Key Takeaways

- A DEX aggregator searches across multiple decentralized exchanges to find optimal trading rates, providing better prices than any single DEX could offer.

- Smart order routing algorithms analyze liquidity, prices, and gas costs to construct trade routes that minimize slippage and maximize value for token swapping.

- Liquidity optimization through aggregation enables efficient execution of large trades by splitting orders across multiple pools to reduce price impact.

- The best DEX aggregators offer cross-chain swaps, limit orders, and gas fee reduction features that enhance the overall DeFi trading experience.

- Non-custodial operation ensures security advantages as users maintain control of their funds throughout the trading process on crypto trading platforms.

- Decentralized exchange aggregator services improve trading experience by eliminating the need to manually search multiple DEXs for the best rates.

- Choosing the right aggregator requires evaluating factors including supported chains, liquidity access, gas optimization, and interface usability.

- DeFi liquidity accessed through aggregators enables sophisticated trading strategies previously possible only on centralized platforms.

The decentralized exchange landscape has expanded dramatically, with hundreds of platforms offering token swapping across multiple blockchain networks. While this growth brings opportunity, it also creates complexity for traders seeking the best rates. DEX aggregators have emerged as essential tools that solve this fragmentation problem, automatically finding optimal trade routes across the entire DeFi ecosystem. Understanding how these platforms improve your trading experience enables smarter, more cost-effective trading decisions.

Introduction to DEX Aggregators

Introduction to DEX aggregators begins with understanding the problem they solve: liquidity fragmentation across the DeFi ecosystem. When liquidity is spread across dozens of exchanges, traders face a challenging choice between spending significant time comparing rates manually or accepting potentially suboptimal prices on their chosen platform. DEX aggregators eliminate this trade-off, providing the best of both worlds through automated optimization.

What is a DEX Aggregator?

A DEX aggregator is a decentralized exchange aggregator platform that connects to multiple DEXs, comparing prices and liquidity to find optimal trade routes for users. Rather than maintaining its own liquidity pools, an aggregator serves as an intelligent routing layer that accesses combined liquidity across the entire DeFi ecosystem. This approach delivers consistently better execution than trading on individual platforms.

The difference between a DEX aggregator and single DEX trading is fundamental. When you trade on a single DEX like Uniswap, you access only that platform’s liquidity pools. An aggregator searches across Uniswap plus dozens of other DEXs simultaneously, finding the best rates and potentially splitting your order across multiple sources for optimal execution. Building crypto exchanges with aggregation capabilities requires sophisticated routing infrastructure.

Why Traders Are Turning to DEX Aggregators

Traders are turning to DEX aggregators for multiple compelling reasons. Trading efficiency improves dramatically when algorithms handle the complex task of comparing rates across hundreds of liquidity sources. What would take a human trader minutes or hours to analyze happens automatically in milliseconds, enabling faster and more informed trading decisions.

Better liquidity and reduced slippage represent the core value proposition. By accessing combined liquidity from all connected DEXs, aggregators enable larger trades with less price impact than any single platform could support. Cross-chain swap possibilities further expand opportunities, allowing traders to move assets between blockchain networks through unified interfaces. Understanding how automated market makers function in DEX trading provides context for why aggregation delivers such significant improvements.

Trading Principle: In fragmented markets, the cost of not aggregating often exceeds the cost of using any single platform. DEX aggregators transform this market reality from a challenge into an advantage for informed traders.

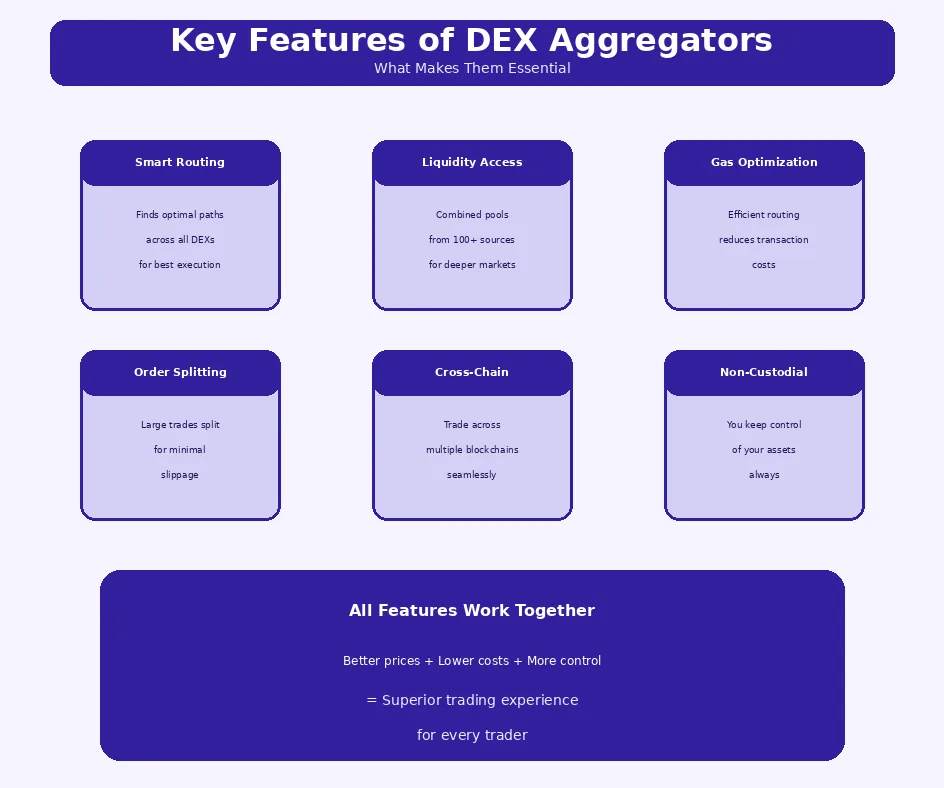

Key Features of the Best DEX Aggregators

Key features of the best DEX aggregators differentiate superior platforms from basic alternatives. Understanding these features helps traders select aggregators that maximize value for their specific needs. The most important capabilities span intelligent routing, liquidity access, and cost optimization.

Smart Order Routing

Smart order routing represents the core technology enabling aggregator advantages. Sophisticated algorithms analyze all available trade routes, considering current prices, liquidity depth, gas costs, and potential slippage to determine optimal execution paths. This analysis happens in real-time, ensuring quotes reflect current market conditions.

How aggregators find the best prices involves more than simple price comparison. The algorithms may identify multi-hop routes through intermediate tokens that provide better overall execution than direct swaps. They may also split orders across multiple DEXs to reduce slippage, achieving better average prices than any single execution path could provide. This smart order routing transforms how traders approach DEX trading.

Liquidity Optimization

Liquidity optimization through aggregation provides access to deeper combined pools than any single DEX maintains. When executing large trades, this DeFi liquidity depth becomes critical. A trade that would move prices significantly on a single DEX can be distributed across multiple sources, minimizing impact on any individual pool.

Efficient execution of large trades distinguishes aggregators from simple DEX interfaces. Rather than accepting significant slippage on size, traders can rely on algorithms to split and route their orders optimally. This capability brings institutional-grade execution quality to retail traders, democratizing access to sophisticated trading infrastructure.

Gas Fee Reduction

Gas fee reduction helps traders keep more value from their trades. While complex routes through multiple DEXs might seem to increase gas costs, well-designed aggregators optimize for total cost including gas. Sometimes accepting slightly worse rates results in lower total costs when gas savings are considered.

The aggregator’s role in batch transactions further reduces costs. Some platforms combine multiple user operations into single transactions, sharing gas costs across participants. This approach makes smaller trades more economical than they would be on direct DEX interactions.

DEX Aggregator Features Comparison

| Feature | Standard DEX | DEX Aggregator |

|---|---|---|

| Liquidity Access | Own pools only | Hundreds of sources |

| Price Discovery | Single source | Cross-platform optimization |

| Order Splitting | Not available | Automatic for large trades |

| Gas Optimization | Basic | Advanced routing |

| Best For | Simple swaps, LP provision | Most trading scenarios |

Benefits of Using a DEX Aggregator

Benefits of using a DEX aggregator extend beyond simple price improvements to encompass the entire trading experience. From convenience to security, these platforms deliver multiple advantages that make them essential tools for serious DeFi participants. Understanding these benefits helps traders appreciate why aggregation has become standard practice.

Improved Trading Experience

The improve trading experience benefit starts with faster, more efficient trading. Instead of opening multiple tabs to compare rates across platforms, traders submit single requests that automatically find optimal execution. This efficiency saves time while consistently delivering better outcomes than manual comparison could achieve.

Reduced manual effort in searching multiple DEXs transforms trading from a tedious comparison process into a streamlined experience. Traders can focus on strategy rather than execution mechanics, knowing that algorithms handle the complex optimization work. Understanding how decentralized exchanges implement trading functionality reveals the technical complexity aggregators abstract away.

Enhanced Crypto Trading Strategies

Enhanced crypto trading strategies become possible through aggregator capabilities. Cross-chain swaps enable portfolio diversification across blockchain ecosystems without manual bridging complexity. Traders can rebalance positions across networks through unified interfaces, implementing strategies that would otherwise require multiple steps and platforms.

Better execution of DeFi trading strategies results from reliable, optimized trade execution. When you can trust that orders execute at competitive prices, strategy implementation becomes more predictable. This reliability enables more sophisticated approaches that depend on precise execution for profitability.

Security Advantages

Security advantages of DEX aggregators stem from their non-custodial design. Users maintain control of their assets throughout the trading process, with trades executing directly through smart contracts. This trustless interaction model eliminates counterparty risk associated with centralized crypto trading platforms.

Trustless interactions on blockchain ensure that trades execute according to transparent, auditable code rather than depending on platform operators. Users can verify exactly what will happen before signing transactions, maintaining full control over their trading activities. These security properties make aggregators attractive for risk-conscious traders.

DEX Aggregator Trade Lifecycle

| Step | Phase | Process | Benefit |

|---|---|---|---|

| 1 | Request Quote | User specifies trade parameters | Simple interface |

| 2 | Route Discovery | Algorithm analyzes all DEXs | Best price finding |

| 3 | Optimization | Calculate optimal split/route | Slippage reduction |

| 4 | Quote Presentation | Show user expected outcome | Informed decision |

| 5 | Execution | Smart contract routes trades | Optimal execution |

| 6 | Settlement | Tokens delivered to wallet | Non-custodial receipt |

DEX Aggregator vs Traditional DEX

Comparing DEX aggregator versus traditional DEX trading reveals why aggregation has become the preferred approach for most trading scenarios. While traditional DEXs serve important functions including liquidity provision and specific pool access, aggregators offer advantages that make them superior for typical trading needs.

Comparing Single DEX Trading with Aggregated Trading

Price differences and slippage represent the most obvious comparison points. Single DEX trading accesses only that platform’s liquidity, meaning large orders experience full price impact on limited pools. Aggregated trading distributes volume across sources, reducing impact on any individual pool and achieving better average execution.

Liquidity access and order fulfillment further differentiate approaches. Single DEXs may have insufficient liquidity for larger orders, leading to partial fills or severe slippage. Aggregators access combined liquidity ensuring reliable execution at reasonable prices for virtually any trade size. Understanding how professional exchange platforms implement trading infrastructure reveals the technical foundation enabling these capabilities.

Build a Next-Generation DEX Aggregator That Traders Trust

Build a smart DEX aggregator with optimized routing, deep liquidity, and seamless multi-chain trading.

Launch Your Exchange Now

Choosing the Right DEX Aggregator

Choosing the right DEX aggregator requires evaluating multiple criteria aligned with your specific needs. The best DEX aggregator for one trader may not suit another depending on trading patterns, preferred chains, and feature requirements. Systematic evaluation ensures optimal platform selection.

Key criteria include liquidity access breadth, gas optimization effectiveness, supported tokens and chains, and interface usability. Some aggregators excel on specific networks while others provide broader multi-chain support. Gas optimization approaches vary, with some platforms offering superior efficiency on certain transaction types.

DEX Aggregator Selection Criteria

When choosing an aggregator, evaluate these factors:

- Liquidity Sources: Number and quality of connected DEXs

- Chain Support: Networks supported for your trading needs

- Gas Efficiency: Optimization for transaction costs

- Token Coverage: Support for tokens you trade

- Features: Limit orders, cross-chain, advanced options

- Interface: Usability and information presentation

Trading Scenario Comparison

| Scenario | Single DEX Result | Aggregator Result | Improvement |

|---|---|---|---|

| $1K ETH→USDC | $997 received | $998 received | +$1 (0.1%) |

| $50K ETH→USDC | $48,500 received | $49,250 received | +$750 (1.5%) |

| Low liquidity token | 5% slippage | 2% slippage | 60% less slippage |

| Multi-hop route | Manual, multiple txs | Automated, one tx | Time + gas saved |

Trading Notice: While DEX aggregators provide significant advantages, all DeFi trading involves risks including smart contract vulnerabilities, market volatility, and potential for failed transactions. Always verify you are using legitimate platforms, check transaction details before signing, and understand that past performance does not guarantee future results.

Conclusion

DEX aggregators fundamentally improve your trading experience by solving the liquidity fragmentation challenge inherent in decentralized finance. Through smart order routing, liquidity optimization, and gas fee reduction, these platforms deliver better execution than any single DEX could provide. The benefits extend from simple convenience to sophisticated trading capabilities that enable strategies previously possible only on centralized platforms.

The comparison between aggregated and single DEX trading clearly favors aggregation for most scenarios. While direct DEX access remains valuable for specific purposes like liquidity provision, traders seeking optimal execution should default to using aggregators. The improved trading experience, enhanced strategy possibilities, and security advantages make aggregators essential tools for serious DeFi participants.

Choosing the right decentralized exchange aggregator requires evaluating your specific needs against available platform capabilities. Consider factors including liquidity access, chain support, gas efficiency, and features when selecting platforms. Understanding how professional exchange infrastructure enables efficient trading helps appreciate the sophisticated technology working behind simple interfaces to optimize your every trade.

Frequently Asked Questions

A DEX aggregator is a platform that searches across multiple decentralized exchanges simultaneously to find the best trading rates for users. Instead of trading on a single DEX with limited liquidity, aggregators compare prices, split orders, and route trades through optimal paths. This approach delivers better prices and reduced slippage compared to trading on individual exchanges.

DEX aggregators use smart order routing algorithms that analyze prices across hundreds of liquidity sources in real-time. They consider factors including current prices, available liquidity depth, gas costs, and potential slippage. The algorithms then construct optimal trade routes that may split orders across multiple DEXs to achieve the best overall execution price.

A DEX is a decentralized exchange that maintains its own liquidity pools where users trade directly. A DEX aggregator does not hold liquidity but instead searches across multiple DEXs to find optimal trading routes. Aggregators provide access to combined liquidity from all connected DEXs, typically offering better prices than any single exchange could provide for most trades.

Most DEX aggregators charge minimal or no direct trading fees, with users paying only the underlying blockchain gas fees and fees from DEX protocols their trades route through. Some aggregators may capture positive slippage or include small protocol fees for specific features. Even with any additional costs, savings from better execution typically exceed fees for most trades.

DEX aggregators are generally safe as they operate non-custodially, meaning users maintain control of their funds throughout trading. Reputable aggregators have undergone security audits and use battle-tested smart contracts. However, users should always verify they are using legitimate platforms, understand the risks of DeFi trading, and check transaction details before signing.

The best DEX aggregator depends on your specific needs. 1inch is popular for its comprehensive liquidity access and advanced features. Paraswap offers competitive rates and gas optimization. Matcha provides a user-friendly interface. Consider factors including supported chains, gas efficiency, available tokens, and interface preferences when choosing an aggregator.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.