Key Takeaways

- DeFi insurance helps protect users from common risks like smart contract bugs, platform failures, governance issues, and stablecoins losing their value.

- Unlike traditional insurance, DeFi insurance works using smart contracts and decentralized funds instead of centralized companies.

- Claims and payouts are handled automatically on the blockchain, which reduces delays and removes middlemen.

- By reducing financial risk, DeFi insurance builds user trust and encourages more people and institutions to use DeFi platforms.

- DeFi insurance does not replace security audits but acts as a safety net when unexpected problems occur.

- As DeFi continues to grow, insurance is becoming an important layer for safer and more secure participation.

Decentralized Finance (DeFi) has changed how digital finance works by removing banks and intermediaries from financial systems. Through smart contracts and blockchain technology, users can lend, borrow, trade, and earn yields directly on decentralized platforms. This open model has driven massive growth, with billions of dollars now locked across DeFi protocols worldwide. However, this rapid expansion has also exposed serious security and operational risks.

Over the years, multiple DeFi platforms, many of them audited, have suffered losses due to smart contract vulnerabilities, protocol exploits, oracle manipulation, and governance attacks. In most cases, users had no protection and no way to recover lost funds. These incidents highlight a critical gap in decentralized finance. While DeFi removes intermediaries, it also removes traditional safety nets. This is where DeFi insurance becomes essential.

DeFi insurance introduces a decentralized risk-protection layer designed specifically for blockchain-based platforms. Instead of relying on centralized insurers, decentralized finance insurance uses smart contracts, liquidity pools, and community-driven claim mechanisms to provide coverage against defined risks. This approach improves transparency, reduces claim delays, and aligns incentives between users, platforms, and liquidity providers.

For DeFi platforms aiming to scale securely, insurance plays a strategic role. It builds user trust, protects locked assets, and strengthens platform credibility, especially for institutional and long-term users. Platforms with insurance integration are seen as more reliable and future-ready in an increasingly competitive Web3 environment.

As DeFi adoption continues to grow, risk management will define which platforms succeed and which fail. In this guide, we explore why DeFi insurance is essential for building secure and scalable DeFi platforms, how it works, the risks it covers, and its role in shaping the future of decentralized finance.

What Is DeFi Insurance?

DeFi insurance is a way to protect users from losses while using decentralized finance platforms. In decentralized finance, people use smart contracts instead of banks. While this gives more freedom and transparency, it also comes with risks. If a smart contract breaks, gets hacked, or a protocol fails, users can lose their funds. DeFi insurance helps reduce this risk.

Unlike traditional insurance, DeFi insurance is fully decentralized and runs on blockchain technology. There are no insurance companies or middlemen involved. Instead of corporate money, coverage comes from on-chain liquidity pools, where users deposit funds to support insurance claims. Everything is visible on the blockchain, which improves trust and transparency.

Decentralized finance insurance also works automatically through smart contracts. Policies, claims, and payouts are handled without manual approval, making the process faster and fairer. Many platforms use decentralized governance, where the community helps decide how claims are approved.

In simple terms, decentralized finance insurance lets users safely participate in decentralized finance. It gives confidence to invest, lend, or stake assets, knowing there is a protection layer if something goes wrong. For DeFi platforms, insurance builds trust and supports secure, long-term growth.

How DeFi Insurance Works

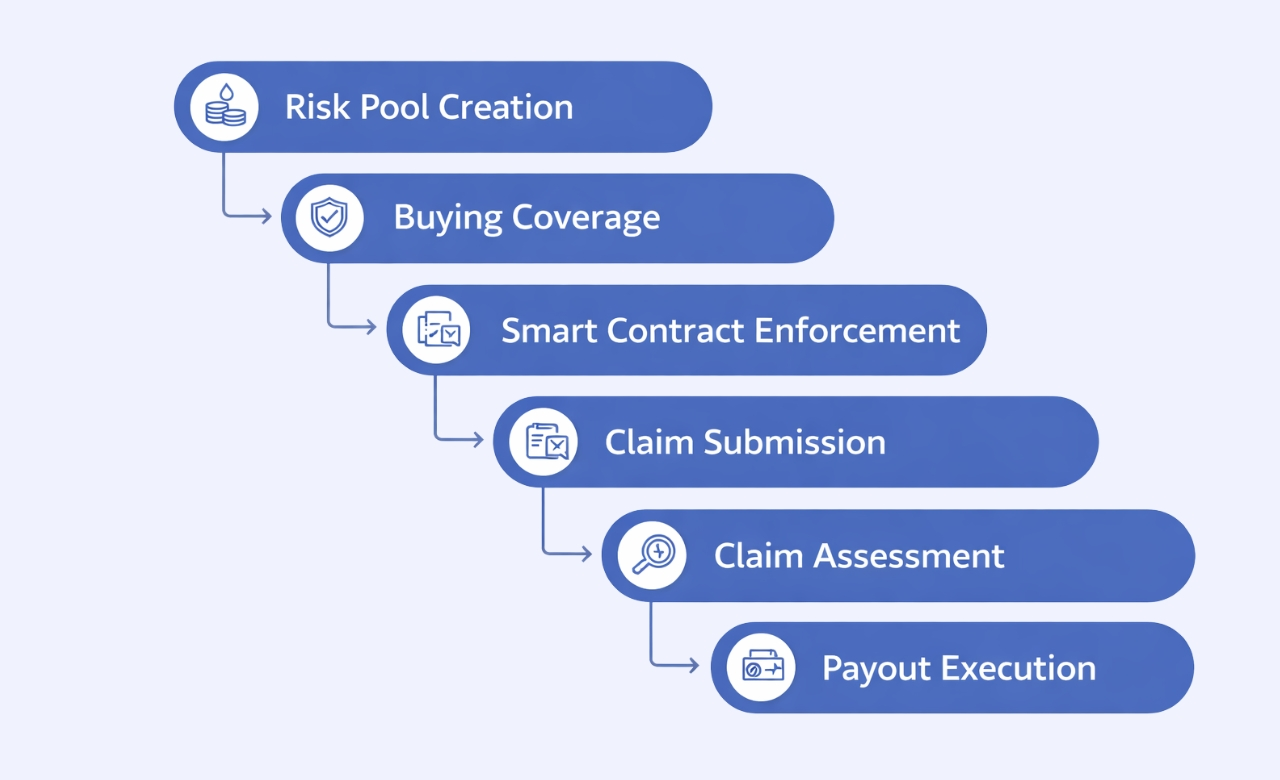

Even though different decentralized finance insurance platforms use different models, the basic working process remains mostly the same. Everything is handled on the blockchain, which makes the system transparent, automated, and trustless.

1. Risk Pool Creation

DeFi insurance starts with risk pools. Liquidity providers deposit their funds into these pools. This pooled capital is used to pay users if a covered loss happens. In return, liquidity providers earn rewards for supporting the insurance system.

2. Buying Coverage

Users buy insurance by paying a premium. The premium amount depends on a few simple factors, such as:

- The risk level of the DeFi protocol

- The coverage amount chosen

- The duration of the insurance

Once the premium is paid, the coverage becomes active for the selected period.

3. Smart Contract Enforcement

Smart contracts control the entire insurance process. They clearly define coverage rules, claim conditions, and payout logic. Once deployed, these contracts work automatically and cannot be changed, ensuring fairness and transparency.

4. Claim Submission

If a covered event occurs, such as a hack or smart contract failure, the user can submit a claim within a fixed timeframe. The claim process is done on-chain and follows predefined rules.

5. Claim Assessment

Claims are reviewed using decentralized methods, including:

- Community voting

- DAO-based governance

- Oracle-based data verification

- Hybrid on-chain and off-chain models

This removes the need for centralized claim adjusters.

6. Payout Execution

When a claim is approved, the payout is automatically sent to the user’s wallet. There are no manual delays or intermediaries involved.

This transparent and automated process is what makes DeFi insurance more efficient and trustless compared to traditional insurance systems.

Types of Coverage in DeFi Insurance

DeFi insurance platforms provide different types of coverage to protect users from various risks in decentralized finance. Here are the most common types:

1. Smart Contract Insurance

This type of insurance covers losses caused by bugs, vulnerabilities, or exploits in smart contracts. If a contract fails or gets hacked, users can claim compensation from the insurance pool.

2. Protocol Failure Coverage

Some DeFi platforms may face critical failures or governance attacks. Protocol failure coverage protects users if a DeFi protocol collapses or experiences major operational issues.

3. Stablecoin De-Peg Insurance

Stablecoins are meant to maintain a fixed value, usually pegged to fiat currency. This coverage protects users in case a stablecoin loses its peg, helping reduce unexpected losses.

4. Custodial Risk Coverage

Although DeFi focuses on decentralization, some users still use centralized exchanges or custodial wallets. Custodial risk coverage protects funds against theft, hacks, or mismanagement in these systems.

5. Yield Farming Insurance

Yield farming can be highly profitable but comes with risks like impermanent loss or protocol-specific failures. Yield farming insurance helps protect investors while they stake or provide liquidity to different protocols.

DeFi insurance allows users to choose coverage based on their risk level and investment type, making participation in decentralized finance safer and more confident.

Key Benefits of DeFi Insurance

DeFi insurance offers several advantages that make decentralized finance safer and more reliable for users and platforms alike.

1. Transparency

All policies, claims, and payouts are recorded on the blockchain. This means anyone can verify transactions, creating a clear and trustworthy system.

2. Automation

Smart contracts handle policies and claims automatically. This eliminates manual processing, reduces delays, and ensures payouts are executed quickly and fairly.

3. No Intermediaries

Users interact directly with insurance protocols, without relying on third parties. This lowers costs, improves efficiency, and removes potential points of failure.

4. Global Accessibility

Anyone with a crypto wallet can purchase coverage, no matter where they are in the world. DeFi insurance removes traditional geographical and regulatory barriers.

5. Community Governance

Many DeFi insurance platforms allow token holders to participate in decision-making. The community helps approve claims and guide protocol rules, ensuring fairness and decentralization.

By combining transparency, automation, and community control, DeFi insurance not only protects users but also strengthens trust in decentralized finance, making it a key tool for secure and scalable platforms.

Popular DeFi Insurance Platforms

Several platforms have emerged as leaders in DeFi insurance, each offering unique coverage models and governance systems.

1. Nexus Mutual

Nexus Mutual provides community-driven smart contract coverage. Users can buy protection for various DeFi protocols, and claims are reviewed through a decentralized process involving the community.

2. InsurAce

InsurAce offers multi-chain insurance products, allowing users to cover assets across different blockchains. It focuses on providing flexible and affordable coverage for diverse DeFi risks.

3. Bridge Mutual

Bridge Mutual is a decentralized coverage marketplace where users can both buy and provide insurance. Its platform emphasizes transparency and community participation in decision-making.

4. Unslashed Finance

Unslashed Finance focuses on capital-efficient insurance pools, optimizing fund usage to provide better coverage while rewarding liquidity providers.

5. Solace

Solace offers portfolio-level DeFi protection, allowing users to secure multiple assets under one policy. It is designed for both individual users and institutions looking for comprehensive coverage.

Each of these platforms uses innovative risk models and governance mechanisms to protect users while maintaining decentralization. Choosing the right platform depends on the type of coverage, assets, and level of risk you want to manage.

A 2024 industry survey lists top DeFi insurance providers, noting that Nexus Mutual maintains a high claim success rate with capital backing over $1.2 billion[1], while Unslashed Finance has processed coverage backed by approximately $560 million and boasts strong claim performance. Bridge Mutual, with $320 million in capital, focuses on cross-chain exploit coverage with rapid processing times and competitive premiums.

DeFi Insurance vs Traditional Insurance

DeFi insurance works very differently from traditional insurance. While both aim to protect users, their approach, control, and accessibility are not the same.

| Aspect | DeFi Insurance | Traditional Insurance |

|---|---|---|

| Control | Decentralized | Centralized |

| Transparency | On-chain and publicly verifiable | Limited and often opaque |

| Claims Process | Automated through smart contracts | Manual and time-consuming |

| Accessibility | Anyone with a crypto wallet can participate | Restricted by region and regulations |

| Trust Model | Code-based and community-driven | Institution-based trust |

The main difference lies in trust and automation. Traditional insurance relies on companies to verify claims and manage funds. DeFi insurance replaces institutional trust with transparent smart contracts, on-chain governance, and community oversight. This reduces delays, eliminates middlemen, and allows users to have more control over their coverage.

In simple terms, DeFi insurance is faster, more transparent, and globally accessible, while traditional insurance relies on central authorities and manual processes. For anyone using decentralized finance, this makes decentralized finance insurance a more suitable solution for managing risk.

Real-World Use Cases of DeFi Insurance

DeFi insurance is not just a concept. It is actively protecting users, projects, and institutions in the decentralized finance ecosystem. Here are some key ways it is being used today:

1. Protecting DeFi Investments

Users can ensure assets are locked in lending, staking, or liquidity protocols. This coverage helps reduce the risk of losing funds due to smart contract failures, hacks, or protocol errors.

2. DAO Treasury Protection

Decentralized Autonomous Organizations (DAOs) often hold significant funds in their treasuries. DeFi insurance allows DAOs to hedge against protocol-level risks, ensuring the community’s assets are safer.

3. Institutional Risk Management

Institutions entering DeFi use insurance to mitigate investment risks. By securing coverage, they can confidently participate in lending, yield farming, and other decentralized activities without worrying about unexpected losses.

4. Boosting Protocol Credibility

Many DeFi projects integrate insurance directly into their platforms. Offering built-in coverage increases user trust, attracts more liquidity, and positions the project as reliable and secure.

In short, DeFi insurance helps investors, DAOs, institutions, and protocols manage risk, build confidence, and participate safely in decentralized finance. It is becoming an essential layer for growth and adoption in the Web3 ecosystem.

Challenges and Limitations of DeFi Insurance

While DeFi insurance offers many benefits, it also comes with certain challenges that users and platforms should be aware of.

1. Limited Coverage Scope

Not every risk in DeFi can be insured. Policies may have restrictions or exclusions, meaning some losses may not be covered.

2. Capital Constraints

Insurance pools rely on community funds. In the event of a large-scale hack or exploit, the available liquidity may not be enough to fully compensate affected users.

3. Claim Disputes

Many DeFi insurance platforms use decentralized voting or community governance to approve claims. While transparent, this process can sometimes introduce delays or disagreements, affecting timely payouts.

4. Regulatory Uncertainty

DeFi insurance exists in a largely unregulated space. Legal frameworks are still evolving, which can create risks for both users and platforms in different jurisdictions.

5. User Complexity

Understanding coverage terms, premiums, and smart contract rules can be confusing for new users. This complexity may discourage some people from participating in DeFi insurance.

Despite these challenges, DeFi insurance continues to evolve. Platforms are constantly improving coverage models, capital efficiency, and user experience, making it an increasingly reliable tool for managing risks in decentralized finance.

How to Use DeFi Insurance to Protect Your Investments

Buying DeFi insurance is easier than it might sound, and the process is fully non-custodial, meaning you always remain in control of your funds. By following a few simple steps, you can protect your assets and participate in decentralized finance platforms with confidence.

1. Choose a DeFi Insurance Platform

The first step is to select a reliable DeFi insurance platform. Popular platforms like Nexus Mutual, InsurAce, or Bridge Mutual offer coverage for a wide range of DeFi protocols. When choosing a platform, consider factors like coverage options, governance model, and past performance to ensure it meets your needs.

2. Connect Your Crypto Wallet

Once you have selected a platform, connect your crypto wallet such as MetaMask, Trust Wallet, or WalletConnect. This connection allows you to interact securely with the insurance platform without giving up custody of your funds.

3. Select the Protocol You Want to Insure

Next, choose the DeFi protocol where your assets are currently locked. This could be a lending protocol, staking platform, liquidity pool, or yield farming project. Selecting the right protocol ensures your coverage applies specifically to the risk associated with that platform.

4. Choose Coverage Amount and Duration

Decide how much of your investment you want to protect and for how long. Coverage amounts and duration determine your premium, so it’s important to balance protection with cost. Some platforms allow flexible options to cover partial or full investments.

5. Pay the Premium

Pay the insurance premium directly from your wallet. Once the payment is confirmed on-chain, your policy becomes active immediately. You are now protected in case of protocol failures, hacks, or other covered events.

6. Monitor Policy Status

It’s important to keep track of your policy. Most platforms provide dashboards where you can check coverage status, expiration dates, and any ongoing claims. Staying informed ensures your protection remains valid at all times.

7. File Claims if Needed

If a covered event occurs, submit a claim through the platform. Many platforms use automated smart contracts or community governance to verify and approve claims. Once approved, payouts are automatically sent to your wallet, without delays or intermediaries.

By following these steps, anyone can secure their DeFi investments while participating in a fully decentralized, transparent, and automated insurance system. DeFi insurance empowers users to take part in blockchain finance confidently, knowing their assets are protected against common risks.

The Role of Smart Contracts in DeFi Insurance

Smart contracts are the backbone of DeFi insurance, automating every step from policy issuance and premium calculation to claims verification and payout execution. By removing intermediaries, they make the process transparent, fast, and trustless, ensuring users can rely on the system without delays or bias.

Because smart contracts handle funds and enforce coverage rules, they must be well-audited and optimized. Properly designed contracts reduce vulnerabilities, prevent additional risks, and form the foundation for secure and reliable decentralized insurance.

Protect Your Crypto Assets Today!

Safeguard your funds from smart contract exploits, protocol failures, and stablecoin risks with a trusted DeFi insurance platform.

DeFi Insurance and Security Audits

DeFi insurance does not replace security audits. It complements them. While audits help reduce the probability of smart contract failures or vulnerabilities, insurance mitigates the financial impact if something goes wrong.

Mature DeFi protocols often use a layered security approach, combining multiple audits, bug bounty programs, and active insurance coverage. This combination not only strengthens platform safety but also boosts user confidence, making it an emerging industry standard in decentralized finance.

How Nadcab Labs Supports DeFi Insurance Development

Building a secure and scalable DeFi insurance platform requires deep blockchain expertise, strong security practices, and future-ready architecture. Nadcab Labs helps businesses launch reliable and trustworthy insurance platforms by designing complete DeFi solutions, developing and auditing smart contracts for automated and transparent execution, and creating efficient risk pool architectures to optimize capital use.

Our team also implements DAO governance systems to enable community-driven decision-making, while integrating oracles and analytics for real-time insights and effective risk management. With a strong focus on security, scalability, and compliance, Nadcab Labs empowers businesses to protect user assets, gain trust, and grow confidently in the decentralized finance ecosystem, offering a solid foundation for long-term success.

Frequently Asked Questions

Yes, DeFi insurance is essential for anyone using decentralized finance platforms. It protects your crypto assets from smart contract failures, protocol exploits, or stablecoin de-pegs, providing a safety net while participating in DeFi.

Yes, institutional investors use DeFi insurance to safeguard treasury funds, hedge large investments, and participate confidently in DeFi protocols. Some platforms even offer portfolio-level protection for institutions.

Premiums vary depending on the risk level of the protocol, the coverage amount, and the duration of protection. Higher-risk platforms or larger coverage amounts generally require higher premiums.

DeFi insurance typically covers smart contract bugs, protocol failures, stablecoin de-pegs, custodial risks, and yield farming losses. Coverage depends on the policy terms, so reviewing the details is crucial before purchasing.

Claims are verified using smart contracts, community voting, DAO governance, or oracle-based systems. This ensures a trustless, automated, and transparent approval process without relying on centralized insurers.

No, DeFi insurance cannot prevent losses; it only mitigates their financial impact. It works best alongside smart contract audits, bug bounty programs, and robust risk management strategies to reduce the likelihood and severity of losses.

Most platforms support major cryptocurrencies and tokens used in lending, staking, or liquidity pools. However, coverage may vary by protocol and asset type, so always check eligibility before purchasing.

No advanced technical skills are required. Platforms provide step-by-step guidance for selecting coverage, connecting wallets, and filing claims. Basic knowledge of DeFi concepts helps but isn’t mandatory.

While DeFi insurance mitigates many risks, it may not cover all losses. Large-scale hacks or unforeseen events could exceed pool liquidity. Policies often have limits and exclusions that users must understand.

DeFi insurance is decentralized, automated, and transparent, using smart contracts and liquidity pools. Unlike traditional insurance, there are no intermediaries, making claims faster, globally accessible, and fully trustless.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.