Key Takeaways

- •Startup platforms cost significantly less upfront but may require expensive migrations as you scale, while enterprise solutions represent larger initial investments but prevent costly transitions.

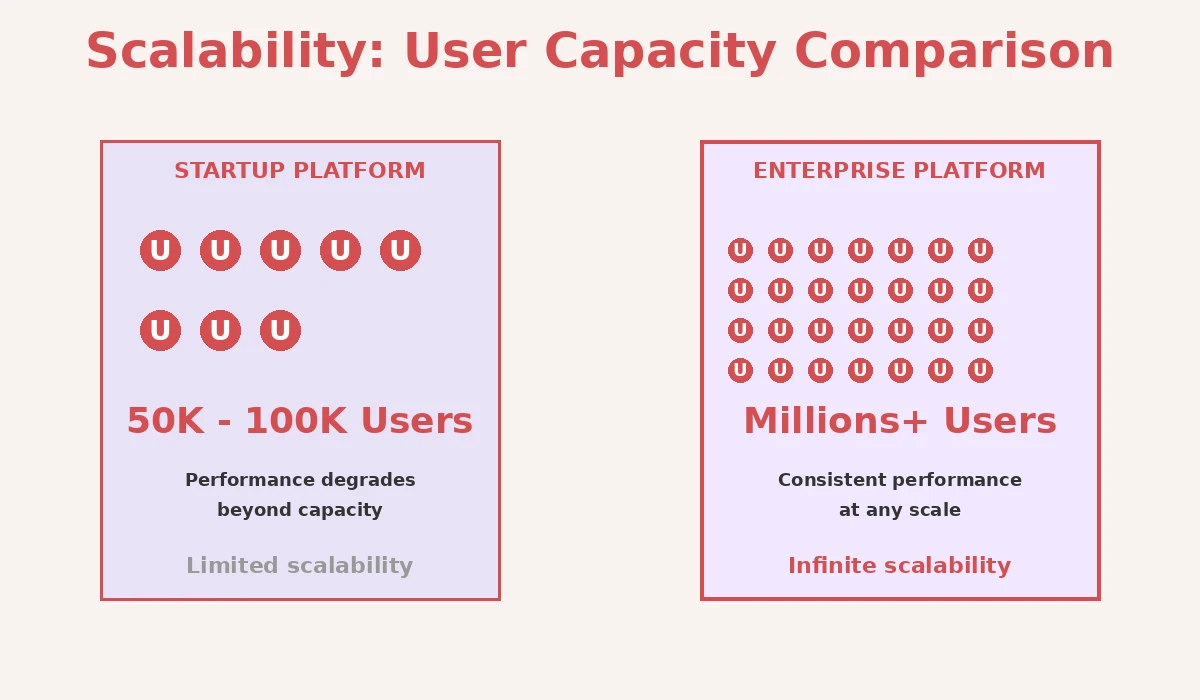

- •Scalability differences are dramatic: startup platforms handle 50K–100K users effectively, while enterprise systems handle millions of concurrent users without performance degradation.

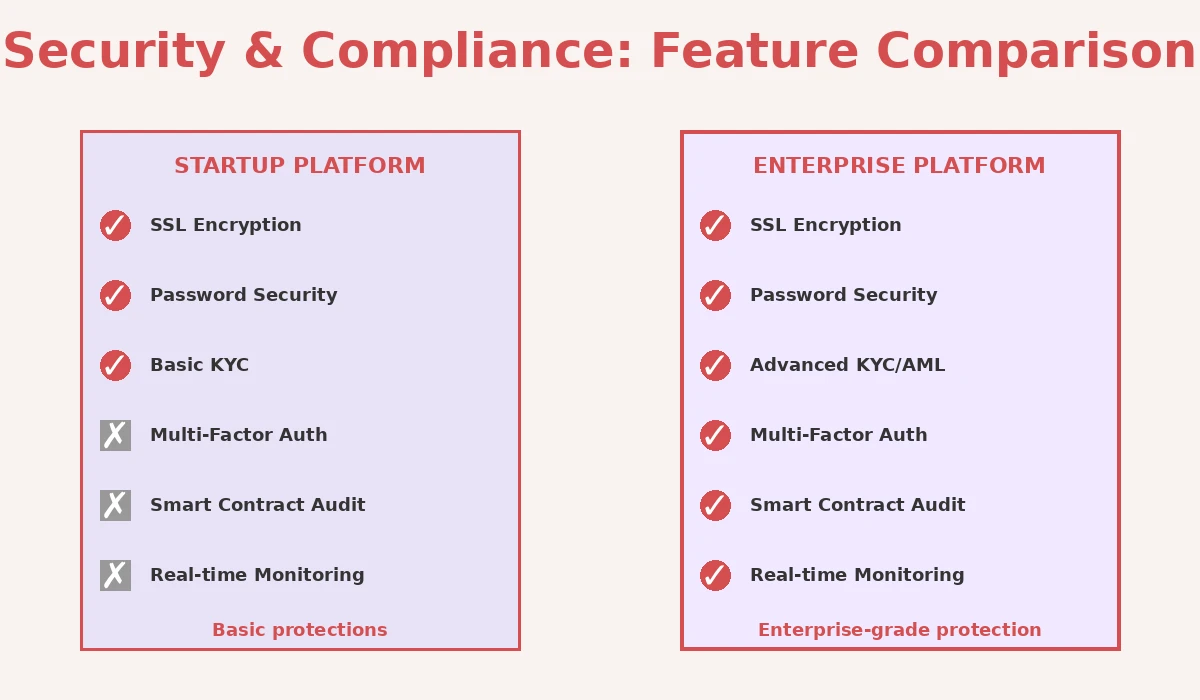

- •Security and compliance aren’t optional; cryptocurrency platforms handling financial transactions require enterprise-grade security protocols and comprehensive compliance frameworks.

- •Startup platforms launch quickly (2–4 weeks) but with limited customization, while enterprise solutions require longer implementation (3–6 months) but offer comprehensive customization matching your business needs.

- •Compliance complexity varies dramatically across jurisdictions; startup platforms may not support multi-regional compliance, while enterprise systems accommodate diverse regulatory requirements.

- •Integration capabilities differ significantly; startup platforms connect to few external systems, creating data silos, while enterprise solutions integrate comprehensively with accounting software, CRM systems, and business intelligence tools.

- •Assess your specific situation using business growth expectations, geographic scope, regulatory requirements, and budget before choosing between startup and enterprise platforms.

Understanding which cryptocurrency MLM platform fits your business model is crucial for long-term success. This guide breaks down the differences between startup and enterprise solutions.

Introduction to Crypto MLM Models

Cryptocurrency multi-level marketing has become a significant component of the digital economy. The global MLM market continues to grow, with businesses exploring blockchain-based solutions to enhance transparency and security. Whether you’re launching a new venture or scaling an established operation, choosing between startup and enterprise crypto MLM systems directly impacts your operational efficiency and growth potential.

Businesses adopt crypto MLM systems for various reasons. Some seek to capitalize on the growing interest in decentralized finance, while others want to improve commission management and distributor tracking through blockchain technology. The key is understanding that not all MLM solutions are built equally. Startup platforms prioritize speed and affordability, while enterprise solutions emphasize security, compliance, and handling massive user bases.

The decision between these two models affects your budget, technical requirements, timeline, and long-term sustainability. Making the wrong choice can lead to costly migrations, system outages, or regulatory complications.

To deepen your understanding of MLM systems and business models, we recommend reviewing resources covering foundational concepts. Our comprehensive guide on MLM meaning, types, benefits, and global regulations provides detailed background on different MLM models and how regulations vary globally.

Understanding Startup Crypto MLM Platforms

Startup crypto MLM platforms are designed for businesses entering the market with limited budgets and moderate scale expectations. These solutions provide essential MLM functionality without unnecessary complexity. They typically include basic commission structures, simple user interfaces, and straightforward network management tools.

The typical user of startup platforms includes new MLM companies, regional distributors, or entrepreneurs testing market viability. These businesses usually operate with lean teams and need solutions that don’t require extensive technical infrastructure. Common deployment approaches involve cloud-based SaaS models with standardized features and limited customization options.

Startup platforms excel at getting you to market quickly. Most can be deployed within weeks, allowing businesses to start recruiting and generating revenue without lengthy implementation periods. However, this speed comes with trade-offs in customization and scalability that become apparent as your network grows.

Understanding Enterprise Crypto MLM Platforms

Enterprise-grade MLM systems are built for organizations operating at scale with thousands or millions of users. These platforms include advanced features like multi-currency support, complex compensation plans, sophisticated analytics, and enterprise-level security infrastructure. Enterprise solutions are designed to handle high transaction volumes while maintaining system stability and regulatory compliance across multiple jurisdictions.

Large-scale operational needs require platforms that support multiple languages, time zones, and regional compliance requirements. Enterprise MLM systems integrate with existing corporate infrastructure, including ERP systems, customer relationship management platforms, and accounting software. They handle intricate network structures, advanced reporting capabilities, and customized workflows that reflect your organization’s specific business logic.

Industry use cases for enterprise solutions include established direct selling companies expanding into cryptocurrency, multinational corporations launching affiliate programs, and large financial services firms implementing blockchain-based distribution networks. These organizations need systems that can grow with them and adapt to changing regulatory landscapes.

Development Cost Comparison

Cost considerations heavily influence the startup versus enterprise decision. Startup crypto MLM platforms typically cost between 10,000 to 50,000 USD for initial setup, depending on basic customization needs. Monthly operational costs range from 500 to 2,000 USD. These figures assume standard features and limited geographical coverage.

Enterprise solutions represent significantly larger investments. Initial development and deployment can range from 100,000 to over 1,000,000 USD, depending on complexity, integrations, and customization requirements. Monthly operational costs typically exceed 5,000 USD and scale with your user base and transaction volume. However, enterprise platforms spread costs across thousands or millions of transactions, making the per-user cost more economical at scale.

Long-term cost implications reveal important differences. Startup platforms may require expensive migrations or complete replacements as you outgrow them. You might invest 50,000 USD initially but face 200,000 USD in migration costs two years later. Enterprise solutions, while expensive upfront, prevent costly transitions and provide better cost predictability as your business scales.

At Nadcab Labs, with over 8 years of experience developing crypto MLM solutions, we’ve guided hundreds of businesses through this cost analysis. Our expertise shows that the cheapest initial solution isn’t always the most economical choice over five years. Selecting the right platform from the beginning prevents expensive technical debt and operational disruptions.

Quick Tip: Calculate your total cost of ownership over five years, not just initial investment. Include migration costs, operational expenses, and opportunity costs from system downtime.

Technology Stack and Infrastructure

Startup platforms typically use simplified technology stacks. Common choices include standard web frameworks, cloud hosting services like AWS or DigitalOcean, and traditional databases. This approach keeps development and maintenance straightforward, allowing small technical teams to manage the system effectively.

Enterprise-grade architecture employs more sophisticated approaches. This includes microservices architecture for independent scaling of different system components, containerization using technologies like Docker and Kubernetes for efficient resource management, and distributed databases designed for high availability and fault tolerance. Enterprise systems often use dedicated blockchain nodes for direct control over cryptocurrency transactions rather than relying on third-party APIs.

Blockchain integration differs significantly between startup and enterprise solutions. Startup platforms may use public blockchain APIs for basic cryptocurrency transfers, storing most data on traditional databases. Enterprise solutions often run full blockchain nodes, implement custom smart contracts for specific business logic, and maintain private or hybrid blockchain implementations for enhanced control and privacy.

Cloud infrastructure choices vary based on scale and compliance needs. Startups often use standard cloud providers with basic configurations. Enterprises may use multi-cloud strategies, dedicated infrastructure, or on-premises deployment options to meet regulatory requirements in different jurisdictions.

Scalability and Network Growth

Growth limitations in startup MLM systems become apparent at specific inflection points. Most startup platforms handle 50,000 to 100,000 active users effectively. Beyond this threshold, response times slow, reporting becomes sluggish, and system stability degrades. Database queries take longer, search functions become unreliable, and real-time notifications fail during peak usage periods.

Growth limitations in startup MLM systems become apparent at specific inflection points. Most startup platforms handle 50,000 to 100,000 active users effectively. Beyond this threshold, response times slow, reporting becomes sluggish, and system stability degrades. Database queries take longer, search functions become unreliable, and real-time notifications fail during peak usage periods.

Network growth challenges include managing commission calculations across thousands of network levels, processing daily payouts to tens of thousands of distributors, and generating real-time analytics without degrading user experience. Startup platforms designed for linear growth struggle with exponential user increases common in successful MLM operations.

Enterprise-level scalability strategies address these challenges through architectural approaches. Load balancing distributes traffic across multiple servers, caching layers reduce database load, and asynchronous processing handles time-consuming calculations without impacting user experience. Enterprise systems handle millions of concurrent users and process billions of transactions daily.

| Aspect | Startup Platform | Enterprise Platform |

|---|---|---|

| Typical User Capacity | 50K to 100K | Millions+ |

| Deployment Time | 2-4 weeks | 3-6 months |

| Monthly Uptime Target | 95-98% | 99.9-99.99% |

| Customization Flexibility | Limited | Extensive |

| Security Certifications | Basic SSL | ISO 27001, SOC 2, More |

The table above illustrates critical differences in infrastructure capabilities. Note that uptime percentages may seem small in difference but represent dramatically different reliability. A 99% uptime platform is unavailable 7.2 hours monthly, while 99.9% means just 43 minutes. For financial platforms managing cryptocurrency transactions, this difference is substantial.

Customization and Feature Flexibility

Standard features in startup platforms include binary or unilevel commission structures, basic distributor dashboards, simple reporting, and essential accounting functions. Customization is limited to configuration adjustments within predefined parameters. You might customize commission percentages or payment terms, but the fundamental system architecture remains unchanged.

Advanced customization in enterprise systems allows building entirely custom compensation plans, creating role-based dashboards with different functionality for different user types, and implementing complex business workflows that match your organizational structure. Enterprise solutions support multiple commission structures operating simultaneously, allowing different product lines to use different payment models.

Role-based modules and workflows represent a key enterprise advantage. Different user types including distributors, managers, accountants, and administrators see different interfaces tailored to their responsibilities. Workflow automation handles approval processes, compliance checks, and notification systems automatically based on business rules you define.

Your ability to customize affects long-term flexibility. Startup platforms become restrictive as your business evolves. You might need to modify your compensation plan based on market feedback, regulatory changes, or strategic shifts. Enterprise platforms accommodate these changes through configuration rather than expensive code modifications.

Security Standards and Risk Management

Basic security practices for startups include SSL encryption for data in transit, regular password requirements, and fundamental database protections. These measures protect against common threats but lack sophisticated safeguards against advanced attacks. Startup platforms may not implement multi-factor authentication, API rate limiting, or advanced intrusion detection systems.

Basic security practices for startups include SSL encryption for data in transit, regular password requirements, and fundamental database protections. These measures protect against common threats but lack sophisticated safeguards against advanced attacks. Startup platforms may not implement multi-factor authentication, API rate limiting, or advanced intrusion detection systems.

Enterprise-level security protocols incorporate multiple layers of protection. This includes encryption at rest and in transit, multi-factor authentication for all users, role-based access control preventing unauthorized actions, regular penetration testing by external security firms, and continuous security monitoring with automated threat detection. Enterprise solutions implement web application firewalls, DDoS protection, and intrusion prevention systems.

Smart contract audits and compliance become critical in blockchain-based systems. Enterprise solutions undergo independent security audits by specialized cryptocurrency security firms. These audits examine code for vulnerabilities, review business logic for unintended consequences, and verify that smart contracts behave as intended under all conditions. Startup platforms may deploy unaudited smart contracts, creating significant financial and legal risks.

Cryptocurrency theft and hacking represent existential risks for MLM platforms. A single security breach exposing distributor funds or personal information can destroy your business. Enterprise-grade security isn’t a luxury feature; it’s essential infrastructure for any platform handling financial transactions and sensitive personal data.

Performance and System Reliability

Load handling in startup systems is straightforward. They work well during normal traffic periods but degrade during peak times. Imagine a network launch day with thousands of new users registering simultaneously. Startup platforms might experience slow page loads, failed transactions, and timeouts. Database queries designed for hundreds of concurrent users struggle with thousands.

High availability in enterprise platforms is built into architecture from the beginning. If one server fails, others immediately take its load. If a data center experiences problems, traffic automatically routes to backup locations. Enterprise systems implement redundancy at every level, ensuring no single point of failure can disrupt operations.

Downtime and redundancy planning differ significantly. Startup platforms may require several hours for updates or maintenance, during which the entire system is unavailable. Enterprise platforms implement rolling updates that upgrade portions of the system while others continue operating, maintaining continuous availability even during major system changes.

| Performance Metric | Startup System | Enterprise System |

|---|---|---|

| Page Load Time | 2-4 seconds (peak: 8+ seconds) | Under 1 second (consistent) |

| Transaction Processing | 50-100 per second | 10,000+ per second |

| Database Backup Frequency | Daily | Continuous real-time |

| Disaster Recovery Time | Hours to days | Minutes to seconds |

| Planned Maintenance | Monthly (2-8 hours downtime) | Rolling updates (zero downtime) |

The performance differences shown in this table accumulate significantly over time. A system processing 50 transactions per second handles about 4.3 million daily transactions. Enterprise systems processing 10,000 per second handle 864 million daily transactions. At startup volumes this seems adequate, but as networks grow, performance becomes inadequate quickly.

Compliance and Regulatory Readiness

Compliance challenges for startups stem from regulatory uncertainty and limited resources. MLM operations face scrutiny from multiple regulators including the FTC in the United States, OFAC for sanctions compliance, and various country-specific authorities. Startup teams often lack dedicated compliance personnel, creating significant regulatory risk.

Cryptocurrency adds another compliance layer. Exchanges and trading platforms must implement Know Your Customer (KYC) procedures, Anti-Money Laundering (AML) controls, and transaction monitoring. Different jurisdictions have different requirements, and non-compliance can result in substantial fines or criminal prosecution. Startup platforms may have basic KYC features but lack sophisticated AML monitoring.

Enterprise compliance frameworks address these challenges through dedicated systems. They include automated transaction monitoring flagging suspicious patterns, geographic restriction enforcement preventing operations in prohibited jurisdictions, audit trails documenting all system changes for regulatory review, and integration with compliance reporting services. Enterprise solutions typically employ compliance officers who ensure adherence to regulations.

Regional regulations vary significantly. The European Union’s MiFID II regulations impose specific requirements on platforms offering investment services. Singapore’s Monetary Authority requires specific licensing for cryptocurrency platforms. India’s regulations around direct selling continue evolving. Enterprise systems accommodate these variations through configuration; startup platforms may not support them at all.

Regulatory compliance isn’t optional; it’s fundamental to operating legally. A platform operating without proper compliance exposes your business to regulatory shutdown, substantial fines, and criminal liability for leadership. This represents one of the most compelling reasons to choose enterprise solutions if you plan significant scale.

Integration Capabilities

Limited integrations for startups reflect their simplified architecture. Most startup platforms integrate with major payment processors like Stripe or PayPal and basic analytics tools. However, they typically don’t integrate with accounting software, CRM systems, or email marketing platforms. This creates data silos requiring manual data entry and spreadsheet management.

Enterprise API and third-party integrations enable seamless workflow automation. A complete enterprise system connects with your existing accounting software, automatically pushing commissions and payouts into your general ledger. It integrates with CRM platforms for distributor management, email marketing services for automated communications, and business intelligence tools for advanced analytics.

Payment gateway integration represents a critical integration point. Startup platforms support one or two gateways; enterprise systems integrate with dozens. This flexibility ensures you can accept payments via methods popular in your target markets, whether credit cards, digital wallets, bank transfers, or cryptocurrency directly.

The difference becomes apparent as your operation scales. With limited integrations, you hire administrative staff to manually transfer data between systems. With comprehensive integrations, data flows automatically, errors decrease, and administrative overhead drops dramatically. This represents significant cost savings as your operation grows.

Maintenance and Support Requirements

Startup-level technical support typically provides business hours email support with response times of 24-48 hours. If a critical issue occurs at 2 AM on Sunday, you wait until Monday morning for help. Support is usually tier-based, with complex issues escalated to development teams who may be busy with other clients. Documentation may be incomplete or outdated.

Enterprise SLA-driven support models guarantee response times. Critical issues receive responses within 15 minutes, 24 hours per day, 7 days per week. Dedicated support engineers familiar with your specific system configuration provide continuity. Enterprise vendors staff their support teams adequately to handle your needs without delays caused by other clients.

Upgrade and patch management differ significantly. Startup platforms may deploy security patches irregularly, leaving your system vulnerable to known exploits. Enterprise platforms implement continuous security patching, deploying critical patches within hours of release. They plan major upgrades during maintenance windows you approve, and they test upgrades thoroughly before deployment.

As a platform handling financial transactions and sensitive data, you need reliable support infrastructure. The difference between waiting hours for issue resolution and receiving immediate attention can mean the difference between a brief service interruption and a major outage affecting your entire network.

Time-to-Market Considerations

Faster launch for startups is a significant advantage. You can move from initial conversation to live platform in 2-4 weeks. This speed appeals to entrepreneurs wanting to validate their business model quickly or capitalize on market trends. The ability to launch rapidly provides a first-mover advantage in competitive markets.

Longer but structured enterprise rollout takes 3-6 months but follows a comprehensive methodology. This period includes detailed requirements gathering, architecture design, development, extensive testing, compliance review, and staff training. While longer, this approach prevents problems that would be costly to fix later.

The trade-offs between speed and stability become apparent over time. Launching quickly with a startup platform means you discover problems in production. A security issue discovered after launching affects all your distributors. A scalability limitation discovered when you reach 100,000 users requires expensive migration. Enterprise solutions discover and resolve these issues during lengthy implementation.

The optimal choice depends on your situation. If you’re validating a new business model and expect moderate growth, startup speed is valuable. If you’re a large organization planning significant scale or operating in heavily regulated markets, enterprise structure is worth the longer timeline.

ROI Expectations and Business Outcomes

Short-term ROI focus for startups emphasizes immediate revenue generation with minimal upfront investment. You spend 20,000-30,000 USD and expect to recover that within 3-6 months through commission fees. This works if your network grows as expected and you don’t encounter major technical problems.

Long-term value creation for enterprises involves substantial initial investment with payoff over years. You invest 500,000 USD initially but operate with greater efficiency, handle 10x the transaction volume, and benefit from superior security and compliance. Over five years, your cost per transaction drops dramatically compared to startups that required expensive migrations and system replacements.

Revenue sustainability comparison reveals different risks. Startup platforms provide early revenue but create technical debt. As you grow and encounter performance problems, you face expensive fixes or complete replacement. Enterprise systems, while requiring larger initial investment, provide stable platforms supporting long-term growth without major disruptions.

Consider a five-year scenario. A startup platform costs 30,000 USD initially with 1,000 USD monthly operational costs. After reaching 100,000 users, you discover you need enterprise capabilities and invest 300,000 USD in migration. Your total five-year cost is 390,000 USD. An enterprise solution costs 400,000 USD initially with 5,000 USD monthly. Five-year cost is 700,000 USD. However, you experience zero migration costs, zero downtime migrations, and zero lost revenue from platform limitations. The financial comparison is more nuanced than it first appears.

Scale Your Crypto MLM with Confidence

Get expert guidance on choosing the right MLM platform for your business. Our team has 8+ years of cryptocurrency development experience building secure, scalable solutions.

Which Crypto MLM Model Is Right for Your Business

Determining the right model requires honest assessment of your business needs. Key decision factors include your expected user growth, geographic scope, regulatory environment, technical complexity of your compensation plan, and available budget. Each factor suggests different platform choices.

Consider the following checklist when evaluating platforms.

| Evaluation Criteria | Startup Platform Better If | Enterprise Platform Better If |

|---|---|---|

| User Growth Expectations | Under 50K users in 2 years | Over 100K users or unpredictable growth |

| Geographic Coverage | Single country, minimal localization | Multiple countries, multiple languages |

| Regulatory Requirements | Minimal compliance needs | Complex compliance, multiple jurisdictions |

| Commission Plan Complexity | Standard unilevel or binary | Multiple plans, custom structures |

| Budget Available | Under 50K total for 3 years | Over 500K investment capacity |

| Time to Market | Need to launch within 30 days | Can afford 3-6 month implementation |

| Integration Needs | Minimal external system connections | Complex integrations with existing systems |

If you check more boxes in the left column, startup platforms likely suit your needs. If most checkmarks fall in the right column, enterprise solutions are worth the investment. If you’re split between columns, consider your specific situation carefully.

Your organization’s technical capability also matters. Do you have developers on staff who can customize and maintain your platform? Startups with technical teams sometimes prefer startup platforms they can modify. Organizations without technical staff benefit from vendor support and should prefer enterprise solutions with comprehensive support.

Risk tolerance is another factor. If you can afford setbacks from technical issues or need to rebuild your network if problems arise, startup platforms are acceptable. If downtime or data loss would seriously damage your business, enterprise platforms’ reliability is worth the cost.

Additionally, Our article explaining what MLM business is and its various types helps clarify different compensation structures and organizational approaches. These resources together provide comprehensive context for choosing your platform.

Final Recommendation

There is no universally correct answer to the startup versus enterprise question. The right choice depends on your specific circumstances, goals, and constraints. However, we offer this guidance based on analyzing hundreds of deployments.

Choose startup platforms if you’re testing a business model with limited initial investment, operating in a single country with straightforward regulations, using standard compensation structures, and can tolerate technical limitations or potential migration costs as you grow. Startup platforms work well for entrepreneurs validating market demand before committing significant capital.

Choose enterprise platforms if you’re a large organization planning significant scale, operating in multiple jurisdictions with complex compliance requirements, need customized functionality matching your business processes, or can’t afford service interruptions or data problems. Enterprise platforms excel when you know you need scale and want infrastructure supporting that from day one.

The hybrid approach involves starting with a startup platform while planning enterprise transition. This works if you clearly define triggers prompting the migration. For example, you might plan to migrate when you reach 50,000 active users or generate sufficient revenue to justify enterprise costs. However, plan this migration carefully, as transitions are disruptive and expensive.

Most importantly, don’t let initial platform choice lock you into poor long-term decisions. Build your business model, revenue model, and technical strategy independently of platform limitations. Choose a platform supporting your strategy, not one that constrains your strategy to its features.

For businesses uncertain about this decision, consulting with experienced cryptocurrency MLM professionals can provide personalized guidance. They can assess your specific needs and recommend appropriate solutions.

About This Article: This guide synthesizes insights from over 8 years of cryptocurrency MLM platform development at Nadcab Labs. We’ve implemented both startup and enterprise systems for clients across diverse industries and geographies. Our experience directly informs the analysis, comparisons, and recommendations presented here.

Frequently Asked Questions

The main difference between startup and enterprise crypto MLM platforms lies in scale, flexibility, and long-term readiness. Startup platforms are designed for quick launches, lower budgets, and limited user bases, making them suitable for early-stage businesses. Enterprise crypto MLM platforms, on the other hand, are built for high transaction volumes, advanced security, regulatory compliance, and global expansion, supporting millions of users without performance issues.

For a new business, a startup crypto MLM platform is usually the better choice due to its lower initial cost, faster deployment, and simpler feature set. These platforms allow entrepreneurs to validate their business model quickly. However, if the business plans rapid growth or operates in multiple regions, investing early in an enterprise crypto MLM solution can prevent costly system migrations later.

Yes, enterprise crypto MLM platforms typically offer stronger security compared to startup platforms. They include advanced features such as smart contract audits, multi-layer encryption, DDoS protection, fraud detection systems, and strict access controls. Startup platforms often rely on basic security measures, which may be sufficient initially but can become risky as transaction volumes and user data increase.

Scalability is one of the biggest differences between startup and enterprise crypto MLM systems. Startup platforms are usually optimized for small to medium user bases and may face performance issues as traffic grows. Enterprise crypto MLM systems are architected with distributed infrastructure, cloud scaling, and load balancing, allowing them to handle millions of users and transactions smoothly.

Migrating from a startup crypto MLM platform to an enterprise solution can be complex, time-consuming, and expensive. It often involves data migration, smart contract re-deployment, downtime risks, and user experience disruptions. This is why businesses with long-term growth plans often choose enterprise crypto MLM platforms early, even if the upfront investment is higher, to avoid future technical challenges.

Startup crypto MLM solutions have lower upfront costs, making them attractive for businesses with limited budgets. However, additional expenses may arise later due to upgrades, integrations, and scalability limitations. Enterprise crypto MLM solutions require higher initial investment but provide long-term cost efficiency through better performance, security, compliance support, and reduced need for major system changes as the business grows.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.