Key Takeaways

- In 2024, dYdX generated over $270 billion in trading volume, demonstrating the growing adoption of order book-based DEX platforms for derivatives trading.[1]

- The total trading volume across all decentralised exchanges reached approximately $1.2 trillion in 2024, with order book DEXs capturing significant market share in perpetual futures trading.[2]

- Perpetual DEX trading volume hit a record $344.75 billion in December 2024, more than doubling from $647.6 billion in 2023 to $1.5 trillion for the full year.[3]

- In 2024, cryptocurrency hacks resulted in nearly $2.2 billion stolen from centralised platforms, highlighting the security advantages of non-custodial order book DEX trading.[4]

- Active self-custody crypto wallets surged by 47% worldwide in 2024, climbing to over 400 million addresses as traders shifted toward decentralised trading venues.[5]

- dYdX experienced a 52% increase in active traders from Q1 to Q4 2024, reaching a peak of 10,749 traders, with open interest expanding by 132% over the year from $140 million to $325 million.

- In January 2024, dYdX v4 topped Uniswap as the largest DEX by daily trading volume, with $757 million over 24 hours compared to Uniswap v3’s $608 million.[6]

- Hyperliquid achieved a 25.3x volume increase in 2024, growing from $21 billion in 2023 to $570 billion, showcasing the explosive growth potential of order book perpetual DEX platforms.[7]

- The average transaction fee on DEXs in 2024 was approximately 0.2%, lower than the typical centralised exchange fee of 0.5% to 1%.[8]

- Over the past decade, 118 hacks on centralised exchanges have led to $11 billion in losses, 11 times more than what has been stolen directly from blockchains or individual wallets.[9]

Understanding the Importance of Order Books in DEXs

The cryptocurrency trading landscape has undergone a fundamental transformation over the past several years. What started as a niche market dominated by centralised platforms has evolved into a sophisticated ecosystem where decentralised exchanges play an increasingly prominent role. At the heart of this evolution lies a trading mechanism that has proven its worth across traditional financial markets for decades: the order book.

Order books in DEXs represent a significant step forward in how traders interact with decentralised finance. Unlike automated market makers that determine prices through mathematical formulas, order book-based DEX platforms bring the familiar price discovery mechanisms of traditional exchanges into the world of blockchain technology. This approach allows buyers and sellers to directly post their desired prices and quantities, creating a transparent marketplace where true supply and demand dynamics determine asset values.

The growing adoption of DEX order books signals a maturing cryptocurrency market. Professional traders and institutions, accustomed to the precision and control offered by traditional order books, are finding that decentralised exchange order book systems can deliver comparable functionality without sacrificing the core principles of decentralisation. The ability to place limit orders, set specific price points, and execute complex trading strategies has made order books in decentralised exchange platforms increasingly attractive to sophisticated market participants.

Throughout 2024, the significance of order books in DEXs became impossible to ignore. Trading volumes surged across order-book-based platforms, with derivatives exchanges in particular witnessing unprecedented growth. This shift reflects a broader recognition that effective price discovery and trading precision need not be sacrificed in the pursuit of decentralisation. As the cryptocurrency market continues to mature, understanding how order books function within decentralised exchanges has become essential knowledge for traders, developers, and anyone interested in the future of digital finance.

What Are Order Books and How Do They Function in Decentralised Exchanges

An order book serves as a real-time record of all active buy and sell orders for a particular trading pair. In the context of a decentralised exchange order book, this mechanism operates through smart contracts on a blockchain network, removing the need for a centralised intermediary to match trades. The fundamental concept remains consistent with traditional finance: buyers submit bids indicating the price and quantity they wish to purchase, while sellers post asks specifying their selling price and available quantity.

The order book displays all active orders organised by price level, creating a visual representation of market depth. When examining order books in DEXs, traders can see the cumulative quantity of buy orders stacked at various price points below the current market price, and sell orders stacked above it. This transparency enables market participants to gauge supply and demand conditions, identify potential support and resistance levels, and make informed decisions about their trading strategies.

The matching engine within an order book-based DEX executes trades when compatible orders meet. Consider a scenario where Alice places a buy order for 1 ETH at $1,800, and Bob submits a sell order for 1 ETH at the same price. The matching engine recognises these compatible orders and executes the trade automatically, updating the order book to reflect the completed transaction. This process, known as price time priority matching, ensures that orders are filled based first on the best price and then on the time they were submitted.

1. On Chain Order Books

On-chain order book implementations store every order directly on the blockchain. This approach maximizes decentralization and transparency since anyone can verify the complete order flow and trade execution history. However, this design introduces performance constraints. Each order submission, modification, or cancellation requires a blockchain transaction, incurring gas fees and subject to block confirmation times. Early experiments with fully on-chain order books on Ethereum demonstrated these limitations through slow execution speeds and prohibitive costs for active traders.

2. Off-Chain Order Books with On-Chain Settlement

To address the performance challenges of fully on-chain systems, many order book DEXs employ hybrid architectures. In this model, the order book state and matching engine operate off-chain, enabling rapid order updates without blockchain transaction costs. Only the final trade settlements are recorded on the chain, maintaining the security and finality benefits of blockchain technology while dramatically improving speed and reducing costs. dYdX v3 exemplified this approach, using StarkWare’s Layer 2 technology to achieve high performance while settling trades on Ethereum.

3. High Performance Blockchain Solutions

The emergence of high-throughput blockchains has created new possibilities for order books in decentralised exchange platforms. Networks like Solana, with sub-second block times and minimal transaction fees, enable fully on-chain order books that approach the performance of centralised systems. Serum, built on Solana, demonstrated that a central limit order book could operate entirely on chain when supported by appropriate infrastructure. Similarly, dYdX v4 migrated to its own Cosmos-based blockchain specifically designed to handle the demands of order book trading, achieving throughput exceeding 2,000 transactions per second.

You May Also Like:

The Critical Role of Order Books in DEXs for Price Discovery

Price discovery represents one of the most valuable functions that order books in DEXs provide to the cryptocurrency market. Unlike automated market makers, where prices are determined by algorithmic formulas based on pool ratios, order book-based DEX platforms reflect actual human sentiment and trading intentions. The aggregation of all active bids and asks creates an organic representation of what market participants believe an asset is worth at any given moment.

In a decentralised exchange order book, the spread between the highest bid and lowest ask serves as a key indicator of market liquidity and sentiment. Tight spreads typically indicate active markets with strong liquidity, while wider spreads may suggest uncertainty or lower trading activity. This information proves invaluable for traders seeking to understand current market conditions and anticipate potential price movements.

The order book’s depth also provides crucial insights that automated market makers cannot replicate. By examining the quantity of orders stacked at various price levels, traders can identify potential support and resistance zones. Large buy orders clustered at a particular price level may indicate strong buying interest that could prevent further price declines, while concentrated sell orders suggest potential resistance to upward price movement.

Professional market makers play a vital role in maintaining liquidity within DEX order books. These participants continuously place buy and sell orders around the current market price, earning the spread between their bids and asks while providing liquidity for other traders. The presence of active market makers in order books in decentralised exchange platforms helps ensure that traders can execute orders efficiently without excessive price impact.

For new token launches and less liquid markets, order book mechanisms offer distinct advantages over automated alternatives. The Central Limit Order Book model allows for more precise initial price discovery, as actual buyers and sellers determine the starting price through their orders rather than relying on initial liquidity pool ratios that may be manipulated. This characteristic has made order-book-based DEX platforms increasingly attractive for token generation events and listings of emerging assets.

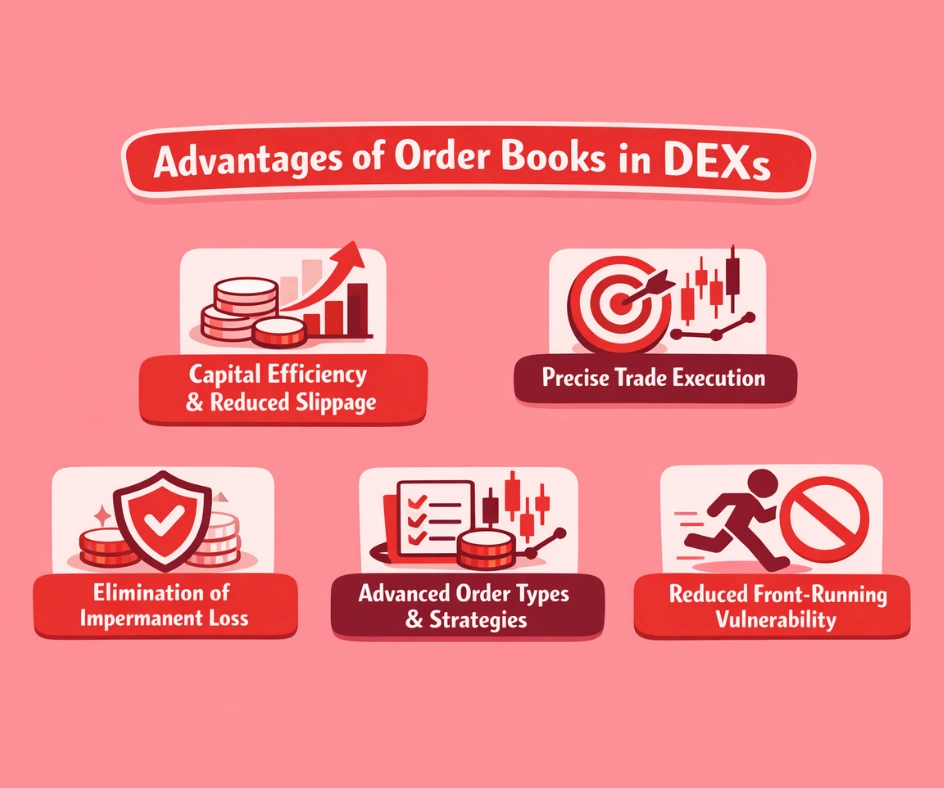

Advantages of Order Books in DEXs Over Automated Market Makers

The cryptocurrency trading ecosystem has been shaped significantly by the rise of automated market makers, pioneered by platforms like Uniswap starting in 2018. While AMMs democratized liquidity provision and enabled permissionless token trading, they introduced certain limitations that order books in DEXs address effectively. Understanding these differences helps traders and developers choose appropriate platforms for their specific needs.

1. Capital Efficiency and Reduced Slippage

Order book-based DEX platforms demonstrate superior capital efficiency compared to traditional AMM designs. In automated market makers, liquidity is distributed across a wide price range following mathematical curves, meaning much of the deposited capital sits unused at price points far from current market levels. Order books in decentralised exchange systems allow market makers to concentrate their liquidity precisely where it is most needed, around the current market price, resulting in deeper effective liquidity and reduced slippage for traders.

2. Precise Trade Execution

Limit orders represent a fundamental advantage of DEX order books. Traders can specify exact prices at which they wish to buy or sell, and orders execute precisely at those levels when matching orders become available. This certainty contrasts sharply with AMM trades, where the execution price depends on trade size and pool conditions at the moment of execution. For large orders or volatile markets, the predictability of order book execution proves particularly valuable.

3. Elimination of Impermanent Loss for Liquidity Providers

Liquidity providers in automated market makers face the risk of impermanent loss, a phenomenon where the value of deposited assets may decline relative to simply holding them due to price divergence. This risk discourages liquidity provision, particularly during volatile market conditions. In order book based DEX environments, market makers actively manage their positions, adjusting orders in response to price movements and market conditions. This active management approach eliminates the structural impermanent loss inherent to constant product AMMs.

4. Advanced Order Types and Trading Strategies

Order books in DEXs support a range of order types familiar to traditional traders. Stop loss orders, take profit orders, post-only orders, and time in force specifications enable sophisticated trading strategies that remain difficult or impossible to implement on AMM platforms. Professional traders and institutions often require these tools to manage risk and execute complex strategies, making order book-based DEX platforms essential infrastructure for the maturation of decentralised trading.

5. Reduced Front-Running Vulnerability

While front running remains a concern across all decentralised trading systems, certain order book implementations incorporate design features to mitigate this risk. Off-chain order matching, batch auctions, and encrypted order submission mechanisms can reduce the ability of malicious actors to exploit pending transactions. Some decentralised exchange order book platforms employ frequent batch auctions that match all orders at a single clearing price, eliminating opportunities for individual transaction ordering exploitation.

Comparison of Order Book DEXs vs AMM DEXs: Key Differences

| Feature | Order Book DEXs | AMM Based DEXs |

|---|---|---|

| Price Discovery | Determined by actual buyer and seller orders reflecting true market sentiment | Algorithmically determined by pool ratios using mathematical formulas |

| Order Types | Supports limit orders, stop loss, take profit, and conditional orders | Primarily market orders with execution at the current pool price |

| Capital Efficiency | High efficiency with liquidity concentrated at active price levels | Lower efficiency with liquidity spread across the entire price curve |

| Slippage | Minimal for limit orders, predictable execution prices | Variable based on trade size relative to pool liquidity |

| Liquidity Provider Risk | Active position management without impermanent loss | Subject to impermanent loss from price divergence |

| Best Use Case | Professional trading, derivatives, large volume transactions | Simple token swaps, long tail assets, casual trading |

Security Benefits of Order Books in Decentralised Exchange Platforms

The security advantages of trading through decentralised exchange order book systems have become increasingly apparent following high-profile failures of centralised platforms. The cryptocurrency industry witnessed devastating losses in 2024, with hacks and exploits draining nearly $2.2 billion from centralised exchanges and protocols. These incidents underscore why many traders have shifted their activity to non-custodial order book-based DEX platforms.

At the core of the security model for order books in DEXs lies the principle of self-custody. Unlike centralised exchanges, where users must deposit funds into platform-controlled wallets, decentralised exchange order book trading allows users to maintain control of their private keys and assets until the moment of trade execution. This fundamental difference eliminates the custodial risk that has resulted in billions of dollars in user losses through exchange hacks, mismanagement, and fraud.

The collapse of FTX in November 2022 serves as a stark reminder of custodial risks. What appeared to be a leading cryptocurrency exchange was revealed to have misappropriated billions in customer funds, leaving users unable to withdraw their assets. The subsequent $477 million hack during bankruptcy proceedings compounded the disaster. Such scenarios become structurally impossible in order-book-based DEX environments where platforms never take custody of user funds.

Throughout the past decade, centralised exchanges have experienced 118 major security breaches resulting in $11 billion in losses. These incidents have affected platforms of all sizes, from early exchanges like Mt. Gox to recent attacks on DMM Bitcoin, which lost over $300 million in May 2024. The consistent pattern of centralised exchange vulnerabilities has driven growth in decentralised alternatives, particularly order books in DEXs designed for professional traders who previously relied exclusively on centralised venues.

Smart contract security remains critical for decentralised exchange order book platforms. Well-designed DEX order book systems undergo extensive auditing and employ proven smart contract patterns to minimise vulnerability. The transparent nature of blockchain-based systems allows security researchers to examine code and identify potential issues before exploitation. While smart contract risks exist, they represent a fundamentally different threat model than the centralised custody risks that have caused the largest losses in cryptocurrency history.

Leading Order Book-Based DEX Platforms Transforming Cryptocurrency Trading

The order book DEX landscape has evolved dramatically, with several platforms emerging as leaders in different market segments. Understanding the characteristics of these platforms provides insight into how order books in decentralised exchange environments are being implemented and adopted across the cryptocurrency ecosystem.

1. dYdX: The Perpetual Derivatives Pioneer

dYdX stands as the most prominent example of order book success in decentralised derivatives trading. The platform processed over $270 billion in trading volume during 2024, generating $45 million in protocol fees while demonstrating that professional-grade trading experiences can exist within decentralised frameworks. The October 2023 launch of dYdX v4 marked a significant milestone, transitioning the protocol to its own Cosmos-based blockchain designed specifically for order book trading.

The dYdX ecosystem experienced remarkable growth metrics throughout 2024. Active traders increased by 52% from Q1 to Q4, reaching a peak of 10,749 traders in the final quarter. Open interest expanded by 132% over the year, growing from $140 million to $325 million. Total Value Locked saw particularly strong growth in the latter half of the year, climbing from $100 million in April to over $400 million by December. These figures demonstrate sustained institutional adoption of order book-based DEX infrastructure for derivatives trading.

2. Hyperliquid: Explosive Growth in Perpetual Trading

Hyperliquid emerged as one of the most remarkable success stories in decentralised finance during 2024. The platform achieved a 25.3-fold increase in trading volume, growing from $21 billion in 2023 to $570 billion in 2024. Operating on a high-performance Layer 1 chain with native order book infrastructure, Hyperliquid demonstrated that decentralised platforms could compete with centralised exchanges on execution speed and user experience.

The platform’s success stems from its focus on performance and user experience. Sub-second finality, support for up to 100,000 orders per second, and gasless trading with advanced order types have attracted professional traders seeking centralised exchange functionality within a decentralised framework. Following its token generation event in late 2024, monthly trading volumes increased dramatically, reaching between $160 billion and $315 billion.

3. Phoenix: On Chain Order Book Innovation on Solana

Phoenix represents a fully on-chain Central Limit Order Book implementation on Solana, demonstrating that blockchain infrastructure has advanced sufficiently to support complete order book functionality without off-chain components. The platform enables true price discovery and efficient market making while maintaining the security and transparency benefits of decentralised trading.

The platform’s architecture eliminates the need for asynchronous settlement processes that affect other Solana-based exchanges. Market makers benefit from the ability to quickly adjust positions and manage risk, while traders enjoy instant settlement and competitive pricing. Phoenix’s innovative Market Rent model, where market makers stake tokens to earn trading fees, creates a sustainable ecosystem for liquidity provision.

4. Dexalot: Bringing Traditional Order Book Experience to DeFi

Dexalot offers a unique approach to order books in DEXs by providing an interface and functionality closely resembling centralised exchanges while maintaining decentralised custody. Originally built on Avalanche, the platform has expanded to Arbitrum, demonstrating the cross-chain potential of order book-based DEX development. With over $1.1 billion in total transaction volume processed on Avalanche alone, Dexalot has established itself as a significant player in the spot trading market.

You May Also Like:

Technical Architecture of Order Books in Decentralised Exchange Systems

Building effective order books in DEXs requires careful consideration of technical architecture, balancing decentralisation with performance requirements. The design choices made by different platforms reflect various approaches to solving the fundamental challenges of on-chain order matching.

1. Smart Contract Design for Order Management

The smart contract layer of an order book-based DEX handles order submission, validation, and settlement. When a user submits an order, the smart contract verifies that the user has sufficient balance or approved allowances, validates order parameters, and either matches the order immediately if compatible orders exist or stores it in the order book data structure. Efficient data structures prove critical for managing large order books without excessive gas costs.

2. Matching Engine Implementation

The matching engine represents the core logic determining how orders are paired and executed. Most order-book-based DEX platforms employ price-time priority, where orders are matched first by best price and then by submission time among orders at the same price. Implementing this logic on the chain requires careful optimisation, as iterating through large order books can consume significant gas. Advanced implementations use balanced binary search trees or similar data structures to maintain logarithmic complexity for order operations.

3. Layer 2 and Application Specific Chains

The limitations of general-purpose blockchains like Ethereum have driven order book DEX development toward specialised infrastructure. Layer 2 solutions, including Optimistic Rollups on Arbitrum and Optimism, and ZK Rollups on zkSync, enable faster and cheaper transactions while inheriting base layer security. dYdX’s decision to build an application-specific chain using the Cosmos SDK demonstrates an alternative approach, creating infrastructure optimised specifically for order book trading with throughput exceeding 2,000 transactions per second.

4. Oracle Integration for Derivatives Trading

Order books in DEXs supporting perpetual contracts require accurate price feeds to calculate funding rates, determine liquidation thresholds, and maintain contract prices aligned with underlying assets. Integration with oracle networks like Chainlink or custom oracle solutions ensures that price data remains accurate and resistant to manipulation. The quality and latency of Oracle data directly impact the safety and fairness of the trading environment.

5. Liquidation Mechanisms

For leveraged trading platforms, robust liquidation engines protect the system from bad debt when positions move against traders. Well-designed liquidation mechanisms in order-book-based DEX environments allow third parties to liquidate underwater positions before losses exceed collateral, maintaining system solvency while providing liquidators with incentives through partial position takeover or bounties.

The Role of Layer 2 Solutions in Advancing Order Books in DEXs

Layer 2 blockchain solutions have proven instrumental in making order books in decentralised exchange platforms practical for mainstream adoption. These scaling technologies address the fundamental throughput and cost limitations that prevented earlier attempts at on-chain order books from achieving commercial viability.

Arbitrum has emerged as a leading ecosystem for order book-based DEX development, offering gas cost reductions of up to 95% compared to Ethereum mainnet while maintaining security guarantees through optimistic rollup technology. The network processes transactions significantly faster than Ethereum, enabling order book operations that would be prohibitively expensive or slow on the base layer. Multiple order book DEXs have launched on Arbitrum, attracted by its developer-friendly environment and growing user base.

Optimism provides similar benefits through its own optimistic rollup implementation, with particular strength in its ecosystem of DeFi protocols. The network’s focus on EVM compatibility ensures that existing smart contract code can deploy with minimal modifications, lowering barriers for order book DEX development. Base, built on the Optimism stack and backed by Coinbase, has explicitly invited order book DEX developers to join its ecosystem, recognising the importance of this trading model for the future of decentralised finance.

ZK Rollups represent the next evolution in Layer 2 technology, using zero-knowledge proofs to verify batched transactions without requiring the fraud-proof period inherent to optimistic rollups. zkSync Era has attracted order book DEX interest through its unique oracle design that allows frequent updates without per update fees, potentially enabling high-frequency order book trading on chain. The mathematical security guarantees of ZK proofs also appeal to traders seeking strong assurances about system integrity.

Beyond Ethereum Layer 2s, purpose-built chains like Solana have demonstrated that high-throughput Layer 1 networks can support order books natively. Solana’s sub-second block times and minimal transaction fees enable on-chain order books handling over $150 million in daily volume, a feat not practical on Ethereum or most Layer 2 solutions due to the high frequency of order placement and cancellation. The network’s architecture, designed for parallel transaction processing, particularly suits the workload patterns of active order books.

Top Order Book DEX Platforms by Trading Volume (2024)

| Platform | 2024 Trading Volume | Primary Market Focus |

|---|---|---|

| Hyperliquid | $570 billion (25.3x growth from 2023) | Perpetual futures with native L1 infrastructure |

| dYdX | $270 billion (cumulative since 2021 exceeds $1.46 trillion) | Perpetual derivatives on the Cosmos chain |

| Jupiter Perps | 5,176% year over year growth | Solana-based perpetual trading |

| Drift | 628% year over year growth | Hybrid AMM and order book on Solana |

| GMX | $100 million+ daily volume | Perpetuals on Arbitrum with real yield |

| Dexalot | $1.1 billion+ cumulative volume | Spot trading on Avalanche and Arbitrum |

Market Trends Driving Adoption of Order Books in DEXs

Several converging trends have accelerated the adoption of order books in decentralised exchange platforms throughout 2024 and into 2025. Understanding these dynamics provides insight into why this trading model has gained significant momentum and how it may continue to evolve.

1. Institutional Interest in Decentralised Infrastructure

Professional traders and institutional participants increasingly seek decentralised alternatives that offer familiar trading tools and interfaces. Order book-based DEX platforms deliver the limit orders, stop losses, and precise execution that institutions expect, while eliminating counterparty and custodial risks associated with centralised venues. The growth in dYdX active traders, increasing 52% over 2024, reflects institutional adoption of decentralised order book infrastructure.

2. Regulatory Uncertainty Around Centralised Exchanges

Increasing regulatory scrutiny of centralised cryptocurrency exchanges has driven interest in decentralised alternatives. Order books in DEXs operate through smart contracts without centralised operators, creating regulatory ambiguity that some market participants view as advantageous. The permissionless nature of these platforms allows global access without geographic restrictions or mandatory identity verification procedures.

3. Derivatives Market Expansion

Perpetual futures contracts have become the dominant instrument for cryptocurrency speculation, with trading volumes far exceeding spot markets. Order book-based DEX platforms excel at derivatives trading, offering the leverage, funding rate mechanisms, and liquidation systems required for perpetual contracts. The perpetual DEX sector achieved record volumes in December 2024 at $344.75 billion, more than doubling from the previous year’s total of $647.6 billion to $1.5 trillion.

4. Technology Maturation

Advances in blockchain infrastructure have made order books in decentralised exchange environments practical, where they were previously impractical. High-throughput chains, Layer 2 scaling solutions, and application-specific blockchains now provide the performance necessary for active order book trading. Sub second finality, minimal fees, and high transaction throughput enable user experiences approaching centralised exchange standards.

5. Self-Custody Movement

The growth of self-custody wallets, increasing 47% to over 400 million addresses in 2024, reflects broader recognition that holding one’s own keys represents the safest approach to cryptocurrency ownership. This shift directly benefits order-book-based DEX platforms that allow trading without surrendering custody. Monthly DEX trading volumes reached all-time highs in early 2025, demonstrating that traders increasingly prefer non-custodial trading venues.

You May Also Like:

Challenges Facing Order Books in Decentralised Exchange Development

Despite significant progress, order-book-based DEX platforms face ongoing challenges that developers and protocols continue to address. Acknowledging these limitations provides a balanced understanding of the current state and future potential of this trading model.

1. Liquidity Fragmentation

Unlike automated market makers, where liquidity pools aggregate capital automatically, order books in DEXs require active market makers to provide continuous liquidity. Attracting and retaining professional market makers remains challenging, particularly for newer platforms or less traded assets. The permissionless nature of decentralised exchanges can result in liquidity fragmented across multiple platforms, reducing depth available on any single venue.

2. Front Running and MEV

Miner Extractable Value and front running remain concerns for decentralised trading systems. Malicious actors observing pending transactions in public mempools can submit their own transactions with higher gas fees to execute ahead of user orders, profiting at traders’ expense. While various mitigation strategies exist, completely eliminating this risk in transparent blockchain environments presents ongoing challenges for order book-based DEX development.

3. User Experience Complexity

Order books in decentralised exchange platforms often require users to understand wallet management, gas fees, blockchain networks, and trading concepts that remain unfamiliar to mainstream users. The learning curve for interacting with self-custody wallets and decentralised applications can deter adoption among casual traders accustomed to the simplified interfaces of centralised platforms or AMM swaps.

4. Cross-Chain Liquidity

The multichain nature of the cryptocurrency ecosystem creates challenges for order book liquidity. Assets on different blockchains cannot be directly traded within a single order book without bridging, which introduces complexity, delays, and additional risk. Solutions like cross-chain aggregation and unified order books across chains are emerging but remain early in development.

5. Regulatory Uncertainty

The regulatory status of decentralised exchange order book platforms remains unclear in most jurisdictions. While the absence of centralised operators complicates enforcement, regulatory developments could impact the availability and accessibility of these platforms. Uncertainty about future regulation creates challenges for institutional adoption and long-term protocol planning.

Future Outlook for Order Books in DEXs

The trajectory of order books in decentralised exchange development points toward continued growth and innovation. Several emerging trends suggest how this market segment may evolve in the coming years.

1. Convergence of Centralised and Decentralised Models

The distinction between centralised and decentralised exchanges continues to blur as hybrid models emerge. Centralised order book matching with decentralised settlement, non-custodial interfaces to centralised liquidity, and federated systems combining elements of both approaches represent various attempts to capture the benefits of each model while minimising drawbacks.

2. Expansion Beyond Cryptocurrency Assets

Order book-based DEX platforms are beginning to support trading of tokenised real-world assets, including equities, commodities, and forex. This expansion could significantly broaden the addressable market for decentralised order book trading, bringing traditional financial instruments into permissionless, globally accessible trading environments.

3. Integration with Traditional Finance

As regulatory frameworks mature and institutional comfort grows, integration points between order books in DEXs and traditional financial systems may emerge. Connections to fiat on ramps, institutional custody solutions, and regulated financial intermediaries could facilitate broader participation in decentralised order book markets.

4. Advanced Trading Features

Continued development will likely bring increasingly sophisticated trading tools to order-book-based DEX environments. Portfolio margining, cross collateralization, options trading, and structured products represent potential areas of expansion that would further bridge the feature gap with centralised platforms.

5. Improved User Experience

Ongoing efforts to simplify wallet management, reduce transaction friction, and create intuitive interfaces will expand the addressable market for order books in decentralised exchange platforms. Account abstraction, social recovery, and embedded wallet solutions represent promising approaches to lowering barriers for mainstream users.

Build Your Order Book DEX with Expert Blockchain Development

Whether you need a complete decentralised exchange platform, smart contract development for order book trading, Layer 2 integration, or perpetual derivatives infrastructure, our experienced development team delivers professional implementations tailored to your requirements. We combine deep expertise in blockchain architecture with proven DeFi development practices to build trading platforms you can trust.

Conclusion

Order books in DEXs have evolved from experimental concepts to essential infrastructure within the decentralised finance ecosystem. The trading volumes achieved throughout 2024, with perpetual DEX volume reaching $1.5 trillion and platforms like dYdX processing over $270 billion, demonstrate that this model has found product market fit among traders seeking professional-grade tools without custodial risk.

The advantages of order book-based DEX platforms extend beyond technical capabilities. True price discovery, precise trade execution, capital-efficient liquidity provision, and the security of self-custody combine to create compelling value propositions for both retail and institutional participants. As centralised exchange failures and security breaches continue to erode trust in custodial platforms, the importance of non-custodial alternatives becomes increasingly apparent.

Technical evolution has made order books in decentralised exchange environments practical where they once seemed impractical. Layer 2 solutions, high-performance blockchains, and application-specific chains now provide the infrastructure necessary for order book trading that approaches centralised exchange performance. This technological foundation supports continued growth and innovation in the space.

Challenges remain, including liquidity fragmentation, front-running risks, and user experience complexity. However, active development across the ecosystem continues to address these limitations. The convergence of improving technology, growing institutional interest, and increasing awareness of custodial risks positions order books in DEXs for continued expansion in the years ahead.

For traders, developers, and anyone following the evolution of financial markets, understanding order-book-based DEX infrastructure has become essential. This trading model represents not merely an alternative to existing systems but potentially a transformation in how markets function, combining the efficiency and precision of traditional order books with the transparency, accessibility, and security of blockchain technology.

Frequently Asked Questions

An order book in a decentralised exchange is a real-time electronic list of all buy and sell orders for a particular trading pair, maintained on blockchain infrastructure through smart contracts. Unlike centralised exchanges, where a company manages the order matching, DEX order books operate without intermediaries. Buyers submit bids specifying the price and quantity they want to purchase, while sellers post asks with their selling price and available quantity. When matching orders meet, the smart contract executes the trade automatically, updating the order book to reflect completed transactions. This system enables true price discovery based on actual supply and demand from market participants.

Order book DEXs and AMM DEXs represent fundamentally different approaches to decentralized trading. Order book-based DEX platforms match discrete buy and sell orders at specific prices, allowing traders to set exact prices through limit orders and providing price discovery through actual market participant behavior. AMM DEXs instead use liquidity pools and mathematical formulas to determine prices algorithmically, with traders swapping against the pool rather than other traders. Order books offer advantages in capital efficiency, precise execution, and professional trading features, while AMMs provide simpler user experiences and guaranteed liquidity for any trade size within pool constraints.

Order books in DEXs operate under a non-custodial model where users maintain control of their private keys and assets until trade execution. This eliminates the custodial risk inherent to centralized exchanges, where users must deposit funds into platform-controlled wallets. The $11 billion lost to centralized exchange hacks over the past decade, including incidents like the FTX collapse and the $300 million DMM Bitcoin breach in 2024, highlight the dangers of custodial trading. Decentralized exchange order book platforms remove single points of failure and eliminate the possibility of exchange insolvency, mismanagement, or internal fraud affecting user funds.

Order book-based DEX platforms support sophisticated trading features familiar to professional traders. These include limit orders allowing exact price specification, stop loss orders for risk management, take profit orders for automated profit realization, and various time in force options controlling how long orders remain active. Advanced platforms offer cross-margining, portfolio margining, and leverage for derivatives trading. The ability to view market depth, analyze order flow, and execute conditional strategies makes order book DEXs suitable for complex trading approaches that AMM platforms cannot accommodate.

Multiple blockchain networks now support effective order book DEX development. High-throughput Layer 1 networks like Solana enable fully on-chain order books with sub-second execution and minimal fees. Ethereum Layer 2 solutions, including Arbitrum, Optimism, and zkSync, provide scalability while inheriting Ethereum security. Application-specific chains like the dYdX Chain built on Cosmos offer infrastructure optimised specifically for order book trading. Each approach involves tradeoffs between decentralisation, performance, security, and ecosystem compatibility, allowing developers to choose infrastructure matching their specific requirements.

The future of order books in DEXs appears promising based on current growth trajectories and development activity. Trading volumes continue expanding, with perpetual DEX volume reaching $1.5 trillion in 2024 and monthly records exceeding $344 billion. Technological improvements in blockchain infrastructure enable increasingly sophisticated trading experiences. Institutional adoption is growing as professional traders seek decentralized alternatives. Future developments may include expansion to tokenized real-world assets, improved cross-chain functionality, advanced derivative products, and simplified user experiences that broaden accessibility beyond current cryptocurrency native users.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.