Why Everyone is Talking About Smart Contracts

The world of finance and technology has evolved rapidly in the last decade, and one of the biggest innovations that continues to reshape industries is the smart contract. Often referred to as the backbone of blockchain applications, smart contracts 101 are becoming essential for business models, payments, and even legal agreements.

But what exactly are they, how do they work, and why do they matter? This Smart Contracts 101 guide will walk you through everything you need to know explained in simple words, with practical examples, benefits, challenges, and future outlook.

What is a Smart Contract?

A smart contract is a digital agreement stored on a blockchain. Unlike traditional contracts that require lawyers, brokers, or paperwork, a smart contract 101 automatically executes itself once certain conditions are met.

Think of it as a vending machine:

- You insert money,

- The machine verifies the amount,

- You instantly get the product you chose.

No human involvement. Just pure automation. That’s exactly how smart contracts 101 function but in the digital financial world.

A Brief History – How Smart Contracts Evolved

Smart contracts are not brand new. The concept was first proposed by computer scientist Nick Szabo in the 1990s. He imagined digital contracts that could execute themselves without human oversight.

At the time, the technology didn’t exist to make his idea possible. But with the launch of Ethereum in 2015, the world finally had a platform where smart contracts 101 could be deployed at scale. Since then, other blockchains like Solana, Polygon, and Avalanche have joined the race, each offering faster, cheaper, or more specialized versions of smart contract 101 execution.

Key Features of Smart Contracts

Smart contracts stand out because of their unique features:

- Automation: Actions are triggered automatically without human interference.

- Transparency: All terms are visible and verifiable on the blockchain.

- Security: Data is encrypted and stored securely, reducing fraud risks.

- Efficiency: Cuts down paperwork, intermediaries, and delays.

- Global Reach: Can work across borders without the need for third-party approvals.

- Immutability: Once deployed, the contract cannot be altered, ensuring fairness.

- Programmability: Customizable logic allows contracts to handle complex tasks.

How Do Smart Contracts Work in Real Life?

At their core, smart contracts 101 follow a simple if-then structure:

- If a buyer sends payment, then the seller transfers the asset.

- If a user deposits funds, then the system issues a reward or access.

This automation ensures speed and trust, especially in industries where disputes or delays often arise.

For example:

- A freelance designer can use a smart contract 101 so that payment is released only when the client confirms delivery.

- An insurance company can automate claims, paying customers instantly if conditions like weather or accidents are met.

Ready to Build Smart, Automated and Transparent Contracts?

Build Smart Contracts 101Everyday Examples of Smart Contracts

To make this easier to understand, here are real-world applications:

- Banking & Payments: Automating loan repayments and peer-to-peer transfers.

- Real Estate: Tokenizing property ownership and transferring deeds instantly.

- Healthcare: Securing patient data and enabling safe record-sharing.

- Insurance: Triggering payouts automatically once conditions are met.

- Gaming: Managing in-game assets and rewards transparently.

- Supply Chain: Tracking goods from manufacturer to consumer with verified data.

- E-commerce: Automating refunds, loyalty points, and delivery guarantees.

- Voting: Transparent election processes with tamper-proof results.

New Era of Finance with Smart Contracts

Smart contracts aren’t just another tech trend; they are rewriting the rules of finance. By eliminating middlemen, they reduce costs, improve trust, and make financial systems more inclusive.

This new era of finance means anyone with internet access can participate in global markets, trade assets, or access financial products once limited to big corporations and banks. Imagine a farmer in a remote village accessing microloans or a student abroad paying tuition instantly without waiting days for bank clearance. This is the power of smart contracts.

Benefits of Using Smart Contracts

Smart contracts bring multiple advantages:

- Cost Savings: No intermediaries mean lower transaction fees.

- Speed: Transactions and agreements execute instantly.

- Accuracy: Automated execution removes errors from manual processing.

- Trustless System: No need to “trust” a party; the code enforces the rules.

- Accessibility: Anyone, anywhere, can use them, making finance more inclusive.

- Scalability: Millions of contracts can run simultaneously.

- Environmental Benefits: By cutting down paperwork, they reduce waste.

Challenges in Smart Contracts

While powerful, they are not without limitations:

- Regulatory Uncertainty: Different countries interpret blockchain differently, slowing adoption.

- Coding Risks: Bugs in smart contracts can cause major losses.

- Scalability Issues: Networks may face slowdowns during heavy use.

- User Awareness: Many still don’t fully understand how they work.

- Integration Challenges: Traditional industries adapt slowly to new tech.

- Data Reliability: Contracts rely on external data (oracles), which may be manipulated.

Energy Concerns: Some blockchains still consume significant resources.

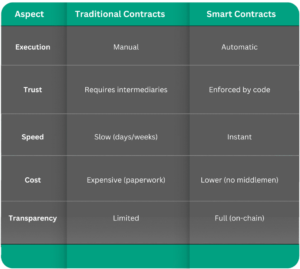

Smart Contracts vs. Traditional Contracts

Smart Contracts in Different Industries

Smart contracts 101 are versatile, with applications across sectors:

- Finance: DeFi platforms, lending, yield farming, and automated exchanges.

- Healthcare: Secure sharing of patient records and automated insurance claims.

- Education: Issuing tamper-proof certificates and student credentials.

- Retail: Managing loyalty programs, discounts, and refunds automatically.

- Energy: Peer-to-peer energy trading using blockchain-based contracts.

- Legal: Recording intellectual property rights and licensing agreements.

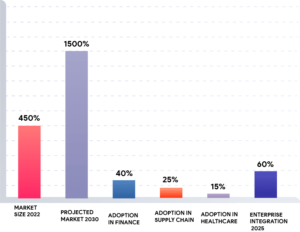

Market Growth of Smart Contracts

Future Outlook – Where Smart Contracts are Heading

The journey has only just begun. In the future, expect:

- Wider institutional adoption by banks, corporations, and governments.

- AI-powered contracts that can analyze data and adapt conditions in real time.

- Cross-chain functionality making contracts usable across multiple blockchains.

- Integration with IoT: Smart devices directly executing agreements.

- Mass participation: Everyday users engaging in tokenized assets and DeFi services.

Smart Contract Revolution

Smart contracts are no longer just an experiment; they are becoming the foundation of tomorrow’s financial systems. From automating payments to redefining ownership, they empower individuals, businesses, and governments alike. By removing intermediaries, smart contracts 101 reduce costs, minimize errors, and accelerate processes that traditionally took days or weeks.

Beyond finance, smart contracts 101 are transforming industries such as real estate, where property transactions can be executed instantly, and supply chain management, where transparency and traceability are automated. Even in creative sectors, they are enabling artists and content creators to receive direct royalties, ensuring fair compensation without middlemen.

As technology matures and regulations catch up, the world will see a financial landscape where trust is coded, transactions are instant, and opportunities are borderless. Cross-border payments, decentralized lending, and tokenized assets will become commonplace, allowing anyone with an internet connection to participate in global markets.

This is the essence of Smart Contracts 101 – a technology that is simple to understand, yet revolutionary in its potential. It bridges traditional systems with digital innovation, creating a future where efficiency, security, and transparency are standard, not optional. The journey is just beginning, and those who understand and leverage smart contracts 101 today are shaping the financial world of tomorrow.

What are smart contracts?

Smart contracts are self-executing digital agreements stored on a blockchain that automatically perform actions once predefined conditions are met, removing intermediaries and increasing efficiency and trust.

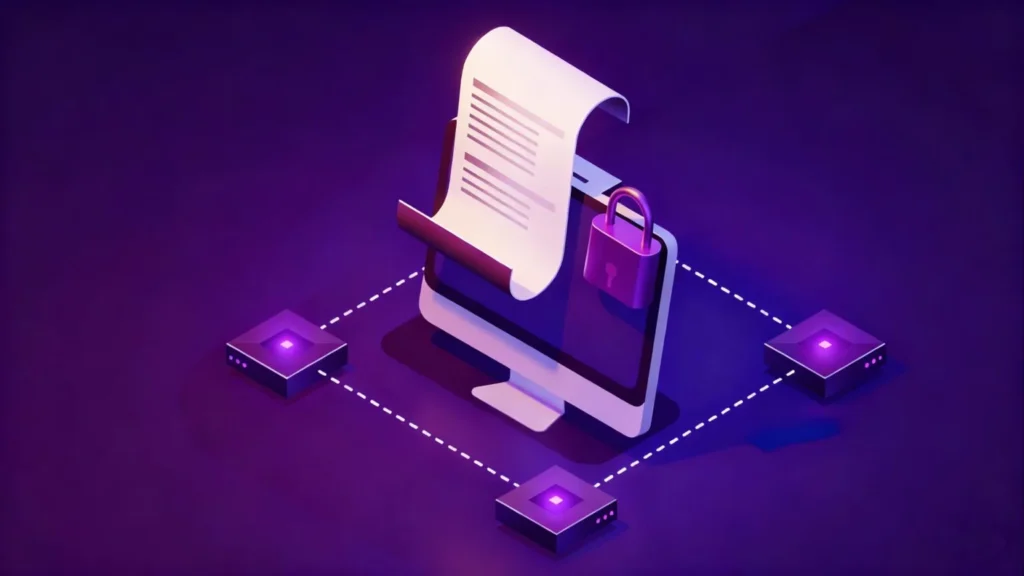

Are smart contracts secure?

Yes, smart contracts are secure due to blockchain immutability and encryption, but risks exist from coding bugs or unreliable external data sources (oracles), making audits essential.

How do smart contracts work?

Smart contracts operate on an if-then logic. When conditions in the code are satisfied, actions like payments or asset transfers execute automatically, ensuring speed, accuracy, and transparency.

What is the future of smart contracts?

The future includes wider adoption, AI integration, cross-chain functionality, IoT-enabled automation, and everyday user participation in tokenized assets and decentralized finance systems.

Which industries use smart contracts?

Finance, healthcare, real estate, supply chain, gaming, education, and legal sectors widely use smart contracts 101 to automate transactions, improve trust, and reduce operational costs.

What are the benefits of smart contracts?

Smart contracts save costs, ensure faster execution, reduce errors, increase transparency, enable global accessibility, and support scalable and secure operations without relying on third parties.