditional systems had long denied them.

DAOs, on the other hand, reimagined how organizations function. They replaced hierarchy with community voting, powered by smart contracts that automatically executed governance decisions.

In both cases, trust shifted from people to protocol.

Create Your Smart Contract with Ease!

Have an idea in mind? We’ll help you turn it into a secure, transparent, and ready-to-launch smart contract. Simple process, real results — let’s begin!

Connect with Our Experts

Beyond Ethereum – The Expanding Universe of Smart Contracts

Ethereum may have been the pioneer, but it wasn’t the final destination. New-generation blockchains like Solana, Cardano, Polkadot, and Avalanche emerged, each improving scalability, transaction speed, and cost efficiency.

Meanwhile, academic research continues to refine how smart contracts are built, verified, and secured. According to Frontiers in Blockchain Research[3] , scientists are exploring ways to make smart contracts safer, more interoperable, and even integrated with artificial intelligence.

This combination of innovation and research ensures that smart contracts aren’t just tools of the present; they’re the infrastructure of our digital future.

The Next Challenge for Smart Tech

While the potential is massive, challenges remain:

- Legal recognition: How do we enforce or dispute an automated contract in court?

- Accessibility: Many users still struggle with wallets, gas fees, and interfaces.

- Ethical design: Who is responsible when code fails?

Addressing these requires a balanced blend of technology, law, and empathy. The goal isn’t just automation, but fair automation — where every user, regardless of background, can participate confidently.

The Future – Smart Contracts and the AI Connection

Looking ahead, smart contracts may become more intelligent and adaptive, merging with Artificial Intelligence (AI) and Internet of Things (IoT) systems. Imagine a world where a smart contract manages your electric car’s charging schedule based on grid demand, or automatically executes business transactions between machines — no human input needed.

This is where the story gets exciting. We’re entering an era where autonomous systems will interact, negotiate, and execute deals on our behalf. The idea that began with Szabo’s “vending machine” has now evolved into a self-governing digital economy.

From Szabo’s Dream to a Decentralized Reality

The history of smart contracts is a story of human curiosity, persistence, and innovation.

From Nick Szabo’s theoretical brilliance to Ethereum’s revolutionary execution, the journey reflects one powerful message: trust can be coded.

But even as we move deeper into decentralized worlds, one truth remains eternal: technology might make systems more reliable, but it’s human imagination that gives them purpose.

Smart contracts aren’t just a piece of technology; they reflect how far we’ve come as humans, building trust, transparency, and smart contract solutions that bring people closer in a digital world.

The dream that started in the 1990s is now shaping our future, a world where promises aren’t broken, agreements never sleep, and trust is no longer a question, but a line of code.

Frequently Asked Questions

A smart contract is a self-executing program that automatically enforces an agreement when predefined conditions are met, without relying on intermediaries like banks or lawyers.

The idea of smart contracts was introduced in the 1990s by computer scientist Nick Szabo, long before blockchain technology existed to support it.

Before blockchain, there was no decentralized, tamper-proof ledger to securely store and execute contracts, making trustless automation impossible.

Traditional contracts rely on legal enforcement and intermediaries, while smart contracts rely on transparent code that executes automatically once conditions are fulfilled.

Bitcoin introduced decentralized, trustless value transfer using blockchain but lacked the flexibility to run complex contractual logic.

Ethereum enabled programmable smart contracts, allowing developers to create decentralized applications that automatically execute logic beyond simple payments.

Legal recognition of smart contracts varies by country. While some jurisdictions accept them, others still rely on traditional legal frameworks for dispute resolution.

Smart contracts can contain coding bugs, lack flexibility once deployed, and may cause irreversible losses if poorly designed or exploited.

They automate financial services, enforce digital ownership rules, distribute creator royalties, and execute governance decisions without centralized control.

The future lies in combining smart contracts with AI and IoT, enabling autonomous systems to make decisions, transact, and execute agreements independently.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.