Decentralized AI Market Making

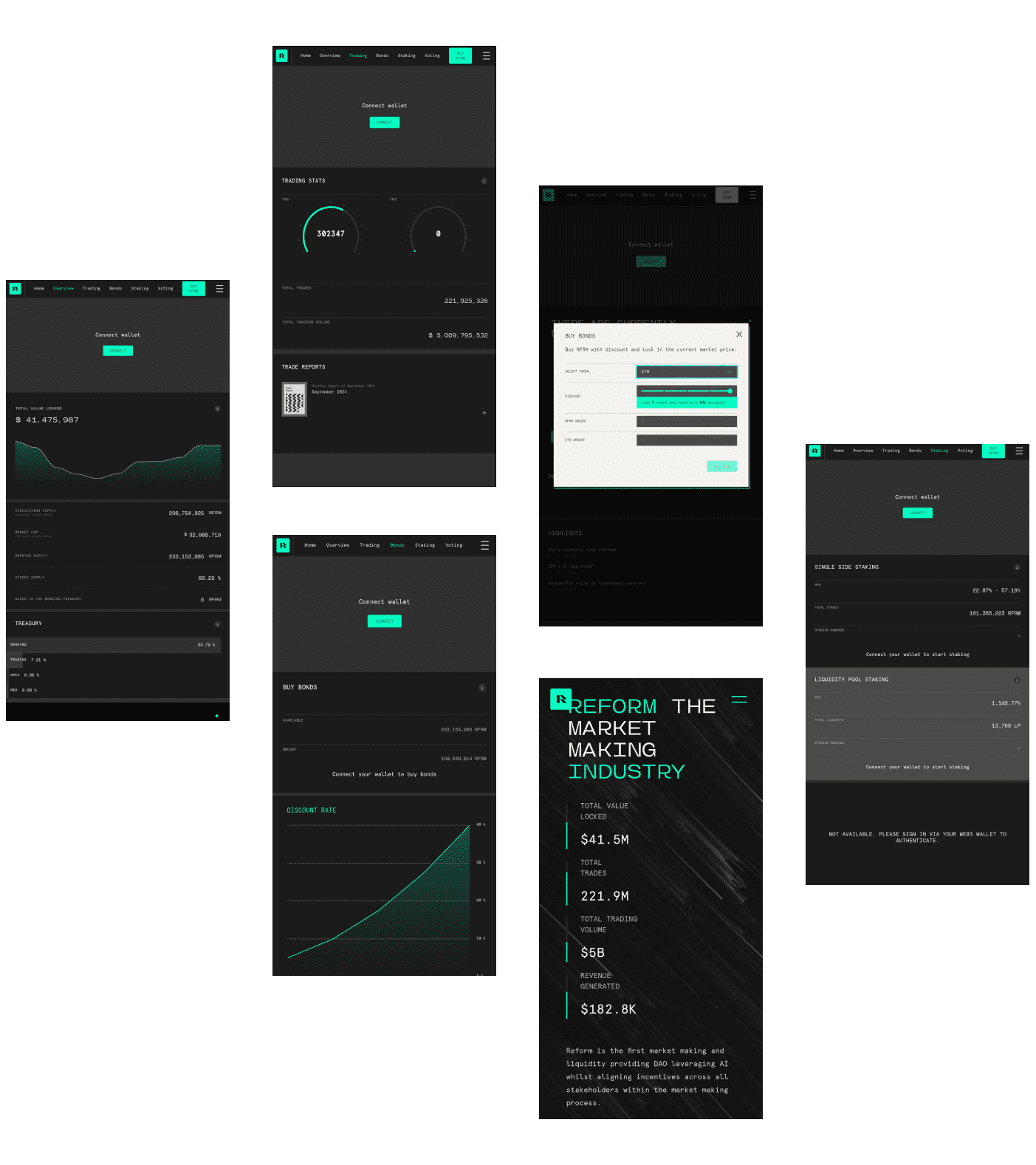

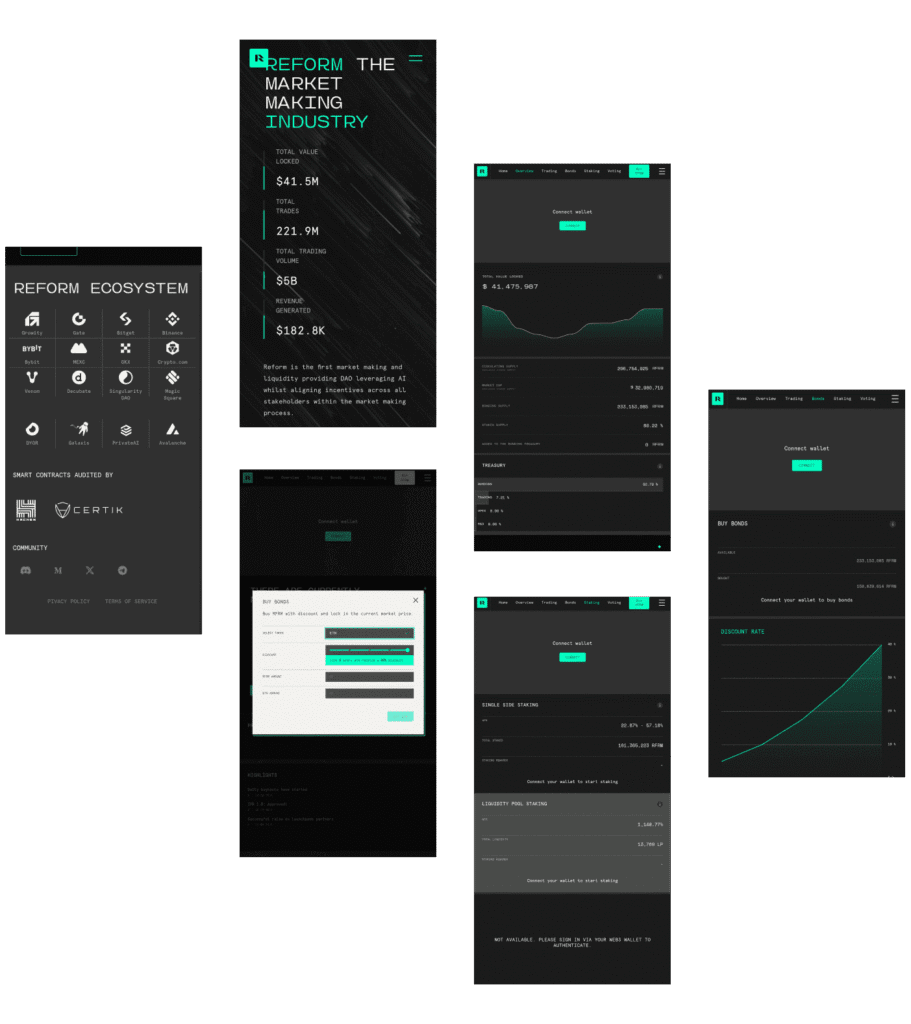

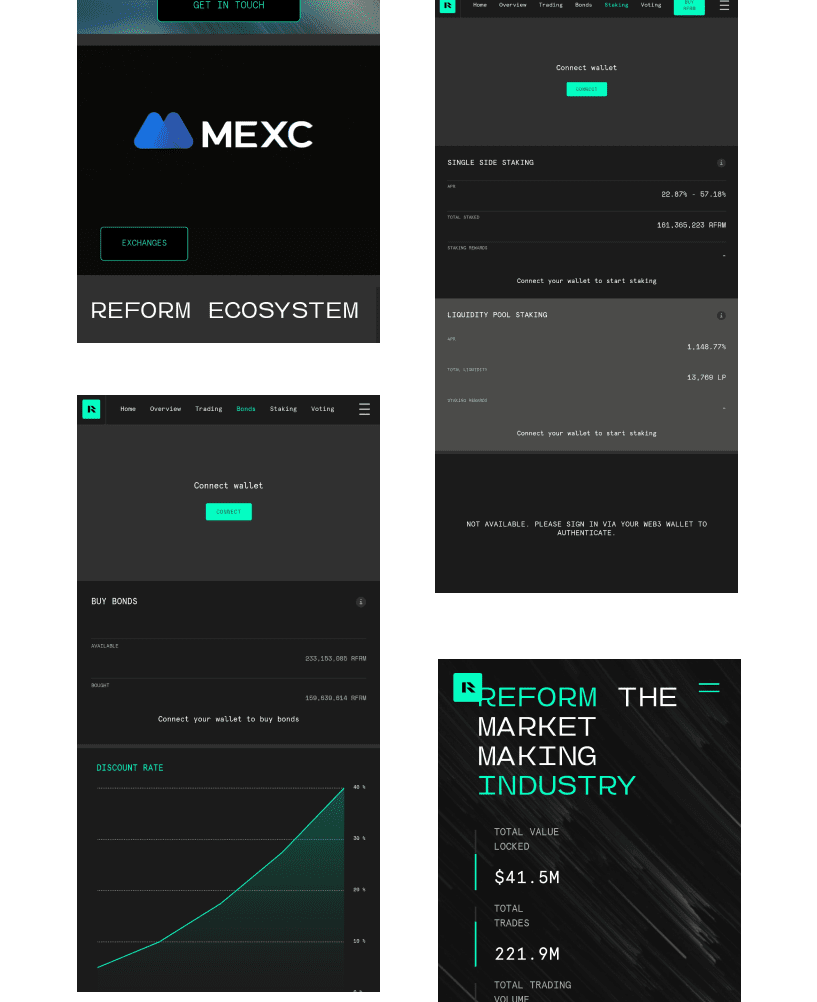

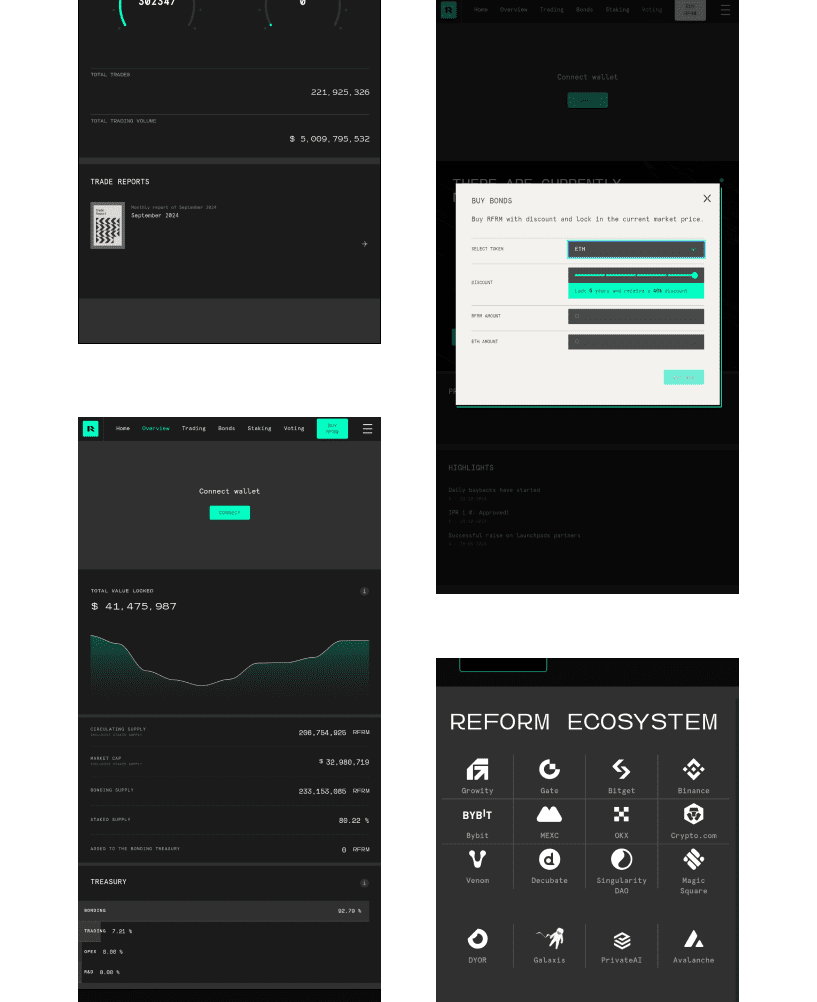

Reform DAO is revolutionizing market making with AI and community governance. Positioned at the heart of Decentralized Finance (DeFi), it offers transparency, efficiency, and user participation. With $41.5M TVL, $5B in volume, and 221.9M trades, Reform DAO optimizes liquidity, reduces volatility, and aligns the interests of projects, exchanges, and liquidity providers.

Get Started with this product

Reform DAO uses AI to predict market trends, ensure liquidity, and reduce volatility. Automated trading improves efficiency, stability, and responsiveness, offering smarter liquidity provision for token projects and traders.

Users can stake short- or long-term, earn rewards, and gain governance rights. Flexible plans suit different risk levels, boosting engagement and liquidity while supporting Reform DAO’s decentralized model.

Integrates with Binance, OKX, Gate.io for broader liquidity access. Seamless multi-exchange support enhances market depth, improves price stability, and offers efficient trading for global users and token projects.

All transactions are recorded on-chain for public viewing. This transparency builds user trust, ensures accountability, and makes Reform DAO a reliable and open platform for decentralized trading and governance.

Users providing liquidity earn rewards like tokens and staking benefits. This aligns user and platform goals, increases participation, boosts trading efficiency, and supports long-term market stability and growth.

Smart contracts are audited by Certik and Hacken. Regular audits identify vulnerabilities, protect user funds, and ensure Reform DAO follows high-security standards, building trust and reliability in the ecosystem.

Users earn rewards for contributing to platform growth through tasks. This promotes active involvement, strengthens decentralization, and fosters loyalty by making every participant part of Reform DAO’s development.

Stakeholders vote on key decisions, ensuring fair, transparent governance. This model empowers users, aligns interests, and builds a community-driven platform that evolves through collective input and decentralized control.

Reform DAO’s clients, including token projects and exchanges, sought a solution to stabilize token liquidity, enhance market depth, and minimize volatility. They required a market-making model that leveraged artificial intelligence (AI) to predict optimal trading scenarios, ensuring a smooth, decentralized experience. The solution needed to maintain transparency, promote fair participation, and reduce reliance on traditional market-making firms. Clients also demanded a secure platform capable of supporting large-scale transactions, with smart contract audits and safeguards against price manipulation to ensure trustworthiness and security.

Clients emphasized the importance of aligning incentives among all participants within the ecosystem, including developers, liquidity providers, and project backers. Reform DAO’s challenge was to design a market-making model that not only addressed liquidity gaps but also improved trading efficiency. By integrating AI and community-driven governance, Reform DAO created a decentralized system that encourages fair participation and supports the growth of token projects. This approach enhanced liquidity, minimized volatility, and made the entire market-making ecosystem more equitable, efficient, and sustainable for all stakeholders involved.

Participants earn influence by building a strong reputation through trustworthy actions. Reliable validators gain more decision-making power, ensuring accountability and transparency. This model prioritizes behavior over stake, promoting a secure, honest, and community-aligned blockchain ecosystem.

A few trusted validators create blocks based on their identity and reputation. PoA ensures fast, secure transactions with minimal decentralization, ideal for private blockchains needing efficient operations, reliable governance, and reduced risk of malicious behavior.

All token holders vote on protocol changes and governance proposals. This decentralized system promotes transparency and collective decision-making. Voting can be equal or stake-weighted, encouraging community participation and reflecting stakeholder interests across the network.

Token holders vote for delegates who validate transactions. This system improves scalability, reduces validator count, and speeds up transactions. Community-elected delegates maintain decentralization while enabling efficient governance in large, performance-focused blockchain networks.

Voting power equals the number of tokens held. More stake means more influence in decisions, aligning governance with investment. This model encourages responsible participation, balancing decentralization with efficient, investment-backed network governance.

Combines PoS energy efficiency with PoW security. PoW validates transactions through computation, while PoS selects validators via staked assets. This hybrid model enhances decentralization, scalability, and eco-friendliness for secure, high-performance blockchain networks.

Multiple participants must approve transactions before validation. This collective approach prevents single-party control, boosts security, and ensures trust. Ideal for high-value transactions or governance, adding accountability and reducing fraud in decentralized environments.

Validators are chosen based on staked tokens. Higher stakes increase validation chances. PoS is energy-efficient, scalable, and secure. Misbehavior risks losing stake, promoting honesty while enabling broader participation and decentralized governance.

Visual identity and design elements

Primary font family and usage

Brand colors

#01ffc3

#cdfa6d

Reform DAO began by identifying market inefficiencies and gathering insights from token projects, exchanges, and users. The goal was to build an AI-driven liquidity model with decentralized governance for transparency and fairness. The team used a structured, agile development process—starting with secure smart contracts, followed by testing and continuous feedback integration. Early focus included integrating major exchanges to provide broad trading access. Core features like staking, trading, and governance were released incrementally, enabling real-time community input and rapid iteration. This participatory method ensured that user needs shaped the platform’s evolution. By blending AI with community governance, Reform DAO aimed to optimize market-making and liquidity provisioning. The result was a reliable, user-driven ecosystem designed to empower both liquidity providers and traders in a secure and transparent crypto environment.

Reform DAO achieved widespread adoption from token issuers and traders due to its AI-powered efficiency and strong liquidity. This boosted trading volume and stabilized markets, reducing volatility across exchanges. The platform’s decentralized governance model and aligned incentives attracted a broad user base, enhancing engagement. As a result, Total Value Locked (TVL) grew significantly, confirming Reform DAO’s influence in the liquidity space. Security audits by reputable firms and on-chain transaction records built user trust. Its transparent model and active community participation helped retain users and shape governance. Empowering users to make decisions fostered loyalty and long-term commitment. Reform DAO’s democratic, transparent, and secure approach established its credibility and ensured continuous growth in the dynamic crypto market, positioning it as a key player among liquidity-focused DeFi platforms.

Reducing token price volatility while ensuring liquidity was a significant challenge for Reform DAO. To address this, the team relied heavily on AI and continuous optimization of trading algorithms to adapt to changing market conditions. By leveraging machine learning models, Reform DAO was able to dynamically adjust to price fluctuations, maintaining stability and preventing market manipulation.

Educating users on the benefits of decentralized market making was a key challenge for Reform DAO, especially since it was a new concept for many in the crypto space. Overcoming the traditional view of Centralized Exchanges required effective communication strategies to highlight the advantages of decentralized liquidity provision, such as transparency, lower fees, and the empowerment of community stakeholders.

Ensuring the highest level of security was a continuous priority for Reform DAO. To protect the platform from potential vulnerabilities, the project underwent repeated security audits by trusted firms like Hacken and Certik. These audits were essential in identifying any weaknesses in the smart contracts and ensuring the integrity of the platform’s on-chain transactions. Additionally, proactive measures were implemented to safeguard against potential hacks or exploits that could compromise the platform’s liquidity.

Reform DAO combines Ethereum and TON blockchains, AI strategies, and decentralized governance (PoS, DPoS). It uses React.js, Web3.js, Node.js, and MongoDB with 2FA and encryption for security, and smart contracts are audited by Certik and Hacken.