Key Takeaways

- Gas optimization is essential for DeFi platforms as it directly impacts transaction costs, user experience, scalability, and long-term adoption.

- High gas fees are one of the main reasons users abandon DeFi platforms, especially during periods of network congestion.

- Efficient smart contract design, reduced on-chain computation, and optimized data storage form the foundation of gas-efficient DeFi protocols.

- Layer-2 scaling solutions such as rollups and sidechains play a key role in lowering transaction fees and improving performance.

- Batch transactions help users complete multiple actions in a single transaction, significantly reducing overall gas usage.

- Optimized gas usage encourages healthier liquidity by allowing users to add, remove, and rebalance positions without excessive fees.

- Gas optimization should never compromise security, as smart contracts often manage funds and critical protocol operations.

- Regular testing, audits, and performance monitoring are necessary to maintain both gas efficiency and protocol safety.

- Gas-optimized architectures make DeFi platforms easier to upgrade, maintain, and scale as user adoption grows.

- Platforms that prioritize gas efficiency demonstrate strong technical expertise and build long-term trust within the DeFi ecosystem.

Decentralized Finance (DeFi) is changing how people access financial services. It allows users to trade, lend, borrow, stake, and earn rewards directly through blockchain based digital contracts, without relying on banks or intermediaries. Everything operates in an open and transparent environment, giving users greater control over their assets and financial decisions.

However, despite these advantages, DeFi still faces a major challenge: high gas fees. When blockchain networks become congested, transaction costs can rise quickly. For many users, even simple actions like swapping tokens or claiming rewards can feel expensive and frustrating.

This is where gas optimization and efficiency in DeFi become essential. Based on real experience working with decentralized finance platforms, efficient gas usage is not just about reducing costs. It plays a critical role in improving user experience, scaling platforms smoothly, and ensuring long term success in an increasingly competitive DeFi ecosystem.

What Is Gas Optimization in DeFi?

Gas optimization in DeFi refers to reducing the amount of gas required to execute transactions and digital contracts on a blockchain. Gas is the computational fee paid to validators for processing and confirming transactions, especially on networks like Ethereum where DeFi activity is high, and block space is limited.

In real DeFi platforms, gas is consumed whenever users interact with a protocol, including:

- Swapping tokens

- Adding or removing liquidity

- Staking assets

- Claiming rewards

- Participating in governance voting

From hands-on experience optimizing DeFi platforms, even small inefficiencies—such as unnecessary storage writes or repeated function calls, can significantly increase gas costs. These issues become even more noticeable during peak network congestion.

Gas optimization focuses on designing digital contracts and transaction flows that reduce unnecessary computation and on-chain storage while maintaining security and reliability. Experienced DeFi teams follow best practices and select suitable blockchain or Layer-2 infrastructure to ensure transactions remain efficient, affordable, and smooth for users.

Why Are Gas Fees Important in DeFi?

Gas fees are a core part of DeFi because every interaction with a protocol requires blockchain computation. If gas costs become too high, users may hesitate to interact with the platform or stop using it altogether.

Gas fees directly impact:

- Overall user experience

- Transaction success rates

- Feasibility of small value transactions

- Liquidity participation

- Protocol adoption

In many DeFi use cases, especially for retail users, gas fees can sometimes exceed the value of the transaction itself. This creates friction and limits accessibility. DeFi consulting services help projects address this challenge by optimizing digital contract logic, recommending Layer-2 solutions, and improving transaction workflows to reduce unnecessary costs.

On Ethereum and similar networks, gas represents the computational cost required to process transactions and execute digital contracts. According to Ethereum’s[1] official developer documentation, gas fees are designed to fairly allocate limited block space and network resources during periods of high demand.

Common Causes of High Gas Fees in DeFi

Understanding why gas fees increase is essential before attempting optimization. In DeFi, high gas costs are often caused by a combination of network limitations and inefficient design choices.

1. Network Congestion

When many users interact with the blockchain simultaneously, competition for limited block space increases. As a result, users pay higher gas fees to get their transactions processed faster.

2. Inefficient Digital Contract Logic

Poorly optimized digital contracts consume more gas. Unnecessary loops, redundant calls, and frequent state updates all increase computational costs.

3. Excessive On Chain Storage

Writing data to blockchain storage is expensive. Platforms that rely heavily on on-chain storage without optimization often experience higher transaction fees.

4. Complex Multi Step Transactions

Advanced DeFi actions such as flash loans, arbitrage strategies, or multi-hop swaps involve multiple interactions in a single transaction, naturally increasing gas usage.

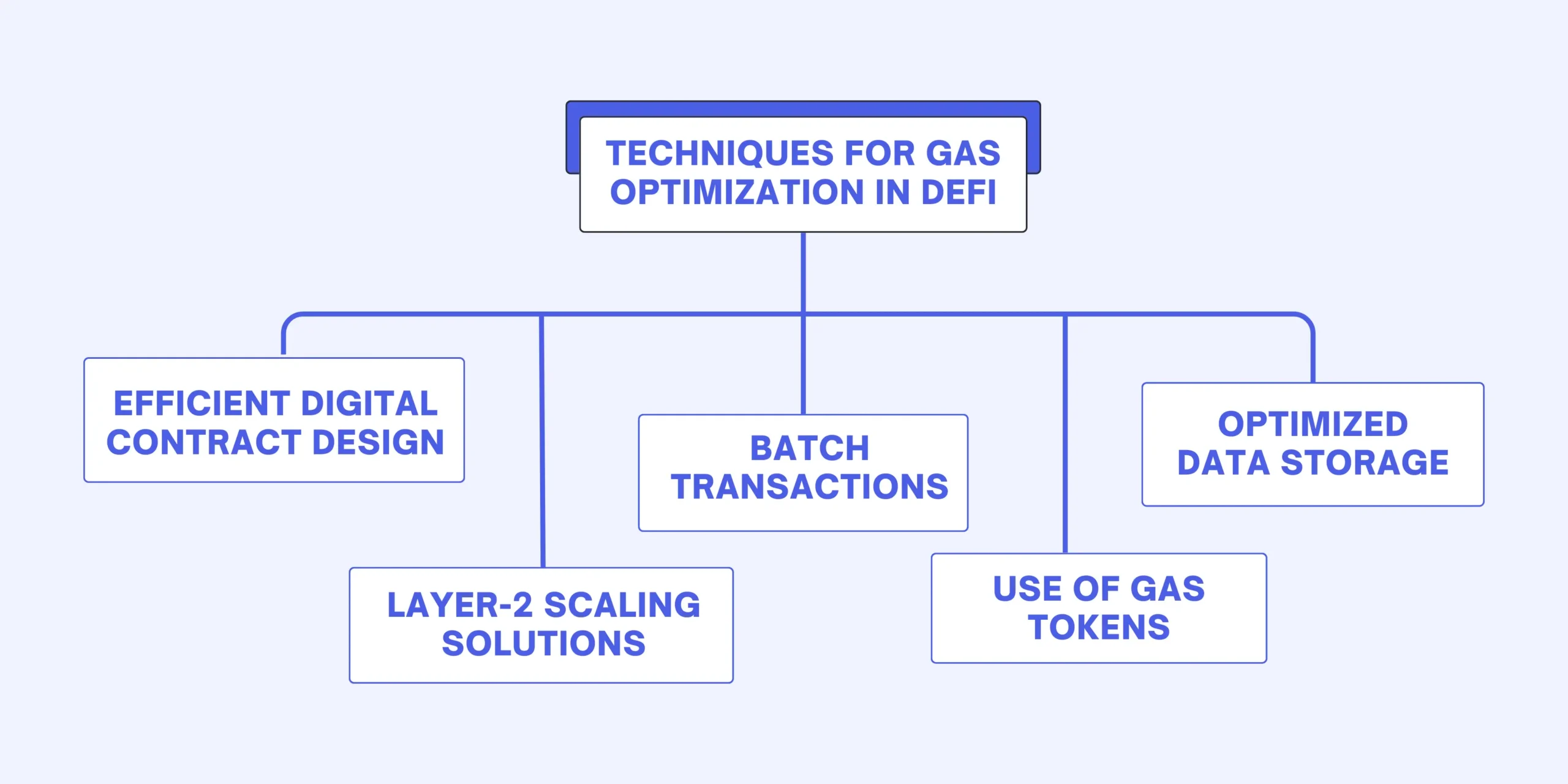

Best Techniques for Gas Optimization in DeFi

Below are proven and widely used gas optimization techniques applied across real DeFi platforms.

1. Efficient Digital Contract Design

Digital contracts should be written with simplicity and efficiency in mind. Reducing unnecessary logic, avoiding repeated calculations, and minimizing storage access can significantly lower gas usage. Well structured contracts improve both performance and reliability.

2. Layer-2 Scaling Solutions

Layer-2 solutions such as Optimistic Rollups, ZK-Rollups, and sidechains move transactions off the Ethereum main network while maintaining security.

Key benefits include:

- Lower transaction fees

- Faster confirmations

- Improved scalability

Many DeFi platforms now rely on Layer-2 networks to provide a smoother and more affordable experience for users.

3. Batch Transactions

Batching allows multiple actions to be executed within a single transaction. Instead of paying for gas for each step, users pay once for the combined operation.

Common examples include:

- Batch approvals

- Multiple swaps in one transaction

- Bulk token transfers

This approach is especially useful for active DeFi users and institutional participants.

4. Use of Gas Tokens

Gas tokens can be minted during periods of low gas prices and redeemed when prices are high. Although their usage has declined after recent Ethereum upgrades, they can still be effective in specific scenarios.

Guidance from DeFi consulting experts helps determine whether gas tokens are suitable for a particular platform.

5. Optimized Data Storage

Reducing on-chain storage remains one of the most effective gas optimization strategies.

Best practices include:

- Using mappings instead of arrays

- Storing hashes instead of full datasets

- Leveraging events for logging

- Avoiding unnecessary state variables

Efficient storage design improves both cost efficiency and platform performance.

Common Gas Optimization Practices Used in DeFi Platforms

Successful decentralized finance platforms do not rely on a single technique to reduce gas costs. Instead, they combine multiple optimization strategies to achieve long-term efficiency, scalability, and security. This layered approach ensures that performance improvements are consistent across different user actions and network conditions.

Some of the most commonly used gas optimization practices include:

- Writing modular and reusable digital contracts helps reduce repeated logic and unnecessary computations across the platform.

- Minimizing external contract interactions, as cross contract calls often consume more gas and increase execution complexity.

- Using memory variables instead of storage wherever possible, since reading and writing to blockchain storage is significantly more expensive.

- Carefully managing approval logic, avoiding repeated approvals that can add unnecessary gas costs for users.

In practice, gas optimization is an ongoing process rather than a one-time task. Continuous testing, performance monitoring, and regular audits help ensure that platforms remain gas-efficient while maintaining strong security standards and user trust.

Can Gas Optimization Be Applied to Non Ethereum Chains?

Yes, gas optimization applies beyond Ethereum. Blockchains such as Polygon, Binance Smart Chain, Avalanche, and others also benefit from efficient transaction design.

Each network has a different fee model and architecture. DeFi consulting solutions help adapt gas optimization strategies to each blockchain, ensuring consistent efficiency across multiple ecosystems.

Tools to Track and Forecast Gas Fees in DeFi

Monitoring gas fees is essential for both DeFi users and development teams. Since gas prices fluctuate constantly based on network demand, having access to reliable tracking and forecasting tools helps avoid unnecessary costs and failed transactions. These tools allow users to choose the right time to submit transactions and help teams design more cost-efficient workflows.

1. Gas Price Oracles

Gas price oracles provide real-time gas fee data directly from the blockchain network. They help users understand current fee levels and select appropriate gas prices for their transactions. For DeFi platforms, gas oracles can be integrated into smart contracts and interfaces to automatically suggest optimal gas fees, reducing the chances of overpaying or transaction delays.

By relying on accurate oracle data, platforms can improve transaction success rates and deliver a smoother experience, especially during periods of moderate congestion.

2. Etherscan Gas Tracker

Etherscan Gas Tracker is one of the most widely used tools for monitoring gas fees on the Ethereum network. It displays live gas prices, including low, average, and high fee estimates, along with historical data.

This historical insight helps both users and teams identify usage patterns, understand peak network times, and plan transactions more efficiently. Developers often use Etherscan data to analyze how their protocols consume gas and identify areas for optimization.

3. GasNow API

GasNow API focuses on gas price prediction and forecasting. Instead of only showing current prices, it estimates future gas fee trends based on pending transactions in the mempool.

This makes it particularly useful for time-sensitive DeFi operations such as token launches, liquidity migrations, or governance actions. By forecasting gas price movements, teams can schedule important transactions during more cost-efficient windows and avoid sudden fee spikes.

4. Blocknative Gas Estimator

Blocknative Gas Estimator provides advanced gas prediction models designed for high-value and complex transactions. It helps users estimate transaction costs more accurately and reduces the risk of failed or stuck transactions.

Many DeFi platforms and wallets use Blocknative tools to enhance transaction reliability, especially during high network activity. For developers, it offers insights into how transactions behave in real-world conditions, supporting better gas-efficient design decisions.

Best Ways to Manage Gas Fees During Peak Network Times

Managing gas fees during periods of high network congestion requires planning and smart execution. When blockchain activity increases, transaction costs can rise quickly, making efficient gas management essential for maintaining a smooth user experience.

Effective approaches include:

- Scheduling non urgent transactions during off peak hours, when network demand is lower and gas fees are more affordable.

- Using real time gas tracking tools, which help identify the best time to submit transactions.

- Implementing batch transactions, allowing multiple actions to be completed in a single transaction and reducing overall gas usage.

- Leveraging Layer-2 networks, which process transactions off the main blockchain and offer faster and cheaper alternatives during peak times.

For complex platforms such as DeFi crowdfunding platforms, combining transaction batching with Layer-2 integration can significantly reduce operational costs while maintaining performance during high-traffic periods.

Reduce Gas Fees. Improve User Experience. Scale with Confidence.

Whether you’re launching a new DeFi protocol or optimizing an existing one, Nadcab Labs offers end-to-end DeFi development and gas optimization services to reduce transaction costs, improve performance, and support long-term scalability.

Security vs Gas Optimization: Finding the Right Balance

Gas optimization should never come at the cost of security. While reducing transaction fees is important, removing essential validation checks or oversimplifying smart contract logic can introduce serious vulnerabilities and expose DeFi platforms to exploits.

Best practices for maintaining this balance include:

- Optimizing contracts only after thorough testing, ensuring core functionality and safety remain intact.

- Conducting regular security audits, especially after making gas-related changes to the codebase.

- Maintaining transparency and traceability, so every transaction and logic path can be reviewed and verified.

In the DeFi ecosystem, paying a slightly higher gas fee is always preferable to risking user funds or protocol integrity. Strong security builds trust, and trust ultimately drives long-term adoption.

The Impact of Gas Optimization on DeFi Performance

Gas optimization in DeFi plays a crucial role in improving usability, scalability, and adoption. From digital contract design and data storage optimization to Layer 2 solutions and transaction batching, every layer of a DeFi platform must prioritize efficiency.

As DeFi continues to evolve, gas efficient architectures will define the success of next generation decentralized applications. Projects that focus on optimization today will be better positioned for long term sustainability, growth, and user trust.

Nadcab Labs is a trusted blockchain and DeFi solutions provider with hands on experience optimizing and scaling DeFi platforms. The team focuses on gas efficient digital contract architecture, Layer 2 integration, and secure DeFi infrastructure.

By combining technical expertise with real world DeFi experience, Nadcab Labs helps projects reduce transaction costs while maintaining performance, security, and decentralization.

Frequently Asked Questions

Yes, gas optimization is still important even for DeFi platforms with lower transaction volume. Optimized transactions reduce unnecessary costs, improve reliability, and prepare the platform for future growth. Early optimization also prevents technical debt, making it easier to scale smoothly when user activity increases over time.

Gas optimization can indirectly improve transaction speed. Efficient transaction design requires fewer computational steps, allowing transactions to be processed more smoothly. While gas price mainly affects priority, optimized transactions are less likely to fail or be delayed, especially during times of moderate network congestion.

Yes, high gas fees are a major reason users abandon DeFi platforms. Gas optimization lowers interaction costs, making platforms more accessible and user-friendly. When users feel they are getting value without excessive fees, they are more likely to stay active, explore features, and trust the platform long term.

Lower transaction costs encourage users to add, remove, and rebalance liquidity more frequently. When gas fees are optimized, liquidity providers can manage positions efficiently without worrying about fees eating into profits. This leads to healthier liquidity pools and more stable DeFi ecosystems.

Gas optimization is especially important for retail users because they often interact with smaller transaction values. If fees are high, participation becomes impractical. Optimized gas usage ensures that everyday users can trade, stake, or earn rewards without fees outweighing the benefits of using the platform.

Yes, gas-optimized platforms often have more predictable transaction behavior. Users experience fewer failed transactions and more consistent costs. This transparency builds trust, as users understand what they are paying for and can plan their interactions without worrying about unexpected gas spikes.

As DeFi grows, users compare platforms based on cost and efficiency. Gas-optimized platforms offer better value, smoother interactions, and fewer barriers. This competitive advantage helps attract users away from expensive alternatives and strengthens the platform’s position within the DeFi ecosystem.

Users trust platforms that consistently deliver affordable and reliable transactions. Gas optimization shows that a platform prioritizes user interests rather than passing unnecessary costs onto them. Over time, this builds confidence, strengthens brand credibility, and encourages long-term engagement.

Gas optimization requires deep understanding of blockchain mechanics, execution flow, and cost structures. Platforms that implement efficient designs demonstrate real technical expertise. This signals credibility to users, partners, and investors, reinforcing trust in the platform’s long-term capabilities.

As DeFi grows, users compare platforms based on cost and efficiency. Gas-optimized platforms offer better value, smoother interactions, and fewer barriers. This competitive advantage helps attract users away from expensive alternatives and strengthens the platform’s position within the DeFi ecosystem.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.