Key Takeaways

- Yield farming in blockchain enables capital holders to generate returns through liquidity provision across decentralized finance protocols using automated market maker mechanisms and incentive structures.

- Smart contract risks represent the primary security concern in yield farming strategies, requiring comprehensive audits and security assessments before committing significant capital to protocols.

- Impermanent loss occurs when token price ratios change within liquidity pools, potentially reducing returns below simple holding strategies despite earning trading fees and rewards.

- Multi-protocol yield stacking through composability allows sophisticated farmers to layer earning opportunities across lending platforms, liquidity pools, and governance staking simultaneously.

- Token emission schedules determine long-term sustainability of yield farming programs, with careful design balancing attractive returns against inflationary pressures on protocol tokens.

- Cross-chain yield farming introduces additional complexity and bridge risks while expanding opportunities to capture yields across multiple blockchain ecosystems and liquidity markets.

- Regulatory frameworks in USA, UK, UAE, and Canada increasingly scrutinize yield farming activities, particularly regarding securities classification and investor protection requirements.

- MEV extraction and front-running present ongoing risks in yield farming strategies where transaction ordering influences profitability and can disadvantage retail participants against sophisticated actors.

- Institutional adoption of yield farming accelerates as treasury management teams seek enhanced returns on idle capital while implementing rigorous risk management and compliance protocols.

- Risk-adjusted yield metrics provide essential frameworks for evaluating farming opportunities beyond simple APY figures, accounting for volatility, liquidity depth, and protocol maturity.

Yield farming in blockchain has revolutionized how participants generate returns on cryptocurrency holdings, transforming idle assets into productive capital through decentralized finance protocols. Since emerging in 2020, yield farming has evolved from experimental DeFi primitives into sophisticated financial strategies employed by individual users and institutional treasuries across global markets. The practice combines liquidity provision, token staking, and algorithmic lending to create multiple income streams from single capital bases. Understanding yield farming requires examining the technical mechanisms enabling these returns, the economic incentives driving protocol participation, and the risk factors that can quickly transform profitable positions into significant losses. Organizations operating in USA, UK, UAE, and Canadian financial centers increasingly allocate resources to yield farming as part of diversified treasury strategies, recognizing both the opportunities and complexities inherent in decentralized finance ecosystems.

Yield Farming as a Capital Allocation Mechanism in DeFi Protocols

Yield farming in blockchain functions as a sophisticated capital allocation mechanism where users deploy assets to maximize returns across decentralized finance protocols. The fundamental concept involves providing liquidity or lending capital to protocols that reward participation through interest payments, trading fees, and governance token emissions. Unlike traditional banking where institutions control deposit allocation and interest rate determination, yield farming empowers individual participants to make autonomous capital deployment decisions based on transparent on-chain data. Protocols compete for liquidity by offering attractive yields, creating efficient markets where capital flows to highest risk-adjusted opportunities. This market-driven allocation mechanism theoretically optimizes capital efficiency across the DeFi ecosystem, directing resources toward protocols providing greatest utility to users. The relationship between Blockchain Technology infrastructure and yield farming creates new paradigms for financial intermediation removing traditional gatekeepers.

Capital allocation through yield farming introduces game-theoretic dynamics where participants continuously optimize positions based on changing protocol incentives, market conditions, and competitive farmer behavior. Early protocol participants often receive outsized rewards through liquidity mining programs designed to bootstrap network effects, while later entrants face diminishing returns as total value locked increases. This creates boom-and-bust cycles where capital rushes into new opportunities before rewards normalize and farmers migrate to emerging protocols. Sophisticated participants in UK and Dubai financial hubs employ automated strategies monitoring hundreds of protocols simultaneously, executing capital rebalancing based on yield differentials, risk assessments, and gas cost optimization. The allocation mechanism self-regulates through yield compression as more capital chases opportunities, preventing sustained arbitrage opportunities while ensuring protocols maintain sufficient liquidity for user operations and trading activities.

Liquidity Incentives and the Game Theory Behind Yield Farming

Liquidity incentives represent the core mechanism driving participation in yield farming in blockchain ecosystems, with protocols distributing native governance tokens to early liquidity providers as compensation for bootstrapping network liquidity. These incentive programs create game-theoretic situations where participants balance short-term yield extraction against long-term protocol value accrual. Protocols must carefully calibrate emission schedules to attract sufficient liquidity without diluting token value through excessive inflation, while farmers strategize around optimal entry and exit timing to maximize returns before incentives decline or migrate. The game theory extends to participant categories including mercenary capital seeking maximum yields regardless of protocol loyalty, long-term believers holding positions despite yield volatility, and sophisticated actors employing complex strategies across multiple protocols simultaneously.

Coordination games emerge within yield farming ecosystems as individual optimization strategies interact with collective protocol outcomes. When too many participants chase identical opportunities simultaneously, yields compress through increased competition while gas costs for entering positions can exceed potential returns during network congestion. Conversely, undiscovered or overlooked protocols may offer asymmetric opportunities for participants conducting thorough research beyond trending farming programs. Protocol designers employ various game-theoretic tools including vesting schedules requiring long-term commitment, boosted rewards for governance participation, and tiered incentive structures favoring earlier participants. These mechanisms attempt to align farmer incentives with protocol sustainability, though tensions persist between extractive short-term strategies and cooperative long-term ecosystem building. Institutional participants from North American and European markets increasingly recognize these dynamics, implementing frameworks distinguishing between sustainable yield sources and unsustainable ponzi-like structures destined for collapse.[1]

Core Yield Farming Strategy Categories

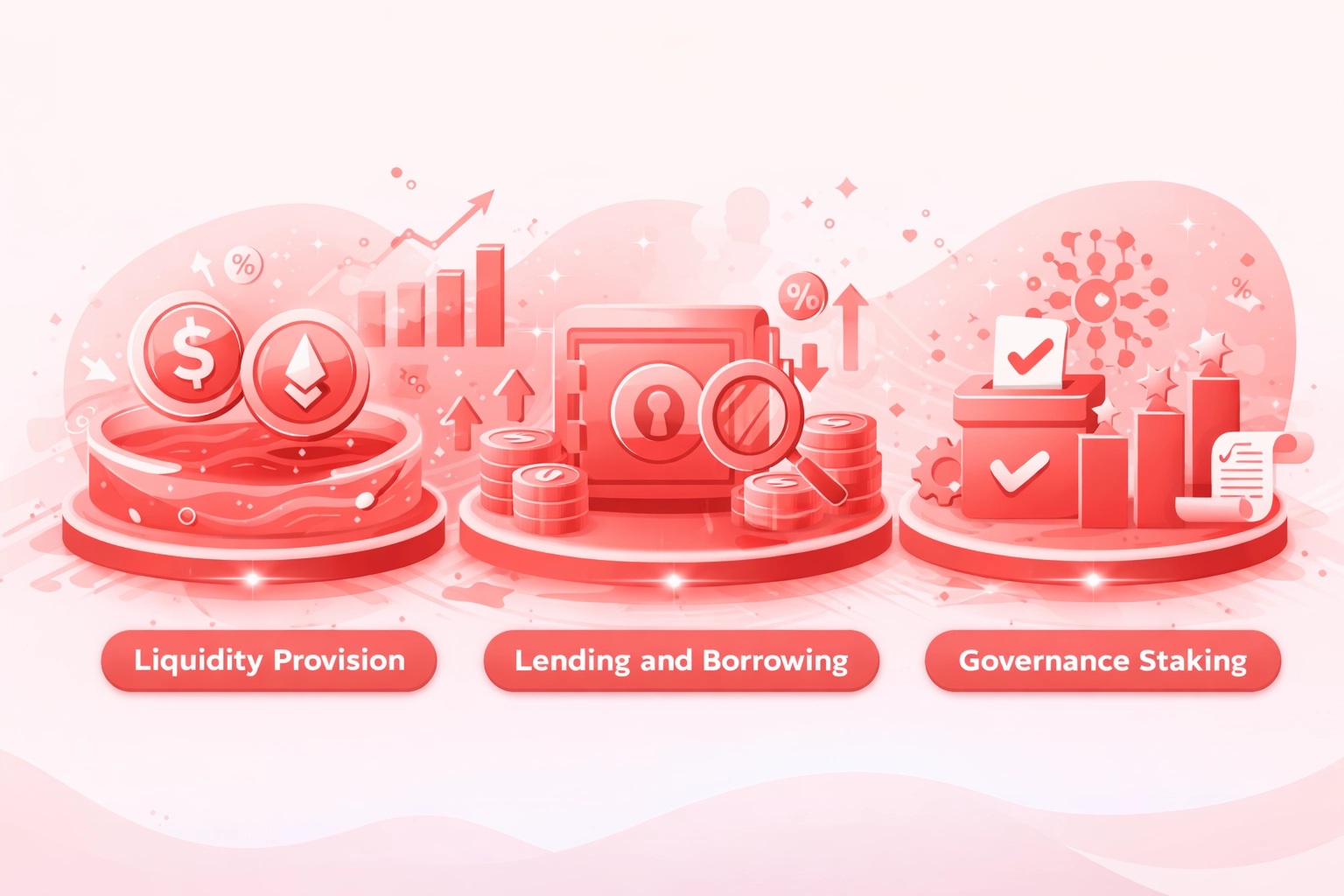

Core Yield Farming Strategy Categories

Liquidity Provision

- Deposit paired tokens into automated market maker pools

- Earn proportional share of trading fees from swaps

- Receive additional governance token incentives

- Face impermanent loss risk from price divergence

Lending and Borrowing

- Supply assets to lending protocols earning interest

- Borrow against collateral to leverage positions

- Capture interest rate spreads between protocols

- Manage liquidation risks from collateral ratios

Governance Staking

- Lock protocol governance tokens for voting rights

- Earn staking rewards and revenue share

- Influence protocol parameter decisions

- Accept liquidity lockup during staking periods

Smart Contract Risk Modeling in Yield Farming Strategies

Smart contract vulnerabilities represent the most significant risk factor in yield farming in blockchain strategies, with billions in total value locked subject to potential exploits from coding errors, logic flaws, and malicious attack vectors. Comprehensive risk modeling requires evaluating multiple dimensions including contract audit quality, code complexity, upgrade mechanisms, and historical security track records. Protocols utilizing simple, audited contracts from reputable security firms present lower risk profiles compared to experimental protocols with novel mechanisms lacking extensive review. Time-tested contracts operating successfully for years without incidents inspire greater confidence than newly deployed code regardless of audit status. Sophisticated risk assessors examine contract upgradeability patterns, as protocols with decentralized governance controlling upgrades pose different risk profiles than those with centralized admin keys capable of arbitrary code changes.

Quantitative risk modeling approaches incorporate various factors including total value locked as proxy for contract scrutiny, smart contract insurance availability and pricing, and composability risks from external dependencies. Protocols integrating numerous external contracts inherit combined risk from entire dependency chain, where vulnerabilities in any connected protocol can create exploitation pathways. Bug bounty programs signal protocol commitment to security by incentivizing white-hat hackers to discover vulnerabilities before malicious actors. Institutional yield farmers in Canadian and USA markets implement formal risk scoring frameworks rating protocols across security dimensions, allocating capital proportionally to risk-adjusted returns rather than absolute yields. This discipline prevents concentration in high-yield but high-risk protocols while maintaining diversified exposure across battle-tested platforms. Risk models continuously update based on new information including discovered vulnerabilities, successful exploits affecting similar protocols, and changes to protocol governance or treasury structures.

Smart Contract Risk Assessment Matrix

| Risk Factor | Low Risk Indicators | High Risk Indicators | Mitigation Strategies |

|---|---|---|---|

| Code Audit Quality | Multiple audits from top firms, public reports | No audits or single audit from unknown firm | Require minimum two independent audits |

| Contract Age | 1+ years operation without incidents | Recently deployed within weeks | Limit exposure to new protocols under 6 months |

| Upgrade Controls | Decentralized governance with timelocks | Centralized admin keys without delays | Monitor governance proposals for changes |

| Insurance Coverage | Available from multiple providers at reasonable cost | No coverage or prohibitively expensive premiums | Purchase insurance for high-value positions |

Role of Automated Market Makers in Yield Optimization

Automated market makers serve as foundational infrastructure for yield farming in blockchain by creating decentralized liquidity pools enabling trustless token swaps without traditional order books. AMMs algorithmically price assets based on pool token ratios using constant product or similar formulas, collecting fees from traders that get distributed to liquidity providers. This mechanism transforms passive token holders into active market makers earning yields from trading volume. Different AMM designs optimize for various use cases, with constant product models like Uniswap prioritizing simplicity, stableswap curves like Curve optimizing for pegged assets, and concentrated liquidity approaches like Uniswap V3 enabling capital efficiency through targeted price ranges. Each design creates distinct yield characteristics and risk profiles for liquidity providers participating in farming strategies.

Yield optimization through AMMs requires understanding fee tier selections, liquidity concentration strategies, and active management requirements. Constant product pools offer passive yield generation requiring minimal monitoring, while concentrated liquidity positions demand active rebalancing as market prices move beyond targeted ranges. Fee tiers create tradeoffs between volume and fee percentage, with lower-fee pools attracting more trading volume but distributing smaller percentages to providers. Sophisticated yield farmers in UK and UAE markets employ delta-neutral strategies providing liquidity in balanced amounts minimizing directional exposure while maximizing fee capture. Multi-pool strategies diversify across various AMM protocols and token pairs, reducing dependence on single protocol performance while capturing yields from different market segments. Automated vault protocols abstract AMM complexity by algorithmically managing liquidity positions, rebalancing ranges, and compounding rewards for users preferring hands-off approaches to yield farming.

Impermanent Loss Dynamics and Hedging Techniques

Impermanent loss represents a critical consideration in yield farming in blockchain through automated market maker pools, occurring when token price ratios diverge from deposit ratios reducing position value compared to simply holding tokens. The phenomenon arises from AMM rebalancing mechanics maintaining constant product relationships, automatically selling appreciating assets and buying depreciating ones to maintain pool ratios. Maximum impermanent loss approaches 25% when one token doubles relative to its pair, though trading fees and reward tokens often compensate for these losses over time. Understanding impermanent loss requires recognizing it only materializes upon withdrawal, remaining unrealized while positions stay active in pools. The terminology emphasizes temporary nature assuming prices eventually revert, though permanent loss occurs if withdrawing at unfavorable ratios or when tokens permanently diverge in value.

Hedging techniques for impermanent loss include selecting low-volatility paired assets like stablecoin pools minimizing price divergence risk, employing delta-neutral strategies through derivatives markets maintaining exposure balance, and accepting higher fees or rewards compensating for loss expectations. Concentrated liquidity positions in narrow ranges can amplify both fee earnings and impermanent loss, requiring careful range selection and active monitoring. Some protocols offer impermanent loss protection programs covering losses under certain conditions, though these typically require extended lockup periods or reduced yields. Quantitative models help farmers calculate break-even trading volumes where collected fees offset impermanent losses at various price movement scenarios. Sophisticated participants in North American markets incorporate impermanent loss expectations into position sizing decisions, allocating capital across multiple strategies balancing high-yield but high-impermanent-loss pools with stable yield sources from single-asset staking or lending protocols.

Yield Farming Position Lifecycle Management

Protocol Research and Selection

Evaluate protocol security through audit reviews, assess total value locked and historical performance, analyze token economics and emission schedules, and compare yields across similar strategies.

Capital Allocation and Position Entry

Determine position size based on risk assessment, acquire necessary tokens through swaps or purchases, approve token spending with smart contracts, and deposit assets into selected liquidity pools or lending protocols.

Active Position Monitoring

Track yield generation rates and reward token prices, monitor impermanent loss in liquidity positions, watch for protocol governance changes or security incidents, and assess gas costs for compound operations.

Reward Harvesting and Compounding

Claim accumulated reward tokens at optimal intervals, decide between selling rewards for realized profits or compounding back into positions, calculate net returns after gas costs, and rebalance allocations based on performance.

Risk Management Adjustments

Implement stop-loss mechanisms for leveraged positions, diversify across multiple protocols to reduce concentration risk, hedge impermanent loss through derivatives if available, and adjust position sizes based on market volatility.

Performance Analysis and Optimization

Calculate realized returns including all fees and impermanent losses, compare performance against holding strategies and alternative investments, identify optimization opportunities through protocol comparisons, and document lessons learned for future positions.

Strategic Reallocation

Migrate capital to higher-yielding opportunities when identified, exit positions showing declining returns or increasing risks, time movements around gas price fluctuations to minimize transaction costs, and maintain liquidity reserves for emerging opportunities.

Position Exit and Settlement

Withdraw liquidity from pools when strategy concludes, claim all pending rewards and governance tokens, convert earned assets to desired denominations, and document complete position history for tax reporting and performance tracking.

Multi-Protocol Yield Stacking and Composability Effects

Multi-protocol yield stacking leverages DeFi composability to layer earning opportunities across multiple protocols simultaneously, compounding returns beyond single-strategy yields. A sophisticated stacking strategy might deposit stablecoins into lending protocols earning interest, use borrowed funds to provide liquidity earning trading fees and incentive tokens, then stake those liquidity provider tokens in additional reward programs. This creates three or more income streams from single capital bases, though each layer introduces additional smart contract risk and complexity. Yield aggregation protocols automate stacking by programmatically deploying capital across multiple opportunities, rebalancing positions, and compounding rewards while abstracting complexity from users. These aggregators compete on optimization algorithms, gas efficiency, and protocol access, creating markets where sophisticated capital management becomes accessible to retail participants.

Composability effects extend beyond simple stacking to create emergent financial primitives impossible in traditional finance. Yield-bearing tokens themselves become collateral for additional borrowing, enable structured products with defined risk-return profiles, and facilitate complex arbitrage strategies across protocols and chains. This composability creates network effects where each new protocol enhances utility of existing protocols, driving ecosystem growth. However, composability also amplifies systemic risks as interdependencies create contagion vectors where single protocol failures cascade across connected systems. The 2020-2022 period demonstrated these risks through multiple incidents where exploits in foundational protocols impacted dozens of dependent applications. Institutional participants operating in Dubai and Canadian markets carefully map dependency graphs when designing yield strategies, implementing concentration limits preventing excessive exposure to single protocols or interconnected protocol groups. Understanding composability risks becomes as important as recognizing composability opportunities for sustainable yield farming success.

Token Emission Schedules and Sustainable Yield Design

Token emission schedules fundamentally determine long-term sustainability of yield farming in blockchain programs by balancing incentive attractiveness against token value dilution. Protocols must distribute sufficient tokens to attract liquidity competing with hundreds of alternatives while maintaining token scarcity supporting price appreciation. Front-loaded emission schedules create early adopter advantages and rapid TVL growth but risk mercenary capital departures once rewards decline. Linear emissions provide predictable yields but may struggle attracting initial liquidity against competitors offering higher short-term rates. Declining emission curves balance sustainability with bootstrapping needs, though require careful calibration preventing catastrophic yield cliff events triggering mass exits. The most sophisticated protocols implement dynamic emissions adjusting to market conditions, increasing rewards during low liquidity periods and decreasing during high participation.

Sustainable yield design extends beyond emission schedules to revenue generation enabling protocol-owned liquidity, real yield distribution from actual protocol earnings, and mechanisms converting mercenary farmers into long-term stakeholders. Protocols generating meaningful revenue from operations can distribute sustainable yields independent of token emissions, creating more stable farming opportunities. Token lockup requirements, vesting schedules for rewards, and boosted yields for long-term participants attempt shifting farmer time preferences toward extended commitment. Governance power tied to farming participation aligns incentives by providing additional value beyond simple yield extraction. Institutional analysts in UK and USA markets increasingly distinguish between sustainable protocols generating real economic value and unsustainable ponzi-like structures dependent on perpetual new capital inflows. This maturation transforms yield farming from pure speculation toward rational capital deployment based on fundamental protocol analysis and sustainable economics assessment.

Oracle-Driven Yield Adjustments and Price Risk Management

Oracle-driven mechanisms enable sophisticated yield farming in blockchain strategies by incorporating external price data into protocol operations, facilitating dynamic yield adjustments responding to market conditions. Interest rate protocols utilize oracles to set lending and borrowing rates based on market demand, asset volatility, and external reference rates. Yield optimization vaults employ oracle data to identify optimal farming opportunities, automatically rebalancing positions as relative returns change across protocols. Liquidation systems depend on accurate oracle pricing to trigger collateral seizures when loan ratios breach safety thresholds, protecting protocol solvency. Oracle quality directly impacts farmer outcomes as inaccurate or manipulated price feeds can trigger unwarranted liquidations, enable exploits, or cause miscalculated returns.

Price risk management in yield farming requires understanding oracle architectures, update frequencies, and manipulation resistance mechanisms. Protocols utilizing time-weighted average prices resist short-term manipulation but respond slowly to legitimate price movements during volatile periods. Multiple oracle aggregation provides redundancy against single oracle failures though increases complexity and gas costs. Decentralized oracle networks like Chainlink offer superior security through consensus mechanisms but introduce additional protocol dependencies. Sophisticated farmers assess oracle configurations when evaluating protocols, recognizing that weak oracle designs create exploitation opportunities for attackers while exposing legitimate users to liquidation risks. Price risk extends to reward token valuations where rapid price declines can transform apparently profitable positions into losses once tokens convert to stablecoins or exit to fiat. Participants in North American markets increasingly implement automated hedging strategies selling reward tokens immediately upon claiming, locking in realized profits rather than maintaining exposure to volatile governance tokens with uncertain long-term value.

Critical Risk Management Principles for Yield Farming

Principle 1: Never allocate more than 10% of total portfolio to any single yield farming protocol regardless of advertised returns or apparent security.

Principle 2: Require minimum two independent security audits from reputable firms before committing significant capital to any protocol smart contracts.

Principle 3: Calculate break-even periods accounting for impermanent loss scenarios at various price movement assumptions before entering liquidity positions.

Principle 4: Monitor protocol governance proposals and set alerts for changes affecting tokenomics, security parameters, or treasury management.

Principle 5: Implement automated stop-loss mechanisms for leveraged positions preventing liquidation risks during extreme market volatility events.

Principle 6: Diversify across multiple blockchain networks to reduce single-chain failure risks while managing bridge security considerations carefully.

Principle 7: Maintain detailed position tracking including entry prices, accumulated rewards, gas costs, and time-weighted returns for accurate performance measurement.

Principle 8: Reserve emergency withdrawal capacity maintaining sufficient liquid capital to exit positions quickly if protocol security concerns emerge suddenly.

Governance Tokens and Yield Farming Power Structures

Governance tokens distributed through yield farming in blockchain programs create complex power structures determining protocol evolution, parameter changes, and treasury allocation decisions. Early farmers accumulating large governance positions influence future protocol direction, creating tensions between early stakeholders and later participants. Token-weighted voting systems enable whales to dominate decisions regardless of broader community preferences, though various mitigation approaches including quadratic voting, conviction voting, and delegation mechanisms attempt balancing power distribution. Yield farmers must evaluate governance models when selecting protocols, as poor governance can lead to value extraction by insiders, unsustainable parameter changes, or security compromises serving narrow interests. Active governance participation transforms yield farming from pure financial activity into political economy engagement requiring ongoing attention beyond position monitoring.

Governance token economics create additional yield farming considerations beyond base protocol returns. Tokens providing governance rights often trade at premiums to intrinsic cash flow values, rewarding participants with influence over protocol futures. Vote delegation markets enable passive token holders to earn additional yields by renting governance power to active participants, creating meta-layers of earning opportunities. Governance attacks where malicious actors accumulate sufficient tokens to pass harmful proposals represent real risks, particularly for smaller protocols with concentrated ownership. Sophisticated farmers in UK and UAE markets analyze governance token distribution, voting participation rates, and proposal quality when assessing protocol maturity. Well-governed protocols attract long-term capital and institutional participation, while governance failures can trigger rapid value destruction regardless of technical merits. The interplay between financial yields and governance power creates multidimensional optimization problems where maximizing pure returns may sacrifice valuable governance influence over protocol evolution.

Cross-Chain Yield Farming and Liquidity Fragmentation

Cross-chain yield farming expands opportunity sets beyond single blockchain ecosystems, enabling capital deployment across Ethereum, BNB Chain, Polygon, Avalanche, and emerging networks offering diverse yield sources. Different chains provide varying gas costs, security assumptions, and protocol maturity levels creating tradeoffs between yield potential and risk exposure. Layer-2 networks offer lower transaction costs enabling profitable farming with smaller capital amounts, though introduce additional technical complexity and bridge security considerations. Multi-chain strategies require managing wrapped asset risks, understanding bridge mechanisms, and monitoring multiple wallet addresses across chains. Yield aggregators increasingly support cross-chain strategies, automatically bridging assets to optimal opportunities regardless of origin chain. This cross-chain capability democratizes access to best yields while introducing operational complexity previously limiting retail participation.

Liquidity fragmentation represents a significant challenge in cross-chain yield farming as capital spreads across numerous chains and protocols rather than concentrating in unified markets. Fragmentation reduces capital efficiency, increases slippage for large trades, and complicates price discovery across ecosystems. Bridge security vulnerabilities create systemic risks as billions in locked value depend on bridge integrity, with several major exploits in 2021-2023 demonstrating these risks. Network effects favor dominant chains accumulating most liquidity and protocol diversity, though emerging chains compete through superior technical features or aggressive incentive programs. Participants must balance opportunity diversification against fragmentation costs including bridge fees, time delays, and additional smart contract exposures. Institutional treasuries operating across USA and Canadian markets carefully evaluate cross-chain strategies, often limiting exposure to well-established chains with proven security records while allocating smaller exploratory capital to emerging ecosystems offering asymmetric opportunities.

Cross-Chain Yield Farming Infrastructure Comparison

| Blockchain Network | Average Gas Costs | Typical APY Range | Primary Advantages |

|---|---|---|---|

| Ethereum Mainnet | $5-50 per transaction | 3-15% | Highest security, deepest liquidity, most protocol options |

| BNB Chain | $0.10-1.00 per transaction | 8-30% | Low costs, fast finality, centralized exchange integration |

| Polygon | $0.01-0.10 per transaction | 5-25% | Ethereum compatibility, minimal fees, growing ecosystem |

| Avalanche | $0.25-2.00 per transaction | 10-40% | High throughput, subnet customization, incentive programs |

Flash Loans as Yield Farming Acceleration Tools

Flash loans enable sophisticated yield farming in blockchain strategies by providing instant, uncollateralized capital access within single transactions, allowing farmers to execute capital-intensive operations without maintaining large reserves. These atomic loans must be repaid within the same block, creating arbitrage opportunities, leverage multiplication, and collateral swap mechanisms impossible in traditional finance. Yield farmers utilize flash loans to refinance positions between protocols capturing interest rate differentials, execute complex arbitrage across DEXs and lending markets simultaneously, and leverage farming positions without risking permanent capital. The zero-cost capital access enables strategies where small percentage gains across large borrowed amounts generate meaningful profits after loan fees. Flash loan attacks represent sophisticated exploits manipulating protocol price oracles or governance mechanisms using borrowed capital, demonstrating both the power and risks of atomic composability.

Legitimate flash loan strategies include debt refinancing where farmers migrate leveraged positions to protocols offering better rates without liquidation risks, collateral swapping enabling portfolio rebalancing without temporary de-leveraging, and arbitrage execution capturing pricing inefficiencies across fragmented liquidity pools. Advanced farmers use flash loans to enter leveraged yield farming positions in single transactions, borrowing capital to amplify returns while carefully managing liquidation thresholds. Flash loan providers earn fees from each transaction, creating additional yield opportunities for lenders willing to provide instant liquidity. The technical complexity and gas costs limit flash loan strategies to sophisticated actors and larger position sizes where percentage gains justify transaction expenses. Participants in North American and European markets increasingly recognize flash loans as infrastructure enabling capital-efficient DeFi operations rather than purely exploitative tools, though ongoing security concerns require protocols to implement flash loan resistant pricing mechanisms and circuit breakers preventing manipulation.

Yield Farming vs Traditional Interest Rate Markets

Comparing yield farming in blockchain against traditional interest rate markets reveals fundamental differences in risk profiles, return mechanics, and regulatory protections. Traditional savings accounts and bonds offer 2-5% annual returns with deposit insurance, regulatory oversight, and institutional guarantees protecting principal. Yield farming provides 10-100%+ potential returns without safety nets, exposing participants to smart contract risks, market volatility, and potential total loss scenarios. Traditional markets achieve stability through centuries of legal framework evolution, central bank monetary policy, and stringent bank capital requirements. DeFi operates through experimental economic mechanisms, algorithmic interest rate determination, and community governance replacing institutional intermediaries. The yield premium in DeFi compensates for additional risks and lack of regulatory recourse available in traditional systems.

Structural differences extend to interest rate determination where traditional markets set rates through supply-demand equilibrium influenced by central bank policy and credit risk assessment, while DeFi protocols use algorithmic models responding to utilization ratios and governance parameters. Traditional finance segments markets by credit quality with differentiated rates for various risk profiles, whereas DeFi largely treats participants identically regardless of individual creditworthiness. Tax treatment varies significantly across jurisdictions, with traditional interest income clearly defined compared to uncertain DeFi yield classification creating compliance challenges. Sophisticated allocators in UK and Canadian markets view yield farming as portfolio diversification rather than replacement for traditional fixed income, accepting higher DeFi risks for uncorrelated return streams and technological innovation exposure. The optimal approach balances traditional stability with DeFi opportunities based on individual risk tolerance, technical sophistication, and regulatory environment.

Real-World Asset Tokenization and Yield Generation

Real-world asset tokenization extends yield farming in blockchain beyond pure cryptocurrency into tangible asset categories including real estate, commodities, invoices, and securities. Tokenized assets bring traditional yields onto blockchain rails, enabling composability with DeFi protocols while maintaining underlying asset economic characteristics. Real estate tokens representing fractional property ownership can generate rental income distributed as on-chain yields to holders, while treasury bill tokens provide government-backed returns through blockchain infrastructure. This convergence enables institutional treasuries to earn yields on tokenized traditional assets while maintaining DeFi position flexibility impossible in conventional markets. Regulatory frameworks in USA, UK, and UAE increasingly accommodate tokenized securities while imposing compliance requirements ensuring investor protections transfer to blockchain implementations.

Yield farming with tokenized real-world assets introduces hybrid risk profiles combining traditional asset fundamentals with blockchain-specific considerations. Legal structures ensuring token holder rights to underlying assets become critical, with poorly structured tokens creating claims without enforceable legal backing. Custody and verification mechanisms determine whether tokenized assets actually represent underlying collateral or merely claims against issuers. Regulatory treatment affects yield realization, with securities tokens requiring compliance with investment regulations while utility tokens may receive different classifications. The tokenized asset category bridges traditional finance seeking blockchain efficiency with DeFi innovations seeking real economic backing, creating opportunities for participants comfortable navigating both domains. Canadian and Dubai financial centers pioneer frameworks enabling compliant tokenized asset issuance, recognizing potential for enhanced capital efficiency while maintaining investor protections developed over decades of traditional market evolution.

Regulatory Pressure Points in Yield Farming Models

Regulatory scrutiny intensifies around yield farming in blockchain as authorities across USA, UK, UAE, and Canada evaluate whether protocols constitute unregistered securities offerings, investment vehicles, or banking services requiring licenses. Securities regulators examine whether governance tokens distributed through farming programs represent investment contracts under existing frameworks, potentially requiring registration and disclosure obligations. Banking regulators assess whether lending protocols accepting deposits and paying interest function as unauthorized banks requiring capital adequacy, deposit insurance, and operational licenses. Tax authorities grapple with yield classification questions including whether rewards constitute ordinary income, capital gains, or novel categories requiring new guidance. Compliance complexity varies dramatically across jurisdictions, with some regulators providing clarity while others maintain ambiguous positions creating uncertainty for participants and protocols.

Protocol responses to regulatory pressure include implementing KYC requirements restricting access to verified participants, geo-blocking users from restrictive jurisdictions, limiting promotions avoiding investment advice implications, and pursuing licenses enabling compliant operations in key markets. Some protocols embrace decentralization pursuing sufficient distribution preventing single-entity control, potentially exempting protocols from intermediary regulations. Legal structures selecting favorable jurisdictions and limiting protocol sponsor liability become critical for risk management. Participants face personal compliance obligations including tax reporting, adherence to investment restrictions, and potential liabilities for participating in unregistered offerings. Institutional participants from regulated financial sectors implement comprehensive compliance frameworks before yield farming, conducting legal reviews, establishing proper accounting treatments, and limiting exposure to protocols with uncertain regulatory status. The regulatory landscape continues evolving as authorities balance innovation encouragement against consumer protection mandates and financial stability concerns.

MEV, Front-Running, and Yield Extraction Risks

Maximal extractable value represents sophisticated yield extraction occurring at protocol infrastructure levels where validators and searchers capture value through transaction ordering, inclusion, and censorship powers. MEV impacts yield farming in blockchain through front-running attacks where bots detect profitable farming transactions in mempools and submit competing transactions with higher gas fees executing first. Sandwich attacks surround farmer transactions with strategically placed trades manipulating prices to extractors’ advantage at farmers’ expense. Back-running strategies execute immediately after farmer transactions capturing arbitrage opportunities created by price impacts. These extraction mechanisms effectively tax DeFi participants, with MEV estimates suggesting billions in annual value transferred from users to validators and searchers. Understanding MEV risks becomes essential for yield farmers as extraction reduces realized returns below theoretical yields calculated from protocol parameters alone.

Mitigation strategies against MEV extraction include using private transaction pools bypassing public mempools, submitting transactions through flashbots enabling direct validator communication, and employing MEV-aware transaction routing services. Limit orders rather than market orders reduce front-running vulnerability by specifying maximum acceptable slippage. Batching operations minimizing transaction frequency decreases MEV exposure opportunities. Some protocols implement MEV redistribution mechanisms where extracted value returns to liquidity providers rather than leaking to external actors. The MEV landscape continuously evolves as protocols, validators, and farmers engage in arms races balancing extraction opportunities against ecosystem health. Sophisticated participants operating in competitive markets recognize MEV as inherent DeFi cost rather than avoidable risk, incorporating extraction estimates into yield calculations and position sizing decisions. Long-term solutions may emerge through protocol designs limiting ordering importance or implementing fair transaction sequencing mechanisms protecting users from predatory extraction.

Yield Farming in Institutional and Treasury Management

Institutional adoption of yield farming in blockchain accelerates as treasury managers seek enhanced returns on corporate cash holdings, protocol-owned liquidity, and DAO treasuries. Traditional treasury instruments offer minimal returns in low-rate environments, driving exploration of DeFi opportunities potentially generating 5-15% yields on stablecoin deployments with manageable risk profiles. Institutions implement rigorous frameworks before participating including comprehensive protocol security reviews, legal compliance assessments, operational procedure documentation, and board-level risk approvals. Custodial solutions enabling institutional participation include qualified custodians supporting DeFi interactions, multi-signature treasury management platforms, and insurance products covering protocol exploits. Geographic concentration in USA, UK, Canadian, and UAE financial centers reflects regulatory clarity and professional service availability supporting institutional DeFi participation.

Institutional strategies emphasize capital preservation over maximum yields, preferring battle-tested protocols with extensive audit histories and substantial insurance coverage. Blue-chip DeFi protocols including Aave, Compound, and Uniswap attract majority institutional interest through demonstrated longevity and security track records. Position sizes start conservatively with single-digit percentage allocations expanding gradually as organizations develop operational expertise and confidence. Professional yield management services emerge providing institutional-grade execution, monitoring, and reporting while abstracting technical complexity. The institutional presence brings maturation pressures on DeFi protocols including demand for regulatory compliance, formal customer support, and traditional financial reporting standards. This professionalization potentially reduces yields as protocols prioritize stability and compliance over aggressive incentive programs, though broader institutional adoption may expand total market size compensating for compressed rates. The trajectory suggests yield farming evolving from retail experimentation toward mainstream treasury management practice across sophisticated organizations worldwide.

Risk-Adjusted Yield Metrics for DeFi Investors

Risk-adjusted yield metrics provide essential frameworks for evaluating yield farming in blockchain opportunities beyond simple APY comparisons, accounting for volatility, smart contract risks, and protocol-specific factors. Sharpe ratio calculations measuring excess returns per unit of volatility enable comparison across farming strategies with differing risk profiles. Sortino ratios focusing on downside deviation better capture asymmetric DeFi risks where losses from exploits vastly exceed typical volatility. Maximum drawdown metrics quantify worst-case scenarios critical for position sizing and risk management. Value-at-risk models estimate potential losses at various confidence levels, informing capital allocation decisions. These quantitative approaches complement qualitative assessments of protocol maturity, audit quality, and team competence creating comprehensive evaluation frameworks.

Advanced metrics incorporate protocol-specific factors including smart contract insurance costs reflecting market risk perceptions, total value locked indicating protocol battle-testing, and governance token volatility affecting reward value realization. Time-weighted returns accounting for position entry and exit timing provide accurate performance measurement compared to misleading simple return calculations. Gas cost adjustments essential for accurate small position profitability assessment, with high Ethereum fees potentially eliminating returns below certain capital thresholds. Impermanent loss adjusted returns for liquidity provision strategies enable true profitability assessment beyond naive APY marketing. Sophisticated investors in North American and European markets employ these frameworks systematically, creating scorecards ranking opportunities across multiple dimensions rather than chasing highest advertised yields. The analytical rigor separates sustainable farming strategies from unsustainable speculation, supporting long-term capital preservation and growth objectives essential for institutional participation and mainstream adoption.

Future Evolution of Yield Farming in Decentralized Finance

Future evolution of yield farming in blockchain points toward increased sophistication through improved tooling, institutional infrastructure, and regulatory integration. Automated strategies will employ machine learning optimizing capital allocation across hundreds of opportunities based on risk-return profiles and market conditions. Cross-chain interoperability protocols will enable seamless capital deployment regardless of underlying blockchain, abstracting chain-specific complexities from users. Real-world asset integration will expand dramatically as tokenization frameworks mature, bringing trillions in traditional assets onto blockchain rails generating yields through DeFi mechanisms. Regulatory clarity emerging across major jurisdictions will enable compliant protocol designs supporting mainstream adoption while potentially fragmenting markets between compliant and non-compliant segments.

Technical innovations including zero-knowledge proofs may enable privacy-preserving farming protecting competitive strategies from front-running while maintaining protocol transparency. Layer-2 scaling solutions will reduce transaction costs making farming profitable at smaller capital amounts, democratizing access beyond current whale-dominated landscapes. Protocol-owned liquidity models may replace mercenary farming through mechanisms where protocols bootstrap their own liquidity eliminating dependence on incentive programs. Institutional-grade infrastructure including prime brokerage services, unified reporting platforms, and comprehensive insurance products will mature supporting treasury-scale deployments. The synthesis of traditional finance expertise with blockchain innovation promises yield farming evolution from experimental frontier toward established asset class within diversified investment portfolios across USA, UK, UAE, and Canadian financial institutions. This maturation trajectory balanced against ongoing innovation creates dynamic ecosystem requiring continuous learning and adaptation from participants seeking sustainable competitive advantages in decentralized finance markets.

Optimize Your DeFi Yield Strategy with Expert Guidance

Partner with our blockchain specialists to design risk-optimized yield farming strategies that maximize returns while maintaining institutional-grade security and compliance standards.

Frequently Asked Questions

Yield farming in blockchain refers to the practice of strategically deploying cryptocurrency assets across various DeFi protocols to maximize returns through interest, rewards, and governance tokens. Users provide liquidity to decentralized exchanges and lending platforms by depositing tokens into smart contract-based pools, earning yields from trading fees, interest payments, and protocol incentive programs. The process involves continuous optimization as farmers move capital between protocols seeking highest risk-adjusted returns. Yield farming combines liquidity provision, staking, and lending strategies while introducing complex considerations including impermanent loss, smart contract risks, and market volatility impacts on portfolio performance.

Yield farming in blockchain can generate returns ranging from 5% to over 100% annually depending on protocol selection, market conditions, and risk tolerance, significantly exceeding traditional savings accounts or bonds. However, these returns come with substantially higher risks including smart contract vulnerabilities, impermanent loss from volatile asset pairs, and potential complete capital loss from protocol failures. Traditional investments offer regulatory protections and stable returns between 2-8% annually with lower volatility. Sophisticated farmers in USA, UK, and UAE markets carefully balance yield opportunities against risk exposures, often allocating only portions of portfolios to high-yield DeFi strategies while maintaining diversified traditional holdings.

Primary risks in yield farming in blockchain include smart contract vulnerabilities allowing hackers to drain liquidity pools, impermanent loss from token price divergence reducing returns below simple holding strategies, and rug pulls where malicious teams abandon projects after attracting deposits. Additional risks encompass regulatory uncertainty particularly in USA and Canadian markets, oracle manipulation affecting price-dependent protocols, and liquidation risks in leveraged farming positions. Market volatility can quickly turn profitable positions negative, while high gas fees on congested networks erode returns. Platform insolvency, governance attacks, and flash loan exploits represent additional threat vectors requiring careful protocol selection and position monitoring.

Automated market makers enable yield farming in blockchain by creating decentralized liquidity pools where users deposit token pairs to facilitate trading without traditional order books. AMMs use mathematical formulas to determine exchange rates based on pool token ratios, collecting trading fees from swaps that get distributed to liquidity providers proportional to their pool shares. These fees combined with protocol incentive tokens create yield opportunities for farmers providing capital. AMMs democratize market making by allowing anyone to become liquidity providers, though participants must understand impermanent loss dynamics where price movements between paired assets can reduce returns compared to simply holding tokens separately.

Institutional investors approaching yield farming in blockchain employ risk-adjusted strategies including diversification across multiple audited protocols, algorithmic rebalancing to maintain optimal asset allocations, and hedging impermanent loss through derivatives markets. Major funds in UK and Dubai financial centers utilize automated treasury management systems executing complex multi-protocol strategies while maintaining compliance with regulatory frameworks. Institutions prioritize blue-chip DeFi protocols with proven security records, substantial insurance coverage, and transparent governance. Many implement staged entry strategies testing protocols with small allocations before scaling positions, while maintaining strict risk parameters including stop-loss mechanisms, concentration limits, and regular security audits of yield-generating positions.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.