Key Takeaways

- Crypto exchange compliance ensures platforms operate legally, securely, and build investor trust.

- AML compliance for crypto exchanges detects suspicious activity and prevents money laundering.

- KYC compliance for crypto exchanges verifies users and reduces fraud risks.

- Crypto exchange regulations like FCA, MAS, SEC, and MiCA guide safe and transparent trading.

- Global standards like FATF guidelines, Travel Rule, GDPR, and PCI-DSS ensure secure operations.

- Step-by-step compliance includes user verification, risk assessment, transaction monitoring, and regulatory reporting.

- AI-powered monitoring and automation help exchanges stay compliant and detect unusual activity.

- Compliance challenges include rapidly changing laws, multi-jurisdiction operations, and high-risk users.

- Future compliance relies on stronger AML/KYC standards and technology-driven solutions.

What is Crypto Exchange Compliance?

Crypto exchange compliance is the process by which cryptocurrency platforms follow the necessary rules and standards to operate safely and legally. Simply put, it ensures that exchanges maintain the highest levels of security, protect their users, and prevent illegal activities.

Why does compliance matter? Without proper compliance, crypto exchanges could face legal penalties, lose user trust, or even be shut down by regulators. Think of compliance as traffic rules for crypto trading. While the rules exist to guide behavior, compliance is how the exchange actually follows them, ensuring smooth and safe operations.

Exchanges integrate compliance mechanisms, such as AML compliance for crypto exchanges and KYC compliance for crypto exchanges, to detect suspicious activity and verify user identities. This combination not only safeguards the platform but also strengthens investor confidence worldwide.

What are Crypto Exchange Regulations?

Crypto exchange regulations are the rules and guidelines that governments and regulatory authorities impose to oversee cryptocurrency trading. These regulations are designed to prevent illegal activities like money laundering, terrorism financing, and fraud while ensuring that platforms operate transparently.

Who Creates Crypto Exchange Regulations?

Regulations for crypto exchanges are created by national governments, financial regulators, and global authorities. Some of the most influential bodies include:

- FCA crypto exchange regulations (UK)

- MAS crypto regulations (Singapore)

- SEC crypto exchange rules (USA)

- FINRA compliance for crypto platforms (USA)

- MiCA regulation for crypto exchanges (European Union)

These authorities establish the legal framework that exchanges must follow to operate within their jurisdiction.

Why Regulations Are Important for Crypto Exchanges

Following regulations ensures that platforms protect their users, maintain transparency, and avoid legal penalties. For instance, adherence to FIU-IND AML compliance in India or GDPR compliance for crypto exchanges in Europe guarantees that user data is secure and that exchanges operate responsibly.

By complying with regulations, exchanges can offer secure trading experiences, attract global investors, and sustain long-term growth.

Role of AML and KYC in Compliance

AML (Anti-Money Laundering) and KYC (Know Your Customer) are the pillars of crypto exchange compliance. Together, they prevent illegal activities, verify user identities, and maintain a secure trading environment.

What Is AML in a Crypto Exchange?

AML in a crypto exchange refers to the systems and processes designed to detect and prevent money laundering. AML compliance for crypto exchanges includes real-time transaction monitoring, risk scoring, and reporting suspicious activities to authorities. Adhering to FATF guidelines for crypto exchanges ensures that the platform can operate safely in multiple jurisdictions.

What Is KYC in a Crypto Exchange?

KYC is the process of verifying the identity of users before they can trade on a crypto platform. KYC compliance for crypto exchanges includes collecting government-issued documents, performing background checks, and screening users against sanction lists. Combined with AML practices, KYC ensures that high-risk users are identified, and illegal transactions are prevented.

Why AML and KYC Are Required for Crypto Exchanges

AML (Anti-Money Laundering) and KYC (Know Your Customer) are essential components of crypto exchange compliance. These frameworks ensure that exchanges operate legally, safely, and transparently. Regulatory authorities worldwide, including the FCA crypto exchange regulations, MAS crypto regulations, and SEC crypto exchange rules, require crypto platforms to implement strict AML and KYC processes to prevent misuse.

Without AML and KYC compliance, exchanges risk facilitating illegal activities such as money laundering, fraud, and terrorism financing. Moreover, these processes protect investors and ensure that platforms remain trustworthy. Adhering to regulatory compliance for crypto exchanges also helps exchanges comply with international standards, from FATF guidelines for crypto exchanges to Travel Rule compliance in crypto, creating a safe ecosystem for all users.

Preventing Illegal Activities

AML measures help detect and prevent illegal transactions on a crypto exchange. By monitoring all transactions and screening users against sanctioned lists, platforms can identify suspicious activities early. Following standards such as FIU-IND AML compliance in India ensures that platforms can flag high-risk transactions and report them to authorities, thereby maintaining full regulatory adherence.

Protecting Users and the Platform

KYC compliance ensures that every user is verified and authenticated before participating in the exchange. This includes collecting government-issued IDs, performing background checks, and ensuring that users are not involved in criminal activities. When combined with AML systems, AML & KYC compliance for crypto exchanges reduces fraud risks and builds confidence among global investors. Proper crypto exchange compliance ensures that both the platform and its users are protected at all times.

Crypto Exchange Legal Requirements and Compliance Framework

To operate legally, crypto exchanges must implement a robust compliance framework. This framework includes clear policies for user verification, ongoing transaction monitoring, and risk assessment. Platforms also adopt PCI-DSS compliance for crypto payments and GDPR compliance for crypto exchanges to secure financial and personal data. Following these frameworks ensures adherence to laws such as FCA crypto exchange regulations, MAS crypto regulations, MiCA regulation for crypto exchanges, and SEC crypto exchange rules.

User Verification and Identity Checks

User verification is the foundation of AML and KYC compliance. Every participant must provide verified identification, and exchanges perform checks to screen for politically exposed persons (PEPs) or sanctioned entities. This ensures that high-risk users are flagged and prevented from conducting illegal transactions.

Transaction Monitoring and Risk Control

Transaction monitoring involves continuous tracking of deposits, withdrawals, and transfers. Exchanges implement automated systems that detect unusual activity patterns, ensuring regulatory compliance in real-time. Risk control frameworks maintain platform security and operational integrity, helping meet FINRA compliance for crypto platforms and global AML/KYC standards.

Global Crypto Compliance Standards Followed by Exchanges

Leading crypto exchanges follow internationally recognized standards to ensure safe and compliant operations. This includes:

FATF Guidelines and Travel Rule

The FATF guidelines for crypto exchanges provide a framework for anti-money laundering, while the Travel Rule compliance in crypto ensures proper reporting of cross-border transfers. These regulations create uniformity in compliance and facilitate safer global transactions.

Regional Regulations (EU, USA, UK, Singapore)

Exchanges also adhere to regional laws such as MiCA regulation for crypto exchanges (EU), FCA crypto exchange regulations (UK), MAS crypto regulations (Singapore), and SEC crypto exchange rules (USA). Combining these with GDPR compliance for crypto exchanges and PCI-DSS compliance for crypto payments ensures complete global compliance, making the exchange secure and legally reliable for international users.

How Crypto Exchanges Follow AML and KYC Compliance in Practice

Crypto exchanges follow AML & KYC compliance through a combination of robust processes, advanced technologies, and strict regulatory alignment. Following FATF guidelines for crypto exchanges, they ensure that every transaction is monitored, users are verified, and suspicious activity is flagged immediately.

Step-by-Step Compliance Process

Exchanges typically implement a step-by-step process to meet regulatory requirements:

- User Registration and Verification – Users must provide valid identification and complete KYC compliance for crypto exchanges checks. This includes document verification and identity authentication.

- Risk Assessment – Each account is assessed for risk based on location, transaction history, and external watchlists. Platforms follow FIU-IND AML compliance in India and adhere to Travel Rule compliance in crypto for cross-border transactions.

- Transaction Monitoring – Exchanges track transactions in real-time using automated systems to detect suspicious behavior. This process aligns with AML compliance for crypto exchanges and ensures adherence to PCI-DSS compliance for crypto payments.

- Regulatory Reporting – Any suspicious or high-risk transactions are reported to the relevant authorities in compliance with FCA crypto exchange regulations, MAS crypto regulations, and SEC crypto exchange rules.

Continuous Monitoring and Updates

Crypto exchange compliance isn’t a one-time task; it’s an ongoing process. Exchanges continuously monitor transactions, user behavior, and platform activity to detect suspicious activity early. Advanced technologies like AI-powered transaction monitoring and machine learning risk scoring help platforms spot unusual patterns in real time, such as sudden large deposits, multiple withdrawals, or cross-border transfers flagged under Travel Rule compliance in crypto.

Exchanges also update internal policies and systems regularly to stay aligned with FCA crypto exchange regulations, MAS crypto regulations, and MiCA regulations for crypto exchanges. Continuous monitoring ensures the platform remains secure, compliant, and trustworthy, protecting both users and investors worldwide.

Build a Secure, Fully Compliant Crypto Exchange

Stay Compliant, Avoid Penalties, and Scale Your Crypto Exchange Confidently

Challenges in Maintaining Compliance for Crypto Exchanges

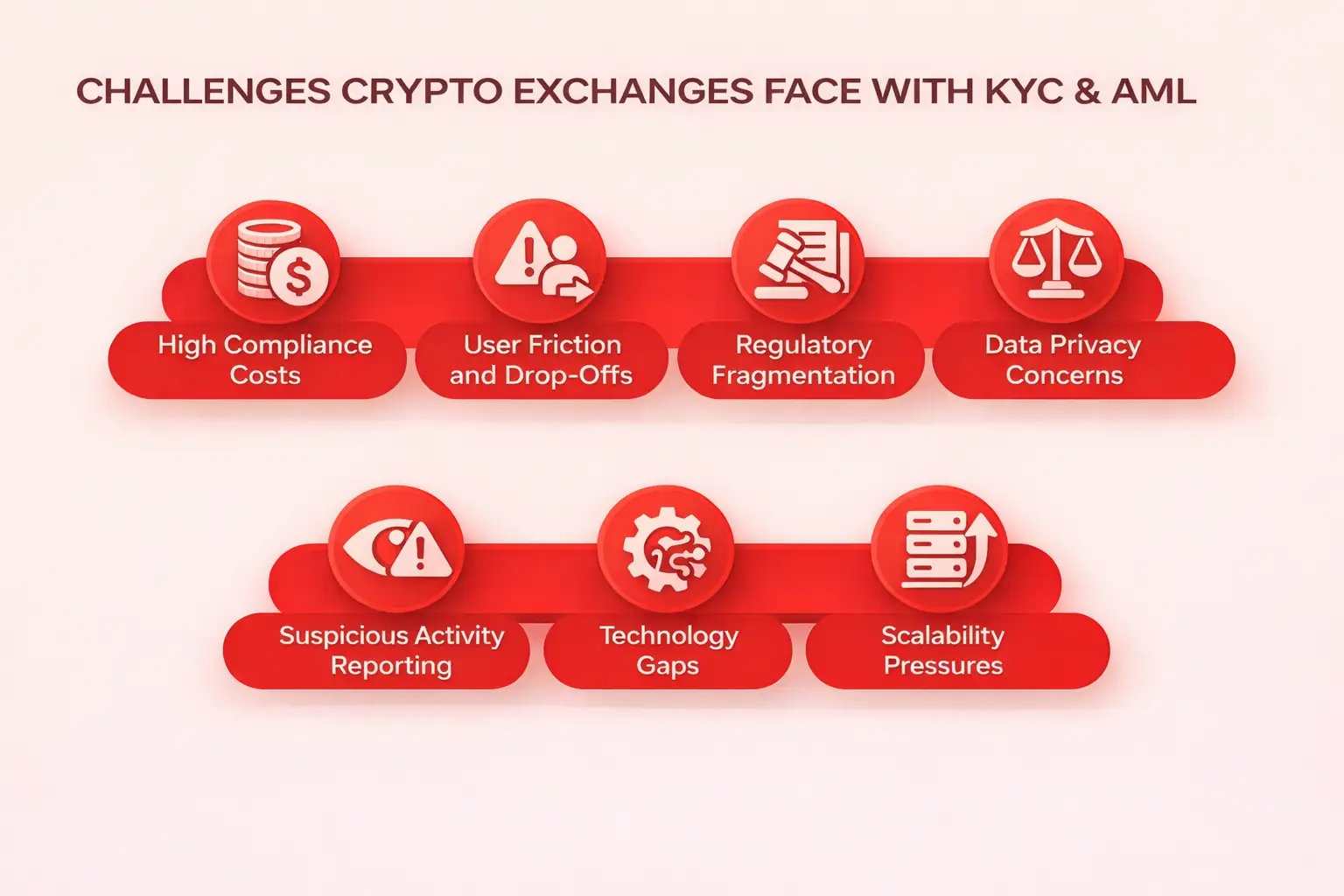

Maintaining compliance is complex due to rapidly evolving rules, multi-jurisdiction operations, and high-risk transactions.

Rapidly Changing Regulations

Crypto regulations vary by country and are frequently updated. Exchanges must stay informed about FCA crypto exchange regulations, MAS crypto regulations, and SEC crypto exchange rules to avoid penalties and maintain crypto exchange compliance.

Multi-Jurisdiction Operations

Global crypto platforms face unique challenges when operating across borders. Different regions have distinct requirements, like MiCA regulation for crypto exchanges in Europe or FIU-IND AML compliance in India. Exchanges must implement adaptable systems to comply with all relevant regulations simultaneously.

High-Risk User and Transaction Management

Not all users pose the same level of risk. Exchanges classify users and transactions based on factors like geography, transaction volume, and past behavior. Politically exposed persons (PEPs), users on global sanction lists, or accounts showing suspicious activity are considered high-risk.

Platforms perform enhanced due diligence by checking government-issued IDs, verifying user histories, and monitoring transactions in real time. These steps are part of KYC compliance for crypto exchanges and AML compliance for crypto exchanges, ensuring that illegal activities such as money laundering or fraud are prevented.

Effective risk management also includes setting transaction limits, automated alerts for unusual patterns, and immediate escalation to compliance teams. By actively managing high-risk users and transactions, exchanges safeguard their platform and maintain investor confidence globally.

Future of Crypto Exchange Compliance and Regulations

The crypto landscape is evolving rapidly. Exchanges are expected to adopt stronger standards, more advanced monitoring, and automated solutions.

- Stronger AML & KYC standards – Regulatory bodies like FATF continue to refine rules, and exchanges must adapt to meet crypto exchange regulatory compliance challenges.

- Technology-driven compliance & monitoring – Modern crypto exchanges leverage technology to enforce compliance efficiently. Tools like automated KYC verification, real-time AML monitoring, and smart contract auditing reduce human error and speed up regulatory adherence. For example, AI algorithms can automatically flag suspicious accounts or high-risk transactions and integrate directly with AML compliance for crypto exchange systems.

This automation not only strengthens platform security but also ensures that crypto exchange regulatory compliance challenges like multi-jurisdiction operations or high-risk users are managed effectively. By adopting technology-driven compliance, exchanges can maintain transparency, prevent fraud, and satisfy global regulatory standards.

- Automation for regulatory adherence – Automated KYC verification, smart contract auditing, and cross-border compliance ensure exchanges remain aligned with Travel Rule compliance in crypto and PCI-DSS compliance for crypto payments.

This proactive approach ensures platforms are prepared for future regulatory requirements while providing secure, transparent services for global users.

Final Thoughts

Maintaining crypto exchange compliance is essential for the credibility and longevity of any trading platform. By following crypto exchange regulations and implementing AML & KYC compliance for crypto exchanges, platforms protect users, build trust, and mitigate legal risks.

Integrating standards like FATF guidelines for crypto exchanges, FCA crypto exchange regulations, MAS crypto regulations, SEC crypto exchange rules, and MiCA regulation for crypto exchanges, alongside GDPR compliance for crypto exchanges and PCI-DSS compliance for crypto payments, ensures operational integrity and global investor confidence.

Frequently Asked Questions

Crypto exchange compliance refers to the process by which cryptocurrency trading platforms follow legal, regulatory, and security standards set by authorities worldwide. It ensures that exchanges operate lawfully, protect user funds, and prevent illegal activities such as fraud, money laundering, and terrorism financing.

Compliance is critical because failure to follow crypto exchange regulations can lead to heavy penalties, license revocation, or complete shutdown. By implementing regulatory compliance for crypto exchanges, platforms build user trust, attract institutional investors, and maintain long-term sustainability in a highly regulated global market.

AML compliance for crypto exchanges focuses on monitoring transactions to detect suspicious activities, while KYC compliance for crypto exchanges verifies user identities before allowing trading. Together, they form AML & KYC compliance for crypto exchanges, which is mandatory in most jurisdictions.

Exchanges collect government-issued IDs, perform identity checks, screen users against sanction lists, and monitor transactions in real time. These practices align with FATF guidelines for crypto exchanges and help platforms comply with laws such as FIU-IND AML compliance in India and FCA crypto exchange regulations in the UK.

Crypto exchange regulations vary by region but aim to ensure transparency, security, and financial integrity. Major global regulations include:

- FCA crypto exchange regulations (UK)

- MAS crypto regulations (Singapore)

- SEC crypto exchange rules (USA)

- FINRA compliance for crypto platforms (USA)

- MiCA regulation for crypto exchanges (European Union)

To operate globally, exchanges must adapt their compliance frameworks to meet multiple regulatory standards while maintaining consistent AML and KYC practices.

Travel Rule compliance in crypto requires exchanges to share sender and receiver information for crypto transactions above a certain threshold. This rule, enforced under FATF guidelines for crypto exchanges, helps regulators track cross-border transfers and prevent illicit financial activities.

Crypto exchanges implement automated reporting systems to comply with the Travel Rule, especially for international transactions. This ensures transparency and strengthens regulatory compliance for crypto exchanges, particularly in jurisdictions like the EU, USA, and Singapore.

Maintaining crypto exchange compliance is challenging due to rapidly changing laws, multi-jurisdictional operations, and high-risk users. Regulations like SEC crypto exchange rules, MAS crypto regulations, and MiCA regulation for crypto exchanges are frequently updated, requiring constant system upgrades.

Exchanges must also manage high-risk accounts through enhanced due diligence, real-time monitoring, and automated alerts. By combining technology-driven solutions with strict AML & KYC compliance for crypto exchanges, platforms can overcome regulatory challenges and remain legally secure.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.