Key Takeaways

- Multiple Fundraising Ideas: Companies today can choose from IPOs (traditional, regulated), ICOs (decentralized, crypto-based), and STOs (regulated tokenized securities), depending on their goals, stage, and investor base.

- Blockchain and Tokenization Are Game-Changers: Tokenization enables fractional ownership, faster transactions, global investor access, and transparency, fundamentally changing how capital is raised.

- Democratization of Capital: ICOs and STOs allow startups and small businesses worldwide to raise funds directly from a global audience, fostering financial inclusion and innovation.

- Fractional Ownership Unlocks Investment Opportunities: Investors can now access high-value assets like real estate or art through tokenized shares, making diversification easier and more affordable.

- Efficiency and Cost Reduction: Blockchain reduces the need for intermediaries, lowering fees, accelerating fundraising, and automating compliance through smart contracts.

- 24/7 Liquidity and Transparency: Tokenized assets trade continuously on blockchain networks, with immutable transaction records that enhance investor trust.

- Balancing Opportunity and Risk: While digital fundraising offers huge potential, risks include regulatory uncertainty, market volatility, and project mismanagement. Due diligence is essential.

- Choosing the Right Model Matters: IPOs suit established companies, ICOs drive rapid innovation for startups, and STOs balance compliance with efficiency, offering the best of both worlds.

- The Future Is Digital: Experts predict tokenized securities could exceed $10 trillion by 2030, integrating with traditional finance and creating a faster, borderless, and transparent fundraising ecosystem.

- Success Relies on Transparency and Real-World Utility: Long-term growth in digital fundraising depends on regulatory compliance, trustworthy projects, and practical use cases—not just hype.

The world of fundraising ideas is changing fast. Traditional methods like IPOs have long dominated how companies raise capital, offering stability and regulatory oversight. But the rise of blockchain technology has introduced innovative alternatives to ICOs and STOs that are redefining how businesses access funds and how investors participate in growth.

From decentralization and faster transactions to tokenization and fractional ownership, digital fundraising models are creating new opportunities and new challenges for businesses and investors alike. Understanding these models is no longer optional; it’s essential for anyone looking to thrive in the digital economy.

In this, we’ll explore how IPO, ICO, and STO work, why tokenization is reshaping markets, and what it means for the future of digital fundraising in a digital-first world.

What is Digital Fundraising

Digital fundraising has evolved far beyond traditional bank loans or equity rounds. Today, businesses have multiple options to raise capital, including Initial Public Offerings (IPOs), Initial Coin Offering (ICO), and Security Token Offerings (STOs). Each model offers unique advantages depending on the level of regulation, investor reach, and speed of funding. Understanding these options is key to navigating the modern financial landscape.

Understanding the Core Concepts

Initial Public Offering (IPO)

An IPO is the traditional route through which a private company becomes public by offering its shares to institutional and retail investors. It involves strict regulatory compliance, disclosure of financials, and underwriting by investment banks. The goal is to raise capital for growth, debt repayment, or expansion while allowing early investors to realize returns.

While IPOs bring credibility and liquidity, they are expensive and time-consuming, often costing millions in legal, accounting, and underwriting fees. Moreover, smaller companies find it difficult to meet the compliance standards required by regulatory bodies like the U.S.

Initial Coin Offering (ICO)

An ICO is a blockchain-based digital fundraising idea where startups sell digital tokens in exchange for cryptocurrencies like Bitcoin or Ethereum. These tokens may represent utility (access to a platform or service) or, in some cases, security (ownership rights).

The ICO Coin boom began with Mastercoin in 2013 and Ethereum’s token sale in 2014, which raised over $18 million[1], marking a new era of decentralized crowdfunding. By 2017, ICOs had exploded in popularity, with startups raising more than $6 billion globally, but many lacked transparency or accountability.

ICOs gained traction because they eliminated intermediaries and allowed global participation in the ICO market. Anyone with a crypto wallet could invest in a project, removing traditional geographic and regulatory barriers. However, this openness also created a fertile ground for scams and project failures, as many Initial Coin Offerings were launched without solid business plans or regulatory clarity.

Security Token Offering (STO)

The STO model emerged as a more regulated and secure evolution of the ICO token. In an STO, tokens represent real financial assets such as equity, bonds, or real estate shares, effectively functioning as digital securities. These tokens are issued on blockchain but are subject to securities laws of the jurisdictions in which they operate.

STOs combine the efficiency and transparency of blockchain technology with the legal safeguards of traditional finance. This hybrid approach offers KYC (Know Your Customer), AML (Anti-Money Laundering) checks, and detailed disclosures, ensuring greater trust and investor protection.

Because of their regulatory nature, STOs are considered the bridge between conventional equity markets and decentralized blockchain ecosystems. They provide investors with confidence and issuers with access to global capital while maintaining compliance.

While IPOs ensure investor protection and stability, ICOs encourage innovation and global participation. STOs attempt to balance both, offering innovation with compliance.

Key Differences Between ICO, IPO, and STO:-

| Feature | IPO (Initial Public Offering) | ICO (Initial Coin Offering) | STO (Security Token Offering) |

|---|---|---|---|

| Asset Type | Company shares | Utility tokens | Security tokens backed by real assets |

| Regulatory Framework | Highly regulated by authorities such as the SEC | Mostly unregulated or lightly regulated | Fully regulated under securities laws |

| Investor Rights | Ownership, voting rights, and dividends | Access to a product or service; no ownership rights | Ownership rights and potential dividends |

| Target Investors | Institutional investors and the general public | Global retail investors | Accredited and institutional investors |

| Ease of Launch | Very complex, costly, and time-consuming | Simple, fast, and relatively low cost | Complex and time-consuming due to legal compliance |

| Transparency Level | High transparency through audited financials and prospectus | Varies depending on project and whitepaper quality | High transparency due to strict regulatory requirements |

Why Tokenization Is Transforming the Global Economy

Tokenization, the process of converting real-world assets into digital tokens on a blockchain, is at the heart of modern digital fundraising. It allows fractional ownership, faster transactions, and global access, opening opportunities for investors and businesses alike. From real estate to intellectual property, tokenization is redefining how value is exchanged in the digital era.

How These Models Are Reshaping the Economy

1. Democratizing Capital Access

Traditional capital markets favor large corporations with access to investment banks and regulatory resources. ICOs and STOs disrupt this monopoly by allowing startups, developers, and entrepreneurs worldwide to raise capital directly from the public.

A blockchain project in Kenya or India can now access funding from investors in the U.S. or Europe without the need for intermediaries. This global participation fuels financial inclusion and supports early-stage innovation on a scale never seen before.

2. Fractional Ownership & Tokenization of Assets

One of the biggest impacts of STOs is fractional ownership. Assets such as real estate, art, or commodities can be tokenized, divided into thousands of small ownership units represented by tokens. This allows small investors to buy fractions of assets previously accessible only to the wealthy or institutions.

For instance, a $10 million property can be divided into 10,000 security tokens worth $1,000 each. Investors can trade these tokens on secondary markets, enhancing liquidity and market efficiency.

3. Reducing Intermediaries & Costs

Blockchain’s decentralized structure eliminates the need for intermediaries such as brokers, custodians, and clearing houses. This results in faster transactions, lower fees, and greater transparency.

While IPOs can take months to complete, ICOs and STOs can be launched in weeks. Smart contracts automate compliance and fund distribution, reducing the dependency on banks or middlemen.

4. 24/7 Global Liquidity

Unlike traditional stock exchanges that operate during fixed hours, tokenized assets can trade 24/7 on decentralized exchanges. This continuous liquidity benefits both issuers and investors, allowing instant settlement and real-time price discovery.

5. Transparency and Immutable Records

Every transaction in an ICO or STO is recorded on a blockchain ledger, creating an immutable and auditable trail. This level of transparency builds trust between issuers and investors. Fraud or double-spending becomes nearly impossible due to the cryptographic verification process.

7. Benefits and Risks Investors Should Know

Digital fundraising is transforming the investment landscape, creating opportunities that were unimaginable just a decade ago. However, while the potential rewards are significant, investors need to carefully consider the risks involved to make informed decisions and protect their capital.

Benefits:

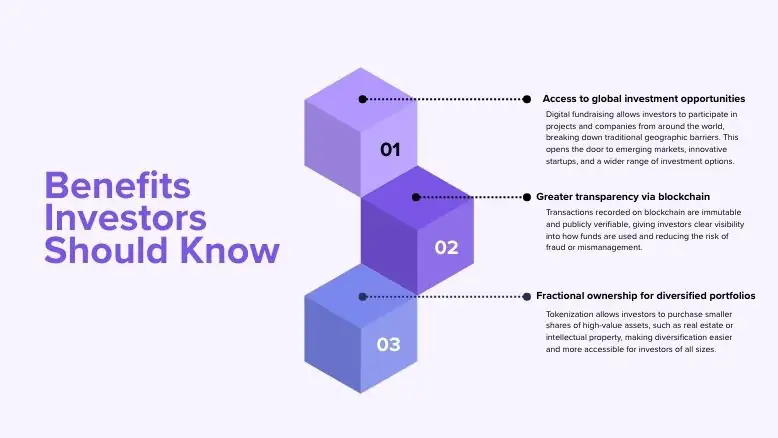

- Access to global investment opportunities: Digital fundraising allows investors to participate in projects and companies from around the world, breaking down traditional geographic barriers. This opens the door to emerging markets, innovative startups, and a wider range of investment options.

- Greater transparency via blockchain: Transactions recorded on blockchain are immutable and publicly verifiable, giving investors clear visibility into how funds are used and reducing the risk of fraud or mismanagement.

- Fractional ownership for diversified portfolios: Tokenization allows investors to purchase smaller shares of high-value assets, such as real estate or intellectual property, making diversification easier and more accessible for investors of all sizes.

Risks:

- Regulatory uncertainty, especially with ICOs: Some digital fundraising models, like ICOs, operate in regulatory gray areas in many countries. This can lead to sudden legal changes or restrictions that impact investments.

- Market volatility: Tokenized assets and crypto-linked projects can experience rapid price swings, creating profit opportunities but also significant financial risk.

- Potential scams or poorly managed projects: Not all projects are legitimate or well-executed. Investors must carefully evaluate the team, roadmap, and regulatory compliance before committing funds.

In this fast-evolving landscape, informed decision-making is critical. Investors should conduct thorough research, understand the legal and financial frameworks of each offering, and prioritize projects that follow regulatory guidelines and demonstrate real-world utility. By balancing opportunity with caution, investors can participate safely in the digital fundraising revolution and maximize the potential benefits while minimizing risk.

How Businesses Choose the Right Digital Fundraising Model

Choosing between an IPO, ICO, or STO depends on your business goals, stage, and long-term vision. Each option offers unique advantages and requires careful consideration to ensure successful digital fundraising.

IPOs: Best for established companies, IPOs provide access to large capital pools, regulatory stability, and strong investor confidence. They require transparency and ongoing reporting, making them ideal for businesses ready for public scrutiny.

ICOs: Designed for startups, ICOs allow fast, decentralized digital fundraising by issuing digital tokens to a global audience. They encourage innovation and community engagement but carry higher regulatory uncertainty, so building trust is essential.

STOs: Security Token Offerings combine blockchain efficiency with regulatory compliance. STOs are ideal for businesses seeking speed, transparency, and investor protection, offering the best of both worlds: innovation without compromising credibility.

The right model aligns with your funding needs, growth strategy, and long-term goals, ensuring a smooth path to sustainable success.

The Future of Fundraising in a Digital-First World

As regulatory frameworks become clearer and investor confidence strengthens, STO platforms are poised to lead the future of digital fundraising. Experts predict that the tokenized securities market could surpass $10 trillion by 2030[2], seamlessly integrating with traditional financial systems and reshaping the way capital is raised.

The shift toward a digital-first economy is accelerating. Innovations like tokenization, smart contracts, and blockchain technology are making digital fundraising faster, more secure, and accessible to investors around the world. This transformation isn’t just about technology; it’s about rethinking how value, ownership, and trust are exchanged in modern markets.

Success in this evolving landscape will depend on more than hype or speed. Transparency, regulatory compliance, and real-world utility will be the pillars of sustainable growth, ensuring that businesses and investors alike can thrive. Companies that adopt these principles while leveraging digital tools will be best positioned to succeed in a world where capital flows are borderless, instantaneous, and increasingly tokenized.

Ready to Explore Digital Fundraising Opportunities? Start Here –

The world of IPOs, ICOs, and STOs is full of exciting potential, offering unprecedented ways to raise capital, invest in innovative projects, and participate in the digital economy through modern crypto fundraising models. But navigating this landscape successfully requires the right guidance, informed decision-making, and a clear understanding of each model’s risks and rewards.

Whether you’re an investor looking for new opportunities to diversify your portfolio or a business preparing for your next funding round, now is the time to act. By exploring different crypto fundraising models, staying informed about market trends, and leveraging the power of blockchain and tokenization, you can make smarter, more strategic choices that drive growth and long-term success.

Take the first step toward shaping the future of finance—dive deeper, explore the opportunities that align with your goals, and position yourself at the forefront of this digital fundraising revolution. The possibilities are vast, and the time to start is today.

Frequently Asked Questions

An IPO (Initial Public Offering) is a traditional fundraising method where a company sells shares to the public, offering regulatory oversight and investor protection. An ICO (Initial Coin Offering) is a blockchain-based method where startups raise funds by selling digital tokens, often with less regulation but wider global access. An STO (Security Token Offering) is a regulated blockchain fundraising method where tokens represent real-world assets such as equity, bonds, or real estate, combining innovation with compliance for safer investments.

Digital fundraising enables companies to raise capital using technology, such as blockchain or online investment platforms. Through methods like ICOs, STOs, or IPOs, businesses can reach investors worldwide, issue tokenized shares, and automate compliance with smart contracts. This approach increases efficiency, reduces intermediaries, and allows global participation, creating new opportunities for both companies and investors.

Tokenization Fundraising is the process of converting physical or financial assets into digital tokens on a blockchain. It enables fractional ownership, allowing investors to buy small portions of assets such as real estate, art, or commodities. Tokenization enhances liquidity, simplifies transactions, and provides transparent and immutable records, making previously exclusive investment opportunities accessible to a wider audience.

Investors in ICOs benefit from fast, decentralized fundraising, early access to innovative projects, and global investment opportunities. ICOs allow anyone with a cryptocurrency wallet to participate, breaking geographic barriers. However, investors must carefully assess the project’s legitimacy, roadmap, and token utility because ICOs typically have less regulatory oversight compared to STOs or IPOs.

STOs provide investors with regulated, blockchain-based assets that represent real-world value, such as equity or real estate. Investors gain transparency, security, and legal protection while enjoying the efficiency and liquidity of tokenized assets. STOs are particularly attractive to those seeking the benefits of blockchain innovation without sacrificing regulatory compliance and investor protection.

Despite the opportunities, ICOs and STOs come with risks. ICOs can operate in regulatory gray areas, making them vulnerable to legal changes or fraud. Both ICOs and STOs can experience market volatility, affecting token values rapidly. Poorly managed projects or a lack of transparency may also result in financial losses. Conducting due diligence and verifying regulatory compliance is essential before investing.

Choosing a fundraising model depends on a company’s stage, growth plans, and investor needs. IPOs suit established companies seeking large-scale capital with strong regulatory credibility. ICOs are ideal for startups needing rapid, decentralized fundraising and community support. STOs provide a balanced approach, offering blockchain efficiency, investor trust, and regulatory compliance, making them ideal for companies that want innovation without legal risk.

Yes, small investors can engage in fractional ownership through tokenized assets. High-value investments, such as real estate, private equity, or fine art, can be divided into smaller tokens, making them affordable and accessible to a wider range of investors. This democratization allows smaller investors to diversify their portfolios and participate in markets that were previously exclusive to wealthy or institutional investors.

Digital fundraising, through ICOs and STOs, democratizes access to capital, enabling startups worldwide to raise funds from global investors. Tokenization and blockchain increase transparency, reduce transaction costs, and enhance liquidity. These innovations foster financial inclusion, support early-stage innovation, and create a more efficient and borderless economy by allowing capital to flow faster and more securely across markets.

The future of digital fundraising is moving toward regulated tokenized securities integrated with traditional financial systems. Experts predict the market could surpass $10 trillion by 2030, driven by smart contracts, global accessibility, and continuous liquidity. Businesses that combine regulatory compliance, transparency, and real-world utility are likely to thrive in this digital-first economy, reshaping how capital is raised and invested worldwide.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.