Key Takeaways

- NFTs have moved beyond digital art to become powerful tools for proving ownership of real estate, intellectual property, financial assets, and personal identity.

- Blockchain technology provides the foundation for NFT ownership through immutable records, smart contracts, and decentralized verification systems.

- Layer-2 scaling solutions and cross-chain interoperability are solving the speed and cost problems that once limited NFT adoption.

- Smart contracts automate ownership transfers, royalty payments, and licensing agreements without requiring middlemen.

- Zero-knowledge proofs add privacy layers to NFT-based identity systems while maintaining security and verification capabilities.

- Companies like Nadcab Labs with 8+ years of blockchain expertise are helping businesses implement custom NFT ownership solutions across multiple industries.

The conversation around NFTs has shifted dramatically over the past few years. What started as a way to buy and sell digital artwork has grown into something much bigger. Today, NFTs represent a fundamental change in how we think about owning things in a digital world.

Most people still associate NFTs with expensive digital pictures or collectible trading cards. But that view misses the larger picture. Blockchain developers and forward-thinking companies have been quietly building systems that use NFT technology for far more practical purposes. These include buying and selling houses, protecting creative work, managing personal identification documents, and even securing loans.

This article breaks down how blockchain solutions have evolved to turn NFTs into genuine digital ownership tools. We will look at the technology behind these changes, examine real-world applications, and discuss what this means for businesses and individuals looking to participate in this new economy.

What Makes an NFT Different from Other Digital Files

To understand how NFTs enable digital ownership, you first need to grasp what sets them apart from regular digital files. When you download a photo or a document from the internet, you create a copy. That copy is identical to the original, and there is no technical way to prove which version came first or who truly owns it.

NFTs solve this problem through blockchain technology. According to Wikipedia, a non-fungible token is a unique digital identifier recorded on a blockchain that certifies ownership and authenticity. Each NFT contains specific data that makes it one of a kind. This data typically includes information about who created the asset, when it was created, a cryptographic hash that verifies its authenticity, and rules written into smart contracts that govern how the NFT can be transferred or sold.

Unlike cryptocurrencies such as Bitcoin, where one coin is exactly the same as another, each NFT is distinct. You cannot swap one NFT for another and expect them to have equal value. This non-fungible quality is what makes NFTs useful for representing ownership of specific items, whether those items exist digitally or in the physical world.

For businesses looking to implement NFT solutions, working with an experienced team matters. NFT marketplace development services from established providers can help create custom platforms tailored to specific industry needs.

The Technology Stack Behind NFT Ownership Systems

Building effective NFT ownership systems requires multiple layers of technology working together. Understanding these components helps explain both the capabilities and current limitations of NFT-based ownership.

Blockchain Networks

The blockchain serves as the foundation for all NFT activity. Different networks offer various tradeoffs between speed, cost, and security. Ethereum remains the most widely used platform for NFTs due to its mature ecosystem and strong developer community. However, networks like Solana, Polygon, and Tezos have gained popularity by offering faster transactions and lower fees.

Nadcab Labs has spent over 8 years working with various blockchain platforms, giving our team deep insight into which network best suits different use cases. A real estate application might prioritize security and legal recognition, making Ethereum a strong choice. A gaming platform handling thousands of small transactions per minute might benefit from Solana’s speed.

Smart Contracts

Smart contracts are self-executing programs stored on the blockchain. They automatically enforce the rules embedded within them when specific conditions are met. For NFT ownership, smart contracts handle tasks like transferring ownership when payment is received, calculating and distributing royalties to original creators, enforcing licensing terms and usage restrictions, and managing fractional ownership among multiple parties.

The programmable nature of smart contracts opens possibilities that traditional ownership systems cannot match. An artist can ensure they receive a percentage every time their work resells, automatically and without any effort on their part. A property owner can set up rental agreements that execute payments and access permissions without needing a property manager.

Storage Solutions

While ownership records live on the blockchain, the actual assets often need separate storage. Storing large files directly on most blockchains would be prohibitively expensive. Instead, NFT systems typically use decentralized storage networks like IPFS or Arweave to hold the actual files while the blockchain maintains references to those files along with ownership data.

Comparison: Traditional Ownership vs NFT-Based Ownership

| Aspect | Traditional Ownership | NFT-Based Ownership |

|---|---|---|

| Verification | Requires contacting issuing authority | Instant verification on public blockchain |

| Transfer Speed | Days to weeks depending on asset type | Minutes to hours |

| Intermediaries | Banks, lawyers, notaries, agents | Optional or eliminated entirely |

| Record Keeping | Centralized databases prone to errors | Immutable blockchain records |

| Fractional Ownership | Complex legal structures required | Built into smart contract functionality |

| Operating Hours | Limited to business hours | 24/7 availability |

| Cross-Border Transactions | Complicated, expensive, slow | Same process regardless of location |

Real Estate: Where NFTs Meet Physical Property

The real estate industry represents one of the most promising areas for NFT adoption. Property transactions have long been plagued by slow processes, high fees, and mountains of paperwork. NFT technology addresses many of these pain points directly.

Virtual Real Estate in the Metaverse

Virtual worlds have created entirely new real estate markets. Platforms like Decentraland, The Sandbox, and Otherside allow users to purchase plots of digital land represented as NFTs. These virtual properties can be developed, rented, or sold just like physical real estate.

What makes virtual land valuable? Location matters in digital worlds just as it does in physical ones. Plots near popular attractions or high-traffic areas command higher prices. Owners can build shops, entertainment venues, or advertising spaces that generate ongoing revenue. The future of NFT integration with metaverse and virtual reality continues to expand these possibilities.

Tokenizing Physical Property

More ambitious projects aim to represent physical real estate as NFTs. This approach offers several advantages. Property ownership records stored on a blockchain cannot be altered or destroyed. Title searches become instant rather than taking days or weeks. Smart contracts can automate rental payments, maintenance schedules, and even property sales.

Fractional ownership through NFTs also opens real estate investment to people who could never afford to buy a whole property. Instead of needing hundreds of thousands of dollars to invest in real estate, someone could purchase a small fraction of a property for a few hundred dollars. Understanding how fractional NFTs work is essential for anyone considering this type of investment.

However, legal frameworks have not yet caught up with the technology in most jurisdictions. Representing property deeds as NFTs requires cooperation from government agencies that record and recognize property ownership. Some regions are beginning to explore these possibilities, but widespread adoption remains years away.

Build Your NFT Ownership Solution Today

Partner with Nadcab Labs to create secure, scalable blockchain solutions for digital ownership. Our 8+ years of experience ensures your project succeeds from concept to launch.

Protecting Intellectual Property with NFTs

Content creators have struggled with copyright protection since the dawn of the internet. Digital files can be copied infinitely at zero cost, making it nearly impossible to control how creative work spreads online. NFTs offer new tools for creators to protect and monetize their intellectual property.

Proving Original Ownership

When a creator mints an NFT of their work, they create a timestamped record on the blockchain showing they were the first to claim ownership. This record cannot be altered after the fact. If someone else later claims to have created the same work, the blockchain provides clear evidence of who registered it first.

This proof of creation extends beyond visual art. Musicians can register songs, writers can register manuscripts, and software developers can register code. Any digital asset that can be hashed can be registered on the blockchain.

Automated Royalty Payments

Traditional royalty systems require constant monitoring and often involve disputes over payments. Smart contracts change this dynamic completely. When an NFT is sold, the smart contract automatically calculates the royalty owed to the original creator and sends it to their wallet. No invoices, no chasing payments, no intermediaries taking a cut.

This system works for secondary sales too. If someone buys an NFT and later resells it for a profit, the original creator still receives their percentage. This ongoing income stream was nearly impossible to enforce before blockchain technology made it automatic.

Licensing and Usage Rights

NFTs can carry detailed licensing terms encoded in their smart contracts. A photographer might sell an NFT that grants the buyer personal use rights but not commercial rights. A musician might sell an NFT that allows the buyer to use a track in YouTube videos but not in paid advertisements. These restrictions can be enforced programmatically, reducing the need for legal action.

Digital Identity and Personal Data Control

Identity theft and data breaches have become common problems in our connected world. Centralized databases holding personal information make attractive targets for hackers. NFT-based identity systems offer an alternative where individuals control their own data.

Self-Sovereign Identity

The concept of self-sovereign identity puts individuals in charge of their personal information. Instead of having your identity verified by a government agency or tech company, you hold credentials as NFTs in your own wallet. When you need to prove something about yourself, you share only the specific information required rather than handing over your entire identity profile.

Managing these digital credentials requires the right tools. Learning about the best NFT wallets available helps users choose secure storage for their identity tokens. For those new to the space, understanding how to create an NFT wallet is an important first step.

Verifiable Credentials

Educational institutions, employers, and professional organizations can issue credentials as NFTs. A university diploma stored as an NFT on the blockchain can be verified instantly by any employer without needing to contact the university. A professional certification can be checked in seconds rather than days.

These verifiable credentials reduce fraud while making legitimate credentials more useful. Fake diplomas become obvious when checked against the blockchain. Real credentials become easier to verify across borders and language barriers.

NFT Digital Ownership Life Cycle

| Stage | Process | Key Actions |

|---|---|---|

| 1. Asset Creation | Original asset is created or identified for tokenization | Document authenticity, gather metadata, establish provenance |

| 2. Minting | NFT is created on blockchain with embedded rules | Deploy smart contract, upload metadata, pay gas fees |

| 3. Listing | NFT made available for sale or transfer | Set price, choose marketplace, define sale terms |

| 4. Transaction | Ownership transfers to new owner | Smart contract executes, payment processed, ownership updated |

| 5. Ownership | New owner holds and manages the NFT | Store in wallet, exercise rights, maintain security |

| 6. Secondary Sale | Owner sells to another party | Royalties distributed, ownership transferred, cycle repeats |

NFTs in Decentralized Finance

The intersection of NFTs and decentralized finance (DeFi) has created new financial instruments and opportunities. According to Investopedia, DeFi refers to financial services built on blockchain technology that operate without traditional intermediaries like banks.

NFTs as Loan Collateral

High-value NFTs can now be used as collateral for cryptocurrency loans. Platforms allow NFT owners to deposit their tokens and borrow against their value. If the borrower fails to repay, the platform liquidates the NFT to recover the funds.

This functionality adds liquidity to the NFT market. Previously, if you owned a valuable NFT but needed cash, your only option was to sell it. Now you can borrow against it while retaining ownership, similar to how homeowners can take out home equity loans.

For a deeper look at how this works in practice, our BendDAO NFT decentralized solutions case study shows real-world implementation of NFT-backed lending protocols.

Fractional Ownership for Investment

Fractionalization allows expensive NFTs to be divided into smaller pieces that multiple people can own. This opens investment opportunities in high-value assets to people who could not afford to buy them outright. Finding the right NFT fractionalization company is important for projects exploring this approach.

A digital artwork worth one million dollars might be split into 10,000 fractions worth 100 dollars each. Each fraction holder owns a small piece of the artwork and can sell their fraction on secondary markets. If the overall value of the artwork increases, each fraction becomes more valuable too.

Technical Innovations Solving Current Limitations

Early NFT systems suffered from high costs, slow transactions, and isolation between different blockchain networks. Recent technical developments are addressing these problems and making NFT ownership more practical for mainstream adoption.

Layer-2 Scaling Solutions

Layer-2 networks process transactions off the main blockchain and periodically settle them in batches. This approach dramatically reduces costs and increases speed while inheriting security from the underlying main chain. Polygon, Arbitrum, and Optimism have become popular choices for NFT projects seeking lower fees without sacrificing security.

Nadcab Labs works with clients to determine which scaling solution best fits their needs. A high-volume application processing thousands of small transactions might benefit from Polygon’s low fees. An application prioritizing maximum security might stay on Ethereum mainnet while using Arbitrum for less critical operations.

Cross-Chain Interoperability

NFTs created on one blockchain have traditionally been stuck there. Moving them to a different blockchain required complex bridging processes that many users found confusing and risky. New interoperability protocols are changing this situation.

Projects like Polkadot, Cosmos, and various cross-chain bridges allow NFTs to move between different blockchains. This increases liquidity by allowing assets to be traded on multiple marketplaces. It also lets users take advantage of different blockchain features depending on their current needs.

Zero-Knowledge Proofs for Privacy

Privacy presents a challenge for blockchain-based systems. By default, blockchain transactions are public and traceable. While this transparency helps verify ownership, it also exposes information that users might want to keep private.

Zero-knowledge proofs allow someone to prove they know something without revealing the actual information. For NFT-based identity systems, this means proving you meet certain criteria (such as being over 21 or holding a valid driver’s license) without revealing your actual age or license details.

Environmental Considerations and Sustainable NFTs

Criticism of NFTs often focuses on energy consumption. Proof-of-work blockchains like early Ethereum required enormous amounts of electricity to secure transactions. This legitimate concern has driven significant changes in how NFT systems operate.

Ethereum’s transition to proof-of-stake reduced its energy consumption by approximately 99.95 percent. Other networks like Solana and Tezos were designed from the start with energy efficiency in mind. These developments make modern NFT systems far more environmentally friendly than their predecessors.

Understanding eco-friendly NFT practices helps creators and collectors make responsible choices. Selecting networks that use proof-of-stake consensus, batching transactions to reduce individual footprints, and supporting carbon offset programs are all ways to participate in NFT markets more sustainably.

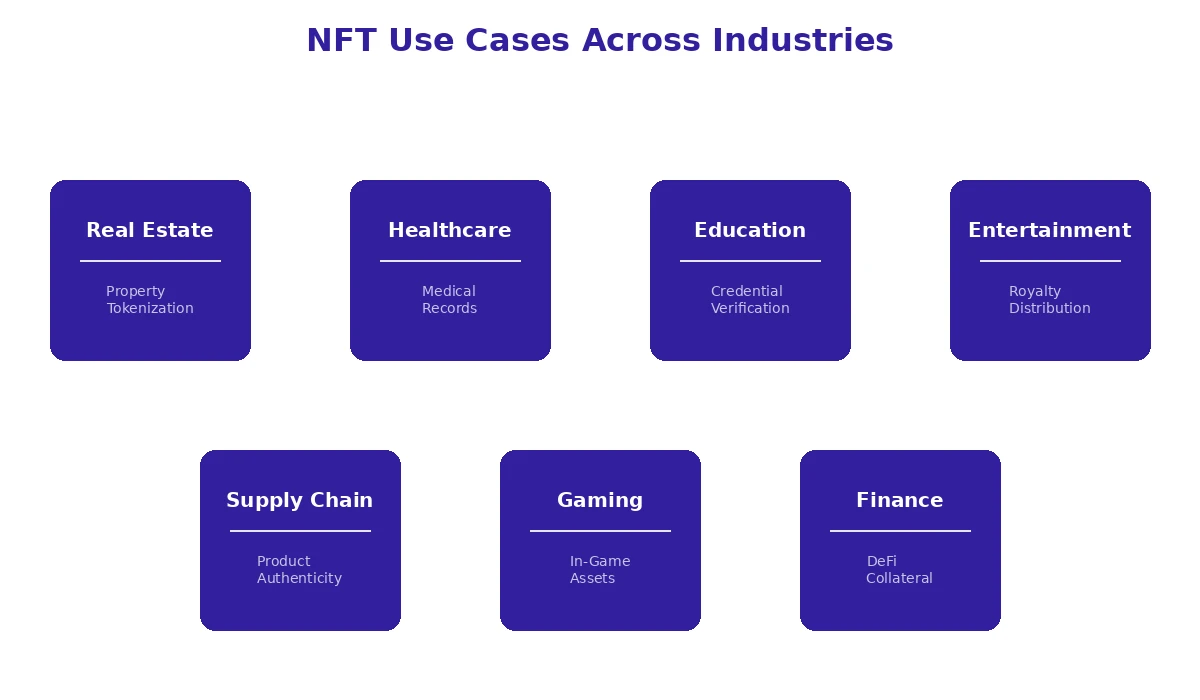

NFT Use Cases Across Industries

| Industry | Application | Benefits | Current Status |

|---|---|---|---|

| Real Estate | Property deed tokenization | Faster transfers, reduced fraud | Pilot programs in select regions |

| Healthcare | Medical record ownership | Patient data control, interoperability | Early development |

| Education | Credential verification | Instant verification, fraud prevention | Active implementation |

| Entertainment | Royalty distribution | Automatic payments, transparency | Widely adopted |

| Supply Chain | Product authenticity tracking | Anti-counterfeiting, traceability | Growing adoption |

| Gaming | In-game asset ownership | True ownership, cross-game portability | Mainstream adoption |

Getting Started with NFT Ownership Solutions

For individuals and businesses interested in exploring NFT-based ownership systems, several paths forward exist depending on goals and technical capabilities.

Individual Participants

People looking to participate in NFT markets as buyers or sellers should start by learning the fundamentals. Understanding wallet security, gas fees, and marketplace dynamics helps avoid common mistakes that cost newcomers money. Our guide on how beginners can make money with NFTs covers these basics in detail.

Starting small and learning from experience beats jumping in with large amounts of money. The technology continues evolving rapidly, and hands-on experience teaches lessons that reading alone cannot.

Business Implementation

Companies looking to implement NFT solutions face more complex decisions. Choosing the right blockchain network, designing appropriate smart contracts, and building user-friendly interfaces all require expertise that most organizations do not have in-house.

Working with an experienced blockchain development partner significantly improves outcomes. Nadcab Labs brings over 8 years of hands-on experience building blockchain solutions across multiple industries. Our team has navigated the technical challenges, regulatory considerations, and practical implementation issues that trip up inexperienced developers.

We work with clients from initial concept through deployment and ongoing support. Whether you need a custom NFT marketplace, an intellectual property protection system, or a tokenized asset management platform, our experience helps avoid costly mistakes and deliver working solutions faster.

“The shift from digital collectibles to digital ownership infrastructure represents one of the most significant changes in how value will be recorded and transferred in the coming decades. Organizations that understand and implement these systems early will have substantial advantages.”

— Nadcab Labs Blockchain Development Team

How Nadcab Labs Approaches NFT Development Projects

With over 8 years of experience in blockchain development, Nadcab Labs has developed a structured approach to NFT projects that maximizes success rates while minimizing costly mistakes. Our methodology reflects lessons learned from dozens of completed projects across multiple industries.

Discovery and Strategy Phase

Every successful NFT project begins with understanding the specific problem being solved. We work with clients to define clear objectives, identify target users, and map out technical requirements. This phase often reveals that clients need different solutions than they initially imagined. A company thinking about creating collectible NFTs might discover that tokenizing existing assets would better serve their business goals.

Technical Architecture

Choosing the right technical foundation determines long-term success. We evaluate blockchain networks based on transaction costs, speed requirements, security needs, and ecosystem maturity. Smart contract design receives particular attention because poorly designed contracts can create security vulnerabilities or lock in problematic behaviors that cannot be easily changed later.

Development and Testing

Our development process emphasizes security at every stage. Code undergoes multiple review cycles and extensive testing before deployment. For projects handling significant value, we recommend third-party security audits to provide additional verification. The cost of thorough testing is always less than the cost of a security breach or major bug after launch.

Launch and Support

Deployment is just the beginning of a successful NFT project. We provide ongoing support to help clients respond to user feedback, implement improvements, and adapt to changing market conditions. The blockchain space moves quickly, and projects that cannot evolve get left behind.

Challenges and Considerations

Despite the potential of NFT ownership systems, significant challenges remain. Understanding these challenges helps set realistic expectations and avoid projects likely to fail.

Regulatory Uncertainty

Governments around the world are still determining how to classify and regulate NFTs. In some jurisdictions, certain NFT types might be considered securities subject to strict regulations. Tax treatment varies widely and remains unclear in many places. Organizations implementing NFT systems need to monitor regulatory developments and be prepared to adapt.

User Experience Barriers

Current NFT systems remain too complicated for average users. Managing wallet seed phrases, understanding gas fees, and navigating marketplace interfaces present barriers that discourage adoption. Successful NFT projects increasingly focus on hiding this complexity behind user-friendly interfaces that feel familiar to people accustomed to traditional apps and websites.

Market Volatility

NFT valuations can swing dramatically based on speculation, celebrity involvement, and broader cryptocurrency market movements. This volatility makes NFTs risky as investment vehicles and can undermine their use as stable ownership records. Building systems that depend on stable NFT valuations requires careful consideration of these risks.

Looking Ahead: The Maturing NFT Ecosystem

The NFT market has moved past its initial speculative phase and is entering a period of practical application development. While media attention has decreased from peak levels, serious builders continue developing infrastructure that will support NFT adoption across industries.

Several trends suggest where the technology is heading. Integration with traditional financial systems continues, with major institutions exploring how NFTs fit into existing frameworks. Interoperability improvements will eventually allow assets to move freely between networks without the friction that exists today. User interfaces will continue simplifying until blockchain complexity becomes invisible to end users.

For those paying attention and positioning themselves appropriately, the next several years offer significant opportunities. The infrastructure being built today will support the ownership systems of tomorrow, and early participants will understand nuances that latecomers will struggle to grasp.

Frequently Asked Questions

An NFT proves ownership of a specific token on the blockchain, but what rights that token grants depends entirely on how it was created. Some NFTs include full intellectual property rights, allowing the owner to commercialize the underlying asset. Others grant only limited viewing or personal use rights. Before purchasing any NFT, check the smart contract terms and any associated licensing agreements to understand exactly what ownership includes. The blockchain verifies you own the token, but legal frameworks determine what that ownership means for the underlying asset.

When creators mint NFTs, they can embed royalty percentages directly into the smart contract. These royalties typically range from 2.5 to 10 percent and are automatically paid to the creator’s wallet whenever the NFT sells on compatible marketplaces. The blockchain handles calculation and distribution without requiring manual invoicing or payment tracking. However, some marketplaces now allow buyers to skip royalty payments, so creators should research marketplace policies. Royalty enforcement remains imperfect, but technical solutions continue improving to ensure creators receive ongoing compensation for their work.

Yes, NFTs can represent ownership of physical items through a process called tokenization. For luxury goods, the NFT serves as a digital certificate of authenticity linked to the physical item. For real estate, NFTs can represent property deeds or fractional ownership shares. The main challenge is ensuring the connection between the digital token and physical asset remains valid. This requires trusted processes for creating the initial link and handling situations where physical items are damaged or stolen. Legal recognition varies by jurisdiction, so physical asset tokenization works best with proper legal frameworks in place.

NFTs exist on the blockchain independently of any marketplace, so your ownership record survives even if the original platform closes. However, you need to ensure your NFT data is stored properly. If the actual asset files were stored on the platform’s servers rather than decentralized storage, those files might become inaccessible. Well-designed NFTs store their data on permanent, decentralized networks like IPFS or Arweave. Always verify where your NFT data lives and keep your wallet credentials secure, as these are your only way to access and transfer your assets regardless of platform availability.

Costs vary significantly depending on the blockchain network and current network congestion. On Ethereum mainnet, minting an NFT might cost anywhere from $5 to $100 or more during peak times. Layer-2 networks like Polygon offer minting costs under $1, sometimes fractions of a cent. Some platforms offer lazy minting, where the NFT creation cost is paid by the buyer at purchase time. Sellers should also factor in marketplace fees, which typically range from 2.5 to 5 percent of sale price. Starting on lower-cost networks makes sense while learning the process before moving to higher-cost chains.

Nadcab Labs brings over 8 years of specialized experience in blockchain development, including extensive work with NFT systems across multiple industries. Our team has successfully delivered projects ranging from NFT marketplaces and fractionalization platforms to enterprise tokenization solutions. We understand both the technical complexities and business considerations that determine project success. Clients benefit from our accumulated knowledge about which approaches work and which create problems down the road. We provide end-to-end services from initial consultation through deployment and ongoing support, helping organizations implement blockchain solutions that deliver real value.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.