India is witnessing a dramatic shift in its investment culture. For decades, traditional investment avenues such as savings accounts, fixed deposits, and physical assets like gold or real estate have dominated the market. However, in recent years, a new concept has emerged that is redefining the way people invest: fractional ownership.

Fractional ownership allows individuals to purchase a “fraction” of high-value assets such as real estate, luxury collectibles, or even digital assets, thus enabling smaller investors to tap into markets that were previously inaccessible. This concept is revolutionizing the Indian investment scene, providing a host of opportunities that weren’t available before, all while lowering the barriers to entry. It’s no longer just about having vast amounts of capital; now, you can invest in premium assets with small amounts and still see attractive returns.

In this blog, we’ll explore how fractional NFTs are changing portfolio strategies in India and why they’re becoming an essential part of modern investing. We’ll dive deep into the benefits, how it works, the types of assets available, and the potential it holds for reshaping how Indians manage and grow their wealth.

What Are Fractional Assets?

At its core, fractional ownership is a model where multiple investors come together to collectively own an asset. Rather than one person needing to put up the full capital required to acquire an asset, fractional ownership allows investors to contribute smaller sums, thereby sharing ownership and benefiting from the returns generated by that asset.

Managed Through Platforms or SPVs

- Investors share the cost, benefits, and risks.

- Ownership is often managed through a special purpose vehicle (SPV) or a platform that takes care of legal, maintenance, and rental aspects.

- Investors earn returns through rental income, capital appreciation, or resale of their fractional units.

Why Are Fractional Assets Gaining Popularity in India?

-

Lowering the Barrier to Entry

The main reason fractional ownership is gaining traction in India is because it significantly reduces the entry cost. Traditionally, assets such as luxury real estate, premium art, and high-demand collectibles have required massive amounts of capital. However, with fractional ownership, investors can purchase a fraction of an asset for a much smaller sum, sometimes as little as ?25,000 or ?50,000.

This drastically opens up the investment opportunity to a wider audience, including younger investors, professionals, and those with limited capital who previously couldn’t afford to invest in high-value assets.

-

Diversification Across Various Asset Classes

Investors today are no longer putting all their eggs in one basket. Fractional ownership allows individuals to diversify their investment portfolios without having to commit a large portion of their capital to a single asset.

For example, a person could allocate their investment across multiple assets: owning a part of a commercial real estate property, a luxury collectible, and a digital asset like an NFT (Non-Fungible Token). This diversification helps in managing risk and mitigating potential losses.

-

Regular Income Streams

One of the key attractions of fractional ownership is the potential for passive income. Assets such as real estate or luxury items can generate steady cash flows. For example, if you own a fractional share in a rented office space, you would receive a portion of the rental income on a regular basis.

This provides investors with a consistent and reliable income stream without the hassle of managing the asset directly. For people looking to supplement their income or even retirees looking for stable returns, fractional ownership presents an attractive option.

-

Technological Integration for Transparency and Security

Modern fractional ownership platforms leverage advanced technologies such as blockchain, artificial intelligence, and smart contracts to ensure transparency, security, and trust in the investment process.

Blockchain technology, in particular, plays a key role in ensuring that ownership records are transparent and immutable. This reduces fraud and ensures that investors’ interests are protected.

-

Regulatory Support and Legal Framework

The Indian government and regulatory bodies such as SEBI (Securities and Exchange Board of India) are introducing guidelines and frameworks to regulate fractional ownership, especially in the real estate fractional NFT sector. These regulations aim to ensure transparency, protect investors, and provide a safer environment for fractional ownership investments. With increasing legal clarity, fractional ownership is becoming a more secure and reliable investment avenue.

How Fractional Assets Are Reshaping Portfolio Strategies

Fractional ownership is changing how modern Indian investors build and manage their investment portfolios.

-

Breaking Traditional Allocation Models

Earlier, Indian portfolios followed a simple structure:

- 40% in fixed deposits

- 30% in real estate

- 20% in gold

- 10% in equities or mutual funds

With fractional investing, a more dynamic model is emerging:

- Real estate via fractional platforms

- Global equities through fractional shares

- Green energy projects via tokenized assets

- Art and collectibles for long-term wealth storage

This new structure allows for greater customization based on risk appetite and return expectations.

-

Enhancing Exposure to High-Growth Assets

Previously, high-growth sectors like commercial real estate or startup equity were out of reach for small investors. Now, one can allocate small percentages of their portfolio to these sectors through fractional ownership — capturing high upside with manageable risk.

-

Strategic Risk Distribution

Fractional investments let investors spread their capital across more investments. For example, instead of buying one apartment, a person can invest ?1 lakh each in 5 different commercial properties. This spreads the risk and increases exposure to multiple income-generating assets.

-

Improved Liquidity with Tokenized Assets

Thanks to blockchain, fractional ownership can be tokenized, enabling faster, peer-to-peer trades. This creates a secondary market, boosting liquidity — a major drawback in traditional investments like real estate.

-

Passive Income Streams

Fractional real estate and leasing platforms offer regular rental income or lease payments. This adds passive cash flow to portfolios, reducing reliance on capital appreciation alone.

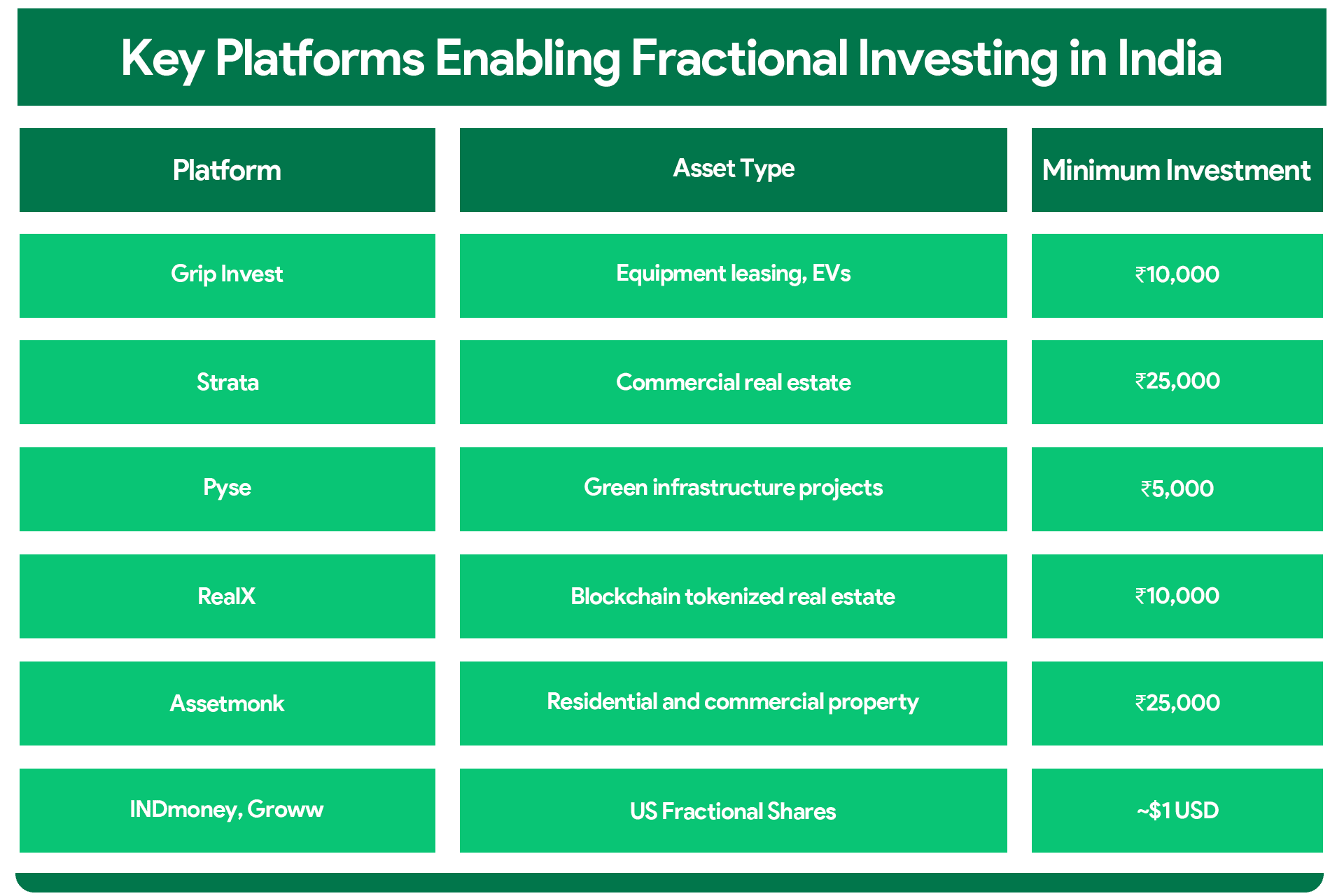

Key Platforms Enabling Fractional Investing in India

Here’s a look at some popular Indian platforms driving this change:

These platforms are building investor trust with transparent documentation, regulatory compliance, and exit options.

Challenges to Be Aware Of

As with any innovation, fractional assets come with certain risks:

-

Regulatory Uncertainty

Fractional ownership is still in a regulatory grey area in India. SEBI is working on frameworks, but clarity is still evolving — especially for tokenized and blockchain-based assets.

-

Liquidity Constraints

Not all platforms offer easy exit options or resale mechanisms. Real estate, in particular, may involve a longer lock-in period.

-

Platform Risk

As the industry is still emerging, it’s essential to invest through credible platforms with transparent policies and asset due diligence.

-

Tax Implications

Taxation rules can vary based on the type of asset. For example:

- Fractional shares in US markets may attract capital gains tax and TDS.

- Rental income from fractional real estate is taxable.

Investors must consult with financial advisors to understand the tax implications clearly.

The Role of Blockchain in Fractional Ownership

Blockchain technology is set to amplify the impact of fractional assets through:

- Immutable Ownership Records

- Programmable Smart Contracts

- Global Accessibility

- Fractional Tokenized NFTs of Real Assets

Projects like RealX, Landeed, and KoineArth are already leveraging blockchain to issue tokenized real estate shares, collectibles, and infrastructure projects. This could further democratize access, reduce fraud, and increase transparency.

The Future of Fractional Investing in India

The growing interest in fractional assets is not just a short-term trend; it signals a fundamental shift in how Indians will build wealth in the next decade. As technology matures and regulations align, fractional ownership could become a mainstay in investment portfolios, similar to mutual funds today. We expect to see:

- Wider adoption across Tier 2 and Tier 3 cities

- SEBI-compliant fractional REITs (Real Estate Investment Trusts)

- Cross-border asset access using tokenization

- Full-fledged Fractional Asset Marketplaces

Rethink, Rebalance, and Reinvest

Fractional assets are changing the rules of the game. They are empowering common investors, providing new opportunities, and reshaping portfolio strategies from the ground up. In a country like India — where financial inclusion is a national priority — fractional ownership is not just an innovation; it’s a revolution. As an investor, this is the right time to:

- Rethink your current portfolio structure

- Rebalance your asset allocation with fractional opportunities

- Reinvest with confidence in platforms that offer fractional ownership in high-potential assets

Why Wait? Invest in Fractions Today!

Fractional ownership is more than just a passing trend in India; it’s a revolutionary shift in how people can invest. By lowering the barriers to entry, providing more diversification, and offering attractive income streams, it is giving investors access to a wide range of high-value assets that were once out of reach.

As fractional ownership platforms continue to grow and evolve, and as regulations become clearer, this model will only become more mainstream. Whether you’re a seasoned investor or a beginner, a fractional NFT project could be your ticket to smarter, more diversified investment strategies.

So, what are you waiting for? Explore fractional ownership platforms today and begin your journey into this exciting new world of investments.