Key Takeaways

- Staking in decentralized exchange platforms enables token holders to earn passive rewards by locking assets in smart contracts while supporting protocol operations and security.

- DEX staking mechanisms vary from simple single-token staking to complex multi-tier systems with governance rights, fee sharing, and protocol-level participation.

- Smart contract staking in DEX ensures trustless, transparent reward distribution without intermediaries through automated on-chain execution and verifiable calculations.

- The staking reward mechanism in DEX typically distributes trading fees, token emissions, or protocol revenue proportionally based on stake size and duration.

- On-chain staking mechanisms provide transparency where anyone can verify stake amounts, reward calculations, and distribution logic through blockchain explorers.

- Lock-up periods and liquidity constraints represent primary trade-offs, requiring users to balance reward potential against capital accessibility during market volatility.

- Protocol-level staking in DEX platforms often grants governance authority, enabling stakers to vote on protocol upgrades, fee parameters, and treasury allocations.

- Advanced staking models including validator-independent and permissionless designs are expanding DEX staking beyond simple reward earning toward comprehensive protocol participation.

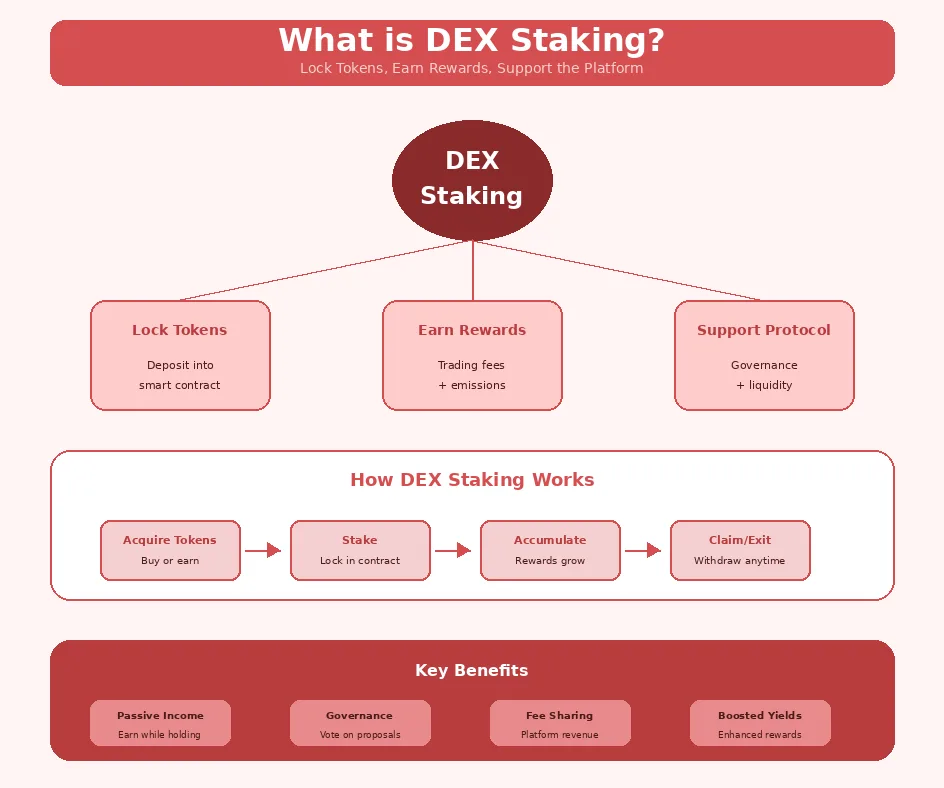

Staking has become a cornerstone feature of decentralized exchange platforms, offering users opportunities to earn passive income while actively participating in protocol governance and security. Understanding how staking works in DEX environments reveals the economic mechanisms that align user incentives with platform success. This comprehensive guide explores the architecture, benefits, risks, and evolving models of DEX staking that every crypto participant should understand.

Staking in Decentralized Exchange Platforms – Overview

Staking in decentralized exchange platforms represents a fundamental economic mechanism that incentivizes long-term token holding while distributing platform value to committed participants. Unlike proof-of-stake consensus mechanisms where staking secures blockchain networks, DEX staking typically focuses on governance participation, liquidity incentivization, and protocol revenue sharing. This distinction is crucial for understanding the specific value propositions and mechanics of token staking in DEX platforms.

The evolution of DEX staking reflects broader DeFi maturation where platforms compete for user capital through increasingly sophisticated incentive structures. Early DEX platforms offered simple staking for governance tokens, while modern implementations integrate staking with trading fee rebates, yield boosting, and multi-faceted protocol participation. Building crypto exchanges today requires thoughtful staking mechanism design that balances user rewards with long-term protocol sustainability.

The importance of DEX staking extends beyond individual rewards to ecosystem-wide effects. Staked tokens typically cannot be sold immediately, reducing circulating supply and potentially stabilizing prices. Governance staking concentrates voting power among committed long-term participants rather than short-term speculators. Understanding how modern exchange platforms integrate staking mechanisms reveals the strategic importance of this feature.

DEX Staking Mechanism Explained

The decentralized exchange staking mechanism encompasses the technical architecture and economic logic governing how users stake tokens, how rewards accumulate, and how distributions occur. These mechanisms vary significantly between platforms but share common principles around transparent calculation, trustless execution, and incentive alignment. Understanding these mechanisms enables informed participation and risk assessment.

Smart Contract Staking in DEX

Smart contract staking in DEX eliminates trusted intermediaries by encoding all staking logic directly in blockchain code. When users deposit tokens into staking contracts, the smart contract records their stake, timestamps the deposit, and begins accruing rewards according to predefined formulas. This on-chain execution ensures that reward calculations are verifiable, manipulation-resistant, and consistently applied to all participants.

The smart contract architecture typically includes several components: a deposit function accepting tokens, state variables tracking individual stakes and global totals, reward calculation logic executed on-demand or periodically, and withdrawal functions handling unstaking with any applicable delays or penalties. Well-designed contracts also include emergency functions for protocol upgrades and security responses while maintaining appropriate access controls.

Security in smart contract staking requires rigorous auditing and careful design. Vulnerabilities in staking contracts can result in locked funds, incorrect reward calculations, or complete fund drainage. Leading platforms invest significantly in multiple audits, formal verification, and bug bounty programs to secure their staking infrastructure. Users should verify audit coverage before staking significant amounts.

Token Staking in DEX Platforms

Token staking in DEX platforms involves depositing platform governance tokens or supported assets to earn rewards and access platform features. The staked tokens serve multiple functions: they represent commitment to the protocol, provide governance voting weight, and often determine fee tiers or reward multipliers for other platform activities. This multi-purpose design maximizes utility while encouraging long-term holding.

Different DEX platforms implement token staking with varying requirements and benefits. Some accept only native governance tokens, while others support multiple assets or LP tokens. Reward sources include trading fees, protocol revenue, token inflation, or external partnerships. Understanding the specific token economics of each platform helps evaluate staking opportunity quality and sustainability.

Staking Principle: Sustainable staking rewards derive from genuine protocol value creation like trading fees and usage, not merely token inflation. Evaluate reward sources to assess long-term viability before committing significant capital.

How Staking Works in DEX Platforms

Understanding how staking works in DEX platforms requires examining both the user-facing process and underlying technical mechanics. From the user perspective, staking involves connecting a wallet, approving token spending, depositing tokens, and later claiming rewards or withdrawing stake. Behind these simple actions, sophisticated smart contracts manage complex calculations ensuring fair and transparent reward distribution.

On-Chain Staking Mechanism in DEX

The on-chain staking mechanism in DEX operates entirely through blockchain transactions, creating permanent records of all staking activities. When you stake tokens, a transaction transfers them to the staking contract which updates its internal state to reflect your deposit. This state change is recorded on the blockchain, providing an immutable record that you staked specific amounts at specific times.

Reward accrual in on-chain mechanisms can follow several patterns. Some contracts calculate rewards in real-time with each interaction, updating a user’s claimable balance whenever they check or claim. Others batch reward calculations periodically, distributing rewards at set intervals. The choice affects gas efficiency, reward precision, and user experience but ultimately delivers equivalent economic outcomes.

The transparency of on-chain staking enables independent verification of all protocol claims. Anyone can query the staking contract to confirm total staked amounts, reward pool balances, and distribution histories. This verifiability contrasts sharply with centralized staking services where users must trust operator claims about reserves and distributions. Learning about how liquidity mechanisms interact with staking in exchanges provides additional context.

Reward Distribution Logic in DEX Staking

Reward distribution logic in DEX staking determines how the reward pool divides among participants based on their contributions. The most common approach uses proportional distribution where your rewards equal (your stake / total staked) × total rewards. This simple formula ensures larger stakes earn proportionally more while maintaining fairness across all participants regardless of stake size.

More sophisticated distribution logic incorporates time-weighting to favor consistent long-term stakers over those who stake briefly during high-reward periods. Some protocols implement boost multipliers for extended lock-up commitments, rewarding users who accept longer liquidity constraints with enhanced APY. These mechanisms help stabilize staking participation and discourage mercenary capital that chases highest current yields.

DEX Staking Model Comparison

| Staking Model | Lock-Up | Reward Source | Typical APY |

|---|---|---|---|

| Flexible Staking | None (instant unstake) | Trading fees | 3-8% |

| Fixed-Term Staking | 30-365 days | Fees + emissions | 10-25% |

| Governance Staking | Variable with cooldown | Protocol revenue | 5-15% |

| Vote-Escrowed | Up to 4 years | Fees + bribes + emissions | 15-50%+ |

DEX Staking Lifecycle

| Stage | Action | Smart Contract Operation | User Requirement |

|---|---|---|---|

| 1 | Connect Wallet | Read wallet address | Web3 wallet |

| 2 | Approve Tokens | Set spending allowance | Gas for approval TX |

| 3 | Deposit Stake | Transfer and record stake | Tokens + gas |

| 4 | Rewards Accrue | Calculate proportional share | Wait (automatic) |

| 5 | Claim Rewards | Transfer reward tokens | Gas for claim TX |

| 6 | Unstake (Optional) | Return tokens, apply cooldown | Gas + wait period |

Benefits of Staking in DEX Platforms

The benefits of staking in DEX platforms extend beyond simple reward earning to encompass governance participation, enhanced platform features, and alignment with protocol success. Understanding these multifaceted benefits helps evaluate whether staking aligns with your investment strategy and risk tolerance.

Earning Rewards through DEX Staking

Earning rewards through DEX staking provides passive income on tokens that would otherwise sit idle in wallets. Reward yields vary significantly based on platform adoption, staking model, and market conditions, typically ranging from modest single-digit APY for flexible staking to substantial returns for long-term locked positions. These rewards effectively reduce the opportunity cost of holding governance tokens.

Reward token types influence staking strategy decisions. Some platforms distribute rewards in the same token being staked, enabling compound staking where rewards are restaked to grow positions. Others distribute rewards in different tokens like stablecoins or platform fee tokens, providing diversification but requiring active management. Understanding how farming mechanisms complement staking strategies reveals opportunities for yield optimization.

Platform Incentives for Staking in DEX

Platform incentives for staking in DEX encompass benefits beyond direct rewards that enhance the overall platform experience for stakers. Common incentives include reduced trading fees for active stakers, early access to new features or token launches, and boosted rewards in liquidity mining programs. These tiered benefits create compelling reasons to stake beyond reward APY alone.

Governance participation represents a particularly valuable incentive for engaged community members. Stakers often receive voting rights proportional to their stake, enabling influence over protocol parameters, fee structures, and treasury allocations. This governance power can be economically valuable when influencing decisions that affect token value or staking rewards.

DEX Staking Architecture Selection Criteria

When evaluating staking opportunities, assess these factors:

- Security Audits: Verify staking contracts have been audited by reputable firms

- Reward Sustainability: Evaluate whether rewards come from genuine protocol revenue or unsustainable inflation

- Lock-Up Terms: Understand all restrictions and penalties affecting liquidity

- APY Realism: Be skeptical of extremely high APY that may indicate risk or unsustainability

- Protocol Adoption: Consider the underlying DEX’s usage, volume, and growth trajectory

- Token Economics: Analyze how staking fits into overall tokenomics and value accrual

Risks and Challenges in DEX Staking

Risks and challenges in DEX staking require careful consideration before committing capital. While staking offers attractive rewards, associated risks can result in partial or complete loss of staked assets. Understanding these risks enables informed decisions and appropriate position sizing.

Smart Contract Risk in Staking

Smart contract risk in staking represents the possibility that bugs, vulnerabilities, or exploits in staking contracts could result in fund loss. Even audited contracts can contain undiscovered vulnerabilities that attackers might exploit. Historical DeFi exploits demonstrate that substantial funds can be lost quickly when contract vulnerabilities are discovered and exploited before fixes can be implemented.

Risk mitigation includes choosing protocols with multiple audits from reputable firms, established track records without security incidents, and active bug bounty programs. Diversifying stakes across multiple protocols limits exposure to any single contract failure. Some users also monitor protocol security disclosures and maintain readiness to withdraw if concerning issues emerge.

Lock-Up Period and Liquidity Constraints

Lock-up periods and liquidity constraints prevent immediate access to staked tokens, creating opportunity costs and risks during market volatility. If token prices decline significantly during lock-up periods, stakers cannot sell to limit losses. Conversely, missing price spikes during lock-ups may mean foregone profits that exceed staking rewards. These constraints require balancing reward optimization against liquidity needs.

Understanding specific lock-up mechanics helps manage liquidity risks. Some protocols offer tiered staking where shorter lock-ups earn lower rewards but provide more flexibility. Others implement cooldown periods where unstaking begins a countdown before tokens become available. Planning around these constraints ensures access to funds when needed while maximizing rewards within acceptable liquidity parameters.

Risk Warning: DEX staking involves risks including smart contract vulnerabilities, token price decline, and liquidity constraints. Never stake more than you can afford to lose or lock for the required period. High APY often indicates higher risk.

Staking Risk Assessment

| Risk Type | Description | Mitigation |

|---|---|---|

| Smart Contract | Bugs or exploits in staking code | Use audited protocols, diversify |

| Price Volatility | Token value decline during lock-up | Stake tokens with strong fundamentals |

| Liquidity Lock | Cannot access funds when needed | Match lock-up to liquidity needs |

| Reward Dilution | APY drops as more users stake | Monitor APY trends, rebalance |

| Protocol Failure | DEX loses users, rewards decline | Stake on established platforms |

Advanced DEX Staking Models

Advanced DEX staking models extend beyond simple token locking to create sophisticated participation mechanisms with enhanced benefits and responsibilities. These models often integrate staking with governance, liquidity provision, and protocol security in ways that increase both rewards and engagement requirements. Understanding how fee mechanisms interact with staking rewards reveals the complexity of modern DEX economics.

Validator-Independent Staking in DEX

Validator-independent staking in DEX separates staking rewards from blockchain validation responsibilities, enabling passive participation without running infrastructure. Unlike proof-of-stake networks where staking supports consensus, DEX staking focuses on protocol-specific objectives like governance, fee sharing, or liquidity incentivization. This independence makes DEX staking accessible to users without technical expertise or infrastructure resources.

The validator-independent model simplifies participation while maintaining meaningful engagement with protocol economics. Stakers benefit from platform success through fee sharing or token appreciation without needing to monitor uptime, manage keys for validation, or risk slashing penalties. This accessibility has broadened staking participation across the DeFi ecosystem.

Build DEXs with Advanced Staking Features

Partner with our DEX development company to create decentralized exchanges with secure staking, smart contract integration, and scalable architecture.

Permissionless Staking Models in Decentralized Exchanges

Permissionless staking models in decentralized exchanges enable anyone to stake without requiring approval, meeting minimum amounts, or satisfying identity requirements. These models align with DeFi principles of open access and self-sovereignty, enabling global participation regardless of geographic location or economic status. Anyone with tokens and gas for transactions can begin earning staking rewards immediately.

The permissionless design extends to exit as well, ensuring stakers retain control over their assets within the constraints of any lock-up periods they accepted. Unlike centralized staking services that might freeze accounts or impose arbitrary restrictions, permissionless DEX staking operates according to transparent, immutable smart contract rules. Exploring how modern exchange platforms implement permissionless mechanisms reveals design principles for inclusive participation.

Future Outlook: DEX staking continues evolving toward more sophisticated models integrating real yield from protocol revenue, cross-chain staking spanning multiple networks, and liquid staking derivatives that maintain liquidity while staked. These innovations will expand staking utility while potentially addressing current liquidity constraints.

Staking in decentralized exchange platforms has matured from simple reward mechanisms into sophisticated economic systems that align user incentives with protocol success. Understanding how staking works in DEX environments enables informed participation that balances reward opportunities against associated risks. As staking models continue evolving, participants who grasp underlying mechanics will be best positioned to optimize returns while managing exposure appropriately.

The principles of smart contract staking, on-chain transparency, and permissionless participation distinguish DEX staking from centralized alternatives while creating unique value propositions for crypto users. Whether seeking passive income, governance influence, or enhanced platform benefits, DEX staking offers pathways to deeper protocol engagement that reward long-term commitment while contributing to ecosystem decentralization and security.

Frequently Asked Questions

Staking in decentralized exchange platforms is the process of locking cryptocurrency tokens in smart contracts to earn rewards while supporting platform operations. Unlike traditional proof-of-stake consensus staking, DEX staking typically involves contributing to liquidity, governance, or protocol security in exchange for a share of trading fees or token emissions. This mechanism aligns user incentives with platform success while providing passive income opportunities.

How staking works in DEX involves depositing tokens into designated smart contracts that track your contribution and calculate rewards based on predefined formulas. The smart contract records stake amounts, duration, and other parameters affecting reward calculation. Rewards accumulate over time from sources like trading fees, inflation emissions, or protocol revenue, which stakers can claim periodically or upon unstaking.

DEX staking benefits include earning passive income through reward distributions, gaining governance rights to vote on protocol decisions, and receiving fee discounts or enhanced platform features. Stakers also contribute to protocol security and decentralization while potentially benefiting from token price appreciation. Many platforms offer tiered benefits where longer staking periods or larger amounts unlock additional advantages.

Staking typically involves locking single tokens to earn rewards without exposure to trading pair dynamics, while liquidity provision requires depositing paired assets into trading pools that facilitate swaps. Liquidity providers face impermanent loss risk from price divergence between paired assets, whereas single-token stakers avoid this specific risk. Both mechanisms earn rewards but with different risk profiles and participation requirements.

Staking reward mechanism in DEX calculates rewards based on your proportional share of the total staked amount, staking duration, and the reward pool size. The formula typically divides total rewards by total staked tokens, multiplied by your individual stake. Some protocols implement boosters for longer lock-ups or introduce time-weighted calculations that favor consistent long-term stakers over short-term participants.

Risks of staking in DEX platforms include smart contract vulnerabilities that could lead to fund loss, lock-up periods preventing access to tokens during market volatility, and potential reward token value decline. Protocol-specific risks include governance attacks, economic design flaws, and dependency on continued platform adoption. Users should evaluate smart contract audits, team reputation, and protocol economics before staking.

Smart contract staking in DEX refers to the automated, trustless management of staking operations through blockchain code. Smart contracts handle deposit acceptance, stake tracking, reward calculation, and distribution without human intermediaries. This on-chain staking mechanism ensures transparency, immutability, and predictable execution while eliminating counterparty risk associated with centralized staking services.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.