A modern dex development company offering seamless LP creation, router routing, factory automation, and wrapped-asset support.

We provide a complete range of decentralized exchange software development services to help businesses establish secure, scalable, and feature-rich platforms. Our solutions are designed for crypto startups, DeFi innovators, and enterprises seeking advanced DEX capabilities.

We provide decentralized exchange consulting that guides you through every stage of building, optimizing, and scaling your DEX. Our experts help you choose the right architecture, from AMM based models to advanced on chain orderbooks, while ensuring strong security, liquidity planning, and smooth user flows. We analyze your ecosystem, create a clear development roadmap, and offer technical strategies that reduce risks and improve performance. With precise guidance and industry proven expertise, we help you launch a reliable, future ready decentralized exchange.

Tech Experts On-Board

Projects Successfully Delivered

Happy Clients

Repeat Business

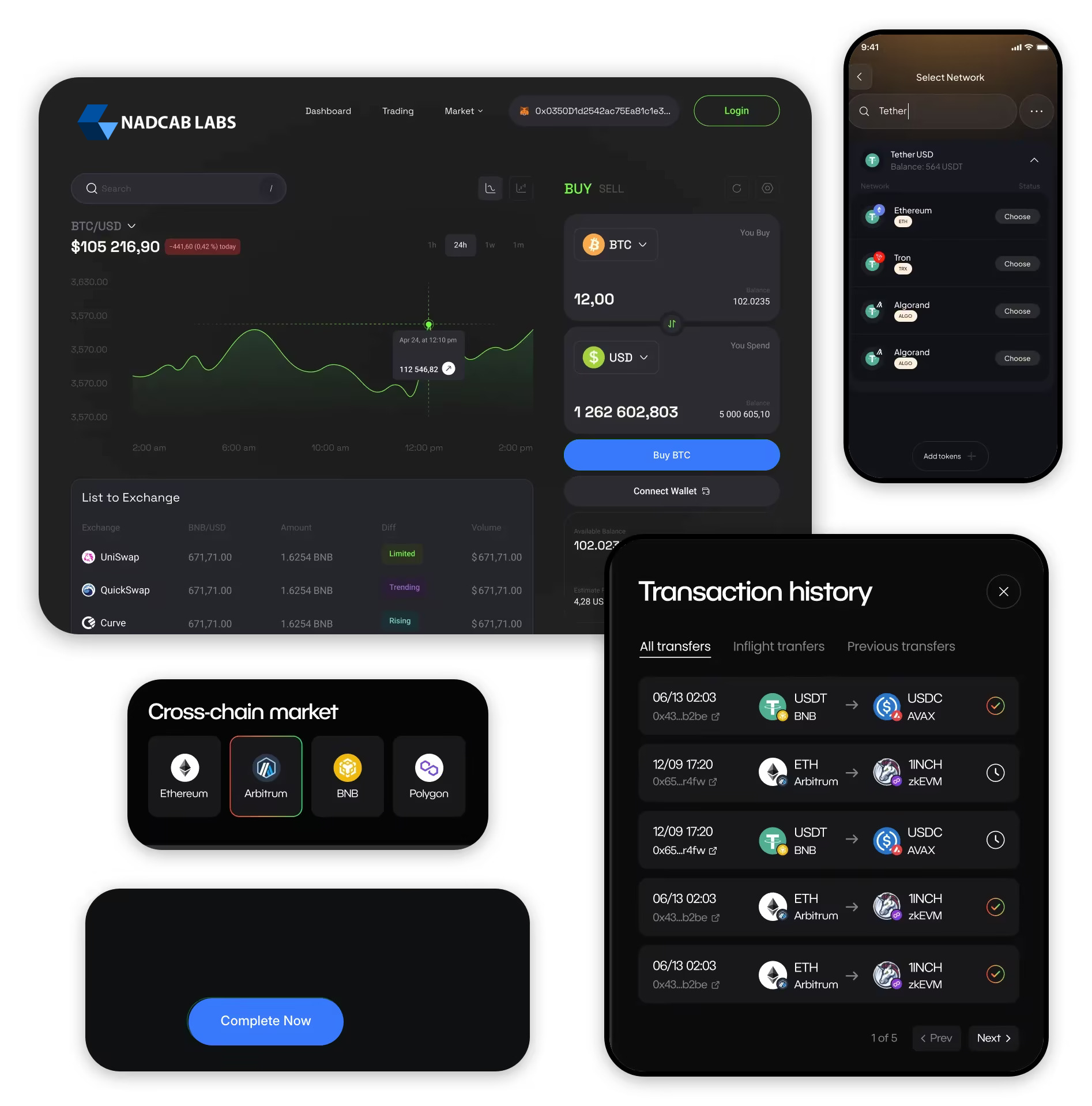

Nadcab Labs is recognized as one of the best DEX development companies, specializing in providing advanced decentralized exchange development services.

Build liquidity pool engine enabling permission less LP creation, dynamic fees, and deep liquidity markets. It supports multi-token pools, smart contract automation, and real-time pool analytics for stable, high-volume DeFi trading environments.

Our router intelligently scans multiple liquidity paths to ensure best-price execution with optimized slippage tolerance, automatically selecting the most efficient pools, enabling multi-hop trades, and delivering smooth, low-slippage swaps through seamless wallet and smart contract integration.

Trade across Ethereum, BSC, Polygon, and more. Our platforms connect multiple blockchains for cross-chain decentralized crypto exchange.

We provide cost-effective solutions for startups and businesses entering DeFi, without sacrificing quality, performance, or essential trading features.

With a distributed architecture, your platform stays secure and online, eliminating central vulnerabilities and enhancing system reliability.

We create platforms anyone can access, anytime, anywhere, bringing borderless finance to users through our DEX development services.

Our Decentralized trading platform development delivers enterprise-grade liquidity with audited smart contracts, transparent processes, strong compliance, and secure infrastructure designed to create a safe, smooth, and trusted global trading environment.

Nadcab Labs offers high-performance and secure DEX platforms that are scalable and utilize audited smart contracts with superior and advanced trading architecture, multi-chain support, and fluctuation and liquidity features for dependable global digital asset trading for institutional purposes.

Decentralized exchanges are designed with AI at the core to enable smarter trade execution, liquidity optimization, and real-time risk detection. This approach ensures consistently fast, stable, and high-performance trading experiences as user demand grows.

Every decentralized exchange software solution is built with audited smart contracts, MEV protection, and enterprise-grade security layers. This security-first mindset helps protect user assets, protocol liquidity, and platform credibility from day one.

DEX platforms are developed to operate seamlessly across multiple blockchains and Layer-2 networks. With cross-chain trading, gasless transactions, and modular architecture, long-term scalability and future readiness come built-in.

Both white label and fully custom decentralized exchange development options are available to meet different launch goals. Proven frameworks enable faster deployment while retaining complete control over branding, features, and platform growth.

Our case studies show how brands achieve real growth through advanced decentralized trading solutions. As a trusted DEX development company, we build secure scalable and high-performing exchange platforms that deliver measurable results.

Learn how DBOE built a decentralized options trading platform, providing secure, fast, and efficient trading solutions for blockchain users.

ViewThe client reviews we’ve received demonstrate the trust businesses place in our core decentralized exchange development solution. These ratings reflect our ability to build secure, scalable, and high-performance DEX platforms that help teams create dependable trading ecosystems, grow rapidly, and confidently choose Nadcab Labs as their long-term blockchain technology partner.

Step into the next generation of crypto trading with our top decentralized exchange software development company that develops feature-enriched DEX platforms.

Fortify your decentralized crypto exchange platform with multi-layered security, end-to-end encryption, and routine audits for complete user protection.

Our custom digital asset trading solutions ensure stable, scalable multi-currency support on every platform to offer a seamless trading experience.

Grow your user base organically with custom rewards and referral systems that drive retention, loyalty, and repeat trading behavior.

Attract long-term users by enabling crypto staking options, helping them earn rewards while supporting your DEX’s liquidity ecosystem.

Our team enables easy fiat-to-crypto transactions through secure crypto gateway integrations to expand user access and simplify crypto purchases

Boost liquidity and automate trading 24/7 with bot support, essential for efficient derivatives trading experiences and market responsiveness.

Experience ultra-fast execution with our trading engine that is built for scalability, perfect for advanced crypto and margin exchange trading platforms.

Deliver easy dashboards with real-time analytics for margin traders, liquidity providers, and decentralized order-matching platform users.

Fortify your decentralized crypto exchange platform with multi-layered security, end-to-end encryption, and routine audits for complete user protection.

Our custom digital asset trading solutions ensure stable, scalable multi-currency support on every platform to offer a seamless trading experience.

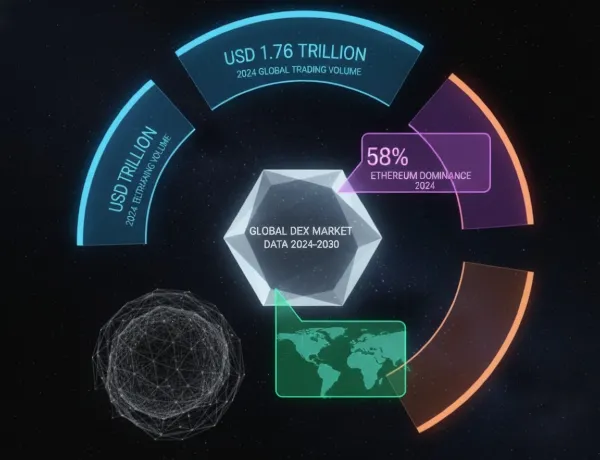

Global DEX trading volume exceeded USD 1.76 trillion in 2024.

Ethereum DEXs controlled over 58 percent of global volume.

North America led decentralized exchange adoption during 2024.

Annual DEX trading volume may exceed USD 480 billion by 2030.

Nadcab Labs delivers a powerful, decentralized exchange development Solution across leading blockchain networks with multi-chain support, audited smart contracts, fast architecture, and scalable security for custom, reliable DEX platforms.

Build decentralized exchanges that are secure, robust, and ready to scale with growing user activity. With Nadcab Labs’ advanced multi-chain technology stack and decentralized exchange development company, we create reliable trading ecosystems using modern blockchain frameworks and optimized infrastructure.

Digital trading is evolving as decentralized exchanges provide secure transparent access to global liquidity. Users are moving to self custodial trading and DEXs are becoming trusted platforms for scalable cross chain asset trading which drives demand for decentralized trading platform development.

Automated contracts remove intermediaries, enabling transparent and immutable trades.

AMM liquidity pools enable 24/7 trading without traditional market makers.

Non-custodial architecture gives traders full control, reducing centralized risks.

Open-source DEX frameworks allow faster development with secure, durable systems.

A successful DEX begins with a clear product vision supported by an experienced decentralized exchange development company. We shape your concept into a secure scalable and fully functional trading platform built to meet real user needs and market demands.

We understand your goals, platform needs, and user expectations to create a development plan for your decentralized exchange that ensures smooth workflows, strong performance, and an improved trading experience.

We have been recognized worldwide and have received numerous awards for our deep belief in building secure, scalable, and high-performance decentralized exchange platforms, strengthening our commitment to the innovative decentralized trading platform development.

We assess your trading engine needs, liquidity goals, and blockchain preferences to deliver a precise, transparent quote for DEX development fully aligned with your platform vision and our expertise as a trusted Decentralized Exchange Development Company.

Trading Engine Requirements

Liquidity Architecture

Smart Contract Scope

Token Standards

Security & Compliance Layer

Maintenance & Upgrade Plan

Decentralized exchanges are blockchain-based platforms that allow users to trade cryptocurrencies directly with each other, using smart contracts without needing a central authority or third party to manage transactions. Some modern platforms also integrate security token exchange capabilities, to enable regulated tokenized asset trading alongside cryptocurrencies.

Choose a decentralized exchange development company with proven experience, strong blockchain expertise, secure coding practices, clear communication, and a track record of successful platform launches tailored to your business goals.

Building a decentralized exchange depends on features and complexity. A basic version can be developed quickly, but decentralized exchange software development for a feature-rich, secure, and scalable platform requires a longer, well-structured process.

Anyone can list a token on most decentralized exchanges, as there are usually no gatekeepers. However, projects must ensure transparency and credibility to attract trust and active trading.

Decentralized exchange development services pricing may include design, smart contract development, backend coding, frontend UI, security audits, hosting infrastructure, and post-launch support.

A DEX Exchange Script is an out-of-the-box, easily customizable piece of software that lets you launch a decentralized exchange. It contains core trading functionality, smart contracts, liquidity modules, and security layers to enable a faster and cheaper DEX deployment experience.

The leading blockchains for building a DEX include Ethereum (ETH), BNB Chain, Polygon, Solana, Avalanche, and Arbitrum. The best network can depend on things such as gas fees, transaction speed, scalability, and the target user base.

Liquidity pools allow users to deposit a pair of tokens into a smart contract that can immediately swap the tokens, without an order book. For providing liquidity, the liquidity provider receives trading fees and rewards for supporting market flow.

Security will be kept in place by auditing smart contracts, penetration testing, layer encryption, logic to protect against frontrunning, and ongoing monitoring of the platform for exploits, vulnerabilities, and market manipulation.

Absolutely! Post launch, support would consist of performance improvements, feature improvements, bug fixes, to improve performance, ongoing security updates, managing liquidity, and continuous adjustments for the platform to improve stability and usability for the users.

Nadcab Labs excels as a top decentralized exchange development company, delivering secure, scalable, and feature-rich DEX platforms designed for seamless trading experiences.

Launch Your DEX Now