Key Takeaways

- Synthetic assets on DEX have transformed decentralized exchanges by enabling permissionless access to traditional markets including stocks, commodities, forex, and indices through blockchain-based tokens.

- The impact of synthetic assets extends beyond trading, fundamentally improving DEX liquidity, capital efficiency, and the range of financial products available in decentralized finance ecosystems.

- DeFi synthetic assets operate through smart contracts and price oracles, creating trustless systems where tokens accurately track real-world asset prices without requiring physical ownership.

- Synthetic asset trading provides significant benefits including 24/7 market access, fractional ownership, no geographic restrictions, and elimination of traditional intermediaries and their associated costs.

- Decentralized exchange (DEX) platforms supporting synthetics face unique challenges including oracle reliability, collateralization requirements, and smart contract security that require careful risk management.

- Use cases span hedging strategies, yield generation, portfolio diversification, and cross-chain asset exposure, making synthetics versatile instruments for various trading and investment objectives.

- Compared to traditional financial instruments, synthetic assets offer superior transparency through on-chain settlement, lower costs, and accessibility advantages that democratize global market participation.

- The future of synthetics includes growing adoption across DeFi platforms, technological innovation in blockchain-based assets, and deeper integration with emerging protocols and cross-chain infrastructure.

Synthetic assets have emerged as one of the most transformative innovations in decentralized finance, fundamentally changing what is possible on decentralized exchanges. By creating blockchain-based representations of real-world assets, these instruments bridge traditional finance with the permissionless, transparent nature of DeFi, opening global markets to anyone with internet access and a crypto wallet.

Understanding Synthetic Assets in Decentralized Finance

Synthetic assets represent a paradigm shift in how financial exposure can be obtained and managed. Rather than purchasing actual stocks, commodities, or currencies, traders can gain price exposure through blockchain tokens that track these assets with remarkable precision. This innovation extends the capabilities of decentralized trading platforms far beyond native cryptocurrency pairs.

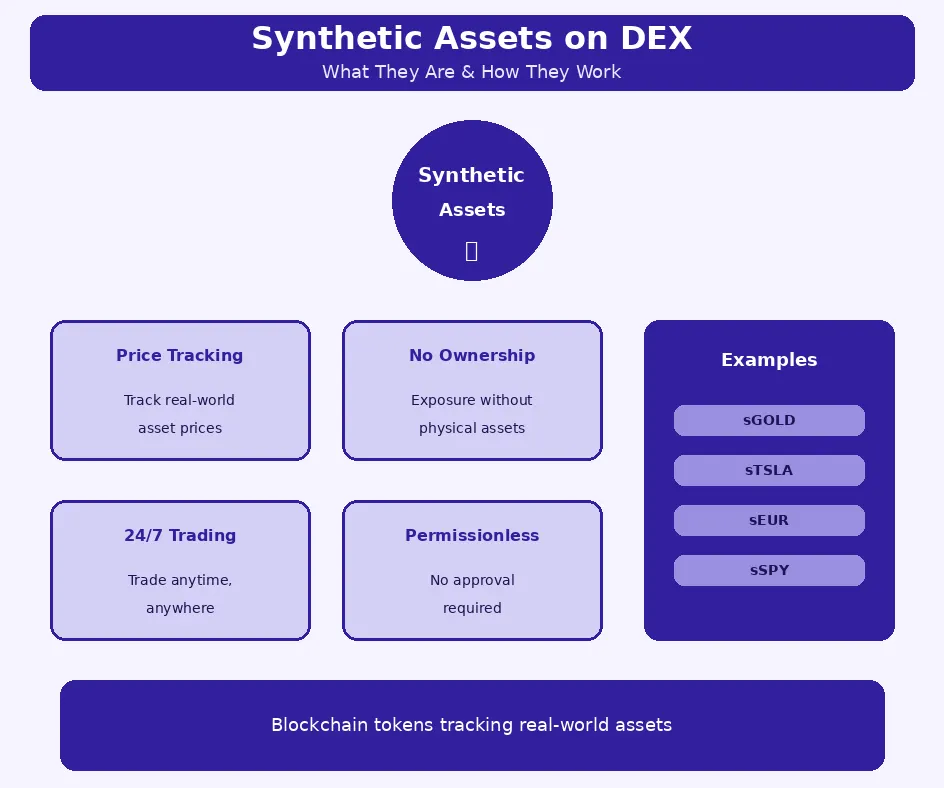

What Are Synthetic Assets in Crypto

Synthetic assets in crypto are digital tokens that mirror the price movements of underlying assets without requiring ownership of those assets. These tokens are created through collateralization mechanisms and maintain their peg through oracle price feeds. Whether tracking gold, Tesla stock, or the Euro, synthetic assets enable exposure to diverse markets through unified blockchain infrastructure.

The synthetic nature means these tokens derive value from their tracking mechanism rather than from holding the actual asset. A synthetic gold token does not represent a claim on physical gold but instead provides price exposure that moves identically to gold market prices. This distinction is fundamental to understanding how synthetics function within DeFi ecosystems.

How Synthetic Assets Work on a DEX

Synthetic assets on DEX platforms operate through carefully designed mechanisms that ensure accurate price tracking, sufficient collateralization, and secure trading. Understanding these mechanisms helps traders appreciate both the capabilities and limitations of synthetic trading.

Role of Smart Contracts

Smart contracts form the foundation of synthetic asset systems, handling token minting, collateral management, liquidations, and price updates automatically. These self-executing programs ensure consistent rule application regardless of market conditions or participant behavior. The code becomes the trusted intermediary, replacing traditional financial institutions with transparent, auditable logic.

When users deposit collateral, smart contracts mint corresponding synthetic tokens based on current oracle prices. The same contracts monitor collateral ratios continuously, triggering liquidations when positions become undercollateralized. This automation creates efficient, 24/7 market operations without human intervention.

Importance of Price Oracles

Price oracles serve as the critical bridge between off-chain markets and on-chain synthetic assets. These systems fetch real-world prices from multiple sources, aggregate them through consensus mechanisms, and deliver verified data to blockchain smart contracts. Without reliable oracles, synthetic assets cannot maintain accurate price tracking.

Decentralized oracle networks like Chainlink provide manipulation-resistant price feeds by aggregating data from numerous independent sources. This decentralization reduces single points of failure that could compromise the entire synthetic asset system. Oracle quality directly determines synthetic asset reliability and user trust.

DeFi Principle: Synthetic assets democratize access to global markets by removing geographic barriers, minimum investment requirements, and intermediary gatekeepers. This accessibility represents a fundamental shift in how financial exposure can be obtained by individuals worldwide.

Role of Synthetic Assets in Decentralized Exchanges

The role of synthetic assets extends beyond simple trading instruments. They fundamentally expand what decentralized exchanges can offer, transforming these platforms from cryptocurrency-only venues into comprehensive financial marketplaces serving diverse investor needs.

Expanding Asset Accessibility on DEX

Synthetic assets dramatically expand asset accessibility on DEX platforms. Markets that traditionally required specific brokerage accounts, geographic presence, or substantial minimum investments become accessible to anyone with a crypto wallet. This expansion attracts new user segments and increases platform utility significantly.

The permissionless nature of DeFi means synthetic trading has no gatekeepers determining who can participate. A trader interested in exposure to international stock indices or precious metals can access these markets regardless of their location, banking relationships, or investment size. Understanding synthetic trading mechanics enables participation in these expanded markets.

Trading Real-World Assets Through Synthetic Tokens

Synthetic tokens enable trading real-world assets that would otherwise be impossible to access through blockchain infrastructure. From agricultural commodities to technology stocks, synthetics bring diverse asset classes into the DeFi ecosystem.

Commodities and Forex Exposure

Commodities and forex represent significant synthetic asset categories. Synthetic gold, silver, oil, and agricultural products enable commodity exposure without physical storage or futures contract complexity. Forex synthetics like sEUR, sGBP, or sJPY provide currency exposure for hedging or speculation without traditional forex broker requirements.

These synthetic versions trade 24/7, unlike traditional commodity and forex markets with limited hours. Fractional ownership enables small position sizes impossible in traditional commodity markets where contract minimums often exclude retail participants.

Stock and Index-Based Synthetic Assets

Synthetic stocks and indices represent particularly valuable additions to DEX capabilities. Traders can gain exposure to companies like Apple, Tesla, or Amazon through synthetic tokens without traditional stock brokerage accounts. Index synthetics tracking S&P 500 or NASDAQ provide diversified market exposure through single tokens.

These instruments enable strategies previously impossible for many global investors: hedging cryptocurrency holdings with equity exposure, building diversified portfolios within DeFi, or speculating on stock movements during hours when traditional markets are closed.

Synthetic Assets vs Native Crypto Trading

| Factor | Synthetic Assets | Native Crypto |

|---|---|---|

| Asset Coverage | Stocks, commodities, forex, indices | Cryptocurrencies only |

| Value Source | Oracle price tracking | Network utility/demand |

| Collateral Required | Yes, overcollateralized | No (direct ownership) |

| Oracle Dependency | High (price feeds critical) | None |

| Market Access | Traditional + crypto markets | Crypto markets only |

Impact of Synthetic Assets on DEX Liquidity

The impact of synthetic assets on DEX liquidity represents one of their most significant contributions to decentralized finance. By expanding tradeable assets and attracting diverse participants, synthetics enhance overall market depth and trading efficiency.

Improving Liquidity Pools

Synthetic assets improve liquidity pools by creating new trading opportunities that attract capital and traders who might otherwise not participate in DeFi. A liquidity provider interested in gold exposure can now contribute to synthetic gold pools, earning fees while maintaining desired asset allocation.

This diversification of liquidity provider motivations strengthens overall pool depth. Rather than relying solely on cryptocurrency enthusiasts, synthetic pools attract traditional market participants seeking DeFi yields or exposure to familiar assets through blockchain infrastructure.

Influence on AMM-Based Trading Models

Automated Market Maker (AMM) models have adapted to accommodate synthetic assets, developing specialized mechanisms for assets with different volatility profiles and trading patterns. These adaptations improve capital efficiency and reduce slippage for synthetic trades.

Capital Efficiency in On-Chain Trading

Capital efficiency improvements enable synthetic assets to trade with reduced slippage despite potentially lower native liquidity. Concentrated liquidity mechanisms, virtual AMM designs, and debt pool models all represent innovations driven partly by synthetic asset requirements. Building decentralized exchanges requires understanding these advanced liquidity mechanisms.

These efficiency gains benefit the broader DEX ecosystem as innovations developed for synthetics apply to other trading pairs. The technical challenges of maintaining accurate pricing for diverse synthetic assets have pushed DeFi protocol design forward significantly.

Benefits of Synthetic Asset Trading on DEX

DeFi synthetic assets deliver compelling benefits that explain their growing adoption. These advantages stem from blockchain’s inherent properties combined with the specific design of synthetic protocols.

Permissionless and Non-Custodial Trading

Permissionless trading means anyone can access synthetic markets without approval processes, credit checks, or account minimums. Non-custodial trading ensures users maintain control of their assets throughout, eliminating counterparty risk from centralized intermediaries.

This combination provides unprecedented access to global markets. A user can trade synthetic Apple stock, hedge with synthetic gold, and speculate on EUR/USD movements all from a single self-custody wallet, something impossible through traditional financial infrastructure for most global citizens.

Global Market Access Without Intermediaries

Eliminating intermediaries reduces costs, increases speed, and removes potential failure points. Traditional market access requires brokers, clearinghouses, custodians, and banks, each adding fees and complexity. Synthetic assets compress this entire infrastructure into smart contracts.

Lower Entry Barriers for Traders

Lower entry barriers manifest in multiple dimensions. No minimum investment requirements mean traders can start with any amount. No geographic restrictions enable participation from anywhere with internet access. No account approval processes eliminate delays and potential rejection. These reduced barriers democratize access to financial markets globally.

Synthetic Asset Trading Lifecycle on DEX

| Step | Phase | Action | Outcome |

|---|---|---|---|

| 1 | Collateral Deposit | Lock crypto as collateral | Minting capacity unlocked |

| 2 | Minting | Create synthetic tokens | Receive synthetic assets |

| 3 | Trading | Trade on DEX liquidity pools | Price exposure achieved |

| 4 | Monitoring | Track collateral ratio | Position health maintained |

| 5 | Burning | Return synthetic tokens | Collateral unlocked |

| 6 | Withdrawal | Retrieve collateral | Position closed |

Risks and Challenges of Synthetic Assets

While synthetic assets offer compelling benefits, they also present unique risks that traders must understand. These challenges stem from the technical complexity of maintaining accurate price tracking in decentralized, trustless environments.

Price Volatility and Oracle Risks

Price volatility affects synthetic assets doubly: both the tracked asset and the collateral can experience significant price movements. When both move adversely simultaneously, liquidation risk increases dramatically. Understanding these dynamics is essential for position sizing and risk management.

Oracle risks include delayed updates, manipulation attempts, and potential failures. Even well-designed oracle networks can experience issues during extreme market conditions when accurate pricing is most critical. These risks require constant vigilance and conservative position management.

Over-Collateralization Concerns

Over-collateralization requirements, while necessary for system stability, create capital inefficiency. Locking 150-400% collateral to mint synthetic assets means significant capital sits unused, reducing potential returns and limiting position sizes for capital-constrained traders.

Smart Contract Vulnerabilities

Smart contract vulnerabilities represent existential risks for synthetic protocols. Bugs in minting logic, liquidation mechanisms, or oracle integration can result in catastrophic losses. While audits reduce risk, they cannot guarantee safety. Users must accept residual smart contract risk when participating in synthetic markets.

Critical Warning: Synthetic asset trading involves significant risks including smart contract vulnerabilities, oracle failures, and potential total loss of collateral. These instruments are experimental and should only be used with capital users can afford to lose entirely. Past performance does not guarantee future results.

Use Cases of Synthetic Assets in DeFi Ecosystem

Synthetic assets serve diverse purposes within DeFi ecosystems, extending far beyond simple speculation. Their versatility makes them valuable tools for sophisticated financial strategies.

Hedging and Risk Management

Hedging represents a primary synthetic asset use case. Cryptocurrency holders can hedge volatile positions by gaining exposure to traditionally uncorrelated assets like gold or stable currencies. This hedging capability was previously unavailable to most DeFi participants without exiting the blockchain ecosystem.

Businesses operating in crypto can hedge operational risks using synthetics. A mining operation might hedge electricity costs through synthetic energy assets. An international crypto business could hedge currency exposure through forex synthetics. These capabilities bring sophisticated risk management to DeFi.

Yield Opportunities Using Synthetic Tokens

Yield opportunities extend synthetic asset utility beyond trading. Liquidity provision for synthetic pairs earns trading fees. Some protocols offer staking rewards for synthetic token holders. These yield mechanisms create additional incentives for synthetic asset participation.

Cross-Chain Synthetic Assets

Cross-chain synthetic assets enable exposure to assets from one blockchain while operating on another. This interoperability expands possibilities significantly, allowing users to access diverse synthetics regardless of which blockchain they prefer for transactions. Building cross-chain exchange capabilities enables these multi-network strategies.

Synthetic Assets vs Traditional Financial Instruments

Comparing synthetic assets with traditional instruments reveals distinct advantages and trade-offs that inform appropriate use cases for each approach.

Transparency and On-Chain Settlement

Transparency through on-chain settlement provides verification capabilities impossible in traditional finance. Every synthetic token, collateral position, and trade is visible on public blockchains. Users can verify protocol health, total supply, and collateralization ratios independently without relying on institutional reports.

On-chain settlement eliminates counterparty risk from intermediaries and provides instant, irreversible transaction finality. Traditional instruments require settlement periods, introduce counterparty dependencies, and operate through opaque back-office processes.

Cost Efficiency Compared to Traditional Markets

Cost efficiency in synthetic trading stems from eliminating intermediary fees, reducing infrastructure requirements, and enabling continuous operation. Traditional market access involves brokerage commissions, exchange fees, custodial charges, and regulatory compliance costs that synthetic protocols largely eliminate.

However, gas costs for on-chain transactions and potential slippage in synthetic pools create their own cost considerations. The optimal choice depends on transaction size, frequency, and specific assets being traded.

Synthetic Protocol Selection Criteria

When choosing synthetic asset protocols, evaluate:

- Oracle Quality: Decentralized, manipulation-resistant price feeds

- Audit Status: Multiple audits from reputable security firms

- Collateral Ratios: Appropriate buffer for asset volatility

- Liquidity Depth: Sufficient trading liquidity for position sizes

- Track Record: Protocol history and team reputation

- Asset Coverage: Available synthetics matching your needs

Synthetic Assets vs Traditional Instruments

| Factor | DeFi Synthetics | Traditional Instruments |

|---|---|---|

| Trading Hours | 24/7/365 | Market hours only |

| Settlement | Instant, on-chain | T+1 to T+3 |

| Custody | Self-custody | Broker/custodian held |

| Minimum Investment | Fractional (any amount) | Often significant minimums |

| Regulatory Protection | Limited/None | Established frameworks |

Future of Synthetic Assets on Decentralized Exchanges

The future of synthetic assets involves continued innovation, expanded adoption, and deeper integration with evolving DeFi infrastructure. These developments will shape how global markets function in the blockchain era.

Growing Adoption in DeFi Platforms

Growing adoption reflects recognition of synthetic asset value propositions. More protocols are integrating synthetic capabilities, expanding asset coverage, and improving user experiences. This adoption creates network effects as increased liquidity and usage attract additional participants.

Institutional interest in DeFi synthetics is emerging as regulatory clarity improves and infrastructure matures. Professional traders and funds recognizing the efficiency advantages of synthetic trading are exploring compliant participation paths.

Build a Next-Gen DEX with Synthetic Asset Trading

Build a secure DEX with synthetic assets and deep liquidity powered by expert developers.

Launch Your Exchange Now

Innovation in Blockchain-Based Assets

Innovation continues across multiple dimensions: improved collateralization efficiency, novel oracle designs, enhanced liquidation mechanisms, and expanded asset categories. Each improvement makes synthetics more practical, secure, and accessible.

Integration With Emerging DeFi Protocols

Integration with emerging protocols creates composable systems where synthetics serve as building blocks for complex financial products. Lending protocols accepting synthetic collateral, derivatives built on synthetic underlyings, and automated strategies incorporating synthetics all represent expanding integration possibilities. Exploring DEX ecosystem evolution reveals these integration opportunities.

Cross-chain bridges, layer-2 scaling solutions, and interoperability protocols will enable synthetic assets to operate across blockchain ecosystems seamlessly. This multi-chain future expands synthetic asset utility and accessibility significantly.

Frequently Asked Questions

Synthetic assets in DeFi are blockchain-based tokens that track the price of real-world assets like stocks, commodities, currencies, or indices without requiring ownership of the underlying asset. These tokens are created through smart contracts using collateral and price oracles, enabling traders to gain exposure to traditional markets through decentralized exchanges without intermediaries or geographic restrictions.

Synthetic assets on DEX work through smart contracts that mint tokens backed by cryptocurrency collateral. Price oracles feed real-time market data to the blockchain, ensuring synthetic tokens track their underlying assets accurately. Users can trade these tokens in liquidity pools or order books, gaining exposure to assets like gold, stocks, or forex pairs while maintaining full self-custody of their funds.

Synthetic assets significantly impact DEX liquidity by expanding the range of tradeable assets, attracting diverse trader segments, and improving capital efficiency. They enable liquidity pools to support trading pairs that would otherwise be impossible on-chain, such as synthetic stocks or commodities. This expanded asset coverage increases trading activity and deepens overall market liquidity on decentralized platforms.

Synthetic asset trading on DEX carries risks including smart contract vulnerabilities, oracle manipulation, and liquidation during volatile markets. Safety depends on protocol security audits, oracle reliability, and collateralization levels. While DeFi offers transparency through open-source code, users should understand these risks, use audited protocols, and only trade with capital they can afford to lose.

DEX platforms support various synthetic assets including synthetic stocks (like sAAPL, sTSLA), commodities (sGOLD, sOIL), forex pairs (sEUR, sGBP), market indices (sSPY, sNASDAQ), and cryptocurrency derivatives. These tokens enable global traders to access diverse markets 24/7 without traditional brokerage accounts, geographic restrictions, or minimum investment requirements.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.