Key Takeaways

- Gas fees in Web3 are payments to validators for computational resources, serving as both spam prevention and security incentives for blockchain networks

- Gas fees are calculated by multiplying gas units (computational work) by gas price (cost per unit), with total costs varying based on transaction complexity and network demand

- Network congestion is the primary driver of high gas fees, as users compete through price bidding when transaction demand exceeds block space capacity

- Layer 2 solutions like Arbitrum, Optimism, and zkSync reduce fees by 10-100x through off-chain processing while maintaining security [1]

- Gas fee optimization strategies include timing transactions during low-demand periods, using Layer 2 networks, and optimizing smart contract code efficiency

- Smart contract complexity directly impacts gas consumption, with simple transfers using around 21,000 gas units and complex DeFi interactions consuming hundreds of thousands

- Gas tracking tools and estimation services help users predict costs and identify optimal transaction timing to minimize expenses

- The future of gas fees points toward lower costs and better user experience through protocol upgrades, account abstraction, and sponsored transactions

Introduction to Gas Fees in Web3

Gas fees in Web3 represent one of the most discussed and sometimes frustrating aspects of blockchain technology. Every transaction on decentralized networks requires payment to the validators who process and verify operations, creating costs that can range from fractions of a cent to hundreds of dollars depending on network conditions. Understanding how gas fees work in Web3 is essential for anyone interacting with blockchain applications, whether trading tokens, minting NFTs, or participating in DeFi protocols.

Web3 gas fees explained in simple terms are the cost of doing business on decentralized networks, analogous to transaction fees in traditional finance but with unique mechanics tied to computational resources. These fees directly impact user experience, application economics, and the viability of different use cases on various blockchain platforms.

Why Gas Fees Exist in Blockchain Networks

Gas fees serve multiple critical functions in blockchain ecosystems. They compensate validators or miners for the computational resources and electricity required to process transactions and maintain network security. Without fees, networks would be vulnerable to spam attacks where malicious actors flood the system with worthless transactions, degrading performance for legitimate users.

Fees also create economic incentives that align validator behavior with network health. Validators earn rewards for honest participation, and the fee market ensures that when demand exceeds capacity, the most valuable transactions get processed first. This market-based allocation of scarce block space enables networks to function without central coordination.

Why Understanding Gas Fees Matters for Users and Developers

For users, understanding gas fees prevents unexpected costs, failed transactions, and poor timing that wastes money. Knowledge of gas mechanics enables strategic decisions about when to transact, which networks to use, and how to estimate costs accurately. For those building and deploying applications, gas optimization directly impacts user acquisition and retention, as high fees can make applications economically unviable for target audiences.

What Is Gas in Web3?

Understanding what is gas in Web3 requires examining its role as a unit of measurement for computational work on blockchain networks.

Definition of Gas in Blockchain

Gas is a unit that measures the amount of computational effort required to execute operations on a blockchain network. The term originated with Ethereum but the concept applies across most smart contract platforms. Each operation in the Ethereum Virtual Machine (EVM) has a fixed gas cost, from simple arithmetic (3 gas) to storage operations (20,000+ gas). Complex transactions consume more gas because they require more computational work from validators.

Gas is distinct from the cryptocurrency used to pay for it. On Ethereum, gas is measured in units but paid in ETH. This separation allows gas costs for operations to remain stable while the payment currency fluctuates in market value.

Role of Gas in Executing Transactions and Smart Contracts

Every transaction and smart contract execution requires gas to complete. Simple ETH transfers have a fixed gas requirement of 21,000 units. Token transfers require more gas because they involve smart contract state changes. Complex DeFi operations like swaps, liquidity provision, or yield farming can require hundreds of thousands of gas units due to multiple contract interactions and storage modifications.

Gas serves as a metering system that prevents infinite loops and runaway computations. If a smart contract has a bug causing infinite execution, it will eventually run out of gas and halt, protecting the network from being locked by faulty code.

| Operation Type | Typical Gas Units | Example Cost at 30 Gwei |

|---|---|---|

| ETH Transfer | 21,000 | ~$1.50 |

| ERC-20 Token Transfer | 65,000 | ~$4.50 |

| Uniswap Swap | 150,000 | ~$10.50 |

| NFT Mint | 100,000 – 250,000 | ~$7 – $18 |

| Smart Contract Deployment | 500,000 – 5,000,000 | ~$35 – $350 |

How Gas Fees Work in Web3

Understanding how gas fees work in Web3 requires examining the components that determine total transaction costs.

Gas Units, Gas Price, and Gas Limit Explained

Three key concepts determine gas costs: gas units, gas price, and gas limit. Gas units measure the computational work required, determined by the operations performed. Gas price is the amount paid per gas unit, typically measured in Gwei (one billionth of an ETH) on Ethereum. Gas limit is the maximum gas units you authorize for a transaction, protecting against unexpectedly high consumption.

Users set gas price and gas limit when submitting transactions. Higher gas prices incentivize faster processing as validators prioritize more profitable transactions. The gas limit prevents runaway costs if something unexpected occurs. Unused gas within your limit is refunded, but if execution requires more gas than your limit allows, the transaction fails and you still pay for gas consumed up to that point.

Gas Fee Calculation Process

Post-EIP-1559 Ethereum uses a two-part fee structure: base fee and priority fee. The base fee is algorithmically determined by network congestion and burned (destroyed). The priority fee (tip) goes to validators as incentive for including your transaction. Total cost equals gas units multiplied by (base fee plus priority fee).

For example, a token swap using 150,000 gas units at a base fee of 25 Gwei plus 2 Gwei priority fee costs: 150,000 × 27 Gwei = 4,050,000 Gwei = 0.00405 ETH. At $2,500 per ETH, this equals approximately $10.13.

Important: Always verify gas estimates before confirming transactions, especially during volatile market conditions or popular NFT drops when fees can spike 10-100x within minutes. Setting appropriate gas limits prevents both overpaying and transaction failures from insufficient gas.

Why Gas Matters in Web3 Ecosystems

Why gas matters Web3 extends beyond transaction costs to fundamental network security and economic alignment.

Gas as an Incentive for Validators and Miners

Gas fees create economic incentives that make blockchain networks function. Validators invest in hardware, stake capital, and consume electricity to process transactions, and gas fees compensate this investment. Without adequate fees, validators would have insufficient incentive to participate, weakening network security and reducing processing capacity.

The fee market also enables efficient resource allocation without central coordination. When demand exceeds capacity, prices rise, signaling validators to prioritize and incentivizing users to optimize. This market mechanism distributes scarce block space to those who value it most while funding network operations.

Gas and Network Security

Gas fees provide critical security benefits by making attacks economically costly. Spam attacks that flood networks with worthless transactions would require paying gas for each transaction, making large-scale attacks prohibitively expensive. Denial-of-service attempts through computationally expensive operations are similarly constrained by gas costs.

The gas metering system also prevents accidental resource exhaustion. Infinite loops, recursive calls, and other problematic patterns automatically halt when gas runs out, preventing single transactions from monopolizing network resources or crashing nodes.

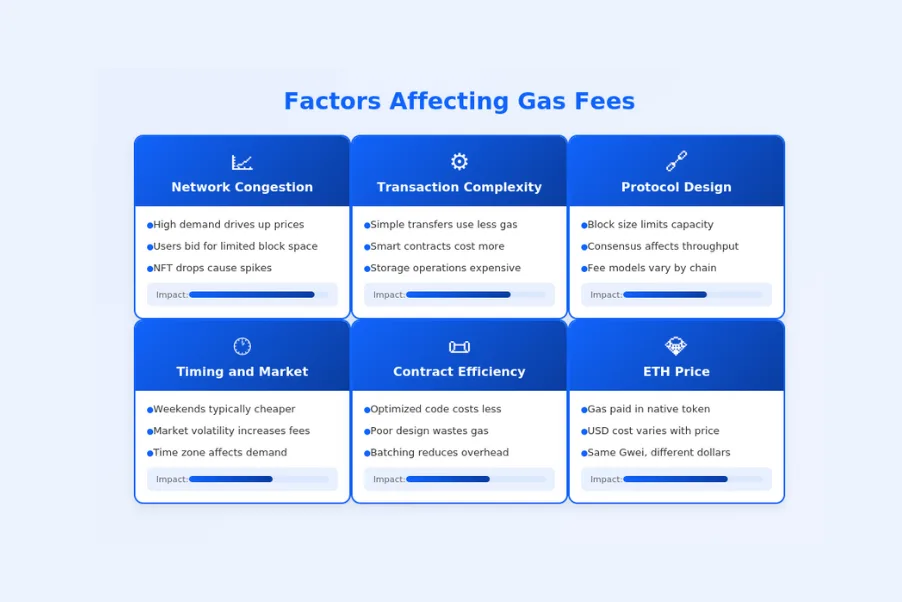

Factors Affecting Gas Fees

Multiple factors influence web3 transaction costs, creating the volatility users experience.

Network Congestion and Demand

Network congestion is the primary driver of gas fee volatility. When transaction demand exceeds block capacity, users must bid higher gas prices to get included in upcoming blocks. Popular events like NFT drops, token launches, or market volatility spikes can increase fees 10-100x within minutes as thousands compete for limited block space.

Conversely, during low-demand periods like weekends or late nights (in major time zones), fees drop significantly. Understanding these patterns enables strategic timing for non-urgent transactions.

Blockchain Protocol Design

Different blockchains have fundamentally different fee structures based on their design choices. Ethereum’s limited throughput and high security creates expensive fees during congestion. Solana’s parallel processing enables much higher throughput and lower fees but with different tradeoffs. Protocol design determines baseline fee levels and how they respond to demand increases.

Smart Contract Complexity

Transaction complexity directly impacts gas consumption. Simple transfers have fixed costs, but smart contract interactions vary dramatically based on operations performed. Contracts that modify storage, perform calculations, or interact with multiple other contracts consume more gas. Poorly optimized contracts can cost users significantly more than well-designed alternatives performing the same function.

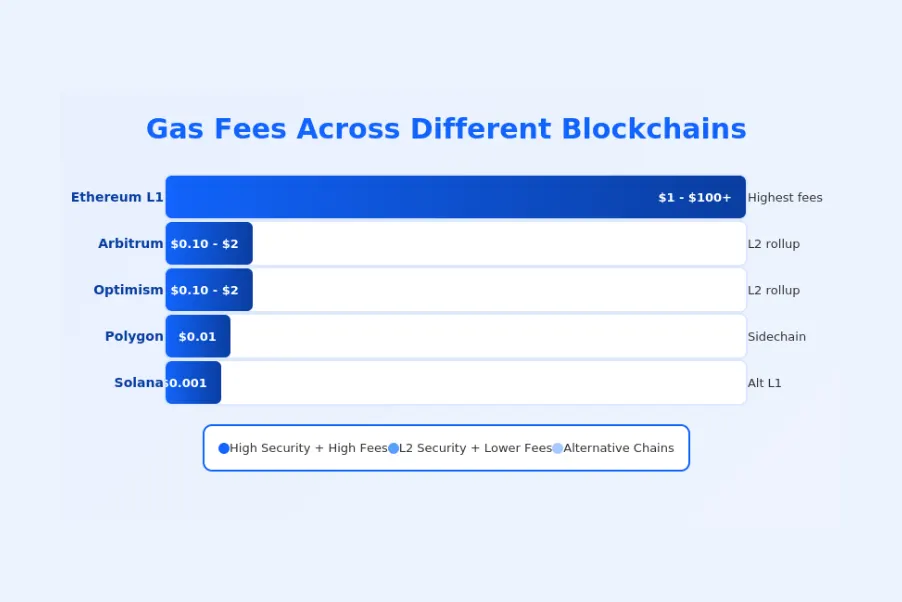

Gas Fees Across Different Blockchains

Gas structures vary significantly across blockchain ecosystems, offering users choices based on their priorities.

Gas Fees in Ethereum

Ethereum remains the most expensive major blockchain for transactions due to its limited throughput and high demand. Simple transfers can cost $1-10 during normal conditions but spike to $50-500 during congestion. Complex DeFi operations regularly exceed $100 during busy periods. Despite costs, Ethereum maintains dominance due to security, decentralization, and ecosystem network effects.

Gas Fees in Layer-2 Networks

Layer 2 solutions dramatically reduce costs while inheriting Ethereum’s security. Arbitrum and Optimism typically offer 10-20x fee reductions through optimistic rollup technology. zkSync and StarkNet use zero-knowledge proofs for similar or greater savings. These networks process transactions off-chain and batch settle to Ethereum, spreading base layer costs across many users.

Low-Gas Blockchain Alternatives

Alternative Layer 1 blockchains offer lower fees through different design choices. Solana processes thousands of transactions per second with fees typically under $0.01. Polygon offers similar low costs as an Ethereum sidechain. BNB Chain, Avalanche, and others provide middle-ground options. These alternatives trade some decentralization or security properties for improved performance and lower costs.

| Blockchain | Typical Fee Range | TPS Capacity | Best For |

|---|---|---|---|

| Ethereum L1 | $1 – $100+ | 15-30 | High-value, security-critical |

| Arbitrum | $0.10 – $2 | 40,000+ | DeFi with ETH security |

| Optimism | $0.10 – $2 | 2,000+ | DeFi, NFTs on L2 |

| Solana | $0.001 – $0.01 | 65,000+ | High-frequency, low-value |

| Polygon | $0.01 – $0.10 | 7,000+ | Gaming, mass adoption |

Cost Optimization Strategies for Gas Fees

Gas fee optimization in Web3 combines strategic timing, network selection, and technical approaches.

Timing Transactions for Lower Gas Fees

Transaction timing significantly impacts costs on congested networks. Gas prices typically drop during weekends, holidays, and late night hours in US and European time zones when trading activity decreases. Non-urgent transactions can save 50-80% by waiting for low-demand windows. Gas tracking tools show historical patterns and current conditions to identify optimal timing.

Using Layer-2 Solutions for Cost Reduction

Layer 2 migration is the most impactful gas fee reduction strategy for regular users. Moving assets to Arbitrum, Optimism, or other L2s enables the same DeFi and NFT activities at fractions of mainnet cost. Initial bridging requires a mainnet transaction, but subsequent L2 operations save significantly. Major protocols now deploy on multiple L2s, making migration increasingly practical.

Optimizing Smart Contract Code

For builders, smart contract optimization directly reduces user costs. Efficient storage patterns, minimized state changes, and optimized logic can reduce gas consumption 20-50% or more. Using established patterns, audited libraries, and gas-efficient data structures benefits both deployment costs and every subsequent user interaction.

Selecting Gas Optimization Strategies: Key Criteria

When choosing gas reduction approaches, consider these factors:

- Transaction Urgency: Time-sensitive transactions may justify higher fees; routine operations can wait

- Value at Risk: High-value transactions warrant mainnet security despite higher costs

- Frequency: Regular users benefit most from L2 migration; occasional users may accept mainnet costs

- Protocol Availability: Ensure needed protocols exist on target L2 before migrating

- Bridge Costs: Factor in bridging fees when calculating L2 savings break-even

- Security Requirements: Some use cases require mainnet settlement guarantees

Gas Management Best Practices

Gas management in Web3 requires tools and techniques for estimation, monitoring, and optimization.

Gas Estimation and Fee Prediction

Accurate gas estimation prevents both overpaying and transaction failures. Wallet software typically estimates required gas, but estimates can be inaccurate during volatile conditions. Buffer gas limits by 10-20% above estimates for complex transactions to ensure completion. For predictable operations like simple transfers, standard gas limits work reliably.

Gas Fee Monitoring Tools and Trackers

Gas tracking tools provide real-time and historical fee data essential for optimization. Etherscan Gas Tracker shows current prices and historical trends. GasNow and similar services offer price predictions and alerts. Wallet extensions can display gas estimates before transaction confirmation. Using these tools enables informed decisions about timing and pricing.

| Phase | Stage | User Actions | Gas Considerations |

|---|---|---|---|

| 1 | Preparation | Check gas prices, assess urgency | Identify optimal timing window |

| 2 | Estimation | Review wallet gas estimate | Add buffer for complex operations |

| 3 | Configuration | Set gas price and limit | Balance speed vs cost preference |

| 4 | Submission | Confirm and sign transaction | Transaction enters mempool |

| 5 | Processing | Monitor transaction status | Can speed up if stuck pending |

| 6 | Confirmation | Verify successful completion | Unused gas refunded |

Gas Fees in DeFi and NFT Transactions

DeFi and NFT activities often involve the highest gas costs due to transaction complexity and timing pressure.

Gas Costs in DeFi Swaps and Yield Farming

DeFi operations consume significant gas due to complex smart contract interactions. Simple swaps on Uniswap use 150,000+ gas units. Yield farming strategies involving multiple protocols can consume 500,000+ gas per transaction. Compounding returns requires repeated transactions, making gas costs a major factor in profitability calculations. Low-value positions can become uneconomical when gas costs exceed potential returns.

Gas Fees in NFT Minting and Transfers

NFT minting typically requires 100,000-250,000 gas units depending on contract implementation. Popular drops create extreme congestion as thousands compete to mint simultaneously, driving gas prices to hundreds or thousands of Gwei. Gas wars during hyped releases can result in fees exceeding the NFT purchase price. Transfers and marketplace listings require additional transactions with their own gas costs.

Impact of Gas Fees on User Experience

Gas fees significantly impact Web3 adoption and usability.

High Gas Fees as a Barrier to Adoption

High and unpredictable gas fees create significant barriers to mainstream Web3 adoption. New users unfamiliar with gas mechanics face confusion when transactions cost more than expected or fail due to insufficient gas. Small-value transactions become uneconomical when fees exceed the transaction value. These friction points drive users away from Web3 applications toward traditional alternatives.

UX Improvements for Gas Abstraction

The ecosystem is actively developing solutions to hide gas complexity from users. Account abstraction (EIP-4337) enables sponsored transactions where applications pay gas on behalf of users. Meta-transactions allow signing without holding native tokens. Gasless experiences through relayers and paymasters are becoming more common. These improvements aim to make Web3 feel as seamless as traditional applications.

Future of Gas Fees in Web3

The trajectory of gas fees points toward lower costs and better user experiences.

Protocol Upgrades and Fee Optimization Models

Ongoing protocol upgrades continuously improve fee efficiency. Ethereum’s transition to proof-of-stake reduced energy costs. Future upgrades like danksharding will dramatically increase data availability, enabling L2s to reduce fees further. Alternative fee models like Solana’s local fee markets prevent network-wide congestion from isolated hot spots.

Towards Predictable and Lower Gas Fees

The combination of scaling solutions, protocol improvements, and UX innovations points toward a future with predictable, low gas fees. Layer 2 adoption continues growing, absorbing transaction volume from expensive mainnet. Account abstraction will enable applications to sponsor user fees. The goal is gas fees that are invisible to end users while still functioning at the protocol level for security.

Want lower gas fees?

Explore proven strategies to optimize your Web3 transactions.

Final Thoughts on Gas Fees in Web3

Gas fees in Web3 represent both a necessary mechanism for network security and a significant challenge for user adoption.

Key Takeaways for Users and Businesses

Understanding gas mechanics empowers users to optimize costs through timing, network selection, and transaction management. Gas fee reduction strategies like Layer 2 migration and off-peak timing can reduce costs by 90% or more. For businesses building Web3 applications, gas optimization directly impacts user acquisition and retention, making efficient smart contract design essential.

The future of gas fees points toward lower costs and better abstraction, but current users must navigate the existing landscape. Tools for gas tracking, estimation, and optimization provide essential capabilities for managing transaction costs. As the ecosystem matures, gas fees will likely become invisible to most users while continuing to secure networks at the protocol level.

Gas fees in Web3 explained fully reveals their role as both challenge and opportunity. Those who understand gas mechanics can use this knowledge to reduce costs, time transactions optimally, and build more efficient applications. As Web3 continues evolving, gas management will remain an important skill even as the user-facing complexity decreases through technological improvements.

Frequently Asked Questions

Gas fees in Web3 are payments made to blockchain network validators or miners to compensate them for the computational resources required to process and validate transactions. Every action on blockchain networks like Ethereum, from simple token transfers to complex smart contract executions, requires gas that users must pay in the network’s native cryptocurrency. These fees ensure network security by preventing spam and incentivizing validators to honestly process transactions.

Gas fees are calculated by multiplying the gas units consumed by the gas price per unit. Gas units measure computational work required, with simple transfers using around 21,000 units and complex smart contract interactions using hundreds of thousands. The gas price fluctuates based on network demand, with users setting maximum prices they are willing to pay. Total fee equals gas units multiplied by gas price in the network’s smallest denomination.

Gas limit is the maximum amount of gas units you are willing to consume for a transaction, protecting you from unexpectedly high costs if something goes wrong. Gas price is the amount you pay per gas unit, typically measured in Gwei on Ethereum. You set both values, with total maximum cost being gas limit multiplied by gas price. Unused gas within your limit is refunded, but insufficient gas causes transaction failure while still consuming fees.

NFT transactions often have high gas fees because minting and transferring NFTs involves complex smart contract operations that consume more gas than simple transfers. Popular NFT drops create extreme demand spikes as thousands compete to mint simultaneously, driving gas prices up through bidding wars. The combination of computational complexity and timing pressure during hyped releases creates some of the highest gas costs in the ecosystem.

Layer 2 solutions are secondary networks built on top of main blockchains that process transactions off-chain before settling batched results back to the main chain. By bundling hundreds or thousands of transactions into single main-chain submissions, they spread the base layer gas cost across many users, dramatically reducing per-transaction fees. Popular Ethereum Layer 2s include Arbitrum, Optimism, and zkSync, offering 10-100x fee reductions while inheriting Ethereum’s security.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.