Key Takeaways

- DeFi insurance provides decentralised coverage against smart contract failures, oracle manipulations, and liquidity crises without relying on traditional intermediaries.

- DAOs in the DeFi Space play a critical role in governance, claims processing, and risk assessment decisions within insurance protocols.

- Smart contract vulnerabilities remain the leading cause of covered losses in DeFi insurance, accounting for over 60% of all claims filed.

- Unlike traditional insurance, DeFi coverage operates through decentralised risk pools where participants share both premiums and potential losses collectively.

- Security audits from reputable firms can reduce insurance premiums by 15% to 40%, depending on the protocol and coverage type.

- Oracle manipulation attacks have caused over $400 million in losses across DeFi protocols, making oracle security a primary concern for insurers.

- Regulatory uncertainty presents both risks and opportunities for DeFi insurance as governments worldwide begin examining decentralised financial products.

- Risk modelling in DeFi insurance combines traditional actuarial methods with on-chain analytics and real-time protocol monitoring.

- Counterparty risk in DeFi insurance differs fundamentally from traditional models because coverage depends on the solvency of decentralised risk pools rather than corporate balance sheets.

- The future of DeFi insurance lies in parametric models that automatically trigger payouts based on verifiable on-chain events without manual claims processing.

Introduction to DeFi Insurance and Its Growing Importance

The explosive growth of decentralised finance has created unprecedented opportunities for investors, developers, and everyday users seeking alternatives to traditional banking systems. However, this innovation comes with significant risks that traditional insurance companies are neither willing nor equipped to address. This gap has given rise to DeFi insurance, a revolutionary approach to risk management that operates entirely on blockchain networks without centralised intermediaries.

DeFi insurance represents a paradigm shift in how we think about financial protection. Instead of paying premiums to large corporations that profit from denying claims, participants in DeFi insurance protocols contribute to shared risk pools governed by transparent smart contracts and community voting mechanisms. The total value locked in DeFi insurance protocols has grown from approximately $50 million in early 2020 to over $2 billion today, reflecting the increasing recognition that robust risk management infrastructure is essential for mainstream DeFi adoption.

The importance of DeFi insurance cannot be overstated when considering the scale of losses in the ecosystem. According to industry reports, DeFi protocols have suffered more than $6 billion in losses due to hacks, exploits, and technical failures since 2020. Without adequate insurance coverage, these losses fall entirely on users who may have invested significant portions of their savings. DeFi insurance provides a safety net that can mean the difference between a temporary setback and financial devastation.

Understanding Risk in Decentralised Finance Ecosystems

Risk in decentralised finance operates fundamentally differently from traditional financial systems. While conventional banking risks are well understood and heavily regulated, DeFi introduces novel risk categories that require entirely new frameworks for assessment and mitigation. Understanding these risks is the first step toward building effective insurance solutions that actually protect users.

The interconnected nature of DeFi protocols creates systemic risks that can cascade across the entire ecosystem. When one protocol fails, it can trigger liquidations and losses in dozens of connected platforms within minutes. This composability, often celebrated as DeFi’s greatest strength, also represents its most significant vulnerability. A single smart contract bug in a widely used protocol can expose billions of dollars across hundreds of applications.

DAOs in the DeFi Space have emerged as the primary governance mechanism for managing these complex risks. Through decentralised voting and proposal systems, token holders can participate in decisions about risk parameters, coverage terms, and claims adjudication. This democratisation of risk management represents a fundamental departure from traditional insurance, where corporate executives make decisions behind closed doors.

How DeFi Insurance Differs from Traditional Insurance Models

Traditional insurance operates on a fundamentally asymmetric model where large corporations collect premiums, invest those funds for profit, and employ teams of adjusters whose primary goal is to minimise claim payouts. DeFi insurance inverts this dynamic by creating peer-to-peer risk-sharing pools with aligned incentives and transparent operations.

The claims process exemplifies these differences most clearly. In traditional insurance, filing a claim initiates an adversarial process where the insurance company seeks reasons to deny or reduce payment. In DeFi insurance, claims are often processed automatically through smart contracts that verify on-chain events, or through community governance, where token holders vote based on transparent evidence. This removes the profit motive from claims adjudication and creates genuinely fair outcomes.

Traditional Insurance vs DeFi Insurance: Key Differences

| Parameter | Traditional Insurance | DeFi Insurance |

|---|---|---|

| Governance Model | Centralised corporate structure | DAOs in the DeFi Space with token voting |

| Claims Processing | Manual review by adjusters (30 to 90 days) | Smart contract automation or DAO voting (1 to 30 days) |

| Premium Allocation | Corporate profits and overhead (40% to 60%) | Risk pool and stakers (85% to 95%) |

| Transparency | Limited disclosure requirements | Full on chain transparency |

| Accessibility | Geographic and credit restrictions | Permissionless global access |

| Capital Efficiency | Regulatory reserve requirements | Flexible collateralisation ratios |

| Risk Assessment | Historical data and actuarial tables | On-chain analytics and real-time monitoring |

Common Risk Categories in DeFi Insurance Protocols

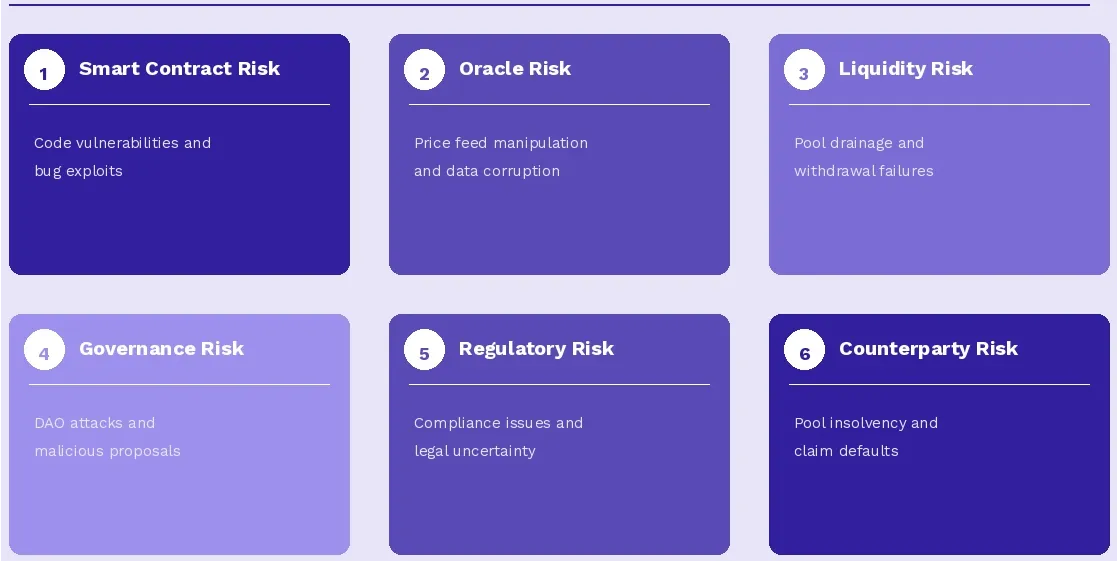

DeFi insurance protocols have developed sophisticated taxonomies for categorising risks that may be covered under various policies. Understanding these categories helps users select appropriate coverage and enables insurers to price policies accurately based on specific risk exposures.

The primary risk categories include technical risks (smart contract bugs, oracle failures), economic risks (liquidity crises, depegging events), and governance risks (malicious proposals, voting attacks). Each category requires different assessment methodologies and triggers different claim processes. Most DeFi insurance policies cover one or more of these categories explicitly while excluding others.

DeFi Insurance Risk Categories and Coverage Parameters

| Risk Category | Description | Typical Coverage | Premium Range |

|---|---|---|---|

| Smart Contract Failure | Bugs or vulnerabilities in protocol code | 80% to 100% of loss | 2% to 8% annually |

| Oracle Manipulation | Price feed attacks or data corruption | 70% to 90% of loss | 3% to 10% annually |

| Stablecoin Depeg | Loss of peg beyond threshold | 50% to 80% of loss | 1% to 5% annually |

| Liquidity Crisis | Inability to withdraw funds | 60% to 85% of loss | 2% to 6% annually |

| Governance Attack | Malicious proposal execution | 50% to 75% of loss | 4% to 12% annually |

Smart Contract Vulnerabilities and Exploit Risks

Smart contract vulnerabilities represent the most significant risk category in DeFi insurance, responsible for the majority of covered losses across the ecosystem. These vulnerabilities arise from coding errors, logic flaws, or unforeseen interactions between different protocol components. Even extensively audited contracts have been exploited, demonstrating that no code can be considered completely secure.

The immutable nature of blockchain technology compounds smart contract risks significantly. Unlike traditional software, where bugs can be patched quickly, smart contract vulnerabilities often cannot be fixed without complex migration procedures or governance votes. Attackers who discover vulnerabilities can exploit them within minutes, draining millions of dollars before developers can respond. This creates an asymmetric threat environment where defenders must be perfect while attackers need only find a single flaw.

Example: The Euler Finance exploit of March 2023 demonstrates smart contract risk in action. An attacker exploited a vulnerability in the protocol’s donation function, combined with a liquidation logic flaw, draining approximately $197 million in a single transaction. Users who had purchased smart contract coverage from DeFi insurance protocols were able to file claims and recover significant portions of their losses, while uninsured users lost everything.

Common vulnerability patterns that DeFi insurance typically covers include reentrancy attacks, where malicious contracts repeatedly call back into the victim protocol, flash loan attacks that manipulate prices or balances within a single transaction, and integer overflow or underflow errors that can create tokens from nothing or destroy existing balances. Understanding these patterns helps users assess whether their protocol exposures are adequately covered.

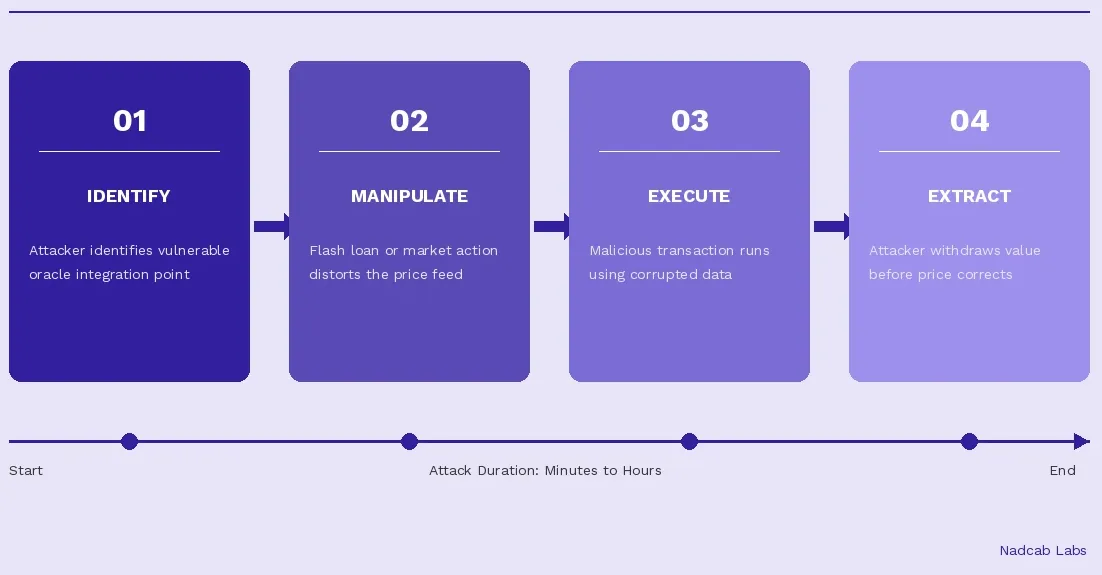

Oracle Manipulation and Data Integrity Threats

Oracles serve as the bridge between blockchain networks and external data, providing price feeds, event outcomes, and other information that smart contracts need to function. This critical role makes oracles attractive targets for attackers who can manipulate data feeds to trigger favourable contract executions or liquidations.

The challenge of Oracle security stems from the fundamental tension between decentralisation and reliability. Highly decentralised oracle networks may be resistant to single points of failure but can be slow to update prices, creating arbitrage opportunities for attackers. Centralised oracles can provide faster updates but introduce trust assumptions that conflict with DeFi’s permissionless ethos.

DAOs in DeFi Space have implemented various strategies to address oracle risks, including time-weighted average prices (TWAP) that smooth out manipulation attempts, multiple oracle sources with outlier detection, and circuit breakers that pause operations when prices move abnormally. Insurance protocols must evaluate these protective measures when pricing coverage for oracle related risks.

Liquidity Risks in DeFi Insurance Pools

Liquidity risk in DeFi insurance operates on two levels: the risk that insured protocols may face liquidity crises, and the risk that insurance pools themselves may lack sufficient liquidity to pay claims. Both dimensions require careful management to ensure that coverage promises can be fulfilled when needed most.

Insurance pool liquidity depends on the balance between premium income, claim payouts, and capital provider incentives. During periods of market stress when claims are most likely, capital providers may simultaneously seek to withdraw their stakes, potentially creating death spirals where withdrawals trigger further withdrawals. Well-designed protocols implement withdrawal delays, diversified risk pools, and incentive mechanisms to maintain stability during crisis periods.

Statement: The sustainability of DeFi insurance depends fundamentally on maintaining adequate liquidity reserves while offering competitive returns to capital providers. Protocols that sacrifice reserve adequacy for higher staking yields may attract capital in bull markets but face existential risks when large claims materialise.

Governance Risks and DAO-Based Decision Making

Governance represents both a strength and a vulnerability of DeFi insurance protocols. DAOs in the DeFi Space enable transparent, democratic decision-making that aligns stakeholder interests, but they also create attack vectors that malicious actors can exploit. Understanding governance risks is essential for both insurers designing robust systems and users evaluating protocol security.

Governance attacks can take multiple forms, including vote buying through bribes or token loans, proposal manipulation that smuggles malicious code into seemingly benign upgrades, and quorum manipulation that passes harmful changes when participation is low. The decentralised nature of DAOs means there is no central authority to reverse malicious governance actions, making prevention far more important than cure.

Effective governance risk mitigation includes time locks that delay proposal execution, allowing community review; multi-signature requirements for critical functions; delegation systems that concentrate voting power with informed participants; and emergency pause mechanisms that can halt operations if attacks are detected. Insurance protocols evaluating governance risks must assess all these protective measures.

DAO Governance Attack Lifecycle

Stage 1

Accumulation: Attacker acquires voting tokens through purchases, borrows, or bribes

Stage 2

Proposal: Malicious proposal submitted during low activity period

Stage 3

Voting: Concentrated votes pass proposal before community responds

Stage 4

Execution: Time lock expires, malicious code executes

Counterparty Risk in Decentralised Coverage Models

Counterparty risk in DeFi insurance differs fundamentally from traditional models because there is no corporate entity with a balance sheet backing coverage promises. Instead, risk is distributed across potentially thousands of capital providers who stake tokens into shared pools. This decentralisation provides resilience against individual counterparty failures but introduces new forms of systemic risk.

The solvency of DeFi insurance pools depends on maintaining appropriate ratios between staked capital and outstanding coverage. When coverage demand exceeds available capital, protocols must either cap new policies, increase premiums to attract more stakers, or accept increased insolvency risk. Monitoring these ratios provides valuable insight into protocol health and claim payment reliability.

Thesis: The future evolution of counterparty risk management in DeFi insurance will likely involve layered capital structures that combine over-collateralised on-chain reserves with off-chain reinsurance arrangements, creating hybrid models that leverage the strengths of both decentralised and traditional risk management approaches.

Reinsurance Challenges in DeFi Insurance Platforms

Reinsurance, the practice of insurers purchasing their own insurance coverage, plays a critical role in traditional insurance markets by spreading catastrophic risks across multiple parties. DeFi insurance faces unique challenges in implementing effective reinsurance mechanisms due to the correlated nature of risks across the ecosystem and the limited number of large capital providers.

The correlation problem is particularly acute in DeFi. Unlike traditional insurance, where house fires in different cities are largely independent events, DeFi risks are highly correlated. A major smart contract vulnerability affecting a widely used protocol could trigger claims across dozens of insurance products simultaneously, potentially exceeding the combined capital of all risk pools. This systemic risk is difficult to reinsure because no external party wants exposure to such correlated catastrophic scenarios.

Emerging solutions include cross-protocol risk-sharing arrangements where multiple DeFi insurance platforms agree to support each other during extreme events, tokenised reinsurance products that allow institutional capital to participate in DeFi risk markets, and algorithmic reserve requirements that automatically adjust based on ecosystem-wide risk indicators.

Regulatory and Compliance Risks in DeFi Insurance

The regulatory landscape for DeFi insurance remains uncertain across most jurisdictions, creating significant compliance risks for protocols, users, and capital providers. Different countries are taking divergent approaches, from outright bans to experimental regulatory sandboxes, leaving participants to navigate a patchwork of potentially conflicting requirements.

Key regulatory questions include whether DeFi insurance products constitute securities requiring registration, whether protocols must obtain insurance licenses in jurisdictions where users reside, and how anti-money laundering requirements apply to pseudonymous participants. The answers to these questions could fundamentally reshape the DeFi insurance landscape, potentially forcing major structural changes to existing protocols.

Proactive compliance strategies include geographic restrictions that block users from high-risk jurisdictions, KYC optional tiers that provide different coverage levels based on verification status, and legal structures that separate decentralised protocol operations from any centralised service providers. These approaches aim to position protocols favourably regardless of how regulatory clarity eventually emerges.

Security Audits and Their Role in Risk Mitigation

Security audits represent a cornerstone of DeFi risk management, providing independent expert review of smart contract code before deployment. Insurance protocols heavily weigh audit status when pricing coverage, with well-audited protocols typically receiving premium discounts of 15% to 40% compared to unaudited alternatives.

However, audits are not guarantees of security. Multiple high-profile exploits have occurred in protocols that underwent extensive auditing, demonstrating the limitations of point-in-time code review. Auditors can only evaluate the code as it exists during review; subsequent upgrades or unexpected interactions with other protocols can introduce new vulnerabilities that audits cannot anticipate.

Best practices for audit-based risk assessment include requiring multiple independent audits from different firms, verifying that deployed code matches audited code, reviewing audit scope to ensure all critical functions were examined, and considering the auditor’s track record in identifying vulnerabilities in similar protocols. DAOs in DeFi Space increasingly mandate these practices for any protocol seeking coverage.

Security Audit Assessment Parameters

| Parameter | High Quality Indicator | Red Flag Indicator |

|---|---|---|

| Number of Audits | 3 or more from reputable firms | Single audit or unknown auditors |

| Audit Scope | Complete codebase including integrations | Partial review or excluded components |

| Finding Resolution | All critical and high findings were addressed | Unresolved critical issues |

| Code Verification | Deployed code matches the audited version | Unverified or modified deployment |

| Ongoing Security | Bug bounty program and continuous monitoring | No ongoing security measures |

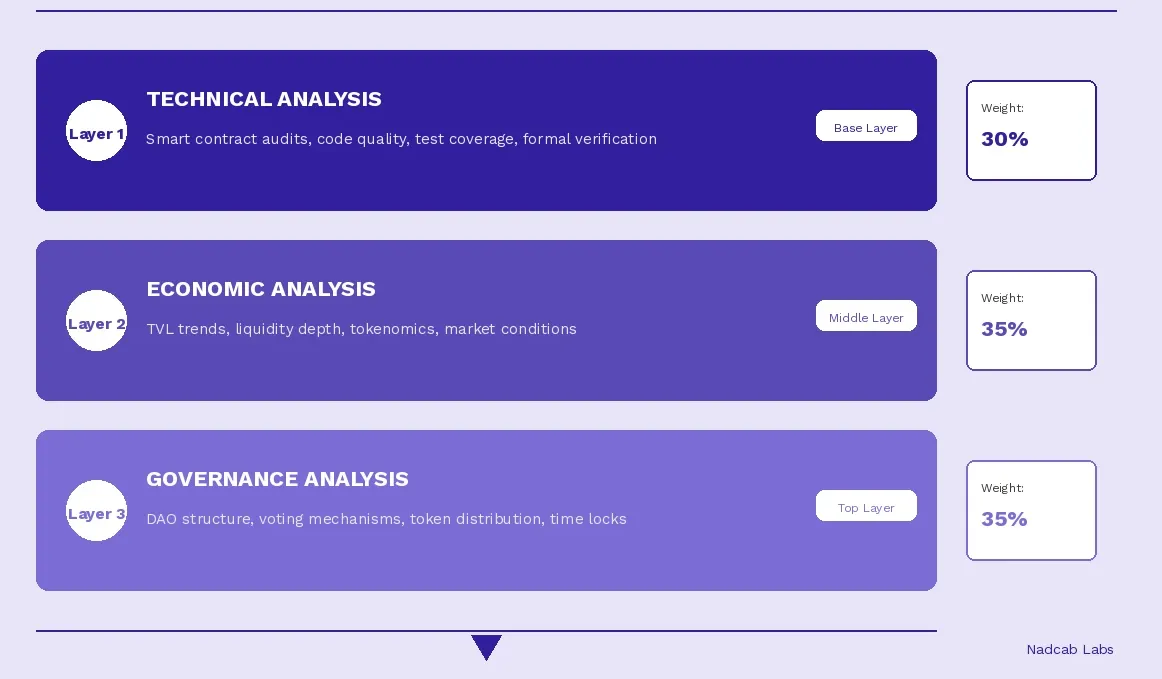

Risk Assessment Frameworks Used by DeFi Insurers

DeFi insurance protocols employ sophisticated risk assessment frameworks that combine traditional actuarial methods with novel on-chain analytics. These frameworks must account for the unique characteristics of decentralised systems, including pseudonymous participants, rapid technological evolution, and limited historical data for emerging risk categories.

Quantitative factors in risk assessment typically include total value locked (TVL) as a proxy for potential loss severity, historical exploit data from similar protocols, smart contract complexity metrics, and time since deployment without incident. Qualitative factors include team reputation and track record, governance centralisation levels, dependency on external protocols, and quality of documentation and community support.

Advanced risk assessment increasingly incorporates machine learning models trained on historical exploit patterns, real-time monitoring of on-chain activity for anomaly detection, and simulation environments that stress test protocols against known attack vectors. These tools enable more accurate pricing and earlier warning of emerging risks.

Claims Processing Risks and Dispute Resolution Mechanisms

Claims processing in DeFi insurance introduces unique risks not present in traditional insurance models. The decentralised nature of claim adjudication means outcomes depend on token holder voting, which can be influenced by factors unrelated to claim validity, including voter apathy, information asymmetry, and potential conflicts of interest among voting stakeholders.

Dispute resolution mechanisms must balance accessibility with protection against frivolous claims. Common approaches include tiered escalation systems where simple claims are processed automatically based on chain evidence, while complex claims require community voting, appeal processes that allow claimants to challenge initial decisions, and staked voting where voters must risk their own tokens to participate in claim adjudication.

Example: When Nexus Mutual processed claims following the Euler Finance exploit, the community voted to approve payouts totalling over $5 million within 14 days of the initial claims. This rapid response demonstrated the potential efficiency of DAO based claims processing when supported by clear on-chain evidence of covered losses.

Cybersecurity Threats Targeting DeFi Insurance Protocols

DeFi insurance protocols face the same cybersecurity threats as other DeFi applications, with the added complexity that successful attacks could compromise both the insurance platform itself and its ability to pay claims on covered protocols. This double exposure makes insurance protocols particularly attractive targets for sophisticated attackers.

Attack vectors specific to insurance protocols include manipulation of claim voting through governance attacks, exploitation of oracle feeds used to determine claim validity, and direct attacks on insurance smart contracts to drain risk pools. The high value locked in insurance pools makes them priority targets for nation-state actors and organised criminal groups with advanced capabilities.

Defensive measures must be comprehensive, including formal verification of critical smart contract logic, defence in depth with multiple security layers, incident response plans that can pause operations and protect remaining funds, and insurance of the insurance protocol itself through external coverage arrangements. These layered protections create resilience against even sophisticated attack campaigns.

Best Practices for Enhancing DeFi Insurance Security

Implementing robust security practices requires coordinated effort from protocol developers, capital providers, and coverage purchasers. Each stakeholder group has specific responsibilities that contribute to overall ecosystem security and insurance reliability.

For protocol developers, best practices include comprehensive security audits before any deployment, formal verification of critical contract functions, extensive testing including fuzzing and simulation, time-locked upgrades with community review periods, and bug bounty programs that incentivise responsible disclosure. These practices reduce the likelihood of vulnerabilities that trigger claims.

For coverage purchasers, best practices include thorough research on policy terms and exclusions, diversification across multiple insurance providers, regular review of coverage adequacy as positions change, participation in governance to ensure protocol health, and maintenance of complete transaction records to support potential claims. These practices maximise the probability of successful claim outcomes.

For capital providers, best practices include assessment of risk pool diversification, understanding of claim triggers and payout mechanisms, monitoring of coverage utilisation ratios, participation in claim adjudication voting, and realistic expectations about yield sustainability. These practices protect staked capital while supporting ecosystem insurance infrastructure.

Role of Risk Modelling and Actuarial Methods in DeFi

Traditional actuarial methods face significant challenges when applied to DeFi insurance due to limited historical data, rapidly evolving risk landscapes, and the difficulty of modelling unprecedented technical failures. However, these methods remain valuable when adapted appropriately and combined with novel approaches unique to blockchain environments.

Effective DeFi risk modelling combines frequency severity analysis from traditional actuarial practice with on chain analytics that provide real time protocol health indicators. Machine learning models trained on historical exploit data can identify patterns that suggest elevated risk, while simulation environments can estimate potential losses from hypothetical attack scenarios. This hybrid approach leverages the strengths of multiple methodologies.

The evolution of risk modelling in DeFi insurance will likely incorporate cross-protocol correlation analysis that accounts for systemic risks, dynamic pricing models that adjust premiums in real time based on changing conditions, and predictive indicators derived from on-chain activity patterns. These advances will enable more accurate pricing and better protection for ecosystem participants.

Future Trends in DeFi Insurance Risk & Security

The future of DeFi insurance will be shaped by technological innovations, regulatory developments, and the maturation of the broader decentralised finance ecosystem. Several emerging trends suggest significant evolution in how risks are assessed, priced, and covered in the years ahead.

Parametric insurance models represent perhaps the most significant innovation on the horizon. These products trigger automatic payouts based on verifiable on-chain events without requiring manual claims processing or governance voting. When an oracle confirms a covered event, such as a stablecoin depeg or liquidity pool drain, smart contracts immediately release funds to affected policyholders. This eliminates claims friction and ensures rapid recovery from covered losses.

Cross-chain insurance solutions will become increasingly important as DeFi expands across multiple blockchain networks. Bridge exploits have caused billions in losses, highlighting the need for coverage that protects assets during cross chain transfers. Insurance protocols are developing products that monitor bridge contracts across multiple networks simultaneously, providing seamless coverage regardless of which chain assets currently reside on.

Institutional participation in DeFi insurance markets will accelerate as regulatory frameworks become clearer and risk assessment methodologies mature. Traditional insurers and reinsurers are exploring tokenised products that allow their capital to participate in DeFi risk pools, potentially bringing significant liquidity and actuarial expertise to the ecosystem. This convergence between traditional and decentralised insurance will create new hybrid models.

DAOs in the DeFi Space will continue evolving their governance mechanisms to improve decision quality and resistance to manipulation. Innovations such as conviction voting that weights participation based on commitment duration, quadratic voting that reduces plutocratic influence, and specialized insurance juries selected for expertise will make governance more robust and legitimate. These improvements strengthen the foundation of decentralised insurance.

Ready to Secure Your DeFi Projects with Expert Solutions?

Partner with industry leaders to implement robust risk management and security protocols for your decentralised finance applications.

Why Choose Nadcab Labs for DeFi Insurance and Security Solutions

Nadcab Labs brings over 8 years of specialised experience in blockchain technology, decentralised finance, and smart contract security to help organisations navigate the complex landscape of DeFi insurance risk and protection. Our deep expertise in DAOs in DeFi Space governance mechanisms, tokenomics design, and protocol security positions us uniquely to deliver comprehensive solutions that address both technical and economic dimensions of DeFi risk management.

Our team has completed more than 200 DeFi projects spanning lending protocols, decentralised exchanges, yield aggregators, and insurance platforms across multiple blockchain networks, including Ethereum, Binance Smart Chain, Polygon, and Arbitrum. This extensive hands-on experience provides invaluable insight into the real-world vulnerabilities, governance challenges, and security requirements that DeFi insurance must address. We understand not just the theory of DeFi risk but its practical manifestations in production environments.

Nadcab Labs offers end to end services including smart contract security auditing that identifies vulnerabilities before they can be exploited, custom insurance protocol architecture that balances capital efficiency with solvency requirements, governance mechanism design that resists manipulation while enabling efficient decision making, and risk assessment framework development that combines traditional actuarial methods with cutting edge on chain analytics. Our authoritative approach ensures that every solution we deliver meets the highest standards of security and reliability.

Whether you are building a new DeFi insurance protocol, seeking to enhance security for an existing platform, or looking for expert guidance on risk management strategy, Nadcab Labs provides the technical excellence and industry authority you need to succeed. Our proven track record, combined with continuous research into emerging threats and best practices, makes us the trusted partner for organisations serious about DeFi security and protection. Contact us today to discuss how we can help secure your decentralised finance initiatives with confidence.

Frequently Asked Questions

Most DeFi insurance protocols do not cover intentional fraud or rug pulls by project founders. Coverage typically focuses on technical failures like smart contract bugs, oracle malfunctions, or liquidity crises rather than malicious acts by development teams.

Claim processing times vary significantly across protocols. DAOs in DeFi space-based governance can take 7 to 30 days for voting and verification, while some automated parametric insurance models can process claims within hours if predefined conditions are met.

Unlike traditional insurance, where premiums are generally non-refundable, many DeFi insurance platforms allow unused premiums to be withdrawn after the coverage period ends. Some protocols also offer yield generation on staked premiums.

Currently, most DeFi insurance operates outside traditional regulatory frameworks. This creates both flexibility and uncertainty. Some jurisdictions are beginning to classify certain DeFi insurance products as securities or financial instruments requiring compliance.

Yes, several DeFi insurance platforms now offer portfolio coverage or basket policies that protect multiple positions simultaneously. However, premium costs and coverage limits may vary based on the risk profile of each underlying protocol.

Mutual coverage pools risk among participants who share losses collectively, while underwritten models involve specific capital providers (underwriters) who assume risk in exchange for premium payments. Underwritten models often provide higher coverage limits but may have stricter claim requirements.

Premiums are calculated using factors including protocol TVL (Total Value Locked), historical exploit data, audit status, code complexity, and current market conditions. Some platforms use algorithmic pricing that adjusts in real time based on risk indicators.

Yes, many DeFi insurance platforms allow users to stake tokens in risk pools as underwriters. In return, stakers earn a portion of premium payments but also bear the risk of their staked capital being used to pay valid claims.

Typical requirements include transaction hashes proving the loss occurred, wallet addresses involved, timestamps of relevant events, and evidence linking the loss to a covered risk category. On-chain data verification is often used to automate parts of this process.

Yes, specialized coverage for NFTs is emerging, protecting against smart contract vulnerabilities in NFT marketplaces, metadata storage failures, and bridge exploits affecting cross-chain NFT transfers. However, coverage for subjective value loss or market depreciation is generally excluded.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.