Key Takeaways

- The DePIN solution market was valued at $226 million in 2024 and is projected to grow to $669 million by 2032, with a compound annual growth rate of 17.0%, driven by the need for distributed ownership and transparent management of physical assets like energy grids and telecom systems. [1]

- Over 13 million devices now contribute daily to various DePIN networks worldwide, and DePIN-related projects raised a total of more than $5 billion in 2024, with funds flowing mainly into AI computing, decentralized storage, and wireless networks. [2]

- The October 2025 AWS outage brought down services like Snapchat, Roblox, and Disney+, with experts citing losses of $34 million per hour for major e-commerce platforms and demonstrating the vulnerability of centralized cloud models. [3]

- Blockchain-based infrastructure solutions have been shown to reduce operational costs by up to 30% while improving system uptime, and decentralized cloud platforms like Fluence report cost savings of up to 75% compared to centralized cloud providers. [4]

- The Filecoin network has grown to nearly 3,000 storage providers since its 2020 mainnet launch and has collectively stored 1.5 exabytes of data, from experimental physics research to historical archives of entire island nations. [5]

- The Helium Network reached over 108,855 mobile hotspots by August 2025 and has partnered with major carriers, including T-Mobile, AT&T, and Telefonica, to offload cellular data through its decentralized wireless infrastructure. [6]

- The energy sector leads DePIN deployment with roughly 38% of global implementations in 2024, mainly through decentralized microgrids and renewable energy projects that enable peer-to-peer energy trading.

- The Render Network has rendered over 63 million cumulative frames to date, with more than one-third completed in 2024 alone, and saw an 87% growth in its GPU marketplace year over year. [7]

- Hivemapper’s decentralized mapping network has mapped roughly 33% of global roads using community-owned dashcams across 90+ countries, growing five times faster than Google Street View did in its first years. [8]

- Between January 2024 and July 2025, over $744 million was invested in 165+ DePIN startups, according to The Block Pro Research, with early-stage funding for DePIN projects surging by 296% in 2024.

For the better part of three decades, the world has built its digital backbone on centralized systems. A handful of cloud providers, telecom giants, and data storage corporations have held the keys to how we communicate, store information, and power our digital lives. This model worked well enough when the internet was smaller. But today, as billions of devices come online and artificial intelligence demands enormous computing power, the cracks in centralized infrastructure are becoming impossible to ignore.

This is where Decentralized Physical Infrastructure Networks, commonly known as DePIN, enter the picture. DePIN adoption solution for centralized infrastructure isn’t just a blockchain buzzword. It represents a fundamental rethinking of who builds, owns, and operates the physical systems that keep the modern world running. From wireless networks and cloud storage to energy grids and mapping services, DePIN architecture is proving that communities of individuals can do what only corporations could do before.

This blog will walk you through why DePIN adoption matters, how it challenges the centralized models we’ve relied on, and what real-world projects are already making it happen. If you’re a business leader, a developer, or simply someone interested in the future of infrastructure, this is the conversation you need to follow.

Understanding Centralized Infrastructure and Its Weaknesses

Before we talk about what DePIN can do, let’s first understand why it’s needed. Centralized infrastructure refers to any physical or digital system that is owned, operated, and maintained by a single entity or a small group of entities. Think of Amazon Web Services (AWS), Google Cloud, AT&T, Verizon, or even national energy utilities. These organizations control the hardware, the data centers, the transmission lines, and the software layers that millions of businesses depend on every single day.

There are clear advantages to this model. Centralized operators can invest heavily in technology, hire specialized talent, and build massive facilities. But the disadvantages are becoming increasingly visible and costly.

1. Single Points of Failure

When one entity controls the entire chain, any disruption at the top cascades across the whole system. The October 2025 AWS outage is a perfect example. A DNS resolution failure in the US EAST 1 region, which powers roughly 32% of global cloud infrastructure, brought down services across the internet. Popular platforms, including Snapchat, Roblox, Disney+, and numerous banking apps, went dark. Newsweek reported that cybersecurity expert Dr. Vahid Behzadan described centralized cloud systems as “single points of failure,” explaining that when one provider’s infrastructure stumbles, every dependent service gets exposed.

2. Enormous Financial Impact of Downtime

IT industry reports show that AWS downtime can cost enterprises between $5,000 and $9,000 per minute, depending on scale. During the October 2025 event, losses quickly escalated into tens of millions, with unprocessed orders, missed advertising impressions, and frozen subscriptions. Dataconomy noted that unscheduled downtime drains an annual $1.4 trillion from the world’s 500 largest companies, equal to roughly 11% of their total revenue.

3. Market Concentration Creates Systemic Risk

Just three companies, Amazon (AWS), Microsoft (Azure), and Google (GCP), control approximately 68% of the global public cloud market. When a third of the internet depends on a single provider, a localized technical issue becomes a global economic event. This level of concentration goes against the very idea of what the internet was supposed to be: a distributed, fault-tolerant network.

4. High Costs and Barriers to Entry

Building centralized infrastructure requires billions in capital expenditure. Data centers, undersea cables, cell towers, and satellite systems are expensive to build and maintain. This means that only the wealthiest corporations can participate, shutting out smaller players and entire regions that lack investment.

📖 Recommended Reading: DePIN Web3, Building the Foundation of a Truly Decentralized Future

What Is DePIN and How Does DePIN Architecture Work

DePIN stands for Decentralized Physical Infrastructure Networks. At its core, DePIN uses blockchain technology and token-based incentives to coordinate the building and management of real-world physical infrastructure. Instead of one company owning all the hardware and charging everyone to use it, DePIN architecture flips the model: ordinary people and businesses contribute physical resources (such as storage drives, wireless hotspots, GPU cards, or sensors), and they earn cryptocurrency tokens in return for their contributions.

Think of it this way. In the centralized model, a company like AWS builds a massive data center, buys all the servers, hires teams to maintain them, and charges customers for access. In a DePIN model, thousands of individuals plug in their own storage drives or computing hardware, the blockchain verifies their contributions, and smart contracts automatically distribute rewards based on performance.

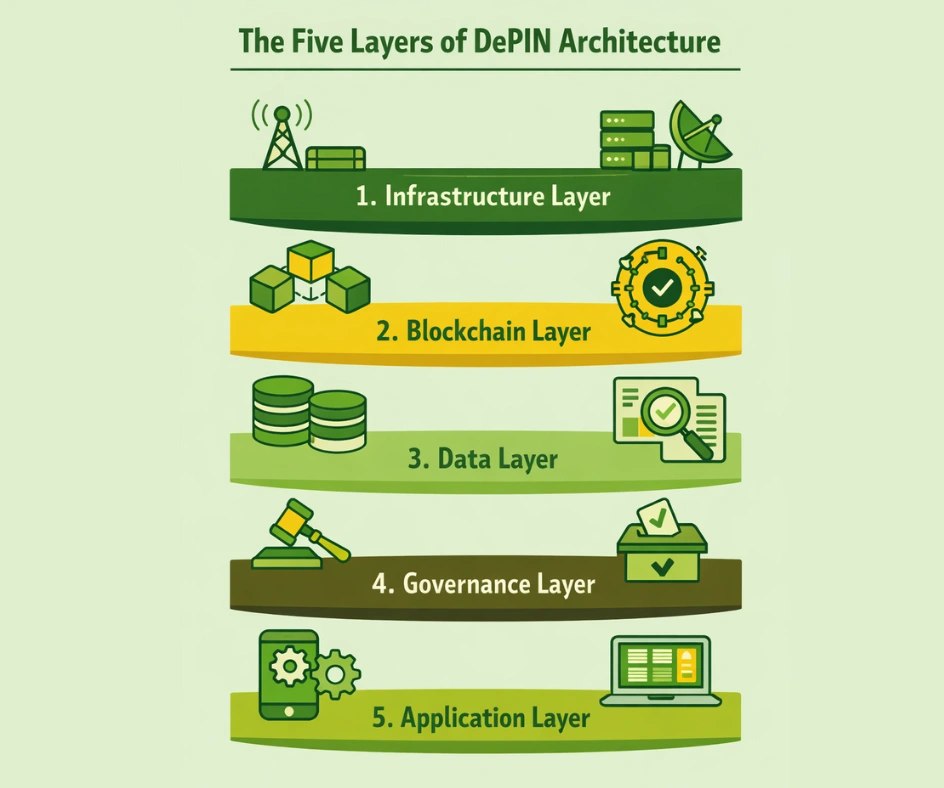

The Five Layers of DePIN Architecture

A research paper published on arXiv describes DePIN architecture as having five distinct layers, each serving a specific purpose:

1. Infrastructure Layer

This is the physical foundation. It includes network devices, computing hardware, terminal devices, and the underlying network protocols that allow data to move. In a DePIN setup, these aren’t owned by one company. They’re distributed across participants worldwide.

2. Blockchain Layer

The blockchain acts as the trust engine. It records all contributions, transactions, and governance decisions on a tamper-proof ledger. Solana, Ethereum, and Filecoin are among the most popular blockchains used for DePIN projects due to their speed and cost characteristics.

3. Data Layer

All operational data, resource usage metrics, and verification proofs are stored and managed here. This layer ensures that every participant’s contribution is accurately measured and recorded.

4. Governance Layer

Unlike centralized companies, where executives make all decisions, DePIN projects use decentralized governance. Token holders can vote on protocol changes, fee structures, and development priorities. This creates transparency and accountability that traditional models often lack.

5. Application Layer

This is what end users see and interact with. Whether it’s a decentralized storage interface, a wireless network app, or a mapping service, the application layer delivers the actual service while the other layers power it behind the scenes.

Why DePIN Adoption Matters: The Case Against Centralized Dependency

Now that we understand what DePIN is and how it works, let’s dig into why its adoption matters, specifically in the context of centralized infrastructure’s growing limitations.

1. Removing the Single Point of Failure Problem

The biggest practical advantage of blockchain-based infrastructure is the elimination of single failure points. When infrastructure is spread across thousands or even millions of independent nodes, there’s no one server room, no one DNS gateway, and no one company whose mistake can shut down a global service. Even if dozens of nodes go offline simultaneously, the rest of the network continues functioning. This is a structural advantage that centralized models simply cannot replicate without enormous redundancy costs.

2. Drastically Lower Costs Through Shared Ownership

Blockchain-based infrastructure solutions have been shown to reduce operational costs by up to 30% while improving system uptime, according to Intel Market Research. In more specific cases, decentralized platforms have reported even larger savings. Fluence, a decentralized cloud computing platform, reports cost savings of up to 75% compared to centralized cloud providers like AWS and Google Cloud. These savings come from a simple principle: instead of one company building everything from scratch, DePIN taps into existing idle resources that individuals already own.

3. Expanding Access to Underserved Regions

Centralized infrastructure goes where the money is. Rural communities, developing nations, and remote areas are often left behind because it’s not profitable enough for a corporation to build cell towers or data centers there. DePIN turns this on its head. Because anyone with the right hardware can become a network participant, infrastructure can grow organically in places where traditional companies would never invest. The Helium Network, for example, has deployed hotspots across 90+ countries, bringing wireless connectivity to areas that traditional telecom operators overlooked.

4. Genuine Community Ownership and Governance

When you pay AWS for cloud storage, you have zero say in how the platform is run, what it charges, or how your data is handled. In DePIN projects, token holders participate in governance decisions. They vote on protocol changes, fee adjustments, and development priorities. This isn’t just a philosophical improvement. It creates accountability. When the users who build and pay for the network also govern it, decisions tend to align with community needs rather than shareholder profits.

5. Transparency Through On-Chain Records

Every contribution, every transaction, every governance vote in a DePIN network is recorded on the blockchain. This creates a level of transparency that centralized companies simply don’t offer. You can verify exactly how many resources someone contributed, how rewards were distributed, and how governance decisions were made. In a world where data privacy and corporate accountability are growing concerns, this transparency is a powerful differentiator.

| Factor | Centralized Infrastructure | DePIN (Blockchain Based Infrastructure) |

|---|---|---|

| Ownership Model | Single entity (corporation or government) owns and controls all hardware and operations | Distributed among thousands of community participants who contribute resources and earn tokens |

| Failure Risk | Single points of failure; one outage can cascade globally (e.g., AWS Oct 2025 outage) | No single failure point; if nodes go offline, the rest continue operating independently |

| Cost Structure | High capital expenditure; costs passed to users through service fees | Up to 30% to 75% lower operational costs by leveraging existing idle resources |

| Geographic Reach | Concentrated in profitable urban and developed markets | Permissionless participation allows organic growth in underserved regions |

| Governance | Executive and shareholder-driven decisions; no user input | Community governance through token voting on protocol changes and fee structures |

| Transparency | Limited companies control what information is disclosed | Full on chain transparency; every transaction and vote is publicly verifiable |

| Speed of Deployment | Years for major infrastructure projects; requires permits, construction, and hiring | Rapid; participants deploy hardware themselves, network scales organically |

| Innovation Pace | Slower; governed by corporate roadmaps and quarterly earnings pressure | Faster; open source development, community proposals, and permissionless building |

Real World DePIN Projects Already Challenging Centralized Models

DePIN isn’t a future concept. It’s happening right now. Several major projects are actively providing services that compete with or complement traditional centralized infrastructure. Let’s look at the most significant ones.

1. Helium: Decentralized Wireless Connectivity

Helium is perhaps the most recognized DePIN project. It allows individuals to deploy wireless hotspots and earn HNT tokens for providing connectivity. The network started with IoT (Internet of Things) coverage and has expanded into mobile cellular service through Helium Mobile.

By August 2025, the Helium Network had over 108,855 mobile hotspots online and was serving more than 1 million daily users. Helium has partnered with major carriers, including T-Mobile, AT&T, and Telefonica, to offload cellular data through its decentralized infrastructure. In Q3 2025, average daily mobile paid traffic grew 57.3% quarter over quarter, reaching 32.4 terabytes per day. The cumulative data offloaded from carriers reached 5,451 terabytes, a 100.4% increase from the previous quarter.

What makes Helium a powerful example of DePIN adoption for centralized infrastructure is that it directly competes with traditional telecom. Helium Mobile’s unlimited plan at $30 per month costs considerably less than the average three-figure plans that dominate American telecom. Harvard Business School even published case studies on Helium’s decentralized model in late 2024 and early 2025, analyzing how it challenges traditional telecom ownership structures.

2. Filecoin: Decentralized Data Storage

Filecoin creates a peer-to-peer marketplace for data storage where individuals rent out their unused hard drive space. Since its mainnet launch in 2020, the network has grown to nearly 3,000 storage providers, collectively storing 1.5 exabytes of data. This data includes everything from experimental physics data housed by major research institutions to the historical and cultural archives of entire island nations.

By the end of Q1 2025, Filecoin hosted 2,340 onboarded datasets, with 804 clients storing large-scale datasets exceeding 1,000 tebibytes each. The Filecoin Virtual Machine (FVM) now supports smart contracts and programmable storage, enabling more advanced use cases for both DePIN and AI applications.

3. Render Network: Decentralized GPU Computing

Render Network connects artists and developers who need GPU power with individuals who have idle graphics cards. The network has rendered over 63 million cumulative frames, with more than one-third completed in 2024 alone. The two-sided GPU marketplace grew 87% year over year, and the network onboarded 40% more rendering compute power in 2025.

In December 2025, Render launched Dispersed, a customer-facing AI compute platform that processes generative AI models on decentralized GPUs. The network now hosts over 5,600 total GPU nodes, with active nodes delivering 2 million OctaneBench in compute capacity. Enterprise GPUs contribute 40% of total network capacity, showing that DePIN adoption is attracting professional-grade hardware, not just consumer-level equipment.

4. Hivemapper: Decentralized Mapping

Hivemapper uses dashcam-equipped drivers to collect real-time map data and rewards them with HONEY tokens. As of late 2024, Hivemapper had mapped roughly 33% of global roads across more than 90 countries. The network grew five times faster than Google Street View did during its initial years.

Three of the top ten map makers globally, including HERE Technologies, now rely on Hivemapper for fresh map data. The cost difference is dramatic: Hivemapper’s Map Image API costs $1 per kilometer, while traditional methods using dedicated vehicles cost approximately 1,000 yuan (about $140) per kilometer in some markets.

📖 Recommended Reading: What is DePIN (Decentralized Physical Infrastructure Network)?

The DePIN Market: Growth, Investment, and Momentum

The numbers behind DePIN adoption tell a compelling story of accelerating growth and increasing institutional confidence.

As of February 2025, the DePIN sector had 1,561 active projects with a total market capitalization of approximately $30 billion, according to the DePIN tracking platform depin. ninja. This puts DePIN in what many analysts call “early stage” territory, since it represents less than 0.1% of the $1+ trillion global infrastructure market. That gap represents an enormous opportunity for growth.

The World Economic Forum has placed the DePIN market, currently valued between $30 billion and $50 billion, on a trajectory toward $3.5 trillion by 2028. This projection is driven by the convergence of blockchain, artificial intelligence, and decentralized infrastructure adoption.

Capital is pouring in. Between January 2024 and July 2025, The Block Pro Research reported over $744 million invested in 165+ DePIN startups, alongside over 89 undisclosed deals. In 2024 alone, DePIN-related projects raised a total of more than $5 billion. Borderless Capital launched a $100 million DePIN Fund III in September 2024, and major investment firms, including Multicoin, Framework, a16z Crypto, and EV3, each made over eight investments throughout the year, with each portfolio raising over $100 million.

Community-driven projects are also scaling rapidly. Grass Network grew from 200,000 to 3 million users within a single year. Leading projects such as Bittensor, Render, and Filecoin are each valued at over $1 billion and $3 billion. Grayscale Research has highlighted Solana as the leading blockchain for high-throughput DePIN applications, hosting projects like Helium, Grass, and Hivemapper.

DePIN Adoption Across Key Industry Verticals

DePIN adoption isn’t limited to one sector. It’s spreading across multiple industries, each with unique characteristics and opportunities.

1. Telecommunications and Wireless Connectivity

The global rollout of 5G networks creates a natural opportunity for DePIN. The distributed nature of 5G small cell deployments aligns well with decentralized management models, and early pilots have shown 25% cost reductions in network maintenance. With 5G infrastructure investment projected to reach $400 billion by 2027, this represents one of the largest growth vectors for DePIN adoption.

2. Energy and Renewable Power

The energy sector currently leads DePIN deployment, accounting for approximately 38% of global implementations in 2024. Decentralized microgrids and renewable energy projects are the primary drivers. Projects like PowerLedger allow individuals to buy and sell renewable energy in peer-to-peer networks, reducing dependence on traditional energy providers and helping cities lower their carbon footprint.

3. Cloud Computing and Storage

Filecoin, Arweave, and other decentralized storage networks are providing alternatives to Amazon S3, Google Cloud Storage, and Microsoft Azure Blob Storage. The appeal goes beyond cost savings. Decentralized storage eliminates the risk of a single provider shutting down or restricting access to data. By encrypting and distributing file fragments across a global network of independent providers, these networks remove single points of failure entirely.

4. GPU Computing and AI Infrastructure

AI-related DePINs dominate the sector by market cap, accounting for 48% according to Grayscale Research. The demand for GPU power is growing exponentially, and centralized providers like AWS and Google Cloud face bottlenecks, including high costs, underutilized hardware, and geopolitical supply constraints. Networks like Render, Akash, and io.net aggregate idle GPUs from individuals and data centers worldwide, offering significant cost advantages. Akash grew its GPU leases from under 200 before November 2024 to over 600 in January 2025, including 398 NVIDIA H100 cards.

5. Mapping and Geospatial Data

Traditional map data collection using dedicated vehicles is extremely expensive. Google Street View vehicles cost about $500,000 each. Hivemapper’s community-driven approach has mapped 33% of the world’s roads using affordable dashcams, growing five times faster than Google did in its early years and at a fraction of the cost.

| Project | Infrastructure Category | Primary Blockchain | Key Milestone |

|---|---|---|---|

| Helium | Wireless / Telecom | Solana | 108,855+ hotspots; partnerships with T Mobile, AT&T, and Telefonica |

| Filecoin | Data Storage | Filecoin (own chain) | ~3,000 storage providers; 1.5 exabytes of data stored |

| Render Network | GPU Computing | Solana | 63M+ frames rendered; 5,600+ GPU nodes; 87% marketplace growth YoY |

| Hivemapper | Mapping / Geospatial | Solana | 33% of global roads mapped; 90+ countries; 5x faster than Google Street View |

| Bittensor | AI / Machine Learning | Bittensor (own chain) | Largest DePIN asset by market cap; decentralized AI training network |

| Akash Network | Cloud Computing | Cosmos | 600+ GPU leases (incl. 398 H100s); $4.6M annualized revenue by Jan 2025 |

| PowerLedger | Energy | Solana | Peer-to-peer renewable energy trading across multiple countries |

| Geodnet | IoT / Geospatial | Polygon | $3M annualized fee revenue in Jan 2025; 518% YoY growth |

How the October 2025 AWS Outage Strengthened the Case for DePIN

If there was a single event in recent memory that put a spotlight on why DePIN for centralized infrastructure matters, it was the AWS outage of October 20, 2025.

At approximately 3:11 AM Eastern Time, a DNS resolution and gateway failure in the US EAST 1 region in Northern Virginia, the same data center hub that powers roughly 32% of global cloud infrastructure, caused a catastrophic cascade. Services worldwide went offline. Amazon’s own platforms, gaming services like Fortnite and Roblox, social apps like Snapchat, streaming services like Disney+, and even banking and government portals were all affected simultaneously.

CNN reported that Mehdi Daoudi, CEO of internet monitoring firm Catchpoint, said the total financial impact would “easily reach into the hundreds of billions.” IT Pro noted that previous research shows both website and IT downtime can be extraordinarily costly. The CrowdStrike incident in July 2024, triggered by a faulty software update, caused $5.4 billion in losses for Fortune 500 companies alone.

Digital rights group Article 19 called the AWS outage a “democratic failure,” pointing to the impact on media platforms and secure messaging apps. Corinne Cath Speth, head of digital issues at Article 19, stressed the urgent need for “diversification in cloud computing.”

This is precisely the diversification that DePIN offers. In a decentralized network, there is no single region whose failure can take down the entire system. The infrastructure is distributed, and participants operate independently. If the world’s cloud computing had been running on a DePIN model, the October 2025 outage simply would not have had the same cascading, global impact.

Challenges Facing DePIN Adoption

For all its promise, DePIN adoption doesn’t come without challenges. Being honest about these limitations is important for anyone evaluating this space.

1. Regulatory Uncertainty

Over 60% of countries currently lack clear legal frameworks for decentralized infrastructure management, according to Intel Market Research. Existing infrastructure regulations were designed for centralized ownership models. Without regulatory clarity, many potential enterprise users remain cautious about transitioning critical operations to decentralized models.

2. Quality Consistency

In a centralized system, one company controls quality standards. In a decentralized network, the quality of hardware and services can vary from participant to participant. Ensuring consistent performance across thousands of independent contributors is a genuine engineering challenge that DePIN projects must continuously address.

3. Technical Complexity

Building a distributed network that combines physical hardware, blockchain coordination, and token economics is technically demanding. The DePIN architecture involves multiple layers that must work in harmony. For average users, the onboarding process can still feel complicated compared to signing up for a centralized cloud service.

4. High Initial Deployment Costs

While DePIN offers long-term savings, the initial deployment requires investment to integrate existing infrastructure with blockchain protocols. Participants need to purchase hardware (hotspots, storage drives, GPUs), and the upfront cost can be a barrier, particularly in regions where the technology is most needed.

5. Token Value Volatility

Most DePIN projects reward participants with cryptocurrency tokens. The value of these tokens can be volatile, which creates uncertainty for contributors who depend on rewards as income. Designing sustainable tokenomics that balance supply, demand, and reward stability remains one of the biggest challenges in DePIN design.

📖 Recommended Reading: DePIN Growth Projections for Market Size Adoption and Future Trends to 2030

The Role of AI in Accelerating DePIN Adoption

One of the most powerful catalysts for DePIN adoption is its connection to artificial intelligence. AI demands enormous amounts of compute power, storage, and data, and centralized providers are struggling to keep up.

In 2024, the top three revenue-generating DePIN projects were all connected to AI computing infrastructure: Aethir (decentralized cloud computing for gaming and AI), Virtuals Protocol (on-chain AI agent network), and IO.Net (decentralized GPU computing for AI applications). This isn’t a coincidence. The insatiable demand from AI for computational power provides a massive demand-side driver for DePIN networks.

AI-related DePINs now dominate the sector by market cap, accounting for 48% according to Grayscale Research. Render Network’s launch of its AI compute subnet in 2025 and Dispersed platform in December 2025 demonstrates how DePIN projects are expanding beyond their original niches to capture AI demand. Akash Network’s growth in GPU leases, including onboarding NVIDIA H100 and AMD MI300X hardware, shows enterprise-level adoption of decentralized AI infrastructure.

The relationship works both ways. AI also helps DePIN networks operate better. AI agents can monitor network health, predict hardware failures, optimize resource allocation, and automate decision-making across thousands of distributed nodes. As DePIN networks grow into millions of participants, AI-powered management becomes not just helpful but necessary.

What DePIN Adoption Means for Businesses and Developers

For businesses considering their infrastructure strategy, DePIN adoption presents both opportunities and considerations worth examining carefully.

1. Cost Optimization

If your organization spends significantly on cloud computing, storage, or network services, DePIN alternatives are worth exploring. The 30% to 75% cost reduction range that DePIN platforms are demonstrating translates to real budget impact, especially for data-heavy operations.

2. Resilience Planning

After the October 2025 AWS outage, many organizations are rethinking their single vendor dependency. DePIN doesn’t have to replace centralized services entirely. It can serve as a complementary layer that provides redundancy and reduces concentration risk.

3. New Revenue Streams

Organizations with idle hardware, whether GPUs, storage capacity, or network bandwidth, can earn token rewards by contributing resources to DePIN networks. This turns underutilized assets into income-generating resources.

4. Developer Opportunities

For developers, the DePIN ecosystem is growing fast. From building decentralized applications on Filecoin to developing AI tools on Render’s compute network, the opportunity space is expanding. Solana, Ethereum Layer 2s, and specialized DePIN chains all offer growing developer ecosystems with active communities and funding support.

5. Early Mover Advantage

With the DePIN sector representing less than 0.1% of the $1+ trillion global infrastructure market, early participants in both building and using these networks stand to benefit as the sector matures. Businesses that integrate DePIN solutions now will be better positioned when these networks reach wider adoption.

Decentralized Infrastructure Implementations in the Real World

The following projects reflect how decentralized architecture is already being applied across telecom, payments, AI computing, and high-throughput blockchain networks. Each implementation showcases the same distributed infrastructure principles discussed throughout this article, from node-based participation and token governance to fault-tolerant design and community-driven scaling.

📡

DentNet: Decentralized Telecom Infrastructure

Built a blockchain-based platform that decentralizes mobile data, voice minutes, and telecom services into a global marketplace. Users can buy, sell, and trade telecom assets across borders with eSIM technology, token staking, and a decentralized swap system, directly mirroring DePIN principles in the telecom sector.

🤖

Athene Network: Decentralized AI Mining Platform

Created a decentralized mining platform for AI development and deployment where researchers, developers, and users securely share AI models, data, and services. The platform uses Proof of Stake consensus and token holder governance, enabling community-driven AI infrastructure without centralized control.

Build Your DePIN Powered Infrastructure Solution Today

We bring 8+ years of blockchain expertise to decentralized infrastructure development. Our specialized team handles everything from smart contract creation and token incentive design to multi-chain integration, ensuring your DePIN project is built for growth, community participation, and long-term sustainability. Whether you need a decentralized storage solution, a wireless network protocol, or an AI compute marketplace, we deliver solutions that work.

Conclusion

The story of DePIN adoption for centralized infrastructure is not a story about replacing everything that exists today. It’s about building something better alongside it, and eventually, where it makes sense, letting the stronger model win.

Centralized infrastructure has served the world well in many ways. It brought the internet to billions, powered the cloud computing revolution, and enabled the global digital economy. But the cracks are showing. The October 2025 AWS outage wasn’t the first of its kind, and it won’t be the last. The $1.4 trillion annual cost of unscheduled downtime, the 68% market concentration among just three cloud providers, and the growing list of services disrupted by single points of failure all point to a model that is struggling under its own weight.

DePIN offers a different path. A path where infrastructure is owned by its users, where transparency is built into the foundation, where costs are lower because idle resources are put to work, and where no single failure can bring down the entire system. With over 1,561 active projects, more than 13 million contributing devices, billions in investment, and real-world services already operating at scale, DePIN has moved well beyond theory.

The Filecoin network stores 1.5 exabytes of the world’s most important data across 3,000 independent providers. Helium has 108,000+ hotspots and partnerships with T-Mobile, AT&T, and Telefonica. Render has processed 63 million frames of GPU workloads. Hivemapper has mapped a third of the world’s roads using everyday drivers. These are not experiments. These are functioning infrastructure networks serving real users and generating real revenue.

For businesses, developers, and forward-thinking organizations, the question is no longer whether DePIN will matter. The question is how quickly you want to be part of it. The infrastructure of the future won’t be owned by a few. It will be built by many. And that shift is already underway.

Frequently Asked Questions

DePIN (Decentralized Physical Infrastructure Networks) uses blockchain technology and token-based incentives to coordinate the building and management of real-world physical infrastructure like wireless networks, storage systems, and compute resources. Unlike traditional centralized infrastructure owned by a single corporation, DePIN distributes ownership across thousands of independent participants who contribute hardware and earn cryptocurrency rewards for their contributions.

DePIN is not trying to replace centralized providers overnight. Instead, it offers a complementary and increasingly competitive alternative. For specific use cases like data storage, GPU rendering, wireless connectivity, and mapping, DePIN projects are already operating at a meaningful scale. Over time, as these networks mature and more participants join, they may capture larger portions of the market.

Enterprise adoption is growing but still in its early stages. Projects like Filecoin store data for major research institutions. Helium partners with AT&T and T-Mobile. Render serves Hollywood studios and AI developers. However, enterprises should evaluate each project’s maturity, governance model, and track record before committing critical workloads to any decentralized network.

Participants contribute physical resources (such as storage drives, wireless hotspots, GPUs, or dashcams) to a DePIN network. Smart contracts on the blockchain verify these contributions and automatically distribute cryptocurrency tokens as rewards. The value of these rewards depends on the specific token’s market price and the amount and quality of resources contributed.

Solana is currently the leading blockchain for DePIN applications due to its speed, low transaction costs, and ability to handle real-time data workloads. It hosts major projects like Helium, Render, Grass, and Hivemapper. Ethereum Layer 2 solutions like Arbitrum and Optimism are gaining traction for compute and AI-focused projects. Filecoin operates its own specialized blockchain for storage applications.

The industries most directly impacted include telecommunications (decentralized wireless and 5G), cloud computing and data storage, energy (decentralized microgrids and peer-to-peer power trading), GPU computing and AI infrastructure, and mapping/geospatial data collection. The energy sector currently leads with 38% of DePIN deployments, while AI-related DePINs account for 48% of total market capitalization.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.